A Harvard economist has recommended principal forgiveness to address the problem of falling house prices. It is the worst policy option being considered today.

Irvine Home Address … 415 East YALE Loop #13 Irvine, CA 92614

Resale Home Price …… $535,900

.jpg)

Yea, yea, yea, Dear Mrs. Bill Collector

I know ya just doing your job,

don't mean to disrespect ya

But we've been going through this thang since way back

I told ya when I get the dough I would pay back

But I got problems baby

¦yea, if you only knew

I got bigger problems baby

J. Cole — Problems

Lenders and loan owners have problems. Lenders made loans their borrowers can't repay, and now both parties to the deal are turning to the US taxpayer for a bailout. Somehow, these two groups have convinced themselves they deserve some of my money. I was not a participant in their transaction. I did not sign on to the risks and rewards of the deal they made, yet both groups feel I should be compelled to bail them out. Screw them both. Their problem is not my problem.

There is a problem here: excessive debt. There is also a solution in the system: foreclosure and bankruptcy. Both parties to this private financial transaction want to avoid the consequences of foreclosure and bankruptcy because it will cost banks their money and borrowers their houses and their credit. Moral hazard dictates both parties should endure the consequences of their actions or they will repeat their mistakes.

The most important step in solving any problem is to define the problem correctly. Failure to carefully identify the problem will inevitably lead to solutions which don't have the desired effect. In fact, many solutions implemented to solve a poorly defined problem actually make conditions worse.

Falling house prices is not the problem

Currently across the country, many people have identified falling house prices as a problem.

Bankers believe falling house prices are a problem because it erodes the value of the collateral backing up their loans. If they need to foreclose on a delinquent borrower, they don't obtain their original loan capital. To make matters worse, falling home prices actually motivate their borrowers to stop making loan payments which exacerbates the problem. For bankers, falling house prices are a problem.

Homeowners believe falling house prices are a problem because it erodes their wealth. Historically, houses have been a reservoir of equity and a vessel that retains wealth. For homeowners, falling house prices are a problem to the degree they depended upon the value of their house for savings, retirement or income supplementation.

Economists believe falling house prices are a problem because it inhibits consumer spending. The negative wealth effect causes people to save rather than spend, and the decreasing value of houses shuts off the home ATM machine. For economists who don't seem to care where demand comes from, falling house prices are a problem.

Each of the above groups views the world through their own prism, and each of them has a legitimate reason to believe falling house prices are a problem. However, they are all wrong. For the broader society, falling house prices are not a problem. Falling house prices mean buyers are less indebted when they purchase real estate. Lower debt levels means homeowners have more disposable income. Increased disposable income creates sustainable demand, unlike Ponzi borrowing which only creates demand as long as more credit is being extended to the borrower.

Debt is the problem

The real problem in our economy — the problem incorrectly identified by economists — is excessive debt. And the only way to solve that problem without major side effects of moral hazard is through foreclosure and bankruptcy.

With foreclosure and bankruptcy, both lenders and borrowers endure consequences for their behavior. The lender losses money, and given the loan practices of the housing bubble, they deserve to lose money. The borrower losses their house and endures restricted access to credit for a time — both of which are appropriate consequences for taking on a debt they could not repay. If neither party experiences these consequences, the mistakes of the past will be repeated. That's the essence of moral hazard.

Bankers and loan owners are the two groups who both agree falling house prices are a problem. However, this is only a problem for them. The problems between bankers and loan owners do not impact me as a renter except to the degree they reach into my pocket through government policy for bailout money. If both parties weren't seeking bailouts I am being asked to pay for, falling house prices would be akin to falling stock prices, a loss endured by private parties which might make the news but wouldn't impact my life.

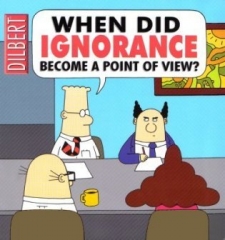

Economists fail to identify the real problem

Some economists get lost in the abstractions of their own theories. They lose site of the impact their proposals have on behavior. For example, many economists believe stimulating demand through mortgage equity withdrawal is a good thing. They call it the “wealth effect.” They completely miss the fact this borrowing quickly degrades into a Ponzi scheme and debt dependency. Mortgage equity withdrawal is not a sustainable form of demand, and stimulating it merely creates the conditions for a larger crash and a more prolonged recession.

