One benefit of gridlock in Washington is that our government will be hampered in its ability to meddle in the housing market.

Irvine Home Address … 63 DARTMOUTH 62 Irvine, CA 92612

Resale Home Price …… $430,000

When you try your best, but you don't succeed

When you get what you want, but not what you need

When you feel so tired, but you can't sleep

Stuck in reverse

And the tears come streaming down your face

When you lose something you can't replace

When you love someone, but it goes to waste

Could it be worse?

Lights will guide you home

And ignite your bones

And I will try to fix you

Coldplay — Fix You

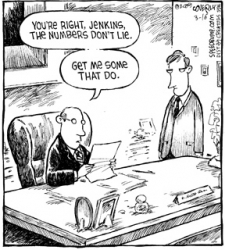

Many in Washington believe they can cure the ills in housing if they manipulate conditions enough. The government can pass some law or fail to enforce another to accomplish their ends. Unfortunately, the meddling cures nothing and the crisis drags on while the bureaucrats lament their lack of control over the housing market and push for more. If prices were allowed to crash everywhere like they have in Las Vegas, the groundwork for recovery would be in place. As it stands, we have too much overhanging debt that isn't going to get repaid draining our resources and weakening our economy. When those in Washington think they can fix a problem, their solutions are generally worse than doing nothing at all. Perhaps gridlock will be a good thing?

Morgan Stanley views political will to fix housing as scarce

by JASON PHILYAW — Tuesday, November 23rd, 2010, 4:05 pm

Housing and housing finance present the largest risk to the overall economy, according to Morgan Stanley analysts, who said they were too optimistic last year when they predicted "only a modest recovery in housing" for 2010.

Analysts said there are many options available to fix the nation's "dysfunctional housing and mortgage markets, but the political will to deploy them is scarce."

The analysts suggest additional loan modifications or refinancings, or principal writedowns may help ease the problems facing the industry.

If that is the best that "analysts" can come up with, then I am thrilled that the political will to screw our country up further does not exist.

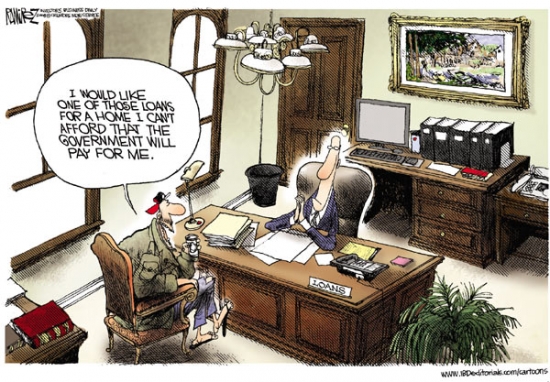

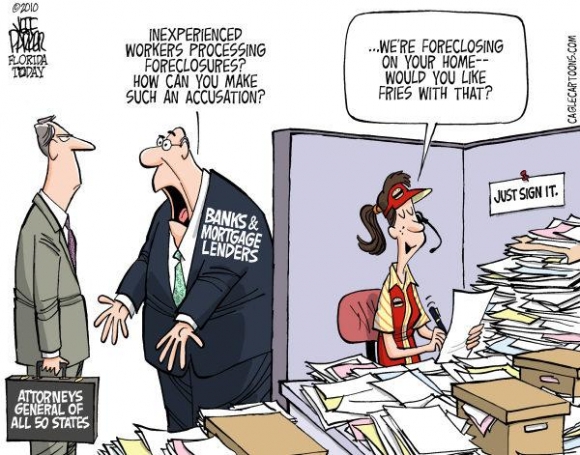

First, loan modifications are a proven failure. No loan modification program can or will be successful. The problem is not that borrowers cannot make the payments, it is that borrowers have too much debt. Modifying the terms of that debt does not make the real problem go away.

Second, principal writedowns are part of the answer, but this must be done through a foreclosure to avoid moral hazard. Remember, Foreclosure Is a Superior Form of Principal Reduction. If we start writing down principal through debt forgiveness, then borrowers will be strongly incentivized to over-borrow next time because they know that if they get in too much trouble either the bank or the government will bail them out.

Banks have tightened lending standards and there's a shadow inventory of some 8 million units that create a vicious circle, according to Morgan Stanley. And without substantial policy reform, the imbalance won't correct itself for years and home prices may fall another 10% before reaching bottom in 2012, the analysts said.

