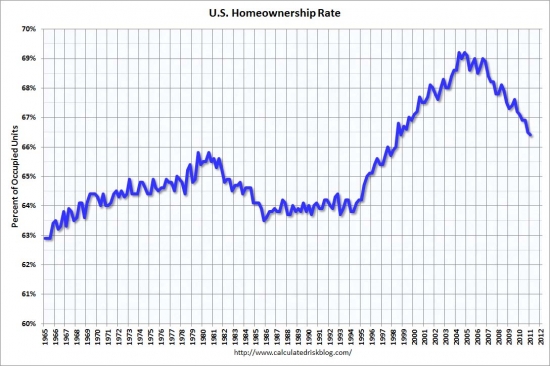

In a recent housing market analysis, PIMCO's Rod S. Dubitsky concludes long-term drags on housing demand will persist beyond the current crisis with distressed supply.

Irvine Home Address … 1703 ELK Grv Irvine, CA 92618

Resale Home Price …… $385,000

Coming over the airwaves

The man says I'm overdue

Sing along, send some money

Join the chosen few

Well mister I'm not in a hurry

And I don't want to be like you

And all I want from tomorrow

Is to get it better than today

Step by step, one by one, higher and higher

Step by step, rung by rung climbing Jacob's ladder

Huey Lewis & The News — Jacob's Ladder

Yesterday I lampooned a writer who didn't want to understand the problems with housing. Today, I am featuring an article from someone who does understand what ails the housing market.

Are There Any Rungs Left on the Housing Ladder?

Rod S. Dubitsky — PIMCP — July 2011

- It appears that limited mortgage availability and vulnerable consumer health are restraining demand.

- Also weighing on the market is regulatory uncertainty over the future structure of mortgage finance and the resolution of foreclosure overhang.

- We believe the housing market, considered to be a key driver of the economic recovery, will generally remain weak for the foreseeable future.

While the housing market is well off its bubble-era peak, the pending distressed supply has been frequently mentioned as creating additional headwinds, thereby preventing the housing market from mounting a meaningful recovery. Perhaps less discussed, we believe demand-side drivers are just as important.

Additional headwinds contributing to what we see as a dramatic cyclical and secular decline in housing demand will likely continue to weigh on the housing market for the foreseeable future. In spite of what may be considered good affordability (driven by dramatically reduced prices and low interest rates), it appears that limited mortgage availability and vulnerable consumer health across the income and age spectrum are restraining demand and may continue to do so. Also weighing on the market is regulatory uncertainty over the future structure of mortgage finance and the resolution of foreclosure overhang. For all of these reasons, we believe the housing market, considered to be a key driver of the economic recovery, will generally remain weak for the foreseeable future.

Demand will remain weak. It will take time for the armies of the foreclosed to regain their credit. If the standards for a qualified residential mortgage make people save for 20% down payments, it will take a very, very long time for demand to return. It's difficult to save 20%, and with the debt loads most people carry with student loans and credit cards, saving 20% of the price of a house is practically unreachable.

The down payment barrier will create significant demand for non-conforming products and second mortgages, but these will carry a stiff price tag. Private mortgage insurance is very expensive, and in today's market second mortgages are not available. It will take many years before the cost of these down payment proxies come down. In the meantime, the amount people will be able to borrow will be significantly reduced.

We may see real dollar-backed demand once people's FICO scores improve and the are eligible for loans, but the amounts these recycled borrowers will be offered will be paltry, and house prices will need to reflect that for sales to occur.

Affordability vs. Availability

Housing affordability in many markets may be considered compelling relative to historical levels, but it appears to be increasingly difficult to get a mortgage. We believe tighter mortgage underwriting criteria and the generally weakened financial state of the average consumer is reducing demand. For example, the Federal Housing Administration (FHA), which allows a 3.5% down payment for the best borrowers, has significantly increased its annual mortgage insurance premiums and halved the closing costs that can be financed in the loan balance (which effectively means more cash up front to cover closing costs). Recently it was reported that the FHA is considering tightening its debt to income ratio standards. This, plus general credit tightening by the FHA, suggests that what once was considered the nation’s affordability loan product may no longer be as widely available or as affordable as it once was.

FHA loans will continue to become more expensive because the FHA is losing money. Risk will be appropriately priced or the government will be pouring money down a rathole forever.

