Home prices are rolling over as expected. Look for the declines to pick up speed over the next four to five months.

Irvine Home Address … 10 FUCHSIA Irvine, CA 92604

Resale Home Price …… $429,900

You know I wouldn’t want to make you feel worse then you should

But if you were me you’d do the same (you know you would, you know you would)

It’s not that hard to say your wrong admit it oh go on, go on

It mean everything, just to hear you say to me

That I was right, and you were wrong

It’s not that hard go on, go on

New Years Day — I Was Right

Last week I profiled a neighborhood in Irvine that inexplicably dropped about 20% in value since the tax credit expired. As it turns out, widespread price declines are beginning to show up in the aggregate statistics. The leg down we have been expecting this fall and winter is happening now.

Clear Capital: Home price drop sudden and dramatic

by KERRY CURRY — Friday, October 22nd, 2010, 12:25 pm

Clear Capital said a 6%, two-month decline in home prices represents a magnitude and speed not seen since March 2009.

“Clear Capital’s latest data through Oct. 22 shows even more pronounced price declines than our most recent (Home Data Index) market report released two weeks ago,” said Alex Villacorta, senior statistician with data analytics firm. “At the national level, home prices are clearly experiencing a dramatic drop from the tax credit-induced highs, effectively wiping out all of the gains obtained during the flurry of activity just preceding the tax credit expiration.”

In other words, the billions the government spent trying to prop up the housing market was a complete waste of taxpayer dollars. We are right back were we started. Since I have consistently maintained that would be the result, I won't pretend to be surprised.

Prices are now at the same level as in mid-April, two weeks prior to the expiration of the federal homebuyer tax credit. The drop, in advance of typical winter housing market slowdowns, paints an ominous picture that will likely show up in other housing indices in the coming months.

If previous correlations between the Clear Capital and S&P/Case-Shiller indices continue as expected, the next two months will show a similar downward trend in S&P/Case-Shiller numbers.

I have also consistently stated we will see the Case-Shiller roll over this fall and winter. We will likely take out the false bottom formed in April of 2009. The bear rally is officially over.

Clear Capital uses rolling quarter intervals that compare the most recent four months to the previous three months. The rolling quarters have no fixed start date and can be used to generate indices as data flows in, the multi-month lag time experienced with other indices.

See chart below:

