Underwater reverse mortgages in concert with a change in government policy is causing widowed seniors to lose their homes.

Irvine Home Address … 72 NAVARRE Irvine, CA 92612

Resale Home Price …… $390,000

Don't bet your future,

on one roll of the dice

Better remember,

lightning never strikes twice

Huey Lewis and the News — Back in Time

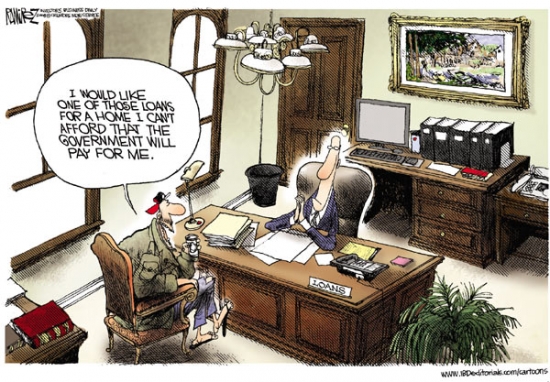

I have made mistakes in my life that made me want to go back in time and undo them. Sometimes you can, but sometiimes you can't go back and reverse the damage. Taking on a reverse mortgage is one mistake that is very difficult to undo.

I don't like reverse mortgages. I don't like many forms of debt, but reverse mortgages are one of the worst forms out there.

According to the Department of Housing and Urban Development:

A reverse mortgage is a special type of home loan that lets you convert a portion of the equity in your home into cash. The equity that built up over years of home mortgage payments can be paid to you. But unlike a traditional home equity loan or second mortgage, no repayment is required until the borrower(s) no longer use the home as their principal residence or fail to meet the obligations of the mortgage.

If you don't have to make any payments, it shouldn't be too difficult to meet the obligations of the mortgage. Also from the HUD website:

What's the difference between a reverse mortgage and a bank home equity loan?

With a traditional second mortgage, or a home equity line of credit, you must have sufficient income versus debt ratio to qualify for the loan, and you are required to make monthly mortgage payments. The reverse mortgage is different in that it pays you, and is available regardless of your current income. The amount you can borrow depends on your age, the current interest rate, and the appraised value of your home, sales price or FHA's mortgage limits, whichever is less. Generally, the more valuable your home is, the older you are, the lower the interest, the more you may borrow.

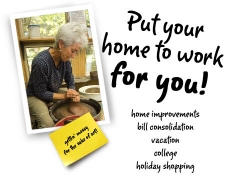

Reverse mortgages provide seniors with plenty of equity and limited income the ability to tap their equity to meet the needs of daily life. Basically, they didn't want grandmothers to eat dog food if they had a lifetime of filet mignon tied up in home equity.

As you might imagine, loaning seniors money when they have no ability to repay has potential for abuse and predatory lending. Fortunately, the market is heavily regulated by HUD.

Good News for Spouses of Reverse Mortgage Holders

By RON LIEBER —In the face of a lawsuit from the AARP Foundation, the Department of Housing and Urban Development has backed off an apparent policy change that was putting some widows and widowers on the brink of foreclosure.

The dust-up involves reverse mortgages, financial products that allow older Americans with a decent amount of home equity to tap some of that equity if they are at least 62 years old. Unlike a home equity loan, where you have to pay the money back, with a reverse mortgage the bank pays you, say in a lump sum or in monthly payments. Once you no longer live in the home, you or your executor (if you’re dead) sells it and pays the bank back.

The foundation and Mehri & Skalet, a law firm, sued HUD in the wake of a policy letter in 2008 that seemed to state that widows or widowers who were not listed on a spouse’s reverse mortgage would have to repay the full amount of the deceased spouse’s mortgage. They’d have to do so even if the home was worth less than the outstanding loan.

Not long after, some surviving spouses found themselves unable to pay off the loans or get a new mortgage for the outstanding balance on the old reverse mortgage. As a result, they ended up in foreclosure proceedings. The foundation had sued on behalf of three of them.

This really is outrageous that HUD would foreclose on an underwater widow. Whoever made this policy didn't think it all the way through.