Most of the people who wrote about the housing bubble before it became commonly accepted fact pointed out the vicious circle of tightening credit and lower prices would go unabated until prices fell below rental parity and buyers had a new reason to participate in the market. Only the amend-extend-pretend policy of the banks coupled with widespread squatting has prevented this inevitable cycle from cleansing the market of its excess debt. The Morgan Stanley analyst is raising this specter as a bogeyman, when in reality, it is exactly what the market needs to correct itself.

Morgan Stanley also said the risk of mortgage putbacks is restricting the supply of credit, as banks are only lending to borrowers with pristine credit and proper housing equity.

If banks want to make money, they should only rent to borrowers with good credit and proper reserves. To suggest otherwise shows how totally clueless our lending industry has become. They are so conditioned to passing the risk off to others that they see any barrier to origination as being an impediment to progress and profit. Our lenders are truly lost.

Still, the analysts expect loan originators to see losses of $85 billion to $165 billion from the putbacks with large-cap banks bearing the burnt of the losses.

Analysts said policymakers should first focus on repairing housing by reducing the supply and demand imbalances and restore market functioning. Then reforms can be implemented "to assure longer-term financial and economic stability."

These "analysts" are complete idiots. They are putting the cart before the horse. For the market to reduce any imbalances between supply and demand, it must be restored to its natural functioning. It doesn't work the other way around. The whole reason we have such imbalances today is because the government is manipulating the market in many ways with the primary goal being to preserve excessive debt and keep prices unnaffordable to a new generation of buyers.

Washington is making the housing crisis even worse

Bad policy and a bad economy make it a terrible time to buy. Instead of pushing cheap credit, Uncle Sam must let the market lower prices.

By Patrick Killelea — November 18, 2010.jpg)

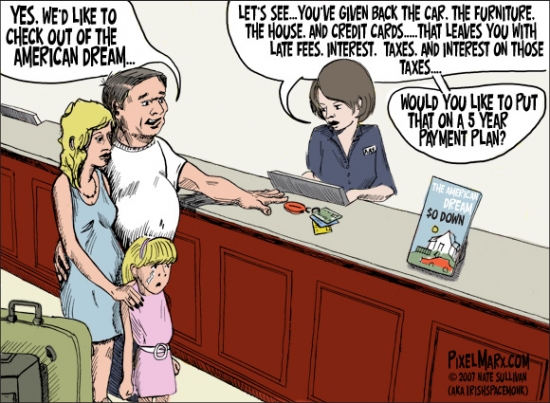

Our long national bender of house price inflation has finally ended. Now all that remains is for the government to get out of the way and let the housing market sober up completely. Unfortunately, Washington is still tempting Americans to have one more drink – "on the house."

Real value of a house

As I explain on my website, http://patrick.net, the value of a house depends entirely on what it would rent for. It doesn't depend on what you paid for it, or on how much you spent to build it. If you can save money every month by renting the same quality house in a nearby location, then it is foolish to buy at that asking price. The price is just too high.

Rents, in turn, depend on salaries. Try walking into a bank and asking for a loan to pay your rent. You know what the answer will be. So why is it that the bank will lend us vast amounts of money to take out a mortgage and take on expenses that will be much higher than rent for the same place?

Because banks are stupid. If banks were smart, they would never loan money under terms where the payment exceeds the potential rental income. Why is that? Because if they did that, they would have no risk of a loss of cashflow in the event of a foreclosure.

Think about it: if lenders would not have made loans were the payments greatly exceeded potential rental income, then even if 10% or more of borrowers decided to default, the bank could take the property back and rent it out for enough to cover the payment.

In fact, the whole amend-extend-pretend policy would be effective if the banks had kept their loan payment below rental parity. They would have foreclosed on the deadbeats and replaced them with renters who could make the "payments" while the bank searched for a new owner-occupant to buy the house and liberate their tied-up capital.

Because it is profitable to get people into debt. Those profits result in political pressure to pass laws encouraging mortgage debt. For everyone above the buyer on the food chain – from seller to real estate agent to bank to Congress, the White House, and the Federal Reserve – there is a strong interest in getting young and inexperienced families deeply into debt. Once in debt, new buyers, too, become part of the game – they need to find new housing victims if they want to eventually sell at a profit.

