Everyone has a sob story from the housing bubble. Many have cast themselves as victims and martyrs. Most are victims of their own lack of financial sense.

Irvine Home Address … 39 SONGSPARROW Irvine, CA 92604

Resale Home Price …… $674,000

The crown of emptiness,

As night descended slowly

Maybe it's an illusion,

One fake dream, one grey plastic

Reality of tears and of repentance.

I felt my life crossing like

A stream of sadness

Wearing a martyr's crown

The crown of sadness

The crown of emptiness

Nightrage — Wearing a Martyr's Crown

Why do people tell sob stories? Is their real motivation to appeal to the sympathy of others in order to gain some special advantage? Should we feel bad for people who borrowed too much and give them a break? Should we let people experience the consequences of their poor decisions? If we give in to the victim mentality, we encourage people to engage in risky and foolish behavior. Why wouldn't they if they believe others will bail them out?

Woman Holds Hunger Strike To Stop Foreclosure

Baltimore Resident Wants Audience With Governor

POSTED: 6:44 pm EST November 8, 2010

BALTIMORE — A Baltimore woman fighting to keep her home has set up a mini-residence outside the state capital and is on a hunger strike in hopes of bringing more attention to the effects that foreclosure has on people.

Lauren Rymer, of Baltimore, said she's watched how the economy and other issues have forced people out of their homes.

The primary issue that has forced people out of "their" homes is the fact that they quit paying on the massive debts they took on to acquire them. Remember, Responsible Homeowners are NOT Losing Their Homes.

She started a hunger strike against foreclosure and said she's prepared to remain at the corner of Maryland Avenue and State Circle — right across the street from the state house in Annapolis — for as long as needed.

"I feel like I'm really representing a lot of people out here," she said.

Yes, there are many people just as foolish as this woman.

Rymer works for a nonprofit agency. She said she bought her two-bedroom southeast Baltimore home with an interest-only loan and still owes more than $200,000 on the mortgage.

In other words, she couldn't afford this house from the beginning. The only reasons people use interest-only financing is because they are ignorant, or they can't afford the fully amortized payment. Since she works for a non-profit, she doesn't make much money, and she doesn't have prospects for a big raise any time soon. Why would she take out an interest-only mortgage under those circumstances? Do you think she was banking on future mortgage equity withdrawal? I do.

She claimed she doesn't live beyond her means and sought help after the property taxes on her home went up 55 percent in the past couple of years.

The taxes are paid with her mortgage bill. Rymer said when it jumped from an affordable $1,500 a month to $2,100 a month, she couldn't keep up.

This womans taxes went up $7,200 a year during a period when home values declined. I call bullshit on that one.

She said she didn't realize she could have challenged the property tax assessment until it was too late.

"I just didn't understand why — at this time when times are so rough and the governor called three weeks before for (federal) banks to stop moving forward with foreclosures on their clients — the state government was moving forward with a foreclosure on mine without trying every possible channel to help me stay in my home," she said.

Borrowers are now entitled to have lenders and the government go to extreme lengths to help them, right? Is that the new entitlement that has come out of the housing bubble?

Rymer said her mortgage had been bundled and sold several times, finally ending up in the hands of the Maryland Department of Housing and Community Development. In less than 45 days, she could lose the house she's owned for four years.

Wait a minute. She hasn't owned anything. She is renting money from the bank with an interest-only loan. Further she is underwater and has no equity. She owns nothing. (see Money Rentership: Housing and the New American Dream).

She is being evicted from a house that has her name on the title because she is failing to make her rent payment on the money she borrowed. This is closer to an eviction than a foreclosure.

The foreclosure notice was taped to her front door on Election Day, she said. Rymer said she wants a few minutes with Gov. Martin O'Malley to tell him it's not just about the amount of foreclosures.

"Everyone that's being affected is a human being … are people that want to have a home, and that's why they bought homes," she said.

The MDHCD told 11 News that it can't discuss a homeowner's file but it will always work with homeowners to explore every viable financial option. The agency said it has set up a meeting with Rymer about her problem.

And at that meeting they will tell her that if she catches up on her mortgage payments she can keep living in the house, and if she doesn't, she needs to get out to make room for someone who can. What else is there to say to her?

Viewer Stories: Housing Market Victims

Our culture of victimhood has plenty of great stories from the housing bubble. Some of these stories are sad, but most are people dealing with the consequences of their poor decisions.

.jpg)

Brenda from Las Vegas I have read all the stories and really do completely understand the concerns of all. My husband, son and I moved from California to Las Vegas in 2001 when the housing market was just starting to climb. We sold our Cali house in 3 days…made a little profit and purchased a new home in Vegas for a good deal. Hubby had a job as Engineer for Lucent Technologies and made 90K so I didn't have to work anymore. It was heaven! Then 9/11 came to pass… 25 percent of his department was laid off so we went from living really well to being financial paupers overnight. It took him over a year to find a job that paid less than half of what he had been making… and I went to work for the Clark County School District being severely underpaid for my skills. We had to re-fi our home twice to make ends meet and not lose our home. Now our house payment is 3K a month plus utilities and many bills. We are deep in debt just surviving day to day fighting to hang on as we don't want to walk away. We would re-fi again to lower the payment but our home will not appraise for the amount we need in order to do so at this time. We purchased our home for 274K and now owe 390K. If not for taking out a monthly sum from his retirement portfolio of 2,500 we would have lost all.

