The North Korean Towers are still dark at night. Prices are still falling and equity is still burning. Even with the huge price reductions, asking prices are still well above fundamental valuations. These units are perhaps the most toxic assets in Orange County.

Asking Price: $430,000

Address: 3131 Michelson #802, Irvine, CA 92612

Down In It — Nine Inch Nails

Kinda like a cloud I was up way up in the sky and I was feeling some feelings

…but I watched it way too long and that dot was pulling me Down.

I was up above it.

Now Im down in it

I last profiled a property in these towers back in May of 2008 with the post Equity Inferno. The post was very popular. At the time, a realtor who owned the unit was asking $1,080,000 for an eighth floor unit in building 3141. Today we have an eighth floor unit in 3131, the building next door, asking $430,000. That is some serious equity burn.

Just for amusement, I calculated the equity burn for our savvy realtor/investor in 3141 Michelson #808. He paid $1,035,000 three years ago in March of 2006. Over the last 36 months, this property has decline in value $605,000 based on the nearly identical unit being profiled today. That puts the monthly equity burn at $16,805 ($605,000 / 36 = $16,805).

However, you could look at it from his point of view. In May of 2008, this guy tried to sell the place for $1,080,000. Apparently, he must have felt the property was worth this much, if only in his own mind. Therefore, in his world (assuming he accepts the $430,000 comp as the true value), his property has lost $650,000 in value over the last 10 months. That translates to a $65,000 monthly equity burn.

Great investment.

Clearly this qualifies as one of the most toxic assets in Orange County.

Income Requirement: $107,500

Downpayment Needed: $86,000

Monthly Equity Burn: $3,583

Purchase Price: $679,500

Purchase Date: 1/20/2006

Address: 3131 Michelson #802, Irvine, CA 92612

| Beds: | 2 |

| Baths: | 2 |

| Sq. Ft.: | 1,367 |

| $/Sq. Ft.: | $315 |

| Lot Size: | – |

| Property Type: | Condominium |

| Style: | Contemporary/Modern |

| Year Built: | 2006 |

| Stories: | 1 |

| Floor: | 8 |

| View: | City Lights, City |

| Area: | Airport Area |

| County: | Orange |

| MLS#: | S568365 |

| Source: | SoCalMLS |

| Status: | Active |

| On Redfin: | 4 days |

first Luxury High-rise Towers. This lowest priced popular C plan at The

Marquee Park Place features a 2BR & 2BA plus a Den floor plan. Walk

to restaurants , retail and more. This unit also features GE Monogram

stainless appliances, granite countertops, rich cherrywood floors &

Cabinetry, marble finishes in the bath. Enjoy the amennities of 24 hour

concierge, guard gate, billard & meeting rooms, fitness center,

pool, spa, and BBQ’s..

amennities? billard?

For whatever reason, the database on these properties is difficult to sort through. I cannot find the mortgage information. From what we do know, this property is being offered for 37% off its purchase price. If the property sells for asking, and if a 6% commission is paid, the total loss on the property will be $275,300.

I must confess, I get a special schadenfreude from this property. The hubris of buyers there was best epitomized by the exchanged I documented in the last post on these towers. I still think of those poor souls who drank the kool aid and purchased there… and I giggle.

{book2}

Kinda like a cloud I was up way up in the sky and I was feeling some feelings

You wouldnt believe sometimes I dont believe them myself and I decided I was

Never coming down. just then a tiny little dot caught my eye it was just about

Too small to see. but I watched it way too long and that dot was pulling me

Down.

I was up above it.

I was up above it.

Now Im down in it

I was up above it.

I was up above it.

