Some housing advocates claime that foreclosures are a problem. In reality, they are essential to the economic recovery.

Irvine Home Address … 13 SPRING BUCK Irvine, CA 92614

Resale Home Price …… $749,000

I ain't got a fever got a permanent disease

It'll take more than a doctor to prescribe a remedy

I got lots of money but it isn't what I need

Gonna take more than a shot to get this poison out of me

Bon Jovi — Bad Medicine

Well meaning people are often wrong. The foreclosure process — essential to the cleansing of consumer debt and the recovery of the housing market — is very painful for the families that must endure it. Many on the left of the political spectrum are pandering to the masses facing foreclosure and proposing policies that would remove the negative consequence of foreclosure for those who over borrowed. Unfortunately, removing these consequences is the essence of moral hazard: if people don't experience consequences of their foolish actions, they tend to repeat the mistake.

John Taylor: Foreclosures Are the Mortal Enemy to Economic Recovery

Lori Ann LaRocco — Monday, 29 Nov 2010 — (edited for brevity)

The foreclosure crisis still divides us into two camps. There are those who believe that foreclosing rapidly on homes subject to defaulted mortgages is vital to clearing the market. Others believe we should do everything we can to keep people in their homes, urging loan modifications to forestall foreclosures.

Obviously, I am in the group that favors rapidly clearing the market. As long as the debt on real estate is excessive and capital is tied up in non-performing assets, the economy will suffer. It's really that simple. The solution is equally simple: foreclose on delinquent borrowers wiping out the debt and extract the remaining capital value. With the excess debt removed, borrowers can use their wage income to buy goods and services rather than giving it to the bank. When the mis-allocated capital is returned to the market, new investment will be spurred in areas where capital is most needed. Right now, we don't need more real estate.

John Taylor, President and CEO of the National Community Reinvestment Coalition, falls solidly in the latter camp. Taylor would like to see widespread mortgage modifications that would allow homeowners in danger of defaulting to keep their homes. Taylor is on the board of directors of the Rainbow/PUSH Coalition and the Leadership Conference for Civil Rights. He has also served on the Consumer Advisory Council of the Federal Reserve Bank Board, The Fannie Mae Housing Impact Division as well as The Freddie Mac Housing Advisory Board. He is extremely passionate on why his idea is the right choice to help turn around the real estate market.

Despite the repeated failure of every loan modification program, people continue to advocate them. These programs are a complete failure. Even the worst government programs are usually touted as a qualified success among its advocates. Nobody thinks loan modification programs have been a success, yet we still have people clamoring for them. I suppose if it is the only solution available that suits an agenda, people will support it even when it is a proven failure.

LL: There has been so much overleveraging in the real estate industry and lower interest rates can only help so much, what needs to get done with this new Congress looking at Financial Reform with Fannie and Freddie because they have not been address yet.

JT: You are absolutely right. It's kind of like pumping plasma into a patient while the patient is still bleeding. We need to stanch the foreclosure crisis first.

How is the government supposed to solve the foreclosure crisis without injecting more money?

So the government has to get serious about this problem. The Administration’s voluntary approach to foreclosure prevention has probably done as much as it can possibly do, and even by their standards has not done enough.

They have to step up the pressure now to achieve better results. The Federal Housing Administration (FHA) and Fannie and Freddie are the only securitizers in town now until the private market comes back; , they ought to be able to get banks and servicers willing to cooperate and modify these loans heading to foreclosure.

It must be done. Because it is absolutely going to slow down any type of economic recovery if we have the eleven million more foreclosures projected by Wall Street analysts; if they go through, it’s going to triple the number of foreclosures we’ve experienced. How is that going to help the economy?

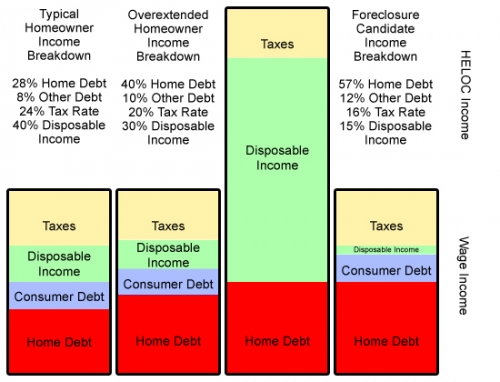

It will help the recovery because it will eliminate the excessive property debt of millions of over-extended borrowers. When borrowers have excessive home debt, the excess comes directly out of disposable income. Since consumer spending is such an important component of the economy, the excess interest payments are a direct financial drain.

