Assaulted by bad news, a home debtor has launched a public relations campaign to keep the kool aid flowing.

Irvine Home Address … 13 WINDJAMMER 2 Irvine, CA 92614

Resale Home Price …… $299,000

Some things in life are bad,

They can really make you mad.

Other things just make you swear and curse.

When you're chewing on life's gristle,

Don't grumble, give a wistle!

And this'll help things turn out for the best…

And… always look on the bright side of life!

Monty Python — Always Look on the Bright Side of Life

Defending Home Ownership

By Barry Ritholtz – August 28th, 2010, 10:42AM

Jonathan Miller and I have been kicking around an idea for a “Home ownership is a good thing” OpEd.

Apparently, we aren’t the only ones:

• Five Reasons to Stop Worrying About Your Home’s Value (Moneywatch)

• In Defense of Home Ownership (NYT)

None of these hit the issues and topics that we want to cover — but it is interesting that other folks are thinking along the same lines.

Now, if only I could figure out whether these articles are 1) Contrarian pushback against the dominant RE meme; or b) proof that the bottom is not yet here, as people cling to the hope of a RE recovery.

I'll answer that one for you Barry: it is a sign that people are clinging to the hope of a real estate recovery. We are not yet at the bottom.

Why is sentiment so important?

Why are market collapses signified by changes in consumer sentiment? First, we need to distinguish between deflating market bubbles and market swings causing temporarily low prices. The housing bubble was a bubble; prices became elevated from fundamental values, and they are in the process of correcting back to true value. Prices were not temporarily depressed, they were temporarily elevated. In a bubble scenario, prices do not recover.

When market sentiment is still in denial — like most of California's coastal markets are — people cling to the hope of a recovery that is not going to happen. Stories about the double dip may push the market into fear, but it is nowhere near capitulation and despair like the subprime markets are today. As long as there is the delusion that prime markets are somehow going to avoid the deflation of the bubble, there will be an overhanging supply of sellers waiting for a slight improvement to sell their properties, and the distressed debt in the market remains. As long as there is overhead supply and people holding distressed debt, the market will not recover because each attempt simply brings out more sellers and prices get pushed downward.

An understanding of this market dynamic is the primary concept separating traders from academics. Traders understand this. Academics don't. Since the banks get most of their advice from academics, they will consistently make the wrong decisions, the market will not clear, and prices will grind lower until they capitulate and the inventory is finally gone. As we are witnessing today in Las Vegas, everyone must sell, abandon hope, and feel widespread despair before the market bottoms.

In Defense of Home Ownership

By RON LIEBER

Published: August 27, 2010

It’s hard to read the headlines and not conclude that becoming a homeowner is a terrible idea.

This week, the National Association of Realtors announced that existing-home sales in July had fallen an astounding 25.5 percent from the previous year. Sure, there was a federal tax credit in place last summer. But with single-family home sales at their lowest level since 1995 and unemployment still stubbornly high, home prices may fall further.

In the meantime, millions of homeowners are still far underwater, and government programs to help them have fallen well short of their goals. More foreclosures are coming, casting a deeper shadow over home prices. So it’s hardly surprising that the conventional wisdom says that home values will never again rise faster than inflation.

The truth is that home prices cannot rise faster than inflation unless we are inflating a bubble. The only thing surprising is that reasonable people who understand this are being heard right now. Usually, the bullshit from the NAr and the general level of kool aid intoxication in the media makes more noise.

But as with stocks and the weather, it is dangerous to assume any certainty in the housing market. And by wallowing too much in the misery of others, people looking for a new place to live run the risk of thinking every home purchase will end in regret, at least financially.

Many still could, if they buy in hard-hit areas where prices could fall further.

The problem is that people don't know where prices could fall further. The markets commonly labeled as safe havens are the most at risk whereas the markets labeled as hopeless are at or near the bottom.

But a mortgage is still a form of long-term forced savings, after all. This is more important than ever, since fewer people have access to generous pensions than they did during the last big housing slump. A 401(k) or similar plan is no bargain, either, with its erratic returns and employer matches that come and go as the economic winds shift. Social Security is also likely to be less generous, and Medicare will probably cost more.

