House prices have crashed in many markets but banks have barely begun the process of writing down their bad loans.

Irvine Home Address … 6 INDIANA Irvine, CA 92606

Resale Home Price …… $999,000

Celebrate the day you've waited for

Party like you're ready for so much more

Do it like you know it's never been done

Go a little crazy, have too much fun

Today's the day, come on everyone

The party's just begun

The Cheetah Girls — The Party's Just Begun

The big mortgage write down party has just begun. Banks have barely scratched the surface on the total dollar value of loans they will need to write off.

The housing bubble was really a credit bubble. Lenders extended far too much credit to people who had no ability to repay it. When the housing market crashed, lenders were in no rush to write their loans down to market value. The result is a huge remaining bubble in home mortgages.

Many lenders honestly believe house prices will rise back to levels that will eliminate the negative equity problem. This is wishful thinking on a grand scale. In reality, the overhang of distressed properties will keep price appreciation in check for quite some time. The mortgage bubble will be deflated by a combination of short sales and foreclosures — many facilitated by accelerated default — causing lenders to write down the mortgage debt to reach market values.

Mortgage Bubble Haunts Housing Recovery

By Lita Epstein Jul 20th 2010

You may not realize it, but there's another major financial bubble ready to burst. Few are talking about it, but Michael David White, a mortgage and real estate professional has graphed the mortgage bubble due to burst.

When the housing bubble burst, it left many with underwater mortgages. Yet nothing was done to deal with the debt levels on these homes. The mortgage values shown on the banks' books are still elevated beyond their true worth.

Right now we're seeing more and more people walk away from this debt. While property values fell from $20 trillion to $13 trillion when the housing bubble burst. Mortgages fell from $11.95 trillion to $11.68 trillion.

John Lounsbury, a financial and investment adviser, says home equity is now over 90 percent mortgaged. Historically our mortgage levels were 50 to 60 percent. He agrees with White that we're in a mortgage bubble that is ready to burst. In order to get back to the normal historic relationship, Lounsbury says "outstanding mortgage values would need to be about $7 trillion, which is $5 trillion below the latest level."

He says, "Banks are looking to resolve this bubble by waiting for mortgage repayment and for house prices to rise." He calls this the "extend and pretend" mode. The big question is: Will people continue to pay these mortgages as they wait for homes to rise enough in price to get back above water. In some of the hardest-hit areas that could take 10 to 20 years or longer.

There is no way borrowers are going to wait that long. Most can't. Do you think people will remain immobilized through 2025 for a decision they made in 2005? No way. When it becomes apparent house prices are not coming back, people will give up hope and walk away. Look for the double dip to crush the feeble hopes of those who haven't accelerated their inevitable defaults.

The Business Insider focused on the 15 hardest hit areas, with Nevada leading the pack. In Nevada, 69.9 percent of mortgages are underwater. Arizona comes in second with 51.3 percent of mortgages underwater, and Florida is third with 47.8 percent.

Based on mortgage debt, we're becoming a country of haves and have-nots. Those stuck in homes underwater cannot move to find work in another location, even if there's no work where their home is located. Without jobs, they may have no choice but to walk away or work with their bank for a deed-in-lieu of foreclosure. In many cases, these homes are so far underwater that banks won't agree to short sales.

As more and more people realize that they have no choice but to give up their homes, the mortgage bubble will deflate. The only question left is whether the bubble will burst rapidly or continue to deflate slowly as foreclosures are resolved.

I do think the mortgage bubble will deflate slowly. Lenders are being allowed to use mark-to-fantasy accounting, so there is no regulator pressure to write down the loan balances. Also, denial is a basic human reaction to catastrophe, and borrowers will surrender and capitulate at different rates. The brief bear rally we just witnessed will give false hope to many who will hang on for a few more payments.

But Lounsbury thinks that some areas of the country that have not yet been hard hit by the housing meltdown are ripe for problems. For example, he thinks the New York area is a bubble waiting to happen. In fact, Keith Jurow of the Real Estate Channel thinks a housing collapse in Queens is almost certain.

IMO, you can add coastal California to that list. I still believe the high end is going to be wiped out. There are no government supports for the jumbo loan market, and very few people can afford the large number of homes priced in that range.