Now Im down in it

Down In It — Nine Inch Nail

I remember the previous comment threat and I get satisfaction from revisiting this property as well. Until I realize that I’ll be paying for this guy’s irresponsibility, along with everyone else’s, via my tax dollar. Well, until the USA declares BK and defaults on its loans…

That said, I really like living in a “flat”. But part of the allure of a high density lifestyle is a walkable neighborhood. I believe that isn’t the case with this condo. Plus, I’m still not sure why I would pay $315 per square foot when plenty of houses are selling for less than that in Irvine. Yes, this building is new and nice, but what about a yard and privacy? Doesn’t it make sense that houses — which are more expensive to build per square foot and come with a yard — should cost more on a square foot basis than flats? Am I missing something, or just being silly by making sense?

I think your point of a “walkable neighborhood” is a valid one and I don’t think the infrastructure around these developments supports that definition.

Sure, there are a few shops off Michelson that you can walk to but I don’t know if I would define it as urban living or whatever concept they were trying to sell when they built these monsters.

I’m also not sure about the $1200/month HOA fee for all of that crappy walkability.

For that price, I can lease a new S-Class every other year, and then who wants to walk?

As the traders say “I’m fartin’ through silk, baby!”

I say “Dayum, I better get my hedges trimmed for 1200/month.”

Chuck

Nobody walks in LA!

Good one Chuck!

$1,200 a month! Holy Excrement Batman!

Are we sure that’s not an error-maybe the fees are actually $1,200 a year ($100 a month)?

It’s probably correct. Few people actually live in those things and few of the remaining “owners” pay their association dues. That means the rest have to make up for what the others aren’t paying. Just one more reason I don’t want a condo.

$1200 is when everyone pays. It will be much higher when foreclosure sets in

Houses are more expensive to build?

I think so, though I’m not an expert. But doesn’t it make sense? Each SFR lot needs separate connections (sewage, electricity) partial road, a driveway, its own foundation and, generally — even in tracts — some kind of customization. Plus, there’s often lawn or pools to contend with. An apartment building, on the other hand, is one design with a series of identical boxes inside. Can anyone with more construction knowledge comment?

Oh yeah, and then there’s the matter of land values. 20 condos can stand on an acre if built up. That will only suit 3 or 4 houses. There’s a reason the Irvine Co has been building tons of “townhouses”, right? More profit.

Construction pro here… you hit it all right on the head, Abroad… that’s exactly why the Irvine Co and the rest of their developer cohorts have been pushing high density development. Trying to get more “bang for the buck”.

High rise construction is insanely expensive, way more than a house.

Yeah, but per square foot? If you build a twenty story tower that contains the same square footage of twenty houses, which would cost more to build-the tower, or the twenty houses?

Even if it does cost more to build (like double), it uses only 5% of the land, so there’s still a good savings assuming the land has significant value, like most land in Irvine.

By any measure, high-rise construction is much, much more expensive than SFD construction. The only thing that justifies high-rise construction is the cost of land. Where land costs are very high, you can pay the higher cost of construction and divide the land costs by a large enough number of units for it to make sense.

Single family detached homes are the cheapest to build. Attached homes have greater complexities and coordinations and the cost is 10%-30% higher. A highrise is more complex and a huge task in coordination and construction safety and logistics then add another 400%.

Wow, I never would have guessed attached homes are more expensive than an equal number of SFDs. So the lower price point is purely due to the maximized density (and lower desirability), eh?

Now I can understand even more why detached condos and other high-density detached houses became popular in Irvine in recent years. I would certainly prefer to give up some square footage in return for two exterior walls and an intervening air space separating me from my neighbor.

Attached is generally more expensive because they tend to be smaller. They still have the same amount of expensive kitchen and bathroom space and less of the inexpensive living and bedroom space, so the average cost per square foot is higher.

Ah, that makes sense — thanks.

Honestly (having moved to CA from NYC some time ago), I would like to live in a place like this and considered these when they first went up, but decided they were too expensive.

Now, I LIKE this price a lot, but still won’t live there:

THE HOA DUES IS $1,200/mo.!!!

For that the the concierge should personally come to your bathroom and wipe your backside for you…

Yes, the prices are dropping to earth and at some point this will be a nice property to live in with a reasonable mortgage.

As it is, the HOA fees are the deal killer. Twelve hundred buckaroos a month is simply the deal killer.

