A mortgage servicer in Florida has given a house to the delinquent borrower. What were they thinking?

Irvine Home Address … 80 MODESTO Irvine, CA 92602

Resale Home Price …… $429,500

Well, I ain't been home to see my baby,

in ninety nine and one half days.

'Bout time I see her,

Wait a minute something's wrong here

The key won't unlock the door.

Jimi Hendrix — Red House

Wait, there's something wrong here. The key will unlock the door.

Perry Laspina was in the middle of foreclosure with the possibility of losing the house he owned in Jacksonville. Then the mail came one day in late January telling him that the house was his.

Despite the $72,000 mortgage that he barely paid anything on, despite the foreclosure … the house was his.

In the middle of foreclosures gone wild, of a system overloaded by sheer volume, judicial investigations and allegations of corners cut, Laspina ended up with the house.

Despite the fact that he didn't have an attorney in the foreclosure proceedings, the mortgage holder simply gave up and walked away.

If they are giving away free houses to delinquent borrowers, there will be a lot of happy people.

Guys like Darrel above are just the kind of borrower lenders should give a free house to.

Or perhaps we should give free houses to the hard working middle-class people below.

“I've never seen anything like this in my life,” he said.

It's a tale populated with many of the major players in the national foreclosure drama: The law firm of David Stern, the Mortgage Electronic Registration Systems (better known as MERS) and a mortgage packaged with others and sold into a securitized trust.

Here's how it happened.

Back in 2006, Laspina, a used-car dealer based in South Florida, had some extra money and decided to buy some real estate that he could resell quickly at a profit. It was, after all, the height of the housing boom with prices skyrocketing and mortgage money easily available.

“Since everyone else was making money flipping houses, I figured I would, too,” he said.

He wasn't familiar with Jacksonville, but his brother owned a house in Fernandina Beach and found the house on Oakwood Street in the Panama Gardens neighborhood of Jacksonville off North Main Street.

It's an old neighborhood where most of the houses are still well-maintained.

Laspina bought the house for $80,000, putting $8,000 down and taking out an adjustable rate mortgage with EquiFirst for the remaining $72,000 with an interest rate of 9.5 percent.

EquiFirst, based in Charlotte, N.C., was one of the nation's leading sub-prime lenders in 2006. But it soon fell victim to the housing and mortgage industry collapse and it closed in 2009.

EquiFirst kept few of the mortgages it wrote; most were packaged and sold to securitized trusts which were owned by investors.

Laspina wasn't worried about the interest rate.

“It didn't matter,” he said. “I figured I'm going to flip this house within six months, maybe three months.”

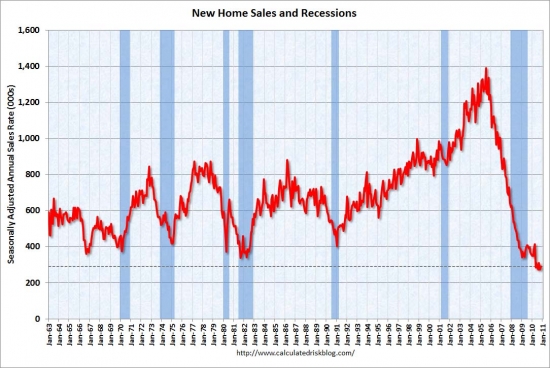

That plan sounds foolish today, but for several years during the bubble, people could buy houses at full retail price, hold them briefly, do minor cosmetic changes, and sell for a reasonable profit. Today, that is only possible for people buying at auction and obtaining a huge discount from resale. Appreciation isn't a realistic expectation.

He also figured he'd get about $120,000 for it after he did a bit of work on it, mostly tearing up the carpet and stripping the paint that covered the hardwood floors.

“But right after I put it on the market, the crash came,” he said. “I couldn't sell it, I couldn't rent it.”

Real estate is not liquid. People forget that inconvenient fact when times are good and prices are rising, a condition most believe is a permanent state.

Hang in there, Shawn. You may get a free house.

By 2008, the increases on his payments kicked in, going from an initial payment of $605 to $894 and then $1,058 in less than a year. He quit making payments, and in September of that year, a foreclosure notice was filed against him. The plaintiff was the U.S. Bank National Association, which was simply acting as the trustee for an unnamed trust that now owned the mortgage.

The court file says that Laspina lost his foreclosure case in February 2009. A sale date was set, then postponed and then canceled, all at the plaintiff's request, later that year.

But the next year, the plaintiff requested that it all be vacated – the suit, the judgment, all of it. In October, Circuit Judge Waddell Wallace signed the order.

Why would a lender vacate the judgment and give away the property?

In December, officials for MERS, which acted as the mortgage holder, signed and filed the documents saying it “has received full payment and satisfaction … and does hereby cancel and discharge said mortgage.”

Laspina had paid less than $1,000 toward the principal on his $72,000 loan.

That's what happened. But there are questions about why.

You think?