As the housing bubble continues to deflate in areas that right now are not among the hardest hit, will that finally cause the mortgage bubble to burst? Will the banks be able to withstand these shocks or are we looking at another bank bailout?

Based on some reports, the banks may have pushed the worst of these mortgages onto Fannie Mae and Freddie Mac, leaving the taxpayers holding the bag for this next bubble burst. So the big question is not whether there's a mortgage bubble, but who will be left holding the bag when it bursts.

There is no question that we will engineer another bailout for the banks if the mortgage bubble deflates too quickly. Whatever losses cannot be pushed off to the taxpayer through the GSEs will become part of another massive bailout. Either that, or we will print money until the problem goes away.

The $4 Trillion Dollar Question

By Barry Ritholtz – July 15th, 2010

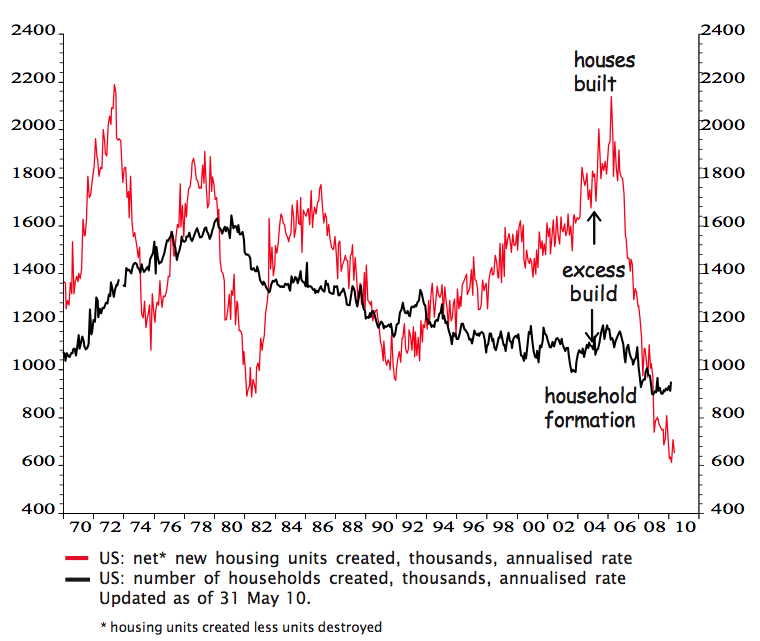

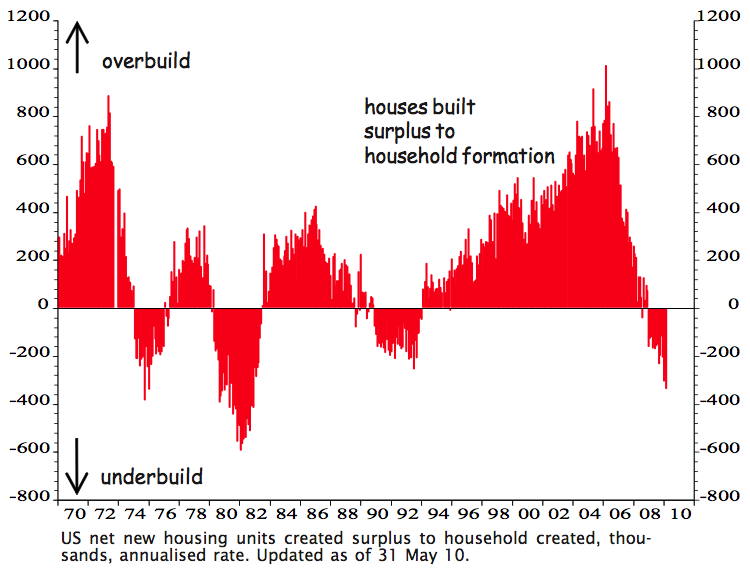

The US has built far too many houses

Perhaps homeowners suffering negative equity are patiently expecting house prices to rise again. But they may be in for a long wait. Prices are likely to be weighed down by a massive oversupply of homes relative to underlying demographic demand.

Between 2002 and 2006, US homebuilders went on a construction binge, building 12 million new homes while the number of households went up by just 7 million. The painful legacy is a massive oversupply of houses relative to the number of households.

The oversupply will take years to clear

With household formation running at just 0.9 million while the US is still building 0.6 million new homes annually, only 0.3 million of the oversupply will be absorbed per year. As there are currently 4 million too many homes, it may take years to mop up the huge oversupply of houses.

