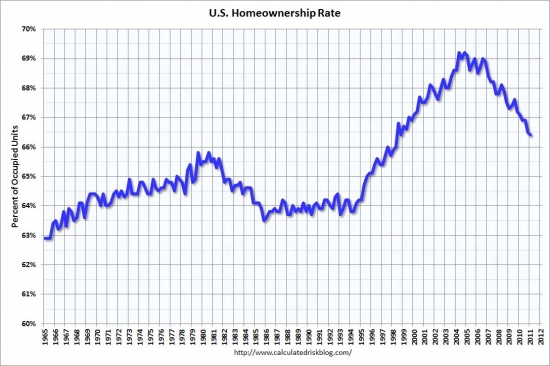

House prices volatility, both up and down, results from residential real estate appraisers using the comparative sales approach without considering a properties potential rental income.

Irvine Home Address … 14 ROCKY Gln #22 Irvine, CA 92603

Resale Home Price …… $450,000

Of our elaborate plans, the end

Of everything that stands, the end

The Doors — The End

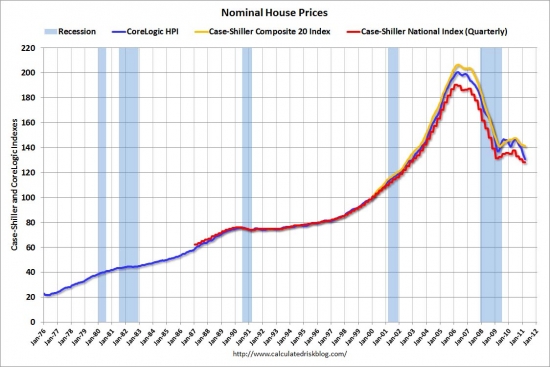

Most people would agree that preventing financial bubbles is preferable to cleaning up the mess in the aftermath. The ups and downs of housing prices must end. The housing bubble shattered the dreams and aspirations of a generation. Some of the wealth lost was an illusion, but those who lost their family homes lost something tangible and real.

Great Britain is trying to recover from its fourth housing bubble in the last 40 years. That rivals California's three bubbles during that span. They too are looking for answers to prevent bubble number five from wiping out their wealth and their economy.

'Cap mortgages at 90% of value' to prevent bubble

Price stability should be government priority

Bloomberg — June 3, 2011

London: UK lenders should cap mortgages at 90 per cent of the property's value and no more than three-and-a-half times a household's annual income to prevent another housing bubble, the Institute for Public Policy Research said.

In The Great Housing Bubble, I proposed capping lending at a 90% loan-to-value ratio just as this group has done. I like the idea:

There are a number of reasons why high combined-loan-to-value lending is a bad idea: (1) it promotes speculation by shifting the risk to the lender, (2) it encourages predatory borrowing where borrowers “put” the property to a lender, (3) it promotes a high default rate because borrowers are not personally invested in the property, (4) it discourages saving as it becomes unnecessary, and (5) it artificially inflates prices as it eliminates a barrier to market entry. This last reason is one of the arguments used to get rid of downpayment requirements. The consequences of this folly became readily apparent once prices started to fall.

Also in The Great Housing Bubble, I explored capping the loan-to-income ratio, and I found the approach lacking:

Another proposed solution is to regulate the loan-to-income ratio of the borrower. When 30-year fixed-rate mortgages first came out, mortgage debt was limited to two and one-half times a borrower’s yearly income. It was an artificial limit that made sense when interest rates were higher and people were accustomed to putting less money toward housing payments. A legislative cap on the loan-to-income ratio would prevent future housing bubbles, if it was enforced. This would not work for the same reason lenders went away from the two-and-one-half-times-income standard years ago: it does not reflect changes in borrowing power due to changes in interest rates. This idea of regulating loan-to-income ratios is actually an evolution of the idea of regulating interest rates. If the total loan-to-income ratio is limited, very low interest rates do not cause dramatic price increases, but since low interest rates were not really the cause of the bubble, limiting the loan-to-income ratio is not addressing the real cause of the bubble. Plus, there are ways to get around a cap on home loan borrowing by obtaining other loans not secured by real estate. It would be relatively easy for a borrower to obtain bridge financing to acquire a property and then obtain a HELOC to pay off the bridge financing. In the end, the borrower would have borrowed more than the cap amount thus rendering any cap meaningless. To close the various loopholes, more regulations would be required, and a regulatory nightmare would ensue.

