No matter how you look at home price data, it is simply too high to be sustained in Orange County.

Irvine Home Address … 25 TAROCCO 25 Irvine, CA 92618

Resale Home Price …… $282,500

.jpg)

She lives in a fairy tale

Somewhere too far for us to find

Forgotten the taste and smell

Of the world that she's left behind

Keep your feet on the ground

When your head's in the clouds

Well go get your shovel

And we'll dig a deep hole

To bury the castle

Paramore — Brick By Boring Brick

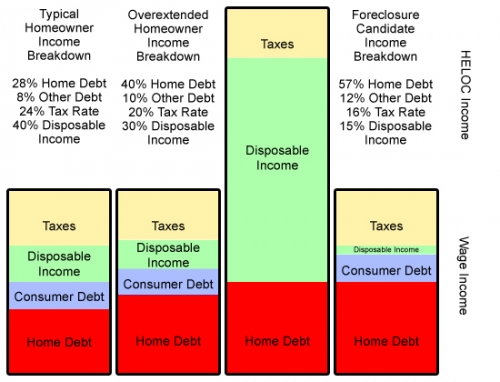

California home buyers live in a fairytale world where house prices go up forever and provide them with endless spending money. It's a seductive tale, and many people put their heads in the clouds (or is it up their a$$), live the fairytale and borrow and spend themselves into oblivion. It doesn't matter how much you pay as long as someone else has to pay the bills.

O.C. home prices still triple U.S. costs

December 1st, 2010, 1:00 am — posted by Jon Lansner

Despite horrific drops in the values of Orange County housing, a local home still practically costs what three typical American homes go for. Yes, one home here or three somewhere near Main Street U.S.A.

That’s one measure of local affordability, on a national scale. Just ponder fresh National Association of Realtors’ home price data for metropolitan areas: A typical Orange County house sold in the third quarter (median selling price: $508,400), cost 2.86 times the median-priced American home (cost: $177,900 in the third quarter!)

It’s equally troubling in a historic context: This Orange County premium remains higher now that it was in 1989 — the peak of the previous run-up in local housing prices.

Let's be clear about what is not happening here: There is not premium for a premium. There is a premium for Orange County real estate compared to the rest of the nation because Orange County residents have higher incomes. However, the premium on the premium paid by Orange County loan owners is causesd by people foolishly over-extending themselves to capture appreciation caused by people foolishly over-extending themselves. It is a self-reinforcing delusion punctuated by periods of steep declines when reality becomes unavoidable.

To be fair, this “Orange County premium” peaked at 3.42 American homes for one Orange County house in 2004. A 19% drop in local prices vs. a 3% drop nationally in the ensuing six years help narrow the local-vs.-national pricing gap.

So, the big question: Is the premium “worth it?” The math suggests that O.C.’s weather, culture and usually above-average salaries — and usually a good job market — supports pricier local housing.

Yes, local imcomes support higher prices, but only to the degree that incomes are higher than other areas. The rest is foolishness and kool aid intoxication.

And since 1982, local housing on average has costs double — eh, 2.38 times to be exact — to buy here compared to that mythical median-price American house.

Current economic weakness, no less some major challenges and the local and state level, bring the size of the premium deserved by Orange County housing into question for the future. Remember, one way to increase demand for housing is to be an attractive draw for out-of-towners seeking new employment of lifestyle.

Who is going to come to Orange County and pay these bloated prices? What high-paying business is going to expand here given the high home prices, high commercial rents, high state taxes, and dysfunctional state government that continually enacts business-unfriendly legislation? And what high wage earners are going to come here so they can pay more taxes and spend 40% or more of their income to live in a house half as nice as what they left behind?

Despite claims to the contrary put forth in the comments, house prices here are not justified by local incomes….

O.C. homes: 4th costliest vs. income

November 22nd, 2010, 9:30 am — posted by Jon Lansner

The price of entry to Orange County remains high.

