Many people buy timeshares believing they are a good investment. In fact, they are the worst possible real estate investment.

Irvine Home Address … 74 LINHAVEN Irvine, CA 92602

Resale Home Price …… $749,000

So don't go away

Say what you say

Say that you'll stay

Forever and a day

In the time of my life

Cos I need more time

Oasis — Don't Go Away

Timeshare or fractional ownership has been around since the 60s, but is was during the 90s this industry really took off. Wikipedia defines Timeshare as follows:

A timeshare is a form of ownership or right to the use of a property, or the term used to describe such properties. These properties are typically resort condominium units, in which multiple parties hold rights to use the property, and each sharer is allotted a period of time (typically one week, and almost always the same time every year) in which they may use the property. Units may be on a part-ownership or lease/”right to use” basis, in which the sharer holds no claim to ownership of the property.

Timeshares give people the opportunity to use property like a hotel occupant while retaining rights of ownership — a right many believe always brings rapid appreciation. Timeshares do not go up in value.

Time-share owners are struggling to sell

Many are looking to sell their time shares amid the still-ailing economy and as the first generation of owners are nearing retirement. Some find their properties are worth pennies on the dollar.

By Jennifer Bjorhus — March 7, 2011

Time shares are tough to sell, even in the best of times. But now the shared vacation properties and their hefty annual fees have become nearly impossible to unload and are breeding a horde of scam artists preying on eager sellers.

Nearly 8 million people — about 7% of U.S. households — own a time share, a vacation property owned by many people who take turns using it.

When I was out of high school and out of the house, my parents bought a timeshare like many Americans did. They didn't go very often, and they got tired of paying the fees, so they sold it for a loss. They were glad to be rid of it.

My parents enjoyed their stays at the resort where they got their timeshare, but the cost versus the benefit wasn't in their favor over the long term. This is the experience of most timeshare owners.

The slow economic recovery, and the fact that the first generation to buy time shares 35 years ago has been retiring, means many people are looking to sell. Craigslist, EBay and specialized listing service Redweek are chock-full of offerings.

But how much they're worth is a different issue. One Florida listing service estimates that most time shares are selling for no more than 10% of the original price. Some owners are lucky to get pennies on the dollar.

I wonder how many of those people kept up the payments on the timeshare while they defaulted on other loans. Why not? If they aren't making a house payment, they will have the money to go enjoy their timeshare. The timeshare operators won't let the “owners” stay if they're in default. It's hard to squat in a timeshare.

“We've never seen the resale market where it is now,” said Brian Rogers of the Timeshare Users Group, a consumer advocacy group in Jacksonville, Fla., that runs the listing service. Most owners “huff away mad” when told their time share has depreciated like a Yugo, he said.

Then there are the scams.

Resale scammers feeding on desperation have run so rampant that the Better Business Bureau last month named time-share resale swindles one of the top rip-offs of 2010.

One such scam goes like this: Someone tells you they have a buyer lined up and to just pay a flat fee. In another, some company says it will take your unwanted time share off your hands and sell it for an upfront fee that can be thousands of dollars. Many like to advertise by postcard.

Florida has launched a statewide crackdown on time-share resale fraud. Its attorney general's office is investigating at least a dozen companies.

Even the top industry group, the American Resort Development Assn. in Washington, has issued five consumer advisories on resale scams in the last six months.

“In a down market they come out of the woodwork,” Chief Executive Howard Nusbaum said.

Desperation will always breed exploitation. For someone selling one of these through a shady service, what did they expect would happen? After paying an up-front fee that was probably half the value of the asset — assuming it has any real value — did the timeshare seller really believe this seller was going to obtain a price far enough above the open market to warrant the fee? Any service you have to pay for up front is probably a scam. Remember the loan mod shops the California Bar had to crack down on?

Time-share sales plunged 35% to $6.3 billion in 2009, the latest year for which data are available, according to the resort development group. Sales have dropped 40% from the 2007 peak.

Owners continue to fall behind on time-share loans, although overall default rates are down from their peak in January 2010, when 1 in 10 time-share owners was in default, according to Fitch Ratings, which tracks securitized time-share loans that are bundled up and resold to investors. The annualized default rate was 8.51% in December.

