House prices have crashed in many markets but banks have barely begun the process of writing down their bad loans.

Irvine Home Address … 6 INDIANA Irvine, CA 92606

Resale Home Price …… $999,000

Celebrate the day you've waited for

Party like you're ready for so much more

Do it like you know it's never been done

Go a little crazy, have too much fun

Today's the day, come on everyone

The party's just begun

The Cheetah Girls — The Party's Just Begun

The big mortgage write down party has just begun. Banks have barely scratched the surface on the total dollar value of loans they will need to write off.

The housing bubble was really a credit bubble. Lenders extended far too much credit to people who had no ability to repay it. When the housing market crashed, lenders were in no rush to write their loans down to market value. The result is a huge remaining bubble in home mortgages.

Many lenders honestly believe house prices will rise back to levels that will eliminate the negative equity problem. This is wishful thinking on a grand scale. In reality, the overhang of distressed properties will keep price appreciation in check for quite some time. The mortgage bubble will be deflated by a combination of short sales and foreclosures — many facilitated by accelerated default — causing lenders to write down the mortgage debt to reach market values.

Mortgage Bubble Haunts Housing Recovery

By Lita Epstein Jul 20th 2010

You may not realize it, but there's another major financial bubble ready to burst. Few are talking about it, but Michael David White, a mortgage and real estate professional has graphed the mortgage bubble due to burst.

When the housing bubble burst, it left many with underwater mortgages. Yet nothing was done to deal with the debt levels on these homes. The mortgage values shown on the banks' books are still elevated beyond their true worth.

Right now we're seeing more and more people walk away from this debt. While property values fell from $20 trillion to $13 trillion when the housing bubble burst. Mortgages fell from $11.95 trillion to $11.68 trillion.

John Lounsbury, a financial and investment adviser, says home equity is now over 90 percent mortgaged. Historically our mortgage levels were 50 to 60 percent. He agrees with White that we're in a mortgage bubble that is ready to burst. In order to get back to the normal historic relationship, Lounsbury says "outstanding mortgage values would need to be about $7 trillion, which is $5 trillion below the latest level."

He says, "Banks are looking to resolve this bubble by waiting for mortgage repayment and for house prices to rise." He calls this the "extend and pretend" mode. The big question is: Will people continue to pay these mortgages as they wait for homes to rise enough in price to get back above water. In some of the hardest-hit areas that could take 10 to 20 years or longer.

There is no way borrowers are going to wait that long. Most can't. Do you think people will remain immobilized through 2025 for a decision they made in 2005? No way. When it becomes apparent house prices are not coming back, people will give up hope and walk away. Look for the double dip to crush the feeble hopes of those who haven't accelerated their inevitable defaults.

The Business Insider focused on the 15 hardest hit areas, with Nevada leading the pack. In Nevada, 69.9 percent of mortgages are underwater. Arizona comes in second with 51.3 percent of mortgages underwater, and Florida is third with 47.8 percent.

Based on mortgage debt, we're becoming a country of haves and have-nots. Those stuck in homes underwater cannot move to find work in another location, even if there's no work where their home is located. Without jobs, they may have no choice but to walk away or work with their bank for a deed-in-lieu of foreclosure. In many cases, these homes are so far underwater that banks won't agree to short sales.

As more and more people realize that they have no choice but to give up their homes, the mortgage bubble will deflate. The only question left is whether the bubble will burst rapidly or continue to deflate slowly as foreclosures are resolved.

I do think the mortgage bubble will deflate slowly. Lenders are being allowed to use mark-to-fantasy accounting, so there is no regulator pressure to write down the loan balances. Also, denial is a basic human reaction to catastrophe, and borrowers will surrender and capitulate at different rates. The brief bear rally we just witnessed will give false hope to many who will hang on for a few more payments.

But Lounsbury thinks that some areas of the country that have not yet been hard hit by the housing meltdown are ripe for problems. For example, he thinks the New York area is a bubble waiting to happen. In fact, Keith Jurow of the Real Estate Channel thinks a housing collapse in Queens is almost certain.

IMO, you can add coastal California to that list. I still believe the high end is going to be wiped out. There are no government supports for the jumbo loan market, and very few people can afford the large number of homes priced in that range.

