Workers in the real estate industrial complex are succumbing to the difficult market environment. Those who aren't squatting are often left homeless with their renting brethren.

Irvine Home Address … 162 PINEVIEW Irvine, CA 92620

Resale Home Price …… $189,900

Yes, how many times can a man turn his head

Pretending he just doesn't see?

The answer my friend is blowin' in the wind

The answer is blowin' in the wind.

Bob Dylan — Blowin' In The Wind

Have you thought about what you would do if you became unemployed? Has that nagging question been draining your energy throughout the recession? Sometimes the consequences are as a bad as you imagine.

Homeless ex-mortgage broker Susan Schneider shows housing bust hit agents hard

Annie Gowen, Washington Post Staff Writer, Saturday, February 19, 2011; 9:15 PM

Before the real estate bust, Rob Paxton and Susan Schneider might have met at a networking event or through their home-buyer clients. Instead, they first crossed paths at a day shelter for the homeless in Falls Church.

Schneider, once a mortgage broker with plenty of disposable income, arrived one cold winter morning with her possessions in tow, looking for a hot meal.

In the kitchen, Paxton stirred a bubbling pot on the stove. He once pulled in more than $200,000 a year in Northern Virginia, but he had taken the part-time job as the shelter's director when his commissions dwindled to almost nothing.

Paxton, 55, noticed Schneider right away. Wearing a knit cap and a slightly dazed expression, hers was one of the few female faces in a sea of mostly Latino men awaiting the noon meal. He said hello, and soon they'd swapped stories.

“We have a lot of common ground,” Paxton says. “Same business: trying to get people into homes.”

The carnage among people who try to make a living from real estate related professions has been remarkable. As I noted yesterday, OC homebuilding is 62% off its historic norms. With demand for new homes is less than half of what it normally is, less than half the money that normally flows into real estate is available to support the industry.

Now it is Schneider who needs a home. And over the past six weeks, Paxton has tried to help her – shepherding her to different shelters to find an open bed, giving her food and calmly taking her calls when her perilous situation frays her emotions past the breaking point.

Although Schneider, 43, is grateful for the help, their alliance is shaky at times. She doesn't hide her bitterness that the man trying to help her – a colleague, really – still has his charming gray-and-white colonial in Fairfax Station, while she lost it all.

“Don't get me wrong – Rob is a nice guy,” she says. “But you really have to live it to know what it's like.”

I wonder if the colleague is making his mortgage payment or if he is struggling with little or no income and squatting in his McMansion?

… She used to love to cook, back when she had an apartment in Alexandria, a new Honda Accord and her own mortgage business. She wasn't rich, but she was comfortable, able to afford dinners out – grilled salmon and a nice pinot grigio – and $100 salon treatments for her hair. In her spare time, she organized community bike rides along the George Washington Parkway.

She'd worked in the mortgage business in Northern Virginia since 1998. Then, in 2005, searching for a change of scenery, she moved to Texas and took a job as a loan officer at Countrywide Financial, the home-loan behemoth now owned by Bank of America, whose lax lending practices made it the poster child of boom excess.

She was named a top rookie – and has the little plastic paperweight to prove it – but began to feel claustrophobic in her cubicle as she and her fellow loan officers were driven to make more and ever riskier loans.

“It was a sweatshop,” she says. “People were refinancing just to save one monthly payment – or $10 a month.”

She left Countrywide in 2006 and ended up back in Northern Virginia, launching her own mortgage business, Mortgage Made Simple, just as the real estate market here began to tank.

She recognized borrowers were not benefitting from the sweatshop work, but she participated eagerly for the financial rewards. Apparently the morality of what she was facilitating was not an issue. In her mind, she was living the American dream until 2006. Too bad it was an illusion projected by a Ponzi scheme.

In the ensuing months, she tried everything she could to keep the business afloat, even delving into the murky subprime mortgage market and doling out loans to customers with bad credit and insufficient incomes. She thinks many of those customers have likely lost those homes by now. Then, in 2008, she was evicted.

