High end Orange County asking prices continue their long-term decline. With declining prices, strategic default among jumbo loan holders continues to rise.

Irvine Home Address … 5021 BARKWOOD Ave Irvine, CA 92604

Resale Home Price …… $469,000

When it will be right, i don't know.

What it will be like, i don't know.

We live in hope of deliverance

From the darkness that surrounds us.

Paul McCartney — Hope of Deliverance

Hope springs eternal, and each spring realtors will call the bottom, and for several months each spring, prices will rise. This is a normal seasonal pattern. By late summer, reality sets in, and the dreams and delusions of the spring give way to the cold reality of winter declines.

Hope of future equity is what motivates underwater loan owners. Most should strategically default, and many will, but what keeps from from doing so is hope. Hope of a better future is a basic human need, and when hope is lost, people are often motivated to take more drastic measures such as strategic default. Declining home prices erode hope, and the biggest worry of most lenders is that a sustained decline will cause underwater borrowers to abandon hope.

More price cuts from high-end O.C. house sellers

November 1st, 2011, 2:14 pm — posted by Jon Lansner

Whatever hopes that high-end sellers of Orange County homes had for a price rebound this year melted in the summer and have continued in an autumnal fall.

HousingTracker.net follows the Orange County market by an interesting metric: the 25th and 75th percentiles of asking prices listed in brokers’ MLS system. Or in simple words: this website follows a median of the top and bottom of the market, by price.

![]()

Through October, HousingTracker shows:

- 75th percentile at $641,160 — that is down 1.69% in a month and the 4th consecutive cut after five straight increases — longest upswing in two years. October pricing is also back at February’s levels and down 6.5% in a year (19th straight year-to-year cut).

- 25th percentile at $286,000 — that is down 1.37% in a month (3rd drop in a row.) It’s also down 6.8% in a year (11th straight dip.)

- Using HousingTracker data, we see that the gap between top and bottom shows the 75th percentile listings running 124.2% more expensive that the 25th percentile vs. 123.5% a year ago and a 133.1% average during the past four years.

- By the way, HousingTracker’s overall median listing price of $407,800 is down 2.84% in a month (4th consecutive month-to-month drop.) The median is also down 8.8% in a year (18th such straight drop.)

Strategic default is caused by a number of factors, but the primary reason is a lack of equity and the belief the loan owner won't have equity any time soon.

Mortgages are like call options. Just because the owner doesn't currently have any equity, there is still value in the house if the owner believes prices are rising and they will have equity soon. The moment a loan owner no longer believes they will have equity in a reasonable period of time, they lose hope and strategically default.

This is one area where lenders embrace the bullshit market puffing of realtors. Lenders and realtors both want to convince people prices will rise but for very different reasons. realtors want to induce people to buy, and if that takes telling them prices are going up, that is what realtors will say. Lenders want to convince loan owners prices are going up so they will not strategically default.

Unfortunately for both realtors and lenders, prices are not going up, and prices will not go up any time soon. The liquidation phase of the housing bubble is going to drag on for a long time, and in all likelihood prices will drift lower while lenders clear out their books. In particular the high end of the market is most likely to see the downward drift because prices are still inflated, and there is no move up market. Therefore, strategic default will be an ongoing problem for the high end where the jumbo loans are concentrated.

Strategic default risk growing for negative equity jumbo mortgages

by JON PRIOR — Tuesday, November 1st, 2011, 4:19 pm

Projected losses on securities backed by subprime mortgages are beginning to stabilize, according to Moody's Investors Service, but the risk of borrowers defaulting on jumbo loans is growing.

The subprime borrowers most at risk of defaulting already have, analysts said. The risk is looming however for jumbo loans, those originated above the conforming limits set by Fannie Mae and Freddie Mac. More than 80% of jumbo loans backing RMBS are current but more than half owe more than the home is worth.

Subprime borrowers have largely already defaulted because their mortgages recast and reset earlier, and since lenders foreclosed on the subprime defaulters, prices where subprime loans dominated have been crushed.

