If 64% of Americans don't have enough liquid savings for a down payment, they don't have a 3.5% down payment for an FHA loan either. Where are tomorrow's buyers going to come from?

Irvine Home Address … 180 GREENMOOR Irvine, CA 92614

Resale Home Price …… $232,800

I would give everything just for a taste

Everything's here, all out of place

Losing my memory, saving my face

KT Tunstall — Saving My Face

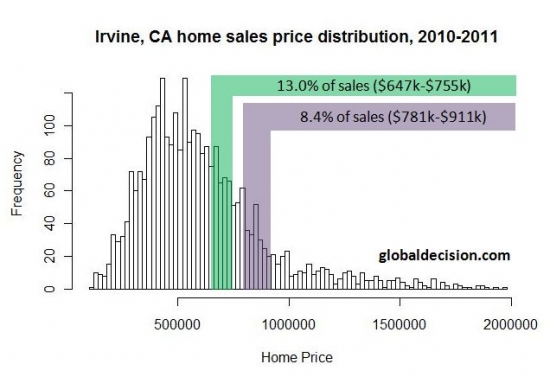

Last month I posed the question, “How are tomorrow’s buyers going to come up with a 20% down payment?” With the overhang of consumer debt and the lingering aftermath of the Great Recession, personal savings rate, at about 5%, are still well below the average of the last 50 years.

Realistically, your average would-be home owner is not going to save up 20% on their own.

The path to ownership and the property ladder

With a return to sane lending standards, most borrowers will obtain their down payment in the traditional manner — they will buy an FHA home and wait until it has gone up in value 20% or more.

Without a 20% down payment, borrowers need to pay private mortgage insurance or an FHA premium. This added cost of borrowing comes directly out of money available to make a payment. In a super-low interest rate environment like today's every dollar that comes out of the payment reduces the mortgage amount significantly. In fact, many of the properties I profile on the IHB are below rental parity for conventional buyers but above rental parity for FHA buyers.

Most people won't save 20% for a down payment from their wage income. It's too hard. Most people don't have the stomach for austerity high savings rates requires. It's far easier to buy a house and wait for it to increase in value.

Once the market bottoms, borrowers will have to wait five to seven years before appreciation adds enough value and amortization pays down the loan enough for them to sell their house and obtain a check after commissions large enough to serve as a 20% down payment on the next property.

By then, most borrowers will also be making more money as they will have progressed in their careers. The accumulated down payment from prior ownership equity and the increased borrowing power of a higher salary allow most buyers the luxury of bidding higher and moving up to a nicer property. That's the way the housing ladder really works.

Many times we have seen large down payments lost in the bubble deflation, but this money was most often a parlay bet with the appreciation of a prior sale. Very few people actually save the full amount a down payment from their wage income to buy property using 20% down.

The broken rungs

Borrowers climbing the property ladder face new challenges to accumulating the equity needed for a move-up. The biggest challenge is their own self discipline. Far too many borrowers avail themselves of the savings in their houses by taking out HELOCs to liberate their equity. Spent equity is not available to put down on a move-up property. Increased earnings is not enough. Without the 20% down payment, move ups are a smaller step than they should be.

The second major challenge to the move-up market is the ongoing decline in low end properties. If equity is disappearing rather than accumulating, move-up buyers are trapped in their starter homes. For the move-up market to function, low-end prices need to appreciate. It's only when these buyers have 20% down payments that the next level up the property ladder has significant buyer support.

Contrary to popular media fiction, there is not a hoard of buyers sitting on the sidelines waiting to deploy their 20% down payments. The reality is the buyer pool is largely broke. Their savings was wiped out in the housing collapse or the stock market crash (or both). Even those who missed those two fiascoes likely have their money sitting in bonds or CDs with yields south of 3%. The money is relatively safe, but it isn't earning much.