| Metro | Price | Income | Ratio |

|---|---|---|---|

| Honolulu | $621,000 | $83,600 | 7.4 |

| San Francisco | $725,000 | $101,000 | 7.2 |

| New York-NJ | $420,000 | $64,700 | 6.5 |

| O.C. | $530,000 | $83,600 | 6.3 |

| Santa Cruz | $502,000 | $84,000 | 6.0 |

| Los Angeles | $353,000 | $61,200 | 5.8 |

| San Jose | $575,000 | $100,400 | 5.7 |

| San Luis Obispo | $380,000 | $69,800 | 5.4 |

| San Diego | $390,000 | $74,100 | 5.3 |

| Oxnard | $413,000 | $86,300 | 4.8 |

| Nation | Price | Income | Ratio |

| U.S. | $177,000 | $62,000 | 2.9 |

| Metro | Price | Income | Ratio |

| Springfield, IL | $116,000 | $74,100 | 1.6 |

| Utica-Rome, NY | $90,000 | $57,800 | 1.6 |

| Grand Rapids, MI | $91,000 | $58,900 | 1.5 |

| Elmira, NY | $85,000 | $58,600 | 1.5 |

| Battle Creek, MI | $81,000 | $56,900 | 1.4 |

| South Bend, IN | $70,000 | $53,600 | 1.3 |

| Decatur, IL | $73,000 | $57,600 | 1.3 |

| Saginaw, MI | $61,000 | $49,500 | 1.2 |

| Detroit | $52,000 | $52,000 | 1.0 |

| Monroe, MI | $63,000 | $63,900 | 1.0 |

Here’s another measure showing that despite steep price declines, Orange County homes are still costly compared to the rest of the nation — especially when local incomes are figured in!

FiServ’s recent home-price outlook contained intriguing stats on 212 markets and the relationship between the median selling price of homes (for second quarter 2010) in major metropolitan areas across the nation and the local household median incomes from 2009.

What did FiServ find?

- In Orange County homes sold for 6.3 times the median family income.

- That’s a little more than double the nationwide median of 2.9 years worth of income vs. median home prices.

- Orange County ranks as the fourth-highest cost ratio of the 212 markets tracked.

- California dominated the 10 costliest list with 8; only Honolulu (No. 1) and New York (No. 3) were from outside the Golden State.

- Where’s the “cheapest” housing by this measure? Five of the 10 at the bottom are from Michigan — including Detroit at one year’s salary for a home!

Orange County residents put twice as much of their wage income toward housing than do people living in the rest of the country. Why is that? They do because they think they will get rich owning California real estate. It is foolishness on a grand scale.

Some have argued that housing is scarce, therefore, people are bidding up prices to get whatever is available. If that were true, rents would be correspondingly high. Rents do not support local pricing.

O.C. homes SoCal’s priciest vs. renting

December 2nd, 2010, 4:48 pm — posted by Jon Lansner

Orange County homes are far pricier than most of the housing in Southern California when compared to respective rents in the 7-county area.

County Ratio Year Change

O.C. 302 +6%

Santa Barbara 297 +19%

Ventura 259 -2%

San Diego 235 +3%

L.A. 210 +5%

Riverside 183 +15%

San Bernardino 141 +13%

All SoCal 212 +8%

That’s the conclusion of fresh statistics from the Real Estate Research Council of Southern California that involved the age-old buy-or-rent debate.

The council’s math compared median selling prices by county from DataQuick and average asking rents from RealFacts. For the third quarter, Orange County home-sale prices were 302 times local monthly rents — a cost ratio 42% higher than the regional average and the highest of the seven SoCal counties tracked.

Orange County has been the region’s priciest place to own a home by this math since the first quarter of 2008 when Santa Barbara County was tops. In the third quarter, Santa Barbara was second priciest by this measure, with its median sale prices 297 times typical monthly rents.

By this math, renting looked a bit better in the third quarter vs. the previosu three months as the ownehsip cost index rose 6% in Oraneg County and 8% regionwide.

Yet, clearly, tumbling home-sale prices has helped narrow the buy-to-rent gap in recent years. Since the cyclical peak for this ownership-cost ratio five years ago, the Orange County buy-to-rent ratio has fallen 34% while the regional ratio is off 41%.

So Orange County loan owners pay far more for housing as a percentage of their incomes, and they pay far more than is justified by the local rents. So what happens when reality catches up the fantasies of appreciation?

High-end homesellers cut prices sharply

December 1st, 2010, 12:36 pm — posted by Jon Lansner

Sellers of Orange County’s upper-crust properties are doing the deepest discounting.

Recent stats from HousingTracker.net — which tracks prices of homes listing for sale in brokers’ MLS system — show:

- At the 75th percentile — the midpoint by price of the upper half of homes listed – Orange County’s asking price in November ran $694,833 – that is down 2.9% vs. the previous month and off 9.8% vs. the year earlier. This marker for Orange County’s higher-priced homes has fallen on a year-over-year basis for eight consecutive months.

- At the 25th percentile — the midpoint of the lower half of homes listed – the asking price in November ran $299,940 – that is -2.2% vs. the previous month and 0.1% vs. the year earlier. This marker for Orange County’s cheaper homes has risen on a year-over-year basis for a year. (Arguably, an 0.1% gain isn’t much of an advance!)

- The changing fortunes of these two niches puts the pricing gap between top and bottom at 122% — or $365,840 — the thinnest difference in listing prices between high and low ends since April 2008.