In a letter it released this week, HUD rescinded the 2008 letter. And while this week’s letter didn’t say so specifically, Jean Constantine-Davis, a senior attorney for AARP Foundation Litigation, reports that the lenders will now halt foreclosure proceedings against its three plaintiffs for the time being. A HUD spokesman did not return a call seeking comment.

The lawsuit is not over, though. The foundation hopes that a judge will confirm that HUD cannot ever force a widow, widower or heir to pay a reverse mortgage lender more than a home is actually worth, whatever the balance may be on the mortgage.

It also wants to establish surviving spouses’ right to stay in the home if they so choose, even if they weren’t party to the original reverse mortgage. That might mean that the lender is on the hook for the reverse mortgage loan longer than it expected to be. But Ms. Constantine-Davis said she thought that as the guarantor, HUD ought to buy the loans from the lender if this became a problem for the lender.

If that becomes too burdensome, HUD might make new rules that could, say, require that both spouses always be listed on the mortgage, while making some kind of provision for people who get married after one of them has gotten the reverse mortgage loan and wants to add a spouse to the mortgage.

Meanwhile, Ms. Constantine-Davis notes that HUD does not currently require both spouses to undergo counseling when only one of them applies for a reverse mortgage. (One spouse may apply alone because the monthly payout from the lender is usually higher if just the older spouse applies.) Without explicit counseling, spouses who are not on the mortgage may not know that they could end up in a situation like those of the plaintiffs in this case.

One easy fix might be for HUD to make both spouses come for counseling no matter what. Another, as I mentioned in a column a few weeks ago, is much simpler and doesn’t require more regulation: Don’t ever take yourself off the loan, even if it does mean that the payout is lower.

This issue will rightfully embarrass HUD, but it will quickly fade from the headlines.

Why I don't like reverse mortgages

First, needing a reverse mortgage is, IMO, a result of poor financial planning. The goal of good retirement planning should be to acquire assets that provide stable cashflow. Obtaining wealth without the ability to turn it into spendable cash is a big mistake. You can't eat gold or diamonds, and you can't sell part of your house.

.jpg)

The real reason I don't like reverse mortgages is because they are a Ponzi virus seniors take on which invariably leads to distress and the unceremonious fall from entitlement. Do you remember the story of the old widow from that post?

The aging socialite

A reader emailed me about the property that became the post HELOC abuse Hollywood Style. The property was purchased in the early 70s in Hollywood for about $150,000. The property was owned by a frugal couple that paid down their debts. The husband died in the late 90s leaving the wife with a beautiful and historic property with millions in equity.

I can imagine the husband's state-of-mind and heart on his deathbed; he knew he provided well for his family, and although his wife might outlive him for quite some time, he was leaving her comfortably and securely set up for life. The inner peace he felt is something I covet for my own death. So should we all.

If there is an afterlife, and if we have the ability to look in on loved ones after we pass, I hope for this man's spirit that he resisted the temptation and rests in peace. Watching his wife either through foolish choices or bad advice spend the family fortune and be forced to abandon the family home — a home that had millions in equity at the moment of death — watching that from afar with no ability to intervene is more akin to hell than to heaven.

For the widow, she must move out of her stately mansion, destitute and alone with only memories of her life of entitlement and glamor to comfort her, or torture her, as she lives out her life in relative obscurity after her unceremonious fall from entitlement. …

Reverse mortgages have limitations on mortgage equity withdrawal that make them less dangerous than HELOC abuse, but the basic dynamic is the same. Once people start tapping their equity, lenders and their compound interest will consume most or all the equity in the home before the senior dies.

Compound interest grows like cancer. if there are no payments, as there aren't in a reverse mortgage, if given enough time compound interest consume everything. Would you like to spend your retirement worried about running out of money? Let's imagine a few scenarios and see how you feel about this.

I could've used that money.jpg)

Imagine your late 60's, your children are stable and prosperous, so you decide you are going to blow a little of their inheritance. It's your money, you can do what you want with it; besides, the kids don't need it.

So you take out a reverse mortgage, or worse yet a HELOC, and you spend a little money. You don't go overboard and spend your house like the socialite in the story above, but you do spend enough that you feel worried that you might need it for yourself someday, so you stop using it.