For conventional mortgages, Government-Sponsored Enterprises (GSEs) such as Fannie Mae and Freddie Mac have imposed Loan Level Pricing Adjustments requiring a 25% down payment in order for the most qualified borrowers to get advertised rates. Those with credit blemishes and/or less cash to put down could face up to 3.25 additional points in fees (or an additional 65 basis point annual cost assuming a five-year life), according to Fannie Mae.

In addition to GSE and FHA tightening, lenders and mortgage insurers often have even tighter criteria imposing more stringent underwriting, additional fees and rate adjustments on top of the GSEs (FHA lenders in particular are generally requiring stricter underwriting than FHA’s guidelines).

The GSEs are tightening for the same reason the FHA is: losses. We will eventually plug that hole as well, but it will require continued tightening of credit standards.

For those expecting private mortgage money and the jumbo market to save the day, those lenders don't want to lose money either. Jumbo standards are already very tight, and as GSE loans become more scarce, portfolio loans will increasingly become the standard. This is good for the market in the long term, but the transition will be painful for those who want to see higher prices.

Saving for the traditional 20% down payment may increasingly become an insurmountable hurdle. To help gauge how much of a hurdle the 20% down payment can be (which outside of FHA loans is becoming the de facto standard), we estimated how long it would take the typical consumer to save for a down payment on a median-priced home, which was $158,700 as of 1Q 2011, according to the National Association of Realtors. Liquid assets held by consumers under 45 years old available for a housing down payment average $22,600, according to the Federal Reserve Board’s Survey of Consumer Finances. In order to cover a 20% down payment and 5% closing costs for the median-priced home, consumers need $39,667. Therefore the amount needed for a 20% down payment on the median home (and likely a modest home at that) was nearly two times the average savings rate.

Think about how much more difficult it is in Orange County. With a median home price north of $400,000, a buyer here needs to save $80,000. Orange County residents are not famous for high savings rates. Realistically, the only way an Orange County resident is going to come up with enough money is if they first buy a home with an FHA mortgage of 3.5%, and that house goes up enough that they can sell and obtain the 20% equity for the next house. It will take a long time before the move-up property ladder provides that kind of equity.

Looked at another way, factoring in the personal savings rate from after-tax income as reported by the Bureau of Economic Analysis, we can arrive at a “saving duration rate” expressed in years. We have applied this methodology to calculate the saving duration on a 20% down payment mortgage, which seems to be what the country is migrating towards as the standard mortgage down payment. Based on the current savings rate of 5.1% and after-tax income of $48,300 (as of 1Q 2011), it would take 16 years for buyers to save the 20% down payment based on the national median–priced home and well over 20 years in many coastal cities where prices are higher. This metric assumes a complete depletion of savings and no retirement savings and other simplifying assumptions. The dramatic spike in sales that occurred as a result of the recently expired housing tax credit shows that relatively nominal assistance in purchasing a home can have an impact on home purchases and affordability. This is a direct reflection of the sparse savings most potential homeowners have available.

People jumped on the tax credit because without it, they feared they would never be able to save enough to buy a house. For many this was probably true. Of course, most didn't realize prices would drop to the new level of affordability, but all those underwater bear rally buyers are very aware of that fact now.

Next Generation Balance Sheets

The hypothetical balance sheet of the next generation of would-be homebuyers looks grim. Average student debt for a bachelor’s degree reached $23,118 in 2008 [and it is projected to go higher (see Figure 1)]…

This younger age group will likely constitute the bulk of potential new entrants to the housing market, and whether a corresponding demand in housing will materialize hinges largely on their ability to save. Although some of these grim statistics can be considered a function of recent economic weakness, we believe that some amount of the reduction in graduate earnings power and rise in debt is a longer-term phenomenon that could serve to limit college graduate home purchasing power for the foreseeable future.

With the enormous debt loans students now have coming out of college. how are they supposed to pay off their student loans and save for the down payment on a house? The generation that came before them was handed the keys to any house they wanted without any sacrifice whatsoever. The current generation is being asked to endure an austerity never before witnessed. How many of them will endure a decade of austerity to own a home?

Retirement Budget Housing Ramifications

A growing percentage of the population appears to be approaching a limited resource retirement, whether due to inadequate retirement resources or doubts about whether “promised” resources will materialize (e.g. state and municipal retirement plans are under threat).

… We expect most will be hesitant to spend these precious savings on a home, given the destruction in housing net worth and potentially limited income generated from DC plans. This could continue to curtail demand for trade-ups, retirement homes, etc.