This is the key point advocates of loan modifications fail to recognize. The banks don't want to see it because purging debt costs them money. Advocates on the left don't want to see it because purging debt requires foreclosure.

So you have to put on the table the idea of taking as many of these troubled loans as possible and putting the homeowners in sustainable, modified loans, that are based on their ability to pay. Banks should have made these kinds of loans, which the homeowner could actually pay back, in the first place.

Yes, banks shouldn't have made stupid loans to begin with. Foreclosure and its associated losses are essential to provide consequences to the banks for their foolishness to ensure this doesn't happen again.

LL: But what about the millions of people who purchased homes they could afford? Why should people be allowed to stay in homes they had no business buying in the first place, because they were way out of their price tag?

JT: Was it a massive, malfeasant, greedy, lending industry that caused the problem or was it stupid consumers who should have known better? I think the evidence overwhelmingly supports the former conclusion.

Yes, Lenders Are More Culpable than Borrowers, but so what? Both parties need to endure the consequences of their decisions. Just because one party is more to blame than another doesn't mean the less blameworthy participant gets a pass.

But that doesn't matter anymore; we don’t have time for that debate.

WFT? We have plenty of time for a debate. It isn't a debate this fool wants to have because he knows his position is weak and he doesn't want to face the stronger arguments on the other side. Interesting debating technique; win by claiming there is not time for debate.

The question now is what do we do to stop the foreclosures that are killing our economy by a thousand cuts, a hundred fold, every month.

Foreclosures are the mortal enemy to economic recovery. We can keep on pumping money into the system to create liquidity for banks and in the market, but it’s simply not going to succeed until they plug the hole at the bottom of the well!

Each word above is complete nonsense. First, foreclosures are not killing our economy, they are curing it. Second, foreclosures are not a hole at the bottom of the well. We are not leaking liquidity. Money is flowing in to the housing market at very low interest rates in an attempt to limit losses on the oversized loans of the bubble.

So what has the Administration done to stem foreclosures? They have put in place a voluntary program, which has done roughly half a million permanent modifications since the program began, but there's been three and a half million foreclosures during the same time period and seven million foreclosure filings.

That kind of performance earns merits a failing grade by any one's standards.

Since the program had no chance of success when it was initiated, and since its real purpose was to create a false hope among borrowers to induce them into making a few more payments, many banking and government interests consider this program a success.

So what do federal officials need to do? They need to stop carrying their hat in hand when dealing with Wall Street; The government can pound these guys, and they have all the leverage they need by merit of the fact that the banks can't do business without them. I hear people critical about the government’s role in the private lending sector; but without the government we don't have a housing market right now. Without the government there is no Fed window and bond issuance and the liquidity they create. Without the government there is no securitization. Wall Street isn't doing these things; there is almost no private label securitization happening.

You know, all these banks are sitting on loans heading into foreclosure because the banks that hold the second liens are refusing to modify; the banks that hold the second liens are expecting the first lien holders will take the entire hit, and they’ll get paid out at 100%. Well these banks holding the second liens need to be taken to task, because they are holding up a lot of modifications.

Despite the exaggeration about the 100% payout, his observation is correct; second mortgage holders are holding up both loan modifications and short sales. The second has no value. The only strength they have in the negotiation for short sale or loan modification is the ability to say no. Therefore, they say no quite often. The cramdown of second mortgages this gentleman advocates is why we have foreclosure. Second mortgages are converted from debt secured by real estate to unsecured debt similar to a credit card in a foreclosure.

Also, what are Fannie and Freddie waiting for? The government holds tremendous regulatory authority over them; but government officials says they can’t tell them what to do, even though the government says no not really, Fannie and Freddie that they are just in conservatorship. and we can’t tell them what to do. That's just not true. The government is in the position to tell Fannie and Freddie to refinance hundreds of thousands of loans tomorrow, but Fannie and Freddie and the administration are looking at their bottom line so they are charging extra fees above the private market on anything that has any type of risk in it. Fannie and Freddie have not reduced the principal on one single mortgage.

Halleluia! Not one penny of my tax dollars should go toward paying down the mortgage of a HELOC abuser.

