Many housing analysts, myself included, stated the $8,000 homebuyer tax credit would fail to cause the housing market to bottom.

Irvine Home Address … 76 KAZAN St #36 Irvine, CA 92604

Resale Home Price …… $245,000

Don't let me down

Don't make a sound

Don't throw it all away

Remember me

The Klaxons — Not Over Yet

The housing bubble is not over yet. Though delayed for two years, the deflation of the bubble has resumed its progress toward affordability and the purging of kool aid from the beliefs and actions of buyers everywhere.

Many of the buyers in the bear rally of 2009-2010 believed they were getting a good deal on the backs of the taxpayer. They believed they were buying at the bottom and getting government assistance to boot.

They were wrong.

Buyers during the tax credit who purchased early to take advantage of the tax credit were merely being duped into overpaying for real estate by a government intent on bailing out our banking system at the expense of homebuyers and taxpayers alike.

Dean Baker predicted the failure of the tax credit in early 2010.

Dean Baker: We’re Still In a Housing Bubble

January 26, 2010, 11:22 AM ET By Nick Timiraos

,,, Housing economist Dean Baker, the co-director of the Center for Economic and Policy Research, laid out his case at a risk conference last week for why we still have a housing bubble. Adjusted for inflation, home prices are still 15-20% higher than they were in the mid-1990s. “There’s no plausible fundamental explanation for that,” he says.

Why? Simple, he says: Economic fundamentals are all going in the other direction. Rental apartment vacancies are reaching record highs. Many segments of the housing market are still oversupplied. And the core demographic in the country—the baby boomers—are reaching the age where they’re more likely to downsize, buying less house in the years to come.

Far from some rosy estimates that housing is going through a temporary, once in a lifetime downturn, and that once the market bottoms, homes will again appreciate well beyond the rate of inflation, Mr. Baker argues that home prices are far more likely to increase annually at the rate of inflation, at best.

“If anything, I expect housing to be weaker than normal rather than stronger over the next decade,” he says. “People who say this is a temporary story, there’s no real reason to believe anything like that.”

The recent burst of good housing news has been fueled by government stimulus, including the tax credit, low mortgage rates and easy financing from the Federal Housing Administration. Mr. Baker, who had been a skeptic of the tax credit, concedes that it has worked. So, too, he says, has the FHA effectively supplied credit to goose sales.

But that’s likely for the worse, he argues, taking the opposite view of policymakers at the FHA.

“As a matter of policy I can’t see that we want people to buy a house in 2009 that’s 10-20% higher than it would sell for in 2011,” he says. “In so far as the FHA was encouraging people to buy homes in bubble markets that were not deflated, that’s not good for the FHA and you didn’t help the homeowner. We didn’t do those people a favor.”

Dean Baker was as right as right can be….

How the $8,000 Tax Credit Cost Home Buyers $15,000

Price declines have more than eclipsed savings, new numbers show.

MAY 10, 2011 — By JACK HOUGH

The government's recent $8,000 cash incentive for first-time home buyers has proved even more costly for recipients than for taxpayers, according to data released Monday. Typical buyers have lost twice as much to price declines as they received from the program.

The median home value fell to about $170,000 in March from $185,000 a year earlier, according to Zillow.com. That means a buyer who closed on a house just before the tax-credit program expired in April 2010 collected $8,000 but has since lost $15,000 in value. Those who bought earlier in the program have done worse; the median price is down $20,000 from March 2009.

By the numbers

“The $8,000 first-time home buyers tax credit . . . has brought many new families into the housing market,” the White House boasted in November 2009 upon announcing an extension and expansion of the program. Judging by sales declines since, that seems beyond doubt. Over the past year, the pace of existing home sales has fallen more than 6% and that of new home sales has fallen 22%.

The credit wasn't great for taxpayers, either. IRS says it paid $26 billion in home buyer credits in 2009 and 2010, enough to cover the maximum $8,000 credit for more than 3 million buyers.

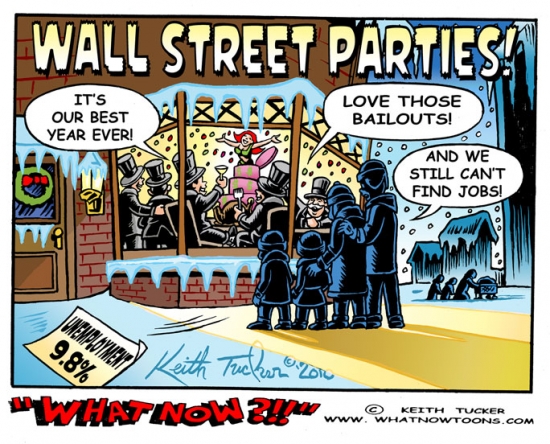

So what did the program accomplish? It funneled money to banks who received larger loan payoffs than they would have if market prices had been allowed to correct naturally. The only beneficiaries of the tax credit were banks.

