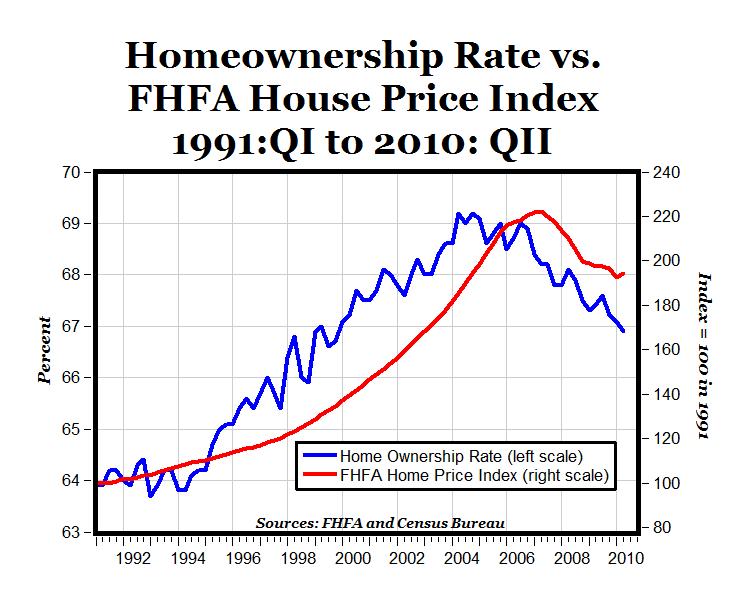

The Obama Administration's open policy of keeping house prices high benefits loan owners at the expense of renters and first-time buyers.

Irvine Home Address … 14691 FIR Ave Irvine, CA 92606

Resale Home Price …… $615,000

I kept the right ones out

And let the wrong ones in

It's amazing

With the blink of an eye

You finally see the light

Oh it's amazing

Aerosmith — Amazing

One housing bubble phenomenon was that the right ones — prudent people who knew what they could afford — were kept out, and the wrong ones — kool aid intoxicated fools — were let in. That mistake was bad enough, but now our own government is frantically working to repeat this mistake. Rather than doing something corrective, like letting house prices fall, our government is going to extreme lengths to keep the right ones out and keep the wrong ones in. Perhaps the administration is finally seeing the light, and in an amazing turn, they might actually let house prices fall.

Grim Housing Choice: Help Today’s Owners or Future Ones

By DAVID STREITFELD

Published: September 5, 2010

The unexpectedly deep plunge in home sales this summer is likely to force the Obama administration to choose between future homeowners and current ones, a predicament officials had been eager to avoid.

Eager to avoid? Every policy rolled out over the last 3 years from the plethora of Bailouts and False Hopes to the Federal Reserves manipulation of interest rates has been designed to keep inflated house prices high. All of these policies force future buyers to pay for the mistakes of bubble buyers.

Over the last 18 months, the administration has rolled out just about every program it could think of to prop up the ailing housing market, using tax credits, mortgage modification programs, low interest rates, government-backed loans and other assistance intended to keep values up and delinquent borrowers out of foreclosure. The goal was to stabilize the market until a resurgent economy created new households that demanded places to live.

As the economy again sputters and potential buyers flee — July housing sales sank 26 percent from July 2009 — there is a growing sense of exhaustion with government intervention. Some economists and analysts are now urging a dose of shock therapy that would greatly shift the benefits to future homeowners: Let the housing market crash.

This is not shifting any benefit to future homeowners. If house prices fall, it merely levels the playing field. Prior to the housing bubble, debt-to-income ratios were reasonable in most of the country, and allowing house prices to crash merely restores the previous order.

When prices are lower, these experts argue, buyers will pour in, creating the elusive stability the government has spent billions upon billions trying to achieve.

“Housing needs to go back to reasonable levels,” said Anthony B. Sanders, a professor of real estate finance at George Mason University. “If we keep trying to stimulate the market, that’s the definition of insanity.”

The further the market descends, however, the more miserable one group — important both politically and economically — will be: the tens of millions of homeowners who have already seen their home values drop an average of 30 percent.

The poorer these owners feel, the less likely they will indulge in the sort of consumer spending the economy needs to recover. If they see an identical house down the street going for half what they owe, the temptation to default might be irresistible. That could make the market’s current malaise seem minor.

