Alan Greenspan refuses to go to pasture quietly; therefore, bloggers like me need to remind everyone that Alan Greenspan is a dangerous fool who plunged the world economy into a near catastrophic depression and caused properties like today's to become elevated in price far beyond any rational measure.

Irvine Home Address … 3131 MICHELSON Dr 1702 Irvine, CA 92612

Resale Home Price …… $899,999

{book1}

When you're a disgrace to the human race?

No committment, you're an embarrassment,

Yes, an embarrassment, a living endorsement,

The intention that you have booked,

Was an intention that was overlooked.

This is a serious matter,

Too late to reconsider,

No one's gonna wanna know ya !

Alan Greenspan is an embarrassment–an embarrassment to himself and to everyone who believed in him and his policies. If there is any one individual that deserves the most blame for the Great Housing Bubble, it is Alan Greenspan.

In the post, I Pity Alan Greenspan, I recapped the status quo:

When Alan Greenspan stepped down as Federal Reserve Chairman in 2006, he was highly regarded by most experts and the wider general public as the man responsible for over 20 years of economic prosperity. Guided by his core beliefs in limited regulation and the wisdom of market participants to limit their own risk, he pursued policies during his tenure that have since proven to be disastrous.

If Alan Greenspan had died shortly after leaving office, he would have perished in ignorance of the problems he created. He would never have known the beating his professional reputation would take when the economic system he helped promote came crashing down. Ken Lay died before he could face justice, and his wife got to keep all the money. If Ken Lay had lived on, he would have faced nothing but suffering in his later years. Like Richard Nixon before him, Alan Greenspan will live on to wrestle with his failures, and also like Nixon, Greenspan will likely spend the rest of his life trying to convince a dubious public that his actions were justified and what he did was not wrong.

Alan Greenspan has publicly admitted to making some mistakes. His feeble defense of his actions usually center on the idea that the problems that brought down our financial system were too big for the FED chairman or anyone else to prevent. This is bullshit, and he knows it. The root of the problem is in the deeply held philosophical beliefs that he acted upon his entire career.

Alan Greenspan strongly believes the participants in the economy are aware of the risks they are taking on, and they are carefully managing those risks. In his world, government regulation to curb the excesses is an unnecessary hindrance to economic growth. Like Ronald Regan and the entire Conservative movement that he inspired, Alan Greenspan believed that government is not the solution, it is the problem.

The failures of Alan Greenspan and those who failed to regulate our financial markets have lead to the economic catastrophe we are facing. Everything Alan Greenspan believed his entire career was wrong. He knows that now; although, he will likely spend the rest of his life trying to deny it. He will live out his life in disgrace partly responsible for the suffering of millions of people around the globe.

I don't feel sad for him. I chose the word "pity" carefully. To feel sadness for someone's actions, you must feel compassion for their plight. Pity masquerades as compassion, but there is a lack of empathy in the emotion of pity–A lack of empathy often caused by the fact that certain tragedies are self-inflicted. The attitudes, beliefs and actions of Alan Greenspan caused his own downfall. I do not feel sad for him; I pity him.

For more information, please read Greenspan's Bubbles: The Age of Ignorance at the Federal Reserve

In case anyone forgot, Alan Greenspan denied the existence of a housing bubble as evidenced by articles like this one from 2004: Fed's Greenspan Doubts 'Housing Bubble' Thesis.

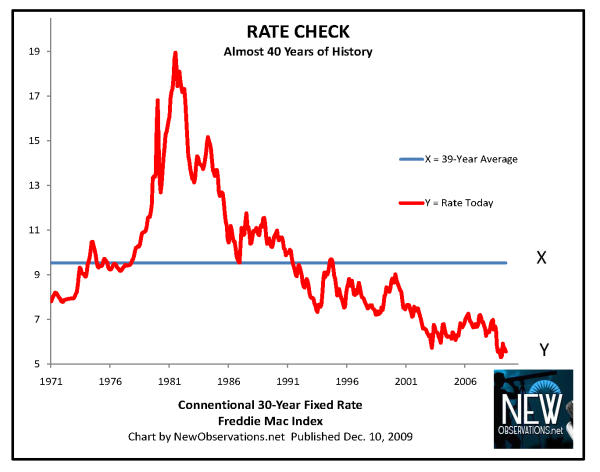

"A number of analysts have conjectured that the extended period of low interest rates is spawning a bubble in housing prices in the United States that will, at some point, implode," Greenspan said. "Their concern is that, if this were to occur, highly leveraged homeowners will be forced to sharply curtail their spending.

"To be sure, indexes of house prices based on repeat sales of existing homes have outstripped increases in rents, suggesting at least the possibility of price misalignment in some housing markets. A softening in housing markets would likely be one of many adjustments that would occur in the wake of an increase in interest rates.

"But a destabilizing contraction in nationwide house prices does not seem the most probable outcome. Indeed, nominal house prices in the aggregate have rarely fallen and certainly not by very much," Greenspan said.