Without the requisite down payments, sales volumes will continue to be very weak, and as the major source of funding for mortgages with less than 20% down, the FHA will have a very large market share for the foreseeable future, despite the onerous cost of its insurance.

Besides the chart of personal savings rates above, there is survey evidence that backs up my contention borrowers simply don't have the savings necessary to buy houses.

Most Americans can't afford $1,000 emergency expense

Jessica Dickler, On Wednesday August 10, 2011, 1:40 pm EDT

When the unexpected strikes, most Americans aren't prepared to pay for it.

A majority, or 64%, of Americans don't have enough cash on hand to handle a $1,000 emergency expense, according to a survey by the National Foundation for Credit Counseling, or NFCC, released on Wednesday.

Only 36% said they would tap their rainy day funds for an emergency. The rest of the 2,700 people polled said that they would have to go to other extremes to cover an unexpected expense, such as borrowing money or taking out a cash advance on a credit card.

Most people take the view that credit cards are emergency savings. It's one of the reasons credit card write-offs are so large now. Many people during the recession relied on their credit cards to maintain their entitlements. When the emergency turned into chronic unemployment or loss of income, the credit card debt grew out of control, and many have opted not to pay them.

“It's alarming,” said Gail Cunningham, a spokeswoman for the Washington, DC-based non-profit. “For consumers who live paycheck to paycheck — having spent tomorrow's money — an unplanned expense can truly put them in financial distress,” she noted.

That's the case for Allyson Curtis, 35. “I think about it every day,” she said.

Curtis was unemployed for only three months last year, but in that time she accumulated $5,000 in credit card debt that she's now struggling to pay down.

Do you think that $5,000 in debt was to pay for food, water, and shelter? How many indulgent entitlements were included in the bill?

In the case of an emergency, Curtis said she would likely postpone other payments and pile on additional debt.

In other words, she would go Ponzi.

She is already putting off $450 in dental work and a car inspection due to a crack in her windshield, which will cost $300 to replace, she said.

Many respondents, 17%, said they would borrow money from friends or family. Another 17% said they would neglect other financial obligations — like a credit card bill or mortgage payment — in order to free up some funds.

It must be horrifying for bankers to realize so many view mortgage payments as optional, like Peggy Tanous of OC Housewives fame who got a boob job instead of paying her mortgage.

Budgeting for an emergency fund

Alternatively, 12% of the respondents said they would have to sell or pawn some assets to come up with $1,000 and 9% said they would need to take out a loan. Another 9% said they would get a cash advance from a credit card, according to the NFCC.

Cunningham finds that particularly troubling. Neglecting other debt obligations — or worse piling on more debt — “really exacerbates the problem,” she said.

An earlier study by the same organization found that 30% of Americans have zero dollars in non-retirement savings. A separate study by the National Bureau of Economic Research found that 50% of Americans would struggle to come up with $2,000 in a pinch.

Annndd it's gone….

Cost of ownership lower than the 00s

Very low interest rates certainly do make properties less expensive to own. Today's featured property is priced to reflect 3.4% annual appreciation. That is about the rate of wage growth in Irvine. The property was purchased in 1999 which was before prices got ridiculous in the housing bubble.

The monthly cost of ownership for these owners back in 1999 would have been similar to the cost of ownership today with most of the modest increase in price being compensated by the enormous reduction in borrowing costs. In fact, most of the appreciation in this property could be attributed to declining borrowing costs rather than increasing area wages. If Bernanke holds to his promise to keep rates low for at least two more years, condo prices will likely bottom soon, if they haven't already.

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 180 GREENMOOR Irvine, CA 92614

Resale House Price …… $232,800

Beds: 2

Baths: 1

Sq. Ft.: 889

$262/SF

Property Type: Residential, Single Family

Style: Two Level, Other

Year Built: 1985

Community: Woodbridge

County: Orange

MLS#: S669455

Source: SoCalMLS

Status: Active

On Redfin: 3 days

——————————————————————————

WONDERFUL OPPORTUNITY. RESORT STYLE LIVING IN WOODBRIDGE. CLOSE TO UCI. EASY ACCESS TO 405 AND 5 FREEWAYS. BLUE RIBBON SCHOOLS. CLOSE TO SOUTH LAKE. BRAND NEW CARPET.

