Is the TARP program a failure or a success? It depends on whether you ask Wall Street or Main Street.

Irvine Home Address … 117 ROCKWOOD 55 Irvine, CA 92614

Resale Home Price …… $289,000

Winners and losers, turn the pages of my life

We’re beggars and choosers, with all the struggles and the strife

I got no reason to turn my head and look the other way

We’re good and we’re evil, which one will I be today?

There’s saints and sinners

Life’s a gamble and you might lose

There’s cowards and heroes

Both have been known now to break the rules

Social Distortion — Winners and Losers

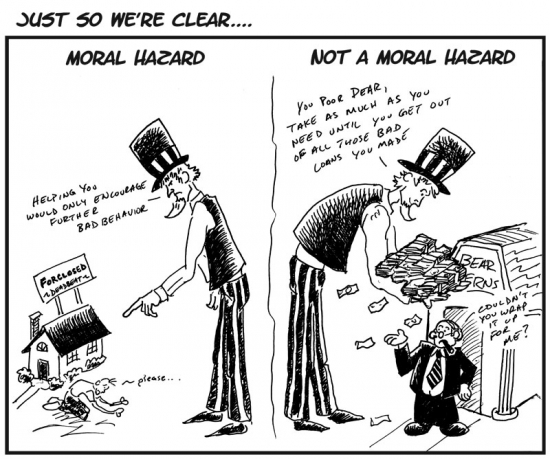

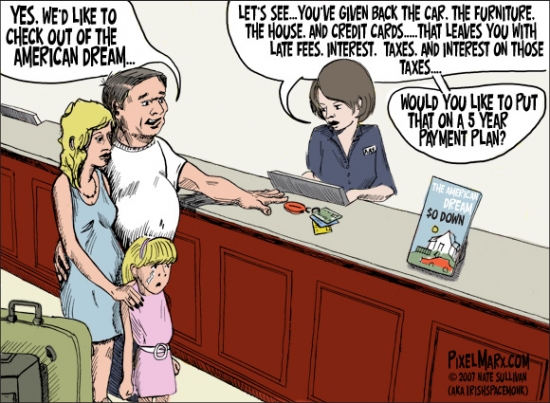

The story of the TARP program has been about winners and losers. Contrary to the much touted goal of preventing foreclosures, the TARP program is primarily designed to prop up our ailing banks. In this regard, it has succeeded. As for helping loan owners stay in their homes, not so much. Of course, the loan owners have benefited from amend-extend-pretend because they have been allowed to squat, but people don't want to squat, they want to own their homes with a reasonable payment. Unfortunately, they paid so much that owning with reasonable payments is not going to happen.

SIGTARP Quarterly Report (PDF)

Office of the Special Inspector General for the Troubled Asset Relief Program

General Telephone: 202.622.1419 Hotline: 877.SIG.2009

SIGTARP@do.treas.gov

www.SIGTARP.gov

October 2010

More than two years have passed since the Emergency Economic Stabilization Act of 2008 (“EESA”) authorized the creation of the Troubled Asset Relief Program (“TARP”). On October 3, 2010, Treasury’s authority to initiate new TARP invest- ments expired, marking a significant milestone in TARP’s history but also leading to the widespread, but mistaken, belief that TARP is at or near its end. As of October 3, $178.4 billion in TARP funds were still outstanding, and although no new TARP obligations can be made, money already obligated to existing programs may still be expended. Indeed, with more than $80 billion still obligated and available for spending, it is likely that far more TARP funds will be expended after October 3, 2010, than in the year since last October when U.S. Treasury Secretary Timothy Geithner (“Treasury Secretary”) extended TARP’s authority by one year. In short, it is still far too early to write TARP’s obituary.

At the same time, TARP’s two-year anniversary is a fitting time for an interim assessment. To what extent has TARP met the goals set for it by the U.S. Department of the Treasury (“Treasury”) in announcing TARP programs and by Congress in providing Treasury authorization to expend TARP funds — avoiding financial collapse, “increas[ing] lending,” “maximiz[ing] overall returns to the taxpayers,” “provid[ing] public accountability,” “preserv[ing] homeownership,” and “promot[ing] jobs and economic growth” — and at what cost? In answering these questions, it is instructive to compare TARP’s impact on Wall Street with its impact on Main Street. By fulfilling the goal of avoiding a financial collapse, there is no question that the dramatic steps taken by Treasury and other Federal agencies through TARP and related programs were a success for Wall Street. Those actions have helped garner a swift and striking turnaround, accompanied by a return to profitability and seemingly ever-increasing executive bonuses. For large Wall Street banks, credit is cheap and plentiful and the stock market has made a tremendous rebound. Main Street, too, has reaped a significant benefit from the prevention of a complete collapse of the financial industry and domestic automobile manufacturers, the ripple effects such collapses would have caused, and increased stock market prices. Main Street has largely suffered alone, however, in those areas in which TARP has fallen short of its other goals.