Besides, owning a home isn’t just about what shows up on a net worth statement — something that bears repeating after all the “investing” that people thought they were doing when buying homes over the last 10 or 15 years. Many of these more qualitative factors, from living free of a landlord’s whim to having access to a good school district or retirement community, haven’t changed and probably never will.

It is possible, as a homeowner, to make very little money but still buy plenty of happiness. So before you swear off real estate, reconsider a few of the basics.

WORST CASES Some buyers may rue the day in 2010 they bought their homes. They may end up like those who bought in 2006 and have lost their jobs. Now those people face the difficulty of moving to pursue employment elsewhere because they owe much more than their homes are worth.

Marke Hallowell and Allison Firmat, who are getting married next month, are well aware of the history. Yet they plan to put 5 percent or less down, using a fixed-rate mortgage backed by the Federal Housing Administration, once they find a condominium in southern Orange County, Calif. (They’ve already been outbid a few times.)

Ms. Firmat is not working, and Mr. Hallowell is a Web developer. Does he worry about mobility problems or making the payments in the event of a job loss, given that he’s the sole breadwinner? “We’re getting such a good deal on interest rates that we could rent our place out,” he said.

Mr. Hallowell and Ms. Firmat say they believe their approach is conservative, at least compared to what they might have done five years ago.

“Nothing is going to change the rate we will have,” Mr. Hallowell said. “Condos like the ones we’re looking at now were unobtainable in the past, unless we went into something with a total balloon payment. There were times I was tempted, but never seriously.”

Indeed, many people who are buying at the moment are locking in mortgage rates of about 4.5 percent. A year ago, they might have paid 5.25 percent on a $300,000 loan for a monthly payment of about $1,657. Today, you could lock in a lower monthly payment of around $1,520 on a mortgage that size, or you might not need to borrow that much, given that prices have fallen in many areas.

FORCED SAVINGS You may make nothing at all beyond inflation over time on a home, but the part of your mortgage payment that goes toward principal is a form of forced savings.

Sure, you might do better by renting and investing the difference between the rent and the total costs of ownership. But at least three things need to go right.

First, you need to actually save the money. Americans have trouble with that sort of plan. Then, you need an after-tax return that’s better than whatever a home would deliver. That’s a task that might not have gone so well over the last 10 or 12 years, and it involves its own future risk, given how little safer investments are returning now. Finally, you must not raid the savings along the way.

LOL! No HELOC abuse? The problem with the whole forced-savings argument is that it is not forced anymore. Unless you live in Texas where they restrict HELOC use — which is why Texas avoided the bubble — then forced savings requires self discipline. In our Ponzi culture here in Southern California, self-discipline is in short supply.

DIFFICULT LANDLORDS A bank can kick you out only if you don’t pay your mortgage. But landlords can drive you away in any number of ways.

Laura Mapp and her husband, Carl Berg, rented from a relative, but it didn’t go particularly well. They found another landlord they liked, but came back from a holiday trip one year to a note saying he wanted to move in himself. They had a month to scram. (The note came with a bottle of wine, at least.)

In yet another rental, they let their landlord know they were looking to buy and inquired about a month-to-month lease. No problem, their landlord said, as long as they used his boyfriend as their real estate agent.

Earlier this year, the couple gave up on landlords and bought a house in the Highland Park neighborhood in Seattle.

This is another specious argument. Landlords rarely if ever throw out a good tenant. In fact, landlords often won't raise rents for fear of losing a good tenant. This article makes it sound like landlords are a capricious lot that likes to exercise their power to make people move. That idea is rather silly.

Look at it another way: how many people have been evicted by their lendinglords over the last 3 years as compared to the number of capricious landlord evictions? Avoiding a landlord is a great idea, but substituting a landlord for a lendinglord isn't much of an improvement. What people should strive for is to pay off a mortgage so they don't need to worry about a landlord or a lendinglord. Of course, that requires sacrifice, so most people opt to service debt, abuse their HELOCs, and take their chances.

THE NICE PART OF TOWN No matter how pretty the neighborhood, prices may still fall further in places like greater Detroit, Cleveland and Las Vegas; outlying areas of Los Angeles, San Francisco and Phoenix; and much of Florida.

