Do you think B of A has given away all the homes they have mortgages on?

Irvine Home Address … 4121 OLD MILL St Irvine, CA 92604

Resale Home Price …… $599,999

I turn on the tube what do i see,

a whole lot a people cryin' "don't blame me"

they point their crooked little fingers at everybody else

spend all their time feelin' sorry for them selves

victim of this, victim of that

your momma's too thin; and your daddy's too fat

get over it,

get over it

all this whinin' and cryin' and pitchin' a fit

get over it, get over it

you say ya haven't been the same since ya had your little crash

but you might feel better if they gave you some cash

The Eagles — Get Over It

As I contemplated the impact of the B of A foreclosure moratorium, the lyrics to the song above kept coming into my mind. Perhaps we should just give these people the houses they are squatting in. That might make them happy.

The squatters and HELOC abusers have already lost their homes, but they are being allowed to squat in the empty shell of their financial lives. They need to move on and get over it.

Shevy got really worked up about it…

Why Would B of A ANNOUNCE that they are halting foreclosures?

"Attention, Attention, everyone considering strategic default, we will not foreclose, you can live in your home for free for the foreseeable future and then rent the same home up the street for 1/2 as much, if and when we get around to foreclosing. By the way, please vote for the politicians that we gave a bunch of money to!" (who cares that your responsible neighbors and grandparents retirements will/are paying for it, the heck with them, our execs need to keep getting bonuses, they are used to it)

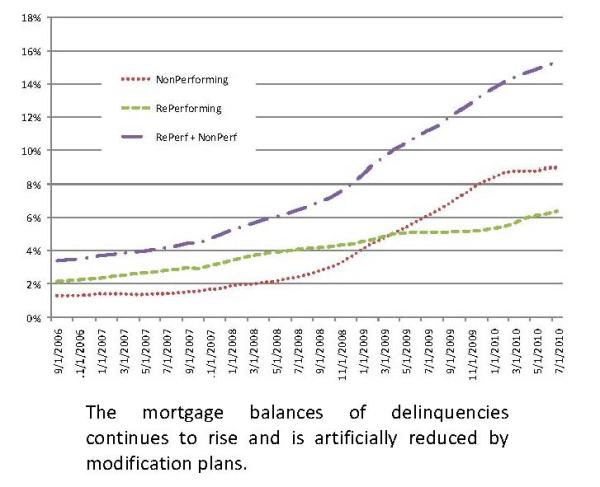

They might as well have announced that everyone that is underwater can stop paying their mortgage because they are increasing the time they will allow them to squat and its already pretty long. I understand that B of A is halting foreclosures because of actions of some attorneys, forcing them look at their foreclosure process and make sure they are executing it correctly. However, B of A has a huge staff of lawyers on staff the last I heard, the foreclosure process is not rocket science, and shouldn't they have already been on top of this?

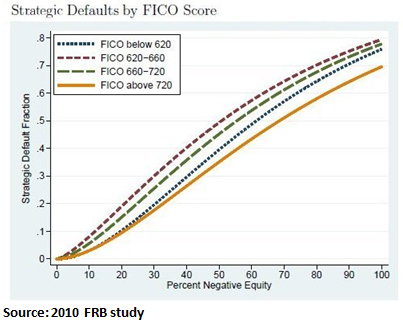

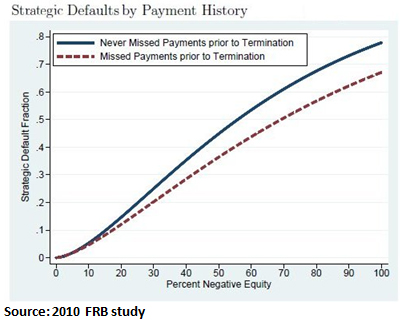

This is highly suspect.?Isn't it likely that by announcing to people that they will not foreclose, at least not in the short term, they will encourage those teetering on the brink of foreclosure to strategically default? Won't many take the leap now that they know that B of A has halted foreclosures? Doesn't it make the most sense for those are underwater, will likely be able to live in the home for free for 6+ months and can likely rent the home up the street for about ½ of the cost of paying for their current home.

Moreover, won't this make title companies apprehensive to give title insurance on foreclosures? How many loans and how many millions if not billions of dollars in losses will this create? Is the system so corrupt that the tax payer will pick up this bill? Can anyone think of any good reason why they would ANNOUNCE this? There is only one reason I can come to.