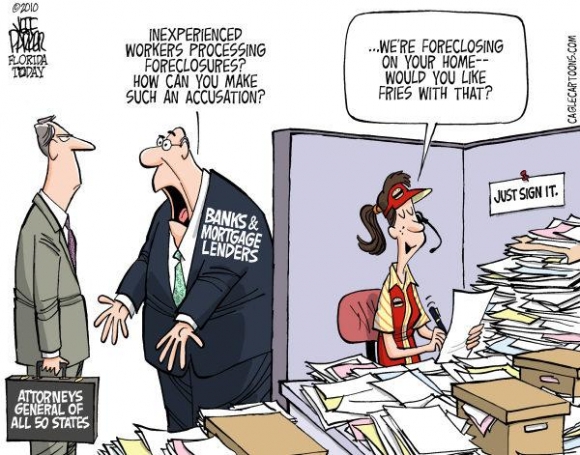

As these quarterly reports to Congress have well chronicled and as Treasury itself recently conceded in its acknowledgment that “banks continue to report falling loan balances,” TARP has failed to “increase lending,” with small businesses in particular unable to secure badly needed credit.

As an aside, I note that I was contacted by my bank and asked if I wanted a credit line for my new business. When I said, no, I run a cash business trading in hard assets, the loan officer told me they are getting pressure to extend these credit lines, and if I change my mind, they want to loan money.

Indeed, even now, overall lending continues to contract, despite the hundreds of billions of TARP dollars provided to banks with the express purpose to increase lending. As to the goal of “promot[ing] jobs and economic growth,” while job losses may have been far worse without TARP support, unemployment continues to hold at roughly 9.6%, 3% higher than at the start of the program. While large bonuses are returning to Wall Street, the nation’s poverty rate increased from 13.2% in 2008 to 14.3% in 2009, and for far too many, the recession has ended in name only. Finally, the most specific of TARP’s Main Street goals, “preserving homeownership,” has so far fallen woefully short, with TARP’s portion of the Administration’s mortgage modification program yielding only approximately 207,000 (out of a total of 467,000) ongoing permanent modifications since TARP’s inception, a number that stands in stark contrast to the 5.5 million homes receiving foreclosure filings and more than 1.7 million homes that have been lost to foreclosure since January 2009.

I find the blunt truthfulness of this report refreshing. I am amazed this came from our own government.

On the cost side of the ledger, the results have been mixed as well. It is undoubtedly good news that recent loss estimates continue to suggest that the financial costs of TARP may be far lower than earlier anticipated, with the most recent estimates placing the dollar loss at between $51 billion and $66 billion. But costs can involve far more than just dollars and cents. Any fair assessment of TARP must account for other costs that, while more difficult to measure, may be even more significant. For example, as SIGTARP has noted in past quarterly reports, increased moral hazard and concentration in the financial industry continue to be a TARP legacy. The biggest banks are bigger than ever, fueled by Government support and taxpayer-assisted mergers and acquisitions. And the repeated statements that the Government would stand by these banks during the financial crisis has given a significant advantage to the larger “too big to fail” banks, as reflected in their enhanced credit ratings borne from a market perception that the Government will still not let these institutions fail, although the impact of this cost may be blunted by recently enacted regulatory reform.

Indeed our big banks are in a race to see who can get too big to fail. Once there, they no longer have to worry about maintaining good financial ratios, making good loans that will get repaid, or sacrificing short-term gains for long-term growth.

