A selloff in the bond market is moving mortgage interest rates higher. Is this the end of cheap money?

Irvine Home Address … 162 TRELLIS Ln Irvine, CA 92620

Resale Home Price …… $515,000

Baby what a big surprise

Right before my very eyes

Yesterday it seemed to me

My life was nothing more than wasted time

But here today you've softly changed my mind

Chicago — Baby What a Big Surprise

I recently wrote that mortgage interest rates hit a five-month high. The real story isn't that interest rates moved higher, it is that mortgage interest rates went up quickly, and the reasons for that move are not centered in real estate.

Rates have been going down along with mortgage demand and home sales since the expiration of the tax credits in the spring of 2010.

Unfortunately, the rise in interest rates is not being caused by a resurging economy paying a premium for capital. The economy is still in the doldrums, home sales are way down, the banks own a lot of homes, and they will ultimately foreclose on many more. Rising mortgage interest rates will hurt pricing and sales volumes. The weight of inventory will push prices lower.

So why are mortgage interest rates going up?

Is the Bond Bubble Bursting?

By BRETT ARENDS — DECEMBER 10, 2010

Has the bond market finally turned? And if so, what is this going to mean for you and your money?

Here's the answer to the first question: It sure looks like it.

The interest rate on five-year Treasury bonds has nearly doubled to 1.9%. The rate on the 10-year has rocketed to 3.2% from 2.4%. The 30-year bond is now paying 4.4%—nearly a full percentage point more than it was at the lows a few months ago. (Bonds work like a seesaw: The yields rise when the price falls.)

At the peak of the boom, about six weeks ago, investors in bond funds lined up to buy Wal-Mart Stores bonds in the hopes of earning 5% a year for 30 years. How's that working out? So far they have already seen their first year's interest effectively wiped out, as the bonds have slumped about 5% in price since the sale.

The usual caveats about forecasts—namely, that nothing in this business is certain—apply. Nonetheless, this looks ominously like the end of the bond mania.

Bonds were a bubble but for a different cause. The real estate bubble was formed because people drove up prices chasing appreciation. The bond bubble was formed because people drove up prices chasing capital protection and cashflow. To much money chasing too few opportunities bids up prices to unsustainable heights.

The reasons are partly positive and partly negative.

The positive: Fears of deflation, and a second economic downturn, have receded. As a result, it isn't just that the yields on regular bonds have risen. So, too, have the yields on inflation-protected government bonds.

But then there are negative reasons. Bonds looked seriously overvalued. Yields were desperately low. They offered little reward and a lot of risk. Meanwhile, the governance and finances of the U.S. government are deteriorating before our eyes.

No wonder bond prices have tumbled, sending yields much higher.

The asset overvaluation of a bubble creates the circumstances where there is little potential reward for a great deal of risk. It is an imbalance that needs to be corrected — usually by a violent change in price. Quantitative easing and the market's perception of government policy could serve as a catalyst to the price correction needed in the bond market.

The rumblings began in August, when Federal Reserve Chairman Ben Bernanke first unveiled his plans to invent yet more dollars and pump them into the economy. The market really began to sell off a month ago, when the elections left a bitterly dividend government.

But President Obama's tax Munich this week, apparently, has been the final straw. Economists at Macroeconomic Advisers estimate that the tax cuts and minor spending increases will add another $900 billion to the deficit in two years' time. But that's just the start. The real issue is the signal it sends about longer-term fiscal discipline.

So much for all those concerns about deficits.

At some point, without fiscal discipline, the world will simply lose confidence in U.S. government finances. They will demand higher yields as more compensation for risk, and for the dangers of inflation.

Are we at that point? Maybe not completely. But the movement in bond prices tells you people are worried.

Ben Bernanke is trying to devalue the dollar and generate inflation. His success will be presaged by a selloff in the bond market as investors come to believe Bernanke will succeed in printing enough money to create inflation. Right now deflation is still a problem.

So what does this mean for your finances?

We've seen so many bear markets in the past decade. But Treasury bonds are much more dangerous on the way down than other assets. When the dot-com bubble burst, blue chips like Johnson & Johnson and Bank of America carried on pretty much unscathed. When the real-estate market crashed, bull markets continued in the likes of Apple and gold and ExxonMobil. When Lehman Brothers imploded, at least Treasury bonds rose.

But if the Treasury market loses control, almost nothing will be safe.

Here's how the repercussions will be felt:

1. The wealth effect. Americans have at least $3 trillion invested in bond funds, according to the Investment Company Institute. A lot of that is in paper backed by one issuer: the U.S. Treasury. Investors have been assured that bonds are "safer" than stocks, but this is a half-truth at best. They are vulnerable to inflation, and to rises in interest rates. A 30-year bond paying $50 in coupons each year is worth $1,000 in an environment where long-term interest rates are 5%. If those long-term rates rise just to 6%, it's worth only $860—and the owner is down 14%. If those rates rise to 7%, that bond's value falls to $750—a 25% loss. Bonds are owned especially by older investors, who in turn are more dependent on their investments for income. A sustained slump can seriously hurt spending and confidence.

