The political pressure to balance the federal budget may force politicians to curtail or even eliminate the home mortgage interest deduction. Momentum is growing toward this end.

Irvine Home Address … 402 FALCON Crk Irvine, CA 92618

Resale Home Price …… $250,000

I feel so good come payday

I think of all the things I'm gonna buy

when I pick up my pay

Don't you know

but then they hand me that little brown envelope

I peep inside Lord I lose all hope

Cause from those total wages earned

down to that net amount that's due

I feel the painful sense of loss between the two

Johnny Cash — After Taxes

The home mortgage interest deduction is a very important tax policy to most Irvine homeowners. The primary beneficiaries of the home mortgage interest deduction are high wage earners with large mortgages — Irvine residents. People with small mortgages don't pay enough interest to itemize. The wealthy don't have large mortgages. If there is any political issue Irvine residents will have an opinion about, it is the home mortgage interest deduction.

I wrote a detailed analysis of the home mortgage interest deduction in Tax Policy and Housing:

Debt subsidies, in particular the home mortgage interest deduction, are seen as a great benefit to home ownership. The benefit is widely overestimated and misunderstood.

First, people fail to understand that to obtain a debt subsidy, you must have debt. You must be making an interest payment on this debt in order to qualify, and you get to reduce your tax burden by a small percentage of the interest amount. In short, you are paying a dollar to save a quarter. There are people who actually seek to maximize their interest payments in order to increase this subsidy. This is really, really foolish. Anyone out there who believes it is a good idea to spend $1 to receive $0.25 in return, please send me as much money as you wish, and I promise to send back 25% of it.

Realtors try to con people with the “throwing your money away on rent” argument. Homeowners buy into the fallacy. Interest is the rent on money. You throw away money on interest just like you throw it away on rent. In fact, people who overpay for housing throw away more money on interest than renters do to obtain the same property, even after the tax subsidy. The only argument one can make for paying extra interest is if you are receiving a return on that investment through property appreciation. We all see how that is turning out.

The main reason the benefits of the home mortgage interest deduction are overestimated is because people forget they must give up the standard deduction in order to obtain it. This is one area where tax policy can have hidden and indirect impact on housing. Changes in the standard deduction greatly impact the benefit of the home mortgage interest deduction. As the standard deduction is increased, the positive impact of the HMID is decreased. In fact, if the standard deduction were doubled, the average American holding a $150,000 mortgage probably would not bother itemizing to obtain the HMID because it would be of no tax benefit at all. This would certainly simplify people's tax returns. A higher standard deduction is also a boon to renters who do not have the option of obtaining the HMID.

When we set up the RentVsOwnulator, we put in a 25% tax benefit from the HMID. Some people have commented that this is too small a number. It is not. Several people have run the calculations both with and without the HMID, and the net difference is only 25% even at the highest tax brackets. Basically, if you want to figure out your real tax benefit, take your highest marginal tax rate and subtract 10%. That will be a much closer estimate to reality. This reduction is caused by losing the standard deduction.

Another facet to the HMID is the cap level. Currently mortgages up to $1,000,000 are eligible for the deduction. Does anyone think this is right? Do you realize you as a taxpayer are subsidizing $1,000,000 mortgages? When the GSEs were set up, they established a conforming loan limit. The reason they did this is because they are mandated to subsidize mid and low income housing. Why is the limit on the HMID any higher than the conforming loan limit from the GSEs? Why are we subsidizing high income borrowers?

If we were to reduce the HMID cap level to $500,000 and adjust it by the CPI going forward, we are still subsidizing relatively high income borrowers ($500,000 is still almost triple the median home price in the US). A reduction in this cap would have the same impact as the lower GSE conforming limit is having: it would lower prices at the high end by eliminating the subsidies.

IMO, the government has no place in subsidizing house prices that are well above the median. One can argue that the government should not be subsidizing anything in housing, but the low and middle income subsidies are here to stay. If we raise the standard deduction and lower the HMID caps, we can greatly reduce the impact of the HMID and the cost we pay for it as taxpayers. This would have the effect of lowering prices on more expensive homes, but it would help stabilize the lower end of the market. That is what the market needs right now.