Caught in the middle is an administration that gambled on a recovery that is not happening.

“The administration made a bet that a rising economy would solve the housing problem and now they are out of chips,” said Howard Glaser, a former Clinton administration housing official with close ties to policy makers in the administration. “They are deeply worried and don’t really know what to do.”

I find those revelations troubling and shocking. First, a rising economy was never going to solve the "housing problem." First, the problem with housing is that prices are too high. The problem isn't a lack of demand, or foreclosures or anything else it has been made out to be. The problem has always been that prices were inflated beyond any reasonable valuation metric, and prices needed to fall.

People in the administration guiding housing policy are under the impression that house prices are temporarily depressed and that putting people back to work will bring buyers to the market that will pay higher prices. That isn't going to happen. Even if we had full employment, prices would still have to fall because they are still too high for current incomes. Unemployment is not the primary problem. Unemployment makes the problem acute, and it causes other related economic problems, but the root of it all is that house prices are just too high.

I am shocked the administration does not see this basic fact. Every policy they have unveiled has only served to prolong the misery because the guiding principal — keeping house prices high — is antithetical to the problem. Their solutions all have one thing in common; they make the problem worse. This is an undeniable fact.

That was clear last week, when the secretary of housing and urban development, Shaun Donovan, appeared to side with current homeowners, telling CNN the administration would “go everywhere we can” to make sure the slumping market recovers.

The housing market is not slumping. Do you see the faulty mindset at work here? These people actually believe house prices are too low. They fail to see that house prices were in a bubble and rather than being in a "slump," house prices remain too high.

Mr. Donovan even opened the door to another housing tax credit like the one that expired last spring, which paid first-time buyers as much as $8,000 and buyers who were moving up $6,500. The cost to taxpayers was in the neighborhood of $30 billion, much of which went to people who would have bought anyway.

Administration press officers quickly backpedaled from Mr. Donovan’s comment, saying a revived credit was either highly unlikely or flat-out impossible. Mr. Donovan declined to be interviewed for this article. In a statement, a White House spokeswoman responded to questions about possible new stimulus measures by pointing to those already in the works.

Let's hope the political capital for further meddling in the housing market has already been spent.

“In the weeks ahead, we will focus on successfully getting off the ground programs we have recently announced,” the spokeswoman, Amy Brundage, said.

Among those initiatives are $3 billion to keep the unemployed from losing their homes and a refinancing program that will try to cut the mortgage balances of owners who owe more than their property is worth. A previous program with similar goals had limited success.

If last year’s tax credit was supposed to be a bridge over a rough patch, it ended with a glimpse of the abyss. The average home now takes more than a year to sell. Add in the homes that are foreclosed but not yet for sale and the total is greater still.

Builders are in even worse shape. Sales of new homes are lower than in the depths of the recession of the early 1980s, when mortgage rates were double what they are now, unemployment was pervasive and the gloom was at least as thick.

The deteriorating circumstances have given a new voice to the “do nothing” chorus, whose members think the era of trying to buy stability while hoping the market will catch fire — called “extend and pretend” or “delay and pray” — has run its course.

“We have had enough artificial support and need to let the free market do its thing,” said the housing analyst Ivy Zelman.

Ivy Zelman is the author of the Option ARM reset chart we have seen so much of. She has consistently been right about the housing bubble.

Michael L. Moskowitz, president of Equity Now, a direct mortgage lender that operates in New York and seven other states, also advocates letting the market fall. “Prices are still artificially high,” he said. “The government is discriminating against the renters who are able to buy at $200,000 but can’t at $250,000.”

That is the simple truth. Artificially high prices discriminates against renters who would like to buy. Low interest rates offset some of this problem, but payment affordability is no substitute for lower prices.

A small decline in home prices might not make too much of a difference to a slack economy. But an unchecked drop of 10 percent or more might prove entirely discouraging to the millions of owners just hanging on, especially those who bought in the last few years under the impression that a turnaround had already begun.

We are facing a tsunami of accelerated defaults. Far too many people are holding on because they have the same delusions as the government. Once they realize that prices are rolling over and they aren't coming back any time soon, many more struggling loan owners will accelerate their defaults and home prices will be crushed. As for those that were duped into buying over the last few years because they believed in the stability of the market, well… shame on the government, and shame on the NAr for peddling this lie. Every person Shevy and I have talked to over the last year and a half has been told that lower prices are a real possibility if not a near certainty.

