The S&P Case-Shiller home price indices have confirmed a double-dip in home prices. The bear rally has failed.

Irvine Home Address … 14 LONGSHORE #77 Irvine, CA 92614

Resale Home Price …… $730,000

Need a shave

Cut myself need a new blade

Something's gone wrong again

And again and again and again again and

Something's gone wrong again

Something's gone wrong again

The Buzzcocks — Something's Gone Wrong Again

The bulls were wrong — again. Eventually they will be right. Like a broken clock that is accurate twice a day, the perma-bulls will have their day. But their day is not today.

Home prices: 'Double-dip' confirmed

Les Christie, On Tuesday May 31, 2011, 10:43 am EDT

Home prices hit another new low in the first quarter, down 5.1% from a year ago to levels not reached since 2002.

It was the third straight quarterly drop for the S&P/Case-Shiller national home price index, which was released Tuesday. Prices are now down 32.7% from their peak set five years ago.

“Home prices continue on their downward spiral with no relief in sight,” said David Blitzer, spokesman for Standard and Poor's.

The index covers 80% of the housing market, and this month's report confirmed “a double-dip in home prices across much of the nation,” said Blitzer.

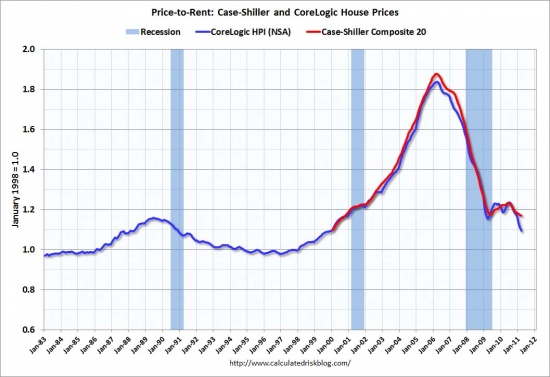

The housing market went through a brief recovery period starting in mid-2009, recovering nearly 5% of earlier losses. After homebuyer tax credits expired last April, the slump resumed.

The only reason people had for believing the crash would not resume was wishful thinking. We can debate whether or not the transfer of trash from lenders to the government was necessary (that is the only thing the tax credit buying accomplished), but a steep decline in prices back to historic norms for price-to-rent and price-to-income was inevitable. With the associated strategic default, a depleted buyer pool, and huge stockpiles of REO, the bust is likely to have a long tail and many years before normal, income-induced appreciation takes over.

A separate S&P/Case-Shiller index covering 20 major cities also dropped during March, the index's eighth straight monthly decline. 10 dirt-cheap housing markets

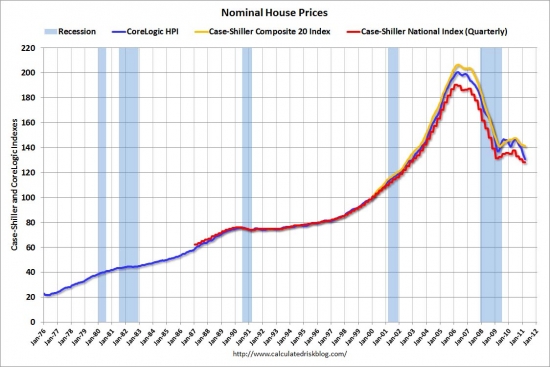

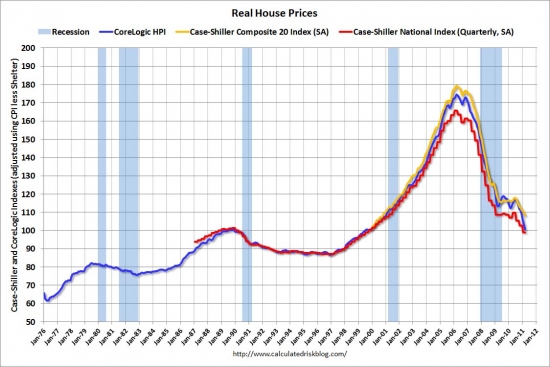

Falling nominal prices only tell part of the story. On an inflation-adjusted basis, the declines have been far worse.

Of the 20 cities, only Washington has posted a home-price gain: 4.3% over the past 12 months.

Minneapolis homes lost the most value over that period, with prices falling 10%.

Other big losers include Phoenix (- 8.4%), Chicago (- 7.6%) and Portland, Ore. (- 7.6%)

Don't forget Las Vegas where prices have declined 12% since last March. The nation's best housing bargains keep getting better.

