Was I right, wrong, or somewhere in between. Let's review the data, and I will let you decide.

Irvine Home Address … 184 PINEVIEW Irvine, CA 92620

Resale Home Price …… $196,000

I believe I can see the future

Because I repeat the same routine

I think I used to have a purpose

Then again, that might have been a dream

Nine Inch Nails — Every Day is Exactly the Same

Groundhog Day is one of my favorite movies. Every day is exactly the same. One of the reasons I enjoy Southern California so much is because I rarely change my outdoor plans due to the weather. Every day is beautiful. Yesterday was, and tomorrow will be as well.

It will feel like groundhog day here over the next few years as we work through the inventory issues. I will offer the same advice: don't buy unless you plan a long-term hold. I will say that until the number of foreclosures gets down near zero, and the backlog of unprocessed bad loans is complete. I don't know how these bad loans will be resolved. I believe foreclosure will resolve most of them, but we may see some form of principal forgiveness become more common before this crisis is truly behind us. I hope not.

My beginning at the IHB

Many of you may not remember that I was not an original writer at the IHB. Zovall and IrvineSingleMom were the two first writers. When they asked me to write, I just started, and I haven't stopped. I don't know where the energy or inspiration comes from, but I do enjoy exploring this artform… or is it a news media…

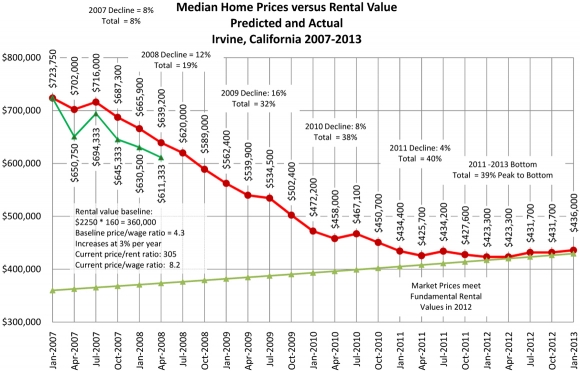

Back on February 27, 2007, I loudly proclaimed we were at the top of the market and that prices were going to crash. I wasn't offering a weak warning that prices might go down a little bit, I was boldly stating prices were going to crash — hard. It was going to be a catastrophe. It was important news.

Of course, when i made these proclamations, I was roundly criticized as a fool who didn't know what he was talking about (read some of the old comments). In order to provide some credibility to my assertions, I wrote a series of analysis posts:

- I am IrvineRenter (Inventory Cholesterol)

- Financially Conservative Home Financing

- How Inflated are House Prices?

- How Sub-Prime Lending Created the Housing Bubble

- What is Past is Prologue

The final post in that series aired on 11 March 2007. Predictions for the Irvine Housing Market contained the chart below.

In that post, I went on to list the main factors that will influence the timing and the depth of the decline:

- Percentage of Income Put Toward Housing Payments

- Interest Rates

- Foreclosures

- Adjustable Rate Mortgage Time Bombs

- Government Intervention

I wrote that back in early 2007 before we had any of the following:

- loan modifications which focus on DTI ratios,

- federal reserve buying mortgage paper to influence interest rates,

- foreclosures that reached maximum market absorption levels,

- ARM resets contributing to delinquencies which are now in shadow inventory, and

- The federal government nationalizing the housing market by taking the GSEs into conservatorship.

On August 25, 2008, I revisited my prediction in I Was Wrong, It’s Worse… It had the updated results through April of 2008.

The initial stages of the crash were surprising in the rapidity of the declines. Irvine's real estate market had experienced patches of weakness, but it avoided most of the 18% statewide decline in the early 90s. Predicting any decline ran the risk of stubborn sellers and sticky prices preventing a decline. By mid 2008, even the most stubborn bulls realized they had no idea what they were talking about back in 2006. They weren't just a little wrong, they were debt-up-to-their-eyes wrong about the direction of house prices.

How wrong was I?

I just obtained the updated median home sales prices for Irvine to see how my predictions compared to what really happened.

Prices did not fall as much as I predicted, not because my reasoning was flawed, but because unforeseeable and unprecedented efforts by bankers and the government delayed the drop, and may have averted a much deeper drop.

I say these events were unforeseeable and unprecedented, but some may argue that such extremes were inevitable. I have no way to counter that point. However, I can say that few predicted those events in advance of when the rumors became news. Any forecaster out there who foresaw those events and accurately gaged their impacts is far better than I am.