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis ![]()

Resale Home Price …… $232,800

House Purchase Price … $156,500

House Purchase Date …. 11/24/1999

Net Gain (Loss) ………. $62,332

Percent Change ………. 39.8%

Annual Appreciation … 3.4%

Cost of Home Ownership

————————————————-

$232,800 ………. Asking Price

$8,148 ………. 3.5% Down FHA Financing

4.19% …………… Mortgage Interest Rate

$224,652 ………. 30-Year Mortgage

$71,492 ………. Income Requirement

$1,097 ………. Monthly Mortgage Payment

$202 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$48 ………. Homeowners Insurance (@ 0.25%)

$258 ………. Private Mortgage Insurance

$241 ………. Homeowners Association Fees

============================================

$1,847 ………. Monthly Cash Outlays

-$173 ………. Tax Savings (% of Interest and Property Tax)

-$313 ………. Equity Hidden in Payment (Amortization)

$12 ………. Lost Income to Down Payment (net of taxes)

$49 ………. Maintenance and Replacement Reserves

============================================

$1,423 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,328 ………. Furnishing and Move In @1%

$2,328 ………. Closing Costs @1%

$2,247 ………… Interest Points @1% of Loan

$8,148 ………. Down Payment

============================================

$15,051 ………. Total Cash Costs

$21,800 ………… Emergency Cash Reserves

============================================

$36,851 ………. Total Savings Needed

——————————————————————————————————————————————————-

Tonight we will deliver our first-time homebuyer's presentation. Admission is free and open to everyone.

I hope to see you there.

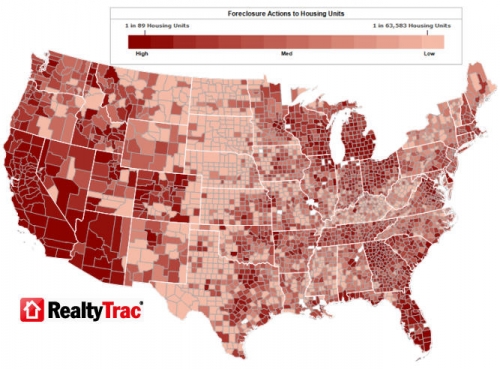

Do you ever find yourself getting impatient with the way lenders have dragged out the housing crash? I do. It isn't merely that I want to see lower house prices as those are prevalent across most of the country. I want to see the economic wounds heal. That isn't going to happen until lenders foreclose on all the delinquent mortgage squatters and resell the resulting REO.

Do you ever find yourself getting impatient with the way lenders have dragged out the housing crash? I do. It isn't merely that I want to see lower house prices as those are prevalent across most of the country. I want to see the economic wounds heal. That isn't going to happen until lenders foreclose on all the delinquent mortgage squatters and resell the resulting REO.

This should be no surprise to IHB readers. I have long contended that robo-signer was merely a ruse, the excuse-of-the-day, to delay foreclosures and avoid writing down more bad loans. Lenders will continue this behavior as long as they believe there is no buyer demand to sell into. Eventually, lenders will realize the buyer demand they are waiting for will never materialize. When they do, they will capitulate and sell for whatever they can get.

This should be no surprise to IHB readers. I have long contended that robo-signer was merely a ruse, the excuse-of-the-day, to delay foreclosures and avoid writing down more bad loans. Lenders will continue this behavior as long as they believe there is no buyer demand to sell into. Eventually, lenders will realize the buyer demand they are waiting for will never materialize. When they do, they will capitulate and sell for whatever they can get.

.jpg)

.jpg)

.jpg)