The average time a defaulting loan owner gets to stay for free in the house has ballooned to over 500 days.

Irvine Home Address … 73 JUNEBERRY Irvine, CA 92606

Resale Home Price …… $510,000

She sits by the fireside,

The room is so warm.

Her children are sleeping,

She waits in their home.

Passing the time.

Passing the time.

Everything fine.

Passing the time, drinking red wine.

Cream — Passing The Time

I really don't get that worked up about the squatters and HELOC abusers anymore. I remember back in 2008 or 2009, when I would see someone who was given half a milion dollars for doing nothing — and spending it — I was shocked and angered that I would pay for that all with everyone else in a banking industry bailout — an ongoing bailout if you consider the inevitable inflation that will finish the process.

Now that I have seen several hundred HELOC abusers and squatters, they are a curiosity, nothing more. Sometimes the details are amusing, and imagining how they blew the money goes through everyone's mind. We're all watching the market, passing the time.

Wait until I tell you some of my eviction stories from Las Vegas… Another time…

Before the market improves, lenders must reach a point where loans are not going delinquent faster than they can cure them or foreclose on the squatters. Until the delinquency rates drops or the foreclosure rate rises, lenders will continue to build shadow inventory.

Then they must liquidate visible and shadow inventory at a rate faster than they are adding to it. Right now, shadow inventory is growing, visible inventory is growing, and liquidation rates are at a seasonal low. Liquidation must outpace additions before the inventory problem goes away.

The amount of inventory in visible and shadow inventory will take many years to clear out. The price levels after the liquidation will be determined by incomes and loan terms at the time. The weight of inventory will squeeze any remaining air out of the housing bubble.

LPS: Overall mortgage delinquencies declined in 2010

by CalculatedRisk on 2/07/2011 11:48:00 AM

LPS Applied Analytics released their December Mortgage Performance data. According to LPS:

• The average loan in foreclosure has been delinquent a record 507 days. This is up from 406 days at the end of 2009, and up from 499 days at the end of November.

• Overall, mortgage delinquencies dropped nearly 18% in 2010.

• On the other hand, foreclosure inventories were up almost 10% in 2010, and are now at nearly 8x historical averages

• “First-time” foreclosures are on the decline, with over 30% of new foreclosure starts having been in foreclosure before

Click on graph for larger image in graph gallery.

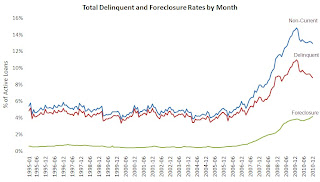

This graph provided by LPS Applied Analytics shows the percent delinquent, percent in foreclosure, and total non-current mortgages.

The percent in the foreclosure process is trending up because of the foreclosure moratoriums.

According to LPS, 8.83% of mortgages are delinquent (down from 9.02% in November), and another 4.15% are in the foreclosure process (up from 4.08% in November) for a total of 12.98%. It breaks down as:

• 2.56 million loans less than 90 days delinquent.

• 2.12 million loans 90+ days delinquent.

• 2.2 million loans in foreclosure process.

For a total of 6.87 million loans delinquent or in foreclosure.

The second graph shows the break down of serious delinquencies.

LPS reported “the share of seriously delinquent loans that have not made payments in over a year continues to increase.”.

Note: I've seen some people include these 7 million delinquent loans as “shadow inventory”. This is not correct because 1) some of these loans will cure, and 2) some of these homes are already listed for sale (so they are included in the visible inventory).

This data is not shadow inventory, but most shadow inventory resides there. CalculatedRisk is correct in pointing out that not all of these loans will become future for-sale inventory, and if you take this data as a direct measure of shadow inventory, there would be double counting with visible inventory. I would also note this data does not capture the number of loan owners with toxic financing that will give up over the next several years as prices grind lower and strategic default becomes more common.

Shadow inventory is continuing to grow larger. We aren't adding to it quite as quickly as the past, but we are still not over the hump and actually reducing shadow inventory. That may come this year if the foreclosure rates pick up.

The bottom line for struggling loan owners is that if they decide to quit paying their mortgage today, there is a good chance they will not get booted out of the property for nearly two years. Even then, they won't have to wait long to get a new GSE loan. It shouldn't be surprising that strategic default is on the rise.

A 40% loss in Irvine

The Irvine Company fans reading today will undoubtedly remind everyone that Columbus Grove is not an Irvine Company property. The supposition is that prices in Columbus Grove have cratered so badly because it isn't to the quality of the rest of Irvine. I don't think so. Columbus Grove was hit hard because the builder, Lennar, finished selling out and pushed prices lower until the found a market clearing level. Columbus Grove is close to the bottom, closer than the rest of Irvine.