2. Corporate bonds. When Treasurys sell off, these get hit too. That's because they are priced in relation to Treasurys. When Treasury yields were down on the floor, brokers and advisers were able to argue corporate bonds were "cheap" because their yields were higher than Treasurys. (The gap is called the "spread.") But once the yields on Treasurys rise, those on corporate bonds have to follow suit just to maintain the same spread.

3. Real estate. Mortgage rates are effectively set relative to the yields on 10-year Treasury bonds. And the turmoil in the bond market has just sent those mortgage rates jumping to six-month highs. According to Bankrate.com, you'll now pay 4.91% on a typical 30-year conforming loan—compared to rates of just 4.4% a few weeks ago. Sure, 4.91% is still pretty low—if it stays there. But it's still very unwelcome news for the flattened housing market.

4. Corporate profits. The bond boom was terrific news for companies. They could take advantage of it to issue long-term paper at very low rates. They could often invest that money at higher rates via expansion—typically overseas, such as in Asia—or even just by buying back their stock. That boosted profits and cut taxes. But if the bond market has now peaked, that game is going to be over. Companies that need cash in the future are going to find it harder to come by—and they will have to pay more for it.

5. Everything else. When Treasury yields rise, that makes every other asset seem less valuable. There are two reasons for this. The first is that when Treasurys offer a higher yield, the yield on other assets needs to rise to compete. The second is that economists and investment analysts use Treasury rates—typically the rate on 10-year bonds—as the basis for many long-term calculations. All other things being equal, higher rates make future profits less valuable in today's money.

Maybe bonds will recover. This business is full of uncertainties. But investors need to understand that there is now a serious danger that the events of the last month are the start of a long-term slump in Treasurys. That makes this investment environment more dangerous than many people seem to realize. Look out.

Write to Brett Arends at brett.arends@wsj.com

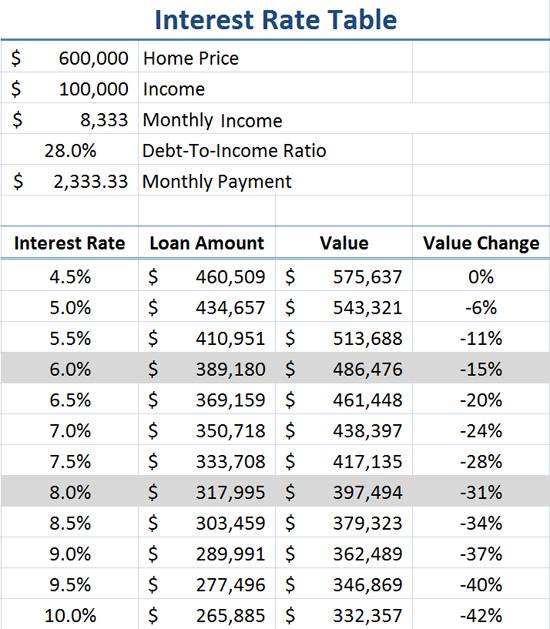

The macroeconomic issues that move the bond market can have significant impact on mortgage interest rates. In markets with elevated prices dependant upon borrowers maximizing their loans (see Orange County), rising interest rates will lower prices because higher interest rates make for smaller loan balances.

So what do you think will happen? Have we seen the peak of the bond market? Have we seen the bottom of interest rates?

Loan Modification: Fail!

- The owners of today's featured property paid $460,000 on 11/20/2003. The mortgage data is unclear as my records show two mortgages for $68,900 which would leave a huge down payment.

-

On 3/27/2007 these owners obtained a HELOC for $242,798.

- Somewhere after that, these people defaulted on some debt and restructured with a loan modification. The strange part is that IndyMac Bank is showing up as the loan originator on 12/28/2009, well after IndyMac was shut down. The loan was a $455,000 first mortgage at 1%. The owners went into default shortly thereafter.

Foreclosure Record

Recording Date: 10/07/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 05/06/2010

Document Type: Notice of Sale

The house was purchased by OneWest Bank on 11/3/2010 for $473,681.

Irvine Home Address … 162 TRELLIS Ln Irvine, CA 92620 ![]()

Resale Home Price … $515,000

Home Purchase Price … $460,000

Home Purchase Date …. 11/20/2003

Net Gain (Loss) ………. $24,100

Percent Change ………. 5.2%

Annual Appreciation … 1.6%

Cost of Ownership

————————————————-

$515,000 ………. Asking Price

$18,025 ………. 3.5% Down FHA Financing

4.87% …………… Mortgage Interest Rate

$496,975 ………. 30-Year Mortgage

$105,063 ………. Income Requirement

$2,629 ………. Monthly Mortgage Payment

$446 ………. Property Tax

$150 ………. Special Taxes and Levies (Mello Roos)

$86 ………. Homeowners Insurance

$134 ………. Homeowners Association Fees

============================================

$3,445 ………. Monthly Cash Outlays

-$431 ………. Tax Savings (% of Interest and Property Tax)

-$612 ………. Equity Hidden in Payment

$34 ………. Lost Income to Down Payment (net of taxes)

$64 ………. Maintenance and Replacement Reserves

============================================

$2,500 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$5,150 ………. Furnishing and Move In @1%

$5,150 ………. Closing Costs @1%

$4,970 ………… Interest Points @1% of Loan

$18,025 ………. Down Payment

============================================

$33,295 ………. Total Cash Costs

$38,300 ………… Emergency Cash Reserves

============================================

$71,595 ………. Total Savings Needed

Property Details for 162 TRELLIS Ln Irvine, CA 92620

——————————————————————————

Beds: 2

Baths: 1 full 1 part baths

Home size: 1,180 sq ft

($436 / sq ft)

Lot Size: 2,408 sq ft

Year Built: 1998

Days on Market: 23

Listing Updated: 40511

MLS Number: P761192

Property Type: Single Family, Residential

Community: Northwood

Tract: Glle

——————————————————————————

According to the listing agent, this listing is a bank owned (foreclosed) property.