The negative equity problem and excess inventory will put pressure on the government to continue to subsidize mortgage interest rates. If interest rates rise and prices resume their downward slide, more people will opt for accelerated default causing the mortgage bubble to finally deflate.

Like foolish buyers during the housing bubble, banks really have no plan B. They are in amend-extend-pretend mode for the long haul. They can't afford to lose $4,000,000,000,000, yet that is what they must do. Perhaps they can extend it long enough to only lose $2,000,000,000,000? The banks have much pain ahead.

Peak buyer walks away

This property was purchased on 10/4/2006 for $1,150,000 the owner used a $805,000 first mortgage, a $115,000 stand-alone second, and a $230,000 down payment which was lost at auction. This property was pushed through the foreclosure process in about a year, so this owner did not get as much squatting time as others.

Foreclosure Record

Recording Date: 11/12/2009

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 07/22/2009

Document Type: Notice of Default

In a last minute attempt to record an interest in the property, there was a loan for $10,500 recorded three days before the trustee sale. I don't know what they were hoping to accomplish as the first lien holder blew them out at trustee sale. This property, like many other trustee sale flips I profile, was purchased by Palladio Properties LLC, a fund very active in the Irvine market.

The property was auctioned on 4/5/2010 for $814,000. The opening bid was $751,500. After sales commissions and preparation for sale, Palladio Properties LLC will probably make about a 12% profit on this deal.

If you would like to learn how you can get involved with trustee sales, please contact me at sales@idealhomebrokers.com.

Irvine Home Address … 6 INDIANA Irvine, CA 92606 ![]()

Resale Home Price … $999,000

Home Purchase Price … $814,000

Home Purchase Date …. 4/5/2010

Net Gain (Loss) ………. $125,060

Percent Change ………. 15.4%

Annual Appreciation … 63.0%

Cost of Ownership

————————————————-

$999,000 ………. Asking Price

$199,800 ………. 20% Down Conventional

4.59% …………… Mortgage Interest Rate

$799,200 ………. 30-Year Mortgage

$197,306 ………. Income Requirement

$4,092 ………. Monthly Mortgage Payment

$866 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$83 ………. Homeowners Insurance

$116 ………. Homeowners Association Fees

============================================

$5,157 ………. Monthly Cash Outlays

-$981 ………. Tax Savings (% of Interest and Property Tax)

-$1035 ………. Equity Hidden in Payment

$343 ………. Lost Income to Down Payment (net of taxes)

$125 ………. Maintenance and Replacement Reserves

============================================

$3,609 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$9,990 ………. Furnishing and Move In @1%

$9,990 ………. Closing Costs @1%

$7,992 ………… Interest Points @1% of Loan

$199,800 ………. Down Payment

============================================

$227,772 ………. Total Cash Costs

$55,300 ………… Emergency Cash Reserves

============================================

$283,072 ………. Total Savings Needed

Property Details for 6 INDIANA Irvine, CA 92606

——————————————————————————

Beds: 5

Baths: 2 full 1 part baths

Home size: 3,471 sq ft

($288 / sq ft)

Lot Size: 8,100 sq ft

Year Built: 1998

Days on Market: 82

Listing Updated: 40355

MLS Number: S614610

Property Type: Single Family, Residential

Community: Walnut

Tract: Camb

——————————————————————————

Large Beautiful Home in Harvard Square Gated Community. 5BR & 3BA with Large Bonus Room. 3 Fireplaces decorated with Marble. Plantation Shutters, Crown Moldings & Recessed Lights Through out. Upgraded Porcelain Tile & Hardwood Flooring. Granite Countertop & Walk-in Pantry in Kitchen. New Stainless Steel Appliances Installed.

After people accelerate their default, many must turn to bankruptcy to wipe the slate clean:

O.C. bankruptcies up 40% in 2010

In the first six months of 2010, almost 6,500 Orange County individuals and businesses filed for protection from the federal bankruptcy court, 40.3% more than the same period of 2009, reports the federal bankruptcy court.

The year-over-year filings continue to grow but at a slower rate, both in Orange County and throughout the Central District of the U.S. Bankruptcy Court, which covers five counties from San Luis Obispo to the Arizona border. For example, June 2009 filings were 77% higher in Orange County than in June 2008.

