Banks attempts to manage MLS inventory have resulted in an enormous REO inventory and an even larger shadow inventory of future REO. Banks will need to sell, but buyers won't have to buy.

Irvine Home Address … 1902 CRESCENT OAK Irvine, CA 92618

Resale Home Price …… $264,900

So let’s try one last time

So we never forget

This is still worth fighting

Still worth fighting for

It’s gone on

For too long

And this is it

My Darkest Days — Still Worth Fighting For

Affordable housing is no longer part of the American Dream. Lenders have usurped the American Dream by forcing everyone to take on huge debts to get an education, a car, and a house.

How many among us were debt-free at 25, 30, 35 or 40? Lenders assail teenagers with credit card offers knowing their parents will pick up the tab. They burden students with college loans that will take an entire career to pay off. By the time most graduate, they are so burdened with debt that they cannot save money to buy a car or a house, so they take on even more debt just to get by.

Now that lenders have inflated a massive housing bubble with even more debt, they pushed millions of people into insolvency where their only hope is strategic default on their mortgages and bankruptcy. As a result, they now have an abundance of homes they can't sell because the over-indebted population cannot afford them. Yet they hold onto these homes at inflated prices to force the next generation of buyers to play along.

As Marie Antoinette would say, “Let them eat house.”

Banks Amass Glut of Homes, Chilling Sales

By ERIC DASH — Published: May 22, 2011

EL MIRAGE, Ariz. — The nation’s biggest banks and mortgage lenders have steadily amassed real estate empires, acquiring a glut of foreclosed homes that threatens to deepen the housing slump and create a further drag on the economic recovery.

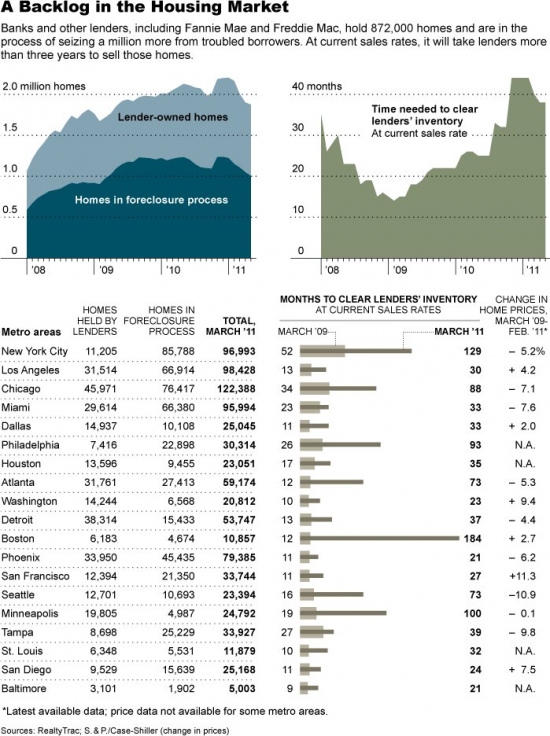

All told, they own more than 872,000 homes as a result of the groundswell in foreclosures, almost twice as many as when the financial crisis began in 2007, according to RealtyTrac, a real estate data provider. In addition, they are in the process of foreclosing on an additional one million homes and are poised to take possession of several million more in the years ahead.

Calculated Risk has added some clarification to the RealtyTrac numbers in a recent post:

I pointed out that the RealtyTrac estimate of 872,000 REO (lender Real Estate Owned) was probably too high, and I also noted that there are approximately 2.25 million homes currently in the foreclosure process. There are another 1.8 million homes with the borrower more than 90 days delinquent – so there is more to come. …

First, the F's (Fannie, Freddie and the FHA) will probably foreclose on close to 500 thousand homes this year since they are picking up the pace. So they will also sell 500+ thousand homes this year – they sold 110,000 in Q1 alone.

But notice that modifications and short sales are twice the number of foreclosures. So if the F's foreclose and sell 500 thousand homes, they might modify/short sell another 1,000,000 (this is mostly modifications, and of course short sales are distressed sales too, but they usually sell for more than REO).

