Despite the optimism for a better 2010, house prices are not going to rise, HELOC money is not coming back, and the giant house party of the 00s has come to an end. Properties like today’s are a symptom of our collective hangover.

Irvine Home Address … 34 CAPISTRANO Irvine, CA 92602

Resale Home Price …… $840,000

{book1}

The party’s over

It’s time to call it day

They’ve burst your pretty balloon

And taken the moon away

It’s time to wind up

The masquerade

Just make your mind up

The piper must be paid

The Party’s Over — Nat King Cole

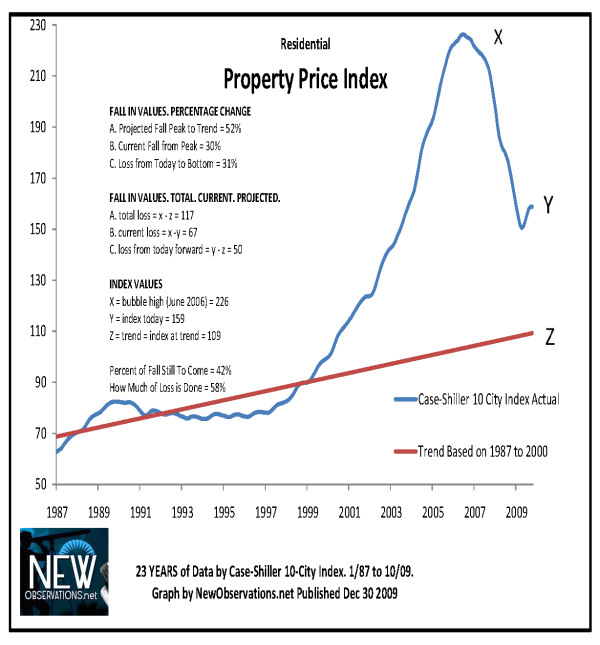

People have not accepted the fact that the The Party’s Over. Even our government and banking oligarchs are trying to re-inflate the housing bubble to avoid the consequences of their greed and incompetence. The mainstream media is full of stories about the bottom for house prices, many are planted by the NAR or their shills, but these stories reflect a concerted effort to either sell overpriced homes or keep people paying oversized loans. Some reporters and bloggers are telling the truth, and today I want to examine why house prices will decline in 2010, and why I am only predicting a small decline in the aggregate median numbers.

Prices are too High

The basic argument as to why prices will fall is not complex; prices are still too high by historic measures. As a recent article quipped, “…we

still have a 30% fall ahead of us and, as you know, we have a 30% fall

behind us. Better send in your mortgage payment.”

Calculated Risk put it this way: “House prices are not cheap nationally. This is apparent in the

price-to-income, price-to-rent, and also using real prices. Sure, most

of the price correction is behind us and it is getting safer to be a

bottom caller! But “cheap” means below normal, and I believe that is

incorrect.”The efforts of the Federal Reserve and the GSEs to reinflate the housing bubble have made payments affordable, but only falling prices is going to make houses truely affordable by conservative metrics.

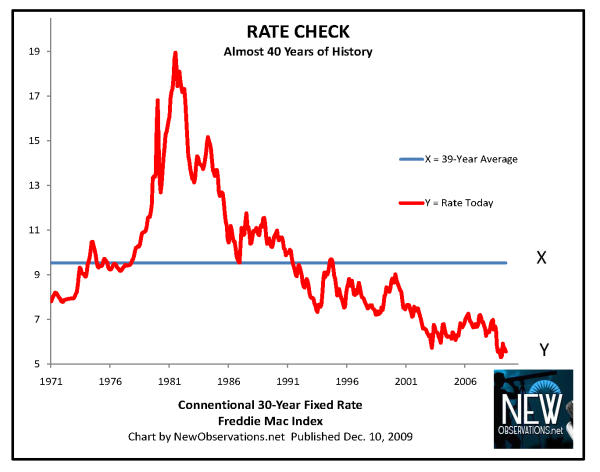

Mortgage Interest Rates will go up

This is also a simple argument; interest rates are nearly zero, and based on the long-term chart, it looks like rates must move higher.

Perhaps the best evidence for concluding interest rates have bottomed and will soon move higher comes from Ben Bernanke, Chairman of the Federal Reserve, who recently refinanced his ARM to a fixed-rate mortgage. Our central banker converted to fixed because he knows the FED is not going to push interest rates lower. Actions speak louder than words, and Ben Bernanke called the bottom in fixed-rate

interest financing without saying anything.