Often public officials have to make statements they don't really believe in order to prevent panic in financial markets, but the discourse above is outside what would be required as a vague Greenspan-speak; The comments display a deeply held and woefully wrong Weltanschauung; in short, he really believed it.

In an astonishing turn (not really), Alan Greenspan is defending his actions, Rich People Things: Alan Greenspan's Window Is Always Open. The author takes him to task:

Well, this is awkward. Alan Greenspan, hailed for most of his nearly two-decade run as chairman of the Federal Reserve as a market savant of the first order, is now assailed from all sides for the Fed’s apparent role in overinflating the country’s garish housing bubble. The charge is a fraught one, reports Fortune magazine’s Geoff Colvin, since should it stick, it will fundamentally reshape perceptions of Greenspan’s legacy at the central bank. Already the sweep of the emerging indictment is such, Colvin writes, that “four years after leaving the Fed as the Greatest Central Banker Ever, the longest-serving chairman, the Maestro, Alan Greenspan is the designated goat."

But Greenspan is not a goat who will go quietly into the good night. He takes vigorous issue with the criticism of Fed policy that is now fueling all the anti-Greenspan rancor: that from the pivotal years of 2002 to 2005, when mortgages remained artificially low and housing prices continued to drift ever higher above the realm of consensual reality, the Fed failed to put the brakes on the downward drift of interest rates. This critical oversight, Greenspan’s critics charge, meant that the Fed kept pumping the derivatives-fed fiction that no serious risks were accruing in the market long past the point of any empirical support.

Greenspan’s rejoinder is that the true causes of the 2008 housing crash were global—that prices kept spiraling upward because of a global savings glut, which channeled capital’s insatiable quest for exotic new forms of market expression into the opaque wonderland of securitized debt. Emerging market economies such as China kept unleashing new investments that, Colvin writes, “naturally pushed interest rates down globally—thus the decoupling of mortgage rates from the Fed funds rate, and the global nature of the housing boom.”

To detractors who point out that this upsurge of global capital didn’t really so much, you know, exist, Greenspan has an elegant rejoinder. As Colvin summarizes, it goes as follows: “You have to look at intended saving and intended capital investment, not actual saving and investment. After all, saving and investment by definition will always balance.” The mere existence of an overabundance of capital was enough, in other words, to prompt markets across the globe to keep their mortgage rates artificially low—thereby permitting housing prices across the globe to ratchet up ever higher.

Do I need to point out that Greenspan's look-at-intent-rather-than-reality defense is bullshit–Embarrassing bullshit? The kind of bullshit that makes you cringe and feel so sorry for the man that you want to run away and hide for him. An embarrassing bullshit that doesn't even pass the giggle test. Perhaps there is a special island where we can put David Lereah and Alan Greenspan to save themselves from further embarrassment. They should get Lost.

If it were only embarrassing, it could be easily forgotten and dismissed, but this fool still has the ability to influence public policy, and if our legislature or bureaucrats believe him, we may repeat Greenspan's grievous gaffes. Hopefully, wiser men (like Paul Volcker) will prevail and Greenspan's debt disease will be cured. I have my doubts.

Who should lose?

Alan Greenspan believed in the ability of financial markets to properly disperse and discount risk. Who do you think he saw as absorbing $900,000 losses on units like today's featured property?

Irvine Home Address … 3131 MICHELSON Dr 1702 Irvine, CA 92612

![]()

Resale Home Price … $899,999

Income Requirement ……. $187,416

Down Payment Needed … $180,000

20% Down Conventional

Home Purchase Price … $1,752,500

Home Purchase Date …. 2/17/2006

Net Gain (Loss) ………. $(906,501)

Percent Change ………. -48.6%

Annual Appreciation … -16.3%

Mortgage Interest Rate ………. 5.05%

Monthly Mortgage Payment … $3,887

Monthly Cash Outlays …..….… $5,740

Monthly Cost of Ownership … $4,400

Property Details for 3131 MICHELSON Dr 1702 Irvine, CA 92612

Beds 2

Baths 2 baths

Home Size 2,062 sq ft

($436 / sq ft)

Lot Size n/a

Year Built 2006

Days on Market 3

Listing Updated 2/10/2010

MLS Number U10000651

Property Type Condominium, Residential

Community Airport Area

Tract Marq

According to the listing agent, this listing may be a pre-foreclosure or short sale.

Penthouse Suite…2 bedroom plus den. Highly upgraded…ultra luxury with 24 hour concierge. HOA dues were just lowered below $1,000. Unit comes with 2 parking spots next to elevator…

ultra luxury? Where do we go from there? Mega luxury? Super-duper luxury?

For your ultra mega super-duper luxury home, you get two assigned parking stalls? For $1,000 a month HOA dues, I should be unconcerned where the staff parks my car… Oh, wait. You mean I have to park it? What are residents getting for $1,000 a month? Hosed.