What they are saying about The Great Housing Bubble

“A very well-written and thoughtful analysis of what went wrong in

the housing world and how we can avoid this problem in the future.

Lawrence Roberts has a great understanding of the subject and does an

excellent job communicating his ideas to the reader.”

Jim Randel – Best-selling author, Confessions of a Real Estate Entrepreneur

What is a Bubble?

A financial bubble is a temporary situation where asset prices

become elevated beyond any realistic fundamental valuations because the

general public believes current pricing is justified by probable future

price increases. If this belief is widespread enough to cause

significant numbers of people to purchase the asset at inflated prices,

then prices will continue to rise. This will convince even more people

that prices will continue to rise. This facilitates even more buying.

Once initiated, this reaction is self-sustaining, and the phenomenon is

entirely psychological. When the pool of buyers is exhausted and the

volume of buying declines, prices stop rising; the belief in future

price increases diminishes. When the remaining potential buyers no

longer believe in future price increases, the primary motivating factor

to purchase is eliminated; prices fall. The temporary rise and fall of

asset prices is the defining characteristic of a bubble.

The bubble mentality is summed up in three typical beliefs:

- The expectation of future price increases.

- The belief that prices cannot fall.

- The worry that failure to buy now will result in permanent inability to obtain the asset.

The Great Housing Bubble was characterized by the acceptance of

these beliefs by the general public, and the exploitation of these

beliefs by the entire real estate industrial complex, particularly the

sales mechanism of the National Association of Realtors.

Speculative bubbles are caused by precipitating factors.[1] Like a

spark igniting a flame, a precipitating factor serves as a catalyst to

begin the initial price increases that change the psychology of market

participants and activates the beliefs listed above. There is usually

no single factor but rather a combination of factors that stimulates

prices to begin a speculative mania. The Great Housing Bubble was

precipitated by innovation in structured finance and the expansion of

the secondary mortgage market, the lowering of lending standards and

the growth of subprime lending, and to a lesser degree the lowering of

the Federal Funds Rate. All of these causes are discussed in detail in

later sections.

Real Estate Only Goes Up

The mantra of the National Association of Realtors is “real estate

only goes up.” This economic fallacy fosters the belief in future price

increases and the limited risk of buying real estate. In general real

estate prices do increase because salaries across the country do tend

to increase with the general level of inflation, and it is through

wages that people make payments for real estate assets. [ii] When the

economy is strong and unemployment is low, prices for residential real

estate tend to rise. Therefore, the fundamental valuation of real

estate does go up most of the time. However, prices can, and often do,

rise faster than the fundamental valuation of real estate, and it is in

these instances when there is a price bubble.

Greed is a powerful motivating factor for the purchase of assets. It

is a natural response for people to desire to make money by doing

nothing more than owning an asset. [iii] The only counterbalance to

greed is fear. However, if a potential buyer believes the asset cannot

decline in value, or if it does, it will only be by a small amount for

a very short period of time, there is little fear generated to temper

their greed. [iv] The belief that real estate only goes up has the

effect of activating greed and diminishing fear. It is the perfect

mantra for creating a price bubble. [v]

Buy Now or Be Priced Out Forever

When prices rise faster than their wages, people can obtain less

real estate with their income. The natural fear under these

circumstances is to buy whatever is available before there is nothing

desirable available in a particular price range. This fear of being

priced out causes even more buying which drives prices higher. It

becomes a self-fulfilling prophecy. Of course, the National Association

of Realtors, the agents of sellers, is keen to exploit this fear to

increase transaction volume and increase their own incomes. If

empirical evidence of the recent past is confirming the idea that real

estate only goes up, the fear of being priced out forever provides

added impetus and urgency to the motivation to buy.