What happened in 2008 to slow the drop in prices?

Two events in 2008 marked important turning points for the market. First, in early 2008 nearly every housing market in the country reached and exceeded its capacity to absorb foreclosures without pushing prices lower. And second, in late 2008, the Treasury department went against 40 years of government statements and took over the GSEs and backstopped the GSEs bad debts. The public was absorbing the losses of private enterprise just like with AIG.

In the last housing bubble on the late 80s-early 90s, lenders foreclosed on delinquent borrowers without delay. There was no shadow inventory. The number of foreclosures did push prices lower, but they were not so overwhelming that prices crashed. In early 2008, the number of foreclosures simply overwhelmed the number of buyers, and prices plummeted. Banks had a decision to make: 1. keep foreclosing and push prices back to the 90s, or stop foreclosing and accumulate a shadow inventory of delinquent mortgage squatters. They chose the latter.

In late 2008, in response to a balance sheet in tatters and mounting losses, the Treasury Department took over the GSEs. by the end of the year, between the FHA and the GSEs, the federal government controlled about 98% of the mortgage market.

Once the government controlled the delivery mechanism for home loans, the only thing they needed was someone willing to buy those loans at high prices, and they could support prices at levels higher than a free market would bear. The patsy to buy home loans in a depreciating market turned out to be the Federal Reserve.

What happened in 2009 to slow the drop in prices?

When the Federal Reserve began its program to buy $1.2 trillion in mortgage-backed securities, it knew it was buying toxic crap, but the with an infinite balance sheet from the ability to print money, they are uniquely suited to absorb these losses — losses their member banks cannot afford to take. In essence, they printed enough money to paper over what was destroyed through lender losses.

Since 2009, the government has been in total control of the housing market. They remain in control to this day. There is talk in Washington about reform, but since any subsidy removal will lower prices and increase bank losses, any transition will happen slowly.

I was wrong: It's better

I was clearly wrong. Prices did not fall as far as I said they would. But how wrong was I?

If prices only fell 2/3 of the amount I projected, was I 1/3 wrong? If prices are 50% below expectations, how wrong am I. Was I at least 66% right?

46% off at the low end

Whatever becomes of the median, it is clear that prices of low-end properties have fallen dramatically. The owner who paid $342,000 for this property in 2006 certainly didn't think it would be worth less than $200,000 in 2011. He was wrong too. However wrong I am, it isn't as painful for me as it is for this former owner.

Irvine House Address … 184 PINEVIEW Irvine, CA 92620 ![]()

Resale House Price …… $196,000

House Purchase Price … $342,000

House Purchase Date …. 5/17/2006

Net Gain (Loss) ………. ($157,760)

Percent Change ………. -46.1%

Annual Appreciation … -11.3%

Cost of House Ownership

————————————————-

$196,000 ………. Asking Price

$6,860 ………. 3.5% Down FHA Financing

4.79% …………… Mortgage Interest Rate

$189,140 ………. 30-Year Mortgage

$39,619 ………. Income Requirement

$0,991 ………. Monthly Mortgage Payment

$170 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$41 ………. Homeowners Insurance (@ 0.25%)

$285 ………. Homeowners Association Fees

============================================

$1,487 ………. Monthly Cash Outlays

-$92 ………. Tax Savings (% of Interest and Property Tax)

-$236 ………. Equity Hidden in Payment (Amortization)

$13 ………. Lost Income to Down Payment (net of taxes)

$24 ………. Maintenance and Replacement Reserves

============================================

$1,195 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$1,960 ………. Furnishing and Move In @1%

$1,960 ………. Closing Costs @1%

$1,891 ………… Interest Points @1% of Loan

$6,860 ………. Down Payment

============================================

$12,671 ………. Total Cash Costs

$18,300 ………… Emergency Cash Reserves

============================================

$30,971 ………. Total Savings Needed

Property Details for 184 PINEVIEW Irvine, CA 92620

——————————————————————————

Beds: 1

Baths: 1

Sq. Ft.: 934

$210/SF

Property Type: Residential, Single Family

Style: Two Level

View: Water

Year Built: 1990

Community: Northwood

County: Orange

MLS#: S646955

Source: SoCalMLS

Status: Active

On Redfin: 49 days

——————————————————————————

Irvine Single Family Attached Home. 2 Story with large living room, tile flooring, new wall paint, new kitchen appliances, new furnace, new carpet, and more. TURNKEY! Upstairs Bedroom and Bathroom. Rear Patio and laundry closet for full sized washer and dryer. Close to restaurants, shopping, schools, and more. HOA dues include trash and water. Carport # 199.