Me thinks this place will either have to jettison a lot of those luxury amenities and drop the HOA to something more like 500 a month or it will turn out to be the “Irvine Projects”.

When this property was first profiled, I think I calculated rental parity at about $320,000. It is so low because of the HOA fees. Perhaps someone may get the ambition to plug the numbers into the calculator and see what it is today. With the lower interest rates, it might be a bit higher. I used a $2,800 monthly rent which also might be too high in today’s market.

I agree with you Tony, I think these are nice places and there is a market for them but the HOA’s really have to go down for most people to consider these. I don’t know what kind of services they have but do you really a doorman, valet or whatever? I think there is a gym on the premises which is cool.

I saw that the school district listed is Santa Ana Unified…is that correct?

Yes, It is Santa Ana. My family moved out of Villa Sienna a few years ago because it is also in the Santa Ana school district.

HOA fees of $1200 per month: I wonder how much higher they are really, when divided among the units that are actually owned/occupied? Of course in a largely unoccupied building, you get the gym to yourself pretty much whenever you want to use it.

A nice flat could be quite attractive, though with the large houses and small lots in Irvine there can’t be that much yardwork and gardening to do anyway as a homeowner. However the flat needs to have an interesting district around it to compensate for the increased noise and loss of privacy.

And, that $1200/mo. dues put towards the mortgage would allow you to buy $260,000 more house (at 5.5%), which means you now need to compare this to other properties at a ~$700,000 price point, and all of a sudden this doesn’t look like a decent value anymore 🙁

It is probably worse than that. Over time the loan would pay off, the HOA would go up^^^.

Ah, The Towers of Greed back again. Where is our bull to champion these fine investment choices?

http://www.crackthecode.us/images/wisechoice.jpg

(giggling like a schoolgirl)

Nice … David does it again … LoL!

actually, that’s a david retread… it was good enough however to bear repeating !

::giggling like a lunatic::

Wonder how that investment’s going for them now? I bet the cream pie would be tastier–at least it’s cream pie, not shit on an aluminum shingle.

The $1200/month HOA is a back breaker. You can’t write it off and it will be there forever.

As was mentioned that turns into an additional 260K of purchasing power. For 700K, you could probably get a decent 3 bed/2 bath rancher in Turtle Rock. That would be a much better investment.

I drive by these towers everyday and rarely see any lights on. They will be monuments of everything that went wrong during the great housing bubble and subsequent collapse. I remember when the OC Register profiled some of the investors who bought here during the peak. They should do a follow up story to see how their investment fared.

I’m BAACK! I’ve been lurking lately and not commenting but this one drew me back out.

You make some very good points. These towers will undoubtedly become the monument to all things Housing Bubble … certainly here in the OC. Greed, greed and more greed.

Greed on the part of Donald Bren and Co. They believed they could stuff more units into yet lessening space and collect yet more fees.

Greed on the part of Irvine. For the same reasons The Irvine Co. did AND they let them zone it for said purposes.

Greed on those who bought into it. Already well discussed and profiled.

My two cents? These towers will go BK and some RE mogul will roll in and buy them for pennies on the dollar. They’ll rename them and perhaps offer them at substantially lower pricing. Moreover, the HOA’s will have to go. How in the H E double hockeysticks do the justify $1200/mo???!!!!

As said earlier, it’s those stratospheric HOA’s that are the true deal killers. No sane person in today’s conditions would be ignorant enough to sign on for that kind of indentured servitude. It’s suicide.

North Korean Towers? LOL! XD

Where did you hear that one, or did you come up with it yourself?

I didn’t understand why they were called this until today. (“Lots of escapees from North Korea live there??”) I take it the satellite image above shows how dark North Korea is (without there having to be a near-nationwide blackout going on), and these near-empty and thus dark-at-night towers are being compared to that?

I honestly do not remember where it comes from. It isn’t my original idea. It does seem fitting, doesn’t it?

