No matter how you slice and dice the mortgage data, it is a deteriorating picture punctuated by very large numbers of delinquencies and foreclosures.

Irvine Home Address … 15306 NORMANDIE Ave Irvine, CA 92604

Resale Home Price …… $995,000

I should have known better than to give a loan to you

That I would lose everything that you do

And I do, hey, hey, hey, and I do.

So, I should have realized a lot of things before

If this is a loan you've gotta give me more

Give me more, hey hey hey, give me more

Beatles — I Should Have Known Better

The banks should have known better than to underwrite the loans they did. Whenever I think about the greed and stupidity that overtook our lending industry — and the damage they have done to our society by creating a generation of Ponzis — I feel no compassion for their losses. Knowing my tax dollars are bailing them out irks me even more. In the ongoing debacle of lender creation, we are seeing further deterioration in loan performance. What a surprise.

Types of Borrowers

Do you remember the various borrower types: subprime, Alt-A, and prime? The ARM reset chart breaks down the outstanding ARMs by those borrower types and mixes in some types of loans (agency, Option ARM, and unsecuritized ARMs) just to make it a bit confusing.

The three main borrower classes can also be divided based on the size of the loan into conforming (up to $417,000), jumbo conforming ($417,000 to $729,750), and jumbo (over $729,750).

The stories forming the basis for today's featured articles examine the three main types of borrowers and separately the jumbo loan category.

As you may recall, subprime ARMs reset first. In 2007 and 2008, nearly all subprime loans reset, and the resulting wave of delinquencies and foreclosures trashed prices wherever subprime was found. From this the banks learned one important lesson: if you foreclose and dispose of the real estate, prices get crushed. Las Vegas proved that. Upon seeing the carnage, lenders opted for another strategy: amend-extend-pretend. As a result, the Alt-A, prime, and jumbo borrowers have similarly gone delinquent on their mortgage, but they have been allowed to squat so banks can preserve the illusion of value on their balance sheets. Homeowners are not complaining.

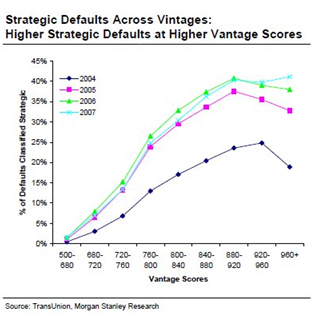

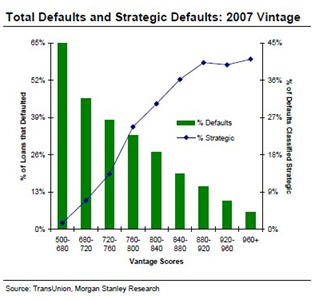

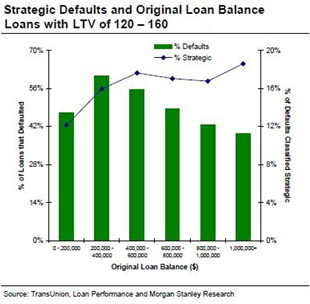

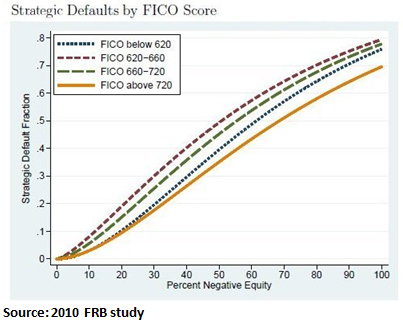

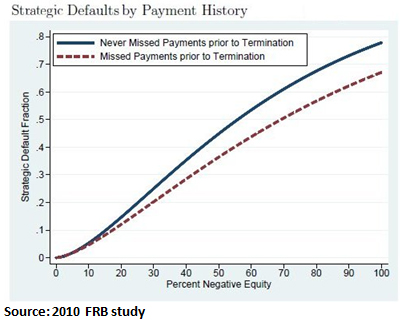

The problem for the banks is that failing to foreclose on people is causing distressed borrowers to strategically accelerate their default to take advantage of the bank's inaction. As we are about to see, Alt-A, prime and jumbo are on their way to becoming subprime; in fact, Alt-A is already there.