Thus we have the mortgage interest deduction, Fannie Mae, Freddie Mac, the Federal Housing Administration (FHA), and other harmful government programs, all of which serve primarily to increase the amount of mortgage debt. Since most people don't do math very well and will take on as much mortgage debt as they can, this government facilitation simply results in higher house prices.

Higher prices negate any benefit to the buyer – but they do benefit people higher up the food chain. Those profits at the expense of the buyer get funneled into campaign contributions that keep the system in place, or make it even more pernicious.

It sounds like a hokey conspiracy theory, but Patrick's description of the mass collusion among the participants in the housing market is essentially correct..jpg)

At some point, the cost of owning shot right past the cost of renting. Owners were losing money, month after month, on a real cash flow basis relative to renting. But they didn't care because they felt rich from the implied increase in their house's value. They could even refinance at the greater valuation implied by "comps" – appraisals or sale prices of similar properties nearby – and pull money out to cover their monthly shortfall.

That worked until it didn't, and America woke up with a dreadful hangover, still ongoing. What's worse is that many powerful financial interests are determined to make sure that we never sober up.

Special interests working against us

Older sellers depend on young families’ getting themselves into debt. Less debt for the young means lower selling prices for the old.

Real estate agents, after years of blathering about how house prices only go up, are finally faced with the incontrovertible reality that house prices also go down. Sales volumes also go down when prices are finally recognized as being too high. The lack of turnover and lower prices directly hurt their commissions.

Banks blew all their depositors’ money on bad mortgage lending, amounts way out of line with salaries. This was fine for them as long as they could get mortgage-backed bond buyers to take the risk off their hands, but the bond buyers got wise, and they don’t want any more of that bad debt. In fact, they want to make the banks buy it back.

The Federal Reserve exists to protect the banks from responsibility for their own bad decisions, at the expense of everyone else, in the name of “financial stability.” So we have the Fed printing cash to buy up those bad mortgage bonds – which weakens everyone’s wealth by inflating the currency – to get the banks off the hook.

Ways to make it better

What should we do?

First, the press should stop characterizing higher house prices as better. Higher house prices are not an "improvement" and lower prices are not a "worsening" of the housing market. Higher house prices are simply inflation, and inflation is bad for buyers.

The president should say that lower housing prices are a wonderful thing for buyers, especially young families. He should point out that lower housing prices are true affordability. Increased mortgage debt is not affordability, just a trap for the unwary.

Why does this issue have no champion? Someone in government will stand up for nearly anything — even stupid ideas have advocates. Why is a government policy that rips off an entire generation of home buyers getting no attention?

Lending regulations should eliminate comps as meaningless. All lending should be based by law on what it would cost to rent the equivalent house. Fannie, Freddie, and FHA lending programs should be stopped immediately, not gradually. It is the hope of lower prices that causes people to delay purchasing. We want to get prices back down below the cost of renting as quickly as possible for the maximum buyer benefit.

People in the Midwest and South should not be forced via their tax dollars to guarantee $729,750 jumbo Fannie and Freddie mortgages for Californians when they cannot get such a guarantee for themselves. The injustice is galling.

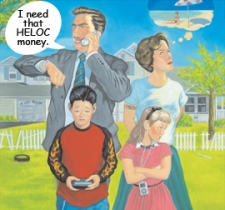

Why do we have an increased subsidy in areas with high prices? Isn't the subsidy actually inflating prices? Why do Nebraska taxpayers subsidize California HELOC abusers?

Banks should be heavily fined for leaving foreclosed property empty and deteriorating. Foreclosures don't ruin neighborhoods – empty houses do. If the banks won't take care of their houses quickly, the title should be auctioned off to people who will occupy and take care of them. Yes, even if the auction lowers comps or forces the bank to take a loss.

No mortgage interest deduction

There should be no mortgage interest deduction. Encouraging debt has resulted in disaster. Instead, we should promote savings, and outright ownership without any debt at all, in every generation.

Current owners usually misunderstand their own interests. If they ever want to upgrade, they will benefit more from the falling price on a bigger place than they lose from the falling price on their current place. Owners who want to upgrade should be firmly on the side of lower prices.