“I lost everything, and I [didn't] have anywhere to go,” she says. “I was depressed, angry – all these emotions. . . . Who wouldn't be?”

At first, she slept on the office floor of another mortgage broker who eventually kicked her out. Then – like the homeless character Will Smith played in “The Pursuit of Happyness” – she spent a week holed up in a bathroom of a hotel in Alexandria. She lived on a friend's boat, then at a campsite in Lake Fairfax Park, surviving on a string of low-wage jobs. She waitressed, washed towels at a gym and now waves signs outside a Liberty Tax office in a Statue of Liberty costume.

By December, though, she hit what she calls “rock bottom.” The cold weather drove her inside to hypothermia shelters in local churches at night – and to Safe Haven.

In their shoes

Paxton became the shelter's director in July, the latest in a string of part-time jobs – including a county position teaching financial education to low-income residents – to supplement his Realtor's income, which took a big hit in the down market.

“It's not a matter of working harder – the business just wasn't there,” says Paxton, who grew up in Arlington County. He and his wife, Mary, an IT manager for Fairfax County, have three daughters and face mounting college tuition expenses. One daughter is a student at Clemson, another is applying to some private institutions.

Although Paxton took the job as a way to pay his bills, he has thrown himself into the work with increasing zeal. He went dumpster diving with one Safe Haven regular to observe how it was done. He posed as a homeless man to check out the food at a nearby church.

Now that the real estate market is recovering, Paxton sometimes goes from a million-dollar listing for Long & Foster to tying an apron around his pressed chinos and Ralph Lauren sweater to serve in the chow line.

Colleagues and family members say he has always had a humanitarian streak, but he's developed a much greater sense of empathy for people in Schneider's situation.

One frigid evening, he took her to three shelters to find a place where she could sleep that night, waiting with her in a long line in the cold.

“That was my first taste of, 'Wow, that's what it's really like,' ” he says.

But his efforts to help Schneider have not always gone smoothly.

Although she admits to being depressed and angry since she lost her home, she does not want to seek counseling or other support. One volunteer's efforts to get her a spare room with an older woman went nowhere. She says she has a strained relationship with her relatives, who live overseas and are unaware of her plight.

“Everybody loves happy endings,” Paxton says. “With Susan, it may be a happy ending. I don't know at this point. I'm having my doubts, but I'm hopeful.”

A former life

Schneider says her game plan is simple: “Get a better job and get out of this mess.” She knows it won't be easy.

After lunch, she goes over to a storage facility in Alexandria where she has been keeping her remaining possessions. She tries to swipe her access card, but it fails. A clerk behind the counter delivers the bad news: She needs to pay $360 by March 11 or the contents of the locker will be sold.

Eventually, she is allowed upstairs to retrieve personal papers from the locker. Inside is the detritus of her formerly middle-class life – kitchenware, a black Wilsons leather jacket, the gold dancing shoes she used to wear to Glen Echo Park, outdoor gear and her beloved bike – a pricey Roubaix that she bought when she was flush.

“Somebody is going to get some really good stuff,” she said, her voice cracking.

She barely blinks when she replaces the lock on door, but once outside, she sighs heavily.

“I miss my bike,” she says, like it's already gone.

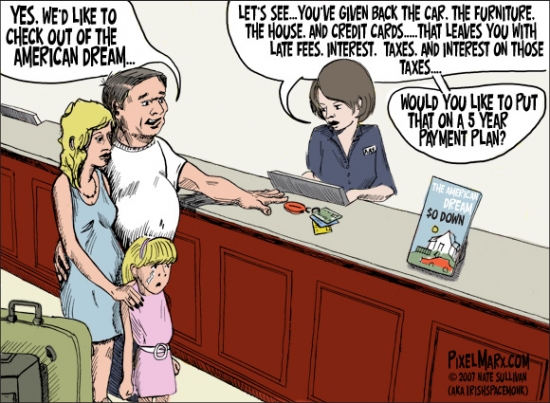

It's easy to make fun of some of the losers who where flushed out of the system in the crash of the Great Housing Bubble, particularly the Ponizis who carried on foolishly as if the good times were going to last forever. However, there comes a point when the crisis has dragged on long enough that good people get punished — people who did not participate in the excesses of the bubble. It's hard to say if the people in today's story are good or bad or worthy of compassion or ridicule. This woman's story was sympathetic. Though some may consider her response degrading, I think her spirit of self-reliance is noble. I would dress up in a ridiculous costume to support myself and my family. I'm thankful I don't have to.

