In a post-bubble world, housing markets and its participants must adjust to the new reality of prudent lending standards and less appreciation. The adjustment will be painful for many.

Irvine Home Address … 28 STREAMWOOD Irvine, CA 92620

Resale Home Price …… $145,000

Pain, I can't get enough

Pain, I like it rough

'Cause I'd rather feel pain than nothing at all

This life is filled with hurt

When happiness doesn't work

Pain — Three Days Grace

The pain from the housing bubble is a familiar topic at the IHB:

In case you haven't noticed, major economic disruptions are painful. It is mentally painful, emotionally painful, and sometimes physically painful. Mentally we all try to figure a way out of this mess. How can we make more money? What can we do about our current circumstances? We tie ourselves in knots trying to solve the enigma. It has no solution. These circumstances lead to emotional pain most often caused by the scarcity of money. We are unable to support our lifestyles, we have to cut back, and sometimes this is not enough. Sometimes the cutbacks are made for us. Creditors close financial lifelines, and lenders foreclose on homes. This can lead to destructive behaviors: divorces, alcoholism, smoking, and a whole host of other problems. This emotional pain leads to stress and physical pain. People start having health problems, and since they can't afford a doctor's visit, these problems often go unattended. In short, recessions really suck.

The pain is not over yet.

“New normal” means a lot more pain to come: Fed economist

by KERRY CURRY –Wednesday, September 7th, 2011, 5:13 pm

The United States needs to make it more attractive for capital to flow back into the housing market to get the residential real estate industry — and the economy — back on track, a Federal Reserve economist said Wednesday.

The nation is in a “new normal” marked by 2% to 3% growth rates, more frequent recessions, low interest rates and sluggish consumer spending, said William Emmons, assistant vice president and economist at the Federal Reserve Bank of St. Louis.

We may not be duplicating Japan of the 1990s, but the conditions he describes are very similar. The overhang of bad debt and mis-allocated capital will plague us until we decide to do something about it. Right now, we either lack the political will or the financial resources to do anything differently.

This new normal includes millions of foreclosures still in the pipeline. Households, he said, will continue to deleverage — both voluntarily by paying down debt and involuntarily via mortgage defaults — putting further constraints on the economy.

“My estimate is that we have in the U.S., somewhere between $3 trillion to $5 trillion too much mortgage debt,” he said. Emmons said the average household needs to deleverage by about $80,000 or about a third of its mortgage debt.

“Many millions of households have experienced great stress on their balance sheets,” he said. “There is tremendous pressure to reduce debt.” That is key in understanding why the economy is going to grow so slowly.

I am impressed with this economist. His analysis is right on. We are going to purge a great amount of debt through the foreclosure process over the next several years, and until it's done, our economy is going to suffer.

The new normal could last as long as seven to 10 years, he predicted, noting that was his own view not that of the Federal Reserve.

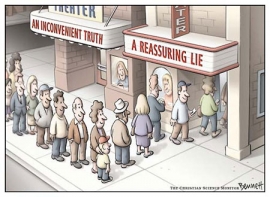

The fools at the federal reserve have to put a happy face on the cataclysm the banks unleashed on society. They may silence this loose cannon for being brave enough to tell the truth.

Emmons gave a decidedly pessimistic view of nation's growth prospects, saying he doesn't expect a bottom before 2015. He spoke as part of a webinar hosted by the American Legal & Financial Network, a national network of legal and residential mortgage banking professionals.

Signposts of the economic bottom will be recognizable

(1) when housing becomes a hated asset class,

(2) when homeownership is denounced by former housing advocates as a trick or a trap and

(3) significant consolidation in the housing and mortgage industries makes people feel that profitability in those industries is hopeless.

Yes. This guy truly understands the dynamics of market psychology. The conditions enumerated above are already coming to pass. The bear rally delayed the needed change in attitudes, but people are starting to realize the beliefs of 5 years ago are no longer operative.

As you can see from the chart above, when the market is in despair, prices are the lowest making for an excellent buying opportunity.

But that will be the time “to get in,” he said.

“We have to find that place where housing becomes exciting again and people want to buy houses,” Emmons said, noting that investors will be key to a “self healing” of the housing economy and pointed to “the capitalistic instinct to realize that any period of turmoil presents opportunities.”

Equity investors who view depressed housing prices as an opportunity could allow for large-scale conversion of for-sale properties into rental properties, helping to reduce the time it will take to re-balance the economy.