How high will interest rates go in 2010? Morgan Stanley thinks they could hit 7.5% in 2010. That would be an unmitigated disaster for the housing market.

Lenders would rather see Real Estate’s Lost Decade. They don’t care if real estate prices go up as long as debtors are making their payments, but further price declines will create more losses, and they would rather see a slow and orderly increase in mortgage interest rates to support prices. It probably will not happen that way.

Foreclosures will Increase

CNN Money recently published an article titled, 3 reasons home prices are heading lower, where the authors cited (1) foreclosures, (2) rising interest rates, and (3) the end of the tax credit. Rising interest rates was mentioned above, and tax credit props made my list of caveats as to why people may not want to buy now. Foreclosures and Shadow Inventory made my list of 2009 Residential Real Estate Stories in Review, and it is the biggest unknown facing the market — it isn’t unknown as to whether or not this inventory exists; it does, what is unknown is when this inventory will hit the market. This inventory may be released and push prices lower more quickly, or it may be withheld to stop prices from falling. The lending cartel may wish for a slow release, but the instability of the cartel will probably make for a quicker one.

The median declines less than the values of individual properties

The changing mix — more sales will occur at the high end — will serve to make the reported median higher, it will not reflect increasing quality in what people are getting for their money, particularly individual properties at the high end which is likely to fall much more than the 2%-5% I am predicting.

The high end is rather unique because current comps are so few and far between that is is difficult to accurately measure what those houses are worth. Our market is characterized by high end delusion with many more properties currently asking prices that only a few buyers can afford. The plethora of high-end inventory — when the actual distress is reflected in the market — will cause large declines in the values of these properties. This will reverberate through the housing market as people substitute up to better properties for less money.

The net effect of more high-end transactions at lower price points is that the median changes very little; people are still spending the same amount of money, but the quality of what buyers get for this money is much higher. We can see 10%-20% drops in the prices of high end properties without much impact on the median, and this is exactly what I believe will happen.

For evidence of these forces in the market, examine today’s featured (previously) million dollar plus property.

Irvine Home Address … 34 CAPISTRANO Irvine, CA 92602

Resale Home Price … $840,000

Income Requirement ……. $180,523

Downpayment Needed … $168,000

20% Down Conventional

Home Purchase Price … $1,127,000

Home Purchase Date …. 6/9/2006

Net Gain (Loss) ………. $(337,400)

Percent Change ………. -25.5%

Annual Appreciation … -7.8%

Mortgage Interest Rate ………. 5.33%

Monthly Mortgage Payment … $3,744

Monthly Cash Outlays ………… $4,910

Monthly Cost of Ownership … $3,690

Property Details for 34 CAPISTRANO Irvine, CA 92602

Beds 4

Baths 3 baths

Size 3,000 sq ft

($280 / sq ft)

Lot Size 4,090 sq ft

Year Built 2002

Days on Market 68

Listing Updated 12/31/2009

MLS Number S600110

Property Type Single Family, Residential

Community Northpark

Tract Bela

According to the listing agent, this listing may be a pre-foreclosure or short sale.

Beautiful home in Northpark gated community with main floor bedroom with full bath, berber carpet, customized ceramic tile, granite counter tops and much more. In addition, there are also fountains in the front and back entrance.

The owner of this home paid $1,127,000 and timed the peak of 6/9/2006. He used a $845,250 first mortgage, a $169,050 second mortgage, and a $112,700 downpayment. The second mortgage on this property is listed as a HELOC, so the lender loss is completely dependent upon how much the borrower took out. I assume the max as this was opened at the closing as a purchase money mortgage. Perhaps someone more knowledgeable can comment on the recourse implications of a purchase money mortgage HELOC. How much use disqualifies a HELOC for non-recourse protections? This owner is probably asking an attorney these same questions, and I suspect the answers will not be favorable.

Homeowners are extremely leveraged. Without a return on their investment, many will succumb to the weight of their debt service payments and wash through the foreclosure system.

Watch the foreclosure phenomenon here under the telephoto lens of the Irvine Housing Blog.

