The Obama administration is taking money from taxpaying renters and giving it to unemployed loan owners so they can give it to banksters. Unemployed renters get to sleep in the street.

Irvine Home Address … 9 STARDUST #5 Irvine, CA 92603

Resale Home Price …… $499,000

Oh it's not fair,

And it's really not OK,

It's really not OK,

It's really not OK,

Oh, you're supposed to care,

But all you do is take,

Yeah, all you do is take.

Lily Allen — Not Fair

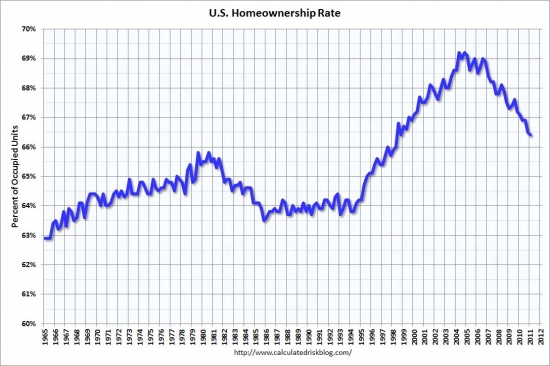

Has fairness been a casualty of the housing bubble? At times it looks that way. The government keeps implementing policies to benefit one group over another not because it is the right thing to do but because it buys them votes. Last year, I wrote about The Policy of Screwing Prudent Renters to Benefit Loan Owners.

One housing bubble phenomenon was that the right ones — prudent people who knew what they could afford — were kept out, and the wrong ones — kool aid intoxicated fools — were let in. That mistake was bad enough, but now our own government is frantically working to repeat this mistake. Rather than doing something corrective, like letting house prices fall, our government is going to extreme lengths to keep the right ones out and keep the wrong ones in.

Since the previous failed policies of screwing renters did not succeed, the Obama administration is looking for ways of expanding the failed policies to really screw prudent renters.

Obama administration boosts aid for unemployed homeowners

Unemployed homeowners with government-insured mortgages will be allowed to miss a year of payments while they try to find a job.

While unemployed loan owners get to benefit from government largess, unemployed renters get to sleep in their cars or on the street.

By Jim Puzzanghera, Los Angeles Times

July 7, 2011

Reporting from Washington — Still scrambling to stabilize the struggling housing market, the Obama administration will allow some unemployed homeowners to miss a year of mortgage payments without threat of foreclosure while they try to find a new job.

Why do loan owners get such a dramatic increase in unemployment benefits while renters get nothing? Free housing is far more valuable than the paltry unemployment checks people receive. If lawmakers wanted to increase unemployment benefits, why don't they just do that? Because the real policy is to give money to the banks. The unfairness of this policy is unconscionable.

The expanded assistance — triple the current limit of four months for those with government-insured mortgages — could help “tens of thousands” of people keep their homes, Housing and Urban Development Secretary Shaun Donovan said.

Why should working renters care if loan owners are allowed to continue to occupy real estate they are not paying for? And why should working renters subsidize loan owners? Either give all unemployed increased benefits or let loan owners lose their houses. Why isn't anyone upset about renters getting kicked out of their homes?

Why should working renters care if loan owners are allowed to continue to occupy real estate they are not paying for? And why should working renters subsidize loan owners? Either give all unemployed increased benefits or let loan owners lose their houses. Why isn't anyone upset about renters getting kicked out of their homes?

“Helping struggling borrowers avoid default is not only good for those borrowers, it is good for the economy,” he said.

Bullshit. It is good for the banks and only the banks. Giving money to lenders to keep people in properties they cannot afford does not benefit the economy. However, it does displace a wouldbe buyer who would have purchased the property currently being occupied by an unemployed delinquent mortgage squatter. Further it provides false hope to the borrower and fosters the borrower's sense of entitlement to occupy real estate they aren't paying for.

But hoping to avoid high expectations that have accompanied other administration foreclosure efforts, Donovan cautioned Thursday that the move wasn't a “silver bullet.”

The new requirement for so-called forbearance comes on top of several initiatives the White House has launched since 2009 to try to stem the tide of foreclosures, which continue to drive down real estate prices.

President Obama admitted this week that those efforts — such as the much-maligned Home Affordable Modification Program, which offered incentives to banks to lower monthly payments for troubled borrowers — haven't tamed the problem.

“We've had to revamp our housing program several times to try to help people stay in their homes and try to start lifting home values up,” Obama said. “That's probably been the area that's been most stubborn to us trying to solve the problem.”