I know I am doing my part…

Emmons said he expected little, if anything, out of Washington with the existing cost-cutting mindset and lack of political will for grand-scale programs that would be large enough to make a difference. He also said the Federal Reserve has done what it can, saying the problem is one of solvency not liquidity.

Many people have pointed out from the beginning that the federal reserve could not solve this problem. If the problem were liquidity (availability of capital) the federal reserve can make more credit available. However, when the problem is solvency (too much debt), the federal reserve is shooting pool with a rope. You can't get people out of debt by loaning them more money.

President Obama is scheduled to address the nation on Thursday evening with a jobs speech for a beleagured nation dealing with an unemployment rate at 9.1%. On Friday, the Labor Department released a report showing zero employment growth in August. It's unclear whether Obama will address the country's housing woes in his speech.

He didn't.

But just waiting to grow out of the problem isn't feasible as it would take 20 to 30 years to grow into the mortgage debt the nation has now and the large debt overhang will continue to constrain markets, Emmons said.

I wonder if I can get this guy to go a guest post on the IHB? Everything he is stating has been sprinkled throughout my posts over the last few years. I fully agree with his assessment.

More likely, Emmons said, is a lost decade of deleveraging, much of that through mortgage defaults. While the adjustment will be more painful, the nation will hit bottom sooner and get back to normal sooner.

Deleveraging will increase disposable income and boost consumer spending. Money spent on interest is wasted to the economy. Debt is only an economic boost while it is getting larger.

With consumers on the sideline, the nation will need to figure out how to grow the economy without the help its gotten in the past from consumer spending, he said.

That means attention toward business growth and global competitiveness.

“We have to create climate for more business investment to take the place of consumer spending,” he said. In the short term, government spending will need to fill the void as the economy works to re-balance, he said.

It's difficult to get business investment when business owners don't believe there is consumer demand for their products. And, it is difficult to get more government spending in a time of huge deficits.

Back in December, Fed Chairman Ben Bernanke expressed concerns that the economy would not continue to be self-sustaining. It takes about 2.5% GDP growth to keep unemployment stable.

As growth slows below 2.5%, it may be more likely that the nation will slip into recession. Emmons suggested that may have already occurred as debt ceiling talks and the recent debt downgrade by Standard & Poor's further pummeled consumer confidence.

Ultimately, a stronger housing market will be key in getting the economy back on track. Five years ago, few would have thought the country would be in a situation with home prices down some 30%.

I did.

People seem incredulous that prices can drop further, but they can, he said.

“The scale of problems is so huge,” Emmons said. “Like a huge earthquake shook the entire nation, and knocked all the houses down.”

Write to Kerry Curry.

Follow her on Twitter @communicatorKLC.

Fantastic article. Few have the insight to see the truth in Mr. Emmons statements, and even fewer have the stomach for the truth it contains.

The low end is still searching for a bottom

The properties undesirable for owner-occupants are not being bid up to rental parity by conventional financing. In fact, they are not being bid up by FHA buyers either. The final line of support will be cashflow investors. With a $1,000 per month cost of ownership, someone will buy this before prices go too much lower.

Property History for 28 STREAMWOOD

| Date | Event | Price | Appreciation | ||

|---|---|---|---|---|---|

| Aug 18, 2011 | Price Changed | $145,000 | — | ||

| Jul 18, 2011 | Price Changed | $150,000 | — | ||

| Jun 25, 2011 | Price Changed | $160,000 | — | ||

| Mar 18, 2011 | Listed (Active) | $170,000 | — | ||

| Oct 30, 2009 | – Price Changed | * | — | ||

| Feb 01, 2007 | – Delisted | — | — | ||

| May 30, 2006 | – Listed | * | — | ||

| Jul 23, 2004 | Sold (Public Records) | $288,000 | 25.7%/yr | ||

| Jun 21, 1999 | Sold (Public Records) | $90,000 | 3.0%/yr | ||

What looked like a teaser listing back in March is still going down. The lender would not be lowering price if a buyer were in place. How much lower will this one go?

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 28 STREAMWOOD Irvine, CA 92620

Resale House Price …… $145,000

Beds: 1

Baths: 1

Sq. Ft.: 639

$227/SF

Property Type: Residential, Condominium

Style: One Level, Other

View: Creek/Stream

Year Built: 1977

Community: Northwood

County: Orange

MLS#: S652046

Source: SoCalMLS

On Redfin: 173 days

——————————————————————————

Excellent Short Sale Opportunity!! This is a beautiful 1BR/1BA unit on the second floor. This home has laminate wood flooring through out the house and is a must see. Hurry! Wont last!