The experience of jumbo borrowers has been very different.

- First, the toxic loans this group took on blew up later.

- Second, most jumbo borrowers have enough other resources to juggle their finances longer than subprime borrowers, so they can hold back the crashing waves.

- Third, banks learned from the subprime crash, so they haven't foreclosed on jumbo borrowers and have instead allowed this group to squat in the bank's house.

- Fourth, and probably most importantly, because lenders haven't foreclosed, prices where jumbo loans predominate have not crashed nearly as hard, so fewer underwater borrowers have strategically defaulted. Many have been suffering from the delusion their neighborhood is immune or that the crash may bypass them. As they realize this isn't the case, many jumbo loan owners will default like their subprime brethren.

As jumbo loan price points continue to erode (see chart in above story), more and more jumbo loan owners will submerge beneath their debts, and the long-term nature of this decline will cause many of them to lose hope that equity is in their near-term future.

Comparatively, roughly 22% of all outstanding mortgages are underwater, according to CoreLogic.

“Since home prices have been fairly stable over the past year, that increasing proportion of underwater borrowers likely reflects the ability of the stronger borrowers to refinance and exit the mortgage pools,” Moody's analysts said.

Borrowers in negative equity are more likely to walk away or default in order to receive a modification or some other loss mitigation service. Falling home prices from a still flooded foreclosure pipeline are simply pushing more of these borrowers further underwater.

Those circumstances will not change any time soon. People will continue to default in larger numbers.

Loans considered always current or those with LTV ratios below 100% are shrinking in the jumbo space. In September 2011, these loans made up less than 35% of the jumbo universe, down from more than 50% in November 2009.

“Indeed, default rates among always-current borrowers have not come down as much as in the subprime sector, meaning that the pool of current borrowers has not strengthened as much over time,” Moody's said.

I have no data to back this, but I speculate that jumbo borrowers are more likely to strategically default than subprime borrowers. Many subprime borrowers recognize that the subprime loan they never should have been given is their only reasonable opportunity to attain and sustain home ownership. This will motivate them to hang on tighter and sacrifice more. On the other hand, jumbo loan owners know they will be given another change to borrow and own again, so if things don't work out in their favor, they can simple walk away and start over. It is much more of a business and financial decision for a jumbo borrower.

I have no data to back this, but I speculate that jumbo borrowers are more likely to strategically default than subprime borrowers. Many subprime borrowers recognize that the subprime loan they never should have been given is their only reasonable opportunity to attain and sustain home ownership. This will motivate them to hang on tighter and sacrifice more. On the other hand, jumbo loan owners know they will be given another change to borrow and own again, so if things don't work out in their favor, they can simple walk away and start over. It is much more of a business and financial decision for a jumbo borrower.

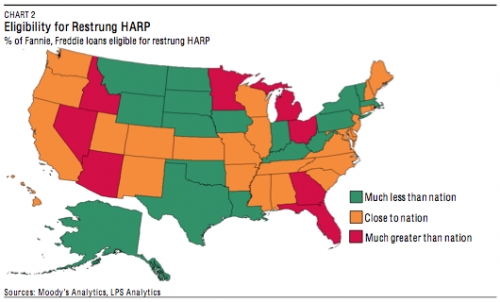

The Obama administration and the Federal Housing Finance Agency revamped new rules for the Home Affordable Refinance Program to help more of these borrowers refinance into lower interest rates. Analysts at Moody's said the retooling could result in 1.6 million more refinancings before the program expires at the end of 2013, benefiting the hardest hit states of Florida and Nevada the most (see the graph below).

As of September, home prices in Las Vegas remain 63% below their peak in November 2006. But the problem is widespread. Marta Libby, a real estate agent in Victorville, California, said several rental houses she manages were bought as new housing tracts similar to Vegas at $312,000 at the peak in 2006 but are now selling for $81,000.

Write to Jon Prior.

Follow him on Twitter @JonAPrior.

They got $80K

- Today's featured REO was purchased on9/16/2004 for $646,000. The borrowers used a $513,000 first mortgage and a $132,400 down payment.