Attention all renters and prospective home buyers: Obama is screwing you. He is taking your money and giving it to loan owners in an effort to make prices unaffordable so you can never own a home. Obama is placing the financial interests of lenders and loan owners over the interests of renters.

Falling home prices are not a problem that needs to be solved. It is a healthy correction from an unsustainable bubble. Efforts to prevent this correction are what has been hurting the economy over the last few years.

Housing advocates and some lawmakers have pushed the administration to increase the amount of time unemployed homeowners would be allowed to skip payments. The White House agreed partly because 60% of people without jobs have been unemployed for more than three months, Donovan said.

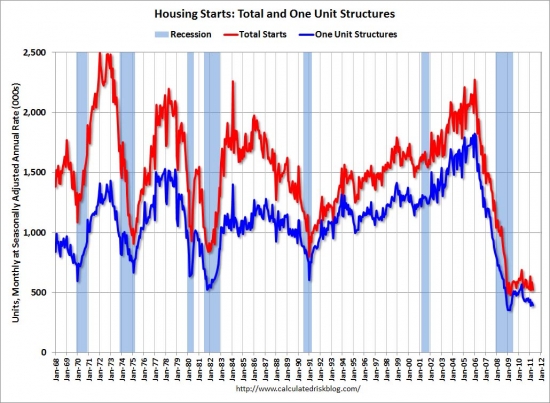

If house prices had been allowed to crash and bottom, the economy would be improving now because homebuilders would have the elusive price stability they need to go back to work. With high unemployment in construction, the economy continues to suffer, and it will as long as government policy prevents a natural bottom from forming in the housing market.

Separately, the Federal Reserve told Congress on Thursday that it wanted uniform standards for how mortgage servicers handle modifications, foreclosures and other issues. The Fed, along with HUD and other federal regulators, is working on such standards.

In addition, regulators are working with attorneys general from all 50 states on a broad settlement with major banks of investigations into botched foreclosure paperwork.

The administration's latest plan, unveiled Thursday, affects a small group of homeowners — about 3,500 borrowers a month who default on loans backed by the Federal Housing Administration and a total of about 1 million people eligible for HAMP aid.

The only solace I find for this misguided effort is how few it actually impacts.

But Donovan said he hoped that the new requirements would be adopted voluntarily throughout the broader mortgage industry.

Under the plan, mortgage servicers for FHA-insured loans will be required to allow qualified homeowners to miss up to 12 months of payments as unemployed borrowers look for new jobs.

The administration also is making it easier for unemployed homeowners to qualify for the assistance, removing what it called some “upfront hurdles” involving screening for employment and payment history.

In addition, mortgage servicers participating in the administration's mortgage modification program will be required “whenever possible” to extend the minimum period that eligible unemployed homeowners can miss payments to 12 months.

The missed payments would be added to the mortgage balance and made up by the homeowner, though in some cases those debts could be forgiven by the lender, Donovan said.

Lenders get to pocket this free money and get the balance added to the borrowers debt. It truly is a win-win for them.

Under what circumstances would the lender forgive this debt? Why would they?

But like the other government attempts to aid homeowners, the new effort has limitations. Only about 10% of some 50 million mortgage loans outstanding nationwide are backed by the FHA. And less than a quarter of the approximately 4.6 million homeowners who are behind on their mortgages qualify for the HAMP program.

Bert Ely, an independent banking consultant, said allowing unemployed homeowners to skip payments sounds good in theory but has problems that would make it difficult for the industry to adopt a 12-month standard.

“Unfortunately, a lot of times forbearance just postpones the problem,” he said. “So you extend from four months to 12 months and things don't work out. Who eats the loss?“

The government, of course. Who else would you expect to eat the loss?

Forbearance is at the heart of the shadow inventory problem. Lenders have been kicking the can down the road endlessly with hopes the problem will somehow work itself out. As they accumulate deadbeats, lenders run into cashflow problems, so now they are looking to the government to pick up the tab.

But the People Improving Communities Through Organizing National Network, a coalition of faith-based community groups, said the administration's announcement Thursday was “yet another step toward breaking the link in America between losing your job and losing your home.”

Yes, this is another step toward breaking the link between losing your job and losing your home. Is that a good thing? People borrowed a great deal of money on the premise that they would work to pay off the debt. Shouldn't they lose their homes if they stop working? If borrowers can break that link, I will see how much I can borrow, then I will quit work and just keep the house. Wouldn't you?