1) Political- Politicians can jump on board and make out like they are coming down on the banks and forcing them to halt foreclosures.?

I believe that bankers and politicians believe they are smarter than everyone else, I hope they are wrong. Unfortunately, even if they are I don't see any good alternatives to our currently corrupt political parties. From what I can tell, this will only help the banks because supply was going up and demand was going down bringing prices closer to reasonable levels and since B of A is now likely the largest property owner in the country and they no longer are forced to use mark to market accounting their assets were losing value fast.

I do not know the details behind their Countrywide deal but I believe that it's likely that the taxpayers are picking up a huge tab for this debacle. If they do not slow play this inventory, they don't have to show losses, thus bank execs can keep getting their bonuses, and politicians can take credit for halting foreclosures all the while they will continue to trick Americans into believing delaying foreclosures and creating artificial value in housing is a good thing. In reality it's only good for the banks.

My recommendation; let house prices fall back in line with incomes, of course with artificially low rates they are in most of the country, but what if rates were at 8%? By keeping rates artificially low they are basically guaranteeing low to no appreciation for a long time to come in most of the country and delaying the inevitable in others. If underwater loan owners don't listen to the spin and guilt trip that having to move to a rental. And have not been tricked into believing or allowing a foreclosure to ruin their family, cause divorce, or cause their children massive amounts of stress and force them into a life of juvenile delinquency. If underwater home owners have a purchase money loan, they should let it go, rent, let prices come down and buy a new home for much less after this mess is cleared. If it's not a purchase-money loan speak with an attorney but don't be tricked into being an indentured servant for the bank for the next 20+ years. They already tricked you once; it does not have to happen again. Enough with the games, if people have not been paying for the last 3 months and are underwater by 10's of thousands of dollars it does not matter how or when you foreclose.

Housing Bubble News from Patrick.net

Fri Oct 8 2010

Housing faces powerful downside risks (lansner.ocregister.com)

Which cities face biggest housing risks (finance.yahoo.com)

Ex-Ginnie Mae's President on US Housing – Going to get worse (bloomberg.com)

The Freddie and Fannie Scam (greatdepression2006.blogspot.com)

Paradise Valley, AZ targets owners of abandoned luxury houses (azcentral.com)

Foreclosure freeze slows South Florida's residential real estate sales (miamiherald.com)

Foreclosure sales freeze leaves buyers in the cold (poten.com)

In foreclosure controversy, problems run deeper than flawed paperwork (washingtonpost.com)

Robosigned? That'll Be $25,000 – Each (market-ticker.org)

Putting the Foreclosure Paperwork Scandal in Perspective (propublica.org)

IMF and World Bank call for cooler heads on currencies (msnbc.msn.com)

Inflation Expectation Noise (Mish)

Refrigerator Price History at NexTag Seems To Show Deflation (nextag.com)

Obama sends bad forclosure documentation bill back to Congress (news.ino.com)

English Housing market crash feared after average house prices take record plunge (guardian.co.uk)

English Property prices drop 6,000 in a month (telegraph.co.uk)

Tech CEOs tell US gov't how to cut $1 trillion from deficit (networkworld.com)

Our Future In Chains: The For-Profit Debtors' Prison System (activistpost.com)

Suburbs take hit as US poverty climbs (dailybreeze.com)

Equality: Thomas Jefferson to James Madison in 1785 (press-pubs.uchicago.edu)

Compare the returns of renting vs buying

Thu Oct 7 2010

Prediction that California metro area price peaks won't return until 2025 (firsttuesdayjournal.com)

Wisconsin foreclosure filings reach record high (jsonline.com)

Real estate improvement for buyers could last 8 years: IMF (marketwatch.com)

Housing market stumbles again (for sellers) (finance.yahoo.com)

10 reasons renters live mortgage free (finance.yahoo.com)

Housing slump hammers local government tax revenue (finance.yahoo.com)

The Gathering Storm Over Foreclosures (dealbook.blogs.nytimes.com)

JPMorgan, Bank of America Face Hydra of Foreclosure Probes (bloomberg.com)

U.S. bank industry entering new crisis (marketwatch.com)

Foreclosure Furor Rises; Many Call for a Freeze (nytimes.com)

Banking giants suspend thousands of foreclosures (webofdebt.com)

Foreclosure Fraud Reveals Structural & Legal Crisis (ritholtz.com)

Foreclosure Procedures by State (all-foreclosure.com)

Global policymakers clash on currency policies (news.yahoo.com)

Stiglitz: Fed's Flood Of Liquidity Throwing World Into Currency Chaos (dailybail.com)

Insider access to Federal Reserve is goose that lays golden eggs (reuters.com)

McDonald's health insurance plan that caps annual benefits at $2,000 (nytimes.com)

Where is renting cheaper than owning?

