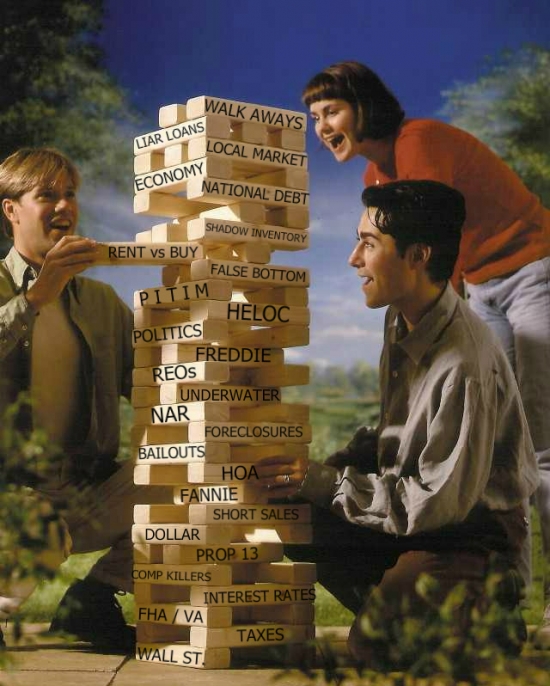

Republicans in the House of Representatives are introducing legislation to tighten lending standards on government-backed loans to limit the exposure of taxpayers to ongoing price declines.

Irvine Home Address … 2418 SCHOLARSHIP Irvine, CA 92612

Resale Home Price …… $325,000

Hey yo I once was a kid all I had was a dream

mo money mo problems when I get it I'm a pile it up

Now I'm dope, wonderbread we can toast

Chiddy Bang — Opposite of Adults

In our two-party political system, the function of the minority party is to oppose policies of the party in power, particularly when the party in power is overreaching or enacting legislation that is not in the best interest of the country. Sometimes, members of Congress act the opposite of adults, and the rhetoric gets heated and sometimes pretty ridiculous. But for the most part, the two-party system is successful in debating ideas and allowing only the most supported to become law.

One of the advantages of the minority party is that they can force uncomfortable public votes on major issues. When the majority party begins pandering to its constituencies with handouts and political seniorage, the minority party can garner attention by introducing good competing legislation and force the majority party to cast an unpopular vote.

The Republicans in the House of Representatives in Washington now hold a majority, and thereby they control the introduction of most new legislation into our grand political theater. They are taking advantage of their majority in the House to force the Democrats which control the Senate and the Presidency to vote down common-sense legislation designed to protect the interests of US taxpayers.

Republicans Aim to Raise FHA Down Payment Requirement

by Adam Quinones — May 25, 2011

The Republican led House Financial Services Committee has drafted legislation that would, among other things, (1) raise the FHA down-payment requirement to 5 percent and (2) prohibit borrowers from financing their closing costs.

The draft legislation, ‘‘FHA-Rural Regulatory Improvement Act of 2011’’, was discussed today in a House Subcommittee hearing entitled “Legislative Proposals to Determine the Future Role of FHA, RHS and GNMA in the Single-and Multi-Family Mortgage Markets”.

If both provisions above were enacted, the already depleted buyer pool would be made much smaller because it would require much more savings for buyers to close the deal. Raising the down payment requirement from 3.5% to 5% will get the most attention, but the other provision prohibiting buyers from financing their closing costs that will really add to the savings requirement and decimate the buyer pool.

I have sold several houses in Las Vegas to FHA borrowers. On properties selling for less than the $118,000 median, FHA dominates the market. In a typical FHA deal, the buyer submits a full asking price offer but asks for the seller to pay all buyer closing costs which generally run between 3% and 5% of the purchase price. If borrowers are prohibited from financing these costs into the loan, the effective down payment doubles to 7% or more.

By far the most damaging provision to the quantity of buyers in the buyer pool is the prohibition against financing their closing costs.