- On 1/19/2005 they liberated some equity with a $63,800 HELOC.

- On 8/8/2005 they obtained another $123,200 HELOC.

- On 12/29/2005 they refinanced with a $600,000 Option ARM with a 1.5% teaser rate and obtained a $75,000 HELOC.

- On 10/31/2006 they refinaced with a $646,000 Option ARM with a 1.25% teaser rate and obtained a $80,000 stand-alone second.

- Total property debt was $726,000 plus negative amortization.

- Total mortgage equity withdrawal was $213,000. Not large by Irvine standards, but considering they purchased this property on late 2004, they managed to get this $213,000 in just over two years.

It was great being a homeowner during the bubble, wasn't it?

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 5021 BARKWOOD Ave Irvine, CA 92604

Resale House Price …… $469,000

Beds: 4

Baths: 3

Sq. Ft.: 1800

$261/SF

Property Type: Residential, Single Family

Style: Two Level, Contemporary

Year Built: 1971

Community: El Camino Real

County: Orange

MLS#: P801778

Source: CRMLS

Status: Active

On Redfin: 3 days

——————————————————————————

Wonderful family home on Cul-De-Sac. The property has a good lay-out, offers a bright and open floor plan, two bedrooms and two bathrooms, kitchen, living room, dining area/ family room downstairs, and two bedrooms and one batroom upstairs. Includes french doors in family rm & master br, master bath , kitchen tile counter & appliances, large country kitchen/family rm w/ fireplace and laminate wood flooring.

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis ![]()

Resale Home Price …… $469,000

House Purchase Price … $646,000

House Purchase Date …. 9/16/2004

Net Gain (Loss) ………. ($205,140)

Percent Change ………. -31.8%

Annual Appreciation … -4.4%

Cost of Home Ownership

————————————————-

$469,000 ………. Asking Price

$16,415 ………. 3.5% Down FHA Financing

4.08% …………… Mortgage Interest Rate

$452,585 ………. 30-Year Mortgage

$124,114 ………. Income Requirement

$2,182 ………. Monthly Mortgage Payment

$406 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$98 ………. Homeowners Insurance (@ 0.25%)

$520 ………. Private Mortgage Insurance

$0 ………. Homeowners Association Fees

============================================

$3,206 ………. Monthly Cash Outlays

-$340 ………. Tax Savings (% of Interest and Property Tax)

-$643 ………. Equity Hidden in Payment (Amortization)

$24 ………. Lost Income to Down Payment (net of taxes)

$137 ………. Maintenance and Replacement Reserves

============================================

$2,384 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,690 ………. Furnishing and Move In @1%

$4,690 ………. Closing Costs @1%

$4,526 ………… Interest Points @1% of Loan

$16,415 ………. Down Payment

============================================

$30,321 ………. Total Cash Costs

$36,500 ………… Emergency Cash Reserves

============================================

$66,821 ………. Total Savings Needed

——————————————————————————————————————————————————-

Shevy Akason and Larry Roberts will host a short sale and REO workshop at 6:30 PM Wednesday, November 16, 2011, at the offices of Intercap Lending (9401 Jeronimo, Suite 200, Irvine, CA 92618).

Register by clicking here or email us a sales@idealhomebrokers.com.

“…Mortgages are like call options…”

I am not an options trader, by any means, but if I own an underwater mortgage, don’t I have the option to “put” it back to the bank?

Yes, it has the function of pushing the risk onto the bank. But like an call option that is out-of-the-money, if the values of houses goes up, the loan owner obtains all the upside just like the holder of call option.

“High end Orange County asking prices continue their long-term decline.”

Every high-end realtor in Orange County should embrace this!

“Most should strategically default, and many will, but what keeps from from doing so is hope.”

Sooooo. Right. However, my good man, lest we forget about fear, a force even more powerful than hope.

Fear of consequences, fear of loss of credit, fear of what neighbors might think, fear of the process, fear of the unknown.

For me fear was different. For me fear was not the stomach pit, but a spoken word, a focused poem.