So somewhere along the way did this family ever consider cutting back on some of their entitlements? Perhaps a loss of income should be matched with a decline in spending? They took out $116,000 and still couldn't make ends meet? What didn't these people do wrong?

Denise from Indianapolis Two years ago I bought my home on a two-year arm, being convinced by the mortgage company I would be able to refinance before the two years were up. Well, the two years were up in September and no one will touch it. I am now being told I owe more than my house is worth. On Sept. 1 my payments went from $850.00 a month to $1,233.00, and Nov. 1 it's going up another $50.00. I am a single mom and only bring home $1,500.00 a month. I am now two months behind. The mortgage compant is not willing to work with me at all. Their only advice was to conact a realtor, which I have to pay for, and try to do a quick sale. If I can't pay my payments, how can I pay a realtor? I am losing a home that I love. The American dream is huge joke!

Listening to mortgage brokers was her mistake. Not understanding the terms of the contract she was signing was another. Those mistakes are costing her the family home.

Justine from Greeley, Colo. I have been in the mortgage industry for 40 years this fall. I have been dedicated to responsible lending. Because of the greed of the CEO and upper management of mortgage companies and banks, who left with their millions in salary and bonus each year, those of us dedicated to financing homeownership responsibly are now faced with loss of income. And I am personally faced with providing for an invalid husband and trying desperately to hold onto my own home.

How many other mortgage brokers feel the same way?

Shannon from Kansas City, Mo. My stress levels are so high that Xanex have become my best friend. My husband and I are in our mid-30s with 4 children. We both work in the corporate world and I attend college for my bachelor's degree at night because we cannot afford for me not to work while I go to school. We fell into one of those adjustable mortgages and were completely scammed to the point our mortgage went up $900 more per month and we were forced into foreclosure and bankruptcy. The bankruptcy courts do not allow us any extra money for savings so when things like life occurs and gas prices, grocery prices, cars breaking down,death in family, medical bills occur we are just completely screwed.

If two corporate employed working Americans can't make it, how do people in third world countries get by? Letting go of a few entitlements would probably help get off the Xanax.

"Average Joe" from Georgia I am 35 years old and working since high school. In the heat of the moment, I purchased a pricy home, expensive home gadgets and a porsche. Now I am bankrupt.

Do you think he sees any cause and effect in his actions and the outcome?

Mike from Merced, Calif. My wife and I bought a house we could afford. Had a 30-year fixed. We made all the payments, never refinanced. Then we got divorced and needed to sell the house. Fifteen months later, we have our second offer. Due to all the forclosures we are losing around $60,000 just to get rid of it. $6,000 out of pocket at closing, the rest is the 20 percent, plus down payment and the $13,000 worth of loan we paid down. We were responsible. We paid. Now we are losing what we had invested. Those of you who banked on good interest rates "down the road" have taken the rest of us down with you. Additionally, everyone is talking about bailing out those near foreclosure, but who's helping those who did it right, but lost tons of money? I can't even write it off as a loss on my taxes!

That is a sad story. These people did nothing wrong, but they are being wiped out anyway.

Remember, The Face of Housing Entitlement Today?

Jennifer from Red Lion, Pa. Because of the housing slump our family was able to finally afford our dream home. There are two sides to every story.

Amen, Jennifer. Amen.

Four years squatting… and counting

Today's featured property is playing the short-sale game. It appears on the MLS periodically while the negotiations over who loses what goes on. It was listed last week when I spotted it, and now it is gone again.

- The property was purchased on 4/8/1999 for $349,000. The owners used a $313,920 first mortgage and a $35,080 down payment.

- On 1/31/2000 they refinanced with a $346,500 first mortgage and got back most of their down payment.

- On 8/30/2000 they obtained a stand-alone second for $35,000.

- On 6/27/2001 they refinanced with a $388,000 first mortgage.

- On 9/3/2004 they got a $162,500 stand-alone second.

- On 7/8/2005 they refinanced with a $765,000 first mortgage.

- On 9/29/2005 they got a $42,500 HELOC.

-

Total property debt is $807,500.

- Total mortgage equity withdrawal is $493,580.

- Total squatting time is 48 months so far.

Foreclosure Record

Recording Date: 09/28/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 10/14/2008

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 07/19/2007

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 02/26/2007

Document Type: Notice of Default

This guy went delinquent sometime before November of 2006. He has not made a mortgage payment for as long as the IHB has been around.