Personally, i am shocked it is that low. Perhaps timeshare owners more than appreciation loanowners are willing to hang on because the timeshare was always primarily a consumptive use. Any resale value was a bonus. Plus, those borrowers weren't using Option ARMs; although, I doubt timeshare loans were underwritten to tight standards either.

Nusbaum blames the current trouble on the recession and credit freeze, as well as the demographics of retiring baby boomers. Not only have cash-strapped consumers cut back on luxuries, but resort developers have found it harder to line up the credit to offer consumers. Most new time shares are sold directly by resort developers such as Hilton Hotels Corp., Marriott International Inc., Wyndham Hotels & Resorts and Starwood Hotels & Resorts Worldwide Inc., which provide their own financing.

There are just not as many consumer protections in the secondary market, where time shares get resold, he said. “We're kind of where the used car industry was in 1962.“

Some desperate owners try to hand time shares back to the resort developer under a so-called quit claim deed. But resorts won't take them unless they think they can resell the property, experts say.

Not all time shares are equal. The best — say a Disney resort — hold their value better than the rest. “If you bought a converted motel room in 1982 in Gatlinburg, Tenn., for the first week of December … I don't think it has a whole lot of economic life,” Nusbaum said.

LOL! This guy is hilarious.

People have to give up thinking that time shares are a financial or real estate investment, he added. It's a lifestyle investment, and its real value is the use owners get out of it.

For the last nearly two years, Shevy has worked with clients who came through the IHB. In my conversations and in his, we have shown people the cost of the purchase they're making and made no illusions about the bleak potential for appreciation and likelihood of continued price decline.

Most clients chose to purchase anyway. But rather than justifying an emotional decision with delusions of appreciation and HELOC riches, these buyers know they are paying a price, a consumptive price to the degree they were paying over rental parity. And that's okay as long as they know that going in.

People are smart and generally rational when they want to be. Buying can still be the right decision, it just isn't buying your own personal ATM machine. It's a shelter that provides a forced savings through amortization and a hedge against inflation.

But Bernie Wiklund hasn't been to his Cape Cod time share in nearly seven years. The retired engineer who lives in Ramsey, Minn., is working as a security guard to make ends meet and can't afford to fly out to Cape Cod or fork out $1,000 a year in fees.

He's advertised his two-week time share on Craigslist for nearly six years and marked it down to $5,000, a fraction of the more than $14,000 he paid in the 1980s. He's gotten responses, but only from people trying to sell the time share for him — for a fee.

“I'd like to retire,” he said. “I'm 72.”

This guy's retirement wealth is tied up in a timeshare? I hope he has other investments.

.jpg)

Kim Holbrook knows the feeling. The 56-year-old Brooklyn Park, Minn., resident has been trying for six years to sell the four time shares she and her husband bought years ago when they lived in the South and the resorts were quick getaways.

Now the children are grown, and she and her husband are spending more than $2,000 a year in annual fees on properties that they don't use like they used to. She can exchange some of the time shares for stays at resorts in different places, she said, but there are fees for that too.

Her advice for first-time buyers: Don't. “There isn't a market. You can't resell,” Holbrook said. “Everything I've seen … it's for pennies on the dollar.”

I have a news flash for the Holbrooks: they should take the pennies on the dollar and be happy they didn't have to pay someone to take those losers off their hands.

That's great news for buyers, of course. Mike Spillane, 67, picked up his eighth time share weeks ago: a one-week stay in a four-bedroom, four-bath unit in historic Williamsburg, Va. It's a “gold crown-rated” unit, referring to a time-share exchange system's top rating, that would cost as much as $30,000 if he bought it directly from a resort developer.

Spillane, who co-owns a small manufacturing company, often uses his time shares to exchange for stays at other resorts. He gives one week each year as a perk to employees and can absorb the $5,000 to $6,000 a year spent in maintenance fees.

“We know if the market doesn't fully recover that we're not going to get a lot of money for some of them,” he said. “But we've gotten use out of them for many years.”

Bjorhus writes for the (Minneapolis) Star Tribune/McClatchy.

Timeshares make fortunes for successful developers, and they create financial nightmares for most buyers.

I'll let you in on some timeshare industry secrets. But first some background.