This writer is a safe-haven fool. Detroit and Cleveland won't come back because their economies are a shambles. However, Las Vegas, Phoenix, Riverside County, most of Florida, and the San Francisco suburbs are going to recover, and the low prices there represent buying opportunities. The "nice part of town" hasn't endured its price correction yet, so those markets are in danger.

If you’re looking elsewhere, consult The Times’s rent-versus-buy calculator, halfway down the page at nytimes.com/yourmoney.

Their rent-versus-buy calculator is crap compared to the IHB calculator. Theirs was likely produced by the NAr.

But if you want to live in the Fox Hill Farm development in Glen Mills, Pa., you’ll have to buy because renters are not allowed, said Bob Kuhn, who lives there. The same may be true of other communities for older people.

And there may not be many family-size rentals — or at least any financial edge to be gained by renting — in suburbs or urban neighborhoods with excellent public schools.

This is nonsense and scare tactics. You can rent beautiful properties in the best neighborhoods in Irvine, and right now, those rents are below the cost of ownership. (High-end rental deal of the day: 31 Plumeria)

After many years of building their down-payment fund and a couple of years of watching the listings in the Eagle Rock and Mount Washington areas of Los Angeles, Garret and Alison Williams realized that prices simply were not falling much there.

That is the worst reason to buy.

By the time they were ready to pounce this year, they had a big enough down payment and interest rates had fallen so far that renting didn’t make much financial sense, even if they could have found a rental big enough for them and their two small children.

“Had we rented, we would be paying more than we’re paying for a mortgage,” said Ms. Williams, who had lived in the same two-bedroom rental for 12 years before she and her family moved into their new house in Eagle Rock earlier this month. “I don’t see how we could really regret having made the move when it’s so much better for us on so many levels.”

I question whether or not this family was getting a house equivilent to a rental if prices had not corrected yet. Perhaps their new mortgage payment is lower than rent, but they are moving into an inferior property.

I am bullish on ownership under certain conditions, and first among those is acquiring the property for a price below rental parity. In fact, I can flip from bearish to bullish quickly if prices fall below rental parity. We should start seeing more properties like that soon. I would prefer to purchase at the top of the interest rate cycle and refi on the way down, but that may be years from now, and if prices are below rental parity, I probably will not wait until 2015 for interest rates to hit 7%.

The bottom line is this: absent appreciation in excess of inflation, home ownership is a financial burden. There are emotional benefits to owning, but obtaining these benefits comes at a price. If the price is right, home ownership is wonderful, and if the price is wrong, home ownership can be a crushing weight or ball and chain.

It's worth noting that not everyone thinks our obsession with home ownership is a good thing:

Promoting Homeownership Is Not Only Un-American: It Contributed to the Housing Bubble

Posted on 08/29/10 at 2:53pm by Professor Mark J. Perry

From the Forbes.com article "The Un-American Dream":

"For nearly a century it has been the policy of the U.S. government to increase American homeownership. Its efforts include (but aren't limited to) bouts of easy money from the Fed, the mortgage-interest deduction, the exclusion of capital gains on primary residence sales, direct and indirect subsidies from the Department of Housing and Urban Development, and artificial liquidity pumped into the mortgage market via government sponsored entities Fannie and Freddie.

Policymakers assure us that the next generation of government housing programs will be "carefully designed" (bring on the next five-year plan, Comrade!). But the real question is why the government should be doing anything to promote homeownership.

"I do believe in the American Dream," said President Bush in 2002. "Owning a home is a part of that dream, it just is. Right here in America, if you own your own home, you're realizing the American dream." Bush was echoing a theme that reaches back at least to Herbert Hoover: When the government encourages homeownership, the story goes, it strengthens individuals and communities and thereby fosters the American Dream. They're wrong. A government crusade to promote homeownership is un-American.

America's distinction is that it was the first nation founded on the principle that you have a right to pursue your own happiness without government interference. But the government's homeownership crusade means it gets to decide how you should live, and stick-and-carrot you into living that way.