What a lovely home in Glenneyre at Lanes End. This is a 2 bedroom + an office, den or gym. All bedrooms are upstairs with 2 full bathrooms. The property is in EXCELLENT condition, including appliances. You enter through a white picket gate, it's quite charming. The downstairs has an open floor plan. Gorgeous parquet floors throughout the downstairs. The living room and dining area both have a view of the fireplace, as does the kitchen. The kitchen has a garden window over the sink, looking toward the yard. There is also a guest bathroom downstairs as well a direct garage access. This home will sell quickly!!

If one is going to talk about the wealth effect from bond prices falling, why don’t they mention rising stock prices? Households only hold $1T in treasuries (per the Fed household balance sheet), but hold ~ $12T in equities and mutual funds. Even if bonds are $3T, stocks are 4X. So a 10% drop in bonds can be wiped out by a 3% rise in stocks. Stocks are up 12% for the past 12 months. Plus, some of the rise in stock prices is simply people shifting from bonds to stocks which doesn’t reflect anything except appetite for more risk.

We’ve also got a long way before people really lose real confidence in the US gov’t. Right now (until the Germans or a PIIGS leave) you have to treat eurozone finances as a whole. Do people really have more confidence in the eurozone than in the US?

BB doesn’t care what happens to Irvine/OC, as it is a small slice of the US housing market. Higher rates won’t be as damaging in other markets as they might in Irvine, or might not in Irvine, depending on down-payment level.

There are probably a lot of properties that were profiled 3-4 years ago that have been sold again since their original profile. It would be neat to see a couple to see what’s happened with them.

I am sure that Russia and China have yet to lose all faith in the US Government but that hasn’t stopped them from sidestepping the Dollar now on their trade relations.

The world and domestic bond market/s are roughly 3 times the size of the stock market/s.

Investors have been assured that bonds are “safer” than stocks, but this is a half-truth at best.

The half truth is what the author is selling.

A 30-year bond paying $50 in coupons each year is worth $1,000 in an environment where long-term interest rates are 5%. If those long-term rates rise just to 6%, it’s worth only $860—and the owner is down 14%.

Except in the case of default, a 30-year bond pays the same damn thing no matter where interest rates go. It just needs to be held until maturity. Not that many 30 year bonds are help to maturity, but plenty of 5 year bonds are.

Only in a greed infested world can opportunity loss be sold as a real loss.

My God! I’ve personally lost billions of dollars when I failed to buy Apple and Netflix IPO’s and really lost big when I failed to put my life savings into Lehman Brother’s puts.

I’m losing money every second and so are you! No one is safe! We’re all going broke!

Kirk – Yes, the bond may be held until maturity and the nominal gain is absolute, but why do you think the price of the bond decreases?

Kirk – I wish you luck with holding those 5% bonds to maturity.

And I wish you luck with comprehension in the future.

Answer awgee’s question and i will work on my comprehension skills.

The joke, assuming you hold millions of dollars in treasuries, was to help you understand the real loss that occurs holding a 5% treasury for 3 decades.

I’m… sorry… sometimes… I… forget… that… my… American… accent… can… be… hard… for… some… people… to… understand… So… I’ll… speak… slowly…

The… following… is… a… quote… :

Investors… have… been… assured… that… bonds… are… “safer”… than… stocks… but… this… is… a… half-truth… at… best…

The… following… is… me… :

The… half… truth… is… what… the… author… is… selling…

The… following… is… another…quote… :

A… 30-year… bond… paying… $50… in… coupons… each… year… is… worth… $1,000… in… an… environment… where… long-term… interest… rates… are… 5%… If… those… long-term… rates… rise… just… to… 6%… it’s… worth… only… $860… and… the… owner… is… down… 14%…

The… following… is… me… again… :

Except… in… the… case… of… default…, a… 30-year… bond… pays… the… same… damn… thing… no… matter… where… interest… rates… go… It… just… needs… to… be… held… until… maturity… Not… that… many… 30… year… bonds… are… held… to… maturity… but… plenty… of… 5… year… bonds… are…

Only… in… a… greed… infested… world… can… opportunity… loss… be… sold… as… a… real… loss…

The… following… is… something… called… sarcasm…

My… God… I’ve… personally… lost… billions… of… dollars… when… I… failed… to… buy… Apple… and… Netflix… IPO’s… and… really… lost… big… when… I… failed… to… put… my… life… savings… into… Lehman… Brother’s… puts…

I’m… losing… money… every… second… and… so… are… you… No… one… is… safe… We’re… all… going… broke…

I… hope… by… speaking… slower… you… can… now… understand… why… the… author… of… the… quotes… is… the… one… selling… the… half… truth…

the effect of rate change on a 30 year is most drastic. The author used this to prove a point.

a 5 year creditor will also lose, just not as much.