The government is on the hook for many of these mortgages, another reason policy makers have been aggressively seeking stability. What helped support the market last year could now cause it to crumble.

Since 2006, the Federal Housing Administration has insured millions of low down payment loans. During the first two years, officials concede, the credit quality of the borrowers was too low.

The strongest argument I can make for inflation ahead is the fact that the government now backs most of the housing market. With the US taxpayer on the hook, a decline of 20%-30% is unlikely. The government will tell the Federal Reserve to crank up the printing press and force prices higher by stealing from savers through devaluing our currency. If they print enough money, they can make wages go up and stabilize house prices. Of course, this will have a whole host of negative consequences, but with the enormous liability the US government now has with our backstops of the mortgage market, I see inflation as inevitable, particularly if house prices start to really slide.

With little at stake and a queasy economy, buyers bailed: nearly 12 percent were delinquent after a year. Last fall, F.H.A. cash reserves fell below the Congressionally mandated minimum, and the agency had to shore up its finances.

Government-backed loans in 2009 went to buyers with higher credit scores. Yet the percentage of first-year defaults was still 5 percent, according to data from the research firm CoreLogic.

“These are at-risk buyers,” said Sam Khater, a CoreLogic economist. “They have very little equity, and that’s the largest predictor of default.”

This is the risk policy makers face. “If home prices begin to fall again with any serious velocity, borrowers may stay away in such numbers that the market never recovers,” said Mr. Glaser, a consultant whose clients include the National Association of Realtors.

I am embarrassed for consultants and economists that make foolish statements like that one. Borrowers will stay away until it becomes cheaper to own than to rent, then they will buy. It is really that simple. The kool aid intoxicated pay attention to price movement and momentum, but many buyers look at their current cashflow and determine that it is less expensive to own, so they buy to save money. That is what always puts a stable bottom in home prices.

Those sorts of worries have a few people from the world of finance suggesting that the administration should do much more, not less.

William H. Gross, managing director at Pimco, a giant manager of bond funds, has proposed the government refinance at lower rates millions of mortgages it owns or insures. Such a bold action, Mr. Gross said in a recent speech, would “provide a crucial stimulus of $50 to $60 billion in consumption,” as well as increase housing prices.

The idea has gained little traction. Instead, there is a sense that, even with much more modest notions, government intervention is not the answer. The National Association of Realtors, the driving force behind the credit last year, is not calling for a new round of stimulus.

Some members of the National Association of Home Builders say a new credit of $25,000 would raise demand but their chances of getting this through Congress are nonexistent.

“Our members are saying that if we can’t get a very large tax credit — one that really brings people off the bench — why use our political capital at all?” said David Crowe, the chief economist for the home builders.

If the builders and the realtors give up on stimulus, then no coherent voice is calling for it. Under those circumstances, nothing will be done.

That might give the Obama administration permission to take the risk of doing nothing.

Take the risk of doing nothing? OMG! Doing nothing is the cure to the problem! I can't believe the insanity that has gripped our policy makers. The mental disease of the housing bubble persists like a malignant tumor.

Thoughtless or reckless?

In the post HELOC Abuse Grading System, I describe some of the distinctions between borrower behavior:

The top of the range of D graded HELOC abusers is the limit of each borrowers self delusion when it comes to how much appreciation they feel comfortable spending without losing their homes. People who earn a D still planned to keep their homes, they were merely misguided by their own ignorance and the incessant Siren's Song of kool aid intoxication. These are the sheeple; like the rats St. Patrick cast into the sea, each borrower followed the Piper to their underwater mortgage and a watery foreclosure.

Most of the HELOC abuse posts I have done have been Grade E abusers because they are entertaining. When someone borrows and spends a $1,000,000, it is dramatic, and as an outside observer, you have to wonder what they spent all that money on.

Somewhere beyond the limit of self delusion, a borrower makes another psychological leap, they no longer worry about the consequences of their actions and they spend, spend, spend. This grading category spans the continuum from thoughtless spending to foolish and reckless spending where the borrower exercises no restraint at all.

HELOC abusers who get an E had to make an effort to spend. It takes time and effort to really spend beyond ones means one small transaction at a time. How many dinners out, trips to Vegas and other indulgences does it take to consume $1,000,000? I don't know, but grade E abusers try to find out.