They have done half of what the banks are doing. We said from the beginning, to Secretary Paulson and then Geithner, that the foreclosure crisis can’t be resolved by the voluntary participation of the banks.

You can't keep on sweetening the pie and expect them to do the right thing. The truth of the matter is that when push comes to shove the banks have no choice because the government has the ability to say to banks that if they want to do business with the government, including the Federal Reserve, FHA and the GSEs, they must cooperate and restructure these loans. If that had been done, some investors would have had to take some losses; but they are losing now at a very slow rate, prolonging the problem.

Yes, we should have nationalized the banks back in 2008, wiped out the shareholders, given haircuts to the bondholders, and started over. If we had done that, we would be past this crisis today.

The government should use the money they earned from TARP and purchase hundreds of thousands of loans at a discount—at a discount because they are not worth what they once were—and then recycle them into good, permanent, sustainable loans. Where people lost their jobs and can't afford their homes, other solutions are necessary. And abandoned properties should be foreclosed on and the properties should be put back on the market.

But we’re not seeing practical solutions to the foreclosure crisis pursued. It seems to me people are just throwing up their arms, letting everything go down and saying if we don't get through all these foreclosures we will never see a bottom. I think its a terrible way to get through all this, and it will undermine our economy for years to come.

Wrong! The people he characterizes as "throwing up their arms" are really sitting on their hands and doing the right thing. Fix the Housing Market: Let Home Prices Fall

LL: What you are proposing is extremely unpopular. How do you convince Americans this is the way to go to help the industry heal?

JT: People have a right to be mad, but they shouldn’t be mad at 17 million plus homeowners that have either gone into foreclosure or are heading there. Seventeen million homeowners can’t all be stupid and greedy and wrong.

No, they can't all be stupid and greedy, but as I have pointed out day after day, many of them were stupid and greedy, and you can't bail out anyone without significant moral hazards. Why is it necessary for 100% of the people facing foreclosure to be stupid and greedy in order to resist loan modifications and principal reduction? If 50% were stupid and greedy, do we want to reward that 50%?

The behavior of the industry is what changed; the financial services sector tricked and trapped these people, without the proper oversight to rein in their irresponsible lending practices.

The old predatory lending justification: people were tricked and trapped. If they were, they were tricked and trapped by their greed and stupidity.

Should people have known better? Yes. But the industry was rigged to push through these loans and convince people they could afford to do it. But again, it’s too late to rehash these tired debates.

No, it is not too late to rehash a debate in which the author is clearly wrong. The reason we have those debates is because policy advocates like this guy push for the wrong solutions. People should have known better than to take out Option ARMs, and they bear some responsibility for their actions.

If we do not respond to the foreclosure crisis now, we can guarantee the pain that will be felt by most of the people in this country. Families facing foreclosure don’t want a handout, they just want reasonable help.

Bullshit, they want a handout. They want principal reduction to get through the crisis, and when house prices start going back up, they want the free money of mortgage equity withdrawal.

In fact, most of the people that got bad loans, perhaps 90 percent of them, are still paying on that sub-prime loan. Some of them have just simply fallen behind.

If we don't do restructure their loans and keep people in their homes, property values will drop and everyone will be impacted who owns a home. We need to share the pain now, because otherwise it will affect us more broadly.

Why do homeowner losses need to be shared with the rest of us? As a renter who chose not to participate in the madness, I don't want to share in paying the bills of HELOC abusing Ponzis.

Many people might think well, gee, if these homeowners had been smart they should have gotten the loan I got.

Yes, Responsible Homeowners are NOT Losing Their Homes.

Well that loan was not available to them because the system was rigged to push people into higher cost loans. Why? Because brokers and lenders got their fees and earnings that were connected to convincing people to take out more expensive mortgages with predatory terms and conditions. That's what was wrong.

You can sit there and say the people should have known better, and call that the moral hazard. Or, you can recognize the real moral hazard here was allowing an industry to prepay upon a substantial portion of the home-owning public, to give them loans with terms and conditions the lenders knew were not sustainable.

Why does it have to be either one position or the other? People should have known better, and if we bail them out, it does create moral hazard. This is the same for the individual or for the lending industry as a whole. Both parties need to feel the pain of their collective bad decisions.

