Address: 8 Del Azul, Irvine, CA 92614 (Westpark)

Plan: 1139 sq ft – 2/2

MLS: R71271 DOM: 15

Sale History: 9/6/2005: $625,000

6/10/2004: $570,000

1/29/2002: $318,000

Prior Listing: 7/17/06 — $719,000 (33 DOM – MLS R67231) – Reduced to $684,000

Prior Listing: 8/19/06 — $683,900 (16 DOM – MLS R68644)

Prior Listing: 9/4/06 — $683,000 (16 DOM – MLS R69211)

Prior Listing: 9/20/06 — $683,000 (21 DOM – MLS R69875)

Prior Listing: 10/12/06 — $683,000 (15 DOM – MLS R70714) – Reduced to $667,000

Price Reduced: 11/09/06 — $667,000 to $645,000

Current Price: $645,000

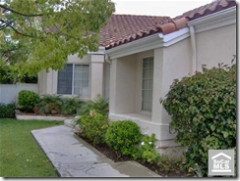

I believe this is a detached 2bd/2ba SFR home in the Bogatta tract in Westpark. It’s hard to tell from the pictures whether it is detached or not but for the price, it better be! Anyone know who the builder was?

Here we’ve got another buyer that purchased near the peak in the fall of 2005. 10 months later and the property is back on the market. The relisting game is in high gear on this property. A buyer who comes across this property on Zip might think it’s been on the market for only 15 days, but when you add up all the DOMs for the expired listings, you’ll see that it’s been about 116 days!

The initial asking price of $719k would have netted the flipper about $50k. That hope disappeared pretty quickly as they had trouble luring a GF. It looks like the home went into escrow during the first listing but perhaps the buyers got skittish and the escrow fell through. After that, the strategy was to relist the home 4 MORE TIMES AT THE SAME PRICE OF $683,000! Now how does that make sense?

The current asking price of $645k is $74,000 lower than the initial asking price of $719k. An asking price of $645k back in July would have made a sale much more likely. They’ve just been chasing the market down for the last few months.

If sold at $645k, the seller will lose about $18,700 (after 6% in selling costs). The actual loss will be even higher because the property has been vacant since at least 7/17/2006. I was only able to find one loan on the property for 75% of the purchase price. The private remarks on the listings say that the seller is very motivated and is relocating. If these things are true, then lower the price and get rid of it!

One last interesting thing I’ve found is that the prior flipper (who bought on 6/10/2004 for $570k and sold on 9/6/2005 for $625k) purchased the home with 100% financing. This prior flipper made $17,500 (after 6% in selling costs) in 15 months using someone else’s money. The actual profit was probably less because they used it at a rental and almost all rentals purchased in Irvine in the last few years are cash negative. This prior flipper was lucky to have gotten out!