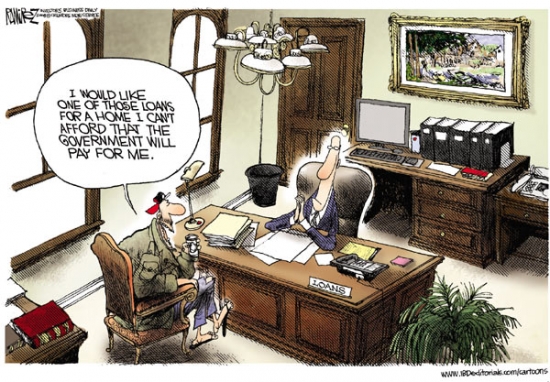

The Wells Fargo CEO is getting involved in the political posturing around mortgage market reform being considered in Washington. Today we will examine his recent statements on reform.

Irvine Home Address … 15 CANDLEWOOD Irvine, CA 92620

Resale Home Price …… $999,999

When you try your best, but you don't succeed

When you get what you want, but not what you need

When you feel so tired, but you can't sleep

Stuck in reverse

Coldplay — Fix you

The CEO of Wells Fargo, John Stumpf (I like saying that last name), has put forth some good ideas concerning mortgage reform. I recently reported that he wanted to see a 30% down payment requirement on the new qualified residential mortgage. His proposal is self-serving as his bank is better able to carry loans than small banks, but it also makes for good policy, so I'll embrace him when he's right.

Wells Fargo's John Stumpf: How to fix the mortgage mess

FORTUNE — For most Americans, their home is the largest and most important investment they will ever make. Ensuring that they have the right kind of mortgage is critical to their financial well-being and — as we've seen recently — critical to our entire economy.That means we have to solve the Fannie Mae and Freddie Mac problem and eventually figure out the proper role of the federal government in supporting a secondary market for home mortgages. Doing that right is one of the most important issues facing Congress and the Obama administration.

This issue is very important. As i wrote recently in Defining qualified residential mortgages: a battle over minimum down payments, “We have witnessed many tempest-in-a-teapot issues like robo-signer that flare up and go away without long-term impact on the housing market. This issue is different. The minimum qualifying standard on this loan is going to become the bedrock of mortgage finance. If we get this wrong, we will rebuild the mortgage market on a weak foundation.”

Some people ask, Why do we even need a secondary market for home mortgages? Why don't we just go back to the good old days before those markets existed and require banks to hang on to all the mortgages they create?

Let me tell you why. When I went to buy my first house in 1976, mortgage money was hard to find. In fact, it was rationed. Banks simply didn't have the deposits on hand to meet the demand. That was 35 years ago, and we don't want to go back to those “good old days.” Mortgage rationing is not the future we want for our customers, their children, or their grandchildren.

I would have no problem at all going back to the mortgage market of 1976. Mortgages were almost exclusively 30-year fixed rates, debt-to-income ratios were manageable, and house prices were affordable. The debt we created since then has only served to inflate real estate values, destabilize pricing, and increase the overall level of indebtedness among the populace. From a banker's point of view, the last 35 years made great progress — at enslaving the population.

Consider these facts: There are 76 million homes in the U.S., of which 51 million have mortgages. Taken together, those mortgages represent a debt of $11 trillion. That's a level of debt that banks can't afford to hold on their balance sheets alone. As a nation, if we want to make home ownership broadly available and affordable, we need a secondary mortgage market that operates fairly and efficiently for all parties.

Freddie Mac and Fannie Mae were created in part to help achieve those goals, but they've run into big trouble along the way. They now own or guarantee nearly 31 million home loans, worth more than $5 trillion. Their role is so critical in mortgage finance that the federal government bailed them out in 2008 to the tune of what might end up to be more than $250 billion.

This is how your tax dollars are paying the debts of Ponzis everywhere. The stupid loans both insured and purchased by the GSEs at the top of the housing bubble paid for many things I would rather not see my tax dollars go toward.