Rep. Barney Frank (D-Mass.) also cheered the move, saying many of his colleagues believed that the previous minimum “was not nearly enough time.”

“I think the 12-month extension will help very much,” he said.

I think Barney Frank is a tool, and if there is one thing I cheered with the Democrats lost the House of Representatives, it was Barney Frank losing power.

Last year, the special inspector general for the Troubled Asset Relief Program, which funded the administration's mortgage modification initiative, urged that the minimum period for skipped payments be increased.

Wells Fargo Home Mortgage, one of the nation's largest mortgage servicers, said it already offered homeowners the ability to skip up to 12 months of payments “in some cases.” From January 2009 to last April, the company has offered assistance to 173,000 customers who have lost their jobs, spokesman Tom Goyda said.

It's called amend-extend-pretend, and all the lenders are doing it. Whether the program is formalized or not, lenders have been accumulating delinquent borrowers in shadow inventory for years, and they will continue to do so as long as the resale market is too weak to absorb the inventory.

It's called amend-extend-pretend, and all the lenders are doing it. Whether the program is formalized or not, lenders have been accumulating delinquent borrowers in shadow inventory for years, and they will continue to do so as long as the resale market is too weak to absorb the inventory.

Because the administration hasn't released details of the changes in its programs, Wells Fargo would not comment specifically on them, he said.

jim.puzzanghera@latimes.com

Obama and the Democrats in power are not the only ones endorsing bad policy ideas. Bill Clinton, the master triangulator, has decided pandering to loan owners is good politics.

Bill Clinton Says BofA Deal May Lead to Principal Reductions

June 30, 2011, 7:11 PM EDT

July 1 (Bloomberg) — Former President Bill Clinton said Bank of America Corp.’s accord with mortgage-bond investors may give more “underwater” borrowers a chance to cut the amount owed on their home loans.

“You’d relieve the anxiety of countless Americans who would know they could hold onto their homes,” Clinton, 64, said in an interview yesterday with Bloomberg Television’s Al Hunt.

If giving away free money is considered a treatment to relieve anxiety, I will attest to being very stressed lately. Can I have some free money too? Oh, wait… I am not a loan owner, so I don't qualify.

Bank of America, the largest U.S. lender by assets, agreed this week to pay $8.5 billion to bondholders who said they were duped into investing in defective mortgages. The deal calls for specialized servicers to manage some of the highest-risk loans, an arrangement that Clinton said could lead to debt reductions and avert foreclosures.

So-called sub-servicers “are often very effective at effecting principal-reduction modifications,” said Laurie Goodman, an analyst at Amherst Securities Group LP, which specializes in fixed-income assets such as mortgage bonds, in a note yesterday. Bank of America, which was blamed by regulators for mishandling foreclosures and modifications, may hand over loans in groups of less than 30,000 to the smaller firms.

What does it take to be very effective at giving away free money? I suspect it really isn't that hard.

Dan Frahm, a spokesman for Charlotte, North Carolina-based Bank of America, declined to comment. Kevin Heine of Bank of New York Mellon Corp., the debt’s trustee, also declined to comment. Kathy Patrick, a lawyer for the bondholder group, didn’t respond to a request for comment.

Leaders at some of the biggest mortgage lenders have opposed cutting homeowner debts. JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon has said principal reductions may be unfair and difficult to implement.

‘Hard to See’

Brian T. Moynihan, 51, CEO of Bank of America, said in April that “we do not see broad-based principal reduction as a sound policy decision” for the country.

“It’s hard to see how we could justify reducing principal for many delinquent customers who represent a small portion of borrowers, but not for the vast majority of our customers who have stayed current on their loans,” he said in the prepared text of a speech.

Exactly. How can banks reward the least prudent borrowers in their portfolio at the expense of everyone else?

Exactly. How can banks reward the least prudent borrowers in their portfolio at the expense of everyone else?

There is “enormous potential” to reduce the drag of U.S. housing on the economy if aspects of the Bank of America settlement are applied to the entire industry, Clinton said. The government could give an incentive to have that happen, he said.

Bill Clinton is right. If we give away billions of dollars of free money, it will certainly stimulate the economy. Of course, it is the dumbest policy idea I can think of, but if the Democrats pull it off, they might buy the loan owner vote.

“What I would like to see happen is some system set up to have the same thing done that they did because of this lawsuit, voluntarily, that encompasses everybody else,” Clinton said.

What i would like to see happen is for loan owners to get foreclosed on. Foreclosure is a superior form of principal reduction, and only through foreclosure will the mortgage mess get cleaned up and the economy will prosper.