How many rent or mortgage payments have you made while you have been an IHB reader?

Irvine Home Address … 39 SONGSPARROW Irvine, CA 92604 ![]()

Resale Home Price … $674,000

Home Purchase Price … $349,000

Home Purchase Date …. 4/8/1999

Net Gain (Loss) ………. $284,560

Percent Change ………. 81.5%

Annual Appreciation … 5.6%

Cost of Ownership

————————————————-

$674,000 ………. Asking Price

$134,800 ………. 20% Down Conventional

4.21% …………… Mortgage Interest Rate

$539,200 ………. 30-Year Mortgage

$127,282 ………. Income Requirement

$2,640 ………. Monthly Mortgage Payment

$584 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$112 ………. Homeowners Insurance

$80 ………. Homeowners Association Fees

============================================.jpg)

$3,416 ………. Monthly Cash Outlays

-$433 ………. Tax Savings (% of Interest and Property Tax)

-$748 ………. Equity Hidden in Payment

$203 ………. Lost Income to Down Payment (net of taxes)

$84 ………. Maintenance and Replacement Reserves

============================================

$2,522 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,740 ………. Furnishing and Move In @1%

$6,740 ………. Closing Costs @1%

$5,392 ………… Interest Points @1% of Loan

$134,800 ………. Down Payment

============================================

$153,672 ………. Total Cash Costs

$38,600 ………… Emergency Cash Reserves

============================================

$192,272 ………. Total Savings Needed

Property Details for 39 SONGSPARROW Irvine, CA 92604

——————————————————————————

Beds: 4

Baths: 2 full 1 part baths

Home size: 1,946 sq ft

($346 / sq ft)

Lot Size: 5,136 sq ft

Year Built: 1976

Days on Market: 81

Listing Updated: 40464

MLS Number: Y1005246

Property Type: Single Family, Residential

Community: Woodbridge

Tract: Cust

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

Huge price reduction! Seller eager to sell property. Beautiful house located in a highly desirable area of Woodbridge. Very quiet neighborhood. Close to shops and schools. Seller had plans to add almost 400sq feet of living area. Blueprints will be provided to buyer at no cost. HOA provides many amenities including community swimming pools, two man-made lakes, tennis courts, sand volleyball courts plus much more! Big backyard!

The young woman in Maryland would be in trouble with her house payments even had taxes stayed level. IO is proof you can’t afford the place. I have zilch sympathy for this woman.

She looks to me like it won’t hurt her a bit to skip a few meals, anyway.

However, taxes ARE going up almost everywhere, and steeply, even though house prices are dropping like a de-cabling elevator.

Here in the Chicago area, property taxes are escalating wildly. A couple of my acquaintance who live in an outer suburb, bought a house well within their means about 10 years ago. They made about $50K a year each for a combined income of $100K, and put 20% down on a $240K house in 2002.Took a 30-year fixed mortgage. Never, ever borrowed against the place.

Two years later, their taxes went to $4400.

The following year, to over $5000.

Then to over $6500.

Then, this year, to $8,800.

Then the wife was laid off her job. Murphy’s Law never rests.

So they now have payments nearly double their original payment, because of year over year tax increases. Meanwhile, the house’s value has dropped to 180K, so they will get out barely even. Their down payment is gone.

House taxes here in the City of Chicago have gone from being extremely reasonable to downright confiscatory in ten years time, because, you see, our officials banked on 20% a year growth in tax revenues stretching into infinity. What’s worse, poor homeowners are being hit with much larger increases than richer ones- while a $1.5M Streeterville condo pays perhaps $10,000 a year, or less than 1% of the market value, little shanties in the desperately poor Englewood and Garfield Park neighborhoods, that could perhaps fetch $40,000, are paying $2000 to $3500 a year in taxes.

Many people who acted prudently, bought places well within their means with substantial down payments and thirty year mortgages, and even people who own outright but are elderly and subsisting on tiny retirement incomes, are being destroyed by the vicious tax increases. You count on your expenses staying somewhat level when you buy, else why buy?

The abusive borrowers and fraud-master lenders who enabled them helped create conditions that are making our economic life here hellishly insecure for nearly everyone who isn’t in the top 1% of the population in income and net worth.

Laura is absolutely correct.

Cook County real estate taxes are computed with a deliberately confusing formula of assessments, assessment districts, classifications,equalizers, multipliers, municipal tax rates,exemptions,clout and who knows what else.

If real estate values fall, rates will rise so that no payroller will have to suffer the indignity of standing next to some poor private sector member of the underclass in the unemployment line.

My wife and I bought a house in Cook County in 2008. The previous owner was paying just under $1000/yr in property taxes. We were warned that he had several property tax exemptions and we would be paying more. Nobody told us how much more.

Our taxes went up from $1000/yr to $6000/yr. More than that, I was being taxed at the old rate for part of 2008 and all of 2009, so I had to double up for 2010. I should be getting a homeowner’s exemption which should knock off about $1000/yr.

