Address: 25 Golden Eagle, Irvine, CA 92603 (Shady Canyon)

Plan: ?? sq ft – 4/4.5

MLS: S452978 DOM: 62

Sale History: 1/6/2006: $4,030,000

Price Reduced: 09/28/06 — $4,480,000 to $4,280,000

Current Price: $4,280,000

For those that might not know, Shady Canyon is one the most prestigious and exclusive communities in Orange County. This village in Irvine consists mostly of custom homes although there are a few ‘tract’ homes as well. Prices currently range from $3,495,000 – $17,900,000.

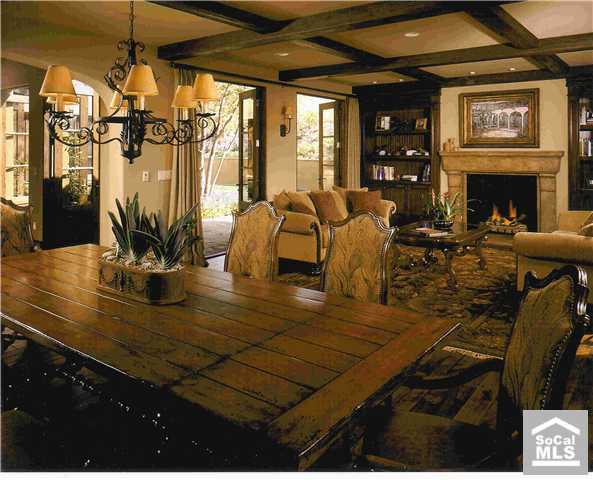

While scouring MLS looking for flips, I came across 25 Golden Eagle. You’ll want to look it up in ZipRealty to check out the rest of the pictures. A gorgeous home in a beautiful setting but you need mucho dinero to play in this part of Irvine.

This home was custom built in 2003 and it appears the original owner listed the home in November 2005 and sold it in January 2006. The new owner is a RE broker and put the home back on the market in August 2006 looking to make $450,000. The price was lowered a couple weeks ago reducing the potential profit to about $250,000. The broker is offering 3% for someone to bring a buyer and that will decrease his profit to about $122,000. I’ve been unable to find any loan information so if someone else is able to dig that up, please post. Imagine what the carrying costs on something like this would be. This one may take a while to sell but I’ll keep checking.

UPDATE #1 – November 16, 2006

This listing fell off the market on November 2nd. If it gets relisted I’ll update the post. In the meanwhile, check out another $4+ Million Flip at OC Renter’s blog.

UPDATE #2 – December 15, 2006

And now it’s BACK on the market at a price of $4,295,000. It’s also now listed with Uber realtor John McMonigle. I’d bump up the selling costs to be about 6% now which would give the seller a profit of about $7,000. Nice 😉

how can nobody comment on this? it’s such a killer?

i can’t believe anybody would try to flip a $4M home. Isn’t that suicide? I mean, this market’s been hot but you really gotta have some guts for this kinda of transaction….

—–

6% mortgage x 4M = 240K a year

1% tax x 4M = 40K a year

bleeding rate: at least 280K a year for interest and tax

even if can sell at 4.28M… barely to get out even…

Wife and I have driven around Shady Canyon…LOOOOVE the area, but flipping in the area? That’s just odd. Doesn’t make sense to tie up so much money just for a flip, does it? Also makes me wonder how much of the other areas, such as Crystal Cove, Woodbury, etc. are investor-purchased? I, for one, am anticipating 50-60% drops to get to normal premium-pricing Irvine homes.

Tom, you might be right:

http://ocfliptrack.blogspot.com/2006/10/shady-canyon-bloodbath.html

Look at the state of the OC market:

http://blogs.ocregister.com/lansner/

Yes, that $4million home can expect to sit on the market for 43 months. That’s 3 and a half years! Damn does that take a bit of capital. Why… one would burn through about $200k by the time it sells.

I’ve been into shady Canyon, great place to live. But that flip is insane! Flipper toast anyone?

No wonder Buffet says high end housing is expected to crash.

Neil

I have been through most of the homes in Shady Canyon that are on the market.

This market is grossly overpriced. The spec developers overpaid for the land and recieved financing incentives from the Irvine Company.

They thought they could build the custom house for $300 a square feet (plus land costs) and get $1100 a square foot for a finished product. Only problem is that there are about 25-30 of these homes in various stages of development.

Irvine company mandates building in 3 years. They also take 66% of profit if you try to sell the land or project before a certificate of completion.

The developers currently are willing to knock $500,000 off the asking price from the get go. Yet all are afraid to reduce the ask price. These homes will fall back to earth within 6-8 months as more of the spec homes come on the market and the existing ones don’t sell.

In the very near term these homes sell for $700 a square foot and could bottom out at $500 a square foot.

What will be interesting is if some of the speculators don’t build out their lot in the mandatory 4 year timeframe. Will Irvine company go after them??

Also take a look at the track homes (Greystone) build in Shady Canyon. They all have 2 car garages. Everyone parks on the streets and it is really congested and tacky.

This along with Turtle Ridge will adjust.