To exacerbate their mistake, economists fail to recognize the economic problems of the last four years are a direct result of the Ponzi borrower and wealth effect spending they advocate. Since they don't see the causes of our problems, they devise solutions which call for more Ponzi borrowing and spending. Debt does not create wealth.

Since economists have wrongly identified falling house prices as the root of our problems, they have wasted much brainpower to devising solutions with the wrong goal in mind. Some of these solutions — like lowering interest rates — create economic distortions and mis-allocations of capital. Other solutions — like government mandated loan modifications — are a threat to contract law and the stability of our mortgage lending system. The worst solutions — like today's suggestion that we forgive principal — create more widespread problems by altering borrower incentives and propagating moral hazard.

How to Stop the Drop in Home Values

By MARTIN S. FELDSTEIN

Published: October 12, 2011

HOMES are the primary form of wealth for most Americans. Since the housing bubble burst in 2006, the wealth of American homeowners has fallen by some $9 trillion, or nearly 40 percent. In the 12 months ending in June, house values fell by more than $1 trillion, or 8 percent. That sharp fall in wealth means less consumer spending, leading to less business production and fewer jobs.

Fallacy #1: the wealth effect. Lower house prices means the new buyer is less indebted than the old one. This new buyer will have more disposable income and thereby stimulate the economy. Only this time, the demand will be sustainable because it is income based rather than debt based.

But for political reasons, both the Obama administration and Republican leaders in Congress have resisted the only real solution: permanently reducing the mortgage debt hanging over America. The resistance is understandable. Voters don’t want their tax dollars used to help some homeowners who could afford to pay their mortgages but choose not to because they can default instead, and simply walk away. And voters don’t want to provide any more help to the banks that made loans that have gone sour.

He has missed the most obvious reasons voters like myself don't want to see principal reduction.

First, it isn't strategic defaulters I am concerned about. They left the house, and they may have lingering debt issues yet to be resolved. The real problem is the borrowers who took on too much debt but hope to dodge the consequences. This breaks down into two groups: late buyers and HELOC abusers.

The late buyers who overextended themselves made a choice. During the bubble, I chose not to buy more house than I could afford. Many people who made less money than I did chose to over-extend themselves and occupy the house which should have been affordable to me. It's a bit like cutting in line. In the process, they bid up home prices and priced me out of the housing market. Now I am being asked to pay for their imprudence with bailouts — after they have been living in my house for the last several years. I feel like I am being robbed twice.

The HELOC abusers obviously don't deserve principal forgiveness. Anyone who was prudent during those times should not be asked to pay the bills of the fools who spent like drunken sailors, yet that is what we are being asked to do with widespread principal reductions.

But failure to act means that further declines in home prices will continue, preventing the rise in consumer spending needed for recovery.

This contention is just wrong. Falling house prices will stimulate the recovery as it will put more money into the hands of consumers. We don't need another debt-fueled Ponzi scheme to save the economy. If we just let prices fall to their natural bottom and allow borrowers to borrow less, the extra disposable income will create the recovery we want to see.

This contention is just wrong. Falling house prices will stimulate the recovery as it will put more money into the hands of consumers. We don't need another debt-fueled Ponzi scheme to save the economy. If we just let prices fall to their natural bottom and allow borrowers to borrow less, the extra disposable income will create the recovery we want to see.

As costly as it will be to permanently write down mortgages, it will be even costlier to do nothing and run the risk of another recession.

Bullshit.

House prices are falling because millions of homeowners are defaulting on their mortgages, and the sale of their foreclosed properties is driving down the prices of all homes. Nearly 15 million homeowners owe more than their homes are worth; in this group, about half the mortgages exceed the home value by more than 30 percent.

Most residential mortgages are effectively nonrecourse loans, meaning creditors can eventually take the house if the homeowner defaults, but cannot take other assets or earnings. Individuals with substantial excess mortgage debt therefore have a strong incentive to stop paying; they can often stay in their homes for a year or more before the property is foreclosed and they are forced to move.

The overhang of mortgage debt prevents homeowners from moving to areas where there are better job prospects and from using home equity to finance small business start-ups and expansions. And because their current mortgages exceed the value of their homes, they cannot free up cash by refinancing at low interest rates.

I give this man credit for accurately identifying the conditions in the market. What is shocking is how incorrectly he identifies the problem and thereby botches the solution.