After a while you forget about the loan since you aren't making payments, and you go about your life. Years go by, and your in your mid 80s, and you want or need some elective medical procedures that require you to come out of pocket. You remember the old credit line and you dig for a statement. You open one up and realize the debt grew as fast as your house went up in value. You still have a little equity, but the debt cancer consumed everything you once had. You can't afford your operation and you languish in discomfort in your final days — all because you took on that invisible Ponzi debt early in your retirement.

Riding the equity wave onto the rocks

Or imagine you are of retirement age, and you rationalize how you worked hard all your life so you deserve a few indulgences. You become a Ponzi accustomed to your great new life. This works great as long as you manage your debt in a sophisticated manner, right?

You do well until house prices crash again, your credit lines are cut off, and you lose your home. If your lucky one of your children is welcoming. If they're not, your life really sucks.

Recognizing the cancer debt

At some point, seniors who take on reverse mortgages recognize them for what they are: a malignant financial cancer. These debt tumors grow until they crowd out home equity. There is no cure, and the tumor cannot be removed without selling the house. The only cure is prevention.

It's worse than gambling

Nearly everyone who has gambled in Las Vegas has had a time when they lost more than they wanted to. Depending on how irrational you get, the financial pain can be mild or extreme. But when you lose in Las Vegas, your done. It's over. The loss doesn't get any worse. Your mistake doesn't haunt you for the rest of your life.

Reverse mortgages are different. If you make a mistake and take on a reverse mortgage, the losses of equity due to compound interest go on and on and get bigger and bigger.

It must be horrible to realize you have a financial leak you can't plug without going back to work or selling the house to pay off the debt. Your debt will continue to grow until you die.

Don't get a reverse mortgage

I apologize if i have belabored the point, but I really don't like these loans.

Here's the funny part: after this post comes out, we will probably be contacted by reverse mortgage companies wanting to buy links in our sidebar.

HELOC Abuse grade A

Today, i want to recognize a special mortgage achievement. The owners of today's featured property paid $190,000 back on 6/5/1999. They used a $75,000 first mortgage and a $125,000 down payment. Who does that? Why didn't they borrow $500,000 and buy a big house?

Perhaps they wanted to pay it off.

There is no other mortgage activity since 1999. During the housing bubble while their neighbors were going crazy, these owners paid down their mortgage. Kudos.

Irvine House Address … 72 NAVARRE Irvine, CA 92612 ![]()

Resale House Price …… $390,000

House Purchase Price … $190,000

House Purchase Date …. 5/6/1999

Net Gain (Loss) ………. $176,600

Percent Change ………. 92.9%

Annual Appreciation … 6.0%

Cost of House Ownership

————————————————-

$390,000 ………. Asking Price

$13,650 ………. 3.5% Down FHA Financing

4.84% …………… Mortgage Interest Rate

$376,350 ………. 30-Year Mortgage

$79,289 ………. Income Requirement

$1,984 ………. Monthly Mortgage Payment

$338 ………. Property Tax (@1.04%)

$125 ………. Special Taxes and Levies (Mello Roos)

$81 ………. Homeowners Insurance (@ 0.25%)

$395 ………. Homeowners Association Fees

============================================

$2,923 ………. Monthly Cash Outlays

-$325 ………. Tax Savings (% of Interest and Property Tax)

-$466 ………. Equity Hidden in Payment (Amortization)

$25 ………. Lost Income to Down Payment (net of taxes)

$49 ………. Maintenance and Replacement Reserves

============================================

$2,206 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,900 ………. Furnishing and Move In @1%