However, Orange County isn’t out of the financial woods yet. June bankruptcies increased 8.6% from May, after two straight monthly declines in 2010.

Individuals continue to be affected by unemployment (9.5% in June), housing foreclosures (up 3.8% in the first half of 2010) and the hangover of consumer debt ($2.4 trillion as of May). And small businesses in California lead the nation in bankruptcies, according to Equifax Inc., affected by tight lending and slow sales.

In Orange County, small-business bankruptcies account for 8.6% of filings. That doesn’t include business owners who had to file personal bankruptcies.

Orange County residents and business spend all their disproportionately to their income on bs like this:

http://orange-county-escorts.cityvibe.com/escorts/

I’m assuming a large/active buyer like Palladio can get some break on the 6% real estate commission (and presumably on contractors hired to spruce it up as well). First they are an all equity/flipping seller so the probability of closing the sale (and commission) is high (ie the Realtor doesn’t have the risk of doing all the work then having a bank reject the short sale). Second there presumably would be some bulk buying discount. Even if they just cut the commission to 5% when you annualize that it is pretty material

Couldn’t someone like Palladio have a Realtor on staff, and contractors too?

How much time is their equity tied up? 6 months? If they’re returning 12% every 6 months, that’s over 25% annual return (1.12^2)! With tons of people earning a percent or less on savings, I would imagine that there would be more people moving into this space, driving up the auction prices, reducing the margins – isn’t that what capitalism would dictate?

And that is exactly what is happening….

There’s an easy way to make up margin, it’s called price.

Good lord I can see it now, new post about the Trustee cartel controlling prices in Irvine.

That’s where we are turning in circles, most people on this blog believe that prices will fall. Palladio will probably learn that lesson the hard way after they get stuck with a few of these properties. Wrong time to be a flipper. But I am grateful for every fool who takes these properties off the banks’ balance sheets so they can finally clear the inventory.

You are wrong, they will continue to make money hand over fist. Even if they rented the properties out at the 100% cash purchase price the dividends would be attractive. No where near as good as their tax payer subsidized profits however.

If they’re going to make 12% on this flip, it’s not happening very quickly. The efficient markets proponents like to claim that ‘the price is always right’, but if the price of this property jumps >12% nearly overnight, one price was too low, or the other too high. It takes some time for prices to reach equilibrium (if it actually exists) and during that time, there are pricing anomalies.

The flippers have no motivation to not sell properties and book profits. They want to churn, and selling to recoup equity & profit is the only way.

I think they will eventually make a lot less money as other buyers come in and the auction prices go up – less margin between cash & loan financed prices.

But don’t you wonder if the banks can continue to value assets at mark to fantasy, then they may not necessarily have to resolve defaulting mortgages? Think about it. Why should the bank recognize the loss if they can pretend?

The big question is, “How long can they keep pretending?” Some people say we can just pull some proven tactics out of the history books, Japanese style. Is this possible for us, considering that Japan has strong exports when our largest export is debt?

US financial system support up $700 bln in past year

How long can this last? Will the Keynesians be proven correct after this massive experiment?

Unfortunately, this situation can last a very long time because the Fed is likely to engineer massive inflation using its printing machines. Banks can continue marking to fantasy till inflation raises house prices to these fantasy levels.

Inflation occurs when too much money chases too little goods and services. And is enhanced by low interest rates making money cheap. Rates can’t go any lower than they are now and no one is borrowing – either because they can’t or because the banks won’t lend.

If anything, we’re headed for deflation – and probably for a significant period of time.

Deflation will lower house prices. The more REOs that are held back now, the more prices will have to drop to sell them later.

Helicopter Ben got his name for good reason. Overnight rates do not need to go lower to bring on inflation. There are many economists such as Paul Krugman and Robert Reich calling for the Fed to start buying corporate debt and treasury’s to pull down longer term rates. The basic idea is to use monetary policy to flood the economy with money. Ben Bernanke has himself given a famous speech (before he became Fed chief) to the affect that the Fed can always engineer inflation.

See Paul Krugman’s recent post and his links:

http://krugman.blogs.nytimes.com/2010/07/21/the-fedfail-index/

http://krugman.blogs.nytimes.com/2010/07/22/joe-gagnon-is-right/

Consumers make up 67% of the economy. There is 9.5% unemployment – 16.5% if you also count the underemployed. Where is the demand necessary to kindle inflation going to come from? Deflation and dropping home prices are, imho, much more likely.

