Credit standards are projected to tighten in 2011 because of losses on 2008-2010 mortgages and the ongoing drop in house prices.

Irvine Home Address … 39 EASTMONT 22 Irvine, CA 92604

Resale Home Price …… $347,800

Have you ever been for sale ?

when your isms get smart

oh so selfish and mindless

with that comment in your eye

Hide your face forever

dream and search forever

night and night you feel nothing

there's no way outside of my land

Guano Apes — Open Your Eyes

Government intervention and the amend-extend-pretend dance kept prices higher than if the market crash had been allowed to proceed unimpeded. Las Vegas is clear evidence of how lower prices can create a downward spiral of prices with strategic default ensuring supply problems will continue to pressure pricing. Prices in Las Vegas are below fundamental valuations by any historic measure. The fate of Las Vegas would have been shared by every distressed housing market in the country if lenders had foreclosed and pushed out the squatters.

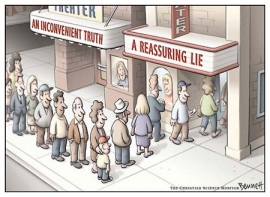

Most pundits and bank economists agree that the between the government intervention and the bank's stopping foreclosure, a more significant decline in prices would have occurred — and, of course, supporting higher prices is a great thing. I disagree. And not just because I want to see lower price locally.

The markets that were not deflated will continue to see sluggish economic growth because so much of the local populations income is going toward their housing debt. Low house prices in Las Vegas, and even in some California fringe markets will be a huge boom to the local economy — not because prices will go up and people will have more HELOC spending money, but because people will be putting less money toward their mortgages, and they will enjoy a higher quality of life.

Get Ready For Another Housing Crash

Published: Tuesday, 18 Jan 2011 — 11:49 AM ET — By: John Carney

The best evidence that we're headed for a double-dip in housing is the quality of the mortgages during the recent period in which the housing market seemed to improve in many areas.

In the Freddie Mac review of Citigroup’s performing loans that I mentioned earlier today, the portion rated as “Not Acceptable Quality” was as high as 32 percent in the fourth quarter of 2009. While this has obvious implications for the repurchase or “put-back” liability of Citigroup, it also has broader implications for the housing market and the economy.

Keep in mind that the quarter in which Citi was churning out the highest amount of flawed mortgages was supposedly a good time for housing. The median price of previously owned single-family homes in the fourth quarter of 2009 rose in 67, or 44 percent, of the 151 metropolitan areas, according to a survey by the National Association of Realtors. Sixteen of the areas posted double-digit increases. The Case-Schiller numbers for that quarter showed U.S. home prices were trending up in 155 out of 384 metro areas.

Now there have been indications in the past that a mini-housing bubble was being built during that period. The Federal Housing Authority, for instance, was backing some very questionable loans. The home-buyer tax credit was allowing individuals to buy loans with no money down. All the bad practices of the 2005-2007 bubble seemed to be back again.

And now we know that this perception was correct. Mortgage quality had fallen off a cliff. If Citigroup's mortgages were this bad, we can expect the same level of problems at Wells Fargo, Bank of America and every other major US mortgage lender.

What does this mean for housing? It implies that home prices may be due for a another crash, as lenders try to avoid incurring losses from mortgage put-backs by raising credit quality once again. Much of the supposed health of the housing market may have been just another easy money illusion.

We may be able to avoid a crash if the economy improves rapidly enough to take up the slack created by the loose lending. Alternatively, more cheap money flowing from the Fed through the banks and into shoddily underwritten mortgages, could keep the bubble inflating for a while longer (and maybe, fingers crossed, the economy will improve and rescue housing.) And if a crash occurs it will likely not be as severe as the last one, simply because the improvements in the housing market in 2009 and 2010 were modest.

But one thing seems certain: much of the improvement in housing over the last two years was built on easy credit.

You can't build a sustainable market rally on easy credit at artificially low interest rates. You can create a great sucker's rally, but sustained house price appreciation requires income growth and household formation. Both of those are in short supply.

I described the problem this way in The Great Housing Bubble:

I described the problem this way in The Great Housing Bubble:

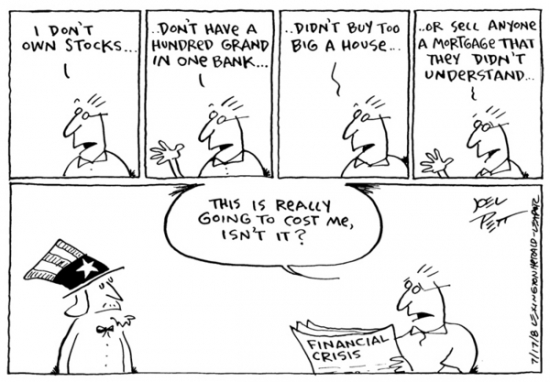

In 2007, the financial markets were abuzz with talk of a “credit crunch.” It was portrayed as some unusual and unpredictable outside force like an asteroid impact or a cold winter storm. However, it was not unexpected, and it was not caused by any outside force. The credit crunch began because borrowers were unable to make payments on the loans they were given. When lenders started losing money, they stopped lending money: a credit crunch. …

The massive credit crunch that facilitated the decline of the Great Housing Bubble was a crisis of cashflow insolvency. Basically, people did not have the incomes to consistently make their mortgage payments. This was caused by a combination of exotic loan programs with increasing payments, a deterioration of credit standards allowing debt-to-income ratios well above historic norms, and the systematic practice of fabricating loan applications with phantom income (stated-income or “liar” loans). The problem of cashflow insolvency was very difficult to overcome as borrowing more money would not solve the problem. People needed greater incomes, not greater debt loads.

