The GSEs are picking up the pace of liquidations by offering incentives and lowering prices. The banking cartel who is still withholding inventory will be left with devalued REO.

Irvine Home Address … 30 SPARROWHAWK Irvine, CA 92604

Resale Home Price …… $361,900

Just take me as I am,

or have nothing at all.

Mary J. Blige — Take Me As I Am

Last September I noted the GSEs were expediting their foreclosures and REO sales and this behavior was going to threaten the banking cartel. The GSEs are still at it, and they are undercutting bank REO pricing to sell their inventory. Take the property as is, or take nothing at all.

Foreclosures for sale, all homes sold as is

By Kenneth R. Harney, Friday, June 24, 8:21 AM

Looking for a deal where the home seller pledges in advance to contribute potentially thousands of dollars to your closing costs? If so, check out the summer sale terms available from two of the largest and most motivated sellers of foreclosed homes in the country: Fannie Mae and Freddie Mac.

You may know the companies for their troubled mortgage businesses or the financial foibles that pushed them into the control of federal conservators in 2008. But the flip side of those problems is that they now have massive numbers of properties taken back through foreclosures.

Fannie Mae had 153,549 of them at the end of the first quarter. Freddie Mac owned 65,174. That’s nearly 220,000 houses for which they need to quickly find new owners, or they’ll rack up even bigger losses for taxpayers.

The GSEs are not engaging in amend-extend-pretend. They don't have to. Since they are now under government conservatorship, they don't have to worry about maintaining financial ratios or preserving capital. They are already broke, and the losses already absorbed are more than double the accumulated profit they earned in the years prior to the government takeover. The GSEs still have a huge shadow inventory, but once they decide to foreclose, they take the property back and sell it immediately. They are the most active market sellers pushing prices lower across America.

The mandate of the GSEs was to provide affordable housing to lower and middle income Americans. They are succeeding brilliantly. By liquidating their REO, they are doing more to make housing affordable than any stupid loan program they attempted over the last forty years.

To move that bulging inventory, both companies have begun time-limited sales campaigns with significant incentives for new owner-occupant purchasers — no investors allowed — and even extra cash for the real estate agents who bring buyers to the table.

Fannie and Freddie both are offering to pay up to 3.5 percent of the price of the house toward buyers’ closing costs, plus they’ll hand over a bonus of $1,200 to participating real estate agents. Fannie’s program covers properties on which contracts are accepted and close no later than Oct. 31. Freddie’s sale requires contracts no later than July 31 and closings by Sept. 30.

Many buyers of GSE properties use FHA loans requiring only 3.5% down. Fannie Mae even has it's own low-money-down program. With the GSEs covering all other closing costs, they are getting those buyers with only the absolute minimum down payment.

Fannie’s program even offers mortgage money to help finance these purchases, sometimes with as little as a 3 percent down payment. The company also has what it calls a “renovation mortgage” option that provides additional mortgage amounts to cover fix-ups.

Freddie does not offer special mortgage financing for buyers during the sale period, but has other inducements, including two-year home warranties and 30 percent discounts on appliances.

All the foreclosed properties are listed with photos and descriptions at either HomePath.com (Fannie) or HomeSteps.com (Freddie). On those sites, you can search by price, local markets, Zip codes and entire states. Featured offerings on HomePath recently included:

• A six-bedroom, five-bath house in Littleton, Colo., with 4,990 square feet of space. Asking price: $424,900.

• A two-bedroom apartment with 1,164 square feet in Las Vegas for $43,999.

• A $184,900 two-bedroom, one-bath home in Long Beach, Calif.

• A four-bedroom, two-bath house in Brentwood, Md. Asking price: $65,000.

The following are HomePath.com properties in Irvine:

3131 Watermarke Pl, Irvine, CA 92612

30 Sparrowhawk, Irvine, CA 92604

20 Lakepines, Irvine, CA 92620

134 Echo Run # 48, Irvine, CA 92614

1428 Scholarship, Irvine, CA 92612

14 Idyllwild, Irvine, CA 92602

The following are HomeSteps.com properties in Irvine:

2233 MARTIN #315 Irvine, CA 92612

377 HUNTINGTON Irvine, CA 92620

The summer clearance sales are part of rapidly accelerating efforts by both companies to get ahead of the tidal waves of foreclosures flowing into their portfolios in recent months. During the first quarter, Fannie Mae acquired 53,549 properties. However, during the same period, it managed to sell 62,814 houses — a record number that produced a net outflow.