The Obama administration has tried a variety of programs to reduce monthly interest payments. Those programs failed because they didn’t address the real problem: the size of the mortgage exceeds the value of the home.

Yes, and the solution — which is already outlined in the mortgage agreement — is for the borrower to vacate the property and the lender to recover what they can of their capital in a foreclosure auction.

The problem with loan modification programs is that they try to keep borrowers in homes they cannot afford. It can't be done fairly or without moral hazard. Would you borrow prudently if you knew the government would bail you out if you got in trouble?

To halt the fall in house prices, the government should reduce mortgage principal when it exceeds 110 percent of the home value. About 11 million of the nearly 15 million homes that are “underwater” are in this category. If everyone eligible participated, the one-time cost would be under $350 billion.

No, no, no! Not $350 billion. Not $350. Not one penny for principal reduction from my tax dollars.

Here’s how such a policy might work:

If the bank or other mortgage holder agrees, the value of the mortgage would be reduced to 110 percent of the home value, with the government absorbing half of the cost of the reduction and the bank absorbing the other half.

The government is going to absorb half the losses from the banks? How isn't that a massive government bailout of the banks? This is a bank bailout disguised as a loan owner bailout, and in my opinion, both should go down in flames.

For the millions of underwater mortgages that are held by Fannie Mae and Freddie Mac, the government would just be paying itself.

I can't believe an economist actually wrote that. [shakes head in disbelief] The government would not be paying itself. It would be paying the investors in mortgage-baacked securities insured by the GSEs, and the bondholders of the GSEs.

And in exchange for this reduction in principal, the borrower would have to accept that the new mortgage had full recourse — in other words, the government could go after the borrower’s other assets if he defaulted on the home. This would all be voluntary.

So every loan owner with no assets will immediately sign up for this program because they had nothing to lose anyway. Plus every borrower in a state like Nevada, where all loans are recourse anyway, would also sign up immediately. And would this agreement supersede state laws to the contrary? In Nevada recourse loans are extinguished after nine months if the lender doesn't try to collect. And does anyone believe the government would actually go after delinquent borrowers, or would they merely forgive the debt themselves in the end?

So every loan owner with no assets will immediately sign up for this program because they had nothing to lose anyway. Plus every borrower in a state like Nevada, where all loans are recourse anyway, would also sign up immediately. And would this agreement supersede state laws to the contrary? In Nevada recourse loans are extinguished after nine months if the lender doesn't try to collect. And does anyone believe the government would actually go after delinquent borrowers, or would they merely forgive the debt themselves in the end?

This plan is fair because both borrowers and creditors would make sacrifices. The bank would accept the cost of the principal write-down because the resulting loan — with its lower loan-to-value ratio and its full recourse feature — would be much less likely to result in default. The borrowers would accept full recourse to get the mortgage reduction.

Those are sacrifices? The bank is getting reimbursed for half its loss, and the borrower is getting to stay in their home. It appears to me as if both parties are escaping all consequences for their foolish behavior. Lenders will be given a green light to underwrite more dodgy loans, and borrwers will be encouraged to take on massive debts with the promise of principal forgiveness. It's the worst possible set of incentives, moral hazard in extreme.

Without a program to stop mortgage defaults, there is no way to know how much further house prices might fall.

Yes, there is. Prices will fall until they are affordable and new buyers come forward to absorb the inventory because owning is cheaper than renting. If the supply is excessive, like it is in Las Vegas, then cashflow investors will step in to supplement the demand when prices get low enough to attract their attention. The market has self-correcting mechanisms if they are allowed to work.

Although house prices in some areas are already very low, potential buyers continue to wait because they anticipate even lower prices in the future.

This effect is over stated. Buyers will react to affordability. If prices are low enough, people will buy to save money versus renting even in a declining market.

Before the housing bubble burst in 2006, the level of house prices had risen nearly 60 percent above the long-term price path. So there is no knowing how far prices may fall below the long-term path before they begin to recover.

I cannot agree with those who say we should just let house prices continue to fall until they stop by themselves. Although some forest fires are allowed to burn out naturally, no one lets those fires continue to burn when they threaten residential neighborhoods.

Is that the best analogy he could come up with? Let me counter with my own from What the Federal Reserve could learn from the US Forest Service:

For years the US Forest Service was dominated by timber production interests. It was a classic example of regulatory capture. The US Forest Service's primary objective, and thereby its land management policies, favored timber production. Forest Fires were seen as an obvious threat to timber production, so policies of fire suppression were absolute: put out all fires as quickly as possible, and do not let anything burn. This was forest service policy for several decades.