When more money and debt was created than incomes could support, one of two things needed to happen: either the sum of money needed to shrink to supportable levels (a shrinking money supply is a condition known as deflation,) or the amount of money supported by the available cashflow needed to increase through lower interest rates. Given these two alternatives, the Federal Reserve chose to lower interest rates. The lower interest rates had two effects; first, it did help support the created debt, and second, it created inflationary pressures which further counteracted the deflationary pressures of disappearing debt and declining collateral assets. None of this saved the housing market.

Credit availability moves in cycles of tightening and loosening. Lenders tend to loosen credit guidelines when times are good, and they tend to tighten them when times are bad. This tendency of lenders often exacerbates the growth and contraction of the business cycle. During the decline of the Great Housing Bubble, the contraction of credit certainly played a major role in the decline of house prices. Lenders continued to tighten their standards for extending credit for fear of losing even more money. This meant fewer and fewer people qualified for smaller and smaller loans. This crushed demand for housing and made home prices fall even further.

Homebuyers will see stricter lending policies in 2011

By Kelli Galippo — Jan 17th, 2011

Buying a home will be more difficult in 2011 than in 2010, prompted by new government lending regulations and the newly-enacted Dodd-Frank Wall Street Reform and Consumer Protection Act.

In an effort to decrease the chances of an encore performance of the Great Recession, new federal legislation requires lenders to maintain at least 5% of the credit risk on the mortgages they originate. This retention of risk, instead of bundling the loans and selling 100% of them to the secondary mortgage market, eliminates this disastrous practice.

Wishful thinking to believe making banks hold some risk will totally eliminate bad loans. It is a step forward from the pure origination model.

What these risk-retention changes mean for the homebuyer is that securing a mortgage will be more difficult going into 2011 compared to the relaxed years of the mid-2000s. Mortgage lenders will now be less inclined to originate a mortgage for borrowers who pose a risk of default – that is, those who lack a solid employment history and peak FICO scores.

I am shocked! Lenders are going to stop lending to people who won't pay them back. What a concept!

Additionally, Fannie Mae and Freddie Mac will be imposing risk-based mortgage fees, dependent on homebuyers’ credit scores and loan-to-value (LTV) ratios. If the homebuyer is perceived as a risk, the increase in fees may result in thousands of dollars more out of pocket — potentially translating to about $10 extra on every monthly payment for a $200,000 mortgage. Thus, that homebuyer will need to wait a couple of years before buying a home to build up their credit score and save for a larger downpayment.

first tuesday take: The new consumer protection legislation is a double-edged sword. On one hand, lenders will be held accountable for their actions by fresh regulations aimed at defending homebuyers from exposure to unsuitable mortgages – particularly adjustable rate mortgages (ARMs). But in a collective and organized response, lenders have increased mortgage fees and are overreacting by making it more costly for anyone to obtain mortgage funding – for most, a requisite for purchasing a home. [For more information regarding Fannie Mae’s new lending guidelines, see the November 2010 first tuesday article, Fannie’s gift for the holidays: stricter lending guidelines.]

I doubt they are overreacting. They are simply taking prudent measures to mitigate risk, something they didn't even consider doing in 2006.

As brokers and agents adjust to lenders’ self-imposed tighter lending policies, loans will remain plentiful for all with a downpayment in hand, a better FICO score and a permanent job – fundamentals of lender underwriting in any market. The volume of sales transactions will not be affected by these developments.

However, these changes will leave the public believing loans are not available, and thus consumers will hesitate to buy a home. It is incumbent upon brokers and their agents to make potential buyers within their community aware that mortgages are in fact available, and the only issue is getting the lowest rate and fees by shopping at least two or three lenders for pre-approvals. This will cost the prospective homebuyer nothing but time and effort. [For more information regarding mortgage shopping, see the June 2010 first tuesday Form of the Month, A borrower’s mortgage worksheet: who has the most advantageous financing.]

LOL! I imagine many in the real estate community have failed to mention to their clients that financing is available. I rather doubt many buyers are sitting on the sidelines because they don't believe they can get financing.

Attitudes of lenders and consumers going forward will be much different, as both camps assert their influence and fight for favorable regulations. Lenders will not win the early battles, but in the long haul they have the staying power to move regulations in their favor. High-functioning brokers and agents will do their part to ensure their buyers succeed in the new real estate paradigm by guiding them to shop around for the best rates and most advantageous loan terms before signing on the dotted line.

