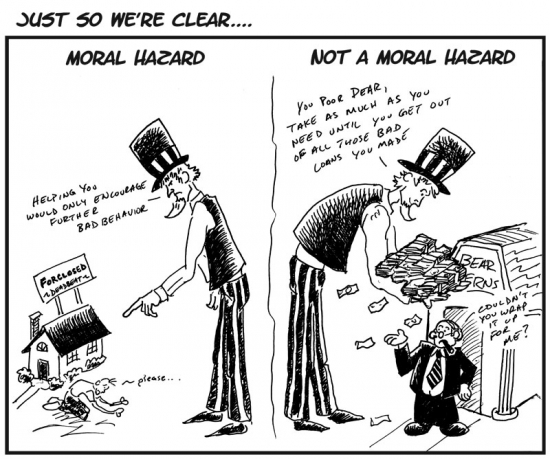

Do policy makers at the Federal Reserve really believe their policies will work, or are they just doing whatever they can to save the banks at the expense of everyone else?

Irvine Home Address … 5242 ROYALE Ave Irvine, CA 92604

Resale Home Price …… $640,000

You take it on the run baby

If that's the way you want it baby

Then I don't want you around

I don't believe it

Not for a minute

You're under the gun so you take it on the run

You're thinking up your white lies

You're putting on your bedroom eyes

You say you're coming home but you won't say when

But I can feel it coming

If you leave tonight keep running

And you need never look back again

REO Speedwaagon — Take It On the Run

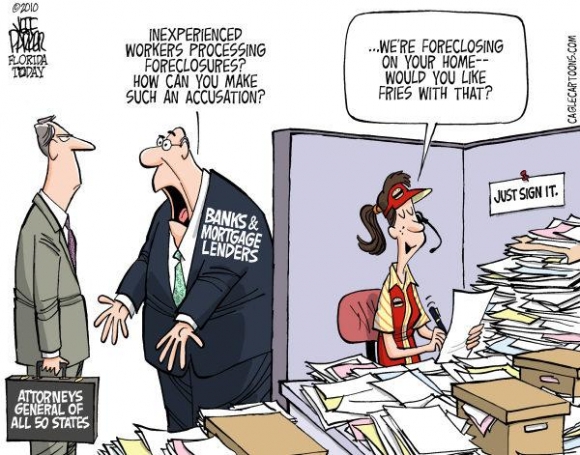

Most of the policy decisions coming out of the Federal Reserve appear as if they are making it up as they go. During 2008 and 2009, some of the emergency lending windows opened at the Fed likely saved the economy from total collapse; however, many of the policy decisions have not been as successful, and the attempt to re-inflate the housing bubble to save bank balance sheets is failing as house prices roll over despite historically low interest rates.

Are the Fed's Honchos Simpletons, Or Are They Just Taking Orders?

(November 1, 2010) — Charles Hugh Smith

Without exception the Fed's policies are pernicious failures; either they are exceptionally thickheaded, or they are just taking orders.

At the risk of boring you with material you already know well, let's quickly cover the Fed's policies and stated goals since the Global Financial Meltdown of late 2008.

The Fed's supposed goal is "get the economy on its feet again" by stabilizing employment and prices. At the risk of sounding naive, we can paraphrase all the Fed's statements thusly: "We're trying to help everyone in the U.S. by fighting this recession."

Sounds noble enough, so let's look at what the Fed has actually done in the real world.

1. The Fed has injected "liquidity" into the banking sector, enabling banks to borrow essentially unlimited sums at essentially zero interest–the infamous ZIRP (zero-interest rate policy).

2. The Fed has pushed down mortgage rates by buying over 10% of all outstanding mortgages in the U.S.–all the toxic garbage loans which the banks were desperate to get off their crippled balance sheets.

3. The Fed has pushed down yields on U.S. Treasury bonds ("monetizing" this newly issued debt) by buying hundreds of billions of dollars of bonds itself.

Much has been made of the latest round of quantitative easing (a fancy term for printing money). That particular policy has caused concerns that inflation is right around the corner. i do believe inflation is going to occur at some point, but not until the Federal Reserve has printed enough money to compensate for the debt destruction that is occurring in residential and commercial loans. The debt creation during the bubble was extremely inflationary as all this new debt inflated massive real estate bubbles in both sectors; however, since the official government compilation of inflation does not include those asset prices, it went unnoticed by the Federal Reserve.