Just before the stock market crash signaling the beginning of the

Great Depression, Irving Fisher, a noted economist at the time, was

quoted as saying “Stock prices have reached what looks like a

permanently high plateau.” [vi] Of course, stock prices dropped

significantly after he made this statement. This sentiment is based on

the idea that inflated prices can stay inflated indefinitely. However,

when valuations cannot be pushed up any higher, prices cannot rise at a

fast rate. In residential real estate markets, the rate of price

increase would only match inflation because wages and inflation are

closely correlated. If the rate of price increase does not exceed

ordinary investments, people lose their enthusiasm for residential real

estate as an investment, and they begin to look for alternatives:

people choose to rent rather than own. Also, when the quality of units

available for rent at a given monthly payment far exceeds the quality

of those available for sale at the same monthly payment level, people

choose not to bid on the property and they rent instead. One sign of a

housing bubble is a wide disparity between the quality of rentals and

the quality of for-sale houses at a given price point. People choosing

to rent curtails the rapid rise in prices and thereby lowers the demand

for real estate. This puts downward pressure on prices, which

eliminates the primary motivation speculators had for purchasing the

asset. Greed created the condition of rapidly rising prices which in

turn spawns the fear of being priced out. When greed ceases to motivate

buyers, prices fall.

Once prices begin to fall, the fear of being priced “out” forever

changes to a fear of being priced “in” forever. A buyer who overpaid

and over-borrowed will be in a circumstance where they owe more on

their mortgage than the property is worth on the open market. They

cannot sell because they cannot pay off the mortgage. They become

trapped in their homes until prices increase enough to allow a

breakeven sale. This puts the conditions in place to reverse the cycle

and causes prices to drop precipitously.

Confirming Fallacies

There are a number of fallacies about residential real estate that

either affirm the belief in perpetually rising prices or minimize the

fears of a price decline. These fallacies generally revolve around a

perceived shortage of housing or a belief that the higher prices are

justified by current or future economic conditions. These

misperceptions are not the core mechanism of an asset price bubble, but

they serve to affirm the core beliefs and perpetuate the price rally.

They Aren’t Making Any More Land

All market pricing is a function of supply and demand. One of the

reasons many house price bubbles get started is due to a temporary

shortage of housing units. [vii] This is a particular problem in

California because the entitlement process is slow and cumbersome.

[viii] Supply shortages can become acute, and prices can rise very

quickly. In most areas of the country, when prices rise, new supply is

quickly brought to the market to meet this demand, and price increases

are blunted by the rebalancing of supply and demand. Since supply is

slow to the market in California, these temporary shortages can create

the conditions necessary to facilitate a price bubble.

The fallacy of running-out-of-land plays on this temporary condition

to convince market participants that the shortage is permanent. The

idea that all land for residential development can be consumed ignores

one obvious fact: people do not live on land, they live in houses, and

land can always be redeveloped to increase the number of housing units.

Basically, builders can build “up” even if they can’t build “out.” If

running-out-of-land were actually a cause of a permanent shortage of

housing units, Japan and many European countries where there is very

little raw land available for development would have housing prices

beyond the reach of the entire population (Japan tried it once, and

their real estate market experienced a 64% decline over a 15 year

period until affordability returned). [ix] Since prices cannot remain

permanently elevated, it becomes obvious that the amount of land

available for development does not create a permanent shortage of

dwelling units.

Over the long term, rent, income and house prices must come into

balance. If rents and house prices become very high relative to

incomes, businesses find it difficult to expand because they cannot

attract personnel to the area. In this circumstance, one of two things

will happen: businesses will be forced to raise wages to attract new

hires, or business will stagnate and rents and house prices will

decline to match the prevailing wage levels. [x] During the Great

Housing Bubble, many businesses in the most inflated markets

experienced this phenomenon. The effect is either a dramatic slowing of

population growth or net outmigration of population to other areas.

Everyone Wants To Live Here

Everyone believes they live in a very desirable location; after all,

they choose to live there. People who make this argument fail to

understand that the place they live was just as desirable before the

bubble when prices were much lower, in fact, probably more so. What is

it about their area that made it two or more times as desirable during

the bubble? Of course, nothing did, but that does not stop people from

making the argument. [xi] There is a certain emotional appeal to

believing the place you chose to call home is so desirable that people

were willing to pay ridiculous prices to live there. The reality is

prices went up because people desired to own an asset that was

increasing in price. People motivated by increasing prices do not care

where they live as long as prices there are going up.