So as Fannie and Freddie unwind, as they certainly will, what principles should shape the future of home financing? I believe the answer comes in three parts. First, all parties involved in making and investing in mortgage loans need to share a financial interest in the quality of those loans. That includes the customer taking out the loan, the financial institution or broker originating the loan, and the investor who ultimately owns the loan. All parties need to have skin in the game. If originators don't have a financial interest in the loan, they will have less concern for its quality, and poor lending decisions will happen and be passed along to investors. That creates a house of cards.

I believe his analysis is accurate. Without financial accountability throughout the supply chain, the incentives are wrong, and bad behavior will ultimately ensue.

A healthy debate is already taking place about how much a homeowner should put down and how much a bank should keep on its balance sheet when it bundles and sells mortgage loans. There is no magic number out there, but I can tell you one thing: The more the risks and rewards of a mortgage loan are shared by all parties — and the better those risks and rewards are understood — the better the quality of the loan will be.

Will this mean higher down payments for homeowners and more financial skin in the game for banks? Probably so, but the long-term costs for homeowners, bankers, and the economy will be dramatically lower. Just look at what past mortgage lending practices have cost all of us.

Mr. Stumpf bears some responsibility for the past mortgage lending practices that caused our woes, doesn't he?

Second, whatever role the federal government assumes in mortgage finance going forward, its role needs to be explicit, not implicit. Currently federal backing for Fannie and Freddie is implied because they are “government-sponsored enterprises.” It needs to be crystal clear for investors around the world whether GSE loans are backed by the full faith and credit of the United States. If they are, consumers would benefit from worldwide liquidity for mortgage products.

Right now, it is crystal clear: GSE mortgage-backed securities are insured by Uncle Sam. There is little difference in risk between a 10-year T-bill and a GSE MBS. There is usually a spread between the two that represents the risk premium the market demands for risk of loss. With direct government backing, the spread is very small, so mortgage interest rates are relatively close to 10-year yields.

Keeping interest rates low allows lenders to roll over their toxic debt into amortizing loans insured by the US government. Eventually the mortgage market will be cleansed, or at least the losses will be transferred to Uncle Sam who can borrow money to pay for it. If lenders absorb all the losses, significant capital would exit the banking system, and our economy would be seriously impaired.

The private market at the government fringe — the jumbo market — is a complete mess. Spreads are high because jumbo loans carry risk, and the underwriting standards are high which means very few borrowers qualify. Hence, the high end has low transaction volume, and a lot of shadow inventory.

If we fully convert to a private market, mortgage interest rates will almost certainly rise because the private market will price the risk back in to mortgage-backed securities. If rates rise too soon, affordability will become a problem, and the supply liquidation will push prices lower.

To protect taxpayers, adequate levels of private capital should be required to take the risk of loss. In this way, the federal government would only act as a “catastrophe risk” backstop much like the role the FDIC plays in protecting bank deposits up to a certain limit. Banks would pay a fee, just as they do for FDIC insurance, and the homeowner's mortgage would be guaranteed up to a certain amount by the federal agency providing the insurance.

This is the traditional role of the FHA. The government through the FHA makes sure loans will always be made available to people who meet their underwriting guidelines. These guidelines are strict in order to protect the government from loss. And despite some weakening after the bubble, FHA guidelines still serve to limit the taxpayer's risk.

The private market is free to underwrite FHA loans, or it can create competing products to entice customers. Since the FHA is a government agency, it doesn't mind losing market share to the private sector. It has no pressure to change its guidelines to adapt to the market. If its market share goes down, the bureaucrats process less paper. They get paid the same either way.

The FHA is a worthy government bureaucracy as far as they go, but the rigid guidelines they adhere to make for a poor business model. Private sector lenders must be responsive to changes in the marketplace or they will lose customers and go out of business. Therefore private lenders must have more flexible guidelines than the FHA if they are to survive.

The GSEs are a poor synthesis of a government program and a private sector endeavor. The mandate of a government program is to provide financing and limit taxpayer risk. This is incompatible with the survival needs of a business entity. The GSEs were asked to provide financial innovation. Financial innovation is an oxymoron. It usually results in a financial bubble or Ponzi scheme.

The GSEs in their current form must die.