“This is crazy,” attorney David Goldman said as he looked over the files at the Times-Union's request.

“They won,” he said referring to the mortgage holder. “They're standing at the goal line, and they just need to sell the house.”

Maybe they will let him keep it?

“One possibility is that they did it by mistake,” said Chip Parker, an attorney who specializes in foreclosure defense. “There are just so many cases out there.”

I think this is the most likely explanation. Someone manages the mortgage-backed securities pool that owned this bad loan along with many others. They probably have many cases pending against properties that get cured or sold, so they may vacate judgments filed on many such properties. This one was merely put on the wrong list.

The other possibility is deliberate mischief by a clerk or a manager who knowingly processed this paperwork to harm the MBS pool or the firm managing it.

One issue possibly complicating the case is that the plaintiff's attorney was David Stern, whose Southeast Florida law firm became the poster child for foreclosure mills. In 2009 alone, it handled 70,000 foreclosure cases, according to news reports, and employed more than 1,000 people.

But after questions were raised about the practice, the Florida attorney general announced an investigation of possibly fraudulent paperwork at Stern and two other firms. Fannie Mae and Freddie Mac, along with many banks, dropped him as their primary foreclosure attorney.

Stern's firm quit its foreclosure work at the end of March.

He made so much money, he probably doesn't care. It was a good run for him. If he hadn't become the poster child for this problem, he would still be adding to his fortune. Now someone else just like him is doing this same work. Perhaps the GSEs will add more vendors to its lists, but the foreclosures will grind on.

MERS itself has been the subject of plenty of controversy. The electronic registration and tracking system helps banks package, buy and sell mortgages without the time and money that used to be required to record each transaction.

MERS is named the nominee on these loans, but it now faces lawsuits across the country seeking unpaid recording fees that normally go to local governments, and several courts have rejected MERS' role in bringing foreclosures.

Parker also theorized that the mortgage owner simply made a business decision.

“The lender was faced with retaining new counsel,” Parker said. “Maybe it looked at the value of the property, realized it's way, way underwater and simply not worth it.“

That appears to be the case, though the mortgage holder provided few details when contacted.

An asset manager is not going to be concerned with any debt on the property. An asset manager is going to either keep the asset and manage it for cashflow or dispose of it and get whatever capital recovery he can. Any positive capital recovery is better than nothing. The house in question here clearly still has resale value. I doubt an asset manager determined is wasn't worth it to sell this property and get the money.

The loan was being serviced by America's Servicing Co., a subsidiary of Wells Fargo.

“The investor on the loan, the bondholder on the trust, decided to write off the loan balance,” said a Wells Fargo spokesman, “because of the significant decreased value of the property.“

Fine. They wrote off the loan balance. That doesn't mean you give away the house. Is the cost of sale really going to result in a negative recovery? This makes no sense.

He declined to give more details or further explanation.

The home — two bedrooms, one bath and 1,120 square feet — is structurally solid, Laspina said. But many of the interior walls are covered with mold ever since the coils were stolen from the air conditioner.

It's appraised at $46,000 by the Duval County appraiser's office in a neighborhood that has inconsistent values.

The house next door sold for $65,000 in January after selling for $91,000 in 2003. A house across the street sold for $153,500 in 2008. But another a couple of houses away was purchased from a bank for $23,000 a year ago after selling for $140,000 in 2006.

A few commenters thought the North Las Vegas neighborhood from a recent post was suspect. Wait until you read this description.

“It's a good neighborhood,” said Jackie Painter, whose family first moved to Panama Gardens in 1958. She spent most of the past decade in Michigan, but when she wanted to move back south, she moved to the neighborhood where her younger sister and 99-year-old mother still live.

“Some of the houses were in really bad shape for awhile,” she said. “But people have come in and fixed them up. They're good neighbors. We get a little riff raff, a few prostitutes will walk down the street, but when they see us watching, they scatter.”

I wonder what she does to make the drug dealers scatter?

Goldman cautioned about anyone expecting to duplicate Laspina's good luck.

“I don't think it's representative,” he said. “Someone won the lottery here. There's a lot of people out there saying they can get you your house free, but they're just selling you something. It's a one-in-a-million thing.”

False hope is a fertile field for scoundrels and villains. Scam artists will use false hope to steal from individuals. The collective theft of false hope is borne by those who make oversized payments waiting for peak values to make them whole. Lenders are the beneficiaries of stories like this one because it serves to motivate the masses to cling to their properties in any way they can. Someday, they might own it, right?

As for Laspina, he plans to clean the mold, mow the lawn and try to sell the house.

“I could certainly use the money,” he said.

roger.bull@jacksonville.com, (904) 359-4296

Well, maybe they won't want to own it…

Perhaps those HELOCs weren't a good idea

The debate in Washington is focusing on the terms of first mortgages, but the real problems in the housing bubble were the second mortgages and HELOCs. Subordinate loans were the free-money vehicle of choice for most.