Prices continue to be hammered by foreclosures with high numbers of repossessed homes flooding the market.

Many repossessed properties are in poor condition and sell at a big discount to conventionally sold homes, driving down overall values.

It is demonstrably true that foreclosures are often in very bad shape. Check out this one I saw go through the Las Vegas auction site yesterday.

The hole in the wall to the right is where they went digging for copper pipe. That may also explain why they jackhammered a hole beneath the sink. The cabinets and counters were too old to have any value, so they left them behind.

Despite the evidence of beaten up foreclosures, it isn't their poor condition that is lowering prices, the lender's willingness to liquidate at very low prices is driving prices lower.

Falling home prices have a devastating impact on new home construction, according to Pat Newport, a housing market analyst for IHS Global Insight.

“They are a key reason why builders aren't building new homes, even in the fastest growing states, like Texas,” he said. “Existing homes are selling for so much less, the builders can't compete.”

That is not accurate. Builders are successfully building and selling homes in Las Vegas and obtaining a 25% premium for their efforts. They aren't building in large numbers like before the crash, but they are successfully exploiting the market niche that wants new and is willing to pay for it.

Normally, new-home construction is an important contributor to the economic recovery. Not so this time, according to Mike Larson, an analyst with Weiss Research.

“Housing has been an albatross for the economy as opposed to an engine powering it,” he said.

If residential development had come back as it has in the past, the current recovery would be much stronger. There's be much more robust hiring of construction workers, building materials manufacturers and drivers and deliverymen to bring the products to site.

Newport pointed out that when developers build a new home for $300,000 it adds $300,000 to the economy, as measured by GDP. An existing-home sale just adds 5% or 6% in broker's commission.

“As a component of the GDP,” said Larson, “housing has been out to lunch.”

Unfortunately, it continues to be a drag on the economy. Until lenders capitulate and dispose of their REO, builders will be facing competition, and they will always be unsure of the stability of prices. Under those circumstances, it is problematic to value and acquire property, set up a production run, and believe the houses can be sold on the other side.

The Irvine Company took that risk, and now they have many unsold homes, and they don't know what to do to kick start sales. Given the weak buyer demand, there isn't much they can do. There is a shortage of qualified buyers at price points at which they want to build and sell.

The national numbers are interesting, but the local data is what matters, right?

L.A./O.C. home prices down 8th straight month

May 31st, 2011, 9:38 am by Jon Lansner

Home values in Los Angeles and Orange counties fell for the 8th consecutive month in March, by the math of the S&P/Case-Shiller indexes as Standard & Poor’s analysts state that the national housing market is officially in a “double dip.”

S&P found locally:

- L.A./O.C. prices were down 0.29% from February to March after falling 0.96% the previous month. March’s dip was the smallest decline since September.

- L.A./O.C. prices were down — on a year-to-year basis – 1.66% in March. It was the fourth consecutive year-over-year drop but down from the 2.07% annual rate of decline seen in February.

- L.A./O.C. prices have fallen 4.8% since last July’s recent peak and 38.8% from the historic high of September 2006.

- The first time L.A./O.C. prices hit the current level was October 2003.

Nationally, S&P found:

- U.S. National Home Price Index declined 4.2% in the first quarter after 3.6% dip in fourth quarter to hit new recession low.

- National home prices are back to their mid-2002 levels.

- In March, 19 of 20 large markets covered by S&P/Case-Shiller are down in a year. DC only gainer.

- 18 of 20 markets feel February to March. DC and Seattle, only gainers.

- Minneapolis posted a 10.0% annual decline, the first market to be in double-digit losses March 2010 (Las Vegas, down 12%.)

- S&P’s David Blitzer: “This month’s report is marked by the confirmation of a double-dip in home prices across much of the nation. … The rebound in prices seen in 2009 and 2010 was largely due to the first-time home buyers tax credit. Excluding the results of that policy, there has been no recovery or even stabilization in home prices during or after the recent recession. Further, while last year saw signs of an economic recovery, the most recent data do not point to renewed gains.”

Patrick Newport, IHS Global Insight economist:

House prices are dropping at a steady clip nearly everywhere. Unfortunately, given that over a quarter of all mortgages are under water, according to zillow.com, and that 12.3% (or 6.3 million) of homeowners with mortgages were either delinquent or in foreclosure at the end of the first quarter, according to the latest Mortgage Bankers Association’s National Delinquency Survey, further declines in prices are etched in stone. Going forward, our view is that weak demand, foreclosures, and a glut of homes for sale should translate into at least another 5% drop in the Case-Shiller composite indices.