That’s fine. Time will tell. IMHO, the next 2 years are likely to be deflationary followed by massive inflation.

Don’t you remember Irvine Renters brilliant analysis way back when:

It’s a cartel and they will all fight eachother to unload all their properties..desperately knocking on Sheila Blair’s door handing over the keys to their insolvent banks.

Anyone who understood the complexities of the housing bubble should have been able to predict quantitative easing, banking, and government policy. It’s easy to stay in business when you can make up your profits and losses with a balance sheet key stroke while buying treasury bills with 0% money. At least IR has changed his tune, and now accepts that the government will take further extreme measures if necessary. Hell Bernanke said that this week and has been sticking to it all along. The money that is created will head to the upper crust and prime markets as it always does.

I have not changed my view. I have always contended that the government would do everything it could. There have been a series of bailouts and false hopes, and the government will continue to try to manipulate the market. I also stated that their efforts would fail, and I still believe they will fail. Further money will not head to the “upper crust” as the huge spread on jumbo loans attests to. A few days ago we joked about lighting money on fire. Putting money into jumbo loans is a financial incinerator.

I did miss the extreme lengths to which the government would go in its failed efforts. I did not foresee the takeover of the GSEs. I can’t find any published predictions of that one occurring. I did not foresee zero interest rates as that has never happened before. I did not foresee widespread squatting at the banks choice nor the suspension of GAAP required to allow it to occur. I figured the the government would at least uphold contract law, but they threw that out the window too.

The cartel will collapse as banks liquidate, and more banks will go under as the balance sheets debt gets written down. This isn’t going to happen overnight. It will be dragged on for years. You are celebrating a victory and we are only in the 4rd inning.

I’m not celebrating any victory, it’s common sense acknowledgement that the big banks will not go out of business and will get even bigger with mark to fantasy and their continued purchase of treasury bills with 0% money. You are hoping for something because you desire an end result. Your analysis has been misguided by desire for a long time now.

I respectfully disagree with you that banks can go on forever allowing squatting and extend/pretend and not take hits. with leverage ratios in excess of 1:40, banks are burried in deep debt, allow mark to market and most major banks will be insolvent overnight.

Most important point is that World has stopped buying US Debt and this is a fact, this is why FED started buying it. At some point FED will have to choose between housing and existance of $ and you guessed it, FED will pick $ over anyone. The only way FED/US Govt. can force globe to continue to buy US Debt is by “Round 2” of global selloff, that will cause more panic and folks heading into T-bills.

In either case, housing is going to be doomed, either due to collpase of $ or due to rising interest rates to entire t-bill buyers.

Hmm, depends on how far in advance you’re talking about but I’m pretty sure Tanta on Calculated Risk called the nationalizing of the GSE’s, and Krugman has definitely talked about the “Zero lower bound” for a long time, which always implied to me that zero was amongst the options…

You were reading them though, I assumed…

The consequences of these extremely childish policies is lack of investor confidence in our gov/t, our economy, and taxpayer ability to back the dollar and service our debts.

The ultimate consequence is repatriation of the dollar. The problem exists and is massive. The question becomes when not if.

Bulls always say, “that can never happen”. but after the most highly-leveraged boom in history, it has become more than just possibility.

The $4 Trillion Dollar Question

http://www.ritholtz.com/blog/2010/07/the-4-trillion-dollar-question-2/

Oops, sorry, didn’t realize already linked in your post.

How about “Economists Take Gloomier Views of Housing Market” instead.

http://blogs.wsj.com/developments/2010/07/22/economists-take-gloomier-views-of-housing-market/

Irvine Renter and Shevy,

In the last 3 days about 26 homes have come on the market. Do you know if these 26 additions were distressed properties (REO/Foreclosure/Short Sale etc.) or whether these were standard sale offerings?

Thanks,

PH

The MLS has 42 new listings in the past 3 days in Irvine. 4 REO’s, 9 Short sales, and 29 “equity sales”, it’s likely that a number of the equity sales will end up as short sales. This is a clink to the CMA of the current 42 new listings.

http://findmylandmark.com/files/images/11618/pdf/11279818401.pdf

Interesting that the bank pushed this one into foreclosure more quickly. I guess a beancounter realized the first loan holder could be made whole, and a second beancounter realized the second loan holder could get back some money.