IrvineRenter,

where do you see median home prices in irvine heading? up? down? sideways? or can’t tell (because of government interference for example)?

The median should drift lower as the inventory is sold. With seasonal variations creating bear rallies each year, it will look more sideways than anything else. 2009 prices — which were 2003 prices in Irvine — will likely be still holding in 2013. If interest rates move higher, or if the inventory release becomes chaotic, we would easily see the median dip below $500,000.

Don’t feel bad just just yet for not being completely correct, IR. I don’t think this is over by any stretch of the imagination yet, let’s wait and see how things play out. The way I see it, all risks are still to the downside…

I feel like we are on a major leg down right now. More inventory is coming and many houses I am watching on redfin are dropping prices. The new irvine homes haven’t sold out either.

What are the feet on the street feeling?

i definitely feel like there’s another series of price declines coming for the sf bay area.

the open houses i’ve been too are priced fairly low but there’s little foot traffic. these are in desirable areas.

in 2009 when the tax credit was available i’d see excited families moving from open house to open house. there was a lot of talk of remodeling and flipping. now the talk seems to be more about renting instead of flipping – which indicates prices are more in line with income.

it’s not just anecdotal either, sales are down substantially year-over-year.

it’s a bit startling how open house traffic has changed over the years.

2005 to 2006, open houses were packed. even the crappiest houses had a lot of traffic. everyone was talking about how to make money; every buyer was an “investor”.

2011, many open houses are like ghost towns. the ones that are nice and priced right do have decent interest but nothing like in 2005. and the interested people are more likely, compared to 2005-2006, to be regular families that want to live in the house, not investors or families buying a primary residence as an investment.

I disagree about the buyers being families who want to live in the houses. I continue to see the low end properties in University Park being bought and put back on the market as rentals. Maybe not exclusively, but I think it’s still a very large number.

Nefron– you are probably right, that said, I have punched the numbers for investors on Irvine deals and they do not pencil as investments unless someone is happy with a 3% return and that’s only if they are not using any leverage. This is why most of the investors that I know in Orange County are buying, fixing, and selling.

Those people that are buying these as long term hold investments and not adding value are speculating and missed the memo that rates are being held artificially low, there is a lot of shadow inventory, and wages have still not caught up to the artificially maintained pricing.

With investment financing at around 5%, if one buys Irvine real estate as a cash flow investment they are probably not getting good investment advice because with 20% down the cash on cash return is negative, they are losing 2% on the borrowed money. Historically successful real estate investors create positive leverage, ie. they borrow money at 5% on properties that have an 8% cap rate and make 8% on their cash and 3% on other people’s money.

IR says that you will know the bottom has arrived when there is no more heloc abuse and all of the shadow inventory is sold, I will add that you will know the bottom has arrived when speculators quit buying up properties that have negative cash flow.

What’s the return if you pay cash for a $500,000 property, collect about $2200 a month in rent and are paying roughly $200 a month HOA plus insurance and taxes? I’m going to guess better than a bank cd but a whole lot less liquid. I don’t know.

BTW, I’m not saying these houses are a good investment right now, I’m just playing devil’s advocate. I’m too lazy to go back and check, but I think at least half a dozen small houses sold in UP since last spring showed back up as rentals. That’s in addition to another half dozen or so from the previous spring.

Nefron, I believe that you are right on regarding the thought process behind the investors that purchase these properties. Many investors feel that there are few safe places to put their money with any kind of return, interest rates at banks are really low, and right or wrong investors are afraid of inflation.

That said, many of them are likely missing pieces of the puzzle if they buy something with a 3 cap. I did a report in January on a property in University Park, Park Crest for a client. The unit was 2 bedrooms and 3 bathrooms and could relatively easily be converted into a 3 bedroom property. The comps were around $558,000 and similar properties were renting for between $2300- $2700. The property was not listed and the owners gave me very little indication of what they would sell it for but we used a transaction price of $558,000 ror the report and we estimated rent relatively conservatively at $2400, however, the property needed some work.