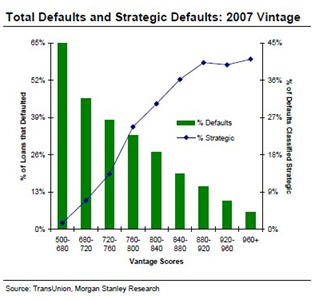

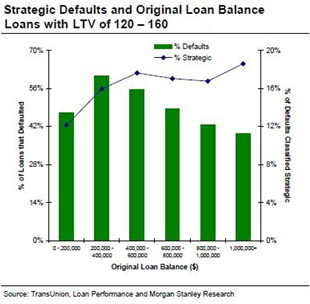

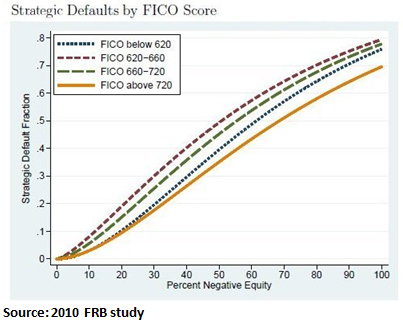

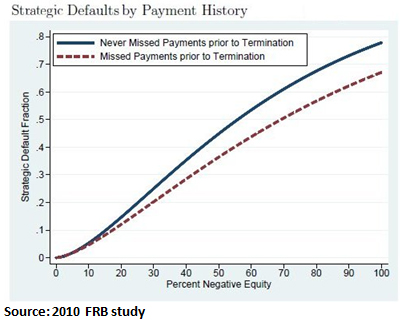

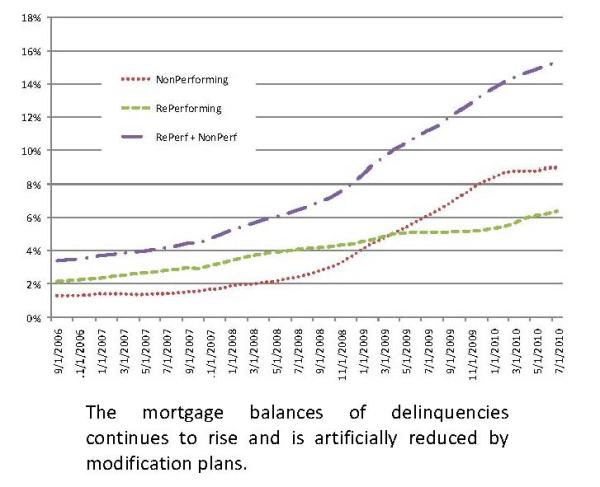

So where does this leave us? If home prices take another steep drop, the resulting strategic defaults will end the bank's denial and may lead to another TARP bailout, only this time, some believe the bailout will benefit loan owners instead.

Shilling Thinks Housing Will Fall Another 20%, But Many Homeowners Will Get Bailed Out

Matt Schifrin — Oct. 18 2010 – 2:55 pm

I just got off the telephone with economist, Forbes magazine columnist and newsletter editor Gary Shilling. As you probably know by now, Gary has been spot-on in his predictions on the economy, global markets and housing.

I asked him what was new and he told me that he had revised his forecast for housing. Here are some of his comments :

“If I am right and we see another 20% decline in housing prices, then we figure that the number of mortgages underwater will go from 23% to 40%. That is a huge amount and at some point the dam breaks,” says Shilling.

Why does the dam have to break? Nobody thought we would get this many underwater loan owners. Why didn't it break at 10% or 20%?

What would really cause problems is loan owner capitulation. If and when loan owners give up hope and accelerate their defaults, banks will have to deal with several million more delinquent squatters. So far they have been dealing with it through a combination of denial and government assistance. Why would a few million more delinquent squatters make any difference?

That’s bad news for the economy and bad news for homeowners and real estate brokers. It’s also bad news for banks and the stock market.

Shilling went on to say that if there is a bright spot in all this gloom it probably will benefit the profligate spending homeowners, who were lured by men like Angelo Mozilo into homes and mortgages they couldn’t afford.

Bailing out HELOC abusers is a bright spot? Perhaps for the HELOC abusers, but not for anyone else.

“Home ownership still has a lot of political clout in this country,” said Shilling. ” By hook or by crook, the politicians will come up with some kind of bailout for a lot of people underwater on their mortgages.”

In other words it doesn’t help anyone to have millions of homeowners foreclosed on and thrown into the street. Gary estimates that houses that are foreclosed on and vacant lose an average of $1,000 per month in value as long as they remain unsold. He adds that all the scrutiny that banks are under fire over concerning foreclosure procedures is creating the perfect environment for a massive bail-out of deadbeat homeowners.

If we bail out HELOC abusers, we will have made the final transition to "banana republic" status. You see the borrowers I profile here every day. Do you want your tax money to go toward paying off their debts? While you were being frugal and playing by the rules, they were out spending like kool aid intoxicated owners and having a good time. Now they are looking to you to pick up the tab.

Perhaps I am too cynical, but I also wonder if this story isn't a plant to convince underwater homeowners to stay on a bit longer and make a few more payments. If there is a false or feeble hope of principal forgiveness, many considering accelerated default may delay the inevitable to see what happens. This is exactly the kind of story the banks want to have circulating the web.

Gary thinks we need a Resolution Trust Corp (RTC) type solution for the housing market. You may remember that the RTC was set up by the Office of Thrift Supervision in the 1980s to deal with hundreds of insolvent thrifts who, like homeowners, got in way over their heads. Some of them invested in Mike Milken junk bonds, others invested in real estate and other highly leveraged loans.

The RTC entered into a number of equity partnerships to help liquidate real estate and other assets it had inherited from insolvent thrift institutions. Gary says the key to the RTC’s success was that it acted relatively quickly and that is what is needed for the housing market in order to lift the giant overhang caused by our zombie homeowner situation.

We don't need an RTC-type institution to clear out the housing inventory. What we need is for the banks to foreclose on the squatters and put the houses back on the market. The sooner we get this done, the sooner the housing market bottoms and the sooner we can get back to a healthy real estate market. Amend-extend-pretend creates an overhand of supply that will hinder economic growth for a decade.