Crook County. Gotta love it.

Stories like yours are exactly what happened in the 1970s in CA precipitating our Pop 13. Now things are full circle. Jerry Brown was Gov then and he’s going to be the Gov now. I remember when Prop 13 was on the ballot how Mr Brown campained heavily against it and then once it passed by a landslide it he flip-flopped and acted like he supported it the whole time. In time, Californians forgot that he was against Prop 13, forgot about “Rose Bird”, never asked why Charles Manson still lives and re-elected him.

It’s easy to keep CPI at 1%. Decrease size of the cereal box by 20% and increase the price by 1%.

Don’t worry the top half of wage earners who already have disposable incom will see wage inflation.

The bottom half, sorry, you’ll need to eat less and lower quality/cheaper foods.

Quantitative easing had little impact on the upper half but destroys the lower half.

PR, you’re so right on that one! A local Chinese restaurant has managed to maintain their $4.95 lunch special for the past 10 years, however a recent visit revealed a small surprise: the containers (and portion sizes) are 20% smaller.

That’s a good thing for me, because now I won’t get as fat when I eat it all.

Explains the ice cream size shrinkage from half gallon to 1.75 quarts 10 1.5 quarts in the last couple years. No price change however….and NO INFLATION!

Maybe the next edition of Freakonomics will have a chapter on this…The relation on portion size to the obesity rate. Obesity has been increasing since the 1950s but has become much more prevelent in the last 20 years. Could be something good comes out of “Quantiative Easing”. It’s a conspiricy to get Americans to loose weight. Wouldn’t really know unless the size of the Big Mac also drops 20%

I don’t know enough about Prop 13 to criticize it.

Here in Cook County, there’s a multitude of exemptions, each of which adds to the tax burden of those with fewer exemptions.

Here they are, from the Assessor’s website:

Homeowner Exemption

Senior Citizen Exemption

Senior Freeze Exemption

Home Improvement Exemption

Returning Veterans’ Exemption

Disabled Veterans’ Homeowner Exemption

Disabled Persons’ Exemption

Obviously, comparable properties in the same community will be hit with a very wide range of taxes. There’s little economic justification for any of these exemptions and taxing everyone at the same rate without political favoritism would be fairer.

And yet Prop 13 continues to be attacked every day by California Democrats…

Well that’s all very fine for them, but they are happy to benefit from the subsidy of all their neighbors who bought more recently and are paying much higher taxes on similar properties. Hell, they may well be the ones voting for more spending and benefits for public sector workers, since their taxes only go up 2% anyway.

Prop 13 is not perfect, but the alternatives are worse. Even though I’m paying a lot more property tax than neighbors who have lived in my area for 20+ years, we both benefit from the “tax certainty” that comes with Prop 13. We both understood the property tax cost when we purchased and we both benefit from that cost not skyrocketing beyond our means and expectations.

I disagree. Prop 13 is a horrendous constitutional amendment. There are many better laws that could be passed.

Some of the major offenses of prop 13 are:

1) properties can maintain tax rates if less than 50% of the property is transferred at a time.

2) The era you bought your home determines your tax rate.

3) It was a give away to existing home owners when the law was passed.

If your goal is to constrain government spending, a constitutional amendment that limits state spending to population growth and inflation is much better.

So the law is terrible for the loop holes and bizarre tax rates for different people living in the same neighborhood. And it really does not accomplish what it set out to do, which was limit state spending.

Oliver

One of the things many people don’t realize is that prop 13 is a huge giveaway to commercial real estate owners. You can create a holding company, buy a piece of commercial real estate, and then sell the holding company without triggering a change in ownership.

Oh contrare… The comerical giveaway has been debated for years. Prop 13 might not have passed if it hadn’t been for contributions from comerical interests in the first place. For example, Macy’s in downtown San Fran pays a fraction of the taxes they would pay if not for Prop 13. Same goes for Disneyland. But reopening Prop 13, which even Warren Buffet told Arnold to do at the start of his governorship, has alwyas been an untouchable subject in CA.

Clearly when I refer to “many people” I’m not talking about the average reader of IHB…

How can this be?

My sister and and husband continually claim that their home and rental property in Naperville have not gone down at all, and in fact probably has gone up a little over the last 5 years. They claim its the Irvine of Illinois and everyone wants to live there.

Naperville is in DuPage County, and I have seen no numbers for that area.

If it’s the “Irvine of Illinois”, well, maybe it will go down slower, but it will eventually happen.

I’d like to see the foreclosure and delinquency stats for DuPage. That would tell us a lot more.