Frank,

I couldn’t agree more. The Irvine company could have a tough decision to make in the next couple of years. If these residential deeds are anything like their commercial ones, they may have a right of first refusal on sale. When the construction lenders take over some of these deals, will the Irvine company buy some of these back from the developers and lenders to prevent these from going for $500/SF? If prices get that low, it will really hurt the Irvine company since residential land is one of their biggest holdings. These are all very nice homes, but Shady Canyon is in an odd location (not very convenient for shopping and restaurants compared to most other luxury priced homes in the area). They are not worth the prices being asked.

Although a little off topic, I have been following Emerald Bay this year, and there have been very few sales, but a lot of price reductions. Seems like a standoff with the buyers. Not many buyers left at $2,000 per square foot for a 40 year old house with no yard ($3,000 – $4,000 for newer construction with a view – I am not kidding, take a look http://www.emeraldbayrealty.com

Correction:

http://www.inthebayrealty.com

From Dataquick records it looks like there is no loan on it. Unless it was owner financed by the previous seller which was a Trust (Even at the multimilion home levels there still might be some ‘all cash’ buyers, who knows?). Taxes on it 21.8K last year on 1.17 tax value, possibly above 70K this year if it is reassessed at the sale value!

25 Golden Eagle was purchased by Kim Kao of the hotel computer kiosk fame. North Golden Eagle was the 1st street to be released by the Irvine Co within SC and where one would find the smallest sf (no subterranean) and lowest $ homes. GE iots initially sold in the 600K range. The latest lot sold for excess of 8mil (Lot 10D). Consequently, the build quality is below that of all other subsequent SC releases. Yes there are numerous homes for sale on this street and other early release streets. The lg estates (15K sq ft up) are commanding $900-$1050 sqft today.

I just shot-up the Q3:2006 reports for Orange County, Inland Empire, and Ventura

thebubblebuster.com

All I can say is….

Puuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuuke.

Who needs a bizillion square feet to live in. I bet this house will have a carpet wear from the toilet to the couch in front of the TV. There may be a minor carpet wear to the refigerator. Face it, houses that are this size are for folks that have no spiritual grounding……..if they did have spiritual grounding, they would donate the extra money to help cure some exotic disease,,,,,,,like the common cold.

Zovall, any thoughts on seeing how these numbers look for OC?

Link.

Merry Christmas!

oc_fliptrack, Nice article! I don’t have an easy way to find out whether a property is vacant or not (other than looking at every listing individually). I may be able to do that for Irvine but it would take some time 😉

This particular example is a testament to how stupid this market has become.

Here’s the real question!

How the F*CK did a 4 bedroom, 4 1/2 bathroom OC house without an ocean view get into the 4 million range?

Shady Canyon is a premier community, however there are simply too many Joe’s that make 200G a year trying to play in this league. I know, I’ve seen the paper facilitating this Ponzi Scheme.

Orange County is full of people that are pretending to be wealthier than they are — all the way from Stanton to Newport Coast. It’s a big mirage that’s going to end with broken dreams.

Another point: I remember looking at very nice courtyard homes (3600 sqft) in Newport Coast when they first started developing it in the mid nineties for a little over a million. Today that same home is selling for about $4-5 million, and for no apparent reason other than extremely liberal lending.

I’ll tell you what I think is going to happen over the next decade or so … the bubble communities are going to look a lot like Japan has looked like for the last 15 years. Prices in most of the country will remain the same, though they’ll actually be declining because of inflation. And places like Orange County are going to drop in value, plus lose value to inflation. The FED will likely start dropping rates again next year, but it’s not going to matter due to much tighter (self governed) lending rules.

The Japanese Central Bank dropped rates to ZERO percent, and it didn’t help their slumping real estate market. Home prices in some parts of Tokyo have lost more than 85% of their value since 1990 due to price declines and inflation. Can some very nice Orange County zip codes lose 85% into the coming decade? I don’t know … but I do think this bubble will end much worse than the last bubble which saw some zip codes lose 40%(+) due to price declines and inflation.

This is no time to become a bag holder!

Hi Zovall and IrvineSingleMom, I’m going through withdrawals (hasn’t been a new post since 12/15) and anxiously awaiting your new post. =)

Cheers,

Hope To Buy In Irvine Some Year

http://www.ziprealty.com/buy_a_home/logged_in/search/home_detail.jsp?listing_num=S467181&page=1&property_type=CONDO&mls=mls_so_cal&cKey=05thg2j2&source=SOCALMLS

a 750 sqft house for 439,000 and the seller decides to put it back for 398,000.

Zillow shows the last sale price in 2004 was 300,000. Did mission viejo house prices went up that much in 2 years?

Sorry for the delay in new posts. We hope to be back at it soon and are working on a new feature. 😉 Thanks for continuing to check in!

Oops,

Sorry if the “investor” had the wrong idea about how long a 4M property is bound to sit on the market.

Shady Canyon or not.

http://www.AllForeClosuresNow.com

I checked with the title insurance co and this does not have a loan on it. Taxes are $21,334. There are 2 owners, both female. Maybe daddy bought it and they just got tired of it. When you are that wealthy, you can afford to change your mind and sell.