In my opinion, the owners of today's featured property earn an E. They don't seem to have given much thought to their spending. It's hard to see how you can spend so much money and really believe your house was going to pay for it.

But was it reckless? Was their spending restrained and calculated in any way, or was it out of control? I will let you decide.

- This property was purchased on 6/4/2001 for $395,000. The owners used a $355,500 first mortgage and a $39,500 down payment (10%).

- On 12/27/2001 they obtained a HELOC for $34,000 and had access to their down payment.

- On 9/18/2002 they refinanced the first mortgage for $384,000.

- On 11/4/2002 they opened a HELOC for $45,000.

- On 12/8/2003 they got a $480,000 first mortgage and a $60,000 HELOC.

- On 7/14/2004 they refinanced again with a $586,000 first mortgage and a $71,000 HELOC.

-

On 5/11/2005 they got a $568,000 first mortgage and a $151,000 HELOC.

- On 8/25/2006, the obtained a stand-alone second for $165,400 right at the peak and maximized their mortgage equity withdrawal. Through periodic refinancing, they managed to obtain every penny of appreciation the moment it appeared, and they left nothing in the walls. The bank bought this property via bad loans right at the peak.

- Total property debt is $733,400.

- Total mortgage equity withdrawal is $377,900.

- They have been squatting about 20 months now.

Foreclosure Record

Recording Date: 08/19/2009

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 05/14/2009

Document Type: Notice of Default

I don't know how we could make kool aid any stronger than that. There are thousands of families out there like this one that extracted nearly $400,000 out of their homes and spent it. Then we allowed them to squat for a couple of years. With benefits like that — or at least the lure of potential benefits like that — it is no wonder that everyone in California wants to own a home and consider themselves a land baron or real estate investment genius.

Irvine Home Address … 14691 FIR Ave Irvine, CA 92606 ![]()

Resale Home Price … $615,000

Home Purchase Price … $395,000

Home Purchase Date …. 6/4/2001

Net Gain (Loss) ………. $183,100

Percent Change ………. 46.4%

Annual Appreciation … 4.5%

Cost of Ownership

————————————————-

$615,000 ………. Asking Price

$123,000 ………. 20% Down Conventional

4.34% …………… Mortgage Interest Rate

$492,000 ………. 30-Year Mortgage

$117,948 ………. Income Requirement

$2,446 ………. Monthly Mortgage Payment

$533 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$51 ………. Homeowners Insurance

$43 ………. Homeowners Association Fees

============================================

$3,074 ………. Monthly Cash Outlays

-$405 ………. Tax Savings (% of Interest and Property Tax)

-$667 ………. Equity Hidden in Payment

$194 ………. Lost Income to Down Payment (net of taxes)

$77 ………. Maintenance and Replacement Reserves

============================================

$2,273 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,150 ………. Furnishing and Move In @1%

$6,150 ………. Closing Costs @1%

$4,920 ………… Interest Points @1% of Loan

$123,000 ………. Down Payment

============================================

$140,220 ………. Total Cash Costs

$34,800 ………… Emergency Cash Reserves

============================================

$175,020 ………. Total Savings Needed

Property Details for 14691 FIR Ave Irvine, CA 92606

——————————————————————————

Beds: 4

Baths: 2 full 1 part baths

Home size: 2,095 sq ft

($294 / sq ft)

Lot Size: 5,000 sq ft

Year Built: 1972

Days on Market: 7

Listing Updated: 40423

MLS Number: I10092718

Property Type: Single Family, Residential

Community: Walnut

Tract: 0

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

Upgraded home in the highly desirable College Park Community. Upgrades include remodeled kitchen with granite counter tops & stainless steel appliance, double paned windows and sliders, remodeled bathrooms with travertine tile. Master bedroom features 2 large walk-in closets, upgraded bath with double sink and balcony. One bedroom and 3/4 bath downstairs. Front yard features a large gated courtyard with a gas fire pit and water fountain. Professionally landscaped backyard with tons of hardscape. Community amenities include Pool and Park. Walking distance to school and conveniently located close to shops and freeways.

With all these fabulous upgrades — the word upgraded or upgrades appears 3 times — why don't we have any interior pictures?

.jpg)

.jpg)