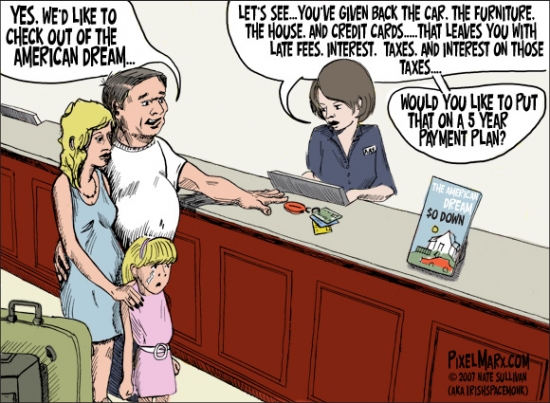

LOL!!! The struggling house debtor up on the cross!

Sums up these news stories perfectly.

Plus the house is a dream come true. I’ve always wanted a garage with an attached house.

She claimed she doesn’t live beyond her means and sought help after the property taxes on her home went up 55 percent in the past couple of years.

Oh and her teaser rate expired too! We must have forgotten to mention that little tidbit.

Rymer said she wants a few minutes with Gov. Martin O’Malley to tell him it’s not just about the amount of foreclosures.

“Everyone that’s being affected is a human being … are people that want to have a home, and that’s why they bought homes,” she said.

Damn it! I can’t stop crying! Governor – you must act quickly! These poor human beings just want to pretend to be homeowners! Please don’t sentence them to more rentership. Use your magical Governor powers and make it all better. Take a break from conducting that State’s business for an hour and listen to my consumer complaints.

We had to re-fi our home twice to make ends meet and not lose our home. Now our house payment is 3K a month plus utilities and many bills.

Yes! We “HAD” to refi our house and extract bubble equity just to “make ends meet“! We have “BILLS” to pay, just like you do AZDavidPhx! The only difference is renters have to adjust to life’s circumstances. Since we are house debtors, we can always use the house to print more cash. You should try it! You can live beyond your means forever that way until that high paying job that you are entitled to comes along.

Two years ago I bought my home on a two-year arm, being convinced by the mortgage company I would be able to refinance before the two years were up.

Yes, dear – it was the lender’s fault.

I am now being told I owe more than my house is worth.

AGAIN! The lender’s fault! Let’s hang the appraiser!

I am a single mom and only bring home $1,500.00 a month. I am now two months behind. The mortgage compant is not willing to work with me at all.

This person is immature. Look at me everyone, nobody wants to help! WOO WOO WOO.

If I can’t pay my payments, how can I pay a realtor?

Excellent point! So just remain in your hopeless situation and make no effort whatsoever to be a grown up.

I am losing a home that I love. The American dream is huge joke!

PFFFF. This person never should have been given a mortgage in the first place. I’m guessing this is one of our subprime folk.

If I can’t pay my payments, how can I pay a realtor?

————————–

I really don’t get this one. Who pays a Realtor upfront for selling a home? This, combined with the fact she didn’t understand how her mortgage worked (teaser rate/ARM), shows that not everyone should be a homeowner.

Go rent, Denise!

I am sensing the answer to your suggestion will be:

“How can I pay rent if I can’t pay a realtor?”

It’s the victim-class of our society.

Great post, IR. Especially the opening Matrix bit.

Love the new “squatting” pic!

Great graphics – keep up the good work!

My sympathy level for the people who got greedy, over leveraged, and subsequently lost their property equals – 0 – they are not “victims”!

“How many rent or mortgage payments have you made while you have been an IHB reader?”

That’s the kicker you are looking at a hundred thousand dollars to rent in Irvine for a few years. Why do people inflict the pain of Irvine upon themselves when they could have bought a house outright in another location. You think you took a red pill. Your red pill is actually a blue pill.

Actually, the “hundred thousand dollars to rent in Irvine for a few years” makes sense to me. The renter is in control of their circumstances, to the extent that as long as they want and can afford to pay a premium to live in in Irvine, they do. If they can no longer afford it, or no longer want to, they give notice and move out. Not so easy with a house and mortgage, unless prices are consistently going up by 5% to 10% per year. And those interest payments are money thrown away. 😉

I bet that fatty squatter is DREAMING of a big, fat, juicy BIG MAC about now!!!!

I bet her hunger strike wont last 2-3 days TOPS.

IrvineRenter, you are correct, its a WIN-WIN !!!

Love those graphics too!!!! Keep it up!!!

Your estimate is 2-3 days? I think you give her too much credit.

I predict that she gains weight during her “hunger strike”.

She had a mortgage that was 56% of her take-home pay. That sounds like a big stretch to me. She should have done what the rest of us do when we can’t afford to buy a house – RENT.

At least she got that part right. When you have to spend 56% of your take-home pay to enjoy that dream, it sure is a joke.

I don’t like this post today. It’s hard to explain. Maybe it’s the pictures making fun of Jesus on the cross (No, I don’t even go to church). Maybe it’s story after story of the people and basically demeaning them all. I don’t know.

I agree they are easy targets, what’s the point of beating them when they already fell to the ground. Letting them occupy any space is a waste of time, but demeaning them is even worse… it’s a waste of time and negative for yourself.

