Paul Jackson from HousingWire persuasively argues that private property rights are being trampled.

Irvine Home Address … 4152 HOMESTEAD Irvine, CA 92604

Resale Home Price …… $640,000

And all the clouds come in day by day

No one stop it in anyway

And all the peacemaker third war officer

Hear what I say

Police and thieves in the streets

Scaring the nation with their guns and ammunition

Police and thieves in the street

Fighting the nation with their guns and ammunition

The Clash — Police and Thieves

What do you do when the people who are supposed to protect you and serve your interests steal from you? Protest? To whom? What do you do when the government that is supposed to look out for us steals our money and gives it to greedy and corrupt corporations and bankers? It's happening to you right now.

The greatest heist in our country’s history

by PAUL JACKSON — Tuesday, October 5th, 2010, 5:29 pm

Our economy is being stolen from us, and our nation’s real estate crisis is providing cover for what will — if it goes unchallenged — go down as one of the greatest heists in our country’s history.

Yes, a mortgage crisis of historic proportions has now suddenly become a foreclosure crisis of historic proportions. And it’s front page news, too, bringing the market pundits out of the woodwork to exclaim as loudly as they possibly can that the entire U.S. mortgage system is a fraud.

Those three links are great supporting materials. If you are inclined to explore them, they are worthy of your time to read.

Banks are admitting to having taken shortcuts with their paperwork, or not having notarized documents properly, or delegated signing authority when they should not have. Yes, procedures haven’t been followed. And, yes, banks are going to pay for it, some far more than others.

Paul is referring to this tempest in a teapot: Paperwork storm hits nation's biggest bank. This news story isn't really news, but it serves to stoke the false hopes among debtors that mortgage relief is forthcoming. It isn't.

I’m even sure all of these procedural errors — and some that have yet to come to light — are on varying levels endemic and common throughout the mortgage servicing industry.

But in the end, am I the only one asking: who really cares? Does any of this make it more likely that a borrower will suddenly be able to afford their mortgage? Isn't that what really matters?

The Fallacy of Financial Innovation.

What really should matter is this: as a nation, we have lost at least $2 trillion in wealth thanks to the economic downturn, led by an absolute collapse of our housing and mortgage markets. It’s a collapse we have all yet to recover from, as a host of well-intentioned but ill-fated policies have done nothing except prolong pain — not only for banks, who are still playing hide-and-seek with bad assets on their balance sheets, but also for borrowers, who are being lied to by our government and by the very consumer advocates who claim to wish to help them.

The results emerging here threaten our nation’s very system of private property rights — a fundamental aspect of our democracy. But not because the banks have abused procedure, as so many pundits have conveniently alleged; instead, it’s because the very procedures designed to protect our nation’s property rights are now being used as a weapon against us.

And most of America doesn’t even know it’s happening.

An economy of lies

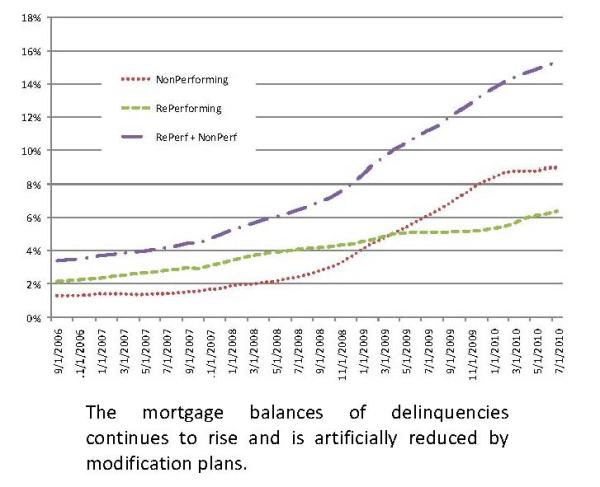

Just how much hide-and-seek is still out there, playing games within balance sheets of major financial institutions? Plenty. In March, I highlighted analysis from Laurie Goodman at Amherst Securities, who found that of more than $1 trillion in second mortgages outstanding, $963 billion remained on the balance sheets of commercial banks, thrifts and credit unions. As another way of slicing it, a look at Federal Reserve data shows that as of Sept. 22, U.S. commercial banks held $592.1 billion in revolving home equity loans — essentially unchanged from August of 2009, when banks held $605.2 billion.

Banks Refuse to Recognize HELOC and Second Mortgage Losses.

If you believe that the second liens and home equity loans banks are holding on their balance sheets are worth anything close to what they’re being booked at, you haven’t looked at what second liens tend to bid at on the secondary market: anywhere from 5 to 7 cents. And that’s for performing second liens.

Let that sink in a moment. Our banks are holding a trillion dollars of worthless second mortgages on their balance sheets. Do you see why short sales take forever? Banks don't want to recognize these losses, so they use the short-sale process as a means of facilitating negotiations with delinquent borrowers to get some recovery on their second mortgage loan debt.