If we add in the PLS and banks and thrifts, the lenders will probably make significant progress on delinquencies this year (and again in 2012). Of course some of the modifications will redefault and end up as REO too, but I just wanted to make sure everyone knows that all of these properties won't end up as REO.

They don't all have to end up as REO to either pummel prices or hold prevent appreciation for several years. There is a very simple dynamic of sales in play: banks need to sell and buyers don't need to buy.

The reason markets capitulate is because sellers give up waiting for the prices they want and liquidate for whatever they can get. Real estate owned inflicts carrying costs and maintenance expenses on banks of about 1.5% each month without providing any income. The more REO a bank has, the more it costs them each month. A lender holding out for top dollar may go broke before the market recovers, assuming they aren't too big to fail.

Since each lender has a different financial strength and different beliefs about the future of pricing, some lenders will sell now even though prices are low and their losses will be large. Each bank that liquidates keeps prices down while they sell and makes the other banks wait longer if they want to get their wishing prices.

Eventually, years go by with banks bleeding cash with no end in sight, and lenders get motivated to liquidate and get what capital they can. When lenders become motivated to liquidate, that is capitulation. It's the same dynamic for individuals who hold cashflow negative properties that are underwater. At some point, most figure out it is pointless to throw bad money after bad, so they cut their losses through strategic default. Lenders don't strategically default, they merely sell REO for whatever they can get, lobby for a bailout, and move on.

Back to the NY Times Article:

Five years after the housing market started teetering, economists now worry that the rise in lender-owned homes could create another vicious circle, in which the growing inventory of distressed property further depresses home values and leads to even more distressed sales. With the spring home-selling season under way, real estate prices have been declining across the country in recent months.

“It remains a heavy weight on the banking system,” said Mark Zandi, the chief economist of Moody’s Analytics. “Housing prices are falling, and they are going to fall some more.”

The double dip was the last gasp of denial market bulls had left. With house prices tunneling to new lows five years after the market peaked, many who held out hope that 2011 and 2012 might help them with their capital recovery are now facing the reality that it will take a very long time to get back to the peak. With carrying costs of 1.5% per month, capitulation becomes a more viable option than waiting with hopes of recovery later, particularly with the GSEs liquidating their inventory.

Over all, economists project that it would take about three years for lenders to sell their backlog of foreclosed homes. As a result, home values nationally could fall 5 percent by the end of 2011, according to Moody’s, and rise only modestly over the following year. Regions that were hardest hit by the housing collapse and recession could take even longer to recover — dealing yet another blow to a still-struggling economy.

Although sales have picked up a bit in the last few weeks, banks and other lenders remain overwhelmed by the wave of foreclosures. In Atlanta, lenders are repossessing eight homes for each distressed home they sell, according to March data from RealtyTrac. In Minneapolis, they are bringing in at least six foreclosed homes for each they sell, and in once-hot markets like Chicago and Miami, the ratio still hovers close to two to one.

Before the housing implosion, the inflow and outflow figures were typically one-to-one.

There is not light at the end of the tunnel. As long as they are taking on many more houses than they liquidate, they fall further behind.

The reasons for the backlog include inadequate staffs and delays imposed by the lenders because of investigations into foreclosure practices. The pileup could lead to $40 billion in additional losses for banks and other lenders as they sell houses at steep discounts over the next two years, according to Trepp, a real estate research firm.

The reasons for the backlog all can be reduced to the desire of lenders to keep prices up. The numerous delays were not holding back banks eager to process foreclosures. Each delay had a cover story such as robo-signer, but the reality is that lenders simply don't want to flood the MLS with properties and recreate Las Vegas in every housing market in the country.

“These shops are under siege; it’s just a tsunami of stuff coming in,” said Taj Bindra, who oversaw Washington Mutual’s servicing unit from 2004 to 2006 and now advises financial institutions on risk management. “Lenders have a strong incentive to clear out inventory in a controlled and timely manner, but if you had problems on the front end of the foreclosure process, it should be no surprise you are having problems on the back end.”

