Everyone has their pet ideas for saving the housing market. Today's post analyses one of the better ideas I have seen so far.

Irvine Home Address … 23 CALISTOGA Irvine, CA 92602

Resale Home Price …… $799,900

You look like

A perfect fit

For a girl in need

Of a tourniquet

But can you, save me

Come on and, save me

Aimee Mann – Save Me

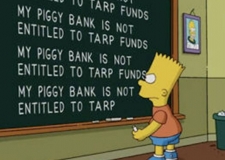

Some housing markets need a tournequet to stop the profuse bleeding of home equity. In the most beaten down markets, prices have overshot fundamentals to the downside. In Monday's post I discussed Another Dumb Idea to Shift Private Mortgage Losses to Taxpayers. Today, I am going to look at a much better proposal for dealing with the reality of millions of foreclosures owned by the US government.

GSEs to Lose Tens of Millions

Lisa Marquis Jackson — John Burns Real Estate Consulting

August 28, 2010

While officials were gearing up for the August 17, 2010 meeting on GSE reform, the GSEs were losing millions of dollars every hour. Why? Because home prices are falling again. We have a solution.

Recent Market Changes: When the tax credit expired on April 30, home buying activity slowed 30%+ and hasn't rebounded much while the number of homes for sale has risen. With lower demand and higher supply, it is once again a buyer's market, where sellers are forced to drop price if they want to sell. It will take almost 1 year to sell every home on the market right now! According to our proprietary survey of home builders across the country, new home prices nationwide have dropped 3% since the tax credit expiration, with declines in 9 of 10 regions, and we are seeing similar signs in the resale market. Falling home prices hurt almost everyone, especially Fannie Mae and Freddie Mac and the taxpayers that are now backing them.

Falling prices do not hurt buyers who want to see lower prices, but lower prices certainly do harm banks and now the US taxpayer who is backing the housing market.

DC Trip: This month, we spent time in Washington D.C. informing HUD, Treasury, Fed, Fannie Mae and Freddie Mac officials of what was going on. While most were not surprised about the price declines after we laid out the facts, we were pleasantly surprised at how much traction our proposal to help alleviate the problem received.

Proposed Rental Housing Solution: Falling home prices don't help anyone, and anyone who says we can let the free market take care of things is saying that it is ok for taxpayers and the banking system to lose many more billions of dollars, virtually assuring another recession and maybe worse.

Falling home prices do help sidelined buyers, and yes, it is okay for taxpayers and the banking system to lose billions of dollars. I don't think anyone really gives a crap about the banks, and if the taxpayers lose money perhaps those in charge that made taxpayers liable for losses they shouldn't be covering will be punished. Probably won't happen, but Ms. Jackson needs to recognize that not everyone shares her view that lower prices are the root of all evil.

To boost housing demand and limit supply, we propose the following:

1) Create an Apartment REIT: Distressed sales need to be kept off the market. Rent out the Fannie, Freddie and FHA REO (owned properties through foreclosure). These properties currently comprise 42% of the 562,000 REO and a large percentage of the 5.1 million homes currently in the foreclosure pipeline (already 90+ days delinquent or in foreclosure). This is best accomplished by contracting with an outside firm (competitively bid of course) to manage local property management firms. The rental income will be self-sustaining and the properties will be financeable in the public markets, just like publicly traded REITs are financeable. The GSEs will benefit from future price appreciation too, as opposed to being damaged by further price deterioration. The Banks, who currently own 22% of the REO, should also be allowed to contribute properties to the REIT. The Administration can keep pushing for loan mods if they want, and we heard over and over again how government doesn't want to foreclose on people. All we ask is that you keep the distressed sales off the market.

Some form of toxic turd fund as described above is the most likely solution to this problem. Renting a property is a far superior form of asset utilization than long-term squatting. People who are paying neither a mortgage nor rent need to be forced out or converted to rental status. In the post How Gaming Interests Could Save the Las Vegas Housing Market, and Why They Should, I laid out a private market solution that keeps owners in their homes and allows them to buy the property back at a later date. If this rent-to-own feature is added to the above proposal, I think the final piece to the puzzle will be in place. Of course, banks will resist the rent-to-own idea because it will encourage accelerated default, but if the government was really interested in keeping people in their homes they could do that. (Which shows where the government's allegiance is.)