And third, as we move forward in a post-GSE marketplace, we need to make sure we have uniform underwriting and servicing standards for mortgage loans, and more common products for what are called conforming mortgage loans. An efficient secondary market depends on relatively standard products and processes. Otherwise every batch of loans has to be examined in detail for its unique qualities, an examination that results in higher transaction costs and ultimately less attractive investments. The lack of standardization drains the lifeblood out of secondary market operations.

Mortgage financing is a big deal for millions of Americans and for our economy overall. All sides should be looking for solutions that will help all Americans. The path forward will not be easy, but I truly believe the solutions can be found. It will require hard work, courage, and cooperation across the board.

The real question we must face with the GSEs is to what degree society wants to subsidize the mortgages of middle- and upper-middle class Americans. We could convert the shell of the GSEs back into a government program, sell off the portfolio of securities, and collect insurance fees to reserve for future losses. We could layer them on top of the FHA to provide price support to places like Orange County.

There will be many in Republican rural America that will resist the idea of their tax dollars going to subsidize the shenanigans they see on the Real Orange County housewives. Republican Orange County won't resist quite so much.

CNN Money on mortgage issues

A little Ponzi

Not all Irvine loan owners are big-time Ponzis. Some are merely frequent credit card consolidators who slowly but consistently grow their mortgage balances albeit at a rate less than appreciation. Is that wise?

In the HELOC Abuse Grading System, I described people like this:

HELOC Abuse Grade C

I hate to give borrowers in this category a “passing” grade, but this is the reality for most Americans. Growing credit card or mortgage debt slowly generally can be compensated for through home price appreciation, and although I consider this a bad idea, I can't really call it HELOC abuse, just foolish HELOC use. Is there a distinction there? I will let you decide.

Financial planners will tell you that most people fail to budget properly for unexpected expenses (they don't save), so when they fall behind a little each month, they put the balance on a credit card and hope they can pay it back with a tax return — or during the bubble with a visit to the housing ATM.

People are still going to manage their bills this way going forward, and there will be pressures to “liberate” this equity to pay for these expenses. The money changers will continue to peddle this nonsense as sophisticated financial management. It is a stupid way to manage debt, and I give it a C.

This property was purchased at the bottom of the last real estate crash.

- On 9/22/1997 they paid $301,000 for today's featured property by using a $240,450 first mortgage, a $30,050 second mortgage, and a $30,600 down payment.

- On 1/12/1999 they obtained a $55,000 stand-alone second and withdrew most of their down payment.

- On 1/29/2002 they refinanced with a $282,000 first mortgage.

- On 7/9/2003 they refinanced with a $322,700 first mortgage.

- On 7/14/2006 they refinanced with a $322,000 first mortgage. I am impressed by that one. Three years after their last refinance, a period in which their property value went up 50% or more, they did not add to their mortgage.

- On 5/23/2008 they refinanced with a $350,000 first mortgage.

- On 8/3/2010 they refinanced one last time with a $360,000 first mortgage.

The will likely leave the closing table with a $500,000 check. It's not as big as it could be, but it is much more than most Ponzis take with them.

The problem with Ponzi borrowing isn't the high-profile flame outs I profile here frequently. The real problem is the pervasive use of Ponzi borrowing to sustain daily life. It's the little guy multiplied millions of times that destabilizes our economy. California has become so dependent upon borrowed money that the entire state economy crumbles when mortgage money fails to flow in.

The only real solution is a period of frugality and economic weakness while the Ponzis adjust to living within their means. We will see some of this natural economic purging take place as many Ponzis endure the unceremonious fall from entitlement. However, this cleansing will not go far enough because government policy and our federal reserve seem determined to keep the Ponzi scheme alive.