Back to the article:

The UK's “addiction to house-price inflation” is damaging the economy and the Conservative-led coalition government should make price stability a priority, the London- based advisory group said in a report.

“Britain has suffered four housing bubbles in the last 40 years, each of which contributed to major economic and social problems,” Nick Pearce, a director at the IPPR, said in the statement. “We need tougher mortgage-market regulation from the FSA, especially caps on loan-to-value and loan-to-income ratios.”

The Financial Services Authority regulates UK mortgage providers and other lenders. House prices tripled in the ten years through 2006, rising by 12 per cent a year, IPPR said. Mortgage lending is 81 per cent of GDP in the UK compared with 73 per cent in the US.

No deposit

The average loan for a first-time buyer was 3.15 times annual household income in March, IPPR spokesman Richard Darlington said by e-mail. In 2007, when the UK's real estate market peaked, 28 per cent of all advanced mortgages had loan-to- income ratios of 3.5 or more. First-time buyers regularly took out mortgages of 100 per cent of the property's value.

Great Britain was doing the same stupid things we were in the United States.

… Fall in demand

Mortgage applications in the US fell for the first time in five weeks as refinancing cooled.

The Mortgage Bankers Association's index of loan applications dropped 4 per cent in the week ended May 27. The group's refinancing index declined 5.7 per cent and the purchase gauge was unchanged.

Falling home prices are keeping more buyers on the sidelines while making it harder for homeowners to refinance current mortgages. Unemployment at 9 per cent and the prospect of more foreclosures in the pipeline mean housing will take time to recover.

“Nobody wants to buy an asset they think will go down in value,” Neil Dutta, an economist at Bank of America Merrill Lynch in New York, said before the report.

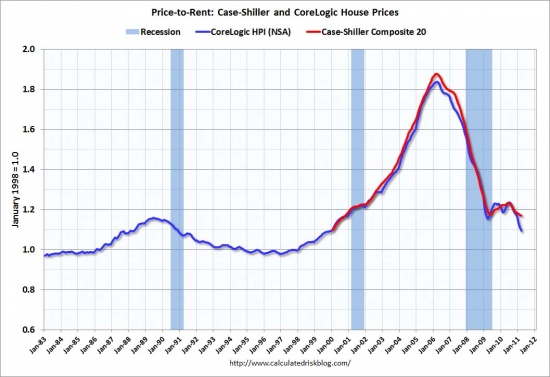

Capping lending and tethering it to a reasonable and affordable percentage of borrower income is essential to prevent future housing bubbles, but the problem is more complex because capping a loan at 90% value requires understanding what value is. Our current approach to residential property valuation relies exclusively on comparative sales, and it is a flawed system.

The income approach appraisal

When lenders underwrite investment property loans, they have an appraiser establish fair-market rents, and they generally consider between 65% and 75% of that income toward qualification for the loan. In places were properties are trading 25% or more below rental parity, the net income of the property will cover the payment, taxes, and insurance. These are low risk loans for lenders that provide them higher interest rates.

If applied to a typical residential real estate transaction, an income approach appraisal would reveal which properties generate sufficient cashflow to cover the loan in the event the lender had to take the property back. If lenders had the income information to compare to comparable sales, they would quickly see which properties are inflated in price and are thereby the riskier loans.

Loans on properties in Orange County with a negative cashflow should require larger down payments and more borrower income and assets. In contrast, a Las Vegas property with a positive cashflow would require smaller down payments and no other collateral to cover the loan. In the event of foreclosure, a lender could rent out the cashflow positive property and receive their desired income stream which effectively mitigates their risk. Lenders take on more risk than they realize when they loan on cashflow negative properties.

I wrote about income approach appraisals in The Great Housing Bubble:

There is one potential market-based solution that would require no government regulation or intervention that would prevent future bubbles from being created with borrowed capital: change the method of appraisal for residential real estate from valuations based exclusively on the comparative-sales approach to a valuation derived from the lesser of the income approach and the comparative-sales approach. … In the current lending system, the income approach is widely ignored.