Consider this: any loan requires some steady stream of payments to pay interest and recover the original capital. Since the loan balance is already set by the oversized loan of the bubble, and since the only available income stream is property rent, the GSEs could modify the interest rate on the loan to be as low as necessary to have the rental income stream pay off the loan over a 30-year term. In this fashion, the "loan" could be kept alive on the GSEs balance sheets and the debt can be retired over time by the rental income stream. There is no need to write down the loan balance if they have a steady income stream and if they control the interest rate. The taxpayers would avoid any paper losses backstopping these loans because the capital is preserved.

Once properties go REO, the GSEs can (1) keep the loan alive, (2) pay it down with the rental income from the property, (3) and offer the property to the former owners with an option to repurchase. This allows the GSEs to avoid costly write-downs, keeps people in their homes, and prevents a wave of foreclosures from pounding prices back to the 1990s like they have in Las Vegas. Isn't that what they are trying to accomplish?

2) Loans to Landlords: To stimulate demand and restrict supply on non-GSE distressed sales, have the GSEs make very safe loans to individuals or corporations who will promise to rent them out for an extended period of time. The GSEs should make a tidy profit on these loans, while also helping provide affordable rental housing to those who need it.

Sign me up for 10 of those loans. I want to buy cashflow properties in Las Vegas, keep them off the resale market, and provide an affordable rental. If they want to loan me cheap money to accomplish this, I will take all they want to offer.

3) Keep Mortgage Liquidity Flowing: Housing is extremely affordable right now [except in Coastal California], but the uncertainty in the mortgage industry is making underwriting more challenging, and uncertainty in the economy is hurting buyer confidence. Stop changing the underwriting rules so everyone knows what is required, and keep the fantastic financing environment. Once the economy turns around, real buyers will return to the market.

That is a fallacy. Many people who want to buy real estate will not be eligible to obtain a loan regardless of their income. The rent-to-own solution I outlined above will help alleviate this problem, but to suggest that buyers with good credit and a substantial down payment will suddenly emerge once the economy picks up is wishful thinking. It is a delusion everyone in the industry suffers from, particularly lenders.

We believe that the solutions above will also help restore home buyer confidence that prices won't plunge, which will boost demand.

That is a strong acknowledgement of the deflation physchology that rules the markets; although, I believe qualification standards create more problems then buyer psychology.

GSE Reform: As far as GSE reform goes, the answer is simply to turn back the clock. Fannie Mae was formed in 1938 to create mortgage liquidity, and the GSEs have played a very useful role in preventing another Great Depression, so we still need them. However, the GSEs need to be told ASAP that elected officials are not going to pull the rug out from under them so they can focus on helping manage us through the remainder of this crisis. Turn back the clock to:

- 1967, which was the last year before Fannie Mae became a publicly traded corporation. It is impossible to serve two masters, and allowing the entities formed to assure mortgage liquidity to have their strategies dictated by shareholders was a grave mistake.

- 1998, which was the last year before elected officials mandated that Fannie and Freddie grow homeownership by making more aggressive loans to low income households.

You can't go back. That simply isn't going to work. I discussed these issues in Can the GSEs Exist Outside of Government Conservatorship? We need to have a secondary mortgage market because it is the only way banks can manage asset-liability mismatch, but the GSEs are not the only method for maintaining a secondary mortgage market. As they are current structured, there is no way they can exist without the explicit backing of the US government. Any attempt to pretend they don't have this backing will be a joke.

We are sure this will create some controversy, particularly among extremists. I am staying out of the politics and making recommendations that we believe are sound business advice. For those who are running the troubled balance sheet of The United States of America, you need to act quickly to make sure that your asset values don't plunge. Only those who want to see you go bankrupt will oppose these ideas.