Irvine House Address … 15 CANDLEWOOD Irvine, CA 92620 ![]()

Resale House Price …… $999,999

House Purchase Price … $301,000

House Purchase Date …. 9/22/1997

Net Gain (Loss) ………. $638,999

Percent Change ………. 212.3%

Annual Appreciation … 8.8%

Cost of House Ownership

————————————————-

$999,999 ………. Asking Price

$200,000 ………. 20% Down Conventional

4.84% …………… Mortgage Interest Rate

$799,999 ………. 30-Year Mortgage

$203,304 ………. Income Requirement

$4,217 ………. Monthly Mortgage Payment

$867 ………. Property Tax (@1.04%)

$150 ………. Special Taxes and Levies (Mello Roos)

$208 ………. Homeowners Insurance (@ 0.25%)

$165 ………. Homeowners Association Fees

============================================

$5,607 ………. Monthly Cash Outlays

-$1023 ………. Tax Savings (% of Interest and Property Tax)

-$990 ………. Equity Hidden in Payment (Amortization)

$371 ………. Lost Income to Down Payment (net of taxes)

$125 ………. Maintenance and Replacement Reserves

============================================

$4,089 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$10,000 ………. Furnishing and Move In @1%

$10,000 ………. Closing Costs @1%

$8,000 ………… Interest Points @1% of Loan

$200,000 ………. Down Payment

============================================

$228,000 ………. Total Cash Costs

$62,600 ………… Emergency Cash Reserves

============================================

$290,600 ………. Total Savings Needed

Property Details for 15 CANDLEWOOD Irvine, CA 92620

——————————————————————————

Beds: 4

Baths: 3

Sq. Ft.: 2350

$426/SF

Property Type: Residential, Single Family

Style: Two Level, Georgian

View: Canyon, Fields, Mountain, Orchard/Grove, Park/Green Belt, Trees/Woods

Year Built: 1998

Community: Northwood

County: Orange

MLS#: S653275

Source: SoCalMLS

Status: Active

——————————————————————————

* * * ONE OF ONLY 10 HOMES ON A SINGLE LOADED STREET FACING MEADOWOOD PARK AND CANYON VIEW ELEMENTARY SCHOOL * * * Cleaner than a Microsoft and Apple computer lab – COMBINED!!! MOST UNIQUE LOCATION ON THE IRVINE RANCH! Light and bright east facing with cathedral ceilings! Incredible privacy and location. Amazing floor plan with guest suite downstairs, 3 bedroom upstairs with option for bonus over garage or 5th bedroom with own bathroom. upgarded with cutom paint, large covered patio, granite kitchen counters, upagrded cabinets, plantation shutters. Hardly been lived in and immaculately clean!

MOST UNIQUE LOCATION? I don't think uniqueness can be modified. How is something less unique than something else? It's either unique or it's not, right?

* * * Cleaner than a Microsoft and Apple computer lab – COMBINED!!! He has a sense of humor.

upgarded? upagrded?

What were you doing at 10:50 last night?

Last night due to a technical problem at 10:50, I lost today's post. I last successfully saved the basic infrastructure of a post, but the analysis of the CEOs comments — something I spent two hours writing — was gone.

For a moment, I was in total shock. I could believe what happened. After a few unsuccessful attempts at recovery, I conceded defeat, and I was devastated. The sense of loss was powerful and jolting. Then the reality of staying up late to re-write the post set in, and I was just devastated (and pissed). I sought out my wife to calm down.

I didn't realize how important it was to me to put up a daily post (weekdays anyway). I felt like an injured Brett Favre who wanted to start if for no other reason than he always started. Some guys are just built that way. I calmed down, wrote this pep talk to myself, drank my coffee, and hunkered down to rewrite it all. Reliability trumps sleep.

And the tears come streaming down your face

When you lose something you can't replace

When you love someone, but it goes to waste

Could it be worse?

Lights will guide you home

And ignite your bones

And I will try to fix you

Coldplay — Fix you

The best quote I’ve seen about financial innovation was from former Fed Chairman Paul Volker who said that the only true financial innovation of the last 20 years that added real value to the economy was the ATM machine. The rest of innovation was just gambling.

I don’t see the point in 30% down, I think 20% down was working just fine. It all went downhill when that started getting chopped down to 10%, then 5%, 3%, and eventually to no-down. Preserving the 20% down should keep homeowners feeling plenty vested to think extremely hard about abandoning ship. It will likely go far in keeping prices in check, which will in turn keep volatility in check and equities more intact.