Freddie Mac also sold more foreclosures than it took in during the first quarter, acquiring 24,709 homes while selling 31,628. In some parts of the country, Freddie’s offerings are even generating multiple bids on houses, said Brad German, the company’s spokesman.

Both companies are targeting only buyers who plan to live in the homes — rather than non-occupant investors who want to flip them or rent them out — as part of a larger neighborhood real estate stabilization effort.

If the GSEs were to open bidding to investors, they would undoubtedly get lambasted for not encouraging owner occupancy. The cost of that government policy is enormous because on many of the properties in their portfolio, there aren't many owners who want to occupy them. As a result, the GSEs discount their properties far more than they should, and they end up pushing home values much lower.

I don't oppose their policy. There are plenty of non GSE properties to invest in, but if the GSEs were truly concerned with getting the best price for their REO, they wouldn't be excluding anyone from the buyer pool. The recovery they are not obtaining is being covered by taxpayers. As a result, we are all contributing to the good deals obtained by the few owner occupants buying today.

The contribution of up to 3.5 percent of the sale price toward the buyers’ closing costs can be substantial. On a $200,000 house, the buyers could receive $7,000 toward their closing expenses, which might determine whether they can afford to buy.

Combine that with additional incentives, such as favorable financing or warranties, and the total package can look extremely attractive to first-time and moderate-income purchasers.

Are there downsides or restrictions for would-be buyers on either HomePath or HomeSteps? Absolutely. Top of the list: Keep in mind that these are foreclosed properties, and some of them have been abused by previous occupants. Fannie and Freddie both do repairs to bring houses up to what they believe are marketable standards, but don’t be surprised to find that they are not in pristine condition.

Second, though foreclosures do generally sell for less than non-distressed houses, you need to understand that both Fannie and Freddie are in the business of maximizing returns on assets. Do not assume that the listing prices are deep-discount giveaways. Be diligent in comparing prices and values before bidding, and negotiate just as you would with any other real estate purchase.

From what I have observed pulling comps on closed sales, the GSEs are making deep-discount giveaways. Anyone looking to be an owner-occupant on a lower cost property should look at the GSE portfolio. These must-sell properties are the best deals in the market today. And given the huge shadow inventory the GSEs have not begun to process, the deals will only get better.

Federal shadow housing inventory is getting bigger

Posted by Tracy Alloway on Jun 21 12:20.

A housing milestone, of sorts.

Federally-backed loans already make up a majority of the mortgages classified as ‘seriously delinquent’ in the US financial system. In other words, there are more soured loans held or backed by the US’s giant GSEs — Fannie Mae and Freddie Mac — plus the Federal Housing Administration (FHA), than those held by banks and in private-label securitisations.

But when it comes to Real Estate Owned (REO) property, some reckon the federal share of so-called shadow housing inventory (foreclosed properties) looks set to surpass the private sector’s too.

Here’s Goldman Sachs, including economists Alec Phillips and Jan Hatzius:

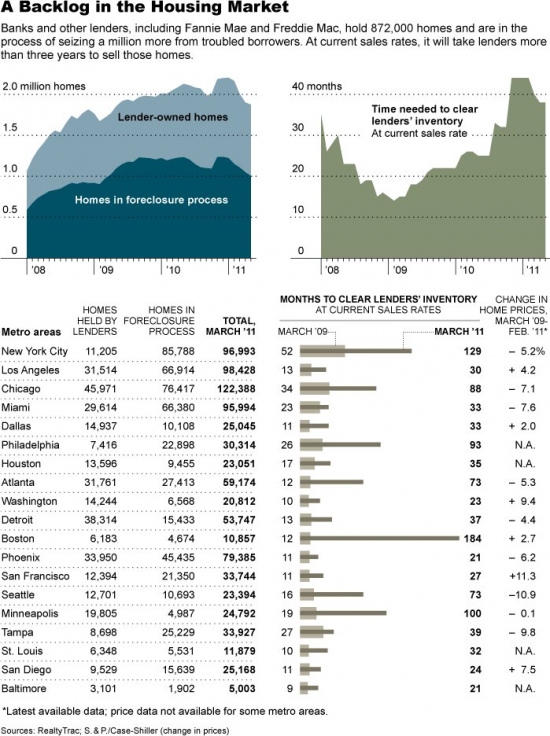

The federal share of REO property is also rising. For 1Q, RealtyTrac estimates that total REO property held by lenders totaled 872,000. Of this, we know from monthly or quarterly financial statements that Fannie Mae, Freddie Mac, and the FHA hold roughly 300,000 of these properties on their books, and that this inventory has been rising by more than total REO inventories over the last year. Over the next few quarters, the federally backed entities are likely to see their inventories of REO property become a larger share of the total. The chart below shows the accumulation of REO property by the GSEs and FHA, which was on a trend to overtake private sector activity until it declined in 4Q, most likely due to legal irregularities in foreclosure processing (the chart relies on filings from the federal entities and assuming that the difference between this number and total REO filings reported by RealtyTrac are related to private label securities or bank portfolios).

Now, Goldman reckons the government could use its newly-acquired shadow inventory in a couple ways — one of which, notably, is to help prop up house prices by not doing anything with it, really.

So far, the GSEs are not withholding inventory from the market. If prices continue to crater, they may change their minds, but for now, REO is being cleared out as fast as it comes in.

Here’s Goldman again:

As the GSEs and FHA begin to take on a larger and larger share of seriously delinquent loans and, ultimately, foreclosed properties, how policymakers approach the operations of these entities could become an important factor for home prices, since these entities could in theory be used to hold supply off of the market in an effort to support prices. As shown in the chart below, distressed property sales appear to be weighing on home prices, with solid gains over the last couple of months in the CoreLogic HPI that excludes distressed sales, compared with weakness in the index that includes them.

However, the federally backed entities have not shown much sign of trying to hold properties back from the market. The FHA may be particularly constrained by costs, since it has been trying to raise its capital level after concerns last year that it would fall below required minimums. But the Treasury is providing temporarily open-ended financial support to the GSEs, so they do not have the same constraint. (though the administration would probably prefer to avoid further losses at the GSEs if possible). Despite federal support, the GSEs have not made any significant new attempts to hold supply off the market.

Indeed, Goldman says the first quarter of this year was the first since 2009 that the GSEs and FHA acted as a combined net supplier of foreclosed properties to the market. They expect the agencies to assume ownership of as many as 180,000 properties per quarter, or 700,000 over the next year.

Which would mean — if the federal entities decide to keep selling as they’ve been doing so far — there would be a whopping 30 per cent increase in the number of properties feeding into the market.

We’ll say it again – the supply! The supply!

Here comes the REO

Ever since the housing bust became headline news, housing bears have been predicting a flood of inventory that would push prices lower. Lenders successfully withheld product from many markets, and the GSEs were not foreclosing in earnest for several years as they attempted various loan modification programs. With the complete and utter failure of all loan modification programs, the GSEs are now shifting toward foreclosure processing. The lenders who are attempting to withhold product are going to sit and watch as the GSEs devalue the holdings of lenders and make them wish they hadn't waited.

Irvine is an unusual market. Relatively little of our inventory was financed by the GSEs because our price points were generally above the conforming limit during the bubble. Some will take that to mean that Irvine will escape the problems of GSE liquidation. Not true. As the GSEs liquidate their properties in nearby communities and lower prices there, the substitution effect will steal buyers away from Irvine. That will lower sales rates even more, and the few must-sell properties that come to market will push prices lower. In other words, the GSEs will cut the Irvine market down at the knees. The price correction will take longer, but it will still occur, just as we are seeing now.

Conservative revisionist history

One of the more annoying lies to come from the housing bubble is the revisionist history the conservatives in the Republican party have been peddling concerning the role of the GSEs. The GSEs did not inflate the housing bubble:

The worst junk mortgages that inflated the housing bubble to extraordinary levels were not bought and securitized by Fannie and Freddie, they were securitized by Citigroup, Merrill Lynch, Goldman Sachs, Lehman and the other private investment banks. These investment banks gobbled up the worst subprime and Alt-A garbage that sleaze operations like Ameriquest and Countrywide pushed on homebuyers.

The trillions of dollars that the geniuses at the private investment banks funneled into the housing market were the force that inflated the bubble to its 2006 peaks. Fannie and Freddie were followers in this story, jumping into the subprime and Alt-A market in 2005 to try to maintain market share. They were not the leaders.

Conservatives are peddling the lie about the GSEs because they want to see them dismantled. I agree with their policy ideas. The GSEs should be dismantled, but not because they inflated the housing bubble. The GSEs are no longer necessary. We have a robust secondary market for securitized loans without the GSEs. At this point, the GSEs are being used to keep mortgage interest rates low through their explicit government guarantee. The government has no place assuming the risk of private enterprise — and pay the billions in losses — and for that reason, the GSEs should be eliminated.