Here's the real lesson: The American Dream is not some government-subsidized house foisted on you by George W. Bush or Barney Frank. It's the undiluted freedom to decide how you want to live–and, if you want to own a home, it's the freedom to work, save, establish credit, and earn one. In America, the government's job is to protect our freedom to pursue our values, not to dictate what our values are. Its homeownership policy should be the same as its toaster oven policy: laissez-faire.

Government intervention in housing runs deep, and it can't be eliminated overnight. But the government should make its long-term goal to fully extricate itself from the housing market. It can then start gradually dismantling Fannie, Freddie, tax preferences for homeowners, and every other government housing program."

MP: You can add the government's role in promoting fixed-rate 30-year mortgages, and subsidizing FHA mortgages that only require a 3.5% down payment to the list of policies that the government has used to increase homeownership.

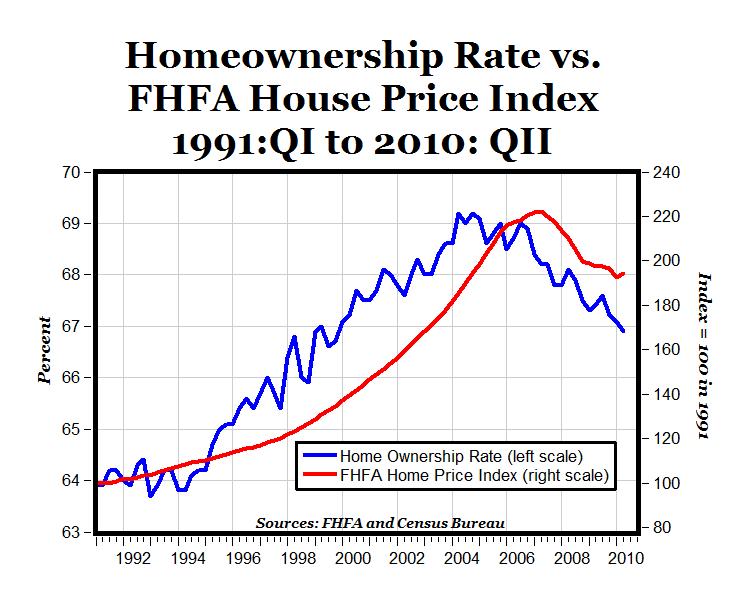

The chart above shows how the political promotion of homeownership in the U.S. may have contributed to the housing bubble. The blue line is the quarterly homeownership rate from the Census Bureau (data here) going back to 1991, which went from 64% in the early 1990s to a record high of more than 69% in 2004. During that same time period, the Federal Housing Finance Agency's (FHFA) Home Price Index (data here) doubled from 100 in 1991 to 200 in 2005, before reaching a peak of more than 222 at the height of the real estate bubble in 2007.

In the aftermath of the real estate bubble's crash, the homeownership rate has fallen to a 10-year low of 66.9% (QII 2010) and the FHFA home price has fallen back to 2004 levels. Promoting homeownerhip is not only un-American, but it helped create an unsustainable real estates bubble, which turned the "American dream" into an "American nightmare" for millions of Americans by turning "good renters into terrible homeowners."

Another hard-working condo

Day after day when I look at how much money people took out of their properties, I am astounded. I get the sense these houses worked harder than the people did. It certainly provided many with a substantial side income.

- Today's featured property was purchased on 10/26/1998 for $169,500. The owner used a $161,025 first mortgage and a $8,475 down payment.

- On 8/8/2000 he obtained a stand-alone second for $21,800.

-

On 11/13/2001 he refinanced the first mortgage for $210,937, and he got a $33,750 HELOC.

- On 1/14/2003 he refinanced with a $191,250 first mortgage.

- On 9/24/2003 he obtained a $279,000 first mortgage.

- On 11/15/2004 he got a HELOC for $83,000.

- On 1/12/2006 he refinanced the first mortgage for $372,000.

- On 3/8/2006 he obtained a $53,000 HELOC.

- On 6/20/2006 he got a Option ARM for $425,000.

- On 4/2/2007 he refinanced with another Option ARM for $412,000 and obtained a $35,000 HELOC.

- Total property debt is $447,000.

- Total mortgage equity withdrawal is $285,975.

- Total squatting time is 8 months so far, but the NOT has not been filed yet. He has more time coming.