There is a feeling of terror that if house prices were allowed to be set by the unmanipulated free market, all consumer spending would stop and a permanent deflation would take hold. That just wouldn't happen. Consumers will always spend on things they need, and deflation will naturally stop at the point where a house is once again cheaper to own than to rent.

The nonsense and fear about lower prices is crazy. Fix the Housing Market: Let Home Prices Fall.

Another pseudo-cashflow property

If you count the appreciation as earned income, Orange County has some great cashflow properties during price rallies. Of course, you can't count appreciation as cashflow because it isn't sustainable, and it takes debt to access it, but many came to believe that appreciation converted to income through mortgage equity withdrawal was a wise way to manage their properties. That's why they are losing them now.

- The owner of this property paid $243,000 on 12/18/1998. Their mortgage information is not available.

- On 11/20/1999 this owner got a HELOC for $36,000 and extracted his first positive cashflow… kind of.

- On 5/31/2001 he refinanced with a $231,000 first mortgage.

- On 4/16/2002 he obtained a $68,000 HELOC.

- On 1/23/2004 the got a HELOC for $100,000.

- On 2/6/2004 he refinanced with a $235,638 first mortgage.

- On 10/15/2004 he obtained a $150,00 HELOC.

- On 11/1/2006 he opened a $250,000 HELOC.

- On 3/12/2007 he refinanced with a $387,800 first mortgage.

-

On 10/10/2007 he obtained a $250,000 HELOC. If he withdrew this money, the property will be a short sale.

With the prospect of future ATM payments being slim, this owner defaulted on his first mortgage.

Foreclosure Record

Recording Date: 10/12/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 06/30/2010

Document Type: Notice of Default

Irvine Home Address … 63 DARTMOUTH 62 Irvine, CA 92612 ![]()

Resale Home Price … $430,000

Home Purchase Price … $243,000

Home Purchase Date …. 12/18/1998

Net Gain (Loss) ………. $161,200

Percent Change ………. 66.3%

Annual Appreciation … 4.8%

Cost of Ownership

————————————————-

$430,000 ………. Asking Price

$15,050 ………. 3.5% Down FHA Financing

4.55% …………… Mortgage Interest Rate

$414,950 ………. 30-Year Mortgage

$84,531 ………. Income Requirement

$2,115 ………. Monthly Mortgage Payment

$373 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$72 ………. Homeowners Insurance

$295 ………. Homeowners Association Fees

============================================

$2,854 ………. Monthly Cash Outlays

-$341 ………. Tax Savings (% of Interest and Property Tax)

-$541 ………. Equity Hidden in Payment

$26 ………. Lost Income to Down Payment (net of taxes)

$54 ………. Maintenance and Replacement Reserves

============================================

$2,051 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,300 ………. Furnishing and Move In @1%

$4,300 ………. Closing Costs @1%

$4,150 ………… Interest Points @1% of Loan

$15,050 ………. Down Payment

============================================

$27,800 ………. Total Cash Costs

$31,400 ………… Emergency Cash Reserves

============================================

$59,200 ………. Total Savings Needed

Property Details for 63 DARTMOUTH 62 Irvine, CA 92612

——————————————————————————

Beds: 3

Baths: 1 full 2 part baths

Home size: 1,524 sq ft

($282 / sq ft)

Lot Size: n/a

Year Built: 1981

Days on Market: 83

Listing Updated: 40507

MLS Number: P751647

Property Type: Condominium, Residential

Community: University Town Center

Tract: Cc

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

This home is bright & cheerful and has many upgrades. The home offers 3 beds, 3 baths, vaulted ceilings, formal living room, fireplace, wooden floors, upgraded kitchen & baths and much more. Location offers the finest schools and shopping and easy access to freeways.

.jpg)

Many loan owners started out in the late 90s and the 00s, so a housing bubble and irresponsible lending is all they know. However, many others survived the previous housing bubble and should have known better than to borrow themselves into oblivion. Today's featured owner borrowed all he could as soon as he could. He didn't leave much equity in the house before the market collapsed.

Many loan owners started out in the late 90s and the 00s, so a housing bubble and irresponsible lending is all they know. However, many others survived the previous housing bubble and should have known better than to borrow themselves into oblivion. Today's featured owner borrowed all he could as soon as he could. He didn't leave much equity in the house before the market collapsed..jpg)

.jpg)