My parents recently retired. Their financial plan does not include buying a new primary residence as the one they have now is paid off. They are not alone.

The days of buying a house to retire on the Ponzi borrowing are over.

Regulatory Headwinds Abound

In addition to these affordability constraints, a number of legislative and regulatory developments could potentially squeeze availability of mortgage loans:

Mortgages: Though it is highly uncertain what the future structure of the mortgage market will look like, one thing is probable: The mortgage market of the future will have less government and more private sector involvement, though this may take several years. This will likely result in rising mortgage rates in general and more risk-based pricing in particular as the private sector increases rates to weaker GSE-eligible borrowers.

Borrowing costs for houses cannot get any lower relative to incomes. We are at 4.5% interest rates. The only way house prices can go up is if income rise, and with 9% unemployment and grim prospects for an employment recovery, Bernanke will need to print a lot of money to get wages to rise.

Basel III: Among other changes potentially impacting the mortgage market, Basel III imposes increased capital charges on retained mortgage servicing, which further increases the cost of securitization as servicers who retain the servicing will be subject to more onerous capital charges. Currently, 100% of the value of mortgage servicing rights is applied to Tier I capital. Under Basel III, the capital benefit of mortgage servicing rights will gradually be phased down to 15% of equity capital.

I had not heard of this. It's another issue that will increase the cost of lending and thereby drive up interest rates.

Dodd-Frank: Among the elements of Dodd-Frank that could suppress mortgage supply are the risk retention rules that require securitizers to retain 5% of securitizations for loans not meeting Qualifying Residential Mortgages (QRM) criteria. Among other elements, QRM mortgages stipulate a minimum 20% down payment and a maximum mortgage debt ratio of 28%. The comment period has ended on these proposals and the rules are expected to become final within 60 days of the end of the comment period (e.g. 60 days from June 10, 2011).

With the uproar over 20% down payments, the more important 28% debt-to-income limitation has gone under the radar. If implemented, the restricted income requirement will greatly drive up lending costs on those who stretch the most.

This could further impair the use of securitization to help stimulate the supply of mortgages. Though the GSEs are exempt from the risk retention rules, given that the future mortgage market will likely be less reliant on the GSEs (and the degree of GSE involvement will be heavily dependent on the political landscape), the securitization market is considered critical to offsetting the dwindling capacity of the GSEs. With a potentially declining presence of the GSEs and a minimalist securitization market, there simply does not appear to be enough bank capital (and banks are the most likely source of alternatives to GSE and securitization funding) to adequately support mortgage lending. …

There will be no shortage of mortgage money, but it will become more scarce at high debt-to-income ratios. That is a good thing. It will drive up costs to the most foolish borrowers, and drive down prices on homes those borrowers would have otherwise purchased.

Conclusion: Appearances Can Be Deceiving

A basic concept of personal finance is that as long as borrowers have sufficient funds for a down payment and a stable source of income, the next rungs up on the housing ladder should be within reach. For the typical American homeowner, these requirements have traditionally been satisfied by solid employment for young graduates, reasonable pricing and availability of mortgage credit, accumulation of funds that allow trade-up purchases of larger homes and finally by the view of housing wealth as a potential income supplement during retirement.

However, we believe the challenging economic situation today has dramatically altered this progression. At the bottom of the ladder, dismal employment prospects and the debt situation of young graduates may be impeding their ability to save for a down payment. In the middle of the spectrum, negative equity is effectively preventing many homeowners from advancing (i.e., Core Logic estimates that over 23% of homeowners have negative equity in their homes preventing them from buying a new home). And at the top of the ladder, the erosion of retirement income could result in downscale housing investments and may push retirees to consign themselves to the status of lifetime renters.

Every rung on the property ladder is effected for different reasons, but they are all under siege.

Instead of serving as a potential wealth builder, housing has in some cases become a potential millstone that can drain limited remaining liquidity and retirement funds. Hence, even buyers who can climb on to the home ownership ladder may opt out of home ownership in favor of what is often times the more flexible, available rental option.

The change in buyer psychology resulting from a multi-year price decline will be difficult to overcome. In fact, I believe this will be the worst problem created by the false rally of 2009-2010. Because the government meddling sent a false buy signal and burned a group of cautious buyers, many will question the real bottom when it materializes. This uncertainty will make the ensuing recovery tepid for all but the most undervalued markets.