$3,900 ………. Closing Costs @1%

$3,764 ………… Interest Points @1% of Loan

$13,650 ………. Down Payment

============================================

$25,214 ………. Total Cash Costs

$33,800 ………… Emergency Cash Reserves

============================================

$59,014 ………. Total Savings Needed

Property Details for 72 NAVARRE Irvine, CA 92612

——————————————————————————

Beds: 1

Baths: 2

Sq. Ft.: 1263

$309/SF

Property Type: Residential, Condominium

Style: Two Level, Villa

Year Built: 1978

Community: 0

County: Orange

MLS#: S653803

Source: SoCalMLS

Status: Active

On Redfin: 2 days

——————————————————————————

RARE ON MARKET! Desirable Two Story TOWNHOME, With Direct Access to TWO CAR ATTACHED GARAGE in one of the most PRESTIGIOUS neighborhoods of Irvine. No one above or Below! This Beautiful TURNKEY Home Features a BRIGHT OPEN FLOORPLAN with CATHEDRAL/VAULTED CEILINGS & Lots of NATURAL LIGHT.  Completely REMODELED KITCHEN overlooks PRIVATE COURTYARD & BBQ Area. HUGE MASTER BEDROOM SUITE, with His & Hers Closet & Mirrored doors. Plus Large LOFT that could be used as an OFFICE/DEN OR 2ND BEDROOM. PREMIUM CORNER LOCATION with Upgraded Brick Floors on Front Porch, Custom MARBLE FIREPLACE & Foyer, Plantation Shutters, Crown Molding & More! . .. RESORT-LIKE Living at community POOL and SPA. Conveniently located by The Racket Club of Irvine, Rancho San Joaquin Golf Course, William R. Mason Regional Park, John Wayne Airport, Freeway Transportation, Shops, Restaurants, UCI and Highly Acclaimed Irvine AWARD-WINNING Schools. MUST SEE TODAY!!!

Completely REMODELED KITCHEN overlooks PRIVATE COURTYARD & BBQ Area. HUGE MASTER BEDROOM SUITE, with His & Hers Closet & Mirrored doors. Plus Large LOFT that could be used as an OFFICE/DEN OR 2ND BEDROOM. PREMIUM CORNER LOCATION with Upgraded Brick Floors on Front Porch, Custom MARBLE FIREPLACE & Foyer, Plantation Shutters, Crown Molding & More! . .. RESORT-LIKE Living at community POOL and SPA. Conveniently located by The Racket Club of Irvine, Rancho San Joaquin Golf Course, William R. Mason Regional Park, John Wayne Airport, Freeway Transportation, Shops, Restaurants, UCI and Highly Acclaimed Irvine AWARD-WINNING Schools. MUST SEE TODAY!!!

What does graffiti say about your community?

Some time ago I was looking at Google Earth images from my hometown. As I took a virtual drive down main street, I noticed the storefront from the old grocery store had been tagged by local high-school students.

Small towns have economic challenges. That's why they are still small towns. This grocery store was one of two locally-owned grocery stores put out of business when a big chain moved in. Today this site is a sand volleyball court for the adjacent bar and bowling alley, currently it's the highest and best use.

Despite the limited financial prowess of towns like this, the residents are happy and exhibit community pride. In other communities, abandoned buildings are often tagged and vandalized by disgruntled locals who rage against the economic depravity. In this community, the teenagers mark their territory with “We love A-F.”

Irvine is a more economically prosperous place than small-town Wisconsin, but it does seem to share the same good feelings about the local quality of life. I spotted the graffiti below in the tunnel below Long Meadow street on the Jeffrey Road entrance to Woodbury. It's probably still there.

.png)

All rooms are open to each other, making this a perfect floorplan for living & entertaining. Gorgeous slate tile flooring accents the main floor. Tranquil master bedroom features bath area with dual sinks, travertine tile floors, & walk in closet. Second bedroom has it's own private full bath w/ travertine tile floor. The versatile den could also be used as an office, playroom, nursery, workout room, or craft area. Your yard & outdoor living area is highlighted by a custom built in BBQ area w/ sink & slate topped dining bar, a patio trellis with outdoor lighting, & mature trees for privacy. Enjoy relaxing in this tranquil oasis at the end of the day. 2 car garage has built in storage. Walking distance to award winning Canyon View Elementary & Northwood High. A real gem!

All rooms are open to each other, making this a perfect floorplan for living & entertaining. Gorgeous slate tile flooring accents the main floor. Tranquil master bedroom features bath area with dual sinks, travertine tile floors, & walk in closet. Second bedroom has it's own private full bath w/ travertine tile floor. The versatile den could also be used as an office, playroom, nursery, workout room, or craft area. Your yard & outdoor living area is highlighted by a custom built in BBQ area w/ sink & slate topped dining bar, a patio trellis with outdoor lighting, & mature trees for privacy. Enjoy relaxing in this tranquil oasis at the end of the day. 2 car garage has built in storage. Walking distance to award winning Canyon View Elementary & Northwood High. A real gem!

.jpg)