.jpg)

In worse-off states, Alt-A is becoming the new subprime

by CHRISTINE RICCIARDI — Tuesday, October 5th, 2010

Data released Tuesday by 1010data, in conjunction with the American Securitization Forum, CoreLogic and Equifax, confirmed what CoreLogic economist Mark Fleming mentioned during an interview with HousingWire one month ago — Alt-A loans are the new subprime. However, Alt-A mortgages passing 25% delinquency rates, levels similar to subprime loans, remain localized to only a few states.

The Market Review of Non-Agency MBS is the first in a series to be released by 1010data and the American Securitization Forum, which recently entered into a partnership. This report uses data collected through September and focuses on trends within the Alt-A category between 2004 and 2008, as well as jumbo and option ARMs.

Jonah Green, head of mortgage analytics at 1010data and contributor to the report, said the delinquency trends with Alt-A loans directly reflect a subprime attitude, or perhaps even worse.

"Alt-A is traditionally considered near prime collateral," Green told HousingWire. "But because of the housing crisis, the delinquencies you're seeing are so great that people are considering Alt-A, effectively, subprime."

According Green, 9% of Alt-A loans that were current six months ago are now delinquent.

Nearly 10% of all Alt-A loans that were current only six months ago are now delinquent. You don't have to run a 10% new delinquency rate very long before the entire pool of Alt-A loans goes bad. Those are horrendous numbers.

Approximately 40% of Alt-A loans originated in Nevada between 2004 and 2008 are more than 60-days delinquent or in foreclosure. Nevada is topped only by Florida, which has a reported 46.4% of issued Alt-A loans 60-days or more delinquent or in foreclosure. Twenty states have Alt-A delinquencies exceeding 25% (see map).

It doesn't look like I will be running out of Las Vegas properties to bid on any time soon.

Green said that state delinquencies north of 25% are high, even for a subprime deal. Not only that, but Green said jumbo loans could be next to follow suit. In Nevada, 24.4% of jumbo loans are 60-plus days delinquent or in foreclosure, followed by 20% in Florida.

"Jumbo prime is performing like subprime, Alt-A is performing worse than subprime and subprime simply isn't performing," Green said. "The private label deals weren't structured with types of delinquencies in mind."

Nobody was prepared for the collapse of the housing bubble. Most were in denial, and many still are.

August delinquency inventory falls on highest foreclosure starts since January: LPS

by CHRISTINE RICCIARDI — Friday, September 24th, 2010

More homes moved from delinquency into foreclosure in August, as the inventory of homes 30-plus days and 90-plus days delinquent decreased and foreclosure starts rose to the highest level since January, according to Lender Processing Services.

HousingWire reported the initial results of the report last week. The firm's final monthly mortgage monitor was released today.

The majority of foreclosure inventory included prime loans, which increased 106.4% over an 18-month period in the agency sector, 102.4% in the non-agency sector, and 107% in the non-agency jumbo sector.

Those are shocking numbers. We have doubled the foreclosure inventory of the best performing loans in the portfolio. When the bank's prime loans become toxic waste, what do they do then?

The numbers below paint an even bleaker picture. I don't see the light at the end of the tunnel yet.

According to CoreLogic, there are about 40 million prime loans in the marketplace, 6.2% of which were 60-days delinquent in June and 3% of which were 90-days delinquent.

CoreLogic analyst Mark Fleming said the percentage of delinquent loans in the prime space have been masked because the volume is so huge.

LPS reported 282,528 foreclosure starts last month, up 1% from July and 3.8% higher than the year earlier. The year-to-date foreclosure rate is now 20.4% higher than 2009. Thirty-day delinquent inventory fell to 9.22%, the lowest level in over a year. The percentage was 9.3% in July and 9.7% a year ago. The inventory of 90-day delinquent loans decreased to 8.22%, down from 8.3% in July. The percentage was 8% a year earlier.

Despite the spike in overall foreclosure starts, the number of starts within agency loans decreased in August for the first time in three months, to less than 140,000. Agencies also have accelerated foreclosures in late-stage delinquencies, six-month delinquencies decreasing to 60,000 from 65,000. Six-month delinquency volume is the highest on agency portfolio. Three-month delinquencies account for more than 30,000 loans and two-month delinquent loans have risen for three month to almost 20,000 loans.