The moral dilemma then is do you put the burden on the people affected, while the banks are allowed to continue with their business? With the exception of investment products, when other other consumer product goes bad, the burden is put on the manufacturer, not the consumer.

Giving borrowers a pass is not the answer. No matter how you cloak it, any bailout that does not have the borrower endure the consequences of their mistakes is going to result in moral hazard and continued bad behavior among borrowers and bankers.

A bountiful harvest

Many people go to the home equity piggy bank each year. Some do this because they can't control their spending, so they must borrow more each year to pay off their credit cards. Some add to their mortgage debt because they believe it is free money they won't have to repay. A few likely knew it was a Ponzi Scheme and gamed the system because the banks were stupid enough to let them.

The owner of today's featured property went to the ATM machine periodically. I have no way of knowing what they did with the money, but it certainly appears as if this money was used to supplement their lifestyle spending. I wonder how well they are adjusting to a life without their own ATM machine?

- The owners paid $179,000 on 4/28/1998. Their original mortgage information is not available.

- On 6/23/1997 they refinanced with a $192,000 first mortgage. Even during the last bust these owners managed to increase their mortgage and extract some spending money.

- On 2/25/1998 they refinanced with a $217,000 first mortgage.

- On 7/31/2001 they refinanced with a $220,000 first mortgage.

- On 5/15/2002 they refinanced with a $234,000 first mortgage.

- On 11/5/2002 they refinanced with a $247,000 first mortgage.

- On 1/31/2003 they refinanced with a $270,000 first mortgage.

- On 6/1/2004 they obtained a $65,000 HELOC.

- On 2/8/2006 they refinanced with a $410,000 first mortgage.

- Total mortgage equity withdrawal is at least $232,000.

Irvine Home Address … 13 SPRING BUCK Irvine, CA 92614 ![]()

Resale Home Price … $749,000

Home Purchase Price … $179,000

Home Purchase Date …. 4/28/1988

Net Gain (Loss) ………. $525,060

Percent Change ………. 293.3%

Annual Appreciation … 6.4%

Cost of Ownership

————————————————-

$749,000 ………. Asking Price

$149,800 ………. 20% Down Conventional

4.55% …………… Mortgage Interest Rate

$599,200 ………. 30-Year Mortgage

$147,241 ………. Income Requirement

$3,054 ………. Monthly Mortgage Payment

$649 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$125 ………. Homeowners Insurance

$135 ………. Homeowners Association Fees

============================================

$3,963 ………. Monthly Cash Outlays

-$730 ………. Tax Savings (% of Interest and Property Tax)

-$782 ………. Equity Hidden in Payment

$254 ………. Lost Income to Down Payment (net of taxes)

$94 ………. Maintenance and Replacement Reserves

============================================

$2,798 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$7,490 ………. Furnishing and Move In @1%

$7,490 ………. Closing Costs @1%

$5,992 ………… Interest Points @1% of Loan

$149,800 ………. Down Payment

============================================

$170,772 ………. Total Cash Costs

$42,800 ………… Emergency Cash Reserves

============================================

$213,572 ………. Total Savings Needed

Property Details for 13 SPRING BUCK Irvine, CA 92614

——————————————————————————

Beds: 4

Baths: 3 full 1 part baths

Home size: 2,451 sq ft

($306 / sq ft)

Lot Size: 3,024 sq ft

Year Built: 1980

Days on Market: 76

Listing Updated: 40455

MLS Number: S632378

Property Type: Single Family, Residential

Community: Woodbridge

Tract: Ch

——————————————————————————

This is a One of a Kind Custom Home in Woodbridge Cottages – Totally remodeled in 1995. 2 Master Bedrooms, one upstairs and the other downstairs and very private. Chef's Kitchen with Granite Counters and Stainless Steel Appliances. Great Room set up includes Family Room, Dining Room and Kitchen all open to each other. Walk In Closet in Upstairs MBR and Recessed Lighting Throughout. Dual Zone A/C and Ceiling Fans Create a Comfortable, Energy Efficient Home. Extra Large Upstairs Laundry Room has Additional Storage. Large Patio with a Built In BBQ on One Side of Home – Storage or a Dog Run on the Other. Walking distance to Shopping, Parks & Award Winning Irvine Schools. No Mello Roos. Standard Sale. This is a Must See!

Totally remodeled in 1995? That was 15 years ago. It probably needs updating again.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)