When faced with an insolvent and bankrupt banking sector, Iceland chose to let them fail. Now while we are struggling, Iceland is recovering. We should have let our banks fail too.

Irvine Home Address … 146 ORANGE BLOSSOM #116 Irvine, CA 92618

Resale Home Price …… $169,000

Bleak church on a cold tundra

Mountain-glacier-glacier-glacier-stream

Black stone beach and a black death bottle

Is all me and my baby'll need

In the tropical, tropical

Tropical ice-land

The Fiery Furnaces — Tropical Iceland

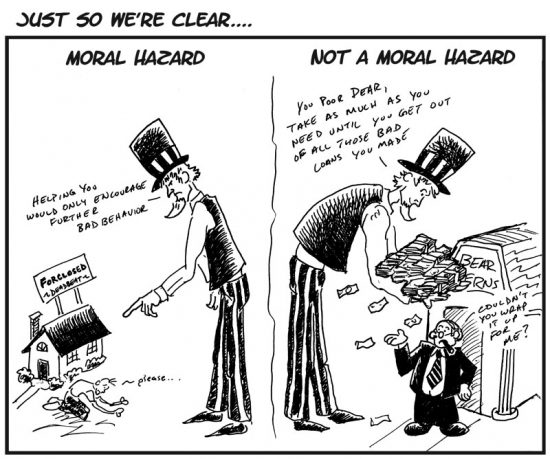

I believe we should have let our too-big-to-fail banks go bankrupt. Many have contended this would have created a global catastrophe of some sort, but I rather doubt it. In reality, a bunch of bondholders and shareholders would have lost a great deal of money, but life would have gone on. The government could have recapitalized the banking system and sold the stock for a profit when the economy recovered. In the end, we bailed out a group of people who should have lost money, and crippled our economy.

Would the recession of 2008 have been worse if we let our banks fail? Sure. It would have been very painful, but it also would have been over. It's better to take a band aid off quickly and get the pain over with quickly than endure the slow bleed we are now. I'm not the only one who believes this to be true.

Key lesson from Iceland crisis is 'let banks fail'

By Haukur Holm | AFP – Sat, Nov 5, 2011

Three years after Iceland's banks collapsed and the country teetered on the brink, its economy is recovering, proof that governments should let failing lenders go bust and protect taxpayers, analysts say.

The North Atlantic island saw its three biggest banks go belly-up in the October 2008 as its overstretched financial sector collapsed under the weight of the global crisis sparked by the crash of US investment giant Lehman Brothers.

The banks became insolvent within a matter of weeks and Reykjavik was forced to let them fail and seek a $2.25 billion bailout from the International Monetary Fund.

After three years of harsh austerity measures, the country's economy is now showing signs of health despite the current global financial and economic crisis that has Greece verging on default and other eurozone states under pressure.

“The lesson that could be learned from Iceland's way of handling its crisis is that it is important to shield taxpayers and government finances from bearing the cost of a financial crisis to the extent possible,” Islandsbanki analyst Jon Bjarki Bentsson told AFP.

Iceland refused to have taxpayers absorb the private losses. They endured a brief period of severe economic contraction, but now its over. The taxpayers don't have a lingering debt, and the economy is recovering more robustly than countries which chose to bail out their banks.

“Even if our way of dealing with the crisis was not by choice but due to the inability of the government to support the banks back in 2008 due to their size relative to the economy, this has turned out relatively well for us,” Bentsson said.

Iceland's banking sector had assets worth 11 times the country's total gross domestic product (GDP) at their peak.

Iceland bailing out the banks was never an option because the problem was too big. It turned out to be a blessing for them. Rather than be saddled with a generation of debt, the Icelandic taxpayers have a clean slate. What do we have? How many trillions of dollars will this cost us?

Iceland bailing out the banks was never an option because the problem was too big. It turned out to be a blessing for them. Rather than be saddled with a generation of debt, the Icelandic taxpayers have a clean slate. What do we have? How many trillions of dollars will this cost us?

Nobel Prize-winning US economist Paul Krugman echoed Bentsson.

“Where everyone else bailed out the bankers and made the public pay the price, Iceland let the banks go bust and actually expanded its social safety net,” he wrote in a recent commentary in the New York Times.

“Where everyone else was fixated on trying to placate international investors, Iceland imposed temporary controls on the movement of capital to give itself room to maneuver,” he said.

That's an accurate description of what happened. Iceland bailed out Main Street while allowing their Wall Street to go belly up, and they are better off for it.

During a visit to Reykjavik last week, Krugman also said Iceland has the krona to thank for its recovery, warning against the notion that adopting the euro can protect against economic imbalances.