At $558,000, with rent at $2400, 5% vacancy, 6% property management fee, a 20% down payment, a 30 year fixed loan at 4.75% the cap rate was around 2.6% and the cash on cash return was -5%. At a cap rate of 2.6% with an interest rate of 4.75% it has negative leverage; one is losing circa 2.15% on the banks money until rents increase. Moreover, if one pays cash and interest rates rise there will likely be other investments that return more than 2.6% and with shadow inventory and artificially low rates there is more downside risk than upside potential.

I believe that those investing in these are betting on appreciation much sooner than it’s likely to happen and will likely be disappointed when other safe investment start to have higher returns.

If I pay cash for a $500,000 property, collect $2200 a month in rent, and then pay HOA, insurance and taxes of roughly $800, another 6% in management fees and just round up to $1000, I am collecting about $14,400 a year, correct?

Assume I lose another month’s vacancy per year due to tenant turnover and I incur maintenance costs of another month’s rent, just for the sake of argument. I’m at about $10,000 a year on my $500,000 property. Hmmm, well, that IS 2%. Okay, you convinced me. 🙂

How about the market in the desert? Those prices are a lot lower than Irvine.

You did a nice job of working through that. I’ve looked at a property and thought, this might actaully make sense, just to work through the numbers and see that it really does not.

There are areas that are much better cash flow wise, including the desert. That said much of this area has a large excess supply and vacancy will likely be higher.

My brother just purchased a couple of places in my hometown in the midwest, I own a couple of there as well. I did IHB reports for one of the properties that my brother purchased and the cap rate was over 10% and using leverage his cash on cash return was over 25%. On the down side the properties were built in the 50’s, they are thousands of miles away, there will not be any wild appreciation, one generally has to have a gardner in the summer and snow removal in the winter, however, they tend to appreciate at a couple of percent a year, unemployment is really low there, under 4% last I checked, and the properties are close to good colleges, easy to keep rented, one does not have to worry about their neighbor not paying their HOA dues. There are a lot of places around the country like this, however, it’s tough to get to know distant areas well enough to be comfortable.

I have been interested in buying in an area I am familiar with that is across the country, for some time, but property taxes seem high to me and I worry about extended vacancy. How do you research that? Do you guys do IHB reports for places outside of OC?

Property taxes are high in many areas compared to California. This is definitely one variable that needs to be accounted for. When I first purchased a property in my hometown my property manager was terrible and I thought that I made the worst investment of my life. A few months in one of my units was sitting vacant, I called my property manager and she said, “I’m in your neighborhood sitting at the beach in long beach,” are you kidding me!? Needless to say, I found a new property manager that has been managing my properties for a few years now, she is fantastic.

My best resources in my hometown are a lady that I purchased my first investment property there from, she owns dozens of properties, she’s really sharp, and I don’t question her motives or angle. My brother is also a good source for me since I got him into investing. To research vacancy I also call around to property managers, speak with agents (hopefully you can find one that’s trust worthy), and visit the area and call signs for properties that are for lease by owners and see what they say about vacancy and if you can find one that you can trust they can provide a lot of great info.

If you can get us reliable sold comps, reliable lease rates, the property taxes, good vacancy numbers, and reliable expenses we can complete IHB reports, the challenge is we trust more in the variables and comps that we use in Orange County and a couple of markets that we are familiar with than what is given to us in areas we are not familiar with. If you are in a cold area make sure you are not paying to utilities or if you are that you are accounting for it, heat bills for a duplex can run $500+ in the winter.

Overall, I we are in a strong downturn. However, it can vary greatly by market and even neighborhood. I have mentioned a couple of times a property that our clients purchased in the Acacia track for $525,000 in November of 2010 that was in an excellent location within the tract and in great condition when the previous closest model match had sold for $637,000 in may of 2010.

In addition, we are helping clients close on a property about 3 blocks from the beach in the Sea Cliff area of Huntington. We originally offered in the low $600’s, I sited one home that was listed in the low $600’s and according to the listing agent was in escrow for just under asking. The sellers sited that a majority of the closed sales were in the high 600’s and that they would not respond. I followed with an email showing them the number of homes coming down the foreclosure pipeline and sited the comp again to no avail. The listing agent told me it was my job to get my buyer up, I told him that it was his job to educate his seller on where the market was going. Ultimately, my client won. We had been using this same strategy on a couple of other properties in the neighborhood and my clients are solid well qualified buyers. We were just waiting for the right motivated seller.

About four weeks later, after I had followed up him every 7-10 days or so pointing out new listings or asking why his listing has not sold, he called me and said his seller was now motivated and ready to sell. We ended up in escrow for less than we would have four weeks earlier because we felt were in a stronger position as a result of additional listings and market conditions.