However, the long-term effect of this will be to have buyers with more of their own money into the deal which makes most borrowers much less likely to strategically default, partly because they are less likely to fall underwater, and partly because they don't want to lose their money in a sale. Despite the horrendous impact this policy would have the in the short term — and it would inflict a great deal of pain in the most beaten down markets — the long term impact is nothing but positive.

In a formal release, the House Financial Services Committee's Republican Chairman Spencer Bachus touted the bill as a coming at an important time in history, “This hearing and legislative proposal come at a pivotal moment, as the Committee debates the future of the mortgage finance system, and in particular, government guarantee programs that could expose taxpayers to significant losses.”

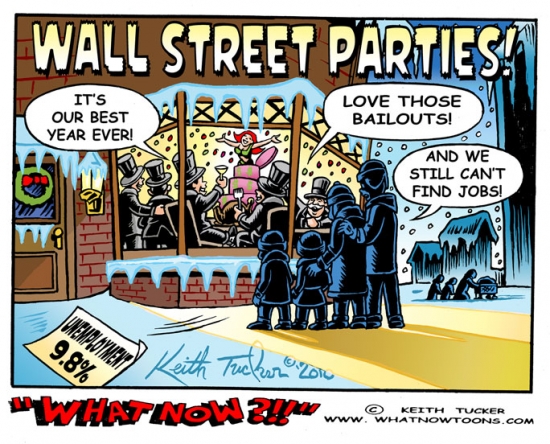

Senator Bachus is right. The various government guarantees have been used to shift much of the private sector garbage onto the balance sheets of Uncle Sam and the federal reserve. It was a short-term policy designed to keep our banks solvent, but since the various players in the real estate industry gain advantage from the government assignment of risk, they are lobbying to keep their advantage in place.

Industry advocates were quick to respond to the proposal as a move in the wrong direction. Michael Berman, Chairman of the Mortgage Bankers Association, explained that down-payments are not the best indicator of payment default. Berman said, “Recently, policymakers have focused on required minimum down-payments as a measure of what factors are necessary to create sound lending practices. While down-payment certainly impacts default risk, other compensating factors, particularly full documentation of conservative loan products, are more influential mitigating factors.”

This is a straw-man argument. This legislation does not argue that down payments are the best indicator of default. It isn't. However, based on the government database of loans in both the GSEs and FHA, the data shows that default rates are inversely related to down payment. As down payments go down, default rates go up. Some of this may be due to the borrower being underwater and hopeless, but much of this documented behavior is because borrowers aren't losing their money.

Berman went on to share the MBA's opinion on the matter, saying, “The current minimum down-payment of 3.5 percent for borrowers with credit scores of 580 or above and 10 percent for borrowers with credit scores of 579 and below permits borrowers to have appropriate “skin in the game” while providing credit-worthy homebuyers with an option for entering the purchase market. Maintaining the existing minimum down-payment requirements, while requiring strong underwriting standards, such as full documentation and income verification, allows borrowers to responsibly become, and stay, homeowners.”

The MBA isn't the only industry group to oppose the down-payment hike. Ron Phillips, President of the National Association of Realtors, shared similar sentiments in his prepared remarks. “NAR strongly opposes increasing the down-payment for FHA. The correlation between down-payment and loan performance is significantly less important than the linkage to strong underwriting, which FHA continues to have. FHA’s foreclosure rate remains less than conventional mortgages, so we don’t believe changes to the down-payment would do anything but disenfranchise many creditworthy homebuyers”.