Now that the residential and commercial real estate bubbles are deflating, debt destruction is causing widespread deflation far in excess of the official government measures. This deflation is what is ravaging our economy. Quantitative easing is one method of combating deflation. Basically, you print money to make up for that which was destroyed. To the degree the two cancel each other out, neither deflation or inflation results. Unfortunately, in the real world, the Federal Reserve generally errors to the side of printing which will cause significant inflation once the deflation ceases and the economy improves.

Here is what each program was intended to do:

1. ZIRP and unlimited liquidity was intended to enable the banks to "earn their way back to solvency" by giving them free money which they could then loan out at much higher rates. The difference between zero (their cost) and the interest rate they charged borrowers (such as those wonderful 19% credit cards) was pure profit, courtesy of the Federal Reserve.

This is also theft from savers. The free market would place a value on stored financial reserves, but the Federal Reserve usurps the free market and diverts the return on savings away from savers to the member banks. The inflation that comes at the end of the cycle is a second form of theft from savers we will see when interest rates go back up.

2. The purchase of $1.2 trillion in mortgage-backed securities was intended to stabilize housing and real estate prices at far above their "natural" level set by "organic" supply and demand; in essence, the goal was to stop market prices from "reverting to the mean," i.e. returning to historical trendlines which are roughly equivialent to pre-bubble valuations circa 1997-98.

This was intended to stop the implosion of banks' balance sheets as their assets–all those mortgage-backed securities and derivatives they own–kept falling in value.

It was also intended to stabilize real estate prices so banks could slowly sell off the millions of foreclosed (REO) and defaulted homes they hold in the "shadow inventory" at prices far above where organic supply and demand would let them settle.

We have certainly seen the result of this policy here in Irvine. Our real estate prices have remained elevated far above their natural market levels. Banks are still hoping to unload their shadow inventory when demand increases as the economy improves. I believe we will see the collapse of the real estate cartel and lower prices in Orange County over the next several years.

On the other hand, markets like Las Vegas have over-corrected. Prices there are back at mid 90s levels, and they are likely to stay there for the foreseeable future. The Federal Reserves policy goals have been a failure in Las Vegas.

In the bigger picture, Las Vegas is actually a success of the free market whereas Orange County is a failure. When prices bottom in Las Vegas, the entire housing stock will be affordable, and as normal appreciation resumes, people will again build equity while enjoying the economic stimulus of low housing costs. Contrast that to Orange County where we will likely see slowly grinding downward pricing, no equity, and a moribund economy because so much of the local incomes are going toward debt service. Which market is a success and which is a failure?

As a side benefit, keeping home prices inflated far above their real value would also allow the Fed to dump its own portfolio of $1.2 trillion mortgage-backed securities without suffering catastrophic losses.

Lastly, the goal was to lower the cost of mortgages to such ridiculously low levels that otherwise prudent citizens might be seduced into buying a house "because rates are so low." (Never mind what happens if the house falls another 40% in value over the next few years.)

I freely admit that the low interest rates are certainly enticing me to buy cashflow properties. Of course, I don't believe those properties will fall 40% more in value, and frankly, even if they did, I wouldn't care because i bought them for their current cashflow not their resale value.

The idea was to encourage rampant home buying (for speculation or long-term ownership, it didn't matter) to prop up the market with "demand," even if that "demand" was driven by the low cost of borrowing rather than organic demand based on the need for shelter. (Please recall that there are 19 million vacant dwellings in the U.S. now.)

3. The outright purchase of U.S. Treasury bonds was intended to drop the yield on newly issued bonds to keep the cost of borrowing trillions of dollars for "fiscal stimulus" down so the potential future cost of all the trillions of dollars in new Federal debt would be masked from a credulous citizenry who care more about their entitlements than what happens to their kids and grandkids.

The lack of consideration for future generations is one of the features of the housing bubble I find most distasteful. The generation of owners who still have artificial equity do so at the expense of the next generation who must grossly overpay for housing. It is a transfer of wealth from the young to the old that rivals social security.

4. All the policies led to super-low yields on low-risk investments so that "cash is trash;" that created a powerful incentive to put capital into risk assets such as stocks, commodities and real estate. By explicitly pushing free money and zero-interest rates, the Fed made it impossible to earn any yield on low-risk assets; thus they have been explicitly pushing capital and borrowed money into the "risk trade": emerging markets, commodities, and stocks.