If I were an asset manager from Washington Mutual during the bubble, I would be hiding my head in shame rather than using that as a credibility booster in a news article. His comments are accurate though.

A drive through the sprawling subdivisions outside Phoenix shows the ravages of the real estate collapse. Here in this working-class neighborhood of El Mirage, northwest of Phoenix, rows of small stucco homes sprouted up during the boom. Now block after block is pockmarked by properties with overgrown shrubs, weeds and foreclosure notices tacked to the doors. About 116 lender-owned homes are on the market or under contract in El Mirage, according to local real estate listings.

But that’s just a small fraction of what is to come. An additional 491 houses are either sitting in the lenders’ inventory or are in the foreclosure process. On average, homes in El Mirage sell for $65,300, down 75 percent from the height of the boom in July 2006, according to the Cromford Report, a Phoenix-area real estate data provider. Real estate agents and market analysts say those ultra-cheap prices have recently started attracting first-time buyers as well as investors looking for several properties at once.

There is a price point where anything will sell. If prices are low enough to attract cashflow investors, they will buy even in a declining market because the cashflow is so rewarding. Prices won't fall to zero, and the activity of cashflow investors is usually the buying interest that causes markets to bottom.

Lenders have also been more willing to let distressed borrowers sidestep foreclosure by selling homes for a loss. That has accelerated the pace of sales in the area and even caused prices to slowly rise in the last two months, but realty agents worry about all the distressed homes that are coming down the pike.

“My biggest fear right now is that the supply has been artificially restricted,” said Jayson Meyerovitz, a local broker. “They can’t just sit there forever. If so many houses hit the market, what is going to happen then?”

Prices will go down. What else could happen? Low prices aren't a bad thing, particularly for today's buyers. realtors seem to forget that for each unhappy seller, there is often a very happy buyer.

Back when lenders began restricting inventory realtors cheered the move. Now that buyers know this inventory is out there and buyer motivation is at a low because of it, realtors are suddenly concerned about the problem. Perhaps realtors believed they could overcome the inventory problem with brute force of bullshit. Unfortunately for them, buyers aren't that stupid.

The major lenders say they are not deliberately holding back any foreclosed homes.

What? I would like to read a quote from someone at a major bank who actually stated that transparent lie. I have profiled many properties on this blog that were bought by the bank a year earlier and finally made their way onto the MLS.

They say that a long sales process can stigmatize a property and ratchet up maintenance and other costs. But they also do not want to unload properties in a fire sale.

“If we are out there undercutting prices, we are contributing to the downward spiral in market values,” said Eric Will, who oversees distressed home sales for Freddie Mac. “We want to make sure we are helping stabilize communities.”

Stabilize communities? Give me a break. They want to maximize recovery at the expense of today's buyers. If they could get everyone to sign on for massive loans with 50% DTIs, they would do it in a moment if it got them out of their mess.

If they really wanted to stabilize communities, they would firesale their homes, and give Americans affordable housing. Imagine a society where we weren't putting 30% or more of our income toward debt service on housing. Wouldn't that free up a great deal of money for stimulating the economy? Of course it would.

The biggest reason for the backlog is that it takes longer to sell foreclosed homes, currently an average of 176 days — and that’s after the 400 days it takes for lenders to foreclose.

Why does it take so long to sell REO? Any property can be sold in 90 days if they just reduce the price.

After drawing government scrutiny over improper foreclosures practices last fall, many big lenders have slowed their operations in order to check the paperwork, and in two dozen or so states they halted them for months.

Conscious of their image, many lenders have recently started telling real estate agents to be more lenient to renters who happen to live in a foreclosed home and give them extra time to move out before changing the locks.

“Wells Fargo has sent me back knocking on doors two or three times, offering to give renters money if they cooperate with us,” said Claude A. Worrell, a longtime real estate agent from Minneapolis who specializes in selling bank-owned property. “It’s a lot different than it used to be.”

Lenient with renters? I feel better knowing the banks have decided to treat the renting subclass with a fraction of the respect they give the deadbeats who squat in their properties for years without making any payments. If banks are conscious of their images, they have completely failed to capture the hearts and minds of the people.