As the housing bubble continues to deflate in areas that right now are not among the hardest hit, will that finally cause the mortgage bubble to burst? Will the banks be able to withstand these shocks or are we looking at another bank bailout?

Based on some reports, the banks may have pushed the worst of these mortgages onto Fannie Mae and Freddie Mac, leaving the taxpayers holding the bag for this next bubble burst. So the big question is not whether there's a mortgage bubble, but who will be left holding the bag when it bursts.

There is no question that we will engineer another bailout for the banks if the mortgage bubble deflates too quickly. Whatever losses cannot be pushed off to the taxpayer through the GSEs will become part of another massive bailout. Either that, or we will print money until the problem goes away.

The $4 Trillion Dollar Question

By Barry Ritholtz – July 15th, 2010

The US has built far too many houses

Perhaps homeowners suffering negative equity are patiently expecting house prices to rise again. But they may be in for a long wait. Prices are likely to be weighed down by a massive oversupply of homes relative to underlying demographic demand.

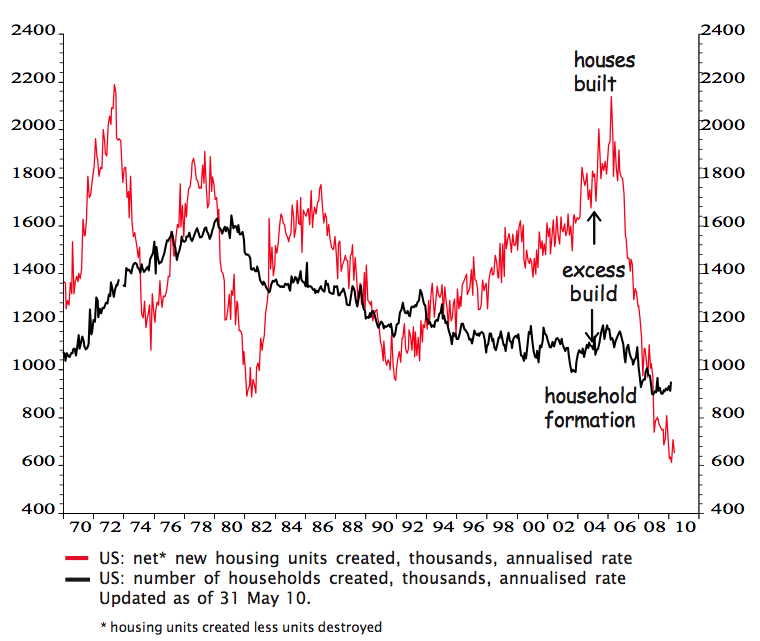

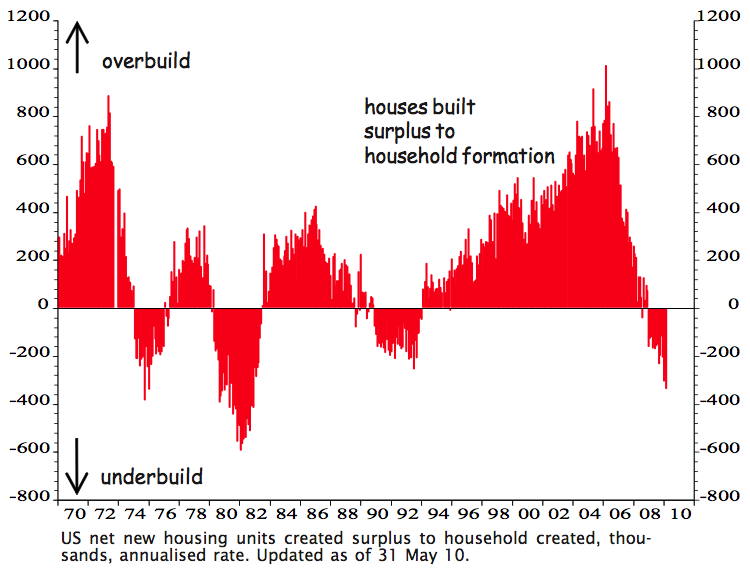

Between 2002 and 2006, US homebuilders went on a construction binge, building 12 million new homes while the number of households went up by just 7 million. The painful legacy is a massive oversupply of houses relative to the number of households.