Columbus Grove does have some negatives, but it is still in the Irvine school district, and it currently represents the best value for the money in the school district. New construction here goes for what 30+ year old construction sells for in El Camino Real. Of course, those old properties have no HOAs or Mello Roos, so the cost of ownership is much lower at the same price point.

Irrespective of your opinion of Columbus Grove, the price declines there have been extraordinary by Irvine standards, and today's featured property is a 40% loss for the bank. They gave out a 100% financing loan back in 2006. The owner quit paying, and this ended up in shadow inventory. How do I know this?

This property went through foreclosure twice. The HOA foreclosed on the property last March for non-payment of dues. They were hoping to force the first lien holder to act. A few days later, an NOD was filed, and the property finally went back to BofA in December.

Foreclosure Record

Recording Date: 04/06/2010

Document Type: Notice of Default

If the loan owner was not paying the HOA dues for long enough that the HOA went through a foreclosure, how likely was it that he was paying the mortgage during that time? Not likely at all. If he was not paying his mortgage and there was no NOD filed, this property was in shadow inventory for quite some time.

Irvine Home Address … 73 JUNEBERRY Irvine, CA 92606 ![]()

Resale Home Price … $510,000

Home Purchase Price … $801,500

Home Purchase Date …. 11/17/06

Net Gain (Loss) ………. $(322,100)

Percent Change ………. -40.2%

Annual Appreciation … -10.6%

Cost of Ownership

————————————————-

$510,000 ………. Asking Price

$17,850 ………. 3.5% Down FHA Financing

4.84% …………… Mortgage Interest Rate

$492,150 ………. 30-Year Mortgage

$103,685 ………. Income Requirement

$2,594 ………. Monthly Mortgage Payment

$442 ………. Property Tax

$360 ………. Special Taxes and Levies (Mello Roos)

$85 ………. Homeowners Insurance

$420 ………. Homeowners Association Fees

============================================

$3,901 ………. Monthly Cash Outlays

-$425 ………. Tax Savings (% of Interest and Property Tax)

-$609 ………. Equity Hidden in Payment

$33 ………. Lost Income to Down Payment (net of taxes)

$64 ………. Maintenance and Replacement Reserves

============================================

$2,964 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$5,100 ………. Furnishing and Move In @1%

$5,100 ………. Closing Costs @1%

$4,922 ………… Interest Points @1% of Loan

$17,850 ………. Down Payment

============================================

$32,972 ………. Total Cash Costs

$45,400 ………… Emergency Cash Reserves

============================================

$78,372 ………. Total Savings Needed

Property Details for 73 JUNEBERRY Irvine, CA 92606

——————————————————————————

Beds:: 3

Baths:: 3

Sq. Ft.:: 2125

Lot Size:: –

Property Type:: Residential, Condominium, Townhouse

Style:: 3+ Levels

Year Built:: 2006

Community:: Columbus Grove

County:: Orange

MLS#:: S645081

Source:: SoCalMLS

Status:: ActiveThis listing is for sale and the sellers are accepting offers.

On Redfin:: 9 days

——————————————————————————

Elegant and refined defines this stunning townhome with upgraded finishes throughout including rich dark wood flooring, granite counters, espresso-colored cabinets and stainless steel appliances in kitchen, granite and travertine in bathrooms; plantation shutters, crown moulding, recessed lighting and extra-wide baseboards! Convenient indoor laundry room on same level as bedrooms. Living room has two-story high ceiling and cozy fireplace. Beautiful home – must see! Close to shopping and award-winning schools.

It’s hard for me to understand why Columbus Grove is not considered to be Irvine, and doesn’t command the Irvine premium.

It has a lot going for it. The location for one seems to be prime next to the District, very close to the Irvine business center, good schools, nice grounds, brand new with extremely nice interiors.

The HOAs and mello roos are very high. That’s certainly a negative. Maybe it has a high concentration of condos and apartments but that’s true of most of Irvine. I’ve heard all the toxic waste or garbage dump rumors, again I imagine that’s true for most of Irvine.

The fact is CG doesn’t command the Irvine premium. It’s a shame because these units are nice. Even at this price it commands a $3000 per month cost of ownership. Someone is going to be very happy at this price.

Are the single family houses here still going for $1M?

You surprise me. I figured you, tenmagnet, and a few others would pile on that CG is a cesspool and TIC properties are far superior.

I remember watching as Lennar kept lowering prices and adding incentives to finish their buildout. They crushed prices in a relatively short period of time. During this same period, the Irvine Company completely shut down production to preserve values on their land.

What we are left with is the imbalance of price premiums caused by the Lennar close out. Will it stay that way? I doubt it. I think Columbus Grove will equalize over time with nearby Irvine neighborhoods. It may not quite reach parity with Westpark, but it will match College Park, Woodbridge, Deerfield, and El Camino Real.