The folly of the GSEs is apparent in properties like today's featured property. The GSEs came in at the end of a long series of Ponzi borrowing and bought an Option ARM the former owners took out. As Dean Baker noted in the quote above, they were followers in the story, and they bought loans like this one in 2005 to maintain market share. In other words, they gambled with money they didn't have and now you and I are paying for it.

Regular housing ATM users (HELOC addicts)

- The owner of today's featured property paid $171,500 on 2/4/2000. They used a $162,925 first mortgage and a $8,575 down payment.

- On 12/5/2000, less than a year after buying the property, they pulled out their first $35,000+ in mortgage equity withdrawal with a new $199,138 first mortgage. They went Ponzi.

- On 10/15/2001, less than a year after their first big payday, they pulled out another $15,000+ with a $215,847 first mortgage.

- On 6/7/2002, less than 9 months later, they refinanced with a $209,600 first mortgage and a $52,400 second mortgage which gave them another $35,000+ cash infusion.

- On 7/10/2003 they were back for $25,000+ more obtaining a $275,500 first mortgage.

- On 6/18/20004 they refinanced with a $290,500 first mortgage. They only got $15,000+ on that year's trip to the housing ATM. I imagine they were disappointed.

-

On 7/27/2005 they obtained an Option ARM with a 1.37% teaser rate for $337,500. The $45,000+ they got in 2005 must have made them feel better after the poor take from 2004. This was the loan Fannie Mae bought.

- On 12/6/2007 they went back for one final trip to the ATM and obtained a $37,187 HELOC.

- Total property debt was $374,687 plus negative amortization.

- Total mortgage equity withdrawal was $211,762.

We joke about the housing ATM, but it was very real for loan owners during the housing bubble. These people went back for income supplementation every year. They would still be doing it today if it weren't for the collapse of the housing bubble.

How many people in California want to buy a house because they think they will be able to do what these people did? With the government now insuring nearly the entire housing market, if we allow this behavior to resurface, all taxpayers will be subsidizing this theft.

Irvine House Address … 30 SPARROWHAWK Irvine, CA 92604 ![]()

Resale House Price …… $361,900

House Purchase Price … $171,500

House Purchase Date …. 2/4/2000

Net Gain (Loss) ………. $168,686

Percent Change ………. 98.4%

Annual Appreciation … 6.5%

Cost of House Ownership

————————————————-

$361,900 ………. Asking Price

$12,667 ………. 3.5% Down FHA Financing

4.49% …………… Mortgage Interest Rate

$349,234 ………. 30-Year Mortgage

$75,747 ………. Income Requirement

$1,767 ………. Monthly Mortgage Payment

$314 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$75 ………. Homeowners Insurance (@ 0.25%)

$402 ………. Private Mortgage Insurance

$310 ………. Homeowners Association Fees

============================================.jpg)

$2,868 ………. Monthly Cash Outlays

-$284 ………. Tax Savings (% of Interest and Property Tax)

-$461 ………. Equity Hidden in Payment (Amortization)

$21 ………. Lost Income to Down Payment (net of taxes)

$65 ………. Maintenance and Replacement Reserves

============================================

$2,210 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,619 ………. Furnishing and Move In @1%

$3,619 ………. Closing Costs @1%

$3,492 ………… Interest Points @1% of Loan

$12,667 ………. Down Payment

============================================

$23,397 ………. Total Cash Costs

$33,800 ………… Emergency Cash Reserves

============================================

$57,197 ………. Total Savings Needed

Property Details for 30 SPARROWHAWK Irvine, CA 92604

——————————————————————————

Beds: 3

Baths: 2

Sq. Ft.: 1240

$292/SF

Property Type: Residential, Condominium

Style: Two Level

Year Built: 1900

Community: 0

County: Orange

MLS#: F11061161

Source: CRISNet

Status: Active

——————————————————————————

End unit condo in excellent community. This 3 bedroom + 1.5 bathroom home occupies approx. 1220 sq. ft. and includes kitchen with appliances. Outside brick patio with cover. Tile downstairs with carpet upstairs. Upstairs bedrooms include mirrored closets. Community includes tennis court, green belts with pool/spa and playground for kids.

Visit msnbc.com for breaking news, world news, and news about the economy

.jpg)