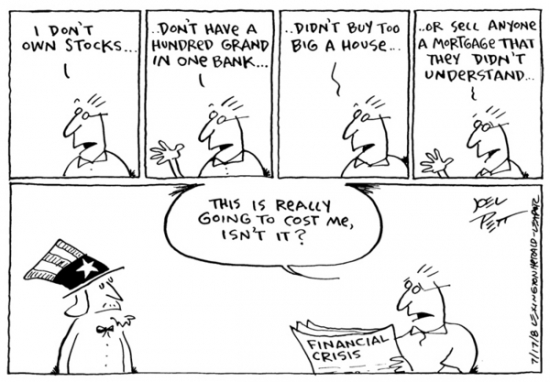

Lenders and borrowers shoulder responsibility for the housing bubble. But do they share the blame equally?

Irvine Home Address … 14102 SAARINEN Ct Irvine, CA 92606

Resale Home Price …… $619,900

You're a rockstar (Baby!)

Everybody wants you

Player!

Who could really blame you?

We're the ones who made you!

Eminem — We Made You

Banks created their own nightmare. They turned good borrowers into HELOC dependent Ponzis, inflated a massive housing bubble, and now that prices are crashing, lenders are surprised at the behavior of borrowers. Each side feels they are being victimized by the other. Lenders are being left to hold the bag and absorb the losses, so they have suffered consequences for their actions. Borrowers lost their homes, so they have suffered too. Beyond enduring the consequences, each party bears some responsibility for what happened. But who deserves blame, and how much?

Back in January of 2010 I advanced the proposition that Lenders Are More Culpable than Borrowers. It's a great old read and a good refresher for today's featured article.

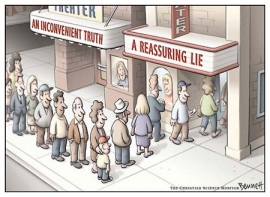

The writing today is challenging for me to deal with because I agree with the central point of this author's argument that banks are more responsible than loan owners. However, the reasoning she uses is faulty and based on emotional appeals. The real points in favor of her position are missed entirely (see link above).

Who's to Blame for the Mortgage Mess? Banks, Not Homeowners

By ABIGAIL FIELD Posted 6:30 AM 01/20/11

As the foreclosure crisis has escalated over the past several months, one overarching debate has been about who bears the most blame: homeowners or banks?

After everything I've learned and written about the foreclosure mess, my verdict is: The banks are responsible for 90% of the problem, troubled homeowners 10%.

After writing about this phenomenon for four years, my verdict is: 66% lenders, 33% borrowers, and 1% for the rest of us that have to pay for it because we allowed it to happen.

Yes, every foreclosure involves a homeowner not paying his mortgage.

This is the classic lead-in where you acknowledge very damning evidence against your position as briefly as possible so the impact falls flat. The fact that loan owners are not paying their mortgage is exactly why they bear responsibility in this mess. Nobody forced people to take out loans. Borrowers were responsible for their actions. I would say they are 50% responsible, but lenders bear more than half because they should have known better.

But every foreclosure also involves a bank that made the loan. And usually another bank, or several more, that profited from securitizing the loan. And still another bank, or several, that profited from servicing the loan.

Banks and investors made money. So what? Making money does not make one evil. The system was set up for banks to originate loans. They did this for a profit.

Together, those banks have done three things that created the massive glut of foreclosures choking America's legal systems and laying waste to its real estate markets:

- They knowingly made millions of loans doomed for foreclosure as soon as the check was written.

- They deliberately and/or incompetently failed to modify many salvageable mortgages.

- They were so careless with their paperwork and processes that they've undermined the rule of law, clouded the title to untold numbers of properties and complicated the processing of the massive backlog of foreclosures that hurts the economically crucial real estate market.

Let's take a closer look at each factor.

Her first point is true. Lenders did knowingly make millions of loans that were doomed. Lenders did this because they were working on an origination model where they were compensated based on filling an order for a loan made by an investor. It was the investors who were demanding stupid loans that were doomed from the start. Investors demanded bad loans because the loans were often packaged into securities given AAA ratings by ratings agencies being paid by the syndicators to give them AAA ratings. The conflict of interest caused risk to be improperly priced and large amounts of money to flow into poorly underwritten mortgages.

Her second point about failing to modify salvageable mortgages is emotional pandering and nonsense. Many former loan owners find vindication in stories about how the evil banks failed to unilaterally change the terms of a contract to suit the borrower. It's easier for the renting-former-owners to rage against the system rather than feel responsible for a delinquent mortgage requiring modification.