Every loan owner who gets the boot will hate the bank for life, and any renter who gets evicted by a bank because the landlord was a deadbeat will similarly hate the bank for life. Further, everyone who realizes the banks are stealing their money through government bailouts will also hate the banks for life. So who exactly thinks positively of banks these days?

Realty agents and buyers say the lenders are simply overwhelmed. Just as lenders were ill-prepared to handle the flood of foreclosures, they do not have the staff and infrastructure to manage and sell this much property.

Most of the major lenders outsourced almost every part of the process, be it sales or repairs. Some agents complain that lender-owned home listings are routinely out of date, that properties are overpriced by as much as 10 percent, and that lenders take days or longer to accept an offer.

It shouldn't be too surprising that REO departments are understaffed and inefficient. Who at the bank is going to get kudos for spending a lot of money to accelerate their loss recognition? Of course, lenders would be better off if they quickly resolved their REO and get what's left of their capital back. But they won't see it that way.

The silver lining for home lenders, however, is that the number of new foreclosures and recent borrowers falling behind on their payments by three months or longer is shrinking.

“If they are able to manage through the next 12 to 18 months,” said Mr. Zandi, the Moody’s Analytics economist, “they will be in really good shape.”

In really good shape? Wishful thinking.

The liquidation phase of the Great Housing Bubble will persist for years. Even if banks begin liquidation in earnest and accept whatever happens to house prices, it will still take three to five years before the REO is gone. Since the banks seem determined not to capitulate, it will likely take another decade before the liquidation is complete. Buyers can sit on the sidelines longer than lenders can remain solvent.

Bought at the peak with 100% financing

The bank unknowingly bought this property at the peak for full asking price. They provided a borrower all the money to obtain this property and thereby took on all the risk in the event of a price decline. With an asking price that represents a 42% loss after commissions, this REO is going to cost the lender plenty.

Irvine House Address … 1902 CRESCENT OAK Irvine, CA 92618 ![]()

Resale House Price …… $264,900

House Purchase Price … $435,000

House Purchase Date …. 5/11/2006

Net Gain (Loss) ………. ($185,994)

Percent Change ………. -42.8%

Annual Appreciation … -9.3%

Cost of House Ownership

————————————————-

$264,900 ………. Asking Price

$9,272 ………. 3.5% Down FHA Financing

4.56% …………… Mortgage Interest Rate

$255,628 ………. 30-Year Mortgage

$55,901 ………. Income Requirement

$1,304 ………. Monthly Mortgage Payment

$230 ………. Property Tax (@1.04%)

$100 ………. Special Taxes and Levies (Mello Roos)

$55 ………. Homeowners Insurance (@ 0.25%)

$294 ………. Private Mortgage Insurance

$239 ………. Homeowners Association Fees

============================================

$2,222 ………. Monthly Cash Outlays

-$120 ………. Tax Savings (% of Interest and Property Tax)

-$333 ………. Equity Hidden in Payment (Amortization)

$16 ………. Lost Income to Down Payment (net of taxes)

$53 ………. Maintenance and Replacement Reserves

============================================

$1,838 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,649 ………. Furnishing and Move In @1%

$2,649 ………. Closing Costs @1%

$2,556 ………… Interest Points @1% of Loan

$9,272 ………. Down Payment

============================================

$17,126 ………. Total Cash Costs

$28,100 ………… Emergency Cash Reserves

============================================

$45,226 ………. Total Savings Needed

Property Details for 1902 CRESCENT OAK Irvine, CA 92618

——————————————————————————

Beds: 1

Baths: 2

Sq. Ft.: 900

$294/SF

Property Type: Residential, Condominium

Style: 3+ Levels, Contemporary

Year Built: 1999

Community: 0

County: Orange

MLS#: P781874

Source: SoCalMLS

Status: Active

——————————————————————————

Nice Irvine Townhouse located in Oak Park community. Great location near the swimming pool. 1 Bedroom, 1.5 Bath, plus attached 2 car tandem garage. Master suite has walk in closet and vaulted ceilings. Oak Park is a gated community with 2 swimming pools, clubhouse and spa. Close to shopping center and restaurants.