Most properties that go to foreclosure quickly are those where the first mortgage is held by one bank and the second is held by another. Rarely do banks go to foreclosure if they hold both mortgages. Instead they endlessly amend-extend-pretend in hopes that these second mortgages will come back in-the-money from their currently worthless position. Banks live in a state of perpetual denial concerning these bad second mortgages. The horror of the reality of their situation is too terrible to be accepted.

Layer on top of that millions of borrowers who aren’t deleveraging yet, because Uncle Sam is telling them not to, and consumer advocates have swooped in to help. We’ve sold the American populace on the idea that their home truly is the American Dream, and that saving that dream is worth wallowing in bad debt and insolvency for years — rather than simply leaving it behind, deleveraging and moving on with their lives.

Foreclosure Is a Superior Form of Principal Reduction.

Toward this end, the HAMP program is an outright and unmitigated disaster: Consider that through August 2010, 468,000 of the 1.4 million homeowners offered trial mods had received "permanent" modifications. Even if only 40% of these “permanent” modifications redefault — an incredibly low redefault rate — that’s 280,800 borrowers that get to stay in their homes. Assume that number triples between now and 2012, when HAMP is slated to expire: that means 842,400 borrowers will be assisted by HAMP when all is said and done.

HAMP's program cost? $50 billion. The final price tag? $60,000 per success. We might as well have just given the whole lot of our nation’s delinquent borrowers a year’s worth of mortgage payments as a cash advance — it would have been just as effective.

But HAMP’s real crime isn’t its inefficiency and cost to the taxpayer. It’s the culture of ‘indentured servitude’ that it has spawned upon an unwitting American public. Our government has convinced millions that it is better for them to wait to resolve their bad debt, to wallow in insolvency — that they should attempt to see that debt restructured into some other bad debt, with much of this new, still-bad debt now guaranteed and backed directly by the U.S. government.

The Mechanism For Diverting Bank Losses to the US Taxpayer.

The result is that bad debt lurches along in our financial system, never really cleaning itself out; and borrowers are left with horrible credit for years as they work through attempting to restructure their debt again and again, damaging their future hopes of ever really contributing to GDP growth again.

It’s a crime upon our nation, financially and socially, yet it’s one that the American people have allowed themselves to be subject to. We are, after all, a government by the people and for the people.

But the real reason we aren’t seeing the sort of economic growth most have expected is precisely because we haven’t allowed the consumer to repair their balance sheets, a necessary and positive thing for the economy in general: we’ve encouraged them to do the exact opposite.

Eliminating Government Housing Subsidies Will Improve the Economy.

It’s somewhat convenient for the nation’s banks, too, that consumers decided to hold onto all of this debt, too — because doing so allows our financial institutions to continue to play hide-and-seek with their bad assets. Which avoids the need for messy additional government bailouts, politically untenable as they are these days.

So everyone plays along with the ruse.

Regardless, the inconvenient truth here is that until we allow this billions of dollars worth of bad mortgage debt to truly course through our economic veins, to work itself out, we won’t see an economic recovery. Deleveraging privately — and now, through transfer of debt, publicly — is a necessary prerequisite to future economic growth in our country.

Foreclosures Will Drive the National Economic Recovery.

Love me tender

Foreclosures, then, aren’t really the enemy at our gates; they’re instead a necessary and healthy indicator of market correction. They are proof that our nation’s well-developed system of private property rights is, indeed, actually working as it should.

Foreclosure is not the problem; foreclosure is the cure.

But our government has instead made foreclosures into a “last stop” measure instead, something to be avoided at all costs as well as something that probably rates just below Big Tobacco on most American’s scale of corporate loathing — this is a huge mistake, as NYU law professor Richard Epstein notes in a brilliant column published in Forbes magazine.

By giving in to sensationalism over robo-signers and who notarized what, we’ve allowed procedural gaffes to substitute for true substance. And we’ve forgotten why those procedures really exist in the first place — not to protect the hapless borrower, who has already defaulted, but to instead protect our nation’s sacred system of land rights. To protect the foundations of our very democracy.

Money Rentership: Housing and the New American Dream

“Foreclosure should be understood as a healthy form of market correction of prior transactions. It should not be regarded as a form of original sin, to be tolerated only under the most extreme circumstances,” writes Epstein. “The older rules were designed to allow strict foreclosures in order to clear title. The new rules will result in short-term victories for some besieged landowners — and fresh losses for everyone else.”

California, at least, seems to have had its priorities straight. Under California law, borrowers looking to challenge a foreclosure sale on grounds of any irregular procedure (like affidavit signing, notarization, and the like) must first make a “valid and viable” tender offer to the lender for the amount due on the loan. In other words: a procedural error doesn’t matter, if the borrower still can’t pay the debt.