Reminds me of the Great Depression stories, where people with some equity left got foreclosed, while people who were hopelessly underwater got to keep living in their houses. And for the same reason, it made bean counter sense, although no moral sense.

There’s a reason this old saying is true..

Borrow $100,000 the bank owns you

Borrow $100,000,000 and you won the bank..

Same thing

BTW:

In regards to the increase in inventory… isn’t that normal during the summer? That’s when most people want to sell their homes when kids are not in school etc etc etc.

Looking at the chart, it seems like the last peak was last summer around this time and every July seems to have a spike dating back to 2007.

07/22/2010 — 818

07/21/2009 — 640 (interestingly, it kept shrinking over summer)

07/22/2008 — 845

07/21/2007 — 1277 (all-time peak, almost)

Another interesting article from Business Insider, Jul 20, has a lot of information on how banks are marketing REO in various areas. The following describes Orange Co., Ca,, as of 7/15/2010:

Repossessed homes (REO): 6270

Repossessed homes on market: 227

Repossessed homes over $300K on market: 85

That’s 85 out of 3800 REO priced over $300K. Does anyone really believe that with 3715 (97.8% of REO inventory) remaining there won’t be future very significant price drops?

What happened to the 2nd and 3rd on this one?

Do they get wiped out by the Trustee Sale?

Foreclosure by the first lien holder always wipes out the junior liens. If there is any value above the balance of the first, the junior lien holders may bid to protect their own interests, but in today’s market, the value is almost always less than the balance on the first mortgage.

Are flips being marketed in comments as “Equity Seller”? Curious how, other than price, these homes get traffic.

My .02c

Soylent Green Is People.

Yes, you bring up a good point that I forgot to mention, in the MLS trustee sale flips will be categorized as standard sales rather than short sales or REOs. These are actually normally better than a regular standard sale because one then knows they are dealing with a motivated seller and that the home will likely be sold in 30 days or less.

The flips in Coto are listed as equity sales, which makes sense to me, and usually sell quickly. They are pros and they know their market. Someone expressed the sentiment that they can’t wait to see some flippers get caught with holding properties while the market takes another turn down. It ain’t gonna happen. The flippers turn over their inventory quickly, way too quickly to be affected by any yearly price decline. They are usually listed within a month of the auction and usually go into escrow within one month.

Awgee hit the nail on the head, it’s tough for a good trustee sale investor to get caught if they know their market unless they get greedy. Moreover, most trustee sale flips show better than any other homes in their area and are priced right and have sellers that are motivated to get their money back and move on. REO’s may new paint and carpet at most and it’s not unusual for them to smell like urine, plus one still has to deal with the bank. Short sales are often in worse condition than REO’s, if one can even go inside to look at it, plus one can expect to wait months to hear from the bank and the bank may foreclose even if the offer is at market value, moreover, even if the short sale gets approved you never know if the banks REO division will end up foreclosing before it’s a done deal regardless. Regular equity sales that are hit and miss.

Mortgage defaults in California at 3-year low

http://www.latimes.com/business/realestate/la-fi-foreclosures-20100722,0,5721319.story

O.C. foreclosure notices surge

http://mortgage.ocregister.com/2010/07/22/34593/34593/

” so there is no regulator pressure to write down the loan balances”

Well, we are in for a market crash shortly, Banks as we know are operating from their trading desk profits while losses continue to mount on REIT’s and Housing. No matter regulators force them or not, when Banks will get hit with another leg of credit crunch (its already started), they will be forced to liquidate to raise cash to pay back from where they borrowed from.

Here is my story on one Mission Viejo Home

Home was for sale at $599K, then lowered to $539K, it took 12-months and several failed buyers who could not get the financing for this home to finally sell. The reason for it not to get financing was that it required well over $100K work. I put an offer of $525K and it was not accepted by the bank, however they sold it to cash buyer for $460K. After 2nd lien and other costs, the buyer ended up with the home for $485-$490K, they are investors. Now if they have to sell it, assume 5% commission, and previous failed financings at $539, I dont think they have much room remaining to profit from. Also due to $8k tax credit expiration, buyers have gone missing.