On the other hand, bad agents and impatient buyers continue to help the market stay inflated in some neighborhoods. Take this area of Woodbridge, the market was trending down and comps were set solidly at the $670,000 range and then this buyer and their agent went in and purchase for $729,000, a WTF price. Did they even look at comps?

S628132 19 Hazelnut $668,000 11/05/2010

S610348 10 Buttonwood $675,000 12/03/2010

S622444 2 Pebble $675,000 11/05/2010

MRM-C10064922 10 SAND $727,000 12/23/2010

I was so blown away by what the buyer paid for 10 Sand that I pulled the tax records and the MLS was accurate. Our IHB fundamental valuation report would have put the likely transaction price of this property at $650,000 and if the buyer had proper representation and could have been patient that’s likely what it would have sold for. The problem now is that sellers in this neighborhood will bury their heads in the sand at least until more product comes and a comp is negotiated lower. Understandably to a point, I will focus on this comp when representing a seller, however, if they are not careful they will focus too strongly on it and follow the market back in the direction it’s going in many areas. Of course, good agents and patient buyers will focus on the rest of the comps, hopefully level heads prevail.

There are half a dozen other examples of this, if there is no other product that can transact and a buyer has put himself in a bad position and does not have proper information, this is still happening, even though the overall market trend is down. The agents representing these buyers and not setting proper expectations or educating them on the patience and strategies necessary to get a good deal will hurt other buyers by providing inflated comps and stabilizing the market in areas they buy at higher prices.

Nice post Shevy.

I see the same thing happening just by observing the buy/sells in various neighborhoods in Irvine.

10 Sand was interesting to me too because it did back East Yale loop and while on a cul-de-sac, the other comps seemed to have better locations. Buttonwood even had a lot size almost twice as large but was very dated inside when we toured it. Maybe it was the presentation? Woodbridge still surprises me as it’s such an old neighborhood to be pulling in $400/sft prices. You can’t even get 3CWGs for less than $900k-$1m and it’s not as new as Westpark II. Fake lake premium?

It just demonstrates that seller and buyer psychology is one thing that can’t be “fundamentalized”. The Force is strong in certain areas of Irvine, you need to be good at Jedi Mind Tricks to get the price you want, listing or buying.

But here’s my question for IR:

While your predictions may have been off for Irvine, were they not accurate for the rest of Orange County (or even SoCal)?

Or are you telling us that had it not been for the gov shenanigans… certain parts of the OC would have been much worse? Would the IE have gone negative?

Irvine Home Owner, it’s impressive how well you know the market, are you in real estate? Did you see 10 Sand, was the lot really twice the size at Bottonwood? I looked at it on a map and it looks like the way it sits on the street that it does have a premium lot, it sold for $675,000 to a cash buyer, it was a short sale and took close to 300 days, pending back taxes, back HOA’s, and if any other liens were paid off that did not show in the sales price this was likely a fair price if the lot is as premium as it looked.

That said, I wanted to use this point for a lower value for a property that I was negotiating in the area, however, according to the realist report the listing agent on Bottonwood exagerated the square footage of the lot, which many agents do and buyers need to be aware of and take into consideration both when looking at the property that they are considering buying and when looking at comps. Although Bottonwood is listed as having a 6742 square foot lot the source is ‘other’ when an agent writes ‘estimated’ or ‘other’ it should raise a red flag because they are likely rounding up or sometimes even really exaggerating. In this case the realist report indicate that the lot is 3400 square feet, which is more in line with the neighborhood, but based upon the map views I’ve looked at seem low.

That said, I’ve seen a few properties in this neighborhood that have a small lot size listed, however, as a result of the way they sit on the lot actually have larger back yards than many homes with much larger lots. In addition, I have a lot of clients that love the way Woodbridge is laid out but do not like how old the homes are or the style.

I live in Westpark, however, I really like the Woodbridge community overall, my kids love the pools and it’s fun riding bike around the lake and stopping off at the park with the kids. We spent some time last summer at the Lagoons, my assistant lives in Woodbridge, and then we’d spend the evening at events on the Lake. The 4th of July activities are great too, with the kids run in the morning.

That said, it still does not justify the premium that some of the areas are getting nor overpaying by circa. $70,000.