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis![]()

Resale Home Price …… $145,000

House Purchase Price … $288,000

House Purchase Date …. 7/23/2004

Net Gain (Loss) ………. ($151,700)

Percent Change ………. -52.7%

Annual Appreciation … -9.4%

Cost of Home Ownership

————————————————-

$145,000 ………. Asking Price

$5,075 ………. 3.5% Down FHA Financing

4.20% …………… Mortgage Interest Rate

$139,925 ………. 30-Year Mortgage

$48,118 ………. Income Requirement

$684 ………. Monthly Mortgage Payment

$126 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$30 ………. Homeowners Insurance (@ 0.25%)

$161 ………. Private Mortgage Insurance

$242 ………. Homeowners Association Fees

============================================

$1,243 ………. Monthly Cash Outlays

-$62 ………. Tax Savings (% of Interest and Property Tax)

-$195 ………. Equity Hidden in Payment (Amortization)

$8 ………. Lost Income to Down Payment (net of taxes)

$38 ………. Maintenance and Replacement Reserves

============================================

$1,033 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$1,450 ………. Furnishing and Move In @1%

$1,450 ………. Closing Costs @1%

$1,399 ………… Interest Points @1% of Loan

$5,075 ………. Down Payment

============================================

$9,374 ………. Total Cash Costs

$15,800 ………… Emergency Cash Reserves

============================================

$25,174 ………. Total Savings Needed

——————————————————————————————————————————————————-

Great post! Unfortunately, there is a lack of this fundamental understanding in Washington DC. Folks on the right shouting on the one hand that Obama needs to FIX IT, and on the other that he hasn’t done anything. Any real thing he could instigate, would be shot down by the GOP in the House immediately. The Dems, have seen the difficulty in getting Frank-Dodd passed, and the subsequent attacks on it since then. As Bill Cosby said, “How long can you tread water?”

Old normal (South FL), 2500sqft 3br2ba, $500k, 6.5% mortgage, monthly outlay $3500, cost to own $2600. New normal, same home, $250k, 4.5%, $1500 outlay, $1000 TCO. Combine the lower prices with lower rates and the cost of ownership is 60% lower. At $1500/month, 25% DTI, you’re at $72k, a reasonable level for that home. @ $3500/mo you need income of $168k to keep a 25% DTI. Median incomes have not fallen 60% even with unemployment where it is. Households that were at two incomes of $72k/yr would have been more stretched in 2006 than a household with one at the same level.

The unemployment situation is terrible, but from a housing cost point of view, for those entering the work force today are in better shape than those 5 years ago. But few worried about the new normal then. The new normal then was celebrated from the paper gains & heloc riches everyone was getting. We should really consider if keeping those people who bought 5 years ago in their homes is worth the expense, or if we should hit the reset (foreclose) button?

“We should really consider if keeping those people who bought 5 years ago in their homes is worth the expense, or if we should hit the reset (foreclose) button?”

The only beneficiaries of keeping them in place is the banks. Both the borrowers and the general public would benefit from a foreclosure. The borrower would have a lower housing cost, and the general public would benefit from the increased consumer spending of the less indebted former owner.

People in positions of power aren’t hearing this and still do not get it – on both sides of the aisle.

Who says the PTB don’t hear or understand the situation?

Do you think the PTB could of sold the 0.7 trillion and the 3 trillion dollar bailout plans by saying the purpose is to:

1. save the banks and WS

2. save the economy by averting a depression

3. save my buddies (banks and WS) and let the rest eat ….

After the 3 trillion dollars in bailout, the unemployment rate keeps going up and more poeple just quit looking for work. The exec. bonus keeps on coming.

Remember what Reagan said: A recession is when my neighbor looses his job. A depression is when I loose my job.

Saving money by renting instead of throwing my money away by owning.

FHFA is considering changes to HARP (home affordable refinance program). One change they could make would be to open it to non-agency mortgages.

e.g. Allow all qualified (by today’s standards) loan-owners to refinance at today’s low rates up to 125% LTV (no cash out) paying mortgage insurance.

As an outside observer(of the California market), the first thing I always notice are those high HOA fees(for a glorified apartment in this case.) Then add on PMI, property tax and homeowners insurance, and I can see why nobody wants to sign on the dotted line. It’s more than just availability of credit. Without appreciation, it makes no sense.

“Without appreciation, it makes no sense.”

That’s California in a nutshell.

Anticipation of appreciation is Gospel here. Everyone expects it, and most base their buying decisions on obtaining it. Appreciation expectation is what keeps our prices inflated. It’s a self-fulfilling prophecy until the crashes come and force people to accept reality… for a while at least.