One of this twin tower building is so well-known by Chinese world. Ironically it is a focused by people live 5 thousand miles away. Because Huang bought a unit and media keep checking if he is in the building.

See news and links below:

“Huang Fang-yen, a former vice president of the Shin Kong Wu Ho Su Memorial Hospital in Taipei, left Taiwan for the United States last November and is widely believed to be staying in Irvine, California.”

http://www.kmtnews.net/client/eng/NewsArtical.php?REFDOCID=00b1hywtto8xjo1i&TYPIDJump=00air17gdql55u7h

The reporters said why he pick the building is because the place is good so he can get into freeway and airport quickly to escape. He can take freeway 5 to Arizona (via 10) or John Wayne to other cities around US. Also you can live in this building without going out for a couple of months.

This place sounds a prison to me!

Huh. Interesting.

Hello IrvineRenter…

Thanks for posting this! I wondered how these overpriced sink-holes were faring in this environment. It is so annoying that these high rise white elephants are being marketed as “urban living.” They are not urban living in any way shape or form. Come to Pasadena. From my dumpy cramped one bedroom apt. I can walk to movie theaters, grocery stores (including Trader Joes), gyms, bookstores, coffee houses, etc. When I was working I walked to work from my place! In an overpriced Irvine high rise you can walk to…the parking structure, and get into your car. You have all the disadvantages of urban living (no yard, limited personal space) with none of the advantages of urban living (convenient access to mass transit, walking distance to retail stores and services, etc.).

You have to look into Water-logged (Watermarke) and see you they are doing.

I agree it’s not urban living but you can easily walk to shopping and movies (Park Place) like Mother’s Market, Huston’s, Wahoo’s, CPK, Starbuck’s… etc. The 405 Fwy also causes a lot of noise to occupants facing the freeway which adds to the “urban living” flare 🙂 At about $1,200 HOA it is back breaking. It will be interesting to see what price point these may (or may not) become attractive to buyers.

Someone here (Joe33) said movie theaters are no longer there… I guess I have not been there at Park Place for a while…

I haven’t either. Didn’t know they were gone.

What are they turning it into?

Yeah, the Edwards Cinemas Park Place has been closed for a few years now (can’t tell you a date as I can’t seem to find any news stories about this on the web). I always get a particularly strong dose of schadenfreude from this given that the walking-distance theater was one of the first “new urban” amenities they used to mention in the ads for those horrible towers (along with feeling pangs for a theater I used to frequent, despite the “I peed in the popcorn” scrawled on an interior wall by one of the former employees after the theater closed).

Haven’t been over to Park Place for a couple of months, but last time I checked, there was still just a pile of dirt where the theater used to be. Edwards / Regal got into a dispute with the owner of the retail center (can’t seem to find who that is with Google — doesn’t seem to be the Irvine Co., nor Maguire) and the upshot is that the center owners had to agree to tear down the theater and not build a new theater in the center for 15 years or something like that. Pretty disgusting.

Get ready, Irvine.

http://www.crackthecode.us/images/irvine_renter_towers_of_greed_poster.jpg

AZDavidPhx – Good job

What kind of person makes that $30,000 a month?

I thought that was the Irvine, CA minimum wage with all that talent running around there.

“What kind of person makes that $30,000 a month?”

approximately:

0.1 to 1 CEO

0.3 to 3 CFO

1 county manager

1.3 to 1.5 OC detectives

1.5 to 2 CA firemen with overtime

1.5 Irvine High School principals

Wasn’t this are the neighboring property profiled a few months ago with some responses from the owner?

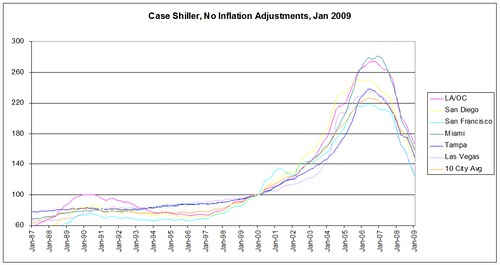

January 2009 Case Shiller data is in. Still dropping like a rock.