Lenders don’t capitulate. They never will. There is no comparison between a lender and an inndividual housedebtor.

Not even close.

The housedebtors tolerance for pain is directly dictated by his/her bank account/income.

The bank, on the other hand can pick and choose the who, what when where and why of the individual foreclosures.

Haven’t we all seen the location flaws of many of the homes Irvinerenter profiles? The banks are gonna sell off the turds first and when they are GOOD and READY, they might sell you a decent house…for a premium.

The bank never loses. Never.

“The bank never loses. Never.”

i guess WAMU didn’t lose like the USA didn’t lose in ‘nam

Yeah, no bank ever foreclosed and sold at a loss. I don’t even know why they have “recourse” in those states that allow it. Why would they need that, since they never lose? Waste of legalese, if you ask me.

And certainly no bank ever found itself loaded up with devalued assets. Never in recorded history. That’s the reason no bank has ever foundered. You see, because a bank is self-interested. As a result, the things that interest it always come to pass. They pray to the Universe, per the Secret, and they just win. Suddenly a buyer shows up who will pay the big bucks. Or suddenly the ever depreciating asset becomes an amazing income producing thing, transformed as if by Captain EO himself. And all those public entities preparing legislation to penalize them for letting properties go to pot–they just stop or repeal all that.

Count on it.

“It shouldn’t be too surprising that REO departments are understaffed and inefficient. Who at the bank is going to get kudos for spending a lot of money to accelerate their loss recognition? Of course, lenders would be better off if they quickly resolved their REO and get what’s left of their capital back. But they won’t see it that way.”

the sooner a bank realizes what’s going on is a race to the bottom, nothing else, the better off they’ll be. restated, first one to sell all their shadow inventory wins.

the good news is, all it takes is one to want to shore up their books and maximize while paying less in holding costs in the long run.

I gotta say that $265k for a 1 bedroom apartment with dated fixtures, stained carpet and cheap tile countertops is still about $125k too high.

I know right..

This dated 1 BR in Irvine, with $500 per month in HOAs and mello roos has a post bubble market value of $265k? Rental parity with 20% down.

Can’t you feel the devastation? That is truly devastating.

20% down? You do realize this is a crappy little 1 bd 900 sqft apartment/condo right? So would you, a ‘sane’ person put down over $50K just so you can claim that it is at rental parity?

Dude the PMI is 7% the $50k every year plus the mortgage rate on the debt. Yes in Irvine this crappy $265k 1 BR is at least a 20% down. Less than 2% of loans in Irvine are FHA. Compare that to Vegas, I double dog dare you.

I couldn’t give a crap about Vegas (or Irvine for that matter, it sucks ass!). It’s the fact that someone, anyone with half a brain, would put down $50K on this 1 br when you could easily get a bigger, better home somewhere else. You can’t say it’s the schools this time either, since this is a 1Br.

Oh, on another note, you are spending a lot of time here so things must be very bad at the CAR/NAR Department of Propaganda (i.e. the Lie Machine). You need to find a real job.

Nice job responding to the economic facts like a man.

What facts? That someone who thinks that it is smart to put down $50K on a 900 sq ft apartment, instead of using that money for a full sized home? Fact is, this is a money loser if they took your advice.

@eat that – so wrong on many levels. So right on the emotional one. It is insane to put 50K down on this piece of dung, BUT, look at all the other fecal homes bringing in 1 million or more just to live in Irvine. It’s all about “belief” from Jesus to Bernanke, with no “belief” it becomes “worthless”. Property is only as desirable as people BELIEVE, and man, there are hardcore fundamentalists in Irvine let me tell you!

At rental parity this is a decent buy for a single professional. You say to use your money “to get a real home”, you must NOT live anywhere near here as a “real home” will cost you about 3x the cost of this real estate offaling, er offering.

Well, you do realize that there’s more to life than Irvine in southern California? I mean, you CAN live elsewhere and be happy.