Another even more fundamental non-financial cost, as SIGTARP warned in October 2009, is the potential harm to the Government’s credibility that has attended this program. Despite the recent surge in reporting on TARP’s successes, many Americans to continue to view TARP with anger, cynicism, and mistrust. While some of that hostility may be misplaced, much of it is based on entirely legitimate concerns about the lack of transparency, program mismanagement, and flawed decision-making processes that continue to plague the program. When Treasury refuses for more than a year to require TARP recipients to account for the use of TARP funds, or claims that Capital Purchase Program participants were “healthy, viable” institutions knowing full well that some are not, or when it provides hundreds of billions of dollars in TARP assistance to institutions, and then relies on those same institutions to self-report any violations of their obligations to TARP, it damages the public’s trust to a degree that is difficult to repair. Similarly, when the Government promotes programs without meaningful goals or metrics for success, such as its mortgage modification programs, or when it makes critical and far-reaching decisions without taking an even modestly broad view of their impact, such as pushing for dramatically accelerated car dealership closings without considering the potential for devastating job losses, or when it fails to negotiate robustly on behalf of the taxpayer, as it did when agreeing to compensate American International Group, Inc.’s (“AIG”) counterparties 100 cents on the dollar for securities worth less than half that amount, the Government invites public anger, hostility, and mistrust. And by doing so, it dangerously undermines its ability to respond effectively to the next crisis.

Interesting that this report documents exactly how the government corporatocracy is screwing us.

While TARP is arguably moving to a new phase, recent actions this past quarter unfortunately suggest that the risks it poses to the public’s trust in Government will continue. Indeed, two areas of the greatest anticipated spending going forward — the Home Affordable Modification Program (“HAMP”) and the AIG recapitalization plan — highlight those risks.

This rather scathing report has generated some uncomfortable questions at the Congressional Oversight Panel.

Schwartz to Congressional Oversight Panel: HAMP gets a bad rap

The government's much-criticized Home Affordable Modification Program helped set the stage for a successful private loan modification effort that likely wouldn't have gotten off the ground without it, said Faith Schwartz, former executive director of Hope Now.

If that is true, I wish this program had never started. Loan modifications do nothing but provide false hope to loan owners and extend this crisis.

Schwartz testified Wednesday before the Congressional Oversight Panel on the Troubled Asset Relief Program, in a hearing about TARP foreclosure mitigation programs.

"The HAMP roadmap set the stage for servicers to better apply solutions for distressed borrowers who failed to meet the HAMP requirements," Schwartz said in written testimony submitted to the panel.

"The Home Affordable Modification Program (HAMP) has received criticism, in part, because it did not immediately produce certain projected numbers of permanent loan modifications," she wrote.

The program has also been criticized by people like me who think it should not exist at all.

"This criticism is not entirely accurate," according to Schwartz. "HAMP has played an important role by helping to organize the participants and process in the loan modification effort and instituted a loan modification protocol that would have been difficult to mandate in any other way. Hope Now and government agencies attempted this in 2008 through the streamlined modification program, but it did not reflect all investors and primarily focused on GSE-owned loans. That was a start, but the HAMP program expanded and formalized those initial standards for loan modifications."

The Hope Now Alliance was formed in 2007 to expand and better coordinate the private sector and nonprofit counseling community to reach borrowers at risk.

"Early on, the goal of the Alliance was simple: reach at-risk borrowers that had no contact with their servicer," Schwartz said. "Research showed that over 50% of all foreclosures involved homeowners who were not in contact with their servicer."

Have you noticed rumors of principal forgiveness crop up whenever lenders want to get people to contact them? I think they use that as a bait-and-switch enticement to get people to contact their lender.

The alliance established a hotline, organized community outreach events, sent letters to delinquent borrowers and launched a website.

It also established HOPE LoanPort, a Web-based system that enables for uniform intake of an application for a modification, allows stakeholders to see the same information in a secure manner, and delivers a completed loan package to the servicer that is actionable. The pilot program includes 14 large mortgage servicers, representing a majority share of the market.

Everyone knows how slow and inneficient government programs are. As soon as the government got involved, it should have been apparent to everyone that by the time they got their programs working, the majority of loan owners would already be foreclosed on.

"HAMP modifications offer a well-defined safety net for borrowers as a first line of defense," Schwartz said. "As evidenced by Hope Now data, servicers are implementing significant modifications after reviewing for HAMP eligibility by offering alternative modifications in lieu of foreclosure. Servicers report proprietary non-HAMP solutions run almost three times greater than HAMP modifications due to eligibility challenges."

"These are modifications that do not require taxpayer dollars and they are meant to benefit the homeowner and investor in lieu of foreclosure," she said.