Wed Oct 6 2010

Marin, CA house values sink (marinij.com)

Housing Inventory Climbs Again In September (blogs.wsj.com)

Feldstein Warns House Prices May Get More Affordable Without U.S. Aid (businessweek.com)

House Prices Will Drop Another 20% (businessinsider.com)

New-house prices fall to levels of 10 years ago (lvrj.com)

Strategic Defaults Threaten To Make All Major Housing Markets Affordable (realestatechannel.com)

No-interest loans offered to jobless houseowners (boston.com)

Japan's central bank cuts key rate to around zero (washingtonpost.com)

Japanese Politicians fed up with Deflation, Challenge BOJ Independence (Mish)

Economy, jobs expected to remain weak through 2014 (money.cnn.com)

Banks have misled houseowners, lawmakers say (mortgage.ocregister.com)

Banker's Foreclosure Fraud Threatens a New Financial Meltdown (thepennsylvaniaprogressive.com)

Please tell President Obama NOT to sign Interstate Recognition of Notarizations Act (4closurefraud.org)

Buffett Compares Wall Street to Church With Raffle (bloomberg.com)

Goldman Sachs Sued Over German Bank's $37 Million Loss on CDO (bloomberg.com)

Lawyer fees bloom along foreclosure paper trail (contracostatimes.com)

Google's CEO: 'The Laws Are Written by Lobbyists' (theatlantic.com)

Real Democracy (patrick.net from 2006)

What are the rent/buy ratios near you?

Tue Oct 5 2010

A Mammoth One in Five Borrowers Will Default; Jumbo Mortgages Plummet (housingstory.net)

Jersey shore house prices still falling (philly.com)

Sellers pulling houses off O.C. market (lansner.ocregister.com)

Companies Fleeing California For Utah Over Confiscatory Tax Rate (nevadanewsandviews.com)

California Has to Delay Bills to Avert IOUs (bloomberg.com)

Plainfield, IL Real Estate Market is Worse Than You Can Imagine (plainfield.patch.com)

Foreclosure numbers poised to rise again (nctimes.com)

A Way Out For Houseowners In Trouble Hits A Snag (npr.org)

Are The Legal Foreclosure Problems Working In Banks' Interests? (butthenwhat.com)

Banking's New Bailout (newsweek.com)

Why monetary policy can't revive housing (boston.com)

Benefits of houseownership challenged by Fed employees (who will soon be fired) (latimes.com)

Lessons From Ireland's Real Estate Crisis (fool.co.uk)

Bankrupt originators paid in full can't foreclose (4closurefraud.org)

3 Banks Freeze Faulty Foreclosures (video – abcnews.go.com)

Health insurers throw support behind Republican candidates (latimes.com)

S. Carolina Lawmaker Introduces Legislation To Substitute Gold, Silver Coins For Dollar (dailybail.com)

When does it make sense to be your own landlord?

Mon Oct 4 2010

Congress puts rest of America on the hook for overpriced Calif. houses, again (cnbc.com)

Las Vegas faces deepest slide since 1940s (msnbc.msn.com)

Pensacola, FL housing market hits slide (pnj.com)

Sesame Street's Elmo Explains How Mortgage Debt Becomes National Debt (dailybail.com)

Net Private Borrowing Graph (monthlyreview.org)

Socialization Of Credit To Prop Up Asset Prices (Mish)

If mortgage rates plunged to 0% (marketwatch.com)

41.7 Million Spend Too Much on Housing (blogs.wsj.com)

The Wisdom of Property and the Politics of the Middle Classes (monthlyreview.org)

Values artificially high because all foreclosures not on market yet (google.com)

Paperwork storm hits nation's biggest bank (washingtonpost.com)

My Turn: Bring the Big Banks to Justice (newsweek.com)