Plus, the whole idea of a salvageable mortgage seems wrong to me. These borrowers are drowning in a cesspool and throwing them a life preserver in the form of a loan modification merely allows them to wallow in their own debt. Is it better to let them drown? I think so. After a foreclosure and bankruptcy, it is over, and they can rebuild their lives. Financial rebirth is a wonderful opportunity.

The emotional pandering is part of the left-wing political meme on this issue. The other political pandering to loan owners concerns robo-signer.

Her third point about procedural delays is off on many levels. First, she implies the procedural delays have hurt the housing market, but she isn't clear on what that means. Lenders have been creating and taking advantage of delays throughout the process in order to slow the flow of foreclosures. Lenders gain by having less inventory pressuring prices. Delinquent borrowers gain by more squatting time. Current borrowers gain by having prices remain higher than levels needed to clear the market. Those interested parties all benefit from delays. Renters and would-be buyers are the ones hurt by these delays, and their voices are seldom heard.

The facts aren't important to her point. She was merely making an emotional appeal to anyone who has gone through foreclosure. Renting-former-owners (RFOs?) think maybe their foreclosure was improper too? And maybe someone will give them a free house because of it?

What Happened to Underwriting?

Getting a mortgage isn't supposed to be as easy as getting cash from an ATM. Banks are supposed to make applicants prove they can repay loans before giving them. The process is called underwriting, and it's one of the most basic in banking.

Yet during the housing bubble, banks largely stopped underwriting in any reasonable way. Indeed, if the banks had been underwriting throughout, the bubble could never have inflated so much.

If you want to get a vivid and entertaining overview of the dynamics that eliminated underwriting, listen to Planet Money's interviews of people at every stage of the process, from making the home loan through its ultimate securitization.

The mortgages made without underwriting have lots of names: Low-doc loans (the borrower stated her income without proof, but proved the assets she claimed to own, or vice versa), no-doc loans (borrower stated both income and assets without proving either), NINJA loans (no proof of income, job or assets). They're all known as liar's loans. According to a recent Forbes article, in 2006 and 2007 liar's loans accounted for 40% of new mortgages, and more than 50% of new subprime mortgages.

The housing bubble would not have gotten legs in 2004 if it were not for Option ARMs and reduced lending standards. Prices were too high in 2004 (as evidenced by the fact that most markets trade below those prices even today). With a diminished buyer pool and higher prices, the market was nearing a top. Wall Street demanded mortgage-backed securities. To meet this demand loan balances would need to get larger and qualification standards would need to drop. The Option ARM allowed much larger loan balances, and the qualification standards were dropped sufficiently to meet demand. Demand was nearly infinite, and qualifications were nearly eliminated.

The Banks Knew Mortgage Applications Were Fraudulent

Now here's the thing: No one forced the banks to make those loans, even if the applicants were lying about their ability to repay.

People shouldn't be sympathetic to banks that effectively say: “Hey, we knew the applicants were lying and wouldn't be able to repay the loans. We didn't care because we didn't hold onto the loans. We offloaded the risk to investors through the securitization process. But so what? Blame the deadbeat borrowers for the volume of foreclosures today.“

That is a compelling argument. Deadbeat borrowers do deserve much of the blame. I peg it at 33%.

Why is it fair to say the banks knew they were being lied to? Well, beyond the obvious — everybody in the business used the term liar's loan — the FBI warned about mortgage fraud back in 2004. And take a look at this 2006 fact sheet from the Mortgage Brokers Association for Responsible Lending that analyzed data from 2004 and 2005. By doing a quick check, the group found that 90 out of 100 stated-income loans exaggerated the applicant's income, and 54 of those loans inflated it by more than 50%.

Or consider this Chase loan officer's email acknowledging that he had made up an inflated income amount to make a borrower's debt-to-income ratio “work.”

By 2007, the FBI reported that industry insiders — loan officers, mortgage brokers, real estate agents, appraisers and lawyers — not wannabe homeowners — were involved in some 80% of mortgage fraud. The FBI calls that “fraud for profit” as opposed to “fraud for housing,” which is when a homeowner lies to get a house he can't afford. As Calculated Risk's Tanta showed in 2007, that distinction started breaking down as the absence of underwriting by the banks enabled both types of fraudsters to join forces.