The goal here is to create a new "wealth effect": if another bubble is inflated in stocks and commodities, then owners of capital will feel wealthier and as a result, they will start spending more.

Right now, nobody is penalized for tucking away cash in their mattress.

Are the Fed's honchos really such knuckleheads that they don't know most Americans have no financial assets to boost in a new bubble?

Source: Wealth, Income, and Power.

The top-earning 20 percent of Americans — those making more than $100,000 each year — received 49.4 percent of all income generated in the U.S., com

pared with the 3.4 percent earned by those below the poverty line.

U.S. median household income fell 3 percent in 2009 to $50,221, the second straight annual drop, the Census Bureau said.

One Year Later, No Sign of Improvement in America's Income Inequality Problem:

Income inequality has grown massively since 2000. According to Harvard Magazine, 66% of 2001-2007's income growth went to the top 1% of Americans, while the other 99% of the population got a measly 6% increase.

The Top 5 percent in income earners — those households earning $210,000 or more — account for about one-third of consumer outlays, including spending on goods and services, interest payments on consumer debt and cash gifts, according to an analysis of Federal Reserve data by Moody’s Analytics.

The Fed's central idea was to create a "trickle down" of wealth as a new stock and commodity bubble increased the financial wealth of the top 10%. That idea has demonstrably failed; could the Fed's economic geniuses really be so stupid as to trust in the long-discredited "trickle down" theory that enriching the top tranch will actually benefit the bottom 90%?

What the author fails to recognize is that financial assets are not required to inflate a housing bubble. Copious amounts of debt are all that's required. The middle class proved they could inflate a massive housing bubble and consume any wealth it created by mortgage equity withdrawal.

5. All the policies were designed to flood the economy with new "free" money, thereby sparking inflation and a new round of consumption that would inject "growth" into the economy.

In other words, the "problem" is perceived as sagging asset prices (real estate and the worthless mortgages written on homes that have lost 50% of their value) which have impoverished homeowners and impaired banks' assets.

The Fed's "solution" is to reinflate the housing bubble (or stabilize its collapse) and push investors and speculators alike into risk assets, in the hopes that a new asset bubble somewhere will boost assets enough to create a "feel good" wealth effect which will trigger massive new consumer spending and repair banks' balance sheets with higher asset valuations.

The concept that asset prices are depressed is part of the problem with banks and the Federal Reserve. Most real estate markets — Las Vegas excluded — are not depressed and undervalued even with the dramatic price declines we have seen so far. Prices were previously elevated beyond their fundamental value, and the crash is a return to stable valuation metrics. This conceptual confusion is why the policies of the Federal Reserve have failed.

Put another way, here are the Fed's goals stripped of niceties:

1. Revoke the business cycle–no recessions allowed. In the normal business cycle of classical Capitalism (as opposed to the crony Capitalism we have today), then expansion of credit/debt and rising assets leads to mal-investment and rampant speculation: overbuilding, overcapacity, over-indebtedness and leveraged bets that misprice risk.

Which is precisely what occurred in the 1995-2000 stock market bubble and the 2002-2007 housing/real estate bubble: mal-investment, over-indebtedness, overbuilding and mispricing of risk on a grand, unprecedented scale.

In the normal scheme of things, all this bad debt would be written off and the assets would be sold/liquidated. Holders of those assets and the debt based on those assets would both suffer losses or even be wiped out. All the overbuilt properties and overcapacity would be sold for pennies on the dollar, and the liabilities (debt) wiped off the balance sheet along with all the inflated assets.

That is a great description of how free markets are supposed to work. Recessions are how free markets purge their excesses. Foolish business plans and excessively leveraged speculative bets are wiped out and capital is redistributed to where it can be used more efficiently. Keeping capital tied up in unproductive assets hinders economic growth and creates the malaise we experience today.

There is no other way to clear the market for future growth. Yet the Fed has pursued a "solution" that violates all the principles of Capitalism: to reinflate asset bubbles or keep them artificially high by injecting more credit/debt into the system.

In other words, if you can't service your current debt and you're insolvent because your assets have declined, then the Fed's "solution" is to give you free money to roll over into a bigger debt load and boost the risk-asset trade so the assets on your books will rise again, "solving" your insolvency.