People generally sell for 2 reasons, greed or necessity. There are few sellers selling because of greed in this market so most are selling out of necessity, if buyers can be more patient than the sellers good deals and fair prices will return.

good post shevy…looking forward to seeing more from you.

i have tried showing comps and explaining how i came to the price but many decent priced irvine homes seem to go decently fast and the ones way overpriced have no desire to move down.

we saw a house we really loved in tustin fields and it had 3 offers 5 days after listing. there isnt an opportunity to negotiate if the property is decently priced in irvine.

Hi rkp; You make a good point, if a home is priced right, shows well, and it’s in a good area it will still likely sell fast and there may even be multiple offers, although much less so than last March through August of 2010. Moreover, I work with investors that buy, renovate, and flip and last year I was getting as many as 10 offers and today I normally get a few and I’m only geting one good well qualified offer. Normally my listings show better than anything else in the neighborhood and are priced right.

It is neighborhood and tract specific and not even necessarily Irvine specific.

Tracts that have low supply and no motivated sellers are not the place to buy right now if one is looking for a deal. There is no reason to be in a rush and there is a good chance that going into the spring many areas will stabilize and this spring/summer may not be the ideal time for a deal in some neighborhoods, many areas in Irvine and a couple of specific areas of Northwood are seeing properties sell really quickly and often with multiple interested parties, even if they are not priced that well and do not show particularly well.

That said, if you are well qualified, have a solid offer package, I recommend that buyers give little weight to listing agents claiming x number of offers. Many times they exaggerate, have FHA offers, or low offers and use this to leverage buyers against each other. I cannot tell you how many times I’ve had agents tell me this and I recommend that my clients walk away only to have the listing agent come back to us a week or so later. I also recommend to set up tracking on these properties to see them all of the way through closing and we normally set up a follow system to check in with the listing agent periodically, many deals fall out and if the seller is motivated they become even more motivated to take an offer from a well qualified buyer once this happens.

@shevy:

Irvine real estate is just a hobby of mine… but I track mostly SFRs so I know almost nothing about North Korea Towers or any of the other smaller attached products (or the ultra high-end Shady stuff).

Woodbridge is an area I am familiar with and try to view open houses of any SFRs that catch my eye. The Buttonwood home is on a pie-shaped lot and it’s actually much bigger than many of the Briarglen lots, just the side yards alone makes the Realist report of 3400 sqft odd. I didn’t get to see 10 Sand in person so it could be very well that it had nice upgrades but the pictures don’t seem to indicate a $70k premium.

Westpark II seems to be one of those areas that are stubborn too. While there may be one or two comp killers, the 3CWGs over there seem to be keeping their $900kish pricing since 2005. This can also be said about Northwood Pointe.

Like you’ve said before, the good stuff that’s hard to find is still very bubbly which is why whenever anyone points out the rising Irvine inventory numbers, I think that has to be a lot higher to have any real downward pressure on the more stubborn tracts.

good advice shevy on putting some weight on the listing agent. many times, i contact listing agent directly to represent me as well so they get double commission and more interested in working with me. esp in short sales, i found thats the only way to get your offer in front of bank.

i have had success getting my offer to the banks and have been close to signing so making progress.

“The listing agent told me it was my job to get my buyer up”

-Bleeh. So ridiculous that often the buyers agent actually works for the seller like that. Glad you didn’t.

Cash-Paying Vultures Pick Bones of U.S. Housing Market as Mortgages Dry Up

http://www.bloomberg.com/news/2011-03-29/cash-paying-vultures-feast-on-u-s-housing-as-mortgages-dry-up.html

“If there weren’t vultures out there, you’d have a city of dead carcasses,” Robert Theocles, an independent consultant for Fort Lauderdale, Florida-based Delavaco, said in a telephone interview. “It’s like the circle of life.”

I grew up in the county where Delavaco is based, and my parents and in-laws still live there. I knew the market was weak but did not expect 69% cash sales. I would imagine that very low priced condos, some going in the 10-20k range, are making up an overwhelming percentage of those cash sales.

Does anyone here know how the final “sale price” is calculated and reported? e.g. Over the last few years, we’ve had people in our neighborhood fail to pay their property taxes for 2-3 years prior to the foreclosure or short sale. So, if a house is listed today for $500k, but there are property tax payments past-due totalling ~$30k, what is the sale price? If it sells for $500k, is the property tax due paid at closing separately, of is it paid out of the seller’s proceeds from the sale price?

I am asking because this could affect neighbors’ property tax bills and affect median home price reports.