Tanta also explained that in addition to being directly complicit in mortgage fraud, lenders engaged in massive cost-cutting efforts that gutted their ability to underwrite loans:

So many of the business practices that help fraud succeed — thinning backoffice staff, hiring untrained temps to replace retiring (and pricey) veterans, speeding up review processes, cutting back on due diligence sampling, accepting more and more copies, faxes, and phone calls instead of original ink-signed documents — threw off so much money that no one wanted to believe that the eventual cost of the fraud would eat it all up, and possibly more.

Beyond the idea that the banks knew, in real time, that they were making loans that couldn't be repaid, evidence shows that banks went a step further and tried to conceal that information from others.

Banks Hid Fraud by Shopping for AAA Ratings

Banks weren't the only entities to stop evaluating risk. Their key allies were the big three ratings agencies, Moody's, Standard & Poor's and Fitch. The ratings agencies put AAA ratings on securities that didn't come close to deserving that golden grade, in part by using outdated risk models that their own analysts complained inflated ratings. But why weren't the agencies worried about their professional reputations?

In 2009, professor and former financial regulator William K. Black used a paper from S&P to discuss how the banks and the raters chose not to look at the documents used to make the loans they were securitizing. Then Black cited a 2007 paper from Fitch to show why it mattered that no one was looking at the loan files, why it was at minimum willful blindness. (Willful blindness is trying hard to not know that the law holds you accountable for knowing.)

What was going on? According to 2010 testimony from former ratings agency executives and their emails, the agencies capitulated to demands from banks for AAA ratings on mortgage-backed securities even though they knew those ratings weren't deserved.

The banks had the leverage to get the AAA ratings they wanted because rating “structured finance products” — mortgage backed securities and the like — had become really profitable for the ratings agencies, and compared to other types of rated securities, very few clients issued them. So if those clients — the big banks — weren't pleased, they could simply “ratings shop” — that is, go from one agency to another until they got the desired rating.

In short, a large proportion of the foreclosures drowning the courts and the real estate market are a direct consequence of the banks' failure to effectively underwrite loans during the bubble. Those borrowers should have had — and today would have had — their loan applications rejected.

That is a good description of the shady dealings at the ratings agencies.

Servicers Get Paid to Foreclose, Not Modify

But wait, you might point out, it's not just the dodgy liar's loans going bust. Foreclosures have spread widely throughout the “prime” mortgage market as well. Surely, the Great Recession, not the banks, is to blame for many of those foreclosures.

You'd be only partly right.

What's generating many recession-induced foreclosures is the relatively new model of mortgage servicing. Prior to the mass securitization of mortgages, the bank that made a mortgage was the same bank that serviced it. As a result, the servicing bank made its money from the mortgage interest, and the long-term repayment of the mortgage was key to its profit. So, a bank was typically willing to work out a mortgage modification with the homeowner to keep that income stream intact.

Of course, sometimes the homeowner was in such trouble that foreclosure made more sense. Foreclosures do happen even in real estate markets filled only with solidly underwritten loans serviced by the bank that made the loan. That's because bad things do happen to prevent a once-creditworthy borrower from repaying.

Unemployment is a big problem. But there are other problems like a borrower's adjustable-rate mortgage recasting to fully amortizing and their payment going up 50%. .png)

How many forecloses result from financial incentive and how many from incompetence isn't clear, but it's also irrelevant. The point is that a good chunk of foreclosures shouldn't happen because modifications make more money for the people the mortgage is owed to (usually, the investors in the mortgage-backed securities).

Simply put, if the banks had kept up normal underwriting and had modified mortgages (or approved more short sales) every time it made sense to do so, we wouldn't have the foreclosure volume, and thus delays, that we currently face.

Her contention that investors would make more from a modified mortgage is not proven. It is likely not true simply because so many modified mortgages fail costing the investors even more money. Since she is mistaken about what is best for the investors of the mortgage-backed securities (as if she cared) she is also mistaken in her contention that less foreclosure volume was in everyone's best interest.

The “Paperwork” Problems Aren't Meaningless

Now you might ask, in addition to volume-related delays, with so many foreclosures in the system, aren't defaulted homeowners to blame for gumming up the process? Aren't they just citing meaningless problems with the banks' paperwork so that they can stay in their homes for free, hurting everyone else in the process?

No.

Actually, yes. Attorneys enable squatters to game the system. The delays caused by this foolish procedural posturing stops a new family from moving into the property — a family likely to be paying a mortgage — which in turn hurts the lender.