Prices Are Supported By Fundamentals

In every asset bubble people will claim the prices are supported by

fundamentals even at the peak of the mania. Stock analysts were issuing

buy recommendations on tech stocks in March of 2000 when valuations

were so extreme that the semiconductor index fell 85% over the next 3

years, and many tech companies saw their stock drop to zero as they

went out of business. Analysts even invented new valuation techniques

to justify market prices. One of the most absurd was the “burn rate”

valuation method applied to internet stocks. [xii] Rather than value a

company based on its income, analysts were valuing the company based on

how fast it was spending their investor’s money. When losing is

winning, something is profoundly wrong with the arguments of

fundamental support. The same nonsense becomes apparent in the housing

market when one sees rental rates covering less than half the cost of

ownership as was common during the peak of the bubble in severely

inflated markets. Of course, since housing markets are dominated by

amateurs, a robust price analysis is unnecessary. [xiii] Even a

ridiculous analysis, if aggressively promoted by the self-serving real

estate community, provides enough emotional support to prompt the

general public into buying. There is no real fundamental analysis done

by the average homebuyer because so few understand the fundamental

valuation of real property. Even simple concepts like comparative

rental rates are ignored by bubble buyers, particularly when prices are

rising dramatically and such valuation techniques look out-of-touch

with the market.

Figure 1: Ratio of House Price to Income in California, 1980-2006

When rental cashflow models fail, which they do during the rally of

a housing bubble, the arguments justifying prices turn to an owner’s

ability to make payments. The argument is that everyone is rich, and

everyone is making enough money to support current prices. It seems

people began believing the contents of their “liar loan” applications

during the bubble, or perhaps they counted on the

home-equity-line-of-credit spending to come from the inevitable

appreciation. [xiv] Even when confronted with hard data showing the

everyone-is-rich argument to be fallacious, people still claim it is

true. One unique phenomenon of the Great Housing Bubble was the exotic

financing which allowed owners the temporary luxury of financing very

large sums of money with small payments. There was some truth to the

argument that people could afford the payments. Unfortunately, this was

completely dependent upon unstable financing terms, and when these

terms were eliminated, so were any reasonable arguments about

affordability and sustainable fundamental valuations.

It Is Different This Time

Each time the general public creates an asset bubble, they believe

the rally in prices is justifiable by fundamentals. [xv] When proven

methods of valuation demonstrate otherwise, people invent new ones with

the caveat, “it is different this time.” It never is. The stock market

bubble had its own unique valuation methods as described previously.

The Great Housing Bubble had proponents of the financial

innovation model. Rather than viewing the unstable loan programs of the

bubbles with suspicion, most bubble participants eagerly embraced the

new financing methods as a long-overdue advance in the lending

industry. Of course, it is easy to ignore potential problems when

everyone involved is making large amounts of money and the government

regulators are encouraging the activity. Alan Greenspan, FED chairman

during the bubble, endorsed the use of adjustable rate mortgages in

certain circumstances (Greenspan, Understanding Household Debt Obligations, 2004),

and official public policy under the last several presidential

administrations was the expansion of home ownership. [xvi] When

everyone involved was saying things were different and when the

activity was profitable to everyone involved, it is not surprising

events got completely out of control.

The Importance of Financial Bubbles

Why should anyone care about financial bubbles? The first and most

obvious reason is that the financial fallout is stressful. People

buying into a financial mania too late, particularly in a residential

housing market, will probably end up in foreclosure and most likely in

a bankruptcy court. In contrast, stock market bubbles will only cause

people to lose their initial investment. It may bruise their ego or

delay their retirement, but these losses generally do not cause them to

lose their homes or declare bankruptcy like a housing market bubble

does. In a stock market collapse, a broker will close out positions and

close an account before the account goes negative. There is a safety

net in the system. In a residential housing market, there is no safety

net. If house prices decline, a homeowner can easily have negative

equity and no ability to exit the transaction. In a housing market

decline, properties become very illiquid as there simply are not enough

buyers to absorb the available inventory. A property owner can quickly

fall so far into negative territory that it would take a lifetime to

pay back the debt. In these circumstances bankruptcy is not just

preferable; it is the only realistic course of action. It is better to

have credit issues for a few years than to have insurmountable debt

lingering for decades.