The reason the bond changes in value reflects the devaluation of the currency in which the bond is denominated. You may hold until maturity and have a nominal gain, but you will probably lose because the “money” you hold will be worth much less than when you bought the bond. The loss in purchasing power is real. The nominal value of the bond at maturity is the illusion.

Dear fools,

The point is that bonds are safer than stocks. There is no half-truth there. Sure, if you are an idiot you can buy a bond that will lose 100%, but it’s pretty hard to do.

How you two (or one) geniuses fixated on inflation, I have no idea. If inflation concerns you so much then you can buy TIPS.

Both of you seem to be clueless on why bond prices fall when interest rates rise. It’s a little something called yield. It is an opportunity loss if it happens to a bond you hold. It only becomes a real loss if you sell the bond.

The author picked a 30 year bond so it was easier to sell his half truth. End of story.

Kirk,

I stand in amazement at your complete lack of understanding of bond pricing.

Wicked awesome that someone who has amassed enough money to buy a bond can be so clueless to it’s intrinsic value.

Please, reread awgee’s comments and answer the question. If you don’t understand the question, then ask what they mean.

Chuck

Chuck, give it up or prepare yourself for some frustration. I am discovering that there are some people who for reasons unknown to me, would rather insist upon a dogmatic position rather than think.

I agree with you Kirk, especially because it is extremely easy to hedge against inflation in a bond portfolio by “laddering” the 30 year bonds at 1 to 5 year intervals. Thus, if nominal coupon rate goes up, you are capturing that as well as hedging against inflation…

Also, like you mentioned, it’s very easy to demonstrate inflation risk on a 30 year bond…

Real life bears out what you are saying. The most drastic rate increases were with the more long-term loans. Short-term stuff like 5- and 7-year ARMs hardly budged as 30-year rates spiked nearly 1% over the last few weeks.

“So what do you think will happen? Have we seen the peak of the bond market? Have we seen the bottom of interest rates?”

This is one of the most laughable post I’ve seen here and that’s saying a lot.

This story will be told in decades not months.

PR –

It sounds like you are now re-arranging the goal posts for yourself. I find it ironic that in the past you would show up here pumping month by month declines in interest rates as evidence of your divine knowledge, mocking those who argued that it could not last.

And here we are today…. Interest rates are rising and you claiming that month by month change doesn’t matter anymore and that we all just have to wait a few decades for your broken clock to be right again.

Similar to the all the housing bulls as the market topped. It was fun watching their little brains grasping at every straw they could in order to find some reason to keep believing in appreciation.

Well,

There’s actually many good reasons to believe in appreciation, the most notable is inflation.

Ever heard of the ka-poom theory? Look it up if you haven’t.

I’m not saying that I believe everything in it (I’m a strong believer in deflation for a while), but sooner or later, we will lose control of the money supply and the USD will be the tail that wags the housing dog.

If you think housing will never go up from here (or at least a decade), I’d be willing to take a wager. Any day. Any amount.

Chuck Ponzi

LOL Planet Realtard “interest rates are going lower watch out 3% here we come”, doesnt that make you look like an idiot right about now…suck it up mate you got it all wrong..

You may be laughing out the other side of your face when the massive wall of foreclosures squeezes your financial gonads harder than you like.

I believe interests rates will rise, and then when thousands more walk from their homes (including myself), they will *have* to lower the interests in order to keep people in their homes paying an insane amount of TAX to keep government services afloat. The banksters already been bailed out, they don’t give a shit anymore as it quite apparant.

If interest rates continue to rise, rejoice, you will get a home for cheap, but you will pay the same, and many more people will quit paying on their mortgage. Pain, pain, and more pain, but banksters got paid. Keep voting the same, perhaps one day owning a car will be a priveledge in our great Amerikkka.

High rates are healthy.

Low prices in real estate are healthy.

Both are the solution.

If homeowners walk because prices fall, good. They purchased with the speculator’s mindset.

If business owners fail and declare bankruptcy because of lack of capital, GOOD, they started a business to only make a profit. (speculate)

Are you investing in the Wall St. casino expecting a return? You are speculating. Are you investing your money in long term things in order to save money on future expenditures? You are speculating.

Or perhaps, you are simply speculating on this blog (speculate – to review something idly or casually and often inconclusively).

I bought a home for a SPECULUM, and the FED and our government, not too mention a large mass of the public, has delivered. Thank you.

Speculum 2. An instrument for dilating the opening of a body cavity for medical examination.

I prefer a smaller speculum.

I am arguing for a balance in prices to create a healthy credit market and investing environment.

Please note there is a difference between speculating and investing. Of course, anything in the future can be construed as speculation.

Risk of failure increases with the amount of leverage. This holds true for an individual, business, economy, country.