Sorry, but there are many reasons to oppose these ideas that are not extremist nor do they require a desire to see the United States go bankrupt. Give me a break.

Despite the occasional hyperbole, the ideas presented are good. If we add in the ability to keep owners in their homes with a rent-to-own arrangement, I think this proposal has real merit. If some solution like this is not implemented, we will see a repeat of the Las Vegas experience in every housing market in the country.

How low are prices in Las Vegas?

When I blather on about Las Vegas properties, people in Orange County can't quite wrap their mind around how much less expensive these properties really are.

The property pictured above is located in Henderson, Nevada. It is a 2000 SF 3/2 built in 2007 in a nice neighborhood. It originally sold for $339,993. The opening bid at auction is $92,605, and comps run about $130,000. It will likely sell for $100,000 to $105,000, and it may go for less than $100,000. That's about $50/SF. It would likely rent for about $1,250 a month. Comparable properties to this one in Irvine would cost $350/SF — seven times as much.

The cheapest 470 SF 1/1 in Irvine sells for $129,000 or $274/SF. The worst property in Irvine is more expensive than this nice middle-class home in Henderson, Nevada.

Does it make sense to you that the Orange County premium is that large?

Why Las Vegas prices are so low

What is it about the Las Vegas market that makes prices so low relative to the peak and relative to rents? When bubble bloggers first began describing what would happen when prices collapsed, the narrative when something like this: exploding loan payments would cause massive numbers of foreclosures, and this must-sell inventory would push prices lower because supply would increase and demand would collapse through a combination of deflation psychology and a diminished buyer pool brought about by all the foreclosures. In fact, this is exactly what has occurred in Las Vegas.

In a normal real estate market, properties trade at a discount to rents. Renting carries a premium because renting provides freedom of movement and insulation from liabilities for property maintenance or declining prices. However, if the renting premium becomes too large, renters are enticed by the lower cost of ownership, and many become homeowners in order to save money versus renting. If you look at historically stable housing markets, you will see the premium for renting is evident, and the premium is relatively stable.

Right now in Las Vegas, the premium for renting is very high. A property that costs $1,000 a month to rent can be owned for about $550 a month. So how does the premium get that large? It isn't because of deflation psychology. The entire buyer pool has been poisoned by foreclosure. There literally are not enough potential owner-occupants in the Las Vegas market to absorb the available inventory. Since there is a severe shortage of potential owner-occupant buyers, and no shortage of potential renters with jobs, the rental premium gets pushed to an extreme, and cashflow investors recognize this opportunity and begin buying to obtain great positive cashflow. (Yes, I know unemployment is high, but vacancy is not a problem for Las Vegas properties in nicer neighborhoods).

Think about it: we all knew the home ownership rate was going to decline because of the large number of foreclosures. That means many properties are going to get converted from owner-occupied to renter-occupied. The only way that happens is if prices fall so low that the rental income stream attracts cashflow investors. It doesn't take Nostradamus to see that cashflow investors were going to be called upon to clean up this mess.

This price-to-rent disparity exists in Las Vegas, and it will likely persist for another three to five years before the renter pool is cleared for home ownership through improved credit scores, expired waiting periods, and accumulated down payments. In the interim, cashflow properties will be abundant, and the returns to cashflow investors will be high. It is what it is.

It may seem like I am selling — and I do plan on selling readers these properties — but I am not exaggerating or puffing. I am merely educating readers to an opportunity to profit from the collapse of the housing bubble — an opportunity that hopefully will never occur again in our lifetimes. If you want to take advantage of this opportunity, I will facilitate that for you. If not, I can only lead the horse to water. Go to Las Vegas and see for yourself, or check out the listings on Realtor.com. Condos start at $12,000, less than 10% of what they cost here, and less than most will spend on their next car.

Her own private ATM machine

The married woman who bought this property as her sole and separate property treated it as her own personal ATM machine. If it doesn't cost you anything, and if you can get hundreds of thousands of dollars out of it that you never have to pay back, why not?

- The property was purchased on 12/5/2001 for $475,500. The owner used a $468,750 first mortgage and a $6,750 down payment.