If any of you spotted any good news in there, point it out. i didn't see any.

They didn't spend the house!

It's very rare that I find a mortgage history with no proven HELOC abuse. It looks like these people were frugal and paid down their mortgage, so I have given them a "B" for mortgage management. They did get a couple of HELOCs, but there is nothing to suggest they actually took the money and spent it.

- This house was purchased on 4/3/1990, the peak of the last housing bubble. I don't have their original mortgage data, but they paid $325,000, and they likely put at least 20% down.

- On 9/8/1998 there is a refinance of the first mortgage for $220,000.

- On 10/25/2000 they were approved for a $99,000 HELOC, but I don't think they used it.

- On 3/17/2003 they refinanced their first mortgage again for $212,000. This tells me they didn't use the HELOC and paid down the first mortgage.

- On 2/9/2005 they were approved for a $275,000 HELOC. Based on their past history, I will give them the benefit of the doubt and suggest that they have consistently reduced their indebtedness on the property.

There is no delinquency, and even if they maxed the HELOC, they are still sitting on a cloud of bubble equity.

Irvine Home Address … 15306 NORMANDIE Ave Irvine, CA 92604 ![]()

Resale Home Price … $995,000

Home Purchase Price … $325,000

Home Purchase Date …. 4/3/1990

Net Gain (Loss) ………. $610,300

Percent Change ………. 187.8%

Annual Appreciation … 5.5%

Cost of Ownership

————————————————-

$995,000 ………. Asking Price

$199,000 ………. 20% Down Conventional

4.21% …………… Mortgage Interest Rate

$796,000 ………. 30-Year Mortgage

$187,902 ………. Income Requirement

$3,897 ………. Monthly Mortgage Payment

$862 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$83 ………. Homeowners Insurance

$0 ………. Homeowners Association Fees

============================================

$4,842 ………. Monthly Cash Outlays

-$914 ………. Tax Savings (% of Interest and Property Tax)

-$1105 ………. Equity Hidden in Payment

$300 ………. Lost Income to Down Payment (net of taxes)

$124 ………. Maintenance and Replacement Reserves

============================================

$3,248 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$9,950 ………. Furnishing and Move In @1%

$9,950 ………. Closing Costs @1%

$7,960 ………… Interest Points @1% of Loan

$199,000 ………. Down Payment

============================================

$226,860 ………. Total Cash Costs

$49,700 ………… Emergency Cash Reserves

============================================

$276,560 ………. Total Savings Needed

Property Details for 15306 NORMANDIE Ave Irvine, CA 92604

——————————————————————————

Beds: 5

Baths: 5 baths

Home size: 3,700 sq ft

($269 / sq ft)

Lot Size: 6,315 sq ft

Year Built: 1971

Days on Market: 60

Listing Updated: 40459

MLS Number: P747674

Property Type: Single Family, Residential

Community: El Camino Real

Tract: Rc

——————————————————————————

Completely remodeled home with unique skylighted-attrium with surround hall way entry, open lighted plan. Travertine flooring, granite kitchen counter,center island gas cook top, new kitchen cabinetry, dual a/c and ON-Demand Electric Tankless water heater. Well kept home with salt water pool, Gas BBQ ready patio, fruit trees, low water usage landscape. Entire yard and driveway with concrete paint, finished garage with Epoxy coated floor. The house also features ceiling fans, new appliances and fire place. A large upstairs Den/Entertainment room with surround sound wiring. All rooms are cable ready. Features also include a main floor bedroom and bath. Spacious Master bath with jacuzzi tub and shower. The house is priced to sell. There is no association or mello roos on this house. Pride of ownerhship. Priced to Sell.

attrium? ownerhship? And Mello Roos is capitalized; it is the last names of the two legislators who introduced the bill. Why did the realtor say it is priced to sell twice?

.jpg)

![[BOFA]](https://sg.wsj.net/public/resources/images/P1-AX620A_BOFA_NS_20101008192429.gif)

.jpg)