The ugly reality of no appreciation anytime soon is finally sinking in for many people. Several generations were spoiled with the never ending CA RE appreciation model. I remember attending by friend’s summer BBQ during 2003/2004 timeframe. His father in law was smugly reminding everybody that CA RE has a historical 8% per year appreciation rate and he greatly benefitted from this.

Since this time, we’ve had zero appreciation and may areas have had huge losses. With all the mess associated with the housing market, it will be YEARS before we see any meaningful gains. I bet my friend’s father in law never dreamed he would see a 15 year (maybe longer) stretch where CA house prices didn’t go up.

Many of the prime areas are still so inflated that it would truly take miraculous circustances to see home price gains anytime soon. I think Joe Six Pack (including FCBs) are finally catching on to this.

The funny thing is that beginning around 2003, you couldn’t go anywhere without hearing someone talk about real estate. Now finally in 2011 it seems to be a forbidden subject. I haven’t heard a single person mention anything about real estate, positive or negative, during casual conversation for this entire past year.

That’s the old adge about the market. When the market is in a rally and even the clerks in the basement are talking market, it’s time to sell…

If true, this is a really good sign….

That’s a good sign. When real estate becomes a taboo subject, we are near the bottom.

The Case-Shiller index for Los Angeles was 100 in 1990, and was 100 again in 2000 – no appreciation in the 90’s. If you bought at the bottom (index was 75 in 1995-1997), you would have seen 33% gains to 2000…BUT that is only if you bought at the bottom. Bought in 1990 – no gains at Y2K. Needed 5 more to see the full fruit.

If no one is mentioning it as a good investment, is that a positive contrarian indicator?

Is this really true?

I know many homes in Irvine that were bought in 1990 that were worth more in 2000 and even more now.

And don’t homes always appreciate, even if a little? Disregard the bubble jump but many of the charts that IR posts here (there is one on this entry) always shows the “normal” as sloping upward, not flat or downward.

Isn’t Case Schiller inflation adjusted in some way?

So yeah, in nominal dollars there are a lot of houses that could be priced higher than in 1990 and 2000, but in real dollars, they might not have kept pace with inflation.

Yes.

C-S, as I quoted is NOT inflation adjusted.

IR has published on the price peaks of 1990:

https://www.irvinehousingblog.com/wp-content/uploads/2008/03/projections-using-case-shiller-index-los-angeles1987-2012.jpg

Why would homes always appreciate? To a large degree they are a depreciating asset, minus the land.

Normal slopes upward because of general price inflation and wage inflation in excess of price inflation.

That’s why I said “disregard the bubble”.

Over an extended period of time, do real estate prices go up or down?

I’m talking Irvine specifically but will prices get back to 1999 levels? By that chart, we should be below 2003 prices but I don’t see that as the average in current Irvine pricing.

And you can’t say “minus the land”, that’s part of your “asset” isn’t it?

Irvine Renter – when you say, “The final line of support will be cashflow investors” you are absolutely right. That’s the only way my mother was able to sell her condo. She has moved into an an assisted and independent living facility, but continued to pay the payments and HOA dues on her condo for about nine months while my brother and various realtors tried to sell the place. It’s an undesirable property in an undesirable location. They finally found a buyer who is a cash flow investor. I didn’t do the math on what his cash flow will be – but it will be a good deal for him. Meanwhile, Irvine Co. is planning to build a huge number of apartments on the old Raging Waters site. I never thought that apartments in Irvine could get overbuilt. Now I am starting to wonder!

I think we should replace CTO (Cost to own) with CTLITH (Cost to live in this House)if there is any kind of financing (ie Mortgage) involved because, let’s face it, the Bank actually “owns” it.

“…the Bank actually “owns” it.”

I totally agree: Money Rentership: Housing and the New American Dream

What is the future of these condo conversion apartments? Particularly the really small ones?

Will anyone other than investors pay the “Irvine premium” to own them?

Which owner occupiers wants to make a 7 year commitment to 600sf with no garage?

Hello FreedomCM…I’m not sure who is making a seven year commitment…tenants will come and go, and just like with an apt. building the unit will have to be cleaned and rented out again, but if the cash flow is healthy this will be profitable. If a cash flow investor can make, say, 8% on his money every year, and sell it in 7 years when prices would presumably be higher that would make it an appealing investment.

At some point in time, (say six months) realtors should be required to eliminate “Hurry! Won’t Last!” from their ad. Pretty much anyone with the IQ of slime mold can see how long this has been sitting. What will motivate people in this business to use facts, not false fears?