Actually, I feel pretty strongly that just this requirement alone should greatly reduce the problems of the past 10 years in the credit market. We don’t even need to mess with controlling the securitized assets if the government restricts over-leverage with this single requirement. There would be no way to build an over-abundance of risky assets when only those with the cash can get a loan.

Gepotah, I agree, If there is not a bubble, 20% down should work fine. That said, I think programs that reduce the interest rate and amortization term incrementally based upon down payment are smart, many programs offer a lower rate for 25% down vs 20% down and for 20 year fixed vs 30 year fixed.

Policy and in this case loan programs can dictate behavior. Just as neg am and stated income encourages the wrong behavior and bad financial management, programs that encourage more responsible lending and good financial management should be promoted and those smart enough to take advantage should be rewarded.

Thank you for taking the time for the rewrite. I know the feeling of doing a data dump and then having to recreate it. 😉

Oh yes, just about forgot to mention that I close escrow today! We moved here from St. Croix to Irvine to Rancho 20 months ago and have found our home here in Ranch Santa Margarita. I’ve enjoyed your blogging and the information provided helped me to make, IMHO, an intelligent long-term decision. So I guess I’m no longer MovingBack and shall now call myself BackHomeAgain.

Thank You.

:cheese:

You’re welcome. I am delighted you find value in the writing here, and congratulations on your new purchase. You made my day.

100% down should be the requirement.

Would you still feel that way if you were selling a house?

I don’t understand the issue with 20% down. It allows the lender to get complete, or almost complete recovery in the vast number of cases.

Add to 20% down a decent credit score and verification of income and call it a day.

At that point our best and brightest needs to figure out what to do with the 1 trillion + the gov is borrowing every year.

Assuming this family lived there the entire time since 1997

Cashing out and departing the closing table with net a $500K check is an excellent move.

In the same time frame, renting in Irvine means you were SOL.

Yep. As our esteemed host frequently points out, timing matters.

I wouldn’t necessarily call buying right before the housing bubble “an excellent move”. It’s unlikely that they planned on benefiting from the largest economic bubble in the history of mankind. Instead they probably bought because it was cheaper than renting (yes, there actually was a time like that in Irvine). Just because you see a baby on third base don’t assume they hit a triple.

Mike Dunn is famous (or notorious) for his listing descriptions. One of my favorites is:

“End of cul de sac, more upgrades than Taj Mahal, Forbidden City, Taipei Tower and the Burj Dubai combined!!!!”

I wonder how his clients feel about his listings… although I’m sure they just want it sold at a high price.

Yes, I have noticed other listings he has done where he slips in a zinger. I think its great.

Yeah, Mike knows the market dead-on.

If you were to use something like Google Docs (or even Gmail) to compose your comments, you probably would not need to worry about losing anything you write. “An ounce of prevention….” Furthermore, because you post your comments publicly, I suppose you wouldn’t need to wrestle with the inherent loss of privacy associated with putting data “in a cloud.”

By the way, although I think you may be a bit obsessed with this blog, I enjoy your astute commentaries. I’ve learned much by reading your comments and those of the other contributors. At the risk of coming across as a preachy do-gooder, because I tend to become far too obsessed myself for my own good, I see many signs that you may be harming your overall health with your current behavior. I’m sorry to preach (I certainly have many, many shortcomings myself) but my hunch is that if were to listen to your wife- who I expect says things like, “Honey, why don’t you come to bed now?”- you might be better off.

The thought crossed my mind last night as well.

It’s all good. I was a bit fatigued today, but I am in good spirits.

[Part 1 of 2]

At the risk of sounding like some preachy know-it-all who thinks he is all high and mighty, I’m going to offer you some more food for thought (pun intended, see later in this observation).

If you accept the following two aphorisms, “Behind every good man is a good woman”

and

http://en.wikipedia.org/wiki/Anna_Karenina_principle

“Happy families are all alike; every unhappy family is unhappy in its own way.”

then when your wife says, “Hey honey it’s getting late, you need to come to bed” you’ll heed her call in spite of what I suppose is a voice inside your head that says something, “I’ve got to get this done!” That later voice is the siren song of obsession which, like a mirage, can easily lead one astray. I regret that I have heeded that siren song for much of my life.