The owner of today's featured property paid $298,000 on 1/25/2002. She used a $238,000 first mortgage, a $29,700 second mortgage, and a $30,300 down payment.

On 4/30/2004 she went Ponzi and refinanced with a $274,000 first mortgage and a $100,000 HELOC. She enlarged the HELOC to $185,000 on 8/24/2007. There is no way to be certain she spent that last $185,000, but she did stop paying the first mortgage.

Foreclosure Record

Recording Date: 04/04/2011

Document Type: Notice of Default

It seems likely this woman could afford the first mortgage without the second mortgage debt. However, adding to the first mortgage and piling on a huge HELOC put her over the edge. Now this will be a distressed sale.

Irvine House Address … 80 MODESTO Irvine, CA 92602 ![]()

Resale House Price …… $429,500

House Purchase Price … $298,000

House Purchase Date …. 1/25/2002

Net Gain (Loss) ………. $105,730

Percent Change ………. 35.5%

Annual Appreciation … 4.0%

Cost of House Ownership

————————————————-

$429,500 ………. Asking Price

$15,033 ………. 3.5% Down FHA Financing

4.87% …………… Mortgage Interest Rate

$414,468 ………. 30-Year Mortgage

$93,949 ………. Income Requirement

$2,192 ………. Monthly Mortgage Payment

$372 ………. Property Tax (@1.04%)

$100 ………. Special Taxes and Levies (Mello Roos)

$89 ………. Homeowners Insurance (@ 0.25%)

$477 ………. Private Mortgage Insurance

$352 ………. Homeowners Association Fees

============================================

$3,582 ………. Monthly Cash Outlays

-$359 ………. Tax Savings (% of Interest and Property Tax)

-$510 ………. Equity Hidden in Payment (Amortization)

$28 ………. Lost Income to Down Payment (net of taxes)

$74 ………. Maintenance and Replacement Reserves

============================================

$2,815 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,295 ………. Furnishing and Move In @1%

$4,295 ………. Closing Costs @1%

$4,145 ………… Interest Points @1% of Loan

$15,033 ………. Down Payment

============================================

$27,767 ………. Total Cash Costs

$43,100 ………… Emergency Cash Reserves

============================================

$70,867 ………. Total Savings Needed

Property Details for 80 MODESTO Irvine, CA 92602

——————————————————————————

Beds: 2

Baths: 2

Sq. Ft.: 1346

$319/SF

Property Type: Residential, Condominium

Style: Split-Level, Spanish

View: Mountain

Year Built: 2001

Community: Northpark

County: Orange

MLS#: S653991

Source: SoCalMLS

Status: Active

——————————————————————————

Bright and airy, large 2 Bedrooms, 2.5 Bathrooms condo in most desirable guard-gated, resort-like Northpark Community. Formal dining room. Seperate living room with over 12 feet high ceiling. Upgraded entry, kitchen and bathrooms floor with Slade stone. Custom window treatment with plantation shutters. Spacious kitchen with built-ins. Two large bedrooms upstairs each has its own bathroom. Balcony off the Master bedroom with hills view. Hugh patio outside of front door. Walk to the Del Mar Garden. Close to shops, school, Tustin Market Place and much more. ..

Seperate? Hugh patio?

Have a great weekend,

Irvine Renter

.jpg)

.jpg)

.jpg)

.jpg)

Completely REMODELED KITCHEN overlooks PRIVATE COURTYARD & BBQ Area. HUGE MASTER BEDROOM SUITE, with His & Hers Closet & Mirrored doors. Plus Large LOFT that could be used as an OFFICE/DEN OR 2ND BEDROOM. PREMIUM CORNER LOCATION with Upgraded Brick Floors on Front Porch, Custom MARBLE FIREPLACE & Foyer, Plantation Shutters, Crown Molding & More! . .. RESORT-LIKE Living at community POOL and SPA. Conveniently located by The Racket Club of Irvine, Rancho San Joaquin Golf Course, William R. Mason Regional Park, John Wayne Airport, Freeway Transportation, Shops, Restaurants, UCI and Highly Acclaimed Irvine AWARD-WINNING Schools. MUST SEE TODAY!!!

Completely REMODELED KITCHEN overlooks PRIVATE COURTYARD & BBQ Area. HUGE MASTER BEDROOM SUITE, with His & Hers Closet & Mirrored doors. Plus Large LOFT that could be used as an OFFICE/DEN OR 2ND BEDROOM. PREMIUM CORNER LOCATION with Upgraded Brick Floors on Front Porch, Custom MARBLE FIREPLACE & Foyer, Plantation Shutters, Crown Molding & More! . .. RESORT-LIKE Living at community POOL and SPA. Conveniently located by The Racket Club of Irvine, Rancho San Joaquin Golf Course, William R. Mason Regional Park, John Wayne Airport, Freeway Transportation, Shops, Restaurants, UCI and Highly Acclaimed Irvine AWARD-WINNING Schools. MUST SEE TODAY!!!