The sales prices reflected in the public records do not show any seller incentives, or if there were large back taxes or HOA back payments.

Builders have relied on this fact to manage their inventory without lowering prices. They want prices to keep going up, and they will provide huge incentives to make that happen if necessary. Price drops remove the urgency builders want to keep sales moving.

The median home price is subject to a myriad of distortions including changes in composition. For instance, the median hasn’t double-dipped yet, but the $/SF, which is more accurate for determining quality for the money, has double dipped. Buyers are clearly getting more for their money. The median reflects only what is being paid, it doesn’t indicate what buyers are getting for their money.

IR brings up good points, they do not show seller incentives on new construction or buyer contirbutions towards seller closing costs on short sales.

In areas where short sales close they occasionally look like fantastic deals, however, when one looks into them the buyer is often paying a 3rd party negotiator that is hired by the listing agent, back taxes, back HOA’s, and sometime other liens that are not reflected in the sales price, this can often add up to 5% or more. For this and many other reasons, it’s reltively rare that a short sale is actually a special deal.

On the other side of the coin, builders will rely on paying closings costs, providing huge amounts of upgrades, and other incentives to keep the prices and comps artifically high so that when someone walks into their office without knowledge of how new construction works, or representation that does, they can sell them towards the higher end of the range and they will not have trouble with the appraisal.

I get calls from appraisers every couple of weeks asking if their were any concessions on deals, however, many appraisers are not that dilligent and this can affect how the appraise, if deals close, and values in areas one way or another.

Love the Matrix reference. This is exactly how I am feeling. How much longer can this delusion continue? Can the Fed really just print fiat paper currency and buy treasuries with it? (QE2) Can BoA really just move trillions of bad Countrywide vintage mortgages to a ‘bad bank’ and then just forget about them? Are lenders really offering people in Irvine 5/1 Cash Out refinancings at 3% assuming home values are poised for appreciation? I have been renting in Irvine for almost 6 years and I am ready to buy, however I just can’t escape the feeling that the end to fantasy land is coming, and when it does it will seem just as mother freaking obvious as the subprime implosion. The one thing I can’t predict is the spark…Japanese Treasury selling? Hyperinflation in energy caused by Middle Eastern unrest? A correction in China?

I have some friends who were interested in 10 Sand. They really liked the upgrades. 8 Whitecloud seems to be a better deal, and is next to the “#1 Elementary school”. Some people don’t want the hassle of remodeling, which may be why 10 Sand sold for $407/sf.

And Irvine Renter…the only thing missing from your chart was the line representing the person who made the “more right” predition…oh, wait.

“Some people don’t want the hassle of remodeling, which may be why 10 Sand sold for $407/sf.”

JB- That’s an excellent point, this is the premise that a lot of trustee sale and other investors use. In many areas comps will have a range that can be as much as 10%, depending on property condition, specific location within the tract, etc. Investors will often get properties that only appear to be a 10% discount compared to the lower end of the comps; however, with their crews they can spend a few % to increase the value 10% or more, thus giving them their target 20% margin before fees.

I expected to be able to go 3 or 4 months before 10 Sand sold and find sales in the low $700’s in this neighborhood, however, there were non.

The seller took a loan for $429,000, which is interesting because likely they would have gotten a fairly significantly better rate if they had taken a loan of $417,000, and even if they did not have the money a $12,000 lower sales price would likely have gotten them the property relatively easily, but also because it’s enough down that the appraisal probably would not matter.

That said, I would pay to see the appraisal on this one. The only comp that I could find in this neighborhood above $700,000 was 2 Hickory sold on 8/7/2009 for $715,000.

Moreover, typically in a declining market, one would want to use the upper comp range on a deal like 10 Sand and typically it would be unlikely that it would sell for more than $700,000, one really has to have a lot of pieces fall into place to get a 10% premium over the average comps when it’s a stretch to find anything that supports this. More often the seller asking too much ends up trailing the market down and getting less than they otherwise would have.

Often when a premium is paid like on 10 Sand, the listing agent has double ended the deal and the buyer did not even ask to look at comps because many buyers assume that they will get the best deal going direct to the listing agent and other buyers really don’t care and just want the property and are willing to pay a premium to get it. This was not the case on Sand, however, may have been on Hickory.

Nice post.

It’s interesting that Irvine real estate continues to be sought after despite and during the economic downturn.

Primary areas will continue to see strong interest from FCBs and other buyers still looking to get into the game.

Great post IR!