So when will prices stop declining? The price to rent ratio gives some indication that we are within 10% of the bottom, depending on how much markets overshoot to the downside.

Another foreign cash buyer bailing on Irvine

Periodically someone in the astute observations will point to the army of foreign cash buyers who will save prices in Irvine. I have pointed out many such buyers are dumb money buying into markets based on narrative rather than valuation. At least some of these buyers are wise enough to cut their losses when they realize prices are going south.

The owner paid cash two years ago when the market was beginning its bear rally. Based on his asking price, he estimates the house has declined in value rather than appreciated. Since he owns the property free-and-clear, this is not a short-sale price set too low in order to generate interest. He is willing to sell this property for a $72,800 loss after commissions. That wasn't supposed to happen to buyers over the last two years, right?

Irvine House Address … 14 LONGSHORE #77 Irvine, CA 92614 ![]()

Resale House Price …… $730,000

House Purchase Price … $759,000

House Purchase Date …. 6/26/2009

Net Gain (Loss) ………. ($72,800)

Percent Change ………. -9.6%

Annual Appreciation … -1.9%

Cost of House Ownership

————————————————-

$730,000 ………. Asking Price

$146,000 ………. 20% Down Conventional

4.54% …………… Mortgage Interest Rate

$584,000 ………. 30-Year Mortgage

$127,412 ………. Income Requirement

$2,973 ………. Monthly Mortgage Payment

$633 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$152 ………. Homeowners Insurance (@ 0.25%)

$0 ………. Private Mortgage Insurance

$277 ………. Homeowners Association Fees

============================================

$4,035 ………. Monthly Cash Outlays

-$497 ………. Tax Savings (% of Interest and Property Tax)

-$763 ………. Equity Hidden in Payment (Amortization)

$247 ………. Lost Income to Down Payment (net of taxes)

$111 ………. Maintenance and Replacement Reserves

============================================

$3,132 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$7,300 ………. Furnishing and Move In @1%

$7,300 ………. Closing Costs @1%

$5,840 ………… Interest Points @1% of Loan

$146,000 ………. Down Payment

============================================

$166,440 ………. Total Cash Costs

$48,000 ………… Emergency Cash Reserves

============================================

$214,440 ………. Total Savings Needed

Property Details for 14 LONGSHORE #77 Irvine, CA 92614

——————————————————————————

Beds: 3

Baths: 3

Sq. Ft.: 2614

$279/SF

Property Type: Residential, Condominium

Style: Two Level, Contemporary

Year Built: 1983

Community: 0

County: Orange

MLS#: U11000211

Source: SoCalMLS

Status: Active

——————————————————————————

Timeless elegance and contemporary flair infuses this spacious two-story townhome with a rare ambiance of peace, quiet and privacy. Located just steps from the Village of Woodbridge's picturesque south lake and a large community swimming pool, the custom-caliber residence measures approximately 2,614 square feet and is host to three spacious bedrooms–each with its own balcony–and two and one-half bathrooms, plus an attached two-car garage. Plush custom carpeting and handsome tile flooring accent grand living areas that reveal two hand-crafted fireplace surrounds, airy volume ceilings, vast window expanses that invite natural light, and recessed and track lighting in select locations. Overlooking a large, lushly landscaped atrium, the generously proportioned L-shape kitchen displays granite countertops, light wood cabinetry, deluxe appliances, built-in dining nook, and oversized atrium windows. Purchase price includes all furniture.

Is leaving the furniture behind a sign of bailing?

Timeless elegance and contemporary flair infuses this spacious two-story townhome with a rare ambiance of peace, quiet and privacy.

Somebody has been practicing their flowery writing with superfluous adjectives.

The world economy is not the next domino to fall. The giant emerging markets (BRIC) will continue to grow & push the prices of commodities (oil might have some speculative money on top, but demand is still rising). However, Europe’s periphery countries can’t pay their debts. There will be massive financial turmoil in Europe which will push investors into…US treasuries – with our without a pseudo-default from debt-limit chicken.