Do you see the foolishness of this approach? You can't borrow your way out of debt.

Does anyone at the Fed really believe this will work , or are they just thick? Or even worse, are they just lackeys taking orders from Wall Street and the Financial Power Elites?

You cannot eliminate the consequences of speculative bad bets and over-indebtedness with more debt and more speculation, yet that is precisely the intent of all the Fed's policies.

The Fed's unprecedented purchase of mortgages and Treasury debt have indeed reinflated the stock and housing bubbles to a limited degree, but most of that free money has flowed into emerging markets and commodities, which are now in their own massive bubbles.

In yet another pernicious consequence, the Fed's bumbling attempts to create inflation in the U.S. have failed–the inflation is raging in China. And as inflation rages there, then the cost of Chinese goods in the U.S. will rise.

Is there any possible way to fail more spectacularly that the Fed? Instead of sparking "good inflation" in the U.S. which they presumed (thickheadedly) would boost wages along with prices, thus enabling debt-serfs to pay down their debts with "cheaper" money, they have sparked runaway asset bubbles in commodities and "bad" inflation in China, which means the cost of goods the debt-serfs need to survive is skyrocketing while their wages and income stagnate.

In other words, the policies of the Fed have completely backfired in terms of "helping" 90% of the citizenry. The "wealth effect" of rising stock prices failed to boost the spirits and balance sheets of the bottom 90% who have essentially no financial capital, average incomes have declined in the recession and yet prices for commodities are climbing.

The Fed's policies have created the worst-case scenario for the average American household: stagnant income and rising prices of essentials. The problem is demand is falling along with net incomes, not the supply of new debt. By raising the costs of commodities, the Fed is actually reducing the net disposable income of households: the reverse of the "wealth effect."

Rather than allow the economy to clear out bad debt and re-set asset prices that would enable organic growth, the Fed has tried to inflate new asset bubbles to save the Financial Power Elites from suffering the losses resulting from the last two bubbles popping.

I have stated on many occasions that I believe the end game is price inflation without wage inflation that will cause a decline in our standard of living. Everyone who is bullish on real estate believes inflation is coming and it will push real estate prices higher. The Federal Reserve's printing money will eventually ignite inflation. I agree with the bulls on that point; however, the inflation in prices will not be accompanied by inflation in wages, something required for house prices to go up. How does the Federal Reserve create wage inflation with chronic high unemployment? They can't. That is why house prices will not be going up any time soon.

It's as if the fever the patient needs to wipe out a deadly infection has been suppressed by the Fed, creating the illusion of "health" even as the infection destroys the patient from within.

2. "Save" Wall Street, the banks, the nation's Financial Power Elites and the nation's homeowners by blowing new asset bubbles with massive injections of free money and the bogus "demand" created by the Fed's own purchases. The dynamic has already been explained above: cover the losses of the last bubble imploding by blowing an even bigger bubble now that boosts the asset side of balance sheets.

Do the Fed's honchos really think there is another end-game here other than the collapse of their latest ZIRP-QE2-driven asset bubbles? Could they really be so blind, so stupid, so misinformed, so ignorant of reality and history, as to believe their policies will actually work?

Are they so detached from reality that they fail to see their policies are backfiring, further impoverishing most of the citizenry as they set up the inevitable collapse of the banks they have tried so hard to save?

Are they really simpletons, or are they just taking orders from the Financial Elites who have the most to lose when the whole sagging sandcastle finally collapses into the waves?

I think they really believe their policies will work. I also think they are mistaken.

Personally, I plan to load up on 4% debt to buy cashflow properties. If I am paying 4% in an inflationary environment where inflation exceeds 4%, I am paying back the debt with dollars declining in value at a rate higher than my interest rate. in other words, they will be paying me to keep the debt alive. This works great for cashflow properties, but not so well for speculative bets on price appreciation because higher inflation — absent wage inflation — and higher interest rates makes borrowing more expensive and reduces loan balances which hinders appreciation.

Cashflow will be the only way to make money in real estate for the next decade or more just like it was in the 90s.