After all, as I noted before and will say again: our nation’s detailed and paperwork-heavy procedural requirements don’t exist for the protection of the borrower in default. They exist to protect our nation’s very system of property rights.

I wasn't aware of this law prior to reading this article. It is a good law, IMO.

California’s "tender rule" has helped the courts in the Golden State avoid much of the same fate as those in Florida, which have quite literally been besieged by claims of procedural irregularities. It’s why California is more able to work through foreclosures, and the single largest reason why the state is closer to finding an equilibrium in housing than Florida is.

Actually, we are only at an equilibrium because we aren't foreclosing and putting supply on the market, but I don't want to take away from Paul's larger point.

But California attorneys I speak with now say that the “tender rule” in California is under heated attack from consumer attorneys that would see the rule turned around, allowing California’s courts to resemble the mess that is Florida’s.

Rather than fighting California’s “tender rule,” what we really ought to be doing is considering a national, federal law that makes something like the “tender rule” a national requirement. In other words, if you can’t make good on your debts anyway, procedural missteps in a foreclosure are immaterial and something for attorneys and their bar to worry about.

By subverting our nation’s real estate law to favor borrowers who have no intention of fulfilling their debts, we risk undermining everything that establishes private property rights in our country — and perhaps the coup de grâce of it all is that the American public will be cheering when it happens.

How very eerily Orwellian of it all.

The enemy at our gates threatening our very republic isn’t Wall Street, isn’t banks, isn’t foreclosure mills, isn’t botched paperwork, isn’t loan officers making empty promises, isn’t investment banks rolling loans into CDOs and other esoteric investments, isn’t rating agencies. Instead, we've met the enemy, and it’s us.

Paul Jackson is the publisher of HousingWire Magazine and HousingWire.com. Follow him on Twitter: @pjackson

Obviously, I think Paul Jackson really gets it.

$300,000 in HELOC abuse

Nearly every day I profile a house where someone extracted hundreds of thousands of dollars in HELOC money. Since these are almost always short sale and foreclosures, you know that these people have nothing to show for all that spending. They couldn't have buried it in the yard because they are losing the yard too.

- Today's featured property was purchased for $475,000 on 10/15/2003. The owners used a $380,000 first mortgage and a $95,000 down payment.

- On 11/5/2004 they refinanced with a $530,000 first mortgage.

- On 5/3/2006 the obtained a HELOC for $150,000. We know they spent it because this property is listed as a short sale.

- Total property debt is $680,000.

- Total mortgage equity withdrawal is $300,000.

Do you want to pay off their debts? The bank is willing to loan you money at 4.3% to do it.

Irvine Home Address … 4152 HOMESTEAD Irvine, CA 92604 ![]()

Resale Home Price … $640,000

Home Purchase Price … $475,000

Home Purchase Date …. 10/15/2003

Net Gain (Loss) ………. $126,600

Percent Change ………. 26.7%

Annual Appreciation … 4.3%

Cost of Ownership

————————————————-

$640,000 ………. Asking Price

$128,000 ………. 20% Down Conventional

4.74% …………… Mortgage Interest Rate

$512,000 ………. 30-Year Mortgage

$128,624 ………. Income Requirement

$2,668 ………. Monthly Mortgage Payment

$555 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$53 ………. Homeowners Insurance

$45 ………. Homeowners Association Fees

============================================

$3,321 ………. Monthly Cash Outlays

-$451 ………. Tax Savings (% of Interest and Property Tax)

-$645 ………. Equity Hidden in Payment

$230 ………. Lost Income to Down Payment (net of taxes)

$80 ………. Maintenance and Replacement Reserves

============================================

$2,535 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,400 ………. Furnishing and Move In @1%

$6,400 ………. Closing Costs @1%

$5,120 ………… Interest Points @1% of Loan

$128,000 ………. Down Payment

============================================

$145,920 ………. Total Cash Costs

$38,800 ………… Emergency Cash Reserves

============================================

$184,720 ………. Total Savings Needed

Property Details for 4152 HOMESTEAD Irvine, CA 92604

——————————————————————————

Beds: 5

Baths: 3 baths

Home size: 2,100 sq ft

($305 / sq ft)

Lot Size: 5,000 sq ft

Year Built: 1972

Days on Market: 77

Listing Updated: 40448

MLS Number: S625484

Property Type: Single Family, Residential

Community: El Camino Real

Tract: Gt

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

**** REMODELED TWO STORY FABULOS HOME IN A GREAT AREA. A BEDROOM AND BATH ON FIRST FLOOR.HARD WOOD FLOOR GRANITE KITCHEN AND MORE. NEAR SHOPPING, SCHOOLS AND PARKS . SHORT SALE, SEE REMARKS FOR SHOWINGS.

FABULOS?

.jpg)