Foreclosure Record

Recording Date: 04/26/2010

Document Type: Notice of Default

Interesting fact: The resale price of this house may end up being less than the previous owner's mortgage equity withdrawal.

Irvine Home Address … 13 WINDJAMMER 2 Irvine, CA 92614 ![]()

Resale Home Price … $299,000

Home Purchase Price … $169,500

Home Purchase Date …. 10/26/1998

Net Gain (Loss) ………. $111,560

Percent Change ………. 65.8%

Annual Appreciation … 4.8%

Cost of Ownership

————————————————-

$299,000 ………. Asking Price

$10,465 ………. 3.5% Down FHA Financing

4.50% …………… Mortgage Interest Rate

$288,535 ………. 30-Year Mortgage

$58,435 ………. Income Requirement

$1,462 ………. Monthly Mortgage Payment

$259 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$25 ………. Homeowners Insurance

$316 ………. Homeowners Association Fees

============================================.jpg)

$2,062 ………. Monthly Cash Outlays

-$134 ………. Tax Savings (% of Interest and Property Tax)

-$380 ………. Equity Hidden in Payment

$17 ………. Lost Income to Down Payment (net of taxes)

$37 ………. Maintenance and Replacement Reserves

============================================

$1,603 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,990 ………. Furnishing and Move In @1%

$2,990 ………. Closing Costs @1%

$2,885 ………… Interest Points @1% of Loan

$10,465 ………. Down Payment

============================================

$19,330 ………. Total Cash Costs

$24,500 ………… Emergency Cash Reserves

============================================

$43,830 ………. Total Savings Needed

Property Details for 13 WINDJAMMER 2 Irvine, CA 92614

——————————————————————————

Beds: 2

Baths: 1 full 1 part baths

Home size: 1,125 sq ft

($266 / sq ft)

Lot Size: n/a

Year Built: 1980

Days on Market: 114

Listing Updated: 40417

MLS Number: S617532

Property Type: Condominium, Townhouse, Residential

Community: Woodbridge

Tract: St

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

APPROVED SHORT SALE! Charming 2 bed, 1.5 bathroom home in Irvine Somerset tract. Ideal quiet location adjacent to greenbelt and amenities. Tremendous value!

Traders are not geniuses. Many of the ‘best’ (highest paid) held onto MBS/CDO positions that went from 60-70% face value, down to zero.

Not all the areas that have capitulated are ‘subprime’. Areas of SoFla that are good enough for professional athletes and olympians have seen their 50% from peak reductions for SFHs, and near 75% from peak reductions for condos. Also, not all the areas across the country experienced the same psychology as the bubble markets.

You get an article in Moneywatch or the NYTimes and they’re talking to a national audience. One of the problems in the bubble was that people focused on ‘home prices on a national level’ not being able to drop, and not realizing that it only takes one step at a simple graph to see that some locales were overcontributing to the rise, and would fall.

Some areas will rise faster than inflation, while others will rise slower. Has Detroit property risen with inflation the past 30 years? How about Manhattan?

Where I’m at in NC, the cost to build new provided a ceiling on prices, and supply/demand didn’t move a whole lot. Places in FL had exotic financing fueled speculative demand, while it seems Irvine is a limited supply situation. What is really varying is the value of the land, so I would not be surprised if at some time and price point developers (TIC) start buying foreclosures. TIC manages some rentals doesn’t it? It would make sense for me to modulate their rental stock, when possible.

“Interesting fact: The resale price of this house may end up being less than the previous owner’s mortgage equity withdrawal.”

Nope, that’s an astounding MEW fact. We often see MEW in the 100-400k range, but there was always an underlying asset value near equal to the MEW. That’s one hard workin’ condo indeed!

Roman: Crucifixion or Freedom?

Slave: Uhh freedom?!?

Roman: Right then. Down the hallway, to the left.

Is now…

Lender: Repayment, or short sale?

DebtSlave: Uhhh… how about squatting for a year, then S.S.?

Lender: Wut?

It’s more like:

The King (U.S. Government) and Servant (Central Bank)

The situation

The king was owed an amount so large the servant could never repay.

The servants’ plea

The servant admitted his debt and begged for mercy.