I know it probably seems obvious, but it’s also probably worth reminding you that your family and your health are far more important than this blog.

Personally I’m a bit like border collie: I tend to succumb to workaholism unless someone or something intervenes to stop me. Unfortunately I’m not married yet. But I’m working on it. I suspect you have a similar workaholic tendency. Although our society tends to applaud workaholics such as Steve Jobs, Bill Gates, Warren Buffet, and so on, it’s not a healthy way to live.

If you approach your wife and say, “Honey. I love you and need your support. I’m spending too much time on this blog. Please help me to keep my blogging habit under control” I strongly suspect not only will your wife smile with a huge grin of joy and relief, but she will be very glad to assist you. Generally speaking, wives yearn to both emotionally support and improve their husbands.

After all, women tend to be attracted to men who they believe can provide and protect whereas men tend to be attracted to women who they believe can birth and nurture. Given your use of songs to introduce postings, here’s one you might be able to relate to: the song does *not* go, “Oh your ma’s rich and your daddy’s good lookin.'” instead it’s, “Oh your daddy’s rich. Your ma’s good lookin.'”

A quick search on Google turned up this:

https://www.youtube.com/watch?v=T03SxaUSs5Q

If you explicitly ask your wife for support in this area, I suspect it would be a bit like offering a bowl of milk to a cat or jar of honey to a bear.

Also, why not broaden the scope of your blog (from Irvine to the US) and then charge $10 for annual subscriptions to your blog? If you were to eventually get 10,000 subscribers (a big “if”) then you’d probably make about $100,000 per year or so. I’m assuming your operating costs would be negligible.

Content is king. In the field of writing, it always has been and always will be. I think you write great stuff. I hope that if you were to spend 10 hours or so each week marketing your blog via Facebook, Twitter, LinkedIn etc., you’d get 10,000 subscribers within a few years.

The common notion that all content on the Internet must be free is absurd on the face of it. Besides, if the price to your subscribers were less than $1 per month (that’s about 5 cents per day) and if your subscribers knew that virtually all of the money they were paying was going into your pocket (not some big corporate entity) then I think many of your readers would be glad to support you. Although I never read his book, I seem to reacall that more or less, this is what Bill Gates predicted in “The Road Ahead.”

Warren Buffet has opined that in the short run the stock market is a voting machine; in the long run it’s a weighing machine. In the long run, I’m hoping that 10,000 folks would “weigh” your content to be worth $10 per year. I think if each of us found 10 bloggers whose work we enjoyed, many of us would pay $100 per year ($10 per month) to read their daily musings particularly if we didn’t need to navigate past increasingly invasive advertisements and worry about the inherent conflict of interest and resulting bias that necessarily occurs when writers become beholden to advertisers.

I predict history will not be kind to AOL’s acquisition of blogs such as the Huffington Post and TechCrunch not merely because the best authors from those sites will likely bolt and post articles exclusively on their own websites (thereby garnering ad revenue for themselves instead of AOL).

Of course those authors will need to keep advertising from being too annoying and/or charge a low enough price to keep readers from trying to obtain pirated copies of their work which they charge for. I could be wrong of course, but I suspect that $10 per year for access to your ad-free blog is probably price point that many in your audience would be comfortable paying. But you could try offering both a $10 per year version of your blog and a free version of your blog with ads. Personally, I’d gladly pay for the ad-free version.

[continued in part 2]

[Part 2 of 2]

I would be pleasantly surprised if you are currently earning enough money from you blog via home sales and Las Vegas real estate investors to justify working as hard as you do on your blog. In other words, I worry that even for a workaholic like you, you are going to run out of steam unless you start making more money from this blog. Again, I hope I’m wrong. And losing your blog would be a real shame for me personally and for our society as a whole because you really do provide a very valuable service.