Thanks Matt for clarifying. It seems most people view anyone that purchased as speculators, when in fact, there is a huge amount of people who bought homes to live in, as a long term investment, but the fraud took a huge portion of that “investment” and turned it upside down to the point where other “investments” are more sound in the LONG TERM.

It makes baby Jesus cry to see homes being dealt like Wall St. casino stocks.

“So what do you think will happen? Have we seen the peak of the bond market? Have we seen the bottom of interest rates?”

First of all, thanks for asking. I am rarely asked my opinion, although very ready to give it. Maybe that is a sign of what it is worth.

Anywhooz, 70/30 the bond market topped and the low for interest rates is in. I would like to make that 95/5, but I have wrong about this too many times before. On what will happen; small increases in mortgage interest rates will affect disproportiionatly large decrease in the number of mortgages applied for and funded. But the large effect of interest rate increases will be on interest rate swaps, tens of trillions of dollars worth of interest rate swaps. The counterparties of the hedges will be discovered to be unable to make good and the dominos will fall. Assets valued at par will be worth zero. There is no collateral like a home to foreclose on, just some bank’s promise or counterhedge with some other bank.

Like everybody else has said previously, I wish you had an edit function, so we could correct our grammer, spelling, and omissions.

I have often wished there was and edit button.

But, it is also one thing I like about this blog–no one can go back and rewrite history.

PR might like an edit button about now so he can change his 3% rate predication to 5%.

“A selloff in the bond market is moving mortgage interest rates higher. Is the is the end of cheap money”

I think it should be- Is this the end of cheap money?

I don’t think this is the end of cheap money.

At a certain point, fed monetization will erase confidence. This phenomenon is in its beginning stages.

The fed and govt will fight interest rate rises tooth and nail and exacerbate the problem.

Planet Reality may still be right in the short term.

Don Bren’s spending spree

http://lansner.ocregister.com/2010/12/15/don-brens-spending-spree/92514/

The interest rate thing is puzzling. Perhaps some big money investors were buying Treasuries before figuring the Fed would do more quantitative easing in the future to push rates still lower, thus making the investors Treasuries worth more and then they could flip the Treasuries for a profit.

But now that Obama has the stealth stimulus passed (tax cuts continued, plus extended UI benefits) the Fed doesn’t need to do as much QE to pump up the economy. Also, having Ron Paul Head the Fed oversight committee makes it seem less politically feasible for Bernake to have as much free rein to pursue QE.

So perhaps the big money investors have bailed on their Treasury buy and flip strategy now that it looks less likely the Fed can lower rates further via QE. And since Treausies are auctioned – less bIdders means the rates have risen.

Even though it is called the Federal Reserve Oversight Committee, neither the committee nor Ron Paul will have any authority over the Fed. The Ben Bernank has the ability to pursue QE at will.

And it isn’t called the Federal Reserve Oversight Committee, is it, although I can not remember what it is called. Anywhooz, whatever it is called, the point is that the Federal Reserve is not accountable to either the committee or any other part of the US government.

The correct name is “House Subcommittee on Domestic Monetary Policy.”

The Fed is, and always has been, accountable to Congress – the body that created it. But, you’d actually have to have a 6th grade understanding of how the U.S. government is structured to know this.

How would knowing how the governement is structured tell me how the Federal Reserve is accountable. The Federal Reserve is a private corporation with stockholders who own it.

accountability is a matter of semantics.

Kirk, gold star for paying attention in civics class.

government and fed, along with the general public, all feel inflation is the path to salvation. jim jones should be our economic advisor.

Agreed, accountability is usually semantics, but for a bank, accountability is an audit.

Awgee-wrong. The Federal Reserve is a public-private entity mainly controlled by the government, similiar to the structure of Amtrak.

And how exactly does the government control the Fed?

Via magic!

http://en.wikipedia.org/wiki/Federal_Reserve_System

According to the Board of Governors, the Federal Reserve is independent within government in the sense that “its decisions do not have to be ratified by the President or anyone else in the executive or legislative branch of government.” However, its authority is derived from the U.S. Congress and is subject to congressional oversight. Additionally, the members of the Board of Governors, including its chairman and vice-chairman, are chosen by the President and confirmed by Congress. The government also exercises some control over the Federal Reserve by appointing and setting the salaries of the system’s highest-level employees. Thus the Federal Reserve has both private and public aspects.[11] The U.S. Government receives all of the system’s annual profits, after a statutory dividend of 6% on member banks’ capital investment is paid, and an account surplus is maintained. The Federal Reserve transferred a record amount of $45 billion to the U.S. Treasury in 2009.[12]

Geotpf,

I’m pretty sure your facts just bounced right off the resident conspiracy theorists.

But, maybe this informative video will help explain how the Federal Reserve Act passed and how it can be altered at any time:

How a Bill Becomes a Law

A+ for both Kirk and Geotpf, civics scholars.

Politicians and voters care little of unintended consequences nor do the have the wherewithal to understand. Their decisions are geared toward short term benefit such as reelection and “fixing” the economy, at any future cost.

Is it a conspiracy when they outwardly tell you they will steal from you via “orderly” decline in the dollar?

Is it a conspiracy when they use money supply and interest rates to subsidize booms and defer busts?