The response

He felt compassion on the servant and released the debt. ($14 Trillion Bailout)

The Unforgiving Servant and another servant

The situation

The Unforgiving servant (Banksters) had a fellow servant (homeowner) who owed him a small amount. The servant grabs his fellow servant and chokes him! No mercy, no compassion.

The servants’ plea

The indebted servant begged for mercy (Loan modifications, principal forgiveness)

The response

He refused to release the debt and demanded payment, but ironically, he put him in a situation where he would never be able to repay.

Same old story…….unfortunately, the real story ends with the King demanding payment from the Banksters because they will not pass the debt forgiveness on, but we all know that will never happen, because our King is not just, nor benevolent.

One of my favorite parables in the Gospels. Our king certainly isn’t a just one. Ask any renter who has missed out on the gravy train homedebtors are being fed off of today.

Although “Life of Brian” may be quite blasphemous to most, I know many a pastor who consider it a fun film, providing you don’t take is seriously. The Pontius Pilate (aka Biggus Dicus)scene is a terrific hoot.

I count 10 mortgages/HELOCs/refinances in about 10 years. It would be curious to know an estimate of the charges and fees that the banks and mortgage brokers took for all that paperwork. Not all of the equity withdrawal was going to the debtor.

I can’t imagine how much brokers must be hurting now. I’m sure it’s like any other career where only the strong survive during tough times.

When I look at the MEW numbers, it makes me realize that all of the rosy economic news of the past decade was mostly a result of the mortgage equity magic. Now that the music stopped and the money has all been spent, I can’t possibly see how there will be any form of recovery any time soon. I’m trying not to be negative, but I just don’t see anything to support a rapid economic recovery.

Don’t cry too hard for the loan brokers. They made their cash during the good times and spent it just like the homedebtors did. Self inflicted wounds tend to be the messiest to clean up.

Now that the music stopped and there aren’t enough chairs for everyone to sit in, someone is going to be pushed to the floor. We cannot inflate our way out of this, nor will there be high wage jobs coming to OC soon enough to stave off a significant collapse of this insular lifestyle of our area IMHO.

My .02c

Soylent Green Is People.

Brokers have also been working to refi nearly everyone into a conforming loan at sub-5% rates. Not a lot of cash to extract, but definitely an aid for cash-flow.

“…This is another specious argument. Landlords rarely if ever throw out a good tenant. In fact, landlords often won’t raise rents for fear of losing a good tenant. This article makes it sound like landlords are a capricious lot that likes to exercise their power to make people move…”

Hmm, this is still the “Irvine” Housing Blog, right? Do people here not have experience with the Irvine Co.? From 2002-2007 they attempted to raise my rent at least 6% every year in the face of a large percentage of vacant units.

It doesn’t take too long to figure out that even paying a slight premium (tax-adjusted) to finance/own a place might be preferable.

I got thrown out because my landlady decided to abandon her primary residence and move back into the unit she was renting to me. I got the idea that it wasn’t that she couldn’t afford to pay the mortgage on the primary place, she just didn’t want to take the huge loss. Why should she when the banks, government, taxpayers = ME will!

I moved into my IAC Rental in 2007. And my rent has gone down from $ 1950 to $ 1650. And I bet it goes down at least another $100 a month if I resign based on what they advertise for on Craigslist. Now is NOT the time to buy. And it wont be for a couple more years unless you enjoy watching your property devalue like everything else around us is these days. Welcome to Japan and its lost Decade.

I bought my house in late ’08 and payment was $2000. It has gone down to $1675 since through refi’s. What’s your point?

I think his point is that rents and prices are both going down together. It’s another risk to consider when making ‘rental parity’ computations.

Bltserv’s example is a 15% rent discount, which is pretty significant and could easily ruin a positive cashflow scenario.

Glad you got your payment down. How much did it cost to refinance ? Has the Property Tax gone down as quickly as your property value in the last 2 years ? Can you move quickly if you need to. Did the HOA fees go down too ?

How much of that payment is to principle. Not much

is it ?

My point is renters have the advantage in this market. And have had it since about late 2006.

