Inventory as of 23rd December: 202.

Lowest: 2 Verde @ $246/SF

Highest: 36 Boulder View @ $1,429/SF

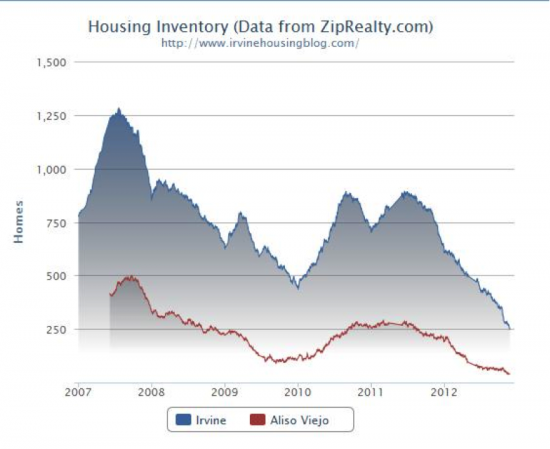

At this rate, we might dip below 200 before the New Year. It's good news for sellers, but not so great for buyers. The market conditions have changed a lot since January this year. The inventory has dipped 65.1% since January. Median List Price has shot up by 45.6%, and Median list Price/SF by 16.4%. Last January when I started writing for Irvine Housing Blog, I knew Irvine was on path to recovery, defying all charts and projected prices and inventory by the experts, but I didn't anticipate this big a change.

Today, I will profile a property that has defied mostly all micro and macro market conditions, and continues to hold a good price of $376/SF despite being more than twenty five year old townhouse. It's been upgraded and updated beautifully. Another half-a-million dollar condo on Irvine, less than 1500 SF area.

131 Goldenrod #70, Irvine CA 92614

Listing Price: $530,000

Price/ SF: $376/SF

Area: 1411 SF

Beds/ Baths: 3 Beds/ 2.5 Bath

Year Built: 1985

Even though the condominium is less than 1500 SF, it has a functional floor plan. You enter into the living room/ dining room. The staircase takes up one side of the wall, and the powder room sits neatly below the staircase. There is a bay window on side of the living room, which to me is the focal point of this space. Kitchen is a separate room, and it has an attached space which can be used as a family room. There is a small patio off the kitchen, and a two car garage attached to the patio. Sometimes it's not the nicest things to have, a patio between garage and home, but some Irvine townhouses have this kind of floor plan. In my opinion, the only con for this property is, it's attached, and that severely restricts natural light and ventilation, limiting the number of windows for each room. The offset space between the house and the curb is good enough to have some green space, something that we don't see in the recent construction. The houses are moving close to each other, and to the curb. The Architects and Developers are maximizing the usable space, and construct on every allowable inch.

Monthly Expenses:

Listing Price: $530,000

HOA Dues: $297/ Month

Current Mortgage Rates: 3.25%

Monthly Mortgage: $1,847

Property Tax: 1.03361%

Monthly Property Tax: $456

Mello Roos: $148/ Annually

Total Monthly Expenses: $2612

Price/ SF, Monthly: $1.85/ SF

(There will be additional Property Insurance, Earthquake Insurance and Home Owner's Insurance expenses, and maintenance expenses considering the age of the property)

Here is another condominium in a very elite Irvine area. It's housed in a guard gated community. It has tandem parking. It has no patio to boast of, not even a small space to stand and water the plants. The offset to the street probably is the minimal required to get a Building Permit. But it shows up on the popular Irvine property list for the week. How are the monthly expenses?

Listing Price: $375,000

Estimated Mortgage: $1310

Monthly Property Tax @ 1.0593: $331

Monthly Mello Roos: $92

HOA Dues: $405

Total Monthly Expenses: $2,138

Price/SF, Monthly: $1.98/SF

Which one would you buy?

Or the question should be, will you buy an attached condominium with tandem parking, or detached garage at these prices?

What's your idea of a perfect condominium?

Discuss below, or share your thoughts at Talk Irvine.