The problem Greece, Italy, Spain and Portugal are having is caused by their being the in Euro. If they still had their own currencies, they would print their way out of debt and inflate away the problem. The resulting decrease in the value of their currency would boost their exports and rebalance their economy. It's what we will ultimately do to correct the problem too. Notice nobody is talking about austerity here in the US.

“Iceland's economic rebound shows the advantages of being outside the euro. This notion that by joining the euro you would be safe would come as news to the Spaniards,” he said, referring to one of the key eurozone states struggling to put its public finances in order.

Iceland's example cannot be directly compared to the dramatic problems currently seen in Greece or Italy, however.

“The big difference between Greece, Italy, etc at the moment and Iceland back in 2008 is that the latter was a banking crisis caused by the collapse of an oversized banking sector while the former is the result of a sovereign debt crisis that has spilled over into the European banking sector,” Bentsson said.

“In Iceland, the government was actually in a sound position debt-wise before the crisis.”

We were running a large deficit due to Bush's policies, so our government wasn't as healthy as it was when Clinton left office, but we could have chosen to allow the banks to fail and recapitalized the system. We didn't have a soverign debt problem until we decided to absorb the banking sector losses and run up a massive debt (thank you Obama).

Iceland's former prime minister Geir Haarde, in power during the 2008 meltdown and currently facing trial over his handling of the crisis, has insisted his government did the right thing early on by letting the banks fail and making creditors carry the losses.

“We saved the country from going bankrupt,” Haarde, 68, told AFP in an interview in July.

Haarde was absolutely correct. I wish Bush would have had the courage to be a Republican back in 2008 and let the free market work. Instead, Bush chose to socialize the losses. Karl Marx would have been proud.

“That is evident if you look at our situation now and you compare it to Ireland or not to mention Greece,” he said, adding that the two debt-wracked EU countries “made mistakes that we did not make … We did not guarantee the external debts of the banking system.“

Like Ireland and Latvia, also rescued by international bailout packages and now in recovery, Iceland implemented strict austerity measures and is now reaping the fruits of its efforts.

So much so that its central bank on Wednesday raised its key interest rate by a quarter point to 4.75 percent, in sharp contrast to most other developed countries which have slashed their borrowing costs amid the current crises.

Iceland devalued its currency, rebalanced its flow of funds, and now they can raise interest rates to stabilize its currency and continue with their economic recovery.

It said economic growth in the first half of 2011 was 2.5 percent and was forecast to be just over 3.0 percent for the year as a whole.

David Stefansson, a research analyst at Arion Bank, told AFP Iceland hiked its rates because it “is in a different place in the economic (cycle) than other countries.

“The central bank thinks that other central banks in similar circumstances can afford to keep interest rates low, and even lower them, because expected inflation abroad is in general quite (a bit) lower,” he said.

Iceland has hit bottom and is recovering because they made a different decision than we did in 2008. We should have let the banks fail, nationalized them, recapitalized the system and endured the pain. We would be much better off now if we had.

Five years and 50% off

Back in 2007 I predicted Irvine house prices would falter by 39%. Some would fall more and some would fall less. Today's featured property is one that fell more.

The loan owners of today's featured property paid $326,000 using a $309,700 first mortgage and a $15,300 down payment. They refinanced on 2/22/2007 for $320,000 and got all but $6,000 of their down payment back.

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 146 ORANGE BLOSSOM #116 Irvine, CA 92618

Resale House Price …… $169,000

Beds: 1

Baths: 1

Sq. Ft.: 739

$229/SF

Property Type: Residential, Condominium

Style: One Level, Contemporary

View: Creek/Stream

Year Built: 1976

Community: Orangetree

County: Orange

MLS#: S679048

Source: CRMLS

On Redfin: 5 days

——————————————————————————

Standard sale . Tranquality awaits you at this charming turn-key home with patio overlooking a peacful stream and lush grounds. Minute to Irvinespectrum. one bedroom condo located close to Irvine vally collage. This condo has loundry inside and installed shelves in living room.

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis ![]()

Resale Home Price …… $169,000

House Purchase Price … $326,000

House Purchase Date …. 1/12/2006

Net Gain (Loss) ………. ($167,140)

Percent Change ………. -51.3%

Annual Appreciation … -10.8%

Cost of Home Ownership

————————————————-

$169,000 ………. Asking Price

$5,915 ………. 3.5% Down FHA Financing

4.06% …………… Mortgage Interest Rate

$163,085 ………. 30-Year Mortgage

$55,102 ………. Income Requirement

$784 ………. Monthly Mortgage Payment

$146 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$35 ………. Homeowners Insurance (@ 0.25%)