Should banks forgive the debts of HELOC abusers?

- The owners of todays featured property paid $419,000 on 4/15/2003. They used a $322,700 first mortgage and a $96,300 down payment.

- On 2/27/2004 they obtained a $50,000 HELOC.

- On 11/16/2004 they got a $100,000 HELOC.

- On 12/29/2005 they refinanced with a $512,000 one-year ARM.

- On 3/31/2006 they obtained a $112,000 HELOC they apparently did not use.

- On 12/12/2006 they refinanced with a $517,500 first mortgage with a 10-year fixed rate.

- They stopped making payments late last year, and the NOD was filled in April of 2011.

Foreclosure Record

Recording Date: 04/22/2011

Document Type: Notice of Default

These borrowers added $200,000 to their mortgage in a three-year span. They likely spent some of it on upgrades to the property, but I think it's fair to say they blew the rest. Is there any potential benefit to the country that makes forgiving their debts a good idea?

I don't think so.

If we forgive the debts of borrowers like these, we implicitly say this behavior is okay. If we do that, everyone will Ponzi borrow until the entire system collapses, then they will expect principal forgiveness to fix it. Home ownership truly does become a path to free money. All one has to do is sign some loan papers, and free money flows like ambrosia conferring endless wealth upon all who own a loan.

This is exactly what Bill Clinton is endorsing above, and many on the left who have been pandering to loan owners for the last few years would be happy to go along.

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 9 STARDUST #5 Irvine, CA 92603

Resale House Price …… $499,000

Beds: 2

Baths: 2

Sq. Ft.: 1747

$286/SF

Property Type: Residential, Condominium

Style: 3+ Levels, Other

View: Hills, Park/Green Belt, Pool

Year Built: 1982

Community: Turtle Rock

County: Orange

MLS#: S665311

Source: SoCalMLS

Status: Active

——————————————————————————

Beautifully remodeled, wonderful location, and great views. You will fall in love with this upgraded townhome offering 2 master suites, 2.5 baths, formal living and dining rooms, fantastic French country kitchen with granite counters and beautiful cabinetry. Enjoy the private patio, the pools and spas, the walking trails and the park across the way with tennis courts. Award winning schools and just a few minutes drive to Newport beaches, Fashion Island, and South Coast Plaza.

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis ![]()

Resale Home Price …… $499,000

House Purchase Price … $419,000

House Purchase Date …. 4/15/2003

Net Gain (Loss) ………. $50,060

Percent Change ………. 11.9%

Annual Appreciation … 2.1%

Cost of Home Ownership

————————————————-

$499,000 ………. Asking Price

$17,465 ………. 3.5% Down FHA Financing

4.59% …………… Mortgage Interest Rate

$481,535 ………. 30-Year Mortgage

$105,672 ………. Income Requirement

$2,466 ………. Monthly Mortgage Payment

$432 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$104 ………. Homeowners Insurance (@ 0.25%)

$554 ………. Private Mortgage Insurance

$260 ………. Homeowners Association Fees

============================================

$3,816 ………. Monthly Cash Outlays

-$398 ………. Tax Savings (% of Interest and Property Tax)

-$624 ………. Equity Hidden in Payment (Amortization)

$30 ………. Lost Income to Down Payment (net of taxes)

$82 ………. Maintenance and Replacement Reserves

============================================

$2,906 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,990 ………. Furnishing and Move In @1%

$4,990 ………. Closing Costs @1%

$4,815 ………… Interest Points @1% of Loan

$17,465 ………. Down Payment

============================================

$32,260 ………. Total Cash Costs

$44,500 ………… Emergency Cash Reserves

============================================

$76,760 ………. Total Savings Needed

——————————————————————————————————————————————————-

The end of this suffering is nowhere in site. The Irvine Company has been employing construction workers for the last couple of years, but they aren't selling many of the homes they built recently, and some wonder if they won't stop due to lack of sales. If the Irvine Company stops construction, it isn't very likely that Rancho Mission Viejo or other competitors will pick up the slack. With residential, commercial and industrial all out of commission, only apartment construction will keep the industry afloat.

The end of this suffering is nowhere in site. The Irvine Company has been employing construction workers for the last couple of years, but they aren't selling many of the homes they built recently, and some wonder if they won't stop due to lack of sales. If the Irvine Company stops construction, it isn't very likely that Rancho Mission Viejo or other competitors will pick up the slack. With residential, commercial and industrial all out of commission, only apartment construction will keep the industry afloat.

.jpg)