I also wrote about the home mortgage interest deduction when Shelia Bair noted the home mortgage interest deduction inflates home prices:

There is a much easier way to figure out how much eliminating the home-mortgage interest deduction would cause prices to drop. What is the marginal tax rate of the borrower? Assume that most buyers borrow the most they can afford on a monthly payment basis, and further assume intelligent ones have already factored in the tax savings. If you eliminate the tax savings, people will need to bring their payment down accordingly. This won't have much effect on the lower priced homes because many of those borrowers don't itemize, but in cities like Irvine, elimination of this deduction would cause loan balances to shrink by 25% to 40% to keep the same payment. Since about 80% of the house price is usually financed, this will lower prices 20% or more.

There is a related issue which isn't often discussed but very important to the housing market. If the home mortgage interest deduction were eliminated, many high wage earners who are underwater would strategically default. First, it would eliminate one of the financial benefits that prompts many to hang on. Second, since most high wager earners who are underwater would realize this will depress home prices in their price range, many more will abandon hope of a recovery and also strategically default.

When this issue was being discussed last year, it really worried the realtor community. In what can best be termed hysterical, California realtors claimed eliminating the mortgage interest deduction would devastate the nation.

The issue is back in the news again, and due to the large federal government budget deficits, some changes to the provisions of this deduction may actually come to pass.

A Taxing Debate: The Mortgage-Interest Deduction

By Ben Steverman – Oct 18, 2011 8:13 AM PT

The mortgage-interest deduction may be your favorite tax break, but be aware that it has some impressive enemies. The fiscal commissions of two different Presidents proposed eliminating it, first in 2005 and then in 2010. There's also a steady stream of research from such places as the London School of Economics and the Brookings Institution arguing that the deduction doesn't boost homeownership, but instead provides incentives for wealthier Americans to buy big houses and take on more debt.

That is exactly what it does.

The home mortgage interest deduction does not boost home ownership because the fringe of home ownership is low wage earners who do not itemize and take advantage of it. If the home mortgage interest deduction were eliminated, it would not impact the home ownership rate in any way.

The deduction does encourage high wage earners to take on extra debt because they are compensated with a tax break. This enables them to increase their bids for real estate and bid up prices higher than they otherwise could and would. In other words, the home mortgage interest deduction inflates home prices in places like Irvine, but it does nothing of value for the rest of society who pays for it.

The people who will argue most vociferously to keep this deduction are existing loan owners who take advantage of it in places like Irvine (don't let me down in the astute observations).

Nevertheless, the mortgage-interest tax deduction survives, fortified in Washington by strong housing industry support and its presumed popularity with voters. Now, according to a recent Bloomberg Poll, a growing number of Americans may be willing to end the mortgage tax deduction — as long as they get something in return. Forty-eight percent of respondents said they were willing to give up all tax deductions, including the home mortgage deduction, in return for lower tax rates for every tax bracket. Forty-five percent were opposed in the survey of 997 adults, conducted for Bloomberg by Selzer & Company.

The results represent a significant shift from a December 2010 Bloomberg survey that asked the same question. That poll showed a majority, 51 percent, opposed to giving up tax deductions, with 41 percent in favor. Given the pressure to lower the federal deficit, “everything is on the table,” says Richard K. Green, director of the University of Southern California Lusk Center for Real Estate. “People are so desperate to figure something out that they're willing to consider anything.”

If politicians believe they have political cover, the home mortgage interest deduction may really be in danger. This is the most momentum I have seen for curbing or eliminating the deduction so far.

Lobbyists versus Academics

The mortgage-interest deduction allows homeowners to lower tax bills by deducting interest on home mortgages from their taxable income. Interest on up to $1 million in mortgages on first and second homes is deductible, along with interest on up to $100,000 in home equity debt.

Lobbyists for homebuilders and realtors vigorously defend the usefulness and popularity of the tax break. Lawrence Yun, chief economist at the National Association of Realtors, says the deduction has “lowered the cost of ownership” and boosted the homeownership rate, which he describes as “the foundation for a very stable, democratic country.” As recently as April, a USA Today/Gallup Poll found that 62 percent of respondents opposed eliminating the tax break.