IR I only state the facts. Fact is it does not command the Irvine premium. IMHO this location has many benefits for someone looking to buy in Irvine. However that buyer would need to buy in Irvine, as you can get much more near by at $3000 per month. Don’t get me wrong, CG still has a premium when you factor in all the cost,, but it’s not the Irvine premium. I’m sure others won’t disappoint in bashing CG.

Side comment the buyers here are definitely not coming to the table with an FHA loan. You need to make that more realistic for Irvine.

The large decline in value in CG highlights the fact that TIC communities are top-tier and far superior to their Lennar counterparts.

Strong buyer demand in Irvine is based on quality and location.

In this particular vicinity Northwood Pointe, Northpark and Woodbury reign supreme.

But I thought the premium was all about the school system and parents were buying these Irvine houses for the sake of the children getting an amazing education and living in a safe area. And now look at all of these blog posts citing trivial superficial reasons to not want to live in this area.

Buildings in Columbus Grove have almost no yard space compared to old communities. Everyhing is crowded.

And yes, people who live there complain about high taxes.

I agree, that’s a huge draw back. At the very least they should have built these units with root top decks.

But, think about it! The school system! The children!

I think Planet Reality bought in Columbus Grove. 🙂

Any location within a short distance to a trash/recycling center is NOT prime. Throw in the high HOA, Mello Roos and massive quantity of underwater owners and that spells trouble.

No local elementary school might be a factor. Although CG feeds into one of the top elem schools in the city, Stonecreek.

Proximity to Jamboree Audobon, power lines and waste facility are others… and don’t forget… it was a former military base (although on the housing side of it). The paperwork disclosures you had to sign were pretty scary (we almost bought there).

The SFRs are still pricey, I’m not sure if IR is totally correct that the house size/price is comparable to El Camino across the board.

Irvine HO –

Are you saying that you would not live next to power lines or a waste facility for the sake of the children‘s education?

If you ever have children of your own… you can answer this question yourself.

But don’t you find it odd; all of the blog posts from people who are worried about things like power lines, waste facilities, neighbors toilets, small yards, etc. And not a single post from anyone saying that they would move there for the sake of the children despite some of those superficial flaws.

Yet high prices elsewhere are totally justified because folks are just doing it for the children and not at all keeping up with the Joneses.

It’s right next to Jamboree, which at that point travels at highway speeds (60mph)

There’s also some kind of quarry on the corner of Baranca and Jamboree. I believe a bus depot is also near by.

While the District is nearby, I wouldn’t consider it walking distance, since you have to walk past some light-industrial areas. There’s a public storage in between, IIRC, if you walk on Warner.

From CG, it’s much better to walk east towards Culver, through different communities and their greenbelts, and away from Jamboree.

IR: Thoughts re this?

WSJ: Cash Buyers Lift Housing

Bargain Hunting Boosts Prices in Depressed Cities; Broader Asset Rebound Spreads

Buyers in markets around the U.S. are snapping up homes in all-cash deals, betting that prices are at or near bottom and breathing life into some of the nation’s most battered housing markets.

Cash buyers represented more than half of all transactions in the Miami-Fort Lauderdale area last year, according to an analysis from real-estate portal Zillow.com. In the fourth quarter of 2006, they represented just 13% of deals. Meanwhile, downtown Miami prices rose 15% in 2010 from a year earlier, according to the Miami Downtown Development Authority.

WSJ’s Mitra Kalita reports more and more homebuyers are selling investments to pay cash for real estate, sensing a bottom in the housing market.

The percentage of buyers in Phoenix paying cash hit 42% in 2010—more than triple the rate in 2008, according to Raymond James’s equity research division.

Nationally, 28% of sales were all-cash transactions last year, according to the National Association of Realtors. The rate was 14% in October 2008, when the trade group began tracking the measure.

The jump in real-estate purchases made with cash is another sign of the revival of animal spirits in the U.S. economy.

“animal spirits” ??

Exactly who are these buyers?

A clue to those who have sufficient assets actually make such a purchase are here:

https://advisors.vanguard.com/iwe/pdf/Spectrem_UHNW_report.pdf

Are we to believe that households with $500K -$1mm in liquid cash are suddenly going to go out and buy real estate for cash?

Anybody else have better data?

This data is correct, IR would be the best person to validate in Las Vegas were I’ve heard as high as 50% are all cash.

This works as long as you have an endless supply of specuvestors with access to debt to flip your 100% cash purchase.

Welcome to the US bubble economy.

http://www.lasvegassun.com/news/2011/feb/08/51-percent-las-vegas-homes-purchased-cash-january/

Las Vegas Sun reported 51% of sales are from cash buyers.