SB

Huge Surge in Bank of America Foreclosures

http://www.cnbc.com/id/44503938

Thanks. I will use that one.

I think BofA is so desperate for cash they are being forced to foreclose in order to free up what capital they can. This is great news.

Nice – is this the start of the lending cartel collapse you’ve been predicting? It’ll be interesting to see how this plays out. I’m sure the other banks are watching this closely as nobody wants to be the last bank holding the bag. Potentially exciting news for sure!

I wonder if there’s any way to know how many delinquent loans BofA has in Irvine or Orange County. What will be the impact of BofA’s action locally?

Data on delinquency is very hard to find. Banks don’t report this information to any public agency. Lender Processing Services and CoreLogic poll lenders to try to measure it, but they don’t publish this data unless you buy it from them.

No, this economist doesn’t get it. What makes people buy anything is either want or greed, that’s it (various sub-names, but that’s it). People with no net cash aren’t going to buy; wild speculators who bought a lot of homes left the marketplace since the bubble is over; real estate agents who all bought three speculative houses can’t any more (claiming to live in each); and other classes of buyers are gone.

Simple, though, in New Normal without these other potential buyers with ready cash or credit competing for new/used homes/second homes, only good jobs at good wages for the middle-upper 60%will make for stable families and thus children and thus home purchasers. THAT’s what Wall Street doesn’t get, and their captive government reflects that attitude. Check out the corelogic report today on California and the US negative equity; California probably has 40%-50% of indebted properties with no net equity in those under 45 years old (after broker, fix up, selling expense). Or worse. (look at the age based reports)

Employed economists don’t seem to get it; those economists who are out of work for a long time, sometimes start to get it. Quicker if they are on food stamps, I speculate.

What’s replacing Wild Rivers?

http://lansner.ocregister.com/2011/09/13/whats-replacing-wild-rivers/122540/

See this article about an ordinary foreclosure for ordinary reasons:

http://www.dailymail.co.uk/news/article-2036979/Texana-Hollis-101-tears-evicted-home-son-fails-pay-property-taxes-time.html#comments

But can you believe all the commenters’ reactions? Everyone is feeling sorry for this old lady, as though it weren’t a direct result of her or her son’s actions. What exactly did her local authorities do that was so wrong, unfair or unjust?

All of this bottom talk jabber… are we conveniently ignoring 0% fed funds rate and the effects on a consumer debt driven economy / housing affordability?

I forgot that the majority on this blog tout the benefits of centrally planned interest rates. “Borrowing demand is low so rates have to stay low to entice borrowers and increase liquidity” – put a guarantee on this and you have a box of guaranteed bullshit. 30 years of interest rate cuts morph a nation from creditors to borrowers and lower rates are the solution? what logic. We spent all the savings, and now spend others’ savings. Will Mars be lending us money at -4% next? When exactly do rates go up?

Mr Roberts no longer speaks of where interest rates should be. I hope he reiterates the powerful effect interest rates have on affordability and thus prices.

How does the simple math work? 1% rise in rates would need prices to fall 10% to maintain the same level of affordability. Prices fall across the board, vegas, Newport Beach, Florida, Hamptons, and yes even Irvine.

Do we think they can inflate wages as they inflate away our debts? I dont know, but the 10% unemployed will work for less. There are economic consequences to taking the easy money path of inflation – future pain.

Mr Roberts seems to be ignoring some very pertinent issues. Does he feel 0% rates are of benefit to an economy of tapped borrowers? Perhaps political stance has swayed him to be more optimistic than he should be, given the circumstances. Maybe i just prefer Larry the Bear and his gloom and doom posts prompting bull outrage.

Not to pick on Vegas, but what are the downside risks to Vegas rental property when the market demands higher interest rates? Further contraction of economy? Price depreciation? Rent depreciation? Increasing vacancy rates?

The returns are attractive, I agree, but no way in hell are we out of the woods. We are creating greater pain in the future with our current “bandaid” fix. There is no “get out of jail free card”.

In effect, 0% interest rates have made Mr Roberts capitulate his bearish stance. He is not alone. Affordability is being subsidized to appear more attractive than it actually is. this tab will be paid in the future by all citizens via the silent tax – inflation.

When cash is getting next to nothing in the bank, current capitalization rates look all the more attractive.

Policy is herding people away from savings and into still-overpriced real estate and equities. What can you do besides run from the inflation bear looking to eat the slowest in camp?

Investors are doing just that, and poor policy is misallocating resources creating further imbalance – all to be paid for in the future.