As usual Lawrence Yun is completely wrong. The home mortgage interest deduction has done nothing to boost the home ownership rate for reasons I outlined above. Further evidence of this comes from countries like Canada which have a higher home ownership rate than the United States without having a home mortgage interest deduction.

If the sentiment in previous polls is an accurate reflection of attitudes, many Americans support the deduction without getting a benefit from it. The deduction has a definite high-income tilt: Only about one in four Americans includes mortgage interest on taxes. Renters and homeowners without mortgages have no interest to deduct, while many lower- and middle-class homeowners receive a standard tax deduction and don't itemize.

Dennis J. Ventry Jr., a professor specializing in tax law at the University of California-Davis School of Law, calls the provision, which costs nearly $100 billion a year, “the most inequitable and inefficient provision in the Internal Revenue Code.” The benefits of deducting interest from income increase with a homeowner's tax rate, he notes. Thus, according to a 2011 study co-authored by Green, 46 percent of the deduction's tax benefit goes to households earnings more than $100,000 per year.

Conservatives always decry the progressive nature of the tax code. Well, the home mortgage interest deduction is the most regressive tax break possible. The more the borrower makes, the more the tax deduction increases. Low and middle income Americans don't gain much if any benefit from this tax break, and of course, renters get none at all.

Conservatives always decry the progressive nature of the tax code. Well, the home mortgage interest deduction is the most regressive tax break possible. The more the borrower makes, the more the tax deduction increases. Low and middle income Americans don't gain much if any benefit from this tax break, and of course, renters get none at all.

Unpredictable Effects

Criticizing the mortgage-interest deduction is far easier than calculating the impact of getting rid of it. If, as many argue, the deduction has spurred “overinvestment” in housing, ending the incentive may have negative and unpredictable effects.

The potential hit to the housing economy is a big unknown. Dean Stansel, an economics professor at Florida Gulf Coast University who has studied the deduction for the Reason Foundation, estimates that the tax break inflates housing prices by less than 1 percent; a separate study calculates that it raises prices by 3 percent to 6 percent.

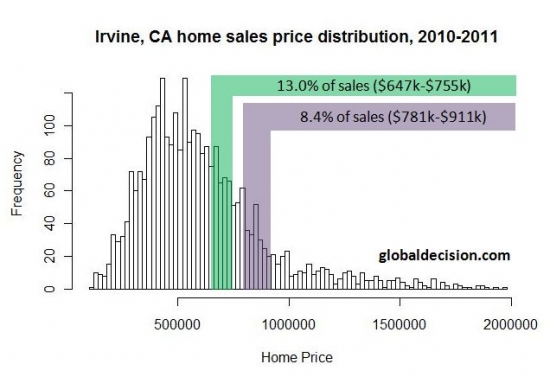

One research paper forecasts serious trouble if the deduction should disappear, predicting that prices could fall from 2 percent to as much as 13 percent, depending on the metropolitan area. Most vulnerable would be parts of the country with higher incomes and higher home prices, which typically benefit most from the mortgage-interest deduction. For example, according to a March 2011 analysis in Tax Notes, residents of Beverly Hills, California, get a $1,873 per person benefit from the deduction, while residents of Clarksville, Mississippi, gain an average of $45 per person.

The research paper mentioned above is probably right. Depending on the area, prices will drop somewhere between 2% and 13%. Locally in Irvine, prices will drop much closer to 13% than 2% because Irvine is much more dependent on the deduction to maintain home values than other areas.

On a personal level, the deduction's biggest beneficiaries will feel the greatest pain if it disappears. Green, of the University of Southern California Lusk Center for Real Estate, estimates that households earning more than $160,000 would pay an average of $2,577 in additional taxes, even after benefiting from a proposed 15 percent tax credit. Places with pricy real estate would bear the brunt of a repeal. “The city of San Francisco would just get whacked,” Green says.

Add Irvine to that list.

Tempting Target

To avoid dire scenarios, Washington would likely do away with the mortgage deduction in a gentle fashion. The tax advisory panel convened by President George W. Bush in 2005 suggested replacing the deduction with a tax credit equal to 15 percent of interest paid. In 2009, the Bowles-Simpson Commission proposed an annual tax credit of 12 percent, limiting interest to first homes and mortgages up to $500,000.