Tight mortgage lending standards, pending GSE reform and weak economic conditions across the demographic spectrum render the prospects for housing demand increasingly grim. Though there will be some rebound in demand as the economy finally achieves escape velocity and income and employment growth return to normal levels, we are arguing that post-recovery demand will be more tempered than it has been in the past. Further, people need to live somewhere, and investors will likely step into the breach (and have already, as a large percentage of today’s home sales are all-cash sales to investors) as more housing becomes rental housing. The implication is that we could see further home price declines as we move from a nation of owner occupants to a nation of renters/investors.

Though much has been made of the distressed supply overhang, we believe the demand side of the housing equation could more than overwhelm the impact of distressed housing supply. Absent a significant economic rebound or more dramatic policy response, housing demand will likely remain a drag on the housing market for the foreseeable future.

There is no reasonable policy response to jack up house prices. Everything attempted so far has been a dismal failure. There is neither the political will nor a viable plan to counter the economic drag created by falling home prices. With banks weakened by balance sheets full of toxic assets they cannot sell without becoming insolvent, new debt is not likely going to provide a strong economic stimulus that could boost housing.

Let's hope Bernanke prints enough money to make everything better… not.

2003 Rollback

The low end of the Irvine housing market continues to tumble. We are firmly back in 2003 pricing, and these owners are in danger of losing money on their purchase from eight years ago.

The owners of today's featured property used 100% financing back in early 2003, but they were restrained in their borrowing thereafter. They only added $14,000 to their mortgage debt during a time when everyone around them was going nuts. Good for them.

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 1703 ELK Grv Irvine, CA 92618

Resale House Price …… $385,000.png)

Beds: 2

Baths: 2

Sq. Ft.: 1200

$321/SF

Property Type: Residential, Condominium

Style: Two Level, Contemporary

Year Built: 2000

Community: Oak Creek

County: Orange

MLS#: S666332

Source: SoCalMLS

Status: Active

On Redfin: 2 days

——————————————————————————

IMMACULATE MEDITERRANEAN-STYLE TOWNHOME with PREMIUM QUIET LOCATION in upscale gated Oak Creek featuring two bedrooms, two & one-half baths, private patio, and two-car garage! IMPECCABLE THROUGHOUT this beautiful residence with ceramic tile entry, upgraded hardwood laminate flooring on both levels, cozy fireplace with custom tile surround, mirrored wardrobe in secondary bedroom, convenient inside laundry room, dramatic archways and niches! SPARKLING KITCHEN features Honey Maple cabinetry, dishwasher, gas oven, and stainless steel refrigerator! SPACIOUS MASTER SUITE with romantic balcony, dual vanities, oval bath, and walk-in closet. ENJOY AWARD-WINNING SCHOOLS and RESORT-STYLE pools, spas, tennis, sport courts, tot-lots, private Oak Park gym, upscale shopping, dining, and more!

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis![]()

hardwood laminate? Is that a genuine imitation?

Resale Home Price …… $385,000

House Purchase Price … $356,000

House Purchase Date …. 5/30/2003

Net Gain (Loss) ………. $5,900

Percent Change ………. 1.7%

Annual Appreciation … 1.0%

Cost of Home Ownership

————————————————-

$385,000 ………. Asking Price

$13,475 ………. 3.5% Down FHA Financing

4.48% …………… Mortgage Interest Rate

$371,525 ………. 30-Year Mortgage

$80,488 ………. Income Requirement

$1,878 ………. Monthly Mortgage Payment

$334 ………. Property Tax (@1.04%)

$90 ………. Special Taxes and Levies (Mello Roos)

$80 ………. Homeowners Insurance (@ 0.25%)

$427 ………. Private Mortgage Insurance

$283 ………. Homeowners Association Fees

============================================

$3,092 ………. Monthly Cash Outlays

-$301 ………. Tax Savings (% of Interest and Property Tax)

-$491 ………. Equity Hidden in Payment (Amortization)

$22 ………. Lost Income to Down Payment (net of taxes)

$68 ………. Maintenance and Replacement Reserves

============================================

$2,390 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,850 ………. Furnishing and Move In @1%

$3,850 ………. Closing Costs @1%

$3,715 ………… Interest Points @1% of Loan

$13,475 ………. Down Payment

============================================

$24,890 ………. Total Cash Costs

$36,600 ………… Emergency Cash Reserves

============================================

$61,490 ………. Total Savings Needed

——————————————————————————————————————————————————-

Have a great weekend,

IrvineRenter

Congrats Irvine Renter!