The real problems for individuals and families come after the

bankruptcy and foreclosure. The debt addicted will suddenly find the

tools they used to maintain their artificially inflated lifestyles are

no longer available. The stress of adjusting to a sustainable,

cash-basis lifestyle can lead to divorces, depression and a host of

related personal and family problems. One can argue this is in their

best interest long-term, but that will be little comfort to these

people during the transition. The problems for the market linger as

well. Those who lost homes during the decline are no longer potential

buyers due to their credit problems. It will take time for this group

to repair their credit and become buyers again. The reduction in the

size of the buyer pool keeps demand in check and limits the rate of

price recovery.

Summary

The Great Housing Bubble, like all asset bubbles, was driven by the

belief in permanent, rapid house price appreciation, an unrealistic

perception of the risk involved, and the fear that waiting to buy would

cause market participants to miss their opportunity to own a house.

These erroneous beliefs were supported by groupthink; if everyone else

believes it, it must be true. As with any mass delusion, it is

difficult to see beyond the comforting fallacies to understand the

deeper truth; however, it is essential to do so because the cost in

emotional and financial terms of getting caught up in the mania is very

high. Foreclosure and bankruptcy are bad for individuals, bad for

families, and bad for society.

[1] Robert Shiller in his book Irrational Exuberance (Shiller, Irrational Exuberance, 2005)

discusses precipitating factors at length from pages 31 -54. Most of

the factors he mentions are macro-factors or more specifically related

to the stock market.

[ii] According to data from the US Census Bureau and The US

Department of Labor, wage growth since 1976 has averaged 4.62% and

inflation has averaged 4.42%.

[iii] From 2002-2006 in Irvine, California, the median house price increased by an amount each year equal to the median income.

[iv] Karl Case and Robert Shiller noted that a buyer’s willingness

to pay high prices depended in part on their perception of risk of

price decline (Case & Shiller, The Behavior of Home Buyers in Boom and Post-Boom Markets, 1988). Very few buyers in the markets they surveyed during the coastal boom of the late 1980s though prices could go down.

[v] Psychologists have noted narrative-based thinking is extremely important in human decision making (Shiller, Historic Turning Points in Real Estate, 2007). When realtors or anyone working in sales creates a compelling narrative, it is very effective in motivating buyers.

[vi] The author could not find the source for the widely cited quote

from Irving Fisher where he said, “Stock prices have reached what looks

like a permanently high plateau.” It is held as the standard for

incorrect market prognostications.

[vii] Robert Shiller has noted there is a tendency among investors

to overestimate how unique an investment they favor is. These investors

fail to take into account the supply response to higher prices (Shiller, Understanding Recent Trends in House Prices and Home Ownership, 2007).

Supply shortages are never permanent. The ends of booms are almost

always associated with an unexpected glut of supply. Also, the idea of

there being “not enough land” was cited in surveys going back to 1988 (Case & Shiller, The Behavior of Home Buyers in Boom and Post-Boom Markets, 1988).