Back in 2000, I worked on a project called Mystic Dunes for a timeshare developer Tempus Resorts.

As part of the project, I was given a behind-the-scenes tour of their sales operation. These guys set the standard for high-pressure sales techniques that worked. I found their tactics appalling but fascinating in a train-wreck sort of way.

Having previously worked for years with homebuilders, I have seen sales with urgency, but these timeshare sales guys won't take no for an answer. And that's a big part of their model for success. Over the course of dealing with thousands of leads in their controlled sales environment, they have encountered every objection imaginable, and they have developed detailed scripts they memorize and regurgitate on command.

Success in timeshare sales is much like that of interrogators. Police interrogators try to induce people to confess. One successful method is to confine the defendant in a room for hours on end and question them over and over again until they break under the pressure. Timeshare sales is the same.

In timeshare sales, one technique is to show people around the resort in large groups with salespeople assigned to each family, couple or individual to politely badger them. These people are herded into an auditorium with small round tables where the salespeople move in for the close.

Some in the group want to buy and eagerly sign up. When these first few buy, they ring a bell and loudly celebrate. This tells the herd purchasing is okay because others have bought. Very few people have the courage to screw up on their own, but as the housing bubble showed, they will go over the cliff together as long as they are reinforced for their foolishness by the people they see. Once a few people buy, momentum builds, and herd dynamics prompts many to buy when they ordinarily wouldn't.

The people who run these operations are master salesmen who know every trick to quickly close the deal. It's an extremely profitable business for the good operators. For those who don't know how to operate one of these unique sales presentations, attempting to go timeshare would be a disaster.

The timeshare business is profitable because they can sell a $200,000 condo 50 times at an average price of $20,000 a week. If you ever go on one of these presentations, do the math for yourself. It's astounding how much they make, but it's also astounding how much they have to pay out to make it.

So when a timeshare owner pays $20,000 for their week in a condo, they are really buying a 1/50 interest in a $200,000 property. Their $20,000 purchase is really only worth $4,000 at best. So back to the main point of the article of the day, timeshares are the worst real estate investment because they are extremely overpriced when you buy them, and the ongoing fees will make them a liability that after a time outweighs the consumptive value.

I'll just stay at a hotel.

This property was first featured on May 25, 2010 when it was for sale as a short for $710,000. Apparently the negotiations with the borrower broke down because the bank foreclosed on 12/13/2010 and now after what looks like a first-rate renovation by the bank, they are offering it for sale.

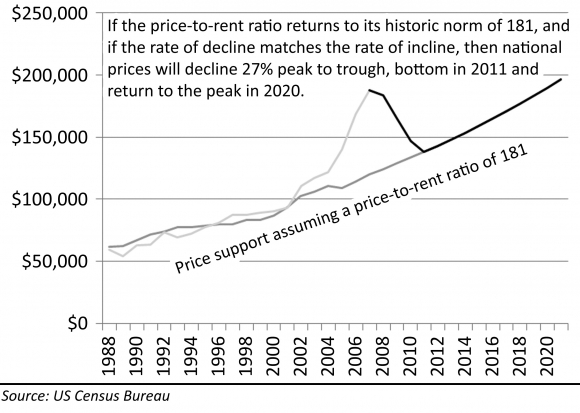

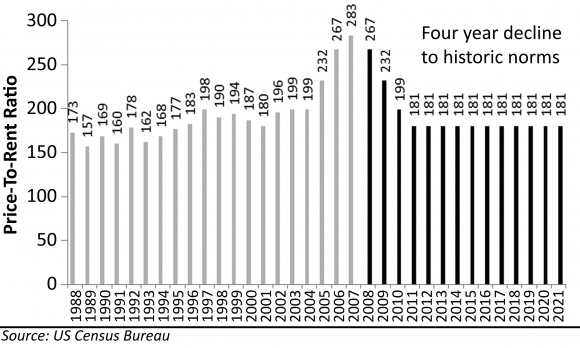

The following is updated from the previous post, The California Economy is Dependent Upon Ponzi Borrowers:

Today's featured Ponzi borrower

- Today's featured property was purchased on 11/13/1999 for $485,000. My records say the owners used a $502,000 first mortgage, but that is unlikely. It is more likely they used a $402,000 first mortgage and a $83,000 down payment.