$188 ………. Private Mortgage Insurance

$270 ………. Homeowners Association Fees

============================================

$1423 ………. Monthly Cash Outlays

-$70 ………. Tax Savings (% of Interest and Property Tax)

-$232 ………. Equity Hidden in Payment (Amortization)

$8 ………. Lost Income to Down Payment (net of taxes)

$41 ………. Maintenance and Replacement Reserves

============================================

$1,171 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$1,690 ………. Furnishing and Move In @1%

$1,690 ………. Closing Costs @1%

$1,631 ………. Interest Points

$5,915 ………. Down Payment

============================================

$10,926 ………. Total Cash Costs

$17,900 ………… Emergency Cash Reserves

============================================

$28,826 ………. Total Savings Needed

——————————————————————————————————————————————————-

Short-Sale and REO Workshop

Tonight is the night.

Shevy Akason and Larry Roberts will host a short sale and REO workshop at 6:30 PM Wednesday, November 16, 2011, at the offices of Intercap Lending (9401 Jeronimo, Suite 200, Irvine, CA 92618).

Gingrich Said to Be Paid $1.6M by Freddie Mac

http://www.bloomberg.com/news/2011-11-16/gingrich-said-to-be-paid-at-least-1-6-million-by-freddie-mac.html

This was for “consulting” work. You could have had the chimps at the zoo doing consulting there and paid them with bananas and came up with the same result.

The Occupy movement needs to target places like Fannie and Freddie. They are disgusting organizations to say the least!

I’ve occupied my local CREDIT UNION, no bank use.

I’ve occupied my WALLET, with CASH, no credit cards, no free fees to pay porn surfer salaries.

I’ve occupied JURIES, with not guilty findings in order to obtain justice for all War on Drug political prisoners.

I’ve occupied my MEDICINE with purchases from companies outside the U.S. and using holistic and natural remedies.

I’ve occupied my PURCHASING by buying “Made in America” wherever possible.

The movement is growing and I hope it changes the way the system is run. For me, I’m changing the way MY system is run.

According to the IMF by way of Wikipedia, Iceland’s GDP in 2010 was $12.6 billion. The US’s GDP was $14,526.6 billion. So that is 0.087% of the US economy.

What is the GDP of Orange County?

Krugman’s article mentions that their 3 biggest banks failed… So far in 2011 the FDIC closed 88 banks in the US.

I’d be wary of drawing too big of a conclusion based on Iceland’s experience.

And while their tax payers avoided being stuck with a lot of the bill… The IMF did pony up 2.5 Billion.

GDP of Iceland $12.6 Billion

GDP of US $14,526.6 Billion

Iceland economy is roughly 0.087% the size of the US’s

Krugman mentions that 3 of their biggest banks failed. In 2011, the FDIC

has closed 88 banks.

I’d be wary of extrapolating too much from that comparison.

And while the Icelandic tax payers did not have to fund the bailout, the

IMF did kick in a $2.5 billion bailout package. I don’t think the US

could expect a proportional response from the IMF.

What is the “GDP” of Orange County vs Iceland? Population of Iceland is roughly 317,000. (2010) Population of Orange County is 3,010,000 (2008)

No one knows how a tanking of the European banking system could destroy the economy of the world. If we knew I would be the first to say let them all fail together.

But we don’t know, we just don’t know. And failure could destroy the 30 year fixed. That could really be problematic. The banksters want to do away with it anyway if they don’t get guarantees on all mortgages. That guarantee coupled with massive easy money could be a big problem going forward. We will see.

According to Michael Lewis’s recently released book “Boomerang”, “flyover” is correct…

Population of Iceland is about 300,000 folks

About the size of Peoria, Illinois

Nearly only economy is based on fishing

Suffered $100 Billion in banking losses + tens of billions of $’s in personal losses

How did this happen? Fishermen began speculating on foreign currency. Much easier money than fishing in the cold north Atlantic. They borrowed yen and Swiss francs, paid 3% on the yen and made a bundle against the krona. It built, and built. Now many young Icelanders own $500,000 houses with $1.5 million mortgages, $35,000 Range Rovers with $100,000 in loans against them. The problem was that their outrageous speculation not only involved their banks, but lots of European banks as well.

It’s the same ol’ story, no? We (people in general) want to make the most amount of money with the least amount of effort. “Get Rich Quick” schemes will always find marks.

Yes, “Get Rich Quick” schemes will always be around. But the question is, How does the World Economy protect itself against major distruptions caused by a very few individuals? How is it that a country with a population of only 300,000 folks could cause a near collapse of the international banking system?