At current rates of decline, LA/OC nominal prices should be at early 2002 levels by the end of 2009.

Condos, in the same complex where I sold my previous condo in early 2002, are almost back to 2002 nominal price level. This drop is after more-than-doubling from mid 2002 to 2006. So I definitely missed selling at the peak, but hopefully, I can buy again (an SFR this time) at the “valley”?

Where was this condo complex? Ours hasn’t retreated back to that level…yet.

It’s in North Tustin near Enderle Center (yeah, not Irvine)… I should have clarified. But the condos on Huntington in Northwood (near Roosevelt & Yale) are at late 2002 levels, where 2BR/2Ba are selling in the high 200k’s or low 300k’s last time I checked.

Thanks for clarifying…I don’t know the Tustin area that well but I think the condos near the Enderle Center are very close to the freeway and tend to be older. Same with the Northwood condos near Roosevelt/Yale.

That could explain why these have crashed harder than some other areas.

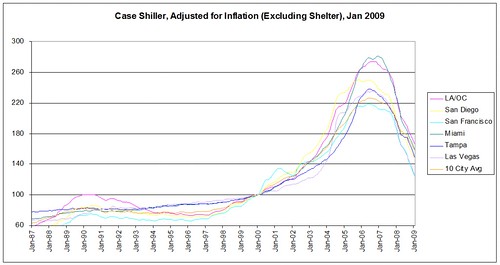

And for those of you who want to see this adjusted for inflation (excluding shelter):

At current rates of decline, prices adjusted for inflation should be back to 2000 levels by July.

So far so good. Looks like the implosion is progressing right on schedule. Get ready to go shopping Jan 1, 2012.

Given the speed of the contraction, I’m predicting 60-70% off high end LA/OC homes, 68-75% off of median homes, and 75-80% off low end homes vs peak. 1996-1998 prices will be back.

Adjusted for inflation, the declines will be moderately larger.

From peak to trough will only be about 5-7 years (2006 to 2011-13). The great majority of the drop will be from 2007 to 2010.

LA/OC is different than many other places. Because the high end loans were jumbos here, there were different financing terms. Of special interest is the time to reset/recast, which was longer for option arms.

“What is the inflation rate?” is the key question.

I wonder how much inflation was influenced locally by the bubble economy which was in full swing for most of this decade.

Wouldn’t it be sump’n if prices fall back to 1998 prices in real terms?

[Enter the chest thumping, horse laughter critic who used to scoff at the 50% decline projections].

I recall my early predictions of 50% declines being met with a furious salvo of horse laughter from a pretty good size group of characters on here. For awhile there, I thought I was in the Twilight Zone.

I’m guessing another 10% at the most for LA/OC but we’ll see. 70% off high-end homes? In Turtle Rock? Sure. Maybe 80% off low-end homes in Palmdale.

Sometimes I think you guys are in the Twilight Zone.

70%? Hmmm. that’s too great a generalization and I don’t thing true. IMHO, if we saw 70% off coastal homes then you’d see like 95% off in inland areas.

They’d be paying you to live in homes in Phoenix…

IMHO, what I think is more likely is that new homes built since ’02 will decline 60% from peak values. This is because they are a small percentage of all homes and were simply WTF priced _before_ the bubble.

Homes in the coastal areas will likely drop at most 50% from the peak. This is because as soon as homes drop below the “conforming jumbo” limit then money is available for them. And, really, there is cheap money for those who do qualify.

This means pricing for SFHs back to ’02 prices.

Inland homes.. east of the 405, I think will drop as much as well… they may drop a bit more but recover too as they go below the “conforming loan” limit.

Condos are fucked…. I mean that word… As SFHs become affordable, condos become unattractive. In those cases I think that 60% may be the norm… sorry, but those apartments turned condos will simply make no sense. And I don’t think you can borrow money for condos right now.