Still cheaper to Rent from the IAC than to own this POS. Those HOA fees are insane. This place was $ 435K at the hight of the bubble. I would bet this place makes it all the way down to about $175K when all is said and done in a couple more years. Love the long “2 Car” Garage. I dislike these weird 3 level “Townhomes”.

You think so? $265K with a 20% down would yield a monthly cost of ownership of around $1350 per month even with the high HOA.

While this tri-level with 2 car garage may be crappy, you don’t get this for $1350 a month with the Irvine Co

Reality why don’t you buy this place since it’s such a smoking deal. I swear you must be one of those annoying realtors who will say anything to keep your income stream coming.

Just like everybody else was saying, anybody who puts 50K down on this POS is insane. This is not a place anyone would stay for an extended period of time. And it still has further to fall…

Just happen to live in an IAC in Quail. I have about the same Sq/Ft. 1 level. Attached Garage.

All Granite in Kitchen. All new Appliances. Outside Laundry with big machines. Fireplace.

Double Sinks in the Bathroom. Built in 2004.

$ 1600 a month.

That $1350 is going to put some Down Payment cash at risk too. Rental Parity means nothing when your buying a depreceating asset class in comparison. Adios Down Payment cash.

Fair enough but I believe “eat that!” had a point. How many people currently paying $1500 a month for a unit like this have the $50k sitting around for the 20% down? I would imagine few to none. So the circle of people who would rent this place and the circle of people who have the cash sitting around for the down payment are two circles that do not overlap. Is that really rental parity?

Just curious, i am looking at some IAC rentals, is yours all furnished? IAC published the unfurnished apt (rates and floor plan) and their weekly special, is there any negotiation room on IAC rentals? For furnished, they said the rates are not on the net and are quoting from US$120/nite for a 2 bedroom (900-1000 sq ft). For that price, i can probably rent a whole house. just curious to know what people’s experiences are with renting from IAC in the current environment. Thanks

their current specials are the latest, and there isn’t much negotiation on that price. any $ off of list for that month varies for each property.

you can ask them to throw in an extra perk (i.e. painting accent walls), or change the lease terms (length) outside of the norm with property manager approval. they change every month and expire at the end of the month, based on how many move-outs and vacancies they have.

no idea with furnished vs. unfurnished. seems cheaper to just get some slightly furn. off craigslist if not rent (rent to own?) it elsewhere.

2 car garage, 2 bath, 1 br? talk about ridiculous layout. but hey, you can let one fly on just about any level.

this appeals to a tiny slice of the population in Irvine. plus you can probably buy one just like it in Newport Beach for the same, and not be saddled with the stupid HOA.

Okay PR, I hate to feel like I’m picking on you but…

Vast majority of 1bd rental in Irvine seems to be around $1300-1500/mo for a nice complex (e.g. 1bd, 830sf in Toscana averages $1350). At $265K with 20% down & $500 HOA, a purchase comes out to around $2300/mo.

How is that rental parity? You’d be paying $800-$1000 more per month, plus your $60K “investment” is getting no return. Wondering if you know what rental parity means?

Rental parity in Irvine means it’s old, dated & ugly

I’ll pay the expense for you to take a rudimentary math class.

The finest night community college of your choice.

Demeaning sarcasm does not improve the strength of your argument; in fact, it reveals how weak your argument really is.

You should have spent the time validating the math and proving what is reality.

I calculated the monthly costs using a 20% down standard loan the same way IR calculated using an FHA loan in the post…total monthly comes out to $1470, not quite $1350 as you stated previously.

You get $1320 if you simply calculated the principal and interest using a 20% down and took out the PMI and kept everything the same. I think somebody needs to pay for their own rudimentary math classes.

Why would there be PMI on 20% down?

“Affordable housing is no longer part of the American Dream. Lenders have usurped the American Dream by forcing everyone to take on huge debts to get an education, a car, and a house.”

The upper half of college tuitions should be crashing any day now.

The upper half of car prices should also be crashing any day now.

That Manhattan beach real estate will be in free fall as well.

It will be great when this happens so that we ALL can afford them. These price increases keep humming along. Don’t worry though it won’t be long before any poor shmuck can afford a million dollar house. It will only take an armful of gold or a tanker truck of oil. Let the liquidation of 90% of America continue.