What, to me, differentiates Florida’s FCBs from seemingly Irvine’s, is that Florida’s FCBs are buying properties there for personal & family use. A condo in FL close to the beach is a huge resource to Canadians. If you’re paying all or mostly cash, and it’s something you’ll use, and don’t need the money out, you hang onto it.

“many years before normal, income-induced appreciation takes over.”

How much income-induced appreciation is actually currency devaluation, (inflation), and not any sort of appreciation in either value or real price?

It depends on which segment of society you are talking about… I would estimate as follows:

Lowest 10%: 110-120% (real income declining)

25th percentile: 80-90% (almost all absorbed by inflation)

50th percentile: 60-80% (middle class declining)

75th percentile: 40-60%

90th percentile: 20-40%

Top 5 percent: 10-20%

Top 2%: meaningless – it’s how they make their money

Yo, Planet Realty, it’s time to stop diverting attention from just how wrong you’ve been on this board, and start spinning the facts to suit your worldview.

Go on! I believe in you!

At least you were right about interest rates going lower and lower. What? No? Wrong at that one too?

Geez, for a guy that talks like he knows so much about everything, the facts just don’t seem to back up your hubris…

The really ridiculous part of his worldview is that he thinks Irvine is one of those Top 2% communities, when in reality it’s just another suburb (exurb?).

-Darth

You guys make up a load of BS.

Irvine tends to be around the 60-70th percentile.

In Irvine there are neighborhoods that are top 10% and some that are 40-50th percentile.

Hey Genius,

since you’ve been telling everyone that prices bottomed in spring 2009 and they’re only going up now, could you please explain this:

http://dqnews.com/Charts/Monthly-Charts/CA-City-Charts/ZIPCAR.aspx

let me save you the time and just paste the good stuff right here:

County/City/Area # Sold Apr 2011 Apr 2010 % Chng Yr-to-Yr

IRVINE 237 $516,500 $599,000 -13.77%

Yeah, somehow that doesn’t seem to jive with your spin, does it?

Today’s featured property is a perfect example that the “bottom” of 2009 was a fake one. With all the government meddling, it will take another few years to see the true bottom. After that, prices will likely be flat for years to come.

Real estate in California ain’t what it used to be plain and simple. Being handcuffed to an overpriced, depreciating assett in a turbulent economy is not an enviable position to be in.

Sign another lease in your rental, enjoy the summer and live stress free…housing will become more affordable every day that goes by!

In terms of gold or bond prices since 2007 – Irvine has crashed.

In nominal price terms today’s featured property is about the same as January 2009. When folks like you thought a nominal crash was immenent. You were wrong.

Buying it in 2009 for $759K and listing it for $730K two years later = The Big Crash!

MAYDAY!

MAYDAY!

30K loss ( plus 6% realtor fees makes another 44K )

Total loss: 74K

BIG WHOOP!!

Straw man alert! Straw man alert!

“The big crash” includes everything that’s happened since 2006 and is ongoing. If the entire crash were limited to what’s happened since early 2009 it would indeed look underwhelming (but still noteworthy).

what difference does it make when it is a 5:1 levered purchase for most.

It could be all inflation induced and as long as you are sufficiently levered, you are making quite well.

Six months ago, in the middle of the bear market bounce, Gary Shilling forecast that house prices would drop ANOTHER 20% nationwide. At the time he was scoffed at. People forgot that has one of the most accurate forecasting records of any economist in the world over the past 25 years.

Irvine house prices remain over valued and could easily drop 20% from here and possibly as much as 30%. Given the amount of shadow inventory in the system, I’m sticking with my 2013 to 2014 time frame for a bottom.

“I’m sticking with my 2013 to 2014 time frame for a bottom.”

(most)excellent ; i still have time for lunch

There certainly is room for further drops.

I still see houses sell though, even at current prices.

My advice to sellers, price conservatively, and please keep your properties clean.

This means that in listing photos, please do not take pictures of the toilet seat up 😉

@IR:

C’mon… you’re showing your Las Vegas bias now. Irvine sells hundreds (actually near a thousand) of new homes last year and you nitpick the numbers based on your data saying they didn’t sell as much as they claimed.

But here you are dropping plaudits on new home sales in Vegas? How many new homes did Las Vegas sell in 2010?