[viii] William Jaeger studied the issue of land use control limiting

local housing supply in his paper The Effects of Land-Use Regulations

on Property Values (Jaeger, 2006). His

conclusions are as follows: “Land-use regulations can affect property

values in a variety of complex ways. In the context of laws like

Oregon’s Measure 37, requiring that landowners be compensated if

regulations reduce property values, the economic effects of land use

regulations on property values have been widely misinterpreted because

two very different economic concepts are being confused and used

interchangeably. The first concept is “the effect of a land use

regulation on property values” which measures the change in value when

a regulation is added to many parcels. The second concept is “the

effect of an individual exemption, or variance, to an existing land use

regulation,” which measures the change in value when a regulation is

removed from only one parcel. The effect of a land-use regulation on

property values can be positive or negative, whereas removing a

land-use regulation from one property can be expected to have a

positive effect. Indeed, many land-use regulations actually increase

property values by creating positive “amenity effects” and “scarcity

effects. “As a result of these differences, a positive estimate for

removing a land-use regulation cannot be interpreted as proof that the

other concept was negative. Despite this, a positive value for an

individual exemption to a land-use regulation continues to be

interpreted as proof that compensation is due under Oregon’s Measure

37. Indeed, this mistaken interpretation may be partly responsible for

public sentiment that land-use regulations tend to reduce property

values.”

[ix] In the paper, Asset Price Bubble in Japan in the 1980s: Lessons for Financial and Macroeconomic Stability (Shiratsuka, 2003),

the author reached the following conclusion, “Japan’s experience of

asset price bubble is characterized by euphoria, that is, excessively

optimistic expectations with respect to future economic fundamentals,

which lasted for several years and then burst. Under such

circumstances, policymakers are unlikely to take an appropriate policy

response without evaluating whether asset price hikes are euphoric or

not, and forecast a correct path for the potential growth rate. In so

doing, it is deemed important to assess the sustainability of financial

and macroeconomic stability.” The paper is more history than analysis,

but it provides a good background understanding of the Japanese housing

and stock market bubble.

[x] Karl Case and Robert Shiller mentioned a report in the Harvard

Business Review that spoke of businesses in boom regions were unable to

attract labor due to the high cost of housing. (Case & Shiller, The Behavior of Home Buyers in Boom and Post-Boom Markets, 1988)

[xi] Karl Case and Robert Shiller noted (Case & Shiller, Is There a Bubble in the Housing Market, 2004)

overwhelming agreement with the statement “Housing prices have boomed

in [city] because lots of people want to live here.” Another recurring

idea in the “everyone wants to live here” meme is the “rich Asians are

buying.” This fallacy is promoted in every real estate bubble. (Case & Shiller, The Behavior of Home Buyers in Boom and Post-Boom Markets, 1988)

[xii] Michael Wolff wrote the book Burn Rate: How I Survived the Gold Rush Years on the Internet (Wolff, 1998) describing the strange investor behavior of the internet startup era.

[xiii] Robert Shiller’s surveys have demonstrated most home

purchasers have little real knowledge or agreement about the underlying

causes of price rallies. Most would cite clichés, images or popular

fallacies rather than hard evidence or analysis of data with

correspondence to prices. (Case & Shiller, The Behavior of Home Buyers in Boom and Post-Boom Markets, 1988)

[xiv] Stated-Income Loans also known as “liar loans” were widespread

during the bubble. People frequently fabricated their income.

[xv] One of the more interesting phenomenon observed in the

scholarly literature during a financial bubble is the number of

analysts who look at the data and are unable to form an objective

opinion about what the data shows them. In the paper Bubbles, Human

Judgment, and Expert Opinion (Shiller, Bubbles, Human Judgment, and Expert Opinion, 2001),

Robert Shiller examines this phenomenon. In his introduction he noted,

“There are many who have been arguing in effect that the market (or

major components of it) has been undergoing a bubble. It would seem

that it is essential to their notion of a bubble that investors’

actions are, in one way or another, foolish. Others sharply disagree

with these bubble stories, and it is precisely this intimation of

foolishness that seems to bother them. It seems to them just

implausible that investors at large have been foolish.” The tone of

many of the journal articles seems rather defensive and dismissive of

the idea of a bubble even when the evidence is clear. One can surmise

this tone is the result of the “foolishness” Dr. Shiller describes. In

his conclusion he writes, “human patterns of less-than-perfectly

rational behavior are central to financial market behavior, even among

investment professionals, while at the same time there is little

outright foolishness among investors. It is hard for writers in the

news media, who describe financial markets, to convey the nature of any

essential irrationality, since they cannot all review the relevant

social science literature in their news article. They are left with

punchy references to pop psychology that may serve to discredit them in

many eyes. That is part of the reason why we have been left with a

sense of strong public disagreement about the nature of speculative

bubbles.” It is amazing to this author how so many academics along with

the general public can completely miss financial bubbles and deny their

existence past the point where it is obvious to everyone. Ben Stein was

the poster child for this behavior during the Great Housing Bubble. One

of the scholarly references showing this dismissal of the obvious is

The great turn-of-the-century housing boom (Fisher & Quayyum, 2005)