Fear became the mirrors image of my parents struggle mortgaged and monied with nothing left.

Fear, the pus-green stare-glare of my neighbors home. Bought and envied for one dime out of ten of my hollow dollars.

Fear was the heavy saddled of my hopes, my fading riches. Let my truth and tooth less dreams, speak about the loss of me.

Fear that big hard men with shining shoes could cast my clan from my home, the debtor’s nest. Worst yet, a home to be paid thrice before forgive of my noted promise—-scary.

Fear, the seed of cowardice claims all men during our walk in time. I am no different, and might argure that I am weaker than most, and most stupid of all.

For I gambled and lost, and do not care.

Hope and/or fear haven’t prevented me from strategically defaulting. We bought a house we could afford. The price was < 3x our household income at the time. We've been fortunate in the last few years and our mortgage, while underwater, is less than 2x our annual household income. I guess I'm hoping for HARP3 (HARP applied to non-GSE loans) or an AGs settlement that results in a lower rate, but that's not why I haven't defaulted.

ChicagoWalkAway,

Very poetic. I may quote you in a future post.

Thanks.

A small window in front, walls a few feet away on both sides, so the only light in the place comes from the back, looking into a similar house across the tiny backyards. Maybe that’s why there are no interior pictures – they would all be done with flash photography.

Way too much Irvine premium in that place.

In my experience with wealthy, or financially sophisticated people – these being different categories with a modest overlap – an unambiguous, iron-clad contractual situation in which they legally owe you $x is regarded as a starting point for how much you will accept to avoid hassle and legal fees, weighed also against their own legal costs.

Since the mortgage, a much weaker contractual tie, has a well-defined exit path, I imagine there is little anxiety about defaulting among those with resources or experience, particularly since personal credit ratings are irrelevant to those who control corporate entities which provide personal profit without personal liability.

As for arrant poseurs, their high-end mortgages are all doomed, anyway.

Many wealthy people regard a mortgage as simply a rental with the bank as a non-nosy landlord who will leave them be.

I am not, have never been, and never will be either wealthy or sophisticated, and I see any future mortgage as a long-term lease.

Careful identifying yourself as someone who will never be wealthy. If your household income exceeds $250K, according to Obama you’re a “millionaire not paying your fair share of taxes” – part of the evil rich!

Thanks. Had not read that one since yesterday evening.

Is there some sort of keystroke macro which spits out this tired little squeak?

Not that I’m aware of, but if you can stop our President from repeating it daily, then maybe you’ll cease hearing its echo squeak from others. Good luck.

Wealthy people don’t need a mortgage.

A third of home owners in Irvine don’t have a mortgage.

According to the census*, 32.2% of owner-occupied housing units nationwide don’t have a mortgage.

But please, tell us more about how exceptional the wealthy elite of Irvine are.

* 2008-2010 American Community Survey 3-Year Estimates MORTGAGE STATUS, Universe: Owner-occupied housing units

i would risk both statements are unlikely true:

a) if you’re wealthy, with 3+% interest rate, it’s better to borrow for your house, deduct interest from taxes, and invest your money elsewhere, as if you are that wealthy, you easily can get 4 o 5% !

b) i’d be very interested to see the statistics on this. It may have been true in the past, as many original Irvine owners have indeed paid their mordgages. However, during the last 10y, Irvine population has probably almost doubled, and all the new comers who have bought certainly have taken a loan. + many existing people with their house almost paid after 20+years have HELOCed it…

So with 1 and 2, i’d say 40-50%+ instead, while it would be great to have actual statistics

“and all the new comers who have bought certainly have taken a loan”

I guess you are not familiar with all the FCBs that will save Irvine from market forces…

http://factfinder2.census.gov

SELECTED HOUSING CHARACTERISTICS

2008-2010 American Community Survey 3-Year Estimates

Irvine, CA

Owner-occupied units 38,520

Housing units with a mortgage 32,048

Housing units without a mortgage 6,472

Percent without mortgage = 16.8%