Exactly Geotpf,

Do you really think that is either control or oversight? Seriously? I am not making fun of you or being sarcastic. Read it a few times and think about if that is either accountability, control, oversight, or anything else.

If you want to do some research, find out how much the Fed pays the primary dealers from POMO. $45 billion is nothing compared to what they transfer to the member banks. And for what, so the PDs can buy the treasuries and then turn around and sell them to the Fed a week later.

The member banks currently borrow from the Fed at 0.125% and the “deposit” the borrowed funds at the Fed as “reserves” to meet their capital reserve requirements and the Fed pays them 0.25% interest on their “deposits”.

Congress demanded the Fed show what was on their balance sheet, who borrowed what and how much and what the collateral was. The Fed told Congress to stuff it. After more than one year, the Fed gave up who borrowed how much, but Ben still refuses to show the collateral. Is that how Congress controls the Fed? The oversight is in word only.

It is not a belief in conspiracy theory to think rather than baa like sheep.

The Federal Reserve is a private corporation with stockholders who own it.

Who said that again? Right… Awgee.

Well, I am making fun of you for being so ignorant.

Dude, if you don’t know which part of the government does what then why are you even yapping about this shit? Why don’t you quit visiting your little conspiracy sites and start actually learning how things work.

The Federal Reserve is a private corporation and it’s stockholders are the member banks. It is fact, not conspiracy. And you are calling me ignorant? It was created as a private corporation in it’s charter created by legislation in 1913. Rather than making fun of me, do a little research.

No, making fun of you and your ilk is much better.

The Federal Reserve System is not “owned” by anyone and is not a private, profit-making institution. Instead, it is an independent entity within the government, having both public purposes and private aspects.

The ignorance of the average American is just fascinating. It’s not so much that people should know the ins and outs of how things like the Fed work. It’s how people just repeat utter bullshit. They’d rather believe the bullshit rather than the facts. It is a choice to be as ignorant as you are.

The shareholders you refer to are nothing more than an artifact of the original startup costs of the Fed. The shares are essentially a one time membership fee as every member bank must buy them to gain entry into the system. Every member bank has the same number of shares. The shares can’t be traded. They are not the same as shares that you would trade on the stock market.

Who cares though. People like you will just continue expanding your ignorance.

I disagree. FED is private entity and has personal interests ahead of Govt. Central banks worldwide control Govt’s and this is a fact. These mafia banksters are today so powerful that they choose on who to put incharge at Govt. and who to take down. Another big hand is payed by big corporations such as Exxon, big pharmas of the worlds. Govt’s are just puppets.

Ever wonder why US went to Iraq war? Not because of Oil but because Iraq has stopped using US Dollar for oil trade and was using Euro. USD is not backed by anything.

You need to stop believeing on what Govt. says. Ron Paul is not an idiot who is suggesting bringing in more competition to FED’s monopoly.

If you believe in Govt. stats, I am sure you wholeheartedly agree that unemployment is getting better too! If you read why Unemployment %age is falling, you will get the real picture.

One thing that I dont understand is that everywhere we look in So. Cal prices have dropped to 2003 or lower levels. South OC it definitely has with exception of few pockets. Irvine on the other hand still has properties that are much higher than 2003 levels. IrvineRenter, do you have a clue over where Irvine prices are today compared to pre- bubble prices? I am sure Irvine is still dreaming in 2005

Deflation is not the problem. It is the correction. It is the solution. It is the cure for overleverage and unsound money positions.

Inflation is the problem. More inflation creates a bigger problem as it perpetuates leverage.

Disagree! I understand that we need to correct and we will overtime, but deflation is a very big threat that cannot be controled. Folks think deflation is good as it makes everything cheaper, and yes it does, buying power goes up. But the biggest impact of deflation is that money becomes hard to come by, folks lose jobs, wages, and investments, thereby decreasing the money available to you to take advantage of lower prices.

If we hit massive deflation which I am sure we are going to and heading that way, I am sure I will lose my job along with millions of folks here. At that time who cares if home values are up or down another 50%. On the contrary if we get inflation everywhere and most importantly inflation in wages, it takes all of us back to normal. Inflation in food/energy without inflation in wages is a disaster and that is what Ben is going to get us, just wait and watch that train wreck coming.

The economy is seeking balance. Why do you argue against balance?

Inflation creates the appearance that prices do not have to fall to achieve balance.

Real prices still fall, real wages still fall, unemployment still occurs until real wages fall to “full” employment levels. The main difference is peoples’ savings lose purchasing power and they must seek alternatives to avoid the loss. This distorts the market as money flows to places it normally wouldnt. This creates further inefficiencies in the economy as saving is discouraged and capital goes elsewhere.

Inflation takes us back to a “distorted” normal, if anything.

Deflation is most definitely a problem. It discourages investment and spending, making the economy stagnate, possibly for a very long time indeed. High inflation is also a problem. A low but greater than zero rate of inflation is ideal, IMHO.

I should not have used the “D” word. It is the boogie man. Money supply manipulation, an increase or decrease, is no solution.

Lack of investment and spending creates savings. When risk and return balance, people invest. Why encourage investment/spending when business/consumers are fearful to do so? Why goose the economy?