by Jonas D. M. Fisher and Saad Quayyum. In it they reach the following

completely erroneous conclusion right at the peak of the bubble, “To

the extent that the quantities can be understood by considering the

underlying economic fundamentals, such as productivity growth and the

evolution of the mortgage market, then the recent growth in house

prices is probably not due to excessive speculation in the housing

market, such as occurs in a bubble. We argue that our findings point

toward the high prices being driven by fundamentals.” Even at the very

peak of the insanity, there are well-educated market observers that

miss the signs or believe the fallacies which serve to inflate the

bubble.

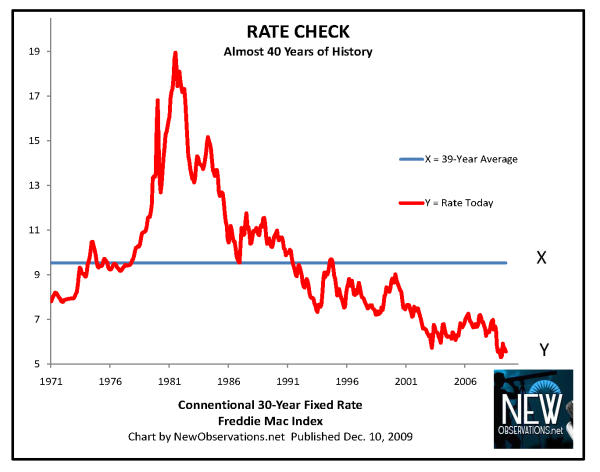

[xvi] Alan Greenspan made the following statements at the Credit

Union National Association 2004 Governmental Affairs Conference,

“Indeed, recent research within the Federal Reserve suggests that many

homeowners might have saved tens of thousands of dollars had they held

adjustable-rate mortgages rather than fixed-rate mortgages during the

past decade, though this would not have been the case, of course, had

interest rates trended sharply upward. American homeowners clearly like

the certainty of fixed mortgage payments. This preference is in

striking contrast to the situation in some other countries, where

adjustable-rate mortgages are far more common and where efforts to

introduce American-type fixed-rate mortgages generally have not been

successful. Fixed-rate mortgages seem unduly expensive to households in

other countries. One possible reason is that these mortgages

effectively charge homeowners high fees for protection against rising

interest rates and for the right to refinance. American consumers might

benefit if lenders provided greater mortgage product alternatives to

the traditional fixed-rate mortgage. To the degree that households are

driven by fears of payment shocks but are willing to manage their own

interest rate risks, the traditional fixed-rate mortgage may be an

expensive method of financing a home.” It is a good thing Alan

Greenspan was our central banker and not a financial adviser. Many

people who “benefited” from the mortgage product alternatives lost

their homes in foreclosure. There is a reason homeowners like

fixed-rate mortgages. How exactly are borrowers supposed to “manage

their own interest rate risks” without using fixed-rate mortgages?

Perhaps if Alan Greenspan had thought that statement through, his

advice might have been different. Daniel Gross wrote about the folly of

this speech in his weekly column on the internet magazine Slate (Gross, Alan Greenspan: ARMed and Dangerous, 2004).

Mr. Gross noted the following, “Greenspan also conspicuously ignored

the non-monetary benefits associated with fixed-rate mortgages.

Homebuyers pay a premium for the ability to lock in a fixed interest

rate – and hence have utter certainty on the size of their payment for

up to three decades. But in return, they receive peace of mind,

security, and the ability to plan.”