Company Stops Insuring Titles in Chase Foreclosures (nytimes.com)

When real estate riches turn to rags (ocregister.com)

Policeman charged with damaging house after being foreclosed on (pe.com)

In a tough market, house sellers feel discouraged (northjersey.com)

The High-End Real Estate Holdouts (online.wsj.com)

116 Cliff Ave, Capitola, CA 95010 (patrick.net)

Human landscapes in SW Florida (boston.com)

Nothing changes (mattweidnerlaw.com)

Irvine Home Address … 4121 OLD MILL St Irvine, CA 92604 ![]()

Resale Home Price … $599,999

Home Purchase Price … $460,000

Home Purchase Date …. 12/5/08

Net Gain (Loss) ………. $103,999

Percent Change ………. 22.6%

Annual Appreciation … 13.9%

Cost of Ownership

————————————————-

$599,999 ………. Asking Price

$120,000 ………. 20% Down Conventional

4.52% …………… Mortgage Interest Rate

$479,999 ………. 30-Year Mortgage

$117,536 ………. Income Requirement

$2,438 ………. Monthly Mortgage Payment

$520 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$50 ………. Homeowners Insurance

$65 ………. Homeowners Association Fees

============================================

$3,073 ………. Monthly Cash Outlays

-$407 ………. Tax Savings (% of Interest and Property Tax)

-$630 ………. Equity Hidden in Payment

$201 ………. Lost Income to Down Payment (net of taxes)

$75 ………. Maintenance and Replacement Reserves

============================================

$2,312 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,000 ………. Furnishing and Move In @1%

$6,000 ………. Closing Costs @1%

$4,800 ………… Interest Points @1% of Loan

$120,000 ………. Down Payment

============================================

$136,800 ………. Total Cash Costs

$35,400 ………… Emergency Cash Reserves

============================================

$172,200 ………. Total Savings Needed

Property Details for 4121 OLD MILL St Irvine, CA 92604

——————————————————————————

Beds: 2

Baths: 2 baths

Home size: 1,192 sq ft

($503 / sq ft)

Lot Size: 5,000 sq ft

Year Built: 1972

Days on Market: 126

Listing Updated: 40447

MLS Number: A10060545

Property Type: Single Family, Residential

Community: El Camino Real

Tract: 0

——————————————————————————

LARGE 2 BEDROOM HOME WITH LIVING ROOM,DINING ROOM KITCHEN FAMJLY ROOM WITH COUNTER,WALKOUT TO SIDE .BEAUTIFUL BACKYARD WITH LOTS OF FRUIT TREES.'TILE FLOOR IN LIVING ROOM,DINING ROOM,KITCHEN, FAMILY ROOM,2 BATHROOM. CARPET IN BEDROOMS. VERY BRIGHT HOME. HOUSE FACES WEST.DOUBLE FRONT ATTACHED GARAGE WITH ENTRANCE INTO THE HOUSE.SHOWS VERY GOOD.READY TO MOVE IN.ON A CUL DE SAC.TWO FULL BATHS . COULD BE ADDED ON UPSTAIRS AND BACK AND FRONT.MUST SEE.IT LOOKS LARGER THAN IT IS .MUST SEE TO BELIEVE.BEAUTIFUL BACK YARD. NOTE: OWNER MAY carry a new first mortgage FOR $460,000 at 6% INTEREST FOR 5 YEARS TERM,INTEREST ONLY.PAYMENT,$140,000 DOWN. NO SECONDS. TO BE $2300 PLUS 1/12 TAXES A MONTH.PURCHASE PRICE MUST BE $600,000.bUYERS TO PAY 1% CLOSING COSTS PLUS TRASFER FEES AND RECORDING FESS AND OTHER FEES NECCESARY TO CLOSE,INCLUDING ALL ESCROW FEES AND TITLE. BUYERS MUST HAVE GOOD CREDIT AND PROOF OF DOWNPAYENT MUST BE SUBMITED WITH THE OFFER.FAMILY ROOM CAN BE CONVERTED TO THIRD BEDROOM.

Financial ripoff

Do you follow the financing terms in the description above? This owner — who is underwater — wants to sell this home by carrying a pass-through note for what he paid for the house and he wants a $140,000 profit as a cash down payment. Please tell me nobody is stupid enough to take this deal.

.jpg)