These are the hard-luck stories we’re receiving in the media daily. We need IHB and others to question these homeowners’ stories. No journalists are doing it. If you think that’s demeaning, so be it.

However, I see it as “calling these people out” for their BS. They never owned anything and they’re not losing anything. They’re being forced out of a home that is beyond their means. Is that unfair?

Journalist question these stories? You must be joking. Journalists today aren’t the same as they were in the old days. With few execeptions such as NPR, all they do now is produce stories that sell papers or TV advertising. That means murders, crimes, celebrities, sports and hard luck – public interest stories. Wether these stories has any merit is irrelevent. The purpose of these blogs is to point out the follies of the established media. None of these stories had merit and none of them should have been brought to the attention of the public.

Breaking NEWS! Stop whatever it is that you were doing! Tune into CNN further details:

Condit’s DNA Found In Gal’s Underbritches

Titilating, I say! Most titilating indeed! Keep up the good work over there!

MOO!

That’s not Jesus on the cross. Its from Monty Python’s Life of Brian.

http://en.wikipedia.org/wiki/Monty_Python's_Life_of_Brian

Price of food going up

http://www.latimes.com/business/la-fi-commodity-prices-20101110,0,6641189,full.story

Seems as if people have forgotten some other things, as well. The California Supreme Court threw out the death penalty in 1972, during the governorship of Saint Reagan the Infallible; the Evil Jerry Brown (Boo! Hiss!) was not sworn in as governor until 1975.

Manson and his followers were removed from death row by this 1972 ruling, before the tenure of Jerry Brown, and well before Rose Bird joined the court in 1977. As questionable as Bird’s service on the court was, neither she nor Brown spared Charles Manson.

Unable to make your $2000 mortgage payment, $400 car payment, $600 in credit-card payments, $200 insurance, and $400 property tax payment each month?

Clearly, it’s the property tax payment which is doing you in!

Exactly. Cherry-picking excuses. I guess the “medical bills” excuse was getting too old. Now it’s on to “property tax bills”!

I am waiting for gas prices to go up so I can call up the bank and let them know that I cannot afford the payment on the car anymore and demand some kind of assistance.

PRC has down rated US debt. “Journalists” report the down rating a humor and QE2 as sound economic policy and not manuipulation of the currency. Making American debt slaves is sound economic policy for whom?

It’s time to wake up.

Why am I pay for 1. a guy to take money out of the house, 2. squat for 4 years, 3. bankers getting extreme bonus/fees and 4. make the foolish bankers whole. Who’s really the fool.

FoolishRenter: Paying rent while I could of been squatting.

Man, I just started letting go of my Schadenfreude and now this post. I feel it bubbling up again. I am no longer mad at this ever increasing cast of entitled idiots, it is not worth my energy, but I certainly do not feel sorry for any of them. You get no guarantees in life and s#%t happens, good and bad.

The best line was

“If two corporate employed working Americans can’t make it, how do people in third world countries get by? Letting go of a few entitlements would probably help get off the Xanax.”

It is so true. We have so much crap in our lives that we think is essential to our happiness that we giving up even a little is “suffering” I just had this argument with a friend in Coto de Caza who is constantly Facebooking how wonderful her life is and how every night is spent by the pool or in the jacuzzi. She then goes on to say that her family has had to make great sacrifices and how “tough” her life is in this economy and I should back away with my callousness. This is entitlement OC style. Most people in OC wouldn’t know true sacrifice if it slapped upside the head. Lowering the temperature of your pool 1 degree to cut energy costs is not sacrifice. But this is what we are faced with unless things become more challenging. If we simply move on to the next bubble, we only re-inforce this kind of behavior.

Compton’s in the house, and it’s HOT! Sweet Flip!

http://www.cnbc.com/id/40110673

“She might just rent it out and have positive cash flow in an area where rents can be higher than mortgage payments.”

What transpires when fifteen people move in, the rent’s unpaid, and PeeWee and his posse are nursing 40oz’s on the front porch when you come to serve a three day notice to pay, or quit?

You rent me, my son, and my son in law (large lads both of them) and we serve the papers, 200.00 a morning each.

First, let’s stop using the term “Victim” when it’s clear this is a self inflicted wound. These people are not victims. They were never “duped” or “tricked” or “forced” to over leverage. After signing multiple disclosures and a stack of papers the size of a good paperback novel, then waiting three business days to close, no one can consider themselves a victim.

Victims are created when a drunk driver crashes into pedestrians. We don’t weep for the dumb basterd who drank themselves into a stupor then turned their vehicle into a poorly guided missile.

Were people taken advantage of? Sure, with bad programs and high fees. Could they have said “no”. Absolutely. No phantom force guided these buyers hands while signing dozens of closing loan documents. To believe otherwise is lunacy.

My .02c

Soylent Green Is People.

There are victims

Most borrowers that borrowed before the giant run up should be liable for their actions if they borrow against their homes, but those that bought homes after 2003-2005 are victims of timing.