Realtors dismiss complaint against blogger

Published on July 22nd, 2011

Written by: Marilyn Kalfus, real estate reporter

http://irvinehomes.ocregister.com/2011/07/22/19523/19523/

Thank you. I will comment next week:

“By MARILYN KALFUS / THE ORANGE COUNTY REGISTER

A formal grievance complaint filed by the Orange County Association of Realtors against an Irvine real estate blogger has been dismissed, the attorney for the blogger says.

The lawyer, Scott Sims, had accused OCAR of being at odds with laws governing free speech in filing its complaint against Larry Roberts of irvinehousingblog.com. But Sims says he was given no reason the case was stopped.

“The bottom line is that OCAR has completely backed down and dismissed the complaint, without any settlement agreement or anything of the sort,” Sims said. “This is a clear and total victory for Mr. Roberts. He looks forward to continuing to provide readers of irvinehousingblog.com with high quality analysis and insight into the housing market.”

Roberts has taken on the real estate industry and accused agents of being dishonest. But while he’s been hard on real estate agents in general, he said in a recent interview, ”I have never singled any Realtor out and called them a liar.”

The grievance didn’t say specifically what Roberts — who is not a Realtor –or anyone else did, according to Roberts, who showed a copy of it to The Orange County Register.

Also subjects of the grievance — and the dismissal — were real estate agent Shevy Akason and broker Tina Rector. Akason, who works at Evergreen Realty, advertises on Roberts’ blog and pays him for referrals. Rector is Evergreen’s founding broker.

An OCAR grievance committee representative previously declined to discuss the case with a reporter, saying grievances are confidential.

Did **reality** hit OCAR right in the face or what?

Congrats IR.

I’m half happy and half bummed. It would have been fun to leverage this to further expose the corruption and fraud that occurs with some OCAR members. But it’s awesome to see IR deservedly come out on top!

I love the “grievances are confidential” line.

I think this is OK in principle, until the point when the “grievance” becomes a “formal complaint” (in writing) and is issued externally to the subject from the OCAR organization. How can it still be regarded as confidential anymore. That’s sounds dumb.

I find it convenient for OCAR that the subjects of the grievance are named individually and publicly, but not the individuals within OCAR who drafted the complaint in the first place.

I do have a question: Was the dismissal of grievances by OCAR accompanied by a written personal or public apology?

While dismissing the grievance is a positive development, without something official or in writing acknowledging OCAR’s “error”, I presume Shevy and Evergreen and IHB have to try and do business in OC with a scarlet letter.

My sign for shopping mall demonstration was going to say:

“OCAR: It’s OK. We know. Just apologize!”

Does anyone know what happened to the PIMCO guy who called the housing bubble in PIMCO articles around 2006? He wrote about his own experience selling his Newport Beach home and moving his family into a rental home? I wonder if he’s still at PIMCO and whether he’s purchased a home.

His name was Mark Kiesel and it looks as if he is still there.

This is the article in which he revealed he sold his home to rent while prices dropped.

Ah, that brought back memories. I like this quote:

“…I will likely not re-enter (and buy a home) for at least another year as I suspect there is more downside ahead for Orange County housing prices…”

We’re in this six years and counting!

You should do a thread based on that thread (unless it’s illegal or violates blogging ethics). The 5th anniversary is coming up in November, which might be an appropriate date.

With 5 years’ hindsight, the comments in particular make very interesting reading . . .

(And if you frequent Lansner’s blog, as I do, you’ll know that the prices-will-defy-gravity comment crowd is even more shrill today than they were back in 2006. Desperation, anyone??)

The comments on that article are priceless. While only a small snapshot of what people were thinking, it summarized the two camps pretty well.

Is this the guy, Mark Kiesel?

He’s still at PIMCO:

http://singapore.pimco.com/LeftNav/Bios/Mark+Kiesel+Bio.htm

As of 2009, he was still renting:

http://articles.latimes.com/2009/aug/17/business/fi-bubble-timers17

Still at PIMCO:

http://www.pimco.com/EN/Insights/Pages/InsightsOverview.aspx?pa=Mark R. Kiesel

I’ve seen 80-10-10 products used fairly regularly. The 2nd 10% loan is usually at a higher rate 1-2% above the 1st. 400k @ 10% down is now $2500/mo. At 25% DTI, that’s 120k in income. Say, 10%/yr towards 401k (with the possibility of a loan for a DP), and a $1250/mo rental banking the $15k/yr savings on housing, it doesn’t take long to get to a 40k DP.