And let’s put the shoe on the other foot. Since now some are claiming that the intervention is becoming ineffective (and let me remind you that this intervention was supposed to never happen the first place) and prices will now continue to drop, what is going to happen to those places that are near bottom already? Is it still smart to buy anywhere (not just Irvine) if depreciation is still another 30%? If Irvine drops 30% (as Nick thinks), what does that mean for Aliso Viejo or other South County cities? Because surely, anyone who is willing to substitute Aliso now at $600k would wait for Irvine $850k homes to hit that same price (and what would that $600k Aliso home end up at?).

Honestly, I would like to see lower prices in Irvine… I’m just worried about what that would do to other cities. And the bigger question… wouldn’t that mean the gov would just step in again?

I’m not making any positive statements about the future of homebuilding in Las Vegas. With the entire city being shadow inventory, it is the most perilous market in the country to build new homes.

I merely commented on what I see: new homes there are selling for 25% more than comparable resales. I don’t think their new home market is strong, and quite honestly, I am amazed they sell anything. The desire for new is pretty strong when someone is willing to pay such a huge premium to obtain it. In Las Vegas, buying a new house is like buying a new car: the depreciation when you get the keys is enormous.

But you get that new house smell!

They’re already stepping in and using low rates to attract potential buyers

The FED knocked down the 10-Year to under 3%

I’m surprised PR hasn’t commented on how low interest rates have fallen. They are nearly back to the lows of last October.

I don’t like to rub it in, also the money I’ve made on the call is my reward and all that really matters.

Good for you. You were rewarded for being an interest-rate contrarian. I wouldn’t have put on that trade. With the current low demand for debt, interest rates are likely to trend lower for a while longer, at least until we see another big bond selloff like we witnessed last October.

My only regret is not believing in gold for the same reasons I believed in the bond rally. I invested in other commodities for the same reasons with decent returns but nowhere near bonds and gold.

I expect Irvine housing will continue to under perform everything except 90% of other housing markets. Eventually rents will start to increase with inflation and in time interest rates will trend up. Irvine housing will inch up eventually, monthly payments (rental parity) will increase at a large rate but the rise in interest rates will temper appreciation. I expect the best time to buy in Irvine is between right now and the next 18 months. Good luck, I hope you find what you want.

I also believe in platitudes. And in things that benefit me in the near term. As a default.

========

Astute Observation by Planet Reality

2010-07-08 08:26 AM

I expect another up year in prices for Irvine. Similar to what I expect for bonds.

========

Sold prices per square foot in Irvine have since fallen 7.5% (345 vs 319, per Redfin). I guess one out of two ain’t bad. If this were a blog about investing in bonds I’d be very impressed. If this were a blog about Irvine housing and I was looking for advice on whether to buy now…. not so much.

The FED knocked down the 10-Year to under 3%

JMHO … I think it’s more a flight to safety.

I always thought we were in the eye of the storm when the economy “recovered”. It will be interesting to watch the coming months. I bet the Fed announces QE3 before year end.

I do not think the Fed will announce QE3. I think QE3 will be the purchase of more treasuries with the proceeds from the interest from the Fed’s current inventory of treasuries and mortgage portfolio.

not working… now what?

Right the medians down from the tax credit.

Why dont we just take a look at this example today.

2 years later this listing is down 3.9% from mid 2009. Mid 2009 is after folks like you realized the world was not in fact coming to an end.

This listing is probably on par with jan 2009 pricing.

Well at the time folks like you said a crash was immenent for Irvine.

2.5 years later and this listing is at the same market price. Are we all supposed to be shocked and amazed by this? Reality is Irvine prices did not crash since Jan 2009 – deal with it.

wrong. assuming 3% inflation, the price after inflation dropped by 6% from 2 years ago. Using 5% inflation then it is 10%.

My bond portfolio has cost average increased 50% since 2007, or in terms of gold Irvine is down more.

In nominal terms Irvine is about the same since January 2009. 2.5 years and counting deal with it – Irvine 0% decline, when fools like you were screaming that a nominal crash was imminent.

Now the world is coming to an end again, now is your chance. Don’t screw up again.

“Reality is Irvine prices did not crash since Jan 2009 – deal with it.”

Spring of 2009 was NOT the bottom for Irvine real estate – deal with that.

Here we are two years later in spring selling season, 4.5% 30yr rates and the government has done everything to save the housing market…and prices are still going down.

We still have some declines ahead of us, take that to the bank!!!!!!!!!!!!!

PR – Don’t you ever get tired of your fallacious logic? Do you really think that people do not see right through it. “World not coming to an end”, “you folks said a crash was imminent, (sic)”

Stick to reality. Latching onto what one or two people said and showing how the extreme was wrong does not make you right or make the 98% wrong. It just makes you look ridiculous. Look up “strawman argument”. Everyone seems to know what it means and how stupid it is except for you.