The “rules of the game” were flawed. Virtually everyone that bought a house after 2005 was going to fail. The lending practices of the banks created this much of the mess, not the borrowers and the buyers, as they are not completely to blame.

If you wanted to buy a house at that time you were at the mercy of not only prevailing market rates for homes, but also for the type of loan you could qualify for. For 2 buyers making 100k a year, one could go Alt A and afford a 500K home, the other on a 30 fixed might only afford 350K….try explaining to your wife that the Jones’s have a bigger better house and they make the same money. The guy with the stable 30 year loan with affordable payments is still making payments, but is so upside down, he cannot move…..tell him he is not a victim

The funny money loans caused a spike in prices. because banks were peddling toxic garbage, and that they were allowed to peddle toxic garbage.

I knew those loans were toxic, Im sure the bankers knew this as well, yet they kept on selling these as there was no law to stop them. Besides if their banks didnt make the loan, some other bank would, so there was always that pressure to keep selling crap that had no future….besides, they could always pawn it off onto Wall St

As for trying to be prudent in your buying or getting reasonable terms, try negitiating terms when lenders produce loan documents….good luck.

This is such a great argument AGAINST total deregulation, as there need to be sensible rules to the game everyone should adhere to…..and I am a die hard Republican (and I am on solid ground since I bought an affordable house…in 1995), I just dont see the knee-jerk “deregulate-deregulate-deregulate” mantra as working all the time. This is a solid case against total deregulation

For starters, Negative Am or even loans with teaser rates should probably be outlawed, as most idiots would would take these, or any other terms, just to get the house they wanted. Sensible rules or regulation should have taken the gun out of their mouth…..and saved the economy

To say there are no victims and that is the buyers fault totally are libertarian or Darwinian in argument only.

The great majority of these “victims” are serial refinancers or incapable of basic math. When you work for a non-profit at X per month (known) and you’re told both in disclosures and final documents that your payment is 2 time X (also known) then there isn’t a victim here. This is a bad decision for which there are consequences.

McDonalds sells some pretty toxic stuff relative to Whole Foods. Are you compelled to buy a Big Mac, or are (were) there other choices out there? Is owning a home a constitutional right? Absolutely not, just as owning a 55 inch Plasma TV with 1000 channels isn’t either. “Victims” in these cases appear to believe otherwise. Herd mentality (or if preferred “Tulip Mania”) took over many buyers and refinancers during the 2001-2007 run up. They could have said “no”, but decided against it. I’d not call this Darwinian, but Newtonian – for every action there is an equal and opposite re-action. Actions do have consequences, many of them terrible in nature, but to say that you’re a victim because of someone elses assistance in your own downfall is blameshifting in the highest order.

If there is any concession to a victim class here it’s the buyers who put cash into a deal, did not re-re-refinance, paid on a traditional mortgage, and have since been “down sized” because of the crappy economy. These buyers (what, 2-3% of foreclosures?) are victims, but I can’t say the rest quite fit into this category.

My .02c

Soylent Green Is People.

We are all victims until we wake up. I’m suprised Soylent would make a post like this. I bought in 2004 and I got victimized. Was it personal? No, it was because the fraud that was perpetrated on this COUNTRY, victimized everyone, whether they bought a home or not.

Millions will lose their homes and be judged “scum”. It will change nothing. The gig is up, the greatest wealth transfer, or shall I say blackmail, has been approved by our government, the same ones YOU voted into office.

No worries from me though, I will default on my home, and ride the months of free rent to recoup some of MY losses. 6 months = $12,000. 12 out of 100 is 12% back from my down payment. That’s a whole lot better than paying for a home that will not recover in the next 10 years. I haven’t even rolled in the savings of renting versus paying mortgage.

I did 20% down and I still have my teat in the wringer. I got f’d by the system, but hey, that’s how finances go in crony capitalism. If my life was a business, every repugnantcan here would tell me to BK, but because it’s my personal life, it’s ok to remain in debt slavery (to corporations/banksters) and “honor” my committments.

I think we may have common ground in that there are for lack of a better term “global victims”, but I’m hard pressed to call anyone in the original post an victim. We’re victims of the banking system and their bought / paid for legislators. TARP, TARP II, Nationalization of FN/FR/GM/etc should not have been done. The ongoing AIG death rattle is another example of how we’re all still being hurt by the system.

I don’t know your personal circumstance, so read the balance of this reply in a general sense.

If anyone purchased in 2004 with 20% down, then perhaps performed a “rate and term” refinance, is hardly a victim of today’s market. My guess is is that in 2005 as values continued higher, the idea was that the investment in a home was a smart choice. Same for 2006. Same for a portion of 2007 – the peak pricing for most of SoCal. 2-3 years of appreciation was soon wiped out by 3 and continuing years of falling prices. That kind of trend does not make anyone a victim. It makes home investors decide if they want to cut and run, or wait and see, but not a victim.