Frankly, I wish schools would introduce blogs like yours and CalculatedRisk into the curriculum. Actually, I think contacting college professors in economics departments and business schools might be an effective way to market your blog. However, powerful interests (such as mainstream media and the National Association of Realtors) are not going to go away now or ever. As with many other primates, we humans tend to form cabals to control large groups of our fellows. But bloggers like you are making great strides towards helping folks like me see past the veil of propaganda spouted profusely by the Ministry of Truth (or the Wizard of Oz).

Reaching out to your readers to get $10 per year is a way to help you help us. In asking for $10 per year from your readers you might post an article entitled with the following quotation from the inimitable Jerry Maguire saying/pleading, “Help me help you!” That would be the carrot. The stick would be, I’m going to start making money (in the vernacular of advertising: monetize eyeballs) from folks who don’t pay by posting ads on my free blog from a source such as this one http://web.blogads.com/publisher_html

This is just my 2 cents. Please feel free to ignore my advice. But one of my favorite podcasts/blogs seems to have ended http://losblogueros.net/ I suspect they didn’t make enough money to justify the work. I’m rooting for another one of my favorite blogs, http://www.ginatonic.net/ but I worry Gina will run out of steam too unless she starts making more money from her blog.

IrvineRentor I’ll do $10.00!

Dude, has anyone ever clued you in to your insufferable busybody tendencies??? If not, they should have long ago.

I am sure IR is capable of managing his own life and stress and finances without your sage advice. I for one applaud his admirable work ethic and dedication.

IR does not strike me as one in risk of tottering over the edge any time soon. Save your prognostications of psychological doom for the Dr. Phil Blog.

+1. Just think, individuals like this are running our government…scary.

There is little difference in risk between a 10-year T-bill and a GSE MBS. There is usually a spread between the two that represents the risk premium the market demands for risk of loss. With direct government backing, the spread is very small, so mortgage interest rates are relatively close to 10-year yields.

—-

This is incorrect. GSE MBS have prepayment and liquidity risk. That is the main reason why they have different rates to similar duration treasuries.

IrvineRenter, 2 much scotch………… sorry 4 the typo.

Thank you Larry, for finding the energy and losing the sleep to rewrite your post. I’ve gotten so addicted to IHB that it would wreck my day if there wasn’t a new one to read. It will be a long slow withdrawal for me when you stop writing.

I second the $10!

> I calmed down, wrote this pep talk to myself, drank my coffee, and hunkered down to rewrite it all. Reliability trumps sleep.

Attaboy!

An thanks to Mrs. IR too. 🙂

(to readers) less effective way than the $10 site fee to show Larry your appreciation is to buy his book. Some of that $ will go to Amazon and the publisher, but some will go to him, and it will help the book’s sales #s.

Have you ever polled your readers to get a profile for advertisers? I’d imagine you’d be getting a good slice of your local population and out-of-state readers would be well-educated and fairly high income (attractive eyes for advertisers).

Bill Gates and Steve Jobs stopped writing code a long time ago. You could add guest posters, or other regular contributors.

Great advice from John Stumpf!

I’m a new reader of your blog. I don’t have an astute observation, but a question for you. We are currently renting and we want to buy a $600,000 home. We have $350,000 for a down payment and no debt. We also need the tax write off of a home. Would your advice be to wait since prices are coming down, or buy now?

Thank you!

Hi Betsy;

Thanks for the note. Historically speaking one is better off buying when interest rates are high and prices are lower and then refinancing when rates go back down. Since you have such a large down payment, the artificially low interest rates that are keeping prices high are working against you.

Buying in today’s market makes more sense for people that plan to leverage and have lower down payments, particularly under 30%, are planning to hold long term, and find a home that is below rental parity. With such a large amount down, you should speak with your accountant to make sure that you have the benefits of the tax write-off in the proper perspective. In addition, with artificially low rates and the banks holding back shadow inventory and all of the loan modifications that will serve as a short term band aid, there is a lot more downside risk than upside potential.

There are a lot of factors that come into play, you can email me at; shevy@idealhomebrokers.com and to set up a time to meeting and discuss your individual situation.

“historically speaking”

LOL

History, it isn’t as long as it used to be.