To its chagrin, the US Forest Service discovered its policy was flawed. By not allowing small fires to burn, leaf litter and other combustible natural growth accumulated. In unmanaged forests, periodic fires eliminate this source of fire fuel. In managed forests this accumulation of fuel fosters fires that get out of control (think Yellowstone).

To combat the accumulation of fire fuel, the US Forest Service changed its policies. Now, small fires in the understory are permitted to burn. By eliminating the excess fuel, the more dangerous and costly canopy fires are avoided. A few trees may get damaged in the small fires, but the forest survives.

We must allow the fire to wipe out the debts of residential home owners. Only then will the green shoots of the next forest have the sunlight to take root and prosper. So it is with the new homeowners who will be buying in at lower price points.

Back to the conclusion of the op-ed:

The fall in house prices is not just a decline in wealth but a decline that depresses consumer spending, making the economy weaker and the loss of jobs much greater. We all have a stake in preventing that.

Martin S. Feldstein, a professor of economics at Harvard, was the chairman of the Council of Economic Advisers from 1982 to 1984 under President Ronald Reagan.

He repeats his fallacious argument that the wealth effect is necessary to stimulate the economy. It's shocking that a man with such impressive credentials is so completely wrong about what should be done.

Whenever I read this kind of crap from an intelligent writer, the cynic in me wonders if the author is being paid off by powerful interests who endorse this policy. Did his banking buddies put him up to this? Or is he a loan owner hoping for a personal bailout? Or is it preferable to conclude he had no nefarious motives, and instead he is a fool?

Countrywide's Option ARM with a 1% teaser rate

Bank of America is desperate for cash. They bought the toxic waste from Countrywide, and now the stupid loans like the one on today's featured property are eating a hole in their balance sheet.

This property is typical of the kind of loan I don't want to see bailed out. The former owner of this property couldn't afford it. He used a $624,000 Option ARM with a 1% teaser rate because he obviously couldn't afford a fully amortized payment. If the banks who underwrote these loans and the borrowers who used them are bailed out, what will they learn? They will learn that no matter how stupid and irresponsible they are, the government will remove any negative consequences for their decisions.

The former owner of this property and the bank who loaned him money were part of the problem. Their actions together inflated the housing bubble. They priced the prudent borrowers out of properties and forced them to rent and wait. We are still waiting.

The former owner of this property did endure consequences. He was foreclosed on, and with the HELOC debt he added to the mortgage, he will likely need to declare bankruptcy to wipe the slate clean. Bank of America is only getting a fractioin of the value they believed they acquired when they obtained this asset in the Countrywide deal. Both parties are experiencing consequences for their actions. So what's wrong with that?

Why do we need to bail out the parties to this stupid loan? What societal benefit will we obtain? Continually inflated house prices and more Ponzi borrowing? That's a benefit we can all do without.

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 415 East YALE Loop #13 Irvine, CA 92614

Resale House Price …… $535,900

Beds: 3

Baths: 2

Sq. Ft.: 2150

$249/SF

Property Type: Residential, Condominium

Style: Two Level, Contemporary

Year Built: 1985

Community: Woodbridge

County: Orange

MLS#: S676659

Source: SoCalMLS

Status: Active

On Redfin: 1 day

——————————————————————————

REO BANK OWNED PROPERTY!!Beautiful condo close to lake! Has 3 bedrooms and 2.5 bathrooms. There is a half bath upstairs and all three bedrooms upstairs. Has an open floor plan with plenty of room. There is carpet through the bedrooms, stairs, and hallway. There is a fireplace in the family room. The backyard is set up great for entertaining. Association has a pool and spa for everyone to enjoy. Don't miss this opportunity to buy a bank owned home!