- On 5/13/2003 they opened a HELOC for $63,400

- On 1/26/2004 they got a HELOC for $100,000.

- On 2/1/2005 they refinanced with a $634,500 Option ARM with a 1% teaser rate.

- On 3/23/2005 they obtained a $80,000 HELOC.

- On 8/10/2005 they got a HELOC for $100,000.

-

On 11/3/2006 they refinanced with a $688,000 first mortgage and a $85,000 HELOC from Wells Fargo. Since Wells owns both mortgages, they are in no hurry to foreclose on this owner and wipe out their HELOC. Look for this property to be in the amend-pretend-extend dance forever.

- Total property debt is $773,000.

- Total mortgage equity withdrawal is $484,227 plus whatever down payment they put into the property.

- Total squatting was at least 11 months.

Foreclosure Record

Recording Date: 04/15/2010

Document Type: Notice of Default

This couple spent almost half a million dollars in a four-year span. That is a one-family stimulus plan. If they were an isolated case, it may be a titillating story, but I have profiled hundreds of these here in Irvine. It is a widespread practice.

Irvine Home Address … 74 LINHAVEN Irvine, CA 92602 ![]()

Resale Home Price … $749,000

Home Purchase Price … $658,600

Home Purchase Date …. 12/13/10

Net Gain (Loss) ………. $45,460

Percent Change ………. 6.9%

Annual Appreciation … 52.6%

Cost of Ownership

————————————————-

$749,000 ………. Asking Price

$149,800 ………. 20% Down Conventional

4.85% …………… Mortgage Interest Rate

$599,200 ………. 30-Year Mortgage

$152,450 ………. Income Requirement

$3,162 ………. Monthly Mortgage Payment

$649 ………. Property Tax

$114 ………. Special Taxes and Levies (Mello Roos)

$125 ………. Homeowners Insurance

$0 ………. Homeowners Association Fees

============================================

$4,050 ………. Monthly Cash Outlays

-$768 ………. Tax Savings (% of Interest and Property Tax)

-$740 ………. Equity Hidden in Payment

$279 ………. Lost Income to Down Payment (net of taxes)

$94 ………. Maintenance and Replacement Reserves

============================================

$2,914 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$7,490 ………. Furnishing and Move In @1%

$7,490 ………. Closing Costs @1%

$5,992 ………… Interest Points @1% of Loan

$149,800 ………. Down Payment

============================================

$170,772 ………. Total Cash Costs

$44,600 ………… Emergency Cash Reserves

============================================

$215,372 ………. Total Savings Needed

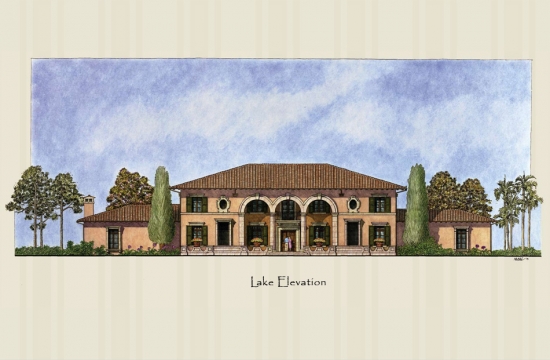

Property Details for 74 LINHAVEN Irvine, CA 92602

——————————————————————————

Beds: 4

Baths: 3

Sq. Ft.: 2478

$302/SF

Lot Size: 6,937 Sq. Ft.

Property Type: Residential, Single Family

Style: Two Level, Mediterranean

Year Built: 1999

Community: West Irvine

County: Orange

MLS#: S648733

Source: SoCalMLS

Status: ActiveThis listing is for sale and the sellers are accepting offers.

On Redfin: 10 days

——————————————————————————

Bank Owned!!! Highly upgraded home in West Irvine. Great curb appeal. Professionally landscaped. Extra long driveway for additional parking. Gourmet kitchen with center island. Granite counters and backsplash. Plantation shutters throughout. Hardwood flooring throughout downstairs. Built-in entertainment center in family room. Ceiling fans throughout. This home is well maintained.

.jpg)