So long as the mortgage rules remain level for all lenders, the competition imposed on them by homebuyers who shop several lenders and then take the best deal will keep mortgage lenders from playing games with the rates and fees they charge. But it is the brokers and agents as gatekeepers that have to gently push and guide their buyers to do the intuitive thing — shop. [For more information regarding the Dodd-Frank Act, see the October 2010 first tuesday Legislative Watch, TILA circa 2010; consumer protection enhancement and Section 32 consumer loans: TILA increases disclosures and tightens parameters; for additional commentary on the prudent practice of shopping around for a mortgage, see the May 2010 first tuesday article, Shop, shop, shop until you drop and the December 2010 first tuesday article, Homebuyers shop around for everything but their mortgage.]

Re: “Would-be homebuyers might encounter obstacles in 2011” from the Sacramento Bee and “Fannie Mae is jacking up mortgage fees” from the LA Times

Credit tightening is the inevitable consequence of bad loans. Credit must continue to tighten until the bad loans stop. That will not happen until borrower indebtedness is under control (less than 31% DTI), and prices fall to ranges affordable by the local populations. Until both of those events occur, lenders will continue to create distressed borrowers who will default either because their DTI is too high or house prices continue to fall.

Appreciation didn't happen

Many purchases at the end of the housing bubble were made purely because prices were going up and lenders were enabling buyers to play an elaborate game of musical chairs with real houses. When the music stops, anyone with a big mortgage and real estate gets wiped out.

The owner of today's featured property bought it at the peak with no money down. It appears they stayed for four years and defaulted last April. The lender wasted no time. These people were foreclosed on as quickly as the system will allow.

Foreclosure Record

Recording Date: 11/01/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 07/27/2010

Document Type: Notice of Default

I believe lenders are playing a form of mortgage roulette. Some delinquent borrowers are singled out each month at random and pushed through the system as quickly as possible. With stories floating around from former owners who did not get a period of squatting, the rest of the herd doesn't know what to do. Are they really going to get 18 months of free rent? What if they only get 7? Is it still worth it to strategically default?

Strategic default is at the root of this problem. Banks know that the squatting they are permitting is enticing those on the fringe to either strategically default or accelerate the inevitable.

By frightening the herd with terrorist tactics, lenders how to keep those on the margin from walking from their mortgage and leaving the bank with low-value real estate.

In this instance, the second mortgage of $97,800 was already wiped out in the December foreclosure. Now the first mortgage holder is going to take their haircut when another $125,000 to $150,000 is lopped off by the real estate crash.

The buyer/borrower only takes a hit to their credit score — that's all they were asked to risk. They had no money in the transaction, except perhaps 4 years where the cost of ownership likely greatly exceeded the cost of a rental. Despite the loss, there is nothing here that would deter this owner from speculating again if given the opportunity.

Irvine Home Address … 39 EASTMONT 22 Irvine, CA 92604 ![]()

Resale Home Price … $347,800

Home Purchase Price … $454,051

Home Purchase Date …. 12/16/2010

Net Gain (Loss) ………. $(127,119)

Percent Change ………. -28.0%

Annual Appreciation … -149.7%

Cost of Ownership

————————————————-

$347,800 ………. Asking Price

$12,173 ………. 3.5% Down FHA Financing

4.78% …………… Mortgage Interest Rate

$335,627 ………. 30-Year Mortgage

$70,223 ………. Income Requirement

$1,757 ………. Monthly Mortgage Payment

$301 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$58 ………. Homeowners Insurance

$271 ………. Homeowners Association Fees

============================================

$2,387 ………. Monthly Cash Outlays

-$287 ………. Tax Savings (% of Interest and Property Tax)

-$420 ………. Equity Hidden in Payment

$22 ………. Lost Income to Down Payment (net of taxes)

$43 ………. Maintenance and Replacement Reserves

============================================

$1,746 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,478 ………. Furnishing and Move In @1%

$3,478 ………. Closing Costs @1%

$3,356 ………… Interest Points @1% of Loan

$12,173 ………. Down Payment

============================================

$22,485 ………. Total Cash Costs

$26,700 ………… Emergency Cash Reserves

============================================

$49,185 ………. Total Savings Needed

Property Details for 39 EASTMONT 22 Irvine, CA 92604

——————————————————————————

Beds:: 3

Baths:: 3

Sq. Ft.:: 1220

Property Type:: Residential, Condominium

Style:: Two Level, Contemporary

View:: Park/Green Belt

Year Built:: 1978

Community:: Woodbridge

County:: Orange

MLS#:: P764835

——————————————————————————

Bank Owned Property!!! 3 Bedrooms with over 1200 Sqare feet of living space! Located in the Beautiful Woodbridge Community of Irvine. This unit is located in a quite and private area with fabulous tree lined pathways to your front door! Large fenced rear patio perfect for the warm summer evening BBQ's! Must see property!! Call today For potential Seller financing and incentives!

.png)