$0 dollars to refinance both times. As long as we have the tax deduction, property tax is pretty much a wash. In this deflationary economy rents and rates are falling. My point is renters are not the only ones benefiting from deflation.

The mortgage payment has more principal in it than my old rent payment did. Sure you have the downside risk of losing property value which will erode your down payment. Of course there is an upside bet that it won’t happen. However, there is a 100% risk that the equity in your rent payment is eroded to zero every year. $2K times 12 months is $24k/yr out of pocket. Three years and that adds to a nice downpayment.

There’s a point when rates will stop falling. If everyone wants to take Japan as an example, I think the mortgage rates there average about 2%.

We still got a full 2+% left to fall (and put me in the “mortgage rates will continue to fall” camp).

Property tax is not a wash when you itemize your deductions (and can therefore take the tax as a deduction.) Your taxes are only reduced by (property tax) * (tax rate).

You clearly do not have a grasp on all of the financial factors affecting your decision to own versus the cost to rent.

I have no knowledge of the Irvine company, but our landlord has decreased our rent and offers to take money off our rent every time I fix something in our house without calling a service person. We have no fear of our landord either raising our rent or kicking us out.

But, to be fair and honest, our first landlord did kick us out when our lease was up after one years. He saw what we had done, (sold in 2005 and started renting), and decided it would be a good plan for himself so he sold the house we were renting.

Getting licked out was a blessing. We could not find another home we liked, so we borrowed my dad’s RV, you know, one of those huge bus like things, with a tow car, and traveled around the US for the whole summer. Going on a two month vacation saved us money; no rent, mortgage, property taxes, upkeep, utilities, etc.

That is an awesome story awgee.

“He saw what we had done, (sold in 2005 and started renting), and decided it would be a good plan for himself so he sold the house we were renting.”

Oh how I wish I had done that as well, as my financial situation would have been different for sure. From 2004, my WTF price I paid, went to WTFWTF!!! in 2005/2006. I honestly didn’t think about my home as a quick turn investment, and if I HAD, I would have pocketed over $100,000 PROFIT, with my initial $100,000 down payment back.

Wow, what a FOOL FOOL FOOL I was to NOT think of my house as a commodity. I was not intelligent enough or business experienced, to cash out.

The moral fool that I was, I didn’t think to HELOC it to the HILT, hide/invest the cash, or buy another property I actually WANT to live in.

I agree with you far more than I disagree – the sensibility of buying a home is mostly about math – and the numbers were insane in 2005 and are probably still not so hot in most parts of the U.S. I was telling everyone who would listen (not many) that it was insane to buy a home in 2004-2005 due to the numbers. However, I thought your comments on the landlord tenant relationship could have been more balanced.

While of course a landlord will not throw out a good tenant, a landlord is not likely to want to do the same kinds of improvements on a house that you and your family may feel is necessary and that you would certainly do if you owned a house. Things like:

Getting rid of all mold issues (including a crawl space) if someone in your family has asthma or other breathing issues.

Installing more energy efficient appliances, double pane windows, solar, etc.

Replacing ancient appliances like outdated electric panels, furnaces, etc.

Changing a yard to suit your family (Do you want grass everywhere or a large deck? Do you want more trees or less? Etc.).

As a single person or perhaps even as a couple having control over the home improvements may not matter so much but when you have a family they matter quite a bit more. A reasonable landlord will usually keep the home in good repair and no more.

We have rented for the past 3 years but just bought a house largely for these types of reasons (and rents are very high where we live anyway so the mortgage+prop taxes+insurance equivalent is now considerably less than rent if you assume home prices stop declining). I think it is likely our home value will decline for the next few years and bottom out some time between 2015-2020 but our quality of life will improve dramatically as we customize our home to suit our needs and desires.

We noticed this as well in our hunt for a good rental. We finally decided that we’d have to tolerate certain things (older kitchen/bath) to get the main things we wanted. And we figured that spending some of our own $ to customize/upgrade (it will run 0.8% of our rental cost if we stay a few years..and the landlord is happy of course)was worth it.

I think that the cost/benefit analysis is going to change dramatically soon in people’s minds. It’s not going to be as much about rental costs vs ownership costs. It’s going to take longer to get the $ together to put a down payment, and Detroit/Vegas, etc…and neighbor stories are going to give pause to plunking down so much of one’s net worth to give up mobility and risk an obliteration of the down payment.