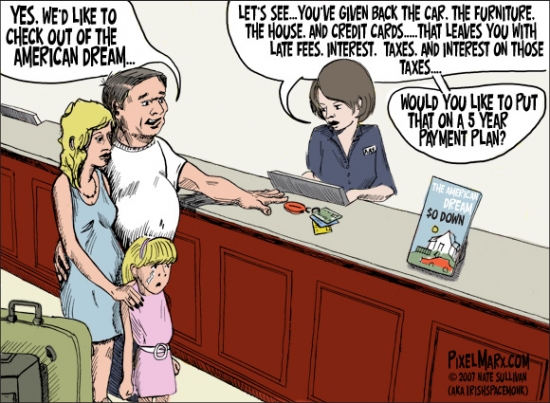

Thinking up their white lies

I've often wondered what long term loan owners tell their families when they finally implode. How do people explain to their friends and relatives that they borrowed more than double what they paid for their house years ago, blew the money, and then lost their family home? It must be an interesting yarn.

- The owners of today's featured property paid $438,000 on 12/18/2000. They used a $365,000 first mortgage, a $36,500 second mortgage, and a $36,500 down payment.

- On 2/20/2003 they refinanced the first mortgage for $322,700. For the first two years, they were going the right direction, but then they tasted a bit of kool aid, and everything went poorly from this point forward.

- On 5/28/2003 they obtained a HELOC for $30,000.

- On 12/30/2003 they refinanced with a $359,400 first mortgage.

- On 3/17/2004 they got a HELOC for $115,000.

- On 7/28/2004 they refinanced with a $376,800 first mortgage and went Ponzi.

- On 1/25/2005 they refinanced the first mortgage for $524,000.

-

On 5/31/2006 they refinanced with a $640,000 Option ARM with a 1% teaser rate.

- On 6/11/2007 they refinanced with a $656,000 first mortgage and a $40,000 stand-alone second.

- Total property debt is $696,000.

- Total mortgage equity withdrawal is $294,500 including their down payment.

- Total squatting time is 18 months.

Foreclosure Record

Recording Date: 07/01/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 07/15/2009

Document Type: Notice of Default

Seriously, how do people explain this behavior? Is it possible to dodge the question at family gatherings?

Irvine Home Address … 5242 ROYALE Ave Irvine, CA 92604 ![]()

Resale Home Price … $640,000

Home Purchase Price … $438,000

Home Purchase Date …. 12/18/2000

Net Gain (Loss) ………. $163,600

Percent Change ………. 37.4%

Annual Appreciation … 3.8%

Cost of Ownership

————————————————-

$640,000 ………. Asking Price

$128,000 ………. 20% Down Conventional

4.29% …………… Mortgage Interest Rate

$512,000 ………. 30-Year Mortgage

$122,018 ………. Income Requirement

$2,531 ………. Monthly Mortgage Payment

$555 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$53 ………. Homeowners Insurance

$0 ………. Homeowners Association Fees

============================================.jpg)

$3,139 ………. Monthly Cash Outlays

-$417 ………. Tax Savings (% of Interest and Property Tax)

-$700 ………. Equity Hidden in Payment

$198 ………. Lost Income to Down Payment (net of taxes)

$80 ………. Maintenance and Replacement Reserves

============================================

$2,299 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,400 ………. Furnishing and Move In @1%

$6,400 ………. Closing Costs @1%

$5,120 ………… Interest Points @1% of Loan

$128,000 ………. Down Payment

============================================

$145,920 ………. Total Cash Costs

$35,200 ………… Emergency Cash Reserves

============================================

$181,120 ………. Total Savings Needed

Property Details for 5242 ROYALE Ave Irvine, CA 92604

——————————————————————————

Beds: : 4

Baths: : 3

Sq. Ft.: : 2011

$0,318

Lot Size: : 6,000 Sq. Ft.

Property Type:: Residential, Single Family

Style:: One Level, Ranch

View:: Faces Northeast

Year Built: : 1969

Community: : El Camino Real

MLS#: : P758091

Source: : CARETS

——————————————————————————

Charming 4 bedroom 3 bath home in the Ranch. Tastefully updated and well maintained. Granite counters in kitchen and bathrooms. Laminate flooring, crown molding, plantation shutters in kitchen, living room and family room. Dual pane windows. Mahogany front door. 2 car garage. Backyard has a pool, patio with awning, and gazebo. No HOA dues.

I hope you have enjoyed this week, and thank you for reading the Irvine Housing Blog: astutely observing the Irvine home market and combating California Kool-Aid since 2006.

Have a great weekend,

Irvine Renter

.jpg)

.jpg)

.jpg)