The oversupply will take years to clear

With household formation running at just 0.9 million while the US is still building 0.6 million new homes annually, only 0.3 million of the oversupply will be absorbed per year. As there are currently 4 million too many homes, it may take years to mop up the huge oversupply of houses.

The negative equity problem and excess inventory will put pressure on the government to continue to subsidize mortgage interest rates. If interest rates rise and prices resume their downward slide, more people will opt for accelerated default causing the mortgage bubble to finally deflate.

Like foolish buyers during the housing bubble, banks really have no plan B. They are in amend-extend-pretend mode for the long haul. They can't afford to lose $4,000,000,000,000, yet that is what they must do. Perhaps they can extend it long enough to only lose $2,000,000,000,000? The banks have much pain ahead.

Peak buyer walks away

This property was purchased on 10/4/2006 for $1,150,000 the owner used a $805,000 first mortgage, a $115,000 stand-alone second, and a $230,000 down payment which was lost at auction. This property was pushed through the foreclosure process in about a year, so this owner did not get as much squatting time as others.

Foreclosure Record

Recording Date: 11/12/2009

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 07/22/2009

Document Type: Notice of Default

In a last minute attempt to record an interest in the property, there was a loan for $10,500 recorded three days before the trustee sale. I don't know what they were hoping to accomplish as the first lien holder blew them out at trustee sale. This property, like many other trustee sale flips I profile, was purchased by Palladio Properties LLC, a fund very active in the Irvine market.

The property was auctioned on 4/5/2010 for $814,000. The opening bid was $751,500. After sales commissions and preparation for sale, Palladio Properties LLC will probably make about a 12% profit on this deal.

If you would like to learn how you can get involved with trustee sales, please contact me at sales@idealhomebrokers.com.

Irvine Home Address … 6 INDIANA Irvine, CA 92606 ![]()

Resale Home Price … $999,000

Home Purchase Price … $814,000

Home Purchase Date …. 4/5/2010

Net Gain (Loss) ………. $125,060

Percent Change ………. 15.4%

Annual Appreciation … 63.0%

Cost of Ownership

————————————————-

$999,000 ………. Asking Price

$199,800 ………. 20% Down Conventional

4.59% …………… Mortgage Interest Rate

$799,200 ………. 30-Year Mortgage

$197,306 ………. Income Requirement

$4,092 ………. Monthly Mortgage Payment

$866 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$83 ………. Homeowners Insurance

$116 ………. Homeowners Association Fees

============================================

$5,157 ………. Monthly Cash Outlays

-$981 ………. Tax Savings (% of Interest and Property Tax)

-$1035 ………. Equity Hidden in Payment

$343 ………. Lost Income to Down Payment (net of taxes)

$125 ………. Maintenance and Replacement Reserves

============================================

$3,609 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$9,990 ………. Furnishing and Move In @1%

$9,990 ………. Closing Costs @1%

$7,992 ………… Interest Points @1% of Loan

$199,800 ………. Down Payment

============================================

$227,772 ………. Total Cash Costs

$55,300 ………… Emergency Cash Reserves

============================================

$283,072 ………. Total Savings Needed

Property Details for 6 INDIANA Irvine, CA 92606

——————————————————————————

Beds: 5

Baths: 2 full 1 part baths

Home size: 3,471 sq ft

($288 / sq ft)

Lot Size: 8,100 sq ft

Year Built: 1998

Days on Market: 82

Listing Updated: 40355

MLS Number: S614610

Property Type: Single Family, Residential

Community: Walnut

Tract: Camb

——————————————————————————

Large Beautiful Home in Harvard Square Gated Community. 5BR & 3BA with Large Bonus Room. 3 Fireplaces decorated with Marble. Plantation Shutters, Crown Moldings & Recessed Lights Through out. Upgraded Porcelain Tile & Hardwood Flooring. Granite Countertop & Walk-in Pantry in Kitchen. New Stainless Steel Appliances Installed.

.jpg)

.jpg)