I just can’t believe someone paid $801,500 for this place back in Nov. 2006. I remember looking at the models for fun. The outdoor space is that little front patio and you’re squeezed in between your neighbors. And is that $801,500 before the updates they did? Wow. Unreal.

Lenders set price … buyers & sellers are pawns.

500k to hear your neighbor flush their toilet? HA!

Don’t be so selfish. Think of the education that the children are going to get in that school system.

The power lines next to Columbus Grove (and part of Westpark) are a big turn-off for me.

Yes, but you need to stop thinking about you. Do it for the children. They will get an amazing education.

There could be a movie in this story, working title: (500) Days of Squatter.

The 10-year bond is taking it on the chin again today, up another 8 bps, yielding 3.73%. That may not sound like a lot, but it’s up about 145 bps in the last 4 months and/or since The Fed announced QE2.

JMO ~ This is exactly what The Fed doesn’t want because they know low mortgage rates are key to housing affordability. They want rates to remain low while they create reserves (dollars), hoping to inflate the economy quickly enough so that the banks can dump all these nonperforming assets at prices that are much closer to par (the banks capital cost).

Follow me …

Most of us know that the banks do not have to mark an asset to market until the asset is sold to another party. Even when the property becomes an REO, they don’t have to take the loss until they sell it to another party.

ALSO, when a borrower stops making the payments on the house, it becomes a nonperforming asset. HOWEVER, the banks get to continue to accrue phantom interest on that non performing asset and include this phantom interest on their quarterly/annual statements as income. This is the primary reason why the banks are showing healthy profits, and the bonuses are back to pre-2008 levels again.

The trick for the Fed is to inflate the economy while keeping interest rates low. This is how The Fed is gonna try to save the insolvent banks. Now The Fed has become the primary buyer of new government issued debt (Quantitative Easing). This puts more dollars into the economy, while suppressing bond yields.

This is indeed a zombie economy, and it ain’t gonna work.

If I were in charge of govt/banking policy, I’d seize all the big banks, destroy the equity and bond holders, markdown all the assets, transfer that to households. Then I’d break the big banks up, recapitalize them as public IPOs, and make them compete. And I’d do all this while reestablishing Glass Steagall.

What are the odds of that happening? 0

I suspect that most of the 100% cash are court auction sales and flippers.

Las Vegas market is basically a different kind of market than Irvine. LV was filled with lots of second houses or vacation properties. It’s alot easy to give up the extra house instead of your primary residence.

The decreasing number of loans serious delinquent is a sign of either economical improvement or issuing new loans or modification to cover/hide the delinquencies.

As a Chicagoan, it is funny to see how the topic of discussion changes from squatters nationwide, to local Irvine housing trends. No wonder this blog is called Irvine Housing Blog.

In any event, does anyone have an opinion on squatters who game the system, or is that old news?

“Funny” how? Isn’t your reasoning kinda backwards? Why wouldn’t you say, because this is the Irvine Housing Blog, it’s not at all surprising that discussion centers around Irvine housing trends with some discussion of nationwide issues?

Wouldn’t that just make more sense for the Irvine Housing Blog? It would be odd/illogical/strange/”funny” if it wasn’t that way.

-Darth

Squatters are so old news. Even I don’t care anymore. They live each day worrying if tomorrow will be the day. They will eventually be dragged out and then will be forced to adopt a lower standard of living. The banks are choosing not to move on them, but they will get around to it. Personally, I would much rather sleep at night than get some free rent and worry about what the future holds.

The landlords are ready and waiting for them with open arms…

Forecast: O.C. rents to soar 4.5% in ’11

http://lansner.ocregister.com/2011/02/01/forecast-o-c-rents-to-soar-4-5-in-11/97760/

Extra wide base boards! HOLY COW!

http://www.crackthecode.us/images/Irvine_BaseBoard_Room.jpg

I hope I can find a place for that one. Classic.

Home Affordability Returns to Pre-Bubble Levels

http://online.wsj.com/article/SB10001424052748703313304576132291585938656.html?mod=WSJ_hp_LEFTWhatsNewsCollection

The power lines are closer to Westpark than they are to CG. Westpark prices haven’t cratered (yet).

calculator is broken

http://www.idealhomebrokers.com/calculator/

Hmm.. can you tell me what is broken? I just visited the link and it worked for me. I know some people have had issues in the past.

hmmm works now.

it was timing out so there was an error message being displayed saying “timed out” or some such error message, instead of showing the spreadsheet.

maybe a problem with the network and not being able to load from the editgrid site?

Might be.. The tool we are using for the spreadsheet no longer offers any support. They said they will allow people to continue using it but I’m not sure how long they can do that if there isn’t a business around it.