Unlike tax deductions, tax credits can be claimed by all taxpayers, including those who do not itemize their taxes. That could help a greater number of lower- and middle-income people afford houses. Green estimates that a 15 percent mortgage-interest tax credit would boost homeownership by 2.5 percentage points.

I would prefer if we eliminated all tax subsidies on home ownership. Why give a tax credit or a tax deduction? The recent decline in the home ownership hasn't caused any civil unrest, unless you count the occupy Wall Street movement.

Not that I want to see it happen, but I believe Richard Green is right that a 15% mortgage interest tax credit would boost home ownership rates because it would impact the low-income buyers on the fringes.

The mortgage deduction could once again be a target for deficit cutters. According to a 2009 Congressional Budget Office analysis, gradually replacing the mortgage deduction with a 15 percent credit would yield $388 billion from 2013 to 2019. Such savings could prove tempting to the Joint Select Committee on Deficit Reduction, which is charged with finding at least $1.5 trillion in deficit savings over the next 10 years.

The inclinations of this “super committee” are, so far, secret, but the mortgage-interest deduction was discussed at a Sept. 22 hearing. Without making any recommendations, Joint Committee on Taxation Chief of Staff Thomas Barthold mentioned the deduction as an example of a “tax expenditure” that could be eliminated as part of an overhaul of the tax code.

The threat of mandatory deep cuts in defense spending and Medicare if the super committee cannot find enough savings may be the only way that the mortgage interest deduction can die. It's tough to end the tax break, says Green, because the costs are widespread and barely noticed, while the benefits are concentrated in a vocal minority that appreciates the deduction. “It's only in the context of overall reform that you might see something happen,” he says. With public opinion turning, that day may be drawing near.

The circumstances are right for eliminating this deduction. When times are good, eliminating a deduction like this is nearly impossible, but with the realities of a budget ballooning out of control, something has to be done. When something has to be done is when changes as controversial as this one are made.

$7,000 down, $246,00 in mortgage equity withdrawal

The owner of today's featured property demonstrates why houses were so popular during the bubble. The lingering memory of so much free money continues to motivate buyers even today. Fortunately, the crash will grind on, and eventually, people will abandon dreams of free money from houses. When they do, the market will finally bottom.

- This property was purchased on 7/23/1999 for $139,000. The owner used a $132,000 first mortgage and a $7,000 down payment.

- On 3/28/2001 the owner refinanced with a $135,000 first mortgage.

-

On 9/7/2001 he obtained a $25,000 HELOC.

- On 2/18/2003 he refinanced with a $192,000 first mortgage.

- On 6/29/2004 he got a $32,600 HELOC.

- On 12/23/2004 he obtained a $60,000 HELOC.

- On 5/3/2005 he refinanced with a $234,600 first mortgage.

- On 8/30/2005 he was given a $75,000 HELOC.

- On 11/29/2005 he refinanced with a $328,000 Option ARM with a 2% teaser rate.

- On 12/11/2006 he received a $50,000 HELOC.

- Total property debt is 378,000.

- Total mortgage equity withdrawal is 246,000.

There have been no notices filed on this property, but since he is selling short, he likely isn't paying the mortgage. This is shadow inventory. It is the kind of borrower which needs to be flushed from the system and the property recycled. The resulting decline in the loan ownership rate will help out this debtor and the rest of the economy.

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 402 FALCON Crk Irvine, CA 92618

Resale House Price …… $250,000

Beds: 1

Baths: 2

Sq. Ft.: 900

$278/SF

Property Type: Residential, Condominium

Style: 3+ Levels, Traditional

Year Built: 1999

Community: Oak Creek

County: Orange

MLS#: S676279

Source: SoCalMLS

Status: Active

On Redfin: 4 days

——————————————————————————

Elegant home in gated Oak Creek featuring a spacious master suite, one and one-half baths, two-car attached garage, and sun-splashed deck! Sparkling kitchen features handsome cabinetry, built-in microwave, and dry-foods pantry. Upgrades include custome tile floors in kitchen and baths, designer carpet, and custom window treatments. Master suite features walk-in close as well as master bath with dual sinks and soaking tub. Enjoy resort-style pools, spas, tennis courts and award-winning Irvine schools!