Huge 2,366 sq ft beauty gated home! 3 BR plus office (can convert to a 4th BR). Steps to the lake and desirable lakes in popular Woodbridge. Gated community. Partial Lake views from kitchen, entry and bedroom. Take an evening stroll around the lake in the safest city in the U.S. Lovely 3 bedroom condominium plus bonus gorgeous wall-to-wall cherry wood office (with its own entrance) with lots of views throughout and tons of UPGRADES! Crown molding, granite countertops, real ‘waterfall’ as you enter the home which can be used as koi pond or enjoy its serenity. An entertainer’s delight. Gorgeous interior with crown molding throughout. Lots of open space. This home is huge and has the feel of a SFR. Remodeled bathrooms, office. Hugest garage on the block with above storage in garage. Lagoon, beaches and tennis courts nearby. This model rarely on the market! Walk to Woodbridge Theatre nearby, or Toy Store or Candy Store. This is definitely a ‘dream‘ location and home unlike any other!

Huge 2,366 sq ft beauty gated home! 3 BR plus office (can convert to a 4th BR). Steps to the lake and desirable lakes in popular Woodbridge. Gated community. Partial Lake views from kitchen, entry and bedroom. Take an evening stroll around the lake in the safest city in the U.S. Lovely 3 bedroom condominium plus bonus gorgeous wall-to-wall cherry wood office (with its own entrance) with lots of views throughout and tons of UPGRADES! Crown molding, granite countertops, real ‘waterfall’ as you enter the home which can be used as koi pond or enjoy its serenity. An entertainer’s delight. Gorgeous interior with crown molding throughout. Lots of open space. This home is huge and has the feel of a SFR. Remodeled bathrooms, office. Hugest garage on the block with above storage in garage. Lagoon, beaches and tennis courts nearby. This model rarely on the market! Walk to Woodbridge Theatre nearby, or Toy Store or Candy Store. This is definitely a ‘dream‘ location and home unlike any other!

I was dreamin’ when I wrote this

I was dreamin’ when I wrote this

Nobody wants to work or have any stress. If people could sit at the pool sipping Margaritas while someone sold their house and came back with a check, most people would chose to do that (have you been to a Lexus dealer?) To the degree sellers are willing to engage themselves in the process — work — they can save themselves money.

Nobody wants to work or have any stress. If people could sit at the pool sipping Margaritas while someone sold their house and came back with a check, most people would chose to do that (have you been to a Lexus dealer?) To the degree sellers are willing to engage themselves in the process — work — they can save themselves money.

This rare, CUSTOM Plan 1 has been ENLARGED to 5 bedrooms–THREE of which are HUGE bedroom SUITES–with one suite + retreat down–4.5 baths, an upgraded tech center, situated on a PREMIUM CORNER LOT w/unparalleled PRIVACY & peek-a-boo views on one of the highest streets in Sienna w/a direct access 2-car garage + long driveway. The chef’s kitchen has a center island breakfast bar + nook, stainless steel appliances with a six-burner gas cooktop, granite counters, full designer tile backsplash, under-cabinet & recessed lighting, double ovens, microwave, a built-in fridge & walk-in pantry. The great room has a fireplace w/brick surround, built-in media center & an added 6 ft. picture window. The opulent master has a built-in media center & sitting area. The ENORMOUS BACKYARD includes a built-in BBQ w/Viking grill, covered patio, flagstone hardscaping w/a raised outdoor seating area, a fountain, & children’s play area. Quail Hill offers award-winning schools & a multiplicity of amenities.

This rare, CUSTOM Plan 1 has been ENLARGED to 5 bedrooms–THREE of which are HUGE bedroom SUITES–with one suite + retreat down–4.5 baths, an upgraded tech center, situated on a PREMIUM CORNER LOT w/unparalleled PRIVACY & peek-a-boo views on one of the highest streets in Sienna w/a direct access 2-car garage + long driveway. The chef’s kitchen has a center island breakfast bar + nook, stainless steel appliances with a six-burner gas cooktop, granite counters, full designer tile backsplash, under-cabinet & recessed lighting, double ovens, microwave, a built-in fridge & walk-in pantry. The great room has a fireplace w/brick surround, built-in media center & an added 6 ft. picture window. The opulent master has a built-in media center & sitting area. The ENORMOUS BACKYARD includes a built-in BBQ w/Viking grill, covered patio, flagstone hardscaping w/a raised outdoor seating area, a fountain, & children’s play area. Quail Hill offers award-winning schools & a multiplicity of amenities.