While it's true that foreclosure defense attorneys want to slow the process to give their clients more time to relocate,

Bullshit! People are not looking for more time to relocate. How long does it take to move out? Two weeks? Three weeks, tops? This premise doesn't pass the sniff test. Attorneys enable squatters to game the system because squatters want them too. Squatters want to stay in a house with no rent and no payment. It is financial greed, pure and simple.

that doesn't mean the “paperwork” problems they're raising are meaningless. [actually, it does.]

For example, the banks' carelessness with the securitization of Massachusetts mortgages has clouded the title to thousands of properties. Foreclosure attorneys' use of nonlawyers in Pennsylvania may have clouded the title to thousands more. The use of a private, electronic database (called MERS) to track mortgages instead of recording them in government land records may have clouded yet millions more. And in any case, MERS is a legally problematic cost-savings strategy that has created only more confusion and delay.

Even homeowners who are capable of curing their default sometimes can't because banks' inaccurate record-keeping about how much the homeowners owe precludes the possibility. More outlandish problems have surfaced too: from multiple banks trying to foreclose on the same property, to banks foreclosing on homes bought with cash, to banks breaking into homes they haven't foreclosed on, to a bank ignoring its court-approved agreement to foreclose and demanding the money instead.

She has recounted every feeble story trying to give the robo-signer scandal legs. Each of them is pretty weak. None of this makes borrowers any less blameworthy for the housing bubble.

What Revelations Are Still to Come?

These cases are probably just the leading edge of a paperwork-problem tsunami. Even though these issues have been in the news for months, the official investigations and litigation are still in relatively early stages. Millions of foreclosures in nonjudicial states haven't gotten the scrutiny they deserve (except presumably as part of the 50-state attorneys general investigation), so who knows what will yet surface?

As major judiciaries force a closer look at bank documents, what will they find? The fact that all the major law firms advising on “typical” securitization deals didn't know that “assignments in blank” violated Massachusetts law is chilling. How many other states' laws were broken by the “typical” deal?

Moreover, everything we're seeing suggests the banks' papers for securitized loans are in total disarray. The note is in one place (theoretically), the record of payments on the loan (inaccurate as it may be) is in another, and the ownership of both the note and the mortgage may or may not be the same. When asked to produce securitization documents, banks frequently submit drafts and contracts without attachments. The attorneys doing the foreclosures are buried in volume, cutting corners themselves, and are unable to meaningfully communicate with their bank clients. Indeed, it may not even be attorneys doing the foreclosures.

Signs of this chaos abound, whether it's dead financial firms signing documents, banks changing their minds about who owns the loan in the middle of court proceedings, or attorneys unable to certify that the information in foreclosure complaints is true.

There is sloppiness in every industry. So what?

And What's the Fate of Mortgage-Backed Securities?

The banks also have a different type of mortgage “paperwork problem” relating to mortgage-backed securities. Will the banks discover that millions of mortgages they thought they had securitized instead stayed with them because they screwed up the paperwork to transfer the mortgages?

Massachusetts will be a leading indicator on that question because the “assignment in blank” problem may have prevented most of those Massachusetts mortgages from being securitized. Or if the securitizations technically succeeded, will investors still win suits against the banks or force them to buy back large volumes of securities because the papers the banks used to sell the securities were fraudulent?

The foreclosure paperwork problem damage the banks somewhat and the broader economy even more so, but the paperwork problem with mortgage-backed securities has the potential to trigger Bank Bailout II.

Whatever happens to mortgage-backed securities is irrelevant. Investors will demand a properly priced mortgage-backed security, and the market will find a way to supply that demand. After years of fighting the legal issues pertaining to buybacks will be resolved and the market will function again. None of this makes borrowers blameless.

No One Is Above the Law

But imagine for a second a world that doesn't exist — one in which the banks' foreclosure documents were all accurate, and their problems were simply a failure to abide by the rules that apply to everybody else? Shouldn't we blame the deadbeats for gumming up the system then? Many readers make comments to that effect on some of my reporting.

Yes, we should. Just like we should blame them now.

Let's flip the question: Why is it OK for the banks to ignore the rules? The rich and powerful and the ordinary Joe are all supposed to play by the same rules. No one is supposed to be above the law.

That is a straw-man argument. First, borrowers are not ignoring the rules. Deadbeat borrowers are exercising a contractual right to quit paying and surrender the property — at least the ones who are not squatting with the aid of an attorney. Flipping the question makes no sense, particularly when the original question was based on faulty observation.

The following points are false.