(It says at least $513 million went for fraudulent claims. Some claimants hadn't bought houses. Some filed twice. Some were under age 18 or incarcerated.)

Mortgage fraud is reaching record levels. It shouldn't be surprising that tax fraud is also on the rise.

In October 2009, when the extension of the $8,000 credit for homebuyers was under consideration, I outlined five reasons the U.S. didn't need more housing perks. These included already-high prices and an abundance of benefits, the questionable stimulus value of home subsidies and a gaping budget deficit. In January 2010, with the extension passed, I recommended that eager buyers wait at least nine months and purposely miss the $8,000 tax credit deadline to take advantage of price declines after. The median price fell about $8,000 over the next nine months and another $8,000 since.

i have consistently maintained that buyers who are concerned about declining prices should wait until the government stimulants were removed from the market. Only after the temporary subsidies were removed would we be able to gauge the health of the housing market. Since the props were removed, prices have steadily fallen, and the pace of the decline is quickening even during the prime buying season.

I realize that writing an apology for this program's failure probably isn't high on Congress's or the President's list of priorities right now. But just in case someone's conscience is bothering them, let me offer a simple draft:

“We thought the $8,000 tax credits would raise house prices and spur the economy. We were wrong. For starters, it makes no sense for a housing affordability program to have the stated goal of raising prices, because higher prices mean less affordability, not more. Another thing: The program didn't work. We squandered taxpayer cash, increased the debt and lured many Americans into losses. We're deeply sorry. We'll try not to repeat the mistake. If anything, in light of America's daunting fiscal challenges, we're going to consider sun-setting costly, existing programs that lure house buyers, like the mortgage interest deduction and capital gains exemption, which together are more than 10 times as expensive as the expired tax credit program, costing about $1,200 per household last year alone.”

No government official will admit failure because they consider it a success. The purpose of the program was to give money to banks. In that regard, it was a success.

For homeowners who are wondering if prices are done falling, and for renters who want to know if now is the time to buy, here's my best guess. In April 2007, when I first wrote that renting had come to make more financial sense than home-ownership, I calculated that prices would have to decline by half to restore the historic relationship between prices and rents. Since then, they've fallen 30% nationwide. Inflation has eaten another 8% of their value. So the worst of the plunge seems done, but prices might drift lower or lose ground to inflation in coming years. In some hard-hit markets, of course, houses are a good deal. For a very rough gauge of value in a specific area, divide recent sale prices by the yearly amount charged to renters for comparable properties. If the result is over 20, prices are probably too high. If it's less than 10, houses might be a steal. If it's in between, well, it's in between.

For another take on prices, consider something I and others have argued about the natural rate of price increase for houses. It's exactly the rate of inflation. Houses, after all, are sticks and stones and other ordinary things, and inflation by definition is the gradual rise in the price of ordinary things. If house prices forever rose faster than the rate of inflation, they'd become infinitely expensive relative to rents, incomes and the cost of building materials.

The truth is a bit more nuanced. Wage inflation is the best barometer of house prices. Inflation of other goods and services may eat into the income available to purchase housing, but the general rate of inflation is not as good a measure as local wage inflation. California house prices have gone up more than the rest of the country partly due to kool aid intoxication and partly due to above average wage growth.

House prices indeed tracked the rate of inflation during the 1970s, 1980s and 1990s, straying only slightly and briefly and returning each time. In 2000, house prices began to detach from the inflation rate and race ahead of it. Therefore, normalcy might be restored once the house price rise since 2000 matches the rate of inflation since then.

Houses are up 41% since 2000. Inflation has increased other costs by 32%. By this measure, too, prices on a national level seem nearly back to normal but not quite there yet.

Not enough time to Ponzi

The owners of today's featured property bought near the peak and began the process of serial refinancing to obtain HELOC spending money, but the housing bust stopped their plans short. Now they are selling for a big loss and passing the buck on to the bank.

- They paid $335,000 on 1/21/2005 using a $268,000 first mortgage, a $67,000 second mortgage, and a $0 down payment. Haven't seen many 100% financing deals lately. A few survivors must be around.

- On 10/14/2005 they refinanced with a $274,891 first mortgage and a $67,000 second.