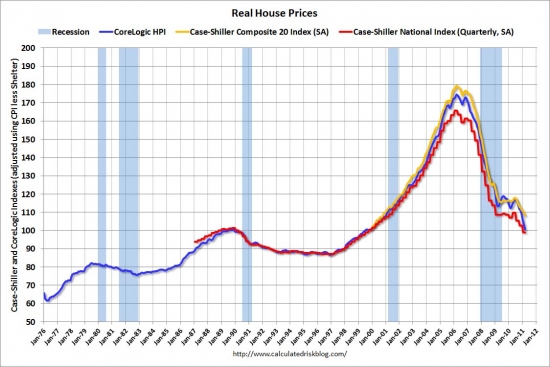

… When the fallout from the Great Housing Bubble is evaluated, it is clear that the comparative-sales approach simply enables irrational exuberance because the past foolish behavior of buyers becomes the basis for future valuations allowing other buyers to continue bidding up prices with lender and investor money. Prices collapsed in the Great Housing Bubble because prices became greatly detached from their fundamental valuation of income and rent. This occurred because the comparative-sales approach enables prices to rise based on the irrational exuberance of buyers. If lenders would have limited their lending based on the income approach, and if they would not have loaned money beyond what the rental cashflow from the property could have produced, any price bubble would have to have been built with buyer equity, and lender and investor funds would not have been put at risk. There is no way to prevent future bubbles, and the commensurate imperilment of our financial system, as long as the comparative-sales approach is the exclusive basis of appraisals for residential real estate.

When I wrote those words, the deflation of the housing bubble had not overshot to the downside in any market. My focus above was on preventing prices from going up too much, but this approach can also address problems we are seeing in markets like Las Vegas where prices have gone down too much.

In a declining market, lenders are cautious because nobody knows what anything is worth, and if lenders underwrite big loans that subsequently go underwater, borrowers walk away from their debts and leave lenders holding collateral worth less than their loan balance. As a consequence, lenders want to be conservative, so they rely on appraisers to keep values comfortably within range of recent comps, no matter how low those comps may be.

There comes a point when recent comps are so low that a property is undervalued based on its potential for cashflow, but since lenders don't use the income approach when evaluating residential real estate, they are not aware of these key price support levels and they approve short sales and REO resales at very low prices. An example comes from a recent community I saw in Las Vegas:

I discovered this neighborhood while looking at another auction property nearby. The property of interest is in a cluster product neighborhood in a nice part of Henderson, Nevada. All the properties were built in 2005 and sold new in the mid 200s.

The list of comparables below are all in the cluster neighborhood, and they are arranged in descending order of closing dates. Take a careful look at the sales price in the column second from the right.

The properties in the above list would all rent for about $1,000 to $1,100. The properties that sold in the $110,000 to $115,000 range represented good cashflow investments yielding 8% or more. In an environment of 1% CD rates and 4.5% mortgage interest rates, an 8% yield is fantastic. The resale value of this neighborhood did not need a 40% reduction to attract buyers. Lenders should never have approved those sales.

If the lender had merely rented their property out instead of dumping it for 40% under comps, the cashflow from the rental would have been nearly double the cashflow from the subsequent loan on the property. A lender in Las Vegas trying to finance its own REO would be well served by renting the property instead. Lenders can get $450 per month in a loan payment if they sell it and underwrite the new loan, or they can net about $750 a month on the rental if they keep it.

Of course, banks aren't REITs, and they don't want to own property long term, but in the short term, they would be much better off renting property. The could dispose these assets through a special home investment trust. An entity receiving the positive cashflow from the millions of rentals would have significant value, and it would provide better asset recovery than lenders are getting now.

Sell with new debt or keep as rental?

For example, B of A and other major banks try to sell their REO to people who take out loans from them. B of A gets capital out of a non-productive asset and converts it to loan payments. They can hold this new loan on their balance sheets or they can sell it in the secondary market. With Bernanke giving them free money, most banks are keeping the best loans for themselves.

However, instead of converting this non-performing asset to a performing stream of income by selling the property and underwriting a loan, the bank could retain ownership and rent the property. Banks would get more value from these properties by selling off the shares of a cashflow property REIT than they will by underwriting loans with much smaller cashflow.

If lenders also looked at cashflow values in terms of rental yields, they could see when they are selling undervalued properties and chose to rent those out instead. The amend, extend, pretend policy they are using to prop up prices in some markets is an attempt to hold on to what they believe to be undervalued assets. But since they are not looking at cashflow, they have no idea which markets have undervalued properties and which ones are overvalued.

In Las Vegas, some version of amend, extend, pretend is the best course of action for lenders because they can rent the properties and obtain better cashflow than if they sold them and put new debt on them. In Orange County, most properties are still reselling for more than rental parity, so lenders cannot rent them out for better cashflow than selling them and putting on new debt.

If lenders were basing their decisions on rental cashflow value — something they could do if they were obtaining appraisals using the income approach — they would quickly realize (1) they are selling properties they should be holding, and (2) they are holding properties they should be selling.