No matter whether it's America's real estate market getting crushed by millions of foreclosures that didn't need to be, or our real property records getting shredded through clouded titles, or

The following points are true.

citizens' tax dollars being used to bail out banks again, we're all paying for the banks “paperwork” problems.

And remember: We don't know yet just how big that bill is ultimately going to be.

We don't know how big the bills are going to be or who will ultimately pay them. As a taxpayer, you can be sure your name is on the bill.

She owned it for years, then she went Ponzi

Today's featured owner is another loss for a stupid lender, and another long-term home owner that went Ponzi and spent their home in just a few years.

My records don't go back far enough to find when they purchased the property. That often happens on properties owned since the mid 90s or longer. My first record is a HELOC she opened on 6/8/1999 for $67,000.

By 2002 she was fighting the urge to go Ponzi. On 3/5/2002 she refinanced her first mortgage for $287,000. This was likely a cash out transaction but still for much less than appraised value. In other words, she got a little kool aid buzz, but she didn't get enough to go crazy. On 11/4/2002 she refinanced the first mortgage again for $283,100. Since this is for a smaller amount, I surmise that she was at least trying to be responsible. She gave that up in 2005 and went Ponzi.

On 3/15/2005 she refinanced the first mortgage for $481,000 with an Option ARM with a 1% teaser rate. One can speculate on why she needed $200,000 in one lump sum, but she must have had bills to pay. Big bills.

Actually, she probably took the money simply because it was offered. With the Option ARM, she was likely told that their payment would go down and she would be given a check for $200,000. Not a bad sales pitch if you want to underwrite lots of mortgages. Once she went Ponzi with the Option ARM, the rest was merely whirling down the drain.

On 12/12/2005, blissfully unaware that she had gone Ponzi, she opened a HELOC for $100,000. The free money was flowing.

On 4/26/2006, with one last suck on the mortgage teat, the owner obtained a $647,000 first mortgage and a $80,000 HELOC to bring the total property debt to $727,000. The total mortgage extraction likely exceeded $500,000.

Oh, and she got to squat for a while too:

Foreclosure Record

Recording Date: 10/16/2009

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 07/08/2009

Document Type: Notice of Default

At the most recent, the last payment she made would have been on March 1, 2009. In all likelihood she was delinquent far longer than that but the bank didn't bother filing the NOD.

Irvine Home Address … 14102 SAARINEN Ct Irvine, CA 92606 ![]()

Resale Home Price … $619,900

Home Purchase Price … $694,179

Home Purchase Date …. 12/16/2010

Net Gain (Loss) ………. $(111,473)

Percent Change ………. -16.1%

Annual Appreciation … -66.0%

Cost of Ownership

————————————————-

$619,900 ………. Asking Price

$123,980 ………. 20% Down Conventional

4.78% …………… Mortgage Interest Rate

$495,920 ………. 30-Year Mortgage

$125,161 ………. Income Requirement

$2,596 ………. Monthly Mortgage Payment

$537 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$103 ………. Homeowners Insurance

$60 ………. Homeowners Association Fees

============================================ .jpg)

$3,296 ………. Monthly Cash Outlays

-$440 ………. Tax Savings (% of Interest and Property Tax)

-$621 ………. Equity Hidden in Payment

$226 ………. Lost Income to Down Payment (net of taxes)

$77 ………. Maintenance and Replacement Reserves

============================================

$2,540 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,199 ………. Furnishing and Move In @1%

$6,199 ………. Closing Costs @1%

$4,959 ………… Interest Points @1% of Loan

$123,980 ………. Down Payment

============================================

$141,337 ………. Total Cash Costs

$38,900 ………… Emergency Cash Reserves

============================================

$180,237 ………. Total Savings Needed

Property Details for 14102 SAARINEN Ct Irvine, CA 92606

——————————————————————————

Beds:: 4

Baths:: 3

Sq. Ft.:: 2268

$0,273

Lot Size:: 4,784 Sq. Ft.

Property Type:: Residential, Single Family

Style:: Two Level, Contemporary

Year Built:: 1973

Community:: Walnut

County:: Orange

MLS#:: S643944

Source:: CARETS

——————————————————————————

Most desirable floor plan with quiet end of cul-de-sac location. Adjacent to community greenbelt/park. Upgraded appliances with near new painted interior. Neutral colored carpet throughout.

This video has nothing to do with real estate, but I thought the artistry was fantastic, so I am sharing it here.

I described the problem this way in

I described the problem this way in

.png)