Most imprtant aspect is that as investor already bought it, it leaves the sale now to the end user only, a property cannot be sold twice in 12 months. I cant wait to see what the cash investor does with this property. I have my offer in at $525k, will let you know if anything happens.

I am patient and not desperate to buy home right now, however its getting to a breaking point with my wife who is very very frustrated.

If it needed well over 100k in work they are taking a huge hit. However, this is one reason why investors make money, they often have their own crews or get huge discounts for the rehab. Many end buyers overestimate the cost of rehab, while others underestimate as well.

Why can’t a property be sold twice in 12 months? Are you referring to the FHA rule?

I was told by the Wells Fargo bank that proterty cannot be sold more than twice in 12-months to prevent fraud. Not sure if it FHA rule or what.

On The cash buyer having its own crew, I came up with the $ budget muself as I am a contractor, it was my cost, I would be hardpressed if anyone can do below this cost.

I have heard that Wells Fargo has some different guidelines, I believe that they may be able to make exceptions to this one at the discretion of the underwriter. Moreover, I believe that as long as everything else checks out there are plenty of lenders that will lend regardless of how many times it’s been sold in the last 12 months.

The sellers are taking a huge haircut with the numbers you have outlined, I wonder what they were thinking.

It can be a frustrating process, particularely if one does not have the right expectations going in. You are in the right frame of mind to be patient, good luck on this one, it sounds like you are in the ballpark.

The fellow had money in the property, so wasn’t allow to squat for long. He was the FoolishBuy or FoolishBorrower.

The US has handled debt by inflation. Even with the Great Depression’s 20% unemployment, FDR still managed to have inflation. Japan’s was tanked by US debt by Japan making the yen expensive; therefore inflating the dollar relative to the yen. If Japan didn’t, the US would have been forced to inflate the dollar another way to pay back Japan. An unoffical 20 year recession for Japan. Will the US take an unoffical 20 year recession? We officially out of the recession with continued high unemployment. The US will continue to have high unemployment until the banks are off the hook, which means that taxpayers need to be on the hook.

Thank you for your blog; if is a helpful read.

You write: “The housing bubble was really a credit bubble. Lenders extended far too much credit to people who had no ability to repay it.”

My response is that in my linked article, I write that charts of US Government debt and other debt suggests that we have reached “Peak Credit” … and are about to enter “the end of credit”.

Interest rates are going higher soon for a number of reasons. One primary reason will be Treasury Auction failures. Which means that Freddie Mac and Fannie Mae will not be funded. Mortgages will not be offered by the GSEs or the banks.

You write: “The mortgage bubble will be deflated by a combination of short sales and foreclosures — many facilitated by accelerated default — causing lenders to write down the mortgage debt to reach market values.”

My response is that if the lenders write down the mortgage debt to reach market values it will decapitalize them so severely that they will go out of business and the FDIC will not be able to close banks fast enough to keep up with the failures. Therefore, I see foreclosures (simply to get the people physically out of the house) and leasing to someone who will pay rent. Perhaps there will be many people living in the property in violation of rules now existing in many better neighborhoods.

The article states: “Based on some reports, the banks may have pushed the worst of these mortgages onto Fannie Mae and Freddie Mac, leaving the taxpayers holding the bag for this next bubble burst. So the big question is not whether there’s a mortgage bubble, but who will be left holding the bag when it bursts.”

And you state: “There is no question that we will engineer another bailout for the banks if the mortgage bubble deflates too quickly.”

My response is there is no resource left to bail out the banks. It’s likely that a Financial Regulator will exercise Discretionary Governance, and announce a home leasing program through the banks.

You write: “The negative equity problem and excess inventory will put pressure on the government to continue to subsidize mortgage interest rates.”

My response is that soon, the interest rate will be out of the government’s control and they will no longer be subsidizing mortgage rates.

You write: “If interest rates rise and prices resume their downward slide, more people will opt for accelerated default causing the mortgage bubble to finally deflate.”

My response is that the deflation will come rapidly.

You write in comments: “The cartel will collapse as banks liquidate, and more banks will go under as the balance sheets debt gets written down. This isn’t going to happen overnight. It will be dragged on for years.”

My response is that I think a more painful situation will come on fast, that is spelled FAST: mortgage money will not available, banks will be going under, and a Financial Regulator requiring leasing.