HAMP should not exist. It has largely been a failure; and in that, I think it was a success.

Get as much as possible as quickly as possible

One of the lessons the Ponzis learned from the housing bubble is that they need to refinance as soon as a new comp gives them some equity, and they need to keep borrowing to the full extend of their borrowing power. Besides the immediacy of the spending money, it gives them downside protection. When the market inevitably crashes, they have already sold the property to the bank for peak pricing. Then they get to walk away, and while the air comes out of the bubble, they can repair their credit to get ready for the next cycle.

- The owner of today's featured property paid $170,000 on 10/3/2000. He used a $163,150 first mortgage and a $6,850 down payment.

- On 8/20/2002 he refinanced with a $189,000 first mortgage.

- On 7/30/2003 he refinanced with a $189,200 first mortgage.

- On 8/29/2003 he refinanced with a $201,000 first mortgage.

- On 10/23/2003 he obtained a 21,500 stand-alone second.

- On 3/25/2005 he refinanced with a $251,000 Option ARM with a 1% teaser rate.

- On 1/10/2006 he refinanced with a $328,000 Option ARM with a 2% teaser rate. and obtained a $90,000 HELOC.

-

Total property debt is $418,000 plus negative amortization and almost two years of missed payments.

- Total squatting time is about 20 months so far.

Foreclosure Record

Recording Date: 08/16/2010

Document Type: Notice of Default

Foreclosure Record

Recording Date: 11/19/2009

Document Type: Notice of Rescission

Foreclosure Record

Recording Date: 06/18/2009

Document Type: Notice of Default

Do you ever wonder when I will run out of these? Irvine is supposed to be an upscale neighborhood where everyone makes hundreds of thousands of dollars a year. Why do we have so much HELOC abuse? Why are so many losing their homes due to their excessive borrowing? Could it be that Irvine is a facade? How much of Irvine is populated by posers trying to impress other posers?

Irvine Home Address … 117 ROCKWOOD 55 Irvine, CA 92614 ![]()

Resale Home Price … $289,000

Home Purchase Price … $170,000

Home Purchase Date …. 10/3/2000

Net Gain (Loss) ………. $101,660

Percent Change ………. 59.8%

Annual Appreciation … 5.2%

Cost of Ownership

————————————————-

$289,000 ………. Asking Price

$10,115 ………. 3.5% Down FHA Financing

4.29% …………… Mortgage Interest Rate

$278,885 ………. 30-Year Mortgage

$55,099 ………. Income Requirement

$1,378 ………. Monthly Mortgage Payment

$250 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$48 ………. Homeowners Insurance

$490 ………. Homeowners Association Fees

============================================.jpg)

$2,167 ………. Monthly Cash Outlays

-$125 ………. Tax Savings (% of Interest and Property Tax)

-$381 ………. Equity Hidden in Payment

$16 ………. Lost Income to Down Payment (net of taxes)

$36 ………. Maintenance and Replacement Reserves

============================================

$1,713 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,890 ………. Furnishing and Move In @1%

$2,890 ………. Closing Costs @1%

$2,789 ………… Interest Points @1% of Loan

$10,115 ………. Down Payment

============================================

$18,684 ………. Total Cash Costs

$26,200 ………… Emergency Cash Reserves

============================================

$44,884 ………. Total Savings Needed

Property Details for 117 ROCKWOOD 55 Irvine, CA 92614

——————————————————————————.jpg)

Beds: 2

Baths: 1 full 1 part baths

Home size: 917 sq ft

($315 / sq ft)

Lot Size: n/a

Year Built: 1980

Days on Market: 65

Listing Updated: 40474

MLS Number: S630604

Property Type: Condominium, Residential

Community: Woodbridge

Tract: Othr

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

Price Reduction!!! CLEAN UPSTAIRS 2 BEDROOM, 2 BATH CONDO. BEAUTIFUL VIEW OF PARK/GREEN BELT. GREAT FOR FIRST TIME BUYERS/INVESTORS AND WONDERFUL FAMILY COMMUNITY. WOODEN BLINDS THROUGHOUT. NEWER CARPET AND PAINT. SEPARATE DINING ROOM.

Good for investors? Sure, I want to pay $289,000 to obtain $1,700 a month in rent, and give $490 a month to the HOA. Only a kool aid intoxicated fool would consider this a good investment.

.jpg)