A real estate market decline, like any market decline, is part technical, part fundamental, and part psychological. In my previous post “How Inflated are House Prices?” I discussed the fundamental value of real estate and described how and why prices fall to their fundamental values once a bubble has burst. In this post, I intend to describe the technical and psychological factors at work during a speculative mania, and demonstrate how sub-prime lending created this bubble.

A Thought Experiment

I would like to start with a thought experiment. Imagine a room with 100 people representing the pool of sub-prime borrowers. These are new entrants to the market. They were previously unable to buy due to bad credit, lack of savings, etc. All of them are told they are going to bid on an asset that never goes down in value, and they will be given the ability to borrow unlimited funds (stated income loans, aka “liar loans”) The only caveat is the borrowed money must be paid back when the asset is sold (not that they would care, they already have bad credit). Imagine what would happen?

People would start to buy the asset, and prices would rise. Others in the room seeing the rising prices would come to believe that indeed the value of the asset never declines. They would then join in the bidding. As the bidding drives prices even higher, a manic quality takes over the bidding and people compete with each other, often bidding higher than the asking prices. Nobody wants to be left out. There are fortunes to be made. Greed drives prices upward at a staggering rate. As the last of the 100 people buy, prices are very high, everyone has made money, and it looks as if prices will continue to rise forever . . .

Then something strange happens: there is nobody left to buy. (A key indication of the end of a speculative mania is a huge decline in sales, just as we have witnessed over the last year or two.)

Transaction volume drops off dramatically, and prices stop their dizzying ascent. Nobody is particularly alarmed at first, but a few of the more cautious sell their asset to pay off their loan. Since there are no more buyers, the first selling actually causes prices to drop. This is unprecedented: Prices have never declined! Most write it off as an aberration and comfort themselves with the past history of rising prices; however, a few are spooked by this unprecedented drop and sell the asset. This selling drives prices even lower.

(This brings us up to today in the local real estate market. But what about tomorrow?… Let’s continue our thought experiment.)

Now those who still own the asset become worried, some maintain denial that there is a problem, and some get angry about the price declines. Some of the late buyers actually owe more than they paid for the asset. They sell the asset at a loss. The lenders now lose some money and refuse to loan any more money to be secured against the asset (notice the recent implosion of sub-prime lending). Now there are even fewer buyers and a large group of owners who all want to sell before prices drop any lower. Panic selling ensues.

Everyone wants to sell at the same time, and there are no buyers to purchase the asset. Prices fall dramatically. This asset which was sought after at any price is now for sale at any price, and there are few takers. People in the market rightfully believe the asset will continue to decline. Owners of the asset have accepted the new reality; they are depressed and despondent.

In any group of people, there are always a few who don’t believe the “prices always rise” narrative. Some recognize that asset prices cannot rise indefinitely and cannot stay detached from their fundamental valuations. These people witness the rally and the resulting crash without participating. They wait patiently for prices to drop back to fundamental values, and then these people buy. As these new buyers enter the market, prices stop their steep decent and market participants start to hope again. It takes a while to work off the inventory for sale in the market, so prices tend to flatten at the bottom for an extended period of time; however, just as spring follows winter, appreciation returns to the market in time, and the cycle begins all over again.

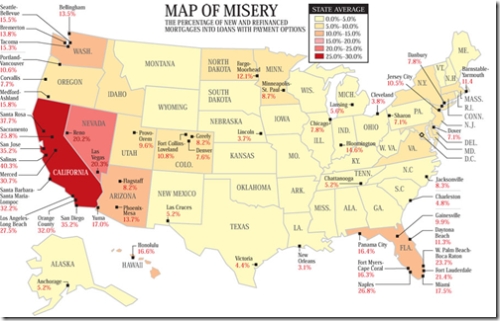

What is written above is true of any asset whether it be stocks, bonds, houses or tulips. In our case, it is the local housing market, and the room of new buyers are sub-prime borrowers, but the concepts are universal. One phenomenon somewhat unique to the housing market is the forced sale due to foreclosure (stocks have margin calls). Even if the psychological factors at work during the panic could somehow be quelled, the forced sales from foreclosures would drive down prices anyway. True panic is not required to crash a housing market, only dropping prices and an inability to make payments. Sub-prime lending was the leading cause of this market bubble, and its implosion will exacerbate the market decline.

.

P.S. A special thanks to OC FlipTrack for the Stages of Grief.

One of the main contentions of the bearish argument is that house prices are overvalued. To determine whether or not that premise is true, there must be some way to appraise the fundamental value of a house. Once determined, this fundamental value serves as a point of comparison to the prices at which houses are currently being bought and sold. If current prices are shown to be above fundamental value, it establishes that house prices are inflated, and it also provides a measure of the degree of that inflation.

One of the main contentions of the bearish argument is that house prices are overvalued. To determine whether or not that premise is true, there must be some way to appraise the fundamental value of a house. Once determined, this fundamental value serves as a point of comparison to the prices at which houses are currently being bought and sold. If current prices are shown to be above fundamental value, it establishes that house prices are inflated, and it also provides a measure of the degree of that inflation.