I reminded Gary that many investors got rich from buying assets of troubled savings and loans, including billionaire Leon Black. We shall see who steps up this time. Any guesses?

Me for one. There are many people stepping up to buy these troubled assets. Cash is king in the aftermath of a debt-fueled asset bubble.

They thought it would be okay

Many of the Irvine equity strippers really believed everything would work out to their advantage. The value of their property was steadily climbing, and the magic of California real estate assured them prices would rise forever. Taking out all the equity to spend it seemed like no big deal. What's the worst that could happen?

Well, if they over-borrowed based on ever-increasing home prices, and if they can't afford the debt service payments, they may be forced to sell. If prices go down, they can't sell, and they end up in short sale or foreclosure. Welcome to the reality of many of those who spent their houses.

- Today's featured property was purchased for $335,000 on 3/19/2002. The owners used a $268,000 first mortgage, a $50,250 second mortgage, and a $16,750 down payment.

- On 4/8/2002 they obtained a $67,000 HELOC which allowed them to consolidate the second mortgage and withdraw all of their down payment. It took them less than three weeks to get their money back out of the property.

- On 5/23/2003 they refinanced with a $304,000 first mortgage and a $38,000 HELOC.

- On 8/23/2003 they obtained a $76,000 HELOC.

- On 4/20/2004 they obtained a $98,000 HELOC.

- On 10/26/2004 they refinanced with a $448,000 first mortgage.

- On 11/29/2004 they got a $100,000 HELOC.

- Total property debt is $548,000.

- Total mortgage equity withdrawal is $229,750.

- Total squatting time is about 18 months so far.

Foreclosure Record

Recording Date: 10/23/2009

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 07/20/2009

Document Type: Notice of Default

Since they stopped going to the housing ATM in 2004 and prices went up thereafter, I think these borrowers knew they were getting overextended and chose not to go Ponzi. They were trying to be somewhat responsible. Unfortunately, it was too late.

Irvine Home Address … 10 FUCHSIA Irvine, CA 92604 ![]()

Resale Home Price … $429,900

Home Purchase Price … $335,000

Home Purchase Date …. 3/19/2002

Net Gain (Loss) ………. $69,106

Percent Change ………. 20.6%

Annual Appreciation … 2.8%

Cost of Ownership

————————————————-

$429,900 ………. Asking Price

$15,047 ………. 3.5% Down FHA Financing

4.23% …………… Mortgage Interest Rate

$414,854 ………. 30-Year Mortgage

$81,379 ………. Income Requirement

$2,036 ………. Monthly Mortgage Payment

$373 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$36 ………. Homeowners Insurance

$280 ………. Homeowners Association Fees

============================================

$2,724 ………. Monthly Cash Outlays

-$321 ………. Tax Savings (% of Interest and Property Tax)

-$574 ………. Equity Hidden in Payment

$23 ………. Lost Income to Down Payment (net of taxes)

$54 ………. Maintenance and Replacement Reserves

============================================

$1,906 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,299 ………. Furnishing and Move In @1%

$4,299 ………. Closing Costs @1%

$4,149 ………… Interest Points @1% of Loan

$15,047 ………. Down Payment

============================================

$27,793 ………. Total Cash Costs

$29,200 ………… Emergency Cash Reserves

============================================

$56,993 ………. Total Savings Needed

Property Details for 10 FUCHSIA Irvine, CA 92604

——————————————————————————

Beds: 3

Baths: 2 full 1 part baths

Home size: 1,495 sq ft

($288 / sq ft)

Lot Size: 1,495 sq ft

Year Built: 1974

Days on Market: 408

Listing Updated: 40403

MLS Number: S589143

Property Type: Condominium, Townhouse, Residential

Community: El Camino Real

Tract: Db

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

This is a beautiful home with 3 bedrooms 2.5 baths, formal living room with fire place, dining room, kitchen with granite counters, extra room off kitchen that is great for eating area or many have used this area as a family room with sofas and TV area, upstairs family room and office area, this home has a nice patio that leads to a 2 car garage. Close to great schools and shopping!

Are you ready to pay to bail out the HELOC abusers?