Oh boy! This is getting real. From December to now we talked about Irvine stabilizing, Irvine recovering, Irvine booming, Irvine bubbling, and as I write this blog, we are going through Irvine kool-aiding! If you thought $400/SF was pricing you out in this market, think again. This listing is asking for $610/SF. With million dollar homes being purchased in cash transactions, this too shall sell, and may be someone might feel charitable enough to bump up that asking price by another hundred thousand.

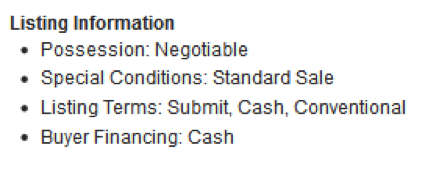

How to find out if it's an all cash purchase? Here is a tip one of the Realtors gave on Talk Irvine: It says in the Redfin link (under Listing Information) how the property was purchased (cash, conventional, FHA, etc). Like this one for 27 Early Lgt in Northwood, under buyer financing:

Listing Price: $1,500,000

Beds/Bath: 4 Beds/ 2.5 Baths

Area: 2460 SF

Builders Tract Name: Olivos (OLIV)

Builders Tract Code: Olivos (OLIV)

Builders Name: California Pacific

Builders Model Name: Plan 2

Price/ SF: $610/SF

For anyone paying this price, especially if they are paying all cash, public schools might not be an attraction. But still, the house is served by all API 10 schools with great test scores.

Elementary: Vista Verde

Middle School: Rancho San Joaquin

High School: University

Here is a little history of the Olivos homes in Quail Hill:

2012:

5/11 126 Treehouse $438/SF

6/27 105 Lattice $480/SF

7/2 100 Treehouse $558/SF

8/1 111 Lattice $449/SF

12/10 121 Lattice $481/SF

2011:

3/11 101 Lattice $451/SF

5/18 130 Weathervane $403/SF

6/17 114 Treehouse $386/SF

That is almost doubling Price/SF from two years ago! Considering most of the purchases made these days are all cash (every Realtor has stories to tell you of these foreign cash buyers who see a house online, decide to make an offer and buy), how will this bubble sustain in the long run? Will the million dollar homes affect the sale prices of the middle class homes now around $800,000? In 2008, there was a long line of foreclosures and short sales in the market. What's the exit strategy now? Up, up and away? Implode?

What are your thoughts? Share on Talk Irvine.