Remember one constant thing about California Real Estate. The nearest the coast you are the more desirable the place is. This is true even for Yorba Linda, Coto de Caza, etc…. As prices drop everywhere, people who still have a job move West.

Of course, none of this matters if you’re in Quail Hill, Northwood II, West Irvine or those “fancy” places East of the I5. Those places are simply toast.

I wonder if TRidge will be able to survive… perhaps the folks there do indeed have the money to tide over?

Another 10% to the bottom? You’ll see 10% before summer 2009.

For those keeping count, currently the low end has already dropped 50.5%. The middle tier has dropped 40%. The high tier has dropped 29.3%.

The low end rose much more on a % basis during the bubble. All three LA tiers are now about 70% above 2000 prices. Only New York has prices which have risen more since 2000.

For a long time, prices at the high end were dropping more slowing in LA. The last 4-6 months, high end prices have been dropping at a similar rate to the midrange.

Thanks for posting the Case Shiller graphs and for the analysis.

God, this place has an association of $1,200. Not only the price is WTF, now the association is also WTF. Some people have mortgages that are less than the association. The end is upon us…

If the HOA came with daily maid service I’d be tempted…. 🙂

Couple of points –

You can’t walk to the movies anymore…just the big fenced off area where the movie theater was before they tore it down a year ago.

Second, somebody mentioned that the cost to build a house per foot is higher than this. That is not correct. It costs a ton more to build something like this per foot. I would guess it costs $400 to $500 per foot all in to build something like this. That is why they were never built until the bubble convinced developers they could sell them for $700 per foot. And why you are not going to see them built again in Irvine anytime soon.

I wish someone who really knew — IR? — would pick up on this and give us a straight answer. I could be wrong, but there’s a reason why “projects” are built upwards and it’s not because they are more luxurious.

Homes are way cheaper to build than high rise. The general I was with built homes and low-rise condos on podium decks. The podium work would cost at least 3-4 times as much as homes. These are high rise and cost way more than low-rise over podiums.

As for the land, the value goes up dramatically for the higher density locations than for single family lots (which makes sense). Site development costs are much higher for high rise construction in semi-urban areas as well.

My rough guess would be that these place cost 5 times as much per SF to build than a SF home. Irvine Renter probably would know a little better than I.

What is a podium deck?? I’m an architect and I’ve never heard that term in all my years. Perhaps it’s a regionally based term for lightweight concrete over steel-rib framing?

If “podium” means what I think it is, than naturally two and three story “lowrise” condo buildings would cost much more than wood-stud framed SOG houses. But high-rise development construction costs per square foot drop rapidly, the more stories up you go. To a point, of course. The 2007 California Building Code added a requirement for a third exit staircase in buildings rising above 500 feet. Call it the “9/11 rule” if you will, but either way, it’s added construction cost and additional area per floor that is non-usable space. And not every residential tower needs to have the slab, foundation and egress requirements of say, the Sears Tower or Empire State Bldg!

A podium deck is a post tension slab over parking with a topping slab (it was a new term for me as well). 2-3 levels of wood framing go on top. Foundation/excavation costs are immense (especially if you can’t find someone to take the dirt) as are framing, plumbing, electrical, drywall and stucco. You also gotta remember that these types of buildings are loaded with common/landscaped areas that add cost but no additional living SF to amortize it against which you don’t have with a house.

High rise construction is even more expensive. True you will add more SF to offset the common areas but now you’re looking at even more stringent codes, curtain wall exteriors, structural steel, etc. and the costs just run quite a bit more. You’re most likely looking at union work also which will really kill your labor budget.

The price a developer could sell units in a residential tower for has nothing to do with the comparative cost to build these type of buildings. It’s apples to oranges. The benchmark is the relative pricing of material types (wood, metal stud, steel or concrete) depending on the type of building being built. For example, concrete is extremely expensive relatively speaking for use in a SFR on grade, but still necessary for completing the foundation. You can’t build foundations out of wood or metal. The cost for concrete goes down proportionally, however, in a multi-family building, or a tower. Since concrete is a necessary element in almost every building now, the labor and construction costs are much less per building square foot in a tower. It is much simpler to park the concrete pumping trucks once on the days they are needed, and pour what is necessary, as opposed to the cost of multiple trucks or stops to pour the slabs on a McMansion sprawling SFR development.