If most Americans still harbor any illusions as to our ‘dominance’ in the world, the Iceland case history should quickly dispell that. We are a global economy, like it or not. And that will probably never change. So what can we, individually or collectively, do to protect ourselves? Elect a president who says things like “nein, nein, nein” and “uze-bec-e-bec-e-bec-stan-stan”, or a lobbiest, or one who only wants to drill, baby drill….or senators who log-gam Congress with their personal agenda? Get rich quick schemes usually only affect a small number of dupes. We are Way Beyond that.

I don’t think comparing the US Economy to Iceland’s Economy to be fair….

Not sure the same methods would work in Iceland as the U.S. No country is dependent on Iceland…

The world DEPENDS on the U.S. to be a functioning non-bankrupt economy… If the US let the big banks fail… The Big Banks might have taken down the world..

At the very least… The Big Banks could have shut off all ATMs for a week or so…

Can’t totally blame the government.. They were literally held hostage by the big banks. It was economic terrorism.. and the US negotiated with the terrorists.

Whether than was good or not.. who knows… Many people might have died had they not negotiated.

“Iceland”….doesn’t the World depend on European banks? Not US Banks….Oh, for sure, US Banks are completely involved in world banking…but it is events in Europe that are making our stock market look like the Rocky Mountains.

Couple of points:

1) Yes, Iceland’s 3 big banks went belly up. But foreign banks are still trying to get Iceland to pay up as much as possible. This story is nowhere near over.

2) I live in San Diego, and I’m starting to see home prices actually creep up a bit here. Very surprising. I’m assuming this is because the inventory seems lower than before, and also interest rates are very low.

3) I swear there’s money coming into the system from somewhere. I don’t know if Operation Twist is actually effective, or whether the US economy is actually gaining traction, or someone is just printing or lending or what. We have Europe in a mess and Asia slowing down. And yet oil broke through $100 today, US markets are within a whisker of recent highs, the shopping malls are full, and headhunters are calling. Something’s going on, but I don’t know what it is.

San Diego County has a bit of a hedge against overbuilding by limiting building permits annually. I could be wrong, but I don’t think the RE market there saw the peaks of pricing, or the depths that Orange County has seen.

IR

You failed to consider the underlying CDS credit default swaps measured in Trillions that would have come due if the market was allowed to collapse. AIG alone would have defaulted on about 2 trillion in CDS Insurance. The Total CDS exposure at that time was about 50 Trillion.

You want ugly ?

Be careful for what you wish for. It may come true. And Real Estate will be a giant ZERO overnight. People will just be trying to eat.

Iceland does not seem a very good analogy to the failures here in our banking system either.

Iceland = Mice nuts.

The CDS’s were synthetic instruments, backed by nothing, and insuring something that for the most part the counterparty had no economic interest in. Therefore its my belief that the default on $30 Trillion of CDS’s whould have had very little marginal effect on the overall financial crisis. IN fact it would not make much difference if the number were $30 Trillion, $50 Trillion Or $10 Trillion, there was practically zero economic substance to the CDS’s

The analogy is if I insure my house, and it burns down, and the insurer defaults on the claim, I am out the value of my house in real economic terms. If the guy next door bought a policy on my house (never allowed, but go with me on the analogy)and the his counterparty defaulted, he is only out the value of his “inusurance premium”, but he has sustained no substantive economic loss.

Great post!

bltserv..if memory serves, Michael Lewis’ book “The Big Bet” discussed CDS’s in the billions..single billions..as a bit bet. Is there a breakdown anywhere on the 50 trillion? I think that I heard Paul Volker mention 30 trillion. It’s hard to imagine who made those bets..

So – Iceland’s bank depositors who were foreigners (ex. British) got the shaft when the banks went belly up.

US depositors (ex. Treasury holders like the Chinese) also getting the shaft as the Fed prints money and the US dollars dips making the Treasuries less valuable. The printed money bails out the US bank depositors (US citizen) but messes up the foreigners.

How is the US not like Iceland again?

Saturday Night Live: China Cold Open

http://www.hulu.com/watch/110317/saturday-night-live-china-cold-open

How Household Debt Contributes to Unemployment: Mian and Sufi

http://www.bloomberg.com/news/2011-11-17/how-household-debt-contributes-to-job-cuts-commentary-by-mian-and-sufi.html

Iceland could not backstop its banks – way too big for the domestic economy to support. It was wise not to try – but since they couldn’t anyway, not as meritorious as it might appear. But as mentioned above they went a step further and defaulted on deposit insurance commitments made as part of Iceland’s EEA (note EU) treaty obligations. These were enacted into national law many years prior to these events. Icelanders are fiercely proud of their democratic traditions, but in this matter they like to pretend that they never actually meant to offer such insurance. 200 years ago, Reykjavik would have been blasted to rubble by the Royal Navy over this, so I guess you can say humanity is progressing.