I still giggle about some of the other characters in real estate who are getting what they deserve…

Total loss on a 2004 investment

The owner of today's featured property paid $290,000 on 11/22/2004. He used a $203,000 first mortgage, a $58,000 second mortgage, and a $29,000 down payment.

You have to imagine when he bought the place he figured that California real estate went up 7% to 10% per year every year, so if he held this property for 6 years, he should be selling it for between $420,000 and $520,000 depending on the appreciation rate. He probably figured the $420,000 was conservative.

The reality is he is now selling this property for $190,000. He has lost his down payment, the second mortgage holder is looking for money, and the first mortgage holder is wondering how they will be made whole.

This is one Irvine investor who didn't acheive his financial projections.

Irvine Home Address … 162 PINEVIEW Irvine, CA 92620 ![]()

Resale Home Price … $189,900

Home Purchase Price … $290,000

Home Purchase Date …. 11/22/2004

Net Gain (Loss) ………. $(111,494)

Percent Change ………. -38.4%

Annual Appreciation … -6.7%

Cost of Ownership

————————————————-

$189,900 ………. Asking Price

$6,647 ………. 3.5% Down FHA Financing

5.02% …………… Mortgage Interest Rate

$183,254 ………. 30-Year Mortgage

$39,410 ………. Income Requirement

$0,986 ………. Monthly Mortgage Payment

$165 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$32 ………. Homeowners Insurance

$295 ………. Homeowners Association Fees

============================================

$1,477 ………. Monthly Cash Outlays

-$93 ………. Tax Savings (% of Interest and Property Tax)

-$219 ………. Equity Hidden in Payment

$13 ………. Lost Income to Down Payment (net of taxes)

$24 ………. Maintenance and Replacement Reserves

============================================

$1,201 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$1,899 ………. Furnishing and Move In @1%

$1,899 ………. Closing Costs @1%

$1,833 ………… Interest Points @1% of Loan

$6,647 ………. Down Payment

============================================

$12,277 ………. Total Cash Costs

$18,400 ………… Emergency Cash Reserves

============================================

$30,677 ………. Total Savings Needed

Property Details for 162 PINEVIEW Irvine, CA 92620

——————————————————————————

Beds: 1

Baths: 1

Sq. Ft.: 932

$204/SF

Lot Size: 763 Sq. Ft.

Property Type: Residential, Condominium

Style: Two Level, Other

Year Built: 1977

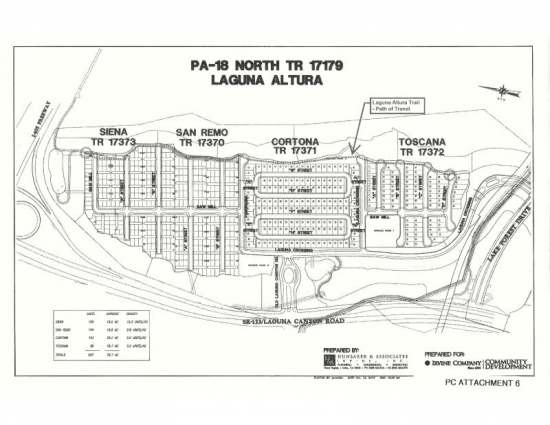

Community: Northwood

County: Orange

MLS#: P764582Source: SoCalMLS

Status: Active This listing is for sale and the sellers are accepting offers.

On Redfin: 41 days

——————————————————————————

Cozy townhouse features 1BD+Loft & 1BR. Large livingroom, comfortable dining area, roomy bedroom with walk in closet. Great location in complex, back to the lake, beautiful view, a short walk to pool area. Short Sale done by experienced Realtor.

.jpg)

.jpg)