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis ![]()

Resale Home Price …… $535,900

House Purchase Price … $780,000

House Purchase Date …. 9/22/2005

Net Gain (Loss) ………. ($276,254)

Percent Change ………. -35.4%

Annual Appreciation … -6.0%

Cost of Home Ownership

————————————————-

$535,900 ………. Asking Price

$107,180 ………. 20% Down Conventional

4.20% …………… Mortgage Interest Rate

$428,720 ………. 30-Year Mortgage

$119,017 ………. Income Requirement

$2,097 ………. Monthly Mortgage Payment

$464 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$112 ………. Homeowners Insurance (@ 0.25%)

$0 ………. Private Mortgage Insurance

$402 ………. Homeowners Association Fees

============================================

$3,075 ………. Monthly Cash Outlays

-$344 ………. Tax Savings (% of Interest and Property Tax)

-$596 ………. Equity Hidden in Payment (Amortization)

$161 ………. Lost Income to Down Payment (net of taxes)

$87 ………. Maintenance and Replacement Reserves

============================================

$2,383 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$5,359 ………. Furnishing and Move In @1%

$5,359 ………. Closing Costs @1%

$4,287 ………… Interest Points @1% of Loan

$107,180 ………. Down Payment

============================================

$122,185 ………. Total Cash Costs

$36,500 ………… Emergency Cash Reserves

============================================

$158,685 ………. Total Savings Needed

——————————————————————————————————————————————————-

Shevy Akason and Larry Roberts will host a short sale and REO workshop at 6:30 PM Wednesday, October 19, 2011, at the offices of Intercap Lending (9401 Jeronimo, Suite 200, Irvine, CA 92618). Register by clicking here or email us a sales@idealhomebrokers.com.

.png)

Banks won't staff up to try to collect bad debt. They will sell this debt to some firm who operates under that business model. It didn't make sense for banks to try to collect this debt before because they still showed it on their balance sheets at full value. As they abandon their fantasies and adjust their accounting to reflect reality, they have to deal with the bad debt. The rise of the zombie debt collector should have happened years ago, but with mark-to-fantasy accounting, banks were able to delay the inevitable.

Banks won't staff up to try to collect bad debt. They will sell this debt to some firm who operates under that business model. It didn't make sense for banks to try to collect this debt before because they still showed it on their balance sheets at full value. As they abandon their fantasies and adjust their accounting to reflect reality, they have to deal with the bad debt. The rise of the zombie debt collector should have happened years ago, but with mark-to-fantasy accounting, banks were able to delay the inevitable.

BRIGHT KITCHEN WITH TILED COUNTERTOPS, PRIVATE PATIO FOR ENTERTAINING, SPACIOUS MASTER SUITE WITH WALK-IN CLOSET, MASTER BATHROOM WITH DUAL SINK VANITY, BEDROOMS 2 & 3 (JACK-N-JILL) WITH SHARED BATHROOM AND DUAL SINK VANITY, FORCED AIR HEATING AND CENTRAL AIR CONDITIONING, 2 CAR ATTACHED GARAGE PLUS FULL DRIVEWAY FOR ADDITIONAL PARKING. SUPER MOTIVATED SELLER. SUBMIT!!!

BRIGHT KITCHEN WITH TILED COUNTERTOPS, PRIVATE PATIO FOR ENTERTAINING, SPACIOUS MASTER SUITE WITH WALK-IN CLOSET, MASTER BATHROOM WITH DUAL SINK VANITY, BEDROOMS 2 & 3 (JACK-N-JILL) WITH SHARED BATHROOM AND DUAL SINK VANITY, FORCED AIR HEATING AND CENTRAL AIR CONDITIONING, 2 CAR ATTACHED GARAGE PLUS FULL DRIVEWAY FOR ADDITIONAL PARKING. SUPER MOTIVATED SELLER. SUBMIT!!!

Observers of the high end market often see what they want to see. Most homeowners in these price ranges truly believe the reason their prices haven't decayed to date is because everyone is rich and there is little mortgage distress. Nothing could be further from the truth.

Observers of the high end market often see what they want to see. Most homeowners in these price ranges truly believe the reason their prices haven't decayed to date is because everyone is rich and there is little mortgage distress. Nothing could be further from the truth.

The orginal buyers were hopelessly overextended. They paid $1,434,000 on 11/3/2005 using a $1,145,000 first mortgage, and $145,000 HELOC, and a $144,000 down payment. Since you can't deduct the interest on a loan over $1,000,000, the only people who borrowed more than $1,000,000 did so because they had to.

The orginal buyers were hopelessly overextended. They paid $1,434,000 on 11/3/2005 using a $1,145,000 first mortgage, and $145,000 HELOC, and a $144,000 down payment. Since you can't deduct the interest on a loan over $1,000,000, the only people who borrowed more than $1,000,000 did so because they had to.

.jpg)