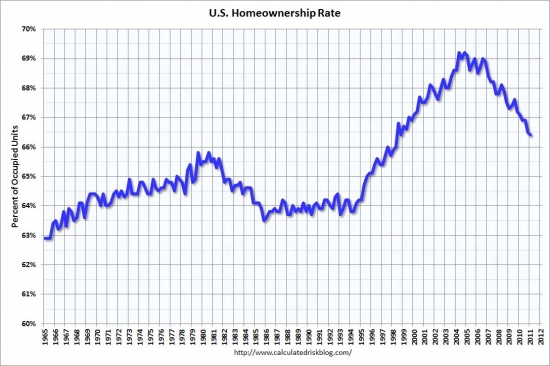

Does the government really want to disenfranchise creditworthy borrowers? Increased home ownership has been the goal of Congressional public policy and every presidential administration since the 1920s. A declining home ownership rate is not politically popular. The only way a policy that negatively impacts the home ownership rate would be proposed is because the alternative is even less appealing — endless government bailouts.

Not all feelings were mutual though. The Cato Institute, a D.C. think tank devoted to limiting government participation in free markets, believes a combination of poor credit history and low down-payment requirements have resulted in “tremendous losses” for private mortgage investors and the FHA. In its prepared testimony Cato said, “Given the relatively “safe” features of an FHA loan, we do not have to guess about loan characteristics driving the borrower into default. We know it is equity and credit history that drives losses.”

To complete their list of causes, they should add unemployment due to the economic collapse that was a direct result of the anti-regulation policies endorsed by groups like the Cato Institute, but I don't want to quibble with their well-reasoned argument….

Cato outlined a variety of FHA program reforms it believes must be implemented immediately to ensure taxpayers are exposed to minimal risk. These reforms include:

- Immediately require a 5 percent cash down-payment on the part of the borrower.

- Require FHA to allow only reasonable debt-to-income ratios.

- Restrict borrower eligibility to a credit history that is equivalent to no worse than a 600 FICO score.

- Require pre-purchase counseling for borrowers with a credit history that is equivalent to a FICO score between 600 and 680.

- Require a 10 percent down-payment, immediately, for borrowers with a credit history equivalent to below a 680 FICO score.

- Borrower eligibility should also be limited to borrowers whose incomes do not exceed 115 percent of median area income, so as to mirror the requirements of section 502(h)(2), as amended, of the Housing Act of 1949.

That's the best policy proposal I have seen come out of Washington. Each one of those provisions would serve to limit the borrower pool to those most likely to repay the debt which in turn limits the exposure of taxpayers to further Ponzi scheme losses.

Besides raising the down-payment requirement, the proposed legislation would also cement the reduction of current “high-cost” loan limits. The maximum loan limits for Fannie Mae, Freddie Mac, and FHA are currently $417,000 with a temporary limit of up to $729,750 for one-unit properties in high-cost areas. The temporary high-cost area limit was first set in the Economic Stimulus Act of 2008, and was extended in subsequent legislation. It expires on September 30, 2011. Without the extension, the high-cost loan limit ceiling would revert back to the limits established under the Housing and Economic Reform Act (HERA), a maximum of $625,500 in high-cost areas.

The change from $729,750 to $625,000 will be effective October 1, 2011. There is no political will to save markets like Irvine where GSE financing between $625,000 and $729,750 is common.

The Obama administration already stated in its white paper that it will not support another extension of the higher loan limits, but the MBA believes the higher limits should be maintained until the housing market stabilizes and the private market shows more signs that demand has returned.

Why should government policy be used to prop up house prices for the upper-middle class? What societal benefit is obtained? Money is fungible, and any assistance the government is providing to upper income households is merely supporting their entitlements.

MBA urged such legislation to be enacted well before October 1, 2011, in order to avoid certain market disruptions that will, because of rate locks, occur within 90 days of the current limits expiring. The National Association of Home Builders echoed that perspective.

NAHB First Vice Chairman Barry Rutenberg, a home builder from Gainesville, Fla., told the House Financial Services Subcommittee, “Counties across the country would see their loan limit reduced by tens of thousands of dollars, placing further downward pressure on home prices and impairing the ability of borrowers to use FHA-insured mortgages to purchase new homes,”

To keep FHA, Fannie Mae and Freddie Mac loan limits at their current levels, NAHB called on Congress to support H.R. 1754, the Preserving Equal Access to Mortgage Finance Programs Act, a bipartisan measure sponsored by Reps. Gary Miller (R-Calif.) and Brad Sherman (D-Calif.).