Blaming stagnation on the correcting forces is fallacy. Intervention delays correction and true growth. Intervention delays the price declines necessary for returns to attract true investors (true in real estate, business, and all asset classes)

Economic contraction is the solution. If prices must fall to correct, let them fall.

Using inflation to counter the market forces is an inefficient use of resources. it perpetuates the problems of overleverage. clearly our society is an example of this.

Our 3 most basic needs are:

1) Food

2) Shelter

3) Energy

The Federal Reserve doesn’t directly use any of these most important COMMODITIES to determine inflation. They’d rather focus on things like technology and manufacturing where cost has dramatically decreased due to productivity and off shoring. What a scam!

I can’t predict interest rates. And doesn’t seem like anyone else can either.

But before anyone starts celebrating the quick rise of interest rates, remember this also happened in mid-2009. There was even a thread on the old IHB forums about it:

https://www.irvinehousingblog.com/forums/viewthread/5337/

But by fall of that year… rates fell back down. More dead cat jumping.

This is kind of an unusual property. It’s rather small, especially for a two story, yet it is completely detached and seems to be classified as a true SFR, as opposed to a townhome, although one with an equally tiny yard.

10-year bond spikes (again) 9 bps just before the close. Squeeeeeeeezzzzeeee!

The 10-year yield is up 40 bps in the last 5 days.

This is a result of an economy ready to boom due to the positive effects of QE2.

Really….no really, you just typed our economy is ready to boom? Perhaps explode and burn down, yes, but boom, as in expand rapidly?

I can sense you puffing, but why do you not pass?

I was being sarcastic.

To make myself clear, the only boom in the economy is from the sound of the shit hitting the fan.

I don’t no WTF is going on in the debt markets, but only an uninformed speep-person or a stupid perma-bull could think it was a result of a good economy.

high rates are the cure for all of this wild borrowing and spending.

rip off the bandaid and we can recover.

FED thinks they can control interest rates…we are finding out in the last week that they cannot.

Bond market crashing again today.

If we hit 4%+ on the 10yr…its all over…run for the hills…the FED will have failed.

Great article on CNBC today.

http://www.cnbc.com/id/40682173

Remember Mr. Mortgage?

BD

Who knows where rates on a 30yr fixed will be in a week or month… That really is not the issue.

The real question is where will rates be in 5 or 10 years?? I would suggest much, much higher.

Wait unitl you try to sell your $1M home in today’s dollars 5 or 10 years from now when people have to borrow money at 9% or more! …now the people that could have afforded the $1M house at 4.5% can only afford $600K.

Good luck to anyone catching knives now…

All I know is that I was pushing for a home at certain price point and had loan/monthly payments figured out around 4.15%, the same property is still pending short sale approval but my monthly payment shock has been increased by almost 7%. That is a lot of money.

Most think that interest rate fluctuations dont matter much, I disagree as they do matter big time. If these rates go any further by anorher 25 basis, my anticipated monthly payments will rise by 8.44% from what I originally figured. I have two choices now,

1. dont buy that home or buy anorher one that fits my original criteria.

2. Wait for rates to fall or prices to fall.

We dont hear much about this rate spike today, give it 2-3 weeks and see how badly it impacts. Lots of folks who were in contract are not going to be able to close anymore due to this big fluctuation in interest rates.

Don’t lenders lock in rates anymore? Say for a month or whatever.

Everyone here says that sellers will lower their prices to match the rise in interest rates.

Just ask for a 10% discount to cover the higher cost.

Lenders do for 30 days with some costs. I did not lock given no certainity over how long this short sale may take. But again, even if I had locked, I dont have short sale approval and lock period would have expired.

I am sure lots of folks are going to face stiff challanges whoever got into their equation in last 6-8 weeks over the price of home and qualifications.

I am now 100% sure about at least 10-15% home price plunge if rates hang around here or go up a bit.

Yes, I will demand that reduction, again now its become a moving target

I agree…you should certainly ask for a discount on price.

My question and or comment is – you must plan to stay and pay for at least a decade. If you don’t you risk a real equity killer. People that believe that rates don’t matter are idiots and not worth listening to… People buy houses with borrowed money. If rates are higher than appreciation you simply loose. I paid 7.25 in 2000. We are kidding ourselves if we don’t believe that is on the horizon in the next 10 years. If it is less you loose less if it is more you loose more.

We have had 30+ years of consistently lower rates that drove prices higher. This was coupled with all the crazy financing that drove prices even higher. None of this is in our future. Prices will grind lower period IMHO. Unbelievably you have to pay 6% just to transact! My guess that if you buy now and sell in a decade you can at best break even. That’s why you have to love the place and plan to stay and pay that thing off…

BD

CA and the US are closer to Greece than we know…

100% excellent points.

The reason housing outpaced inflation over the last 30 years is money has become progressively cheaper. Expect the opposite phenomenon to occur as we move from cheap to expensive money.

I agree.. rates do matter. In fact, they are the priciple determinant of all purchases that require borrowed money.

I would tell you that these issues won’t be played out in weeks or months but many years.

If you personally feel like these small fluctuations in rates impact your ability to pay.. I think you should personally reconsider.

Prices will be lower in absolute dollars 5 years from now if you believe my thesis.