Thanks. Good to hear from you.

i remember the ISM posts when this blog first started…whats the status now? any plans for guest posts?

Oh you are sweet! But I don’t think I have much to say that would interest IR’s current readers.

Your posts would always be welcome.

Hi rkp,the last numbers I read were that only about 1 in 5 short sales ever sell as short sales. In addition, in my opinion this brings up two of the most common misconceptions that buyers have in the market today.

1) Many buyers believe that short sales are generally great deals and

2) Many believe that it’s generally advantageous to go directly to the listing agent.

From my experience

A) Generally, most shorts sales are not special deals and generally not worth the agony that buyers go through and

B)Generally, buyers pay towards the upper end of market value on most properties that I see double ended.

To elaborate, regarding short sales,

1) I think it’s important to note that most banks will not pay a listing agent on both sides so if they represent the buyer and seller the fee is often the same and most of the time this is actually worse for them for numerous reasons including but not limited potential higher fees to their broker, more liability, and more work. To that point, I never represent buyers on my own short sale listings. If a buyer comes to me and does not have an agent, I refer them to my lead buyer’s agent but truly to not care who they use as long as their agent is competent and setting the right expectations. My fiduciary duty is to my client and I and most agents, regardless of what people think will not risk a short sale not being approved by taking an inferior buyer just because they may get an extra fee, which in reality does not exist on most short sales. Short sales are tough enough to get through with the best, most qualified buyers, working with the best most knowledgeable listing agents that are setting expectations of the process with both the buyer and seller.

2)The list price on a short sale means little to nothing. It is normally set by the listing agent, normally it’s a price that they feel should solicit multiple offers because until they get an offer the bank will not negotiate the short sale or let them know what price they are willing to sell the property for.

a) It’s rarely the first offer that is accepted and submitted to the bank, we have had good luck putting in back up offers on old short sales and setting up a strategic follow up campaign so when the short sale is finally approved and the listing agent goes back to the original buyers agent to find they have purchased something else we are in line.

3) Short sales are rarely a special deal. The bank gets a BPO and an appraisal, most of the time multiple banks get multiple BPO’s and appraisals. The investors that hold the loans then decide what they will let the property go for. In nicer areas it’s normally market value. That said, even in nicer areas I’ve seen discounts of circa 5%. Moreover, they will often not accept FHA offers.

That said, for areas or properties that are not financeable, I’ve had investors purchase properties for as much as 20% below market value, we’ve found lenders that will lend, repaired and resold the property and the investors have made money. Moreover, if one is willing to submit dozens or hundreds of offers, a large discount and successful short sale transaction is possible.

4) On short sales the seller will normally not do termite work, not do repairs, you may have to pay back HOA’s, taxes, or other liens, which will be negotiated after an offer is accepted by the seller and submitted to the bank, most short sales never sell as short sales and normally come back up later as trustee sale owned or REO’s. That is if the short sale seller is not trying to sell to a family member or friend and buy it back later.

5)Most of the best deals I’ve seen and been involved in, in the last 6 months have been motivated equity sellers, trustee sale owned, or REO’s.

I make my offers directly through the listing agent. If the listing agent will not take my offer, I will make my offer directly to the seller. Works for me.

6) That said; if you offer on enough short sales there is a possibility to get a deal on one.

7) If you have specific areas that you like and all that are available are short sales I recommend submitting on them as part of a larger strategy but only if you understand and are comfortable with the risks and challenges associated with short sales.

8) It’s important to make sure that the sellers sign all short sale approval letters from the lenders. I’ve heard of deals getting short sale approval and the listing agent failing to provide or make sure that their sellers read it and then 5 days before closing when the seller is asked to do x, y, or z, they say that they will not and refuse to agree to the terms of the short sale.

9) Do not give notice or plan to move until you are handed the keys on a short sale. An agent in my office had a written extension of a trustee sale on a short sale that the buyer had loan docs signed and all of the money wired to escrow on. Before it recorded the bank foreclosed. The agent flew to Texas with the letter, went into the negotiators office, showed them the letter and they had to reverse the sale. Not all listing agents will go to that extreme and the short sale departments are often not communicating with the REO departments and have been known to foreclose despite short sale approval.

10) Keep in mind most short sales have sellers that do not really want to sell and banks that really don’t want to recognize the loss. Many times the sellers are just trying to delay the foreclosure or trying to sell to a family member or friend so they can buy it back for much less than their current loan later.