In a recent article, Dean Baker pointed out the foolishness of current government policies toward housing:

As far as the housing market, a little clearer thought would get policy to distinguish between markets where the bubble is still deflating (e.g. Seattle, Los Angeles, Boston) and markets where prices are likely overshooting on the low side (e.g. Los Vegas and Phoenix). It might make sense to have policies to boost prices in the latter set of cities. It makes no sense to have policies to boost prices in the former.

Mr. Baker proposes the right-to-rent as a public policy to address this problem. I believe income approach appraisals would give lenders better valuation tools so they could make better decisions concerning property liquidations on a market by market basis. Any lender looking at rental parity would liquidate their holdings where prices were inflated and hold properties where prices have overshot to the downside. Currently, that is the opposite of what lenders are doing, and their failure to understand valuation is going to cost them billions of dollars while the liquidations go forward over the next several years.

Large down payment lost

The owner of today's featured property paid $645,000 using a $417,000 first mortgage and a $228,000 down payment. He obtained a $100,900 HELOC on 1/15/2008, but there is no indication he used it. If this property sells for its current asking price, the owner will get a check for $6,000 of his remaining equity. That's $228,000 put in and $6,000 coming out. This was probably not the real estate investment this owner was looking for.

Irvine House Address … 14 ROCKY Gln #22 Irvine, CA 92603 ![]()

Resale House Price …… $450,000

House Purchase Price … $645,000

House Purchase Date …. 4/16/2007

Net Gain (Loss) ………. ($222,000)

Percent Change ………. -34.4%

Annual Appreciation … -8.6%

Cost of House Ownership

————————————————-

$450,000 ………. Asking Price

$15,750 ………. 3.5% Down FHA Financing

4.54% …………… Mortgage Interest Rate

$434,250 ………. 30-Year Mortgage

$94,741 ………. Income Requirement

$2,211 ………. Monthly Mortgage Payment

$390 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$94 ………. Homeowners Insurance (@ 0.25%)

$499 ………. Private Mortgage Insurance

$497 ………. Homeowners Association Fees

============================================

$3,691 ………. Monthly Cash Outlays

-$356 ………. Tax Savings (% of Interest and Property Tax)

-$568 ………. Equity Hidden in Payment (Amortization)

$27 ………. Lost Income to Down Payment (net of taxes)

$76 ………. Maintenance and Replacement Reserves

============================================

$2,870 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,500 ………. Furnishing and Move In @1%

$4,500 ………. Closing Costs @1%

$4,342 ………… Interest Points @1% of Loan

$15,750 ………. Down Payment

============================================

$29,092 ………. Total Cash Costs

$43,900 ………… Emergency Cash Reserves

============================================

$72,992 ………. Total Savings Needed

Property Details for 14 ROCKY Gln #22 Irvine, CA 92603

——————————————————————————

Beds: 2

Baths: 2

Sq. Ft.: 1600

$281/SF

Property Type: Residential, Condominium

Style: Two Level, Contemporary

View: Trees/Woods

Year Built: 1978

Community: Turtle Rock

County: Orange

MLS#: P779770

Source: SoCalMLS

Status: Active

——————————————————————————

BEAUTIFUL OPEN, LIGHT AND BRIGHT HOME ON A CUL DE SAC WITH A GREAT VIEW. TWO MASTER SUITES, ONE WITH AN ATTACHED OFFICE OR RETREAT AREA. FRENCH DOORS, PLANTATION SHUTTERS, UPGRADED KITCHEN, HARDWOOD FLOORS DOWNSTAIRS. SKYLIGHTS, CUSTOM PAINT. PATIO AND BALCONY OVERLOOK A LANDSCAPE OF TREES AND NATURAL HABITAT. ASSOSIATION POOL, SPA, TOT LOT, SPORTS FIELD, AND ENDLESS WALKING TRAILS. AWARD WINNING SCHOOLS, CLOSE TO UCI, SHOPPING, AND THE FRWYS. PLEASE PARK IN VISITOR PARKING. THANK YOU. PROPERTY CAN BE SHOWN NOW. CALL AGENT 2HRS AHEAD TO SET THE APPOINTMENT. THE HOUSE HAS SOME HOLES IN THE WALLS, BUT THEY WILL BE REPAIRED BY THE ASSOCIATION.

ASSOSIATION?

.png)

BTW, you may find this interesting: Realtors go after blogger who says they lie. Freedom of speech?