I personally own RE in other states where cash flow more than pays the costs. In OC this is simply not the case.. prices have to fall any where from 5% at the low end to 50% at the high end (1M plus) to get to anything reasonable.

Only you know your personal situation…

I wish you the best.

BD

The Real Estate market has survived rate spikes in the past. Only last year were rates in the low 5’s and did we see sales prices collapse? Why not? Well, we had the $8k FTHB Tax Credit for one.

What this recent spike will do is deflate enthusiasm to purchase. There are many a buyer out there pre-approved at X price, assuming a sub 4.5% rate. Those buyers now must look at X minus price which sellers are not yet willing to surrender to.

Come February we’ll see several data points:

1) The crash in sales volume (not price…yet)

2) The realization that the economy is as stable as we’ve thought it was.

3) The holiday sales season wasn’t as wild as we had expected.

4) The unemployment rate will spike over 10% (my guess) because many seasonal jobs will terminate.

At that time we might begin a retracement back to the mid 4’s for mortgage rates. I doubt we’ll get to 6 before we return once again to 4.5%.

SGIP

I aree with most of what you have outlined. But, why do we care about rates in the next 6 months or a year??

Over the next 10 years rates will rise. It’s not the price and rate you purchase at but, the price and rate people pay in a decade or more that matters.

I personaly, would much prefer to buy at a 20% rate and drastically reduced price than at a 5 percent rate at todays prices.

Bottom line.. we have had a generation of lower rates fueling prices but, that is now reversing.

I personaly, would much prefer to buy at a 20% rate and drastically reduced price than at a 5 percent rate at todays prices.

Exactly! You just discovered the secret to the baby boomer generation’s wealth!

Yep! you got it…

The baby boomers have lived in a golden time. 30 plus years of falling rates have dramatically inflated their RE assets.

Unfortunately, we will be the generation that lives in a world of slowly (at best) of rising rates.

We will be the ones that live in a word of slowly deflating prices of RE – only if rates rise slowly! God forbid they rise rapidly, as the rest of the world looses faith in our ability to pay all this back….!

Buying a house in OC is a real risk. I hope the current knife catchers don’t have to move in a decade. The HELOC for pretending to be rich is over in the OC and the entire coutry. People need to stop pretending and grow up. Wealth is created principely by saving!!!!!!!!!!!!!!

BD

There is no disagreement with you per-se. I’m simply reviewing for some who are in the buying process now and don’t know where things are going. Before QE2 there were companies saying mortgage rates would be in the 3’s. Today there are people saying we’ll see rates in the 7’s. Neither situation will come true in the next 12-24 months.

As to the reversing, one only needs to look at Japan and how their rates have been for the past 20 years. Are we the land of the rising sun? Not exactly but kinda close, and I recognize there will be a day when everything will come to a boiling point. 10 years is a long way away. Let’s hope it’s 20 or more before the bomb falls away.

My .02c

Soylent Green Is People.

Ha! I agree… let’s hope the bombs are far away. Unfortunately, we are more like Greece than Japan. Our debt is owned by foreigners. Japan’s debt is owned principly by the Japanesse. I know it is subtly but, this is why their rates have stayed low…

We are far more like Greece. Our debt is owned by foreigners. When they stop believing that we can pay it back OMG. In fact, I would argue that we would already be there if the EU wasn’t in such bad shape.

The ironic thing is that the US is in the best place possible only b/c the rest of the globe is collapsing.

I live in Newport. I still own property in HB. I only don’t sell b/c I know I have a 50 percent equity buffer. The OC is going down. Pretending with a HELOC and other peoples money is gone.

I won’t buy again until I can buy the 2M dollar house for what it costs me to rent it…

I actually just saw a place on Huntington Harbor that you can rent for 6K a month but, to buy with 20 percent down it will cost you 20K a month. \

Why would someone rational ever do that???

I will save and grow my money… Knife catchers will get what they deserve being stupid.

BD

PR might be right about low interest rates for Japan is an example. Only Japan had record trade surplus to live on, while the US has a record debt to payoff and trade imbalance to payoff. As with FDR a good war can raise the US economy if the US stay out of the war and just supplies the arms and supplies. The US needs to learn to stay out of shooting wars until the US can tip the balance and decide the winner in a short time. As for all the talk about the Feds being under the control of the congress and president, it the other way around. Although the president chooses the regional governors and head of the Feds, the Feds allow the president to choose between A, B or C that are nominated by the Feds. The president can choose his own man as long as that man is choose by the Feds. A Soviet style election. The US gets the profits after the banks’ expenses are paid, fees paid and with unaudited books. I wish I could set my bonus and expenses based on my books that can’t be audited. Ron Paul has tried to get an audit. Fat chance. Ron hasn’t a hope, not a prayer, not even a ….. The US interest rates can be also kept low if other countries currencies and governments are view as unstable. Do you want to invest in Greece? Too much debt, riots? Those that don’t think interest rates effect house prices are living in a dream especially when the average American is spending 30% of their income on housing which is mostly debt service. Deflation is a 4 letter word for the economist. Car interest at 0% instead of lowering the sticker prices on cars. I would rather have a lower cash price.