The draft legislative proposal will require a full Committee vote before it is formally introduced to be voted on by the entire house. Such measures would not be expected to pass the Senate.

Is anyone surprised that two California legislators signed on to a bill designed to support the California real estate Ponzi scheme? I'm not.

A stable home ownership rate requires the limiting of access to home loans to those who cannot make the payments. It doesn't serve anyone for lenders to let borrowers move into properties they cannot afford, develop a sense of entitlement to property they cannot afford, and then foreclose on them because the borrower cannot afford it. The cycle merely upsets everyone involved and makes the taxpayer lose money through losses on the insured loan.

It has been a long and painful process as the bubble deflates back to levels of affordability. Housing deflation is not over yet, particularly in markets like ours where price deflation has been slowed by the government meddling. Kool aid intoxication must die, and buyers must give up on the idea of their California house being a substitute wage earner. Until that happens, a few people will overpay, the the slow grind of lower prices will go on.

Welcome to our new normal.

A 50% loss in an Irvine high rise

One of the most obvious signs of the housing bubble was the rise of buildings on the Jamboree corridor about 25 years ahead of when the economics may support it. These properties should never have been built. The units within them are worth less than half of what they were at the peak, and if today's pricing would have been the order of the day back when these were proposed, they wouldn't have been financed.

The owner of today's featured property paid $635,000 back on 1/27/2006. He used a $507,650 first mortgage and a $127,350 down payment. However, on 10/6/2006 he obtained a $150,000 HELOC from Wells Fargo which gave him access to his down payment plus $22,650 in HELOC booty.

Do you think he took the HELOC money, or did he lose his down payment?

And, if he didn't take the HELOC money, do you imagine he wishes he did?

Irvine House Address … 2418 SCHOLARSHIP Irvine, CA 92612 ![]()

Resale House Price …… $325,000

House Purchase Price … $635,000

House Purchase Date …. 1/27/2006

Net Gain (Loss) ………. ($329,500)

Percent Change ………. -51.9%

Annual Appreciation … -12.0%

Cost of House Ownership

————————————————-

$325,000 ………. Asking Price

$11,375 ………. 3.5% Down FHA Financing

4.54% …………… Mortgage Interest Rate

$313,625 ………. 30-Year Mortgage

$68,424 ………. Income Requirement

$1,597 ………. Monthly Mortgage Payment

$282 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$68 ………. Homeowners Insurance (@ 0.25%)

$361 ………. Private Mortgage Insurance

$460 ………. Homeowners Association Fees

============================================

$2,767 ………. Monthly Cash Outlays

-$257 ………. Tax Savings (% of Interest and Property Tax)

-$410 ………. Equity Hidden in Payment (Amortization)

$19 ………. Lost Income to Down Payment (net of taxes)

$61 ………. Maintenance and Replacement Reserves

============================================

$2,179 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,250 ………. Furnishing and Move In @1%

$3,250 ………. Closing Costs @1%

$3,136 ………… Interest Points @1% of Loan

$11,375 ………. Down Payment

============================================

$21,011 ………. Total Cash Costs

$33,400 ………… Emergency Cash Reserves

============================================

$54,411 ………. Total Savings Needed

Property Details for 2418 SCHOLARSHIP Irvine, CA 92612

——————————————————————————

Beds: 2

Baths: 2

Sq. Ft.: 1260

$258/SF

Property Type: Residential, Condominium

Style: Two Level, French

Year Built: 2007

Community: 0

County: Orange

MLS#: P782365

Source: SoCalMLS

Status: Active

——————————————————————————

THIS CONDO HAS OVER 100K IN UPGRADES. .. INTERIOR IS IMMACULATE. .. TURN KEY READY. ..

Off Topic: Las Vegas auction property in today's offerings

Anyone want that house? They ripped out the copper plumbing in the walls.

.jpg)