Your post notes that it will take 10 years to recover your expenses. What’s the matter in waiting those 10 years for anyone in this situation? We overpay for cars, but don’t drop them when they are worth less than the loan. We don’t complain to the jeweler when we overpay for an engagement or wedding ring. Ask the Mrs. if your married if you should toss your ring aside because it’s not worth what you paid for it. There is no difference in owning a stock in your 401k thats lost value. My guess is that plenty of retirement funds have “buy and hold” stocks that are simply in the crapper now, but are still being retained just in case. Why do behavior examples apply to cars, personal items, cash investments, but not for a home?

I recognize that we’re living in the days of zero recourse, that shame is a quaint idea of days gone by. When Client #9 goes from the Governors mansion to the streets, then gets his own TV show, we know we’re way past the days of being embarassed by the choices we’ve made. I’m not saying you should continue to pay for something out of shame or commitment, but this mad rush to the exit doors because of something that was done with full knowledge which didn’t turn out well, blaming others along the way for these choices, is not living in a reality based world.

There are victims in this catastrophic collapse, but it’s not the people who bought with eyes wide open, then refinanced their way into poverty.

Soylent Green Is People.

IR,

I’ve read several definitions of adverse possession, and it seems that if a squatter stays in a property for a period of 5 years (in California), they can legally claim that property as their own. As long as they continued to pay their property taxes, is there any reason why they can’t do this?

http://legal-dictionary.thefreedictionary.com/adverse+possession

Adverse possession is one way to obtain property, but it is difficult to do. The use of the property has to “open and notorious” meaning the squatter must visibly take possession. Then they must pay the taxes. Most people who own property pay the taxes, so if someone else started doing it, you would find out as an absentee owner and go protect your property rights.

Most cases of adverse possession is by family members who have a sibling that doesn’t pay taxes on an inherited parcel. For instance, Brother Al is an alcoholic who can’t hold a job. Brother Bob is a hard-worker who is responsible. The parents die leaving Al and Bob a property. Al never makes his payments on the property taxes and disappears for 10 years. Brother Bob pays all the taxes and builds a new home on the inherited parcel. Brother Al shows up and demands half of Brother Bob’s house. Brother Bob says the property is mine now due to adverse possession. If it goes to court, Brother Bob should win that claim.

“That is a sad story. These people did nothing wrong, but they are being wiped out anyway.”

It’s God’s punishment for divorce. “Nothing wrong” indeed.

“God’s punishment for divorce” or a nutural consequence?

Druken Smo and Jane walk out into freeway traffic and Smo is killed. Is that God’s punishment on Smo and God’s blessing on Jane?

Ok, you got me. I am one of the idiots that took out a home loan of 305k on a home probably worth 229k. I did not do a cash out re-fi, but I did walk away.

I am now squatting for my 13th month, and I think I will now get a lawyer to ensure another 8 or 9 months.

What can I say. Call me a shit, stupid, whatever. But to be honest, the 3k monthy savings ain’t bad. Instead of pissing off the money, I found a better place. When the time is right, I am outta here.

Thank you Irving Housing Blog. Without your great website,and (Patrick.net) I never would have considered strategic default!

I have to say, these caption-added graphics are getting better and better every post! You must spend a great deal of time and effort working up some of these great little vignettes. Keep up the good work!

As a single mom who has been scrimping and saving to purchase a home, I could never figure out who was purchasing all these really expensive homes around me. I had a good job, I made decent money. All the calculations I did told me I had NO chance of buying a home in my area. I simply couldn’t figure out how anyone could afford the prices of homes around me. Who were they? What were they doing to earn enough to pay for these exorbitantly priced homes? Every few months, I would drag myself out to look for a house and every time I went to the books, things were not adding up, my real estate agent even got me to sign paperwork on a home that I was NOT at all sure I wanted to purchase because I couldn’t afford it even though I was approved. I got all way to the table, and found that they had changed the price on the house, it had gone up several thousand. I asked them for some time to consider the new number as it was a surprise to me, they refused, they threatened, and the minute they did that, they lost me, I ran out of there, gripping my cashier’s check to my chest as threats of being sued followed my wake. That home I was close to purchasing is now worth 15% less. In the meantime, I have saved up a sizeable downpayment. I keep my eye on the foreclosures in my area, nothing has tempted me so far. I don’t want to purchase a home with the hopes that it will make me money, but I also don’t want to purhcase a home and lose out because others were irresponsible. But it has now become possible to rent a house and as soon as my lease is up on my condo, I plan to rent one of those homes I had been dreaming of buying. It works out to be the cheaper deal, believe it or not, and I am not stuck with a mortgage.

I love how you point out that having a mortgage doesn’t necessarily mean you own the home. Especially if you haven’t made any payments on the premium! We have definitely picked up a sense of entitlement in the last few years.

On another note, there will be a lot of homelessness if rental requirements are not relaxed, or people don’t start moving in with extended family.