In my last post “How Sub-Prime Lending Created the Housing Bubble,” I went through a thought experiment to demonstrate how the psychological and technical factors interrelate to create a speculative mania. In this post I intend to examine the details of the most recent Southern California residential real estate bubble to deflate, and see what it portends for the future.

Today, we are just past the market top. Predicting when a top will occur is very difficult, but recognizing when one has occurred is not: The market has topped. Volume is down as the pool of buyers is exhausted, and inventories are increasing. Flippers are looking for renters, and everyone is praying for the big spring selling season to bail them out. Denial and bargaining dominates the mindset of sellers.

Since prices are softening, there will be one last push of buyers entering the market: those who felt they were “priced out” but see this softening as an opportunity. These buyers actually believe in the fantasy of continual appreciation. They just missed out on the rally. They are classic “bitter renters.” That is why the first selling season after the top gets the most robust bear rally. Many will call the bottom, and many more will be duped into buying this false rally. The strength of the first selling season gets weighed down by the large volume of inventory that ultimately reverses prices and pushes prices lower.

Owners move from denial and bargaining to anger after seeing the failure of the spring selling season and even lower prices than the year before. Many begin to recognize they have a real problem, but many hold out hope that things will turn around “next year.” The second year after the peak, the spring selling season is even weaker than the first, mostly because sellers are more motivated and buyers less so. In year two the remaining sellers who were in denial have moved to anger and acceptance. By the end of year two, all the market participants know prices are declining and will continue to do so.

The third year after the top, selling really gets panicky. Prices are falling quickly and volume is increasing. There is no spring bounce, and prices decline every month of the year. Everyone has accepted that prices are going to fall, and owners are very depressed. This may continue for multiple years if prices remain above fundamental valuations.

In the fourth year, if prices have fallen low enough to be close to the upper range of fundamental valuations, buyers begin to enter the market. The market may even experience its first price rally in two years. However, the large number of foreclosures and large overall inventories prevent this rally from taking hold. Prices resume their descent after the spring push. At this point in the decline, most participants in the market see residential real estate as a bad investment. Why wouldn’t they, most just lost money? People believe that renting is better than buying, and the belief in appreciation is dead.

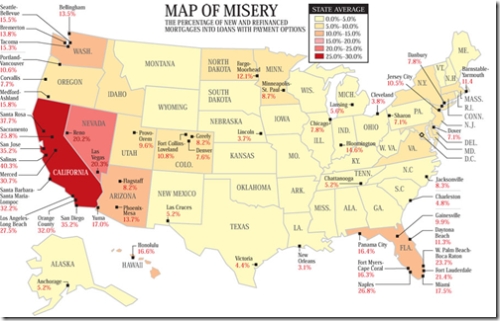

In the years that follow, market prices enter the range of fundamental valuations where they find support. Prices may continue to decline somewhat, perhaps even overshooting the fundamentals due to the foreclosure inventory, but if prices fall low enough, cashflow investors will enter the market in force and create a durable bottom. However appreciation will not return quickly. The market will flatten at the bottom as the Rent Savers and Cashflow Investors absorb the market inventory. The inventory will remain high. All of the ARM’s issued during the rally are now resetting, and most of the borrowers are underwater. This forces a sale, and generally another bankruptcy.

.

“What is past is prologue.” William Shakespeare. The Housing Bubble vs. The Great Depression

One of the main contentions of the bearish argument is that house prices are overvalued. To determine whether or not that premise is true, there must be some way to appraise the fundamental value of a house. Once determined, this fundamental value serves as a point of comparison to the prices at which houses are currently being bought and sold. If current prices are shown to be above fundamental value, it establishes that house prices are inflated, and it also provides a measure of the degree of that inflation.

One of the main contentions of the bearish argument is that house prices are overvalued. To determine whether or not that premise is true, there must be some way to appraise the fundamental value of a house. Once determined, this fundamental value serves as a point of comparison to the prices at which houses are currently being bought and sold. If current prices are shown to be above fundamental value, it establishes that house prices are inflated, and it also provides a measure of the degree of that inflation.