- This gap was at its peak at 167% — or $500,000 — as recently as August 2009. Since then the “bottom” pricing — the 25th percentile — has been flat while the top’s asking prices — the 75th percentile — dropped 16%!

By the way, the actual median listing price — the 50th percentile — for November was $432,600, down 3.2% in a month and down 3.8% in a year.

The downward trend in asking prices for high-end properties is unmistakable. It will also continue for the foreseeable future because prices are way, way too high. Once the banks get around to foreclosing on the squatters in more expensive homes, inventory will swell further and prices will continue their descent.

Condo values and volatility

One of the more obvious signs that real estate was in a bubble was the price change and price levels of condominiums. Condo values are historically the most volatile. These are typically undesirable or semi-desirable properties, but once kool aid intoxication takes over and lenders fuel the flames with cheap debt, prices really catch fire.

All real estate is valuable in a housing bubble because appreciation rewards everyone. Since condos are relatively inexpensive, it is an easy way for the small-time specuvestor to play the game. The demand for these assets rises to the limit of lender folly during the boom, and it falls to its utilitarian value during a bust. Since people prefer larger detached properties, condos have limited utility, and prices fall precipitously.

It is truly astonishing what people were willing to pay for old, fee-laden, and cramped condos in Irvine. Today's featured property was purchased for $410,000 on 3/23/2006. It was probably a bargain at the time considering it has two bedrooms. There were some one-bedroom units that sold for over $400,000 in Irvine at the peak. The owners used a $328,000 first mortgage, a $82,000 HELOC, and a $0 down payment.

They quit paying the mortgage sometime in early 2009.

Foreclosure Record

Recording Date: 08/20/2009

Document Type: Notice of Default

Since this property is empty, the bank is in no hurry to foreclose. Instead after almost 500 days on the market, it dances to the tune of amend-extend-pretend.

Irvine Home Address … 25 TAROCCO 25 Irvine, CA 92618 ![]()

Resale Home Price … $282,500

Home Purchase Price … $410,000

Home Purchase Date …. 5/23/2006

Net Gain (Loss) ………. $(144,450)

Percent Change ………. -35.2%

Annual Appreciation … -8.1%

Cost of Ownership

————————————————-

$282,500 ………. Asking Price

$9,888 ………. 3.5% Down FHA Financing

4.55% …………… Mortgage Interest Rate

$272,613 ………. 30-Year Mortgage

$55,535 ………. Income Requirement

$1,389 ………. Monthly Mortgage Payment

$245 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$47 ………. Homeowners Insurance

$370 ………. Homeowners Association Fees

============================================

$2,051 ………. Monthly Cash Outlays

-$128 ………. Tax Savings (% of Interest and Property Tax)

-$356 ………. Equity Hidden in Payment

$17 ………. Lost Income to Down Payment (net of taxes)

$35 ………. Maintenance and Replacement Reserves

============================================

$1,620 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,825 ………. Furnishing and Move In @1%

$2,825 ………. Closing Costs @1%

$2,726 ………… Interest Points @1% of Loan

$9,888 ………. Down Payment

============================================

$18,264 ………. Total Cash Costs

$24,800 ………… Emergency Cash Reserves

============================================

$43,064 ………. Total Savings Needed

Property Details for 25 TAROCCO 25 Irvine, CA 92618

——————————————————————————

Beds: 2

Baths: 1 full 1 part baths

Home size: 995 sq ft

($284 / sq ft)

Lot Size: n/a

Year Built: 1983

Days on Market: 493

Listing Updated: 40455

MLS Number: P696563

Property Type: Condominium, Residential

Community: Orangetree

Tract: Othr

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

SHORT SALE APPROVED FOR $295,000 BUT 2ND LIEN HOLDER IS STILL CRUNCHING NUMBERS ON WHAT THEY WILL ACCEPT TO RELEASE LIEN. MOTIVATED SELLER. Beautiful, bright and airy 2- bed / 1.5 Ba COndo, Upper-Corner unit. Great Location, walking distance to Irvine Valley Community College. SUBMIT ALL REASONABLE OFFERS. SELLER WILL GIVE EACH OFFER SERIOUS CONSIDERATION.

2ND LIEN HOLDER IS STILL CRUNCHING NUMBERS ON WHAT THEY WILL ACCEPT TO RELEASE LIEN — That is the story will all short sales. Short sales are primarily a negotiation between the delinquent borrower and the second lien holder. It's the main reason short sales take forever and rarely transact.

I hope you have enjoyed this week, and thank you for reading the Irvine Housing Blog: astutely observing the Irvine home market and combating California Kool-Aid since 2006.

Have a great weekend,

Irvine Renter

.jpg)

.jpg)