Cars are the anomaly in that group (houses, college, etc.), aren’t they? I understand stretching dollars to buy the “best” college or house, but a car?

And yet inflation in higher end cars far exceeds the inflation rate. Inflation in all higher end goods far exceeds the inflation rate.

There must be a bubble right? or is there something else going on hmmmmmm

“These price increases keep humming along.”

Remember everyone, in the year and a half or so since Planet Reality began telling us how misguided those with a bearish view on Irvine prices were, this condo has fallen in value 20%.

Oh, it’s so noted. And he knows it. While he dribbles sarcasm about the lack of devastation, the simple consolidated numbers are all the rebuke required.

The gap between the classes continues to widen.

There are more discretionary dollars at the upper end chasing premium goods and services.

My belief (and I have no skin whatsoever in any OC RE) is the number of rental units in Irvine skews the median household income dramatically downward.

As discussed a few days back, the areas around Irvine have much more pronounced corrections. Even when the “shadow inventory” comes online, I believe there will be enough interest in owning Irvine RE to retain a stupid premium over renting.

1) Rental prices are low because IAC’s massive supply

2) Enough folks from north & south OC plus IE pine for a commute reduction and a nice nabe (“the schools” is a red herring – there are great schools to be found in backwaters like Temecula, Walnut and Santa Clarita).

So: my grand unified theory of the Irvine housing premium* is that it attracts residents at two basic price points: the working professionals, who rent and the $200k+ crowd, which owns. The supply of the latter is finite but Irvine finds a way to extract this crowd from points far and wide.

*Caveat: the standard deviation in the household income data is required to prove the theory.

“…Buyers can sit on the sidelines longer than lenders can remain solvent…”

Buyers “can,” but “will” they?

Probably not. When people become emotionally motivated to buy, they buy. On the margins, many will be demotivated by the prices and chose to rent instead which will serve as a long-term drag on demand.

“Buyers “can,” but “will” they? ”

Depends… If the buyer is married to a nagging,

high maintenance wife, who wont spread her

legs for him, until he buys her a house. 🙂

Not necessary to talk like that Johnny.

Yea, let’s not let the truth get in the way of the discussion Johnny. Maybe you hit a nerve with Sue? LOL!

I’m with Sue, a little decorum here would be nice. (And I am a male)

In Sue’s defense, she didn’t deny the validity of the comment.

Yes, that comment was over the top. I usually don’t censure anyone unless they call names, but that comment made me cringe as well.

how about ApocalypseFuck posts about eating NAR people or grinding them into beef patties yesterday?

even as a joke…

Buyers who haven’t already emotionally capitulated are increasingly becoming conditioned to the new reality of “real estate blows” (the mirror opposite of the psychology during the rise). So–I think–the emotional triggers for buying will be more tempered that usual.

Couple that with more of a scarcity of cash/credit with first time buyers than previously experienced, and possible move/unemployment risk aversion on the 2-4 year horizon and the emotional desire to buy–even with a modest financial advantage of $100-$300 monthly–might not be enough to coax a buyer who figures with prices dragging and even sliding a little bit, there’s really not a strong need to do so. And next year looks better than this one. Even if I’ve been saying that for years. It just keeps being true. So I just keeps being renter.

I really thought hard about during the last month. But then I looked at the graphs and woke up.

10 years to clear the NYC metro market?

15 years to clear Boston?

I read on CR yesterday that the REO delay after NOT in NYC metro is now 900 days. That’s almost three years!

Who would pay $2k/month to live in outer Irvine if you could squat for three years in NYC?

The reason NYC metro is at 900 days is banksters are refusing to foreclose in Manhattan, because that’s where they own and it would negatively affect their own equity. So, they have made the choice for their companies to specifically not foreclose in their area so as not to negatively impact their personal net worth.

Yes. Their behavior is entirely self serving.