We don’t have 20% GDP and 25% appreciation in homes, so PR’s forecasts are all wrong!

Your fallacious arguments have about much credibility as your handle.

I do not keep track of all of OC, but the price per square foot in Coto de Caza is the lowest it has been in at least eight years. I use eight years because my records only go back that far, but my suspicion is that ppsf has not been this low for much longer.

http://www.cotohousingblog.com/?p=16464

Coto de Caza means:

Condo next to Mansion

In Spanglish

Now, that was funny.

BTW, I love Spanglish. I am Mexican, (American of Mexican heritage).

How about this one? Donde esta frijole, hombre? Do you know what that means?

Where ya bean, man? Ja ja ja.

This is precisely the reason why Irvine will continue on a down trend for the next 3-5 years. Many of you like to point out Irvine prices have not gone down since 2009, but you’re going to have to factor in that there’s going to be a lot of downward pricing pressure from nearby cities. A certain percentage of people who want to buy in Irvine are gonna see these high prices and they will start peeping at places like Tustin, Costa Mesa, HB, etc and they’re gonna opt for lower prices there because those areas have declined more. You can get more at a lower price point in these decent cities. This is gonna exert pressure on Irvine prices to drop; but since there is still high demand here you’re probably only gonna see 3%-5% a year. It’s just gonna be a slow bleed until it balances out with other cities. Likely 12%-18% loss when all is said and done; and i wouldn’t even rule out 25%.

Welcome to deflation awgee. Price per sq foot will stay lower than we imagined, longer than we imagined.

Check out a 20 year chart of Japan housing for reference.

Be prepared for shock and awe, all you Irvine-is-so-special folks. Irvine has a “failed” village on it’s hands. Laguna Altura. There’s lots of hand wringing and nervous tics appearing in the 550 building on Newport Center Drive, even executives announcing the panic in industry meetings. And when this one tumbles, so does Stonegate, Woodbury, and the rest.

I hope so… it will teach TIC some lessons about recycling floorplans and then trying to add $200k to the price.

Comparatively, they are priced within the range of Quail Hill, but LagAlt, even with the gate, is not as nice as QH.

They should have used unique floorplans at the very least (and not removed some of the amenities in the original LagAlt design).

Stonegate is already struggling… but since most of Woodbury is built out… that’s probably not going to be affected as much other than the San Marino project.

P.S. Irvine isn’t special because of new home sales… but it is unique that it’s a non-coastal community that has the premium perception.

You can’t teach a pig to sing. LagAlt is an island, remote and cut off from Irvine. There is no “there”, there. One small pool area for 600 families? No parks, nothing to call “community”. All folks who want to enter or leave will have to risk their lives on Laguna Canyon Road and the conga line of SUV’s at the gate in the morning to take the kiddies on a 10 mile ride to very remote schools will be killer. The floorplans are only the beginning. They simply tried to cram too much density into a small space.

I agree with you. I find that West Irvine and North Irvine to be very remote and even Quail Hill, though very nice, also feels cut off since you can’t drive through Shady Canyon to get to the other side. Woodbury might as well be another city but at least it’s built out.

LagAlt should be “LagAltDElete”. It’s impossible. Everything that could be done wrong was done wrong. Back in the 80’s, IP tried to pull plans off the shelf and plug them into every community. Fortunately, a few of the marketing guys saved the bacon then which led to some more innovative design. Now they’re back to square one. The site plan, as it now exists will create a virtual sea of garage doors, back yards of 10 feet (if that) and all the floor plans are virtually the same….just slightly larger rooms in the larger product. With 1.7% and 1.8% tax rate on the smaller homes and 1.6% on the larger, plus $295 HOA fees…..have they not realized that buyers actually have to qualify on actual income?????

Ya’ll just move to Austin like I did six years on and be done with California. We got eht jobs, we have the infrastructure and every house on my block has appreciated more than 10% every year since I arrived. YES.

b tuck~not sure what “eht” jobs are, but by Texas state law mortgage loans (except for FHA/VA) must have 80% equity….no HELOC problems, no home ATM’s….

Someone tell me why prices won’t fall past their fair value — based on price-rent ratios — and keep falling? Prices got too high, because of stupidity. They can get too low because of stupidity, too.