With this the 2nd becomes something like a DP program. It should have a shorter term than the first so that a bigger chunk goes towards building equity. It is much easier to do this at lower DTIs. The 35-45% DTI that gets talked about here seems dangerous to me, but I haven’t tasted the CA-RE punch.

“Realistically, the only way an Orange County resident is going to come up with enough money is if they first buy a home with an FHA mortgage of 3.5%, and that house goes up enough that they can sell and obtain the 20% equity for the next house.”

Now who’s being infected by the REIC meme, IR?? 😉

There is another way. Buy a home with an FHA mortgage AND PAY THE MORTGAGE DOWN. At some point the equity from that home will serve as a deposit for the move-up without any requirement for appreciation; in fact, the less appreciation the better since it will keep the changeover price lower.

This is a healthy move-up market. What will impact Irvine (and CA in general) is the availability of financing for DTI > 30%. It will be interesting what the private lending market will do, especially if banks have to hold more capital for a non-qualifying mortgage vs. one with DTI < 28%.

Tot lots! AYYYY!

http://www.crackthecode.us/images/Irvine_Tot_Lot.jpg

walk-in closet

http://www.crackthecode.us/images/WalkinCloset.jpg

Impeccable

http://www.crackthecode.us/images/Impeccable.jpg

White House to tackle housing reform after debt ceiling fight (Jon Prior at HousingWire)

I love it when the analysts come out and state the rather obvious. If you gather the facts and do your own thinking, not much in this paper would’ve surprised you. But it’s comforting nonetheless to see a “pro” confirm what we either knew, suspected or otherwise predicted would happen.

Higher education is becoming increasingly more expensive, gone are the days when a Cal State education cost little more than books and materials, tuitions are continually on the rise. As pointed out, graduates are emerging with greater amounts of debt and worse, few job options. Servicing debt, paying more for essentials (even a cheap new car is $14-15K now) and stagnating wages have all but decimated any savings ideals. The idea of owning a home is a retreating mirage, ever unattainable.

IR said – “The change in buyer psychology resulting from a multi-year price decline will be difficult to overcome. In fact, I believe this will be the worst problem created by the false rally of 2009-2010. Because the government meddling sent a false buy signal and burned a group of cautious buyers, many will question the real bottom when it materializes.” I couldn’t agree more and to me, this is one of the most salient points made. Its my belief a fundamental shift is underway in how people will look at their housing options going forward … I know I am.

Renting is losing its stigma (as has long been the case in Europe) and many are rethinking taking on the responsibilities that come with owning one’s home. Maintenance costs, insurance, appliances and major repairs dull the sheen of owning a home; considering a likely very slow appreciation in value for the foreseeable future, coupled to the risk, it simply may not be worth it.

Saving for a DP has always been hard. The employment situation in the late 70’s and early 80’s was not great, and my parents used a loan from my grandparents for their DP. I actually think that used to be more common.

The change has already taken place. It’s not the false rally that has changed sentiment though, it’s the buyers of 2005-2007 who potentially had their down-payments dissolve. I don’t know if 100% financers who squatted for more than a year have owning look like a less attractive option.

Housing as an investment has taken a huge hit (you’ll know to get back in when you see the magazine cover below relating to housing). With that, you’ll have more people choosing to rent, and also spending less of their income on housing – because it’s more consumption than investment.

I’ve seen this with the residents in training at my wife’s hospital. When she started in 2003 up till just recently, nearly everyone bought a home. Even if they were only going to be here 3 years, or had no need for a the space of a home & yard. But, if you made 50-75k on your last $175k home that you owned for 3-4 years, why not buy? Some of those buyers are now accidental landlords, but many more incoming residents are choosing to rent (which is the right choice).

It will take a couple years for multi-family and apartment construction to catch up with where sfr was a couple years ago. There are a lot of condos though, that will become rentals instead of purchases, either by the original owner or investors.

Congrats.

One happy reader.

Congratulations on them dropping that silly action. Thanks for providing a place for us to have discourse. Best of luck to you!!!

$1.2 million mansion for $10K?

http://www.bankrate.com/financing/mortgages/1-2-million-mansion-for-10k/?ec_id=m1078089