Nit pick alert: the “I want home prices to fall, and I want to see the banks go bankrupt.” image (Darth Maul? I stopped watching the Star Wars films before the end/beginning) is just wrong. It just isn’t an evil dream any longer. I think it needs to be a fine, wholesome image of Dorothy, or an “everyman” Henry Fonda type.

I don’t even live in CA these days, but I can tell you that the buyers are definitely motivated here, where $500K asking prices abound in zip codes where median household income is $75K.

The catch: motivation is a necessary but not sufficient condition for purchasing. Buyers just don’t have the income and down payments to qualify at even today’s slightly tighter lending standards.

The banks, though more than willing to offer their backlog of foreclosures at WTF prices, aren’t suicidal, so they’re not offering money to folks who can’t afford these homes, and the FHA requires at least a shocking 3% down.

Plenty of motivated buyers; few actual buyers.

The Kool-Aid has not worn off, but fat lot of good it’s doing for sales. My newest neighbor offered 80% of asking for the cheapest listing within a several-block radius, and after a few attemps to negotiate, more out of pride than anything, the seller accepted.

Even with willing buyers and cultural attitudes that place renters just above meth-using pedophiles on the social ladder, Denver can’t find enough qualified buyers at these already-reduced prices.

I believe there will be more investment and first-time buyers as prices drop another 10%, as long as the FHA stays in the picture, but I think this will merely prolong the agony. There are just too many people waiting to sell at every price point along the way down. From boomers who have to sell, to people who bought at the top because they feared never being able to afford a place, there is a growing line at the exit.

Financial reality is ahead of buyer sentiment. We have at least 15% further to fall here, and it will take at least 5 more years. We have buyers galore, but not at these prices.

There wouldn’t.

How I calculated:

$1,081 … Monthly Mortgage Payment

$230 … Property Tax (@1.04%)

$100 … Special Taxes and Levies (Mello Roos)

$55 … Homeowners Insurance (@0.25%)

$0 … Private Mortgage Insurance

$239 … Homeowners Associates Fees

==========

$1,705 … Monthly Cash Outlays

-$103 … Tax Savings

-$276 … Equity Hidden in Payment

$93 … Lost Income to Down Payment

$53 … Maintenance and Replacement Reserves

==========

$1,471 … Monthly Cost of Ownership

and how I think Planet Reality calculated:

$1,081 … Monthly Mortgage Payment

$230 … Property Tax (@1.04%)

$100 … Special Taxes and Levies (Mello Roos)

$55 … Homeowners Insurance (@0.25%)

$0 … Private Mortgage Insurance

$239 … Homeowners Associates Fees

==========

$1,705 … Monthly Cash Outlays

-$120 … Tax Savings

-$333 … Equity Hidden in Payment

$16 … Lost Income to Down Payment

$53 … Maintenance and Replacement Reserves

==========

$1,321 … Monthly Cost of Ownership

(basically I’m assuming PR didn’t change tax savings, amortization and lost income to down payment).

MBA National Delinquency Survey Loan Count

Q2 2007 Q1 2011 Change Seriously

Delinquent

Prime 33,916,830 31,897,319 -2,019,511 1,859,614

Subprime 6,204,535 4,180,219 -2,024,316 1,109,848

FHA 3,030,214 6,285,254 3,255,040 511,620

VA 1,096,450 1,366,455 270,005 62,720

Survey Total

44,248,029 43,729,247 -518,782 3,572,679

Looks like the delays are working — the bad loans are being transferred from bank prime and subprime to the FHA, i.e., taxpayers will take the hit for the bad loans. Give it another 10 years and 80% of the bad loans can be transferred from the banks’ liability to the taxpayers’ liability. Bend over.

That graph from Calculated Risk is waaay off in timing IMHO – it’s taking a lot longer than that to reach capitulation, we are by no means there yet.

Here in the Bay Area, in most places you’d actually want to live, we are NOWHERE NEAR rental parity.

I’ve seen many “run of the mill” apartments in Tustin and Irvine that look nicer. What’s the antithesis of a chef’s kitchen? I’m not even sure most upright vacuums could navigate that so wonder nobody’s buying it. Why downgrade into a declining asset (albatross) at roughly the same price as rental parity?