- On 9/11/2006 they enlarged their second mortgage with a $80,000 refinance.

- On 2/28/2007 they obtained a $85,000 HELOC.

- Their total debt is $359,891 which only represents $24,891 in mortgage equity withdrawal. They bought too late to get much HELOC money, but based on their behavior, that was clearly the plan.

- They were served notice in February. There is no way to know how long they were in shadow inventory before that.

Foreclosure Record

Recording Date: 02/23/2011

Document Type: Notice of Default

Irvine House Address … 76 KAZAN St #36 Irvine, CA 92604 ![]()

Resale House Price …… $245,000

House Purchase Price … $335,000

House Purchase Date …. 1/21/2005

Net Gain (Loss) ………. ($104,700)

Percent Change ………. -31.3%

Annual Appreciation … -4.8%

Cost of House Ownership

————————————————-

$245,000 ………. Asking Price

$8,575 ………. 3.5% Down FHA Financing

4.59% …………… Mortgage Interest Rate

$236,425 ………. 30-Year Mortgage

$51,883 ………. Income Requirement

$1,211 ………. Monthly Mortgage Payment

$212 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$51 ………. Homeowners Insurance (@ 0.25%)

$272 ………. Private Mortgage Insurance

$185 ………. Homeowners Association Fees

============================================

$1,931 ………. Monthly Cash Outlays

-$112 ………. Tax Savings (% of Interest and Property Tax)

-$306 ………. Equity Hidden in Payment (Amortization)

$15 ………. Lost Income to Down Payment (net of taxes)

$51 ………. Maintenance and Replacement Reserves

============================================

$1,578 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,450 ………. Furnishing and Move In @1%

$2,450 ………. Closing Costs @1%

$2,364 ………… Interest Points @1% of Loan

$8,575 ………. Down Payment

============================================

$15,839 ………. Total Cash Costs

$24,100 ………… Emergency Cash Reserves

============================================

$39,939 ………. Total Savings Needed

Property Details for 76 KAZAN St #36 Irvine, CA 92604

——————————————————————————

Beds: 2

Baths: 1

Sq. Ft.: 900

$272/SF

Property Type: Residential, Condominium

Style: One Level, Other

Year Built: 1972

Community: 0

County: Orange

MLS#: S644297

Source: SoCalMLS

Status: Active

On Redfin: 117 days

——————————————————————————

Great location! Award winning Irvine Schools, and shopping. Quiet and private upstairs location, and close to HOA Amentities. Washer dryer room in unit. Well kept and Perfect for investors or the first time buyer.

“Wage inflation is the best barometer of house prices.”

Yes but it’s very hard to capture for the differet segments of society. The upper quarter is far different than the lower quarter. The two middle quarters have also seen vastly different wage inflation.

When major companies move an employee to southern CA they offer a cost of living adjustments. Typically this is around 16% depending on where the employee moves from. You may say this is not enough but reality is different. If the said employee was spending 28% of their income to live in TX, they can now take that full 16% and put it towards housing. That is what the cost of living adjustment is for. Other cost are generally the same, cars, clothes, food… There may be some marginal different but generally the main difference is housing expense.

Population is another factor for prime areas. In regions that have seen population double in a short period of time, the premium areas will be inflated due to supply and demand. Short supply and the higher incomes bid up the premium areas.

Regions like Las Vegas and Riverside saw growth they could never sustain but Irvine keeps on growing. It will be a very long slide down for Vegas and Riverside in full blown depression.

Unfortunately COLA is the exception nowadays. I work for GE and they don’t offer COLA for a relocation within the US, same with a few other multinationals that I am familiar with…A lot of big companies don’t take the local cost of living into consideration and therefore “underpay” their SoCal employees 🙂

Actually, that 16% is a relic of the past — outside of hot dotcoms, which are definitely absent in Orange County. Most companies, in this economy, offer only as much as they think is necessary and could care less where the potential employee is moving from.

For those movers now gaining 7% or less, as compared to their TX salary, their net income available for housing is actually reduced. TX state income tax: 0%. CA state income tax (top rate) 9.55%. Yes, you can deduct state from federal, so it nets to around 7%.

Typically a tax adjustment is included as a separate payment. In cases where it’s not the cost of living adjustment is increased to account for tax differences.

The point is the cost of living adjustment is meant to cover mostly housing. In a situation where 28% of income was going to housing, a 14% cola was provided with extra tax adjustment payment.. The relocated employee could afford an increase of 50% in housing.

When income is inflated that inflation goes mostly towards housing.