I find it amazing when renters upgrade on their own dime. I wish I could find tenants like that.

I think it requires a non-adversarial relationship between landlord and renter, and a lot of trust. And a landlord who sees the property as something besides a cash cow that s/he will milk until it’s become a slum and lost all its appeal to higher-income, and perhaps more trustworthy, renters.

You can’t assume that happy relationship at the beginning of a lease, but perhaps a few months in both parties can re-assess each other’s trustworthiness, and negotiate improvements.

But this also speaks to length of rental term.

Changing homes every year may be fine for singles, DINKs and maybe 2+1 families… but moving is quite the pain and as your family grows, so does your stuff… which is even more to move.

It’s okay if you can find a stable place to stay for 2+ years but it’s harder nowadays with these landlords who are going underwater.

And I would think that someone would want to be in a place for at least 3 years to even think about doing improvements from their wallet.

Joe G.,

All of the things you mentioned are true. The rental I am currently in suffers for lack of many of those features. There are many improvements I would make to this property if I owned it that don’t make sense as a rental.

Providing balance to my posts is one of the features of the comments. Thanks for adding balance.

Your comment is very gracious. I wish on my site I got the quality and quantity of comments that I see on this particular post – what a great discussion! I guess anything to do with the home purchase decision is a pretty popular topic these past few years . . .

From wikiLeak:

O: my rating keep sinking, why all ur stimulus not working, Mr. Hellicopter.

H: Because I promised u re-elected in 2012 when u re-nominated me.

O:Why that matter?

H:In order the aggregated monetary effect explode at election, we need to have 0% rates ALAP.

O:But hurry, what if my rating goes lower that un-employment rates.

H: The Hellicopter will start next April, so the monetary effect peaks at election.

O: smart u, okay, give me a lot of more HELOC $$$$… from China.

H: u got it.

O/H: Ha ha ha ….

H: $#@! Alan, this is for us, I cover ur *$#@ for free.

Somebody set up us the bomb.

The rent on our Irvine Apartment Community 3-story townhouse went down by $400 a month last year! A co-worker is living in another Irvine Community and his 1-bedroom apt went down by $150 a month. There are still many vacancies here in Turtle Ridge, despite the rent reductions.

We have noticed more families with kids moving in, and those that are moving out are headed to Texas and Colorado.

My TRock condo rent on a 4-plex only went down $100 per month ($2900 to 2800 for 2500sf. Coworkers have gotten $150 less per month in larger apt building (1800 to 1650 for 1600sf). One was upset when he found out that another unit that negotiated got $400 off, but it was with a detached unit in his complex ($2300).

But that doesn’t come close to the cost reduction of squatting.

Winstongator has a good summary on why local markets behave differently. Buying at current rent parity has some risk: lowing rents, changing neighorhoods, and relocation (especially if you have money down on the RE). Safest to use the FHA 3.5% down as a walkway option in non-recouse states. Why rent when you can be squatting?

“When market sentiment is still in denial — like most of California’s coastal markets are — people cling to the hope of a recovery that is not going to happen. Stories about the double dip may push the market into fear, but it is nowhere near capitulation and despair like the subprime markets are today.”

For sentiment to change a long period of time needs to pass first. 5-6 years of lack of price appreciation should do it. More importantly all the knife catchers who jumped in between 2008 and 2010 need to get an arm or leg (or at least a couple of fingers) severed before a thorough change of market psyche could take hold. Don’t mean to evoke the gruesome image of financial amputation, but it’s a very necessary step to purge the excesses in the system. By 2012/2013 Knife catchers will have served their noble function of providing temporary market liquidity and prying out properties from the firm grip of banking cartels.

Given the recent economic and housing data we are inching closer to that stage.

This blog is hysterical, so glad I found it. It seems the only people who have this figured out don’t get national media coverage.

IrvineRenter, wouldn’t you agree an equally important (to inflation) metric to watch is wage growth? I didn’t predict all of this, but back in mid-decade, I recall discussing with a homeowner friend the fact that housing prices can’t keep going