-

On 4/16/2003 she refinanced with a $450,000 first mortgage.

- On 5/11/2004 she obtained a $600,000 first mortgage.

- On 7/7/2005 she got a HELOC for $106,000.

- Total mortgage equity withdrawal is $237,250.

- Total property debt was $706,000.

- She didn't get to squat long as Wells Fargo foreclosed on her quickly. Surprise, surprise, Wells Fargo did not originate the HELOC that was blown out in the foreclosure, so the process was expedited.

Foreclosure Record

Recording Date: 05/03/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 02/01/2010

Document Type: Notice of Default

She put down $6,750 and withdrew $237,250. Do you think she will want another house? I do.

Irvine Home Address … 23 CALISTOGA Irvine, CA 92602 ![]()

Resale Home Price … $799,900

Home Purchase Price … $475,500

Home Purchase Date …. 12/5/2001

Net Gain (Loss) ………. $276,406

Percent Change ………. 58.1%

Annual Appreciation … 5.9%

Cost of Ownership

————————————————-

$799,900 ………. Asking Price

$159,980 ………. 20% Down Conventional

4.36% …………… Mortgage Interest Rate

$639,920 ………. 30-Year Mortgage

$153,773 ………. Income Requirement

$3,189 ………. Monthly Mortgage Payment

$693 ………. Property Tax

$283 ………. Special Taxes and Levies (Mello Roos)

$67 ………. Homeowners Insurance

$145 ………. Homeowners Association Fees

============================================

$4,378 ………. Monthly Cash Outlays

-$755 ………. Tax Savings (% of Interest and Property Tax)

-$864 ………. Equity Hidden in Payment

$254 ………. Lost Income to Down Payment (net of taxes)

$100 ………. Maintenance and Replacement Reserves

============================================

$3,113 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$7,999 ………. Furnishing and Move In @1%

$7,999 ………. Closing Costs @1%

$6,399 ………… Interest Points @1% of Loan

$159,980 ………. Down Payment

============================================

$182,377 ………. Total Cash Costs

$47,700 ………… Emergency Cash Reserves

============================================

$230,077 ………. Total Savings Needed

Property Details for 23 CALISTOGA Irvine, CA 92602

——————————————————————————

Beds: 3

Baths: 2 full 1 part baths

Home size: 2,223 sq ft

($360 / sq ft)

Lot Size: 3,922 sq ft

Year Built: 2000

Days on Market: 39

Listing Updated: 40410

MLS Number: P746520

Property Type: Single Family, Residential

Community: Northpark

Tract: Othr

——————————————————————————

According to the listing agent, this listing is a bank owned (foreclosed) property.

This property is in backup or contingent offer status.

BANK REPO!!! BEAUTIFUL EXECUTIVE HOME IN GATED 'NORTHPARK'. FRESH INTERIOR TWO TONE PAINT AND NEW CARPET. TILED ENTRY, FORMAL LIVING ROOM WITH PLANTATION SHUTTERS, GUEST BATH WITH PEDESTAL SINK, OPEN AND BRIGHT KITCHEN WITH GRANITE COUNTERTOPS & CENTER ISLAND, SEPARATE FAMILY ROOM WITH FIREPLACE, CEILING FAN AND FRENCH DOOR, SPACIOUS MASTER SUITE WITH WALK-IN CLOSET AND BUILT-INS, DUAL SINK VANITY AND TILED FLOORS IN MASTER BATH, JACK AND JILL BEDROOMS WITH PLANTATION SHUTTERS, UPSTAIRS LAUNDRY ROOM. SUPER MOTIVATED SELLER. SUBMIT!!!

.JPG)

.jpg)

.jpg)

.jpg)

I hope you have enjoyed this week, and thank you for reading the Irvine Housing Blog: astutely observing the Irvine home market and combating California Kool-Aid since 2006.

I hope you have enjoyed this week, and thank you for reading the Irvine Housing Blog: astutely observing the Irvine home market and combating California Kool-Aid since 2006.