This type of thinking is the cause of SoCal’s housing bubbles. According to you, anyone moving to California should expect to pay 42% of their gross income to housing. With realistic underwriting standards, this means any newcomer to California will become a permanent renter. Peoples’ desire to buy homes then leads to “financial innovations” such as lowered underwriting standards, interest-only loans, and option ARMs, which just serve to further inflate house prices.

Southern California is a great place to live, and there should be a premium attached to that, which should also cause higher incomes to attract “necessary” workers. However, those incomes are only slightly higher than cheaper areas of the country, and even assuming your theory of extra income to pay strictly for a 50% increase in housing, it is not adequate when home prices are triple (or more) than those cheaper areas.

That said, I agree with other posters that the COLA is pretty much gone. It may have been true in the past, but it has disappeared along with corporate pensions and employer-paid health care.

Also, I’ve worked for large corporations and have never even heard of a separate payment to adjust for tax differences, at least at the cubicle level – though it could be different up in the corporate suites.

Speaking of the cubicle level, I’d like to see someone take a look at the correlation between home prices and engineering salaries. IEEE has a pretty thorough data set on differences in engineers’ salaries both geographically and over time. Engineering is a good upper-middle-class career where jobs are fairly similar throughout the country, which would allow a more fair comparison between different areas. I think it might be instructive to look at an “Engineer’s Housing Pain Index” for various areas around the country.

TX property taxes are also like 3%(depending on county).

3% of half of what So Cal property valuations are. typical tax in OC is 1.25-1.5%… so yeah the net payment is almost the same. which works out great when you’re paying 7% less in total income taxes. not to mention gas taxes, sales taxes, and all the other crap citizens are bombarded with daily.

why, so some union hacks can have a nice cushy pension, and we can support more illegalians.

IR,

I follow Barry’s blog and have seen that graphic before. I was curious if you’ve ever seen a similar graph that would index monthly payments adjusted for inflation using the 30 year fixed rate as the financing barometer as opposed to nominal housing prices adjusted for inflation.

The graph would seem to indicate that prices would need to fall approximately 40% to get back to the 100 level on the index. However, that does not seem likely considering where interest rates are. It just seems to me that when you factor in interest rates, we’re much closer to the 100 level on the index than 140.

It is complicated, isn’t it? There’s no way the vast majority of Americans can make these determinations – which is why it’s so important we prevent another housing bubble (or at least prick it when we see it).

and when prices fall another 10-20%, and then interest rates climb 25-40%? then what happens to prices??

One great(?) thing about statistics is that it can be presented in various different ways, and depending on that can influence the views of the observers. In the case of Shiller’s graph above, it looks at a period of 120 years. Viewing this without too much thought can cause many observers to conclude that we should be shifting back to the 100 level of 1890. We are taught in statistics that one of the major factor of measuring is the time range of the observations. Too long of a time range can result in discounting of important shifts that may mark a permanent shift of the basis.

I think by looking at 120 years, we can see this shift occurring in a couple of occasions. If you take the 120 years as a whole, the base should probably be somewhere south of 100 if you discount the past few years. However, you can see a shift that looks permanent around 1950. So for the past 50 years prior to the 2000’s, looks like the baseline should be around 110. And that what of 2000 & beyond? Is that another permanent shift of some kind that will now play out for another 40-50 years? Obviously we can’t be sure but I think it’s naive to assume that we should be regressing back to the 100 number (which is actually arbitrary purely based on when the measurement started), or to a 90-95 number that seems to be more of the baseline of this entire range, without considering how significant this time range is.

Looking at it purely statistically, that’s what I see.

PR, you must be hard of hearing, we are telling you that companies are no longer offering COLAs and tax equalization agreements. In my case, the employer pointed out that while Irvine might be high priced, there was nothing preventing me from living in the surrounding communities that are lower priced. They covered my moving expenses and that was it.

I suggest you sue your company for denying your children the opportunity to attend the 10/10 schools, and they are now stuck with 9/10 schools. There goes their chance at Harvard, Stanford, Chicago. Or even UC Irvine!! Damn the employers!

If you’re not receiving a COLA, then you are clearly not sufficiently talented to be an Irvinite. I would suggest re-training yourself for a different field, or re-locating to a region more suitable to your earning power such as Santa Ana or Fresno.

On the other hand, my brilliant Ph.D. engineer friends are living the high life in beautiful Irvine homes with skyrocketing incomes and genius violin-playing offspring. If you ever stop by the IRVINE SPECTRUM, where it is Christmas and Easter EVERY SINGLE NIGHT OF THE WEEK, you will see them and their families spending their disposable income and making Irvine the envy of other world-class cities.