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis ![]()

Resale Home Price …… $250,000

House Purchase Price … $139,000

House Purchase Date …. 7/23/1999

Net Gain (Loss) ………. $96,000

Percent Change ………. 69.1%

Annual Appreciation … 4.8%

Cost of Home Ownership

————————————————-

$250,000 ………. Asking Price

$8,750 ………. 3.5% Down FHA Financing

4.18% …………… Mortgage Interest Rate

$241,250 ………. 30-Year Mortgage

$79,205 ………. Income Requirement

$1,177 ………. Monthly Mortgage Payment

$217 ………. Property Tax (@1.04%)

$100 ………. Special Taxes and Levies (Mello Roos)

$52 ………. Homeowners Insurance (@ 0.25%)

$277 ………. Private Mortgage Insurance

$223 ………. Homeowners Association Fees

============================================.jpg)

$2,046 ………. Monthly Cash Outlays

-$185 ………. Tax Savings (% of Interest and Property Tax)

-$337 ………. Equity Hidden in Payment (Amortization)

$13 ………. Lost Income to Down Payment (net of taxes)

$51 ………. Maintenance and Replacement Reserves

============================================

$1,589 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,500 ………. Furnishing and Move In @1%

$2,500 ………. Closing Costs @1%

$2,412 ………… Interest Points @1% of Loan

$8,750 ………. Down Payment

============================================

$16,162 ………. Total Cash Costs

$24,300 ………… Emergency Cash Reserves

============================================

$40,462 ………. Total Savings Needed

——————————————————————————————————————————————————-

Larry Roberts and Shevy Akason will host a first-time homebuyer workshop at 6:30 PM Wednesday, October 26, 2011, at the offices of Intercap Lending (9401 Jeronimo, Suite 200, Irvine, CA 92618). Register by clicking here or email us a sales@idealhomebrokers.com.

Larry Roberts will be hosting a Las Vegas Cashflow property workshop at 8:00 at the same location. Register by clicking here.

.png)

.png)

.png)

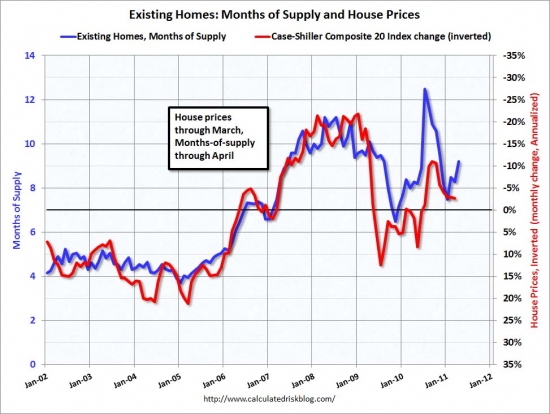

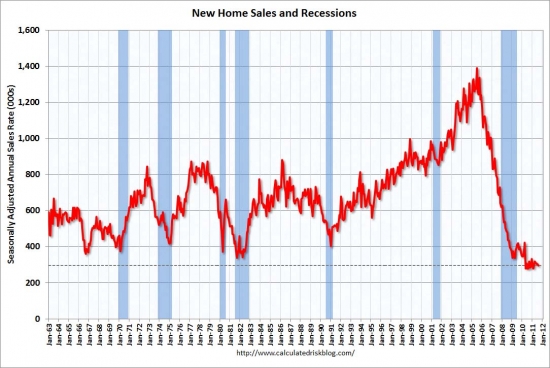

The economy won't recover until some sector other than real estate creates new jobs. Once some other sector creates jobs, new households will form which will in turn create demand for real estate. With fresh demand for real estate, housing employment will start to recover, and the demand will snowball from there. The catalyst will not be housing. It must start in another sector of the economy.

The economy won't recover until some sector other than real estate creates new jobs. Once some other sector creates jobs, new households will form which will in turn create demand for real estate. With fresh demand for real estate, housing employment will start to recover, and the demand will snowball from there. The catalyst will not be housing. It must start in another sector of the economy.

.png)