I don’t know the specific numbers for a high-rise like this, but IMO the higher cost to build this type of tower development (compared to SOG SFR’s) is a function of the WTF land pricing for its parcel and availability to develop SOG SFR’s over a larger area elsewhere relatively nearby. Look around Irvine… there’s a reason Northpark, Woodbury and Portola Springs were on the hit list for McMansion development, but even still, the land eventually runs out. There are impassable mountains on one side and the ocean on the other side. Not too many more opportunities in OC to build a KB Home-style tract development with Mello Roos fees and model homes. Take your choice, keep going further into the plummeting, scorching 909, or go upward in OC!

“SOG” means slab-on-grade for those not in the construction field, sorry…

AD, I don’t want to get too far off topic but there is no way you can compare the foundation of a SOG house against a monster like this. Your typical house would cost $15k-$20k per home. I used $12/SF of slab (not livable SF) for budgeting purposes in the past for a post tension SOG.

Now with a monster like this you’ll have a PT SOG with huge piers/footings, concrete foundation walls and a post tension 1st floor deck w/topping slab at the very minimum and that is gonna cost big bucks. I could easily see this place costing more for foundations on a per unit basis than a SF home.

Lunatic, on second thought, you’re probably right about this. And with union labor… cha-ching!

Back to topic now…

The theater’s been torn down for more than a year. I can’t seem to find an exact date, but I can say that in October 2007 they were doing some work in that dirt area (thought at the time they were building something new, but evidently they were just removing some of the dirt), and it had been down for quite some time before that (and the theater of course sat empty for quite awhile before that).

There’s a forum on these at https://www.irvinehousingblog.com/forums/viewthread/1453/P325/

and here’s another board which looks like residents griping at http://www.savethemarquee.org/forum/index.php

I looked at these about 3 years ago, not seriously, but they are nice, and they’re not for everyone.

The HOA fee is high becuase of the landowner charging an easement (not correct term but something like that).

I looked at those forums.

Jeez… It does sound like a North Korean prison.

Fines of 2000 bucks because of a dog?

Car towed away?

HOA fees raised to $1400 per month?

A revolt by the homeowners against the HOA board?

HOA Board members working for the developer?

Jesus H. Christ… it makes North Korea’s leadership look like the paragons of responsible governance.

This place has problems beyond the price. This place is simply toxic.

;-P

With the North Korean towers selling at these price levels. Does anyone know how Astoria at central park west is selling.

Roya is the one who made me a daily reader! I have to thank her for that!

SB

Let’s not forget the TOTALLY EMPTY $600,000,000.00 towers around the corner at Skyline MacArthur Place! THOSE will be the “Projects of O.C.” someday soon.

Does anyone what the deal is with the apartment complex going up near the Irvine Spectrum. I look at that when I commute and I think: Are they really that stupid to put that many apartments and condos up right now?

Lots of foreclosure “victims” need apartments to live in now!

I thought the same thing but it IS the Irvine Company…and they have deep enough pockets to wait until the market returns.

Plus, lots of people can’t qualify for loans nowadays so they have to rent.

So they want us to pay $430,000 for the privilege of renting this place for $1200/month? Hehehe. That’s just silly.

I bet the cheerleader realtors just love this blog.

Good explanation of housing affordability by the Financial

Times

http://www.ft.com/cms/bfba2c48-5588-11dc-b971-0000779fd2ac.html

Thanks for the link, though I’d say their graph showing houses being more affordable than they’ve ever been before is pretty misleading — it must just be comparing mortgage rates today vs. mortgage rates on an imaginary equivalently priced property in past years, ignoring the fact that property prices are still way above fundamentals, especially in bubble markets. Presumably it’s also not factoring in wage growth or lack thereof.