Exactly, valet parking has become quite a nightmare over there.

I hate having to self-park my Panamera Turbo

All joking aside, PS is right, it’s always Christmas at the Spectrum with their ice rink and Christmas trees…. where do these people get their money?!?

Thank you, I didn’t want to have to break the news to them: they didnt get a cola? Move to Riverside or improve your skills so they are more desirable. I know people who work there who recently received colas.

Ahh … now the first two sarcastic responses make sense. They knew you were an ass and would post something along the lines that you did.

Actually only about 40% of national and 25% of regional firms offer COLA, and about 1/3 of those who do have caps. Most said they work to limit relocation costs. So, about 3/4 of all firms have no or limited COLA. I see no indication this would somehow be skewed towards IE and away from Irvine…

Wow, you just confirm every day again and again how dumb real estate agents are. “I know people”, that really puts a lot of substantiation behind your case for COLA.

I’ve asked this before but was told that if something wasn’t done to slow the freefall, we would be much worse off.

I think my original question was would the world have ended if not for government intervention, bailouts and credits.

Someone said it was a necessary evil to prevent an economic meltdown. To all the experts here, would it have been better to just let it all crash quickly?

I don’t think the answer is absolute, but my opinion is that there is something to be said about letting one down easy. But that is with the caveat that eventually we as people need to learn a lesson, and history has shown that slow burn hasn’t taught us anything. So we’ll keep on repeating the same mistakes over and over. As to the permanent impact of intervention on our economy, there may be some but my suspicion is that Asia emergence will have a greater impact than whether we let it burn slow or pull the rug.

There would have been no crash, except for the insolvnet banks, lenders, and institutions. The economy of the US is not dependent upon the banking as the banking system has you believing.

yes just see the great depression thingie. that wasn’t a crash. the WW that was needed to get us out of it wasn’t really a war either.

It’s the other way around, the banking system controls the US economy.

The government should have left it alone. In doing something, they picked winners and loser and decided to interfere in the invisible hand of capitalism.

Banks and owners “won” while renters lost.

if you can’t beat em, join em.

you need better reading comprehension. loanholders lost.

No owners won because housing would be even lower today if not for the government injection of money. The loan holders lost, but they should have lost more.

The purpose of the program was to give money to banks. In that regard, it was a success.

The people would of rebelled if the expressed reason was to give money to the banks.

The reasons that people will support are:

1. Preventing a depression.

2. Helping people keep their homes

3. Helping the misfortunate

The people will not support are:

1. Enriching the banks and Wall Street

2. Removing the liability from the banks and brokers

3. To cause a hidden tax through inflation

4. To stick it to the children, grandchildren and yet to be born.

I really question if the bailout was sucessful in the expressed goals, but am confident that the 4 unexpressed reasons were accomplished or at least in part.

Tax slave and subject.

That is a very good summary.

What-if, in early 2009 and 2010, we did not have those home-buyer credits. And existing home sales continued their free-fall, down to 3M/yr or even lower. We’d have 3-4M more homes on the market than we do currently. Think about the implication of that.

What is really holding the economy back? Housing. Greasing the wheels to get transactions happening again is not the worst thing our gov has done in the past 10 years.

Systems can overshoot on the bottom side of prices just as easily as they can on the high-side. Even at bubble’s peak, prices in a lot of the country were not that far out of line. Letting them fall further, and more out of line than the areas that were just falling to a stable point, would cause significant damage.

The credit was not well targeted. Lots of people got it who would have bought anyway. Lots of people in areas that didn’t especially need it got it. One of the problems with ‘national housing policy’ is that we don’t have a ‘national housing market’. It’s a lot of local markets. What you do to help one market may end up hurting another.

If the housing prices fell, I and hundred of thousand renters and investors would be buying — that’s greasing the wheel. Disposible incomes would increase due to lower rents and housing cost. The losers would be the banks, realtors, mortage brokers and anybody else that collects a fee on the percentage of the house cost or transactions.

The foreclosure pipeline is pretty much full. Had home prices fallen further, you wouldn’t see more homes for sale (and there are plenty – there aren’t a horde of investors everywhere). You would see a lot more strategic default. So you have nobody in Florida paying their mortgage because 75% are deep underwater, and their neighbors feel like chumps.

The argument against the $8k credit is the same as against keeping Fannie around, or having the fed buy mbs’s.

My issue with the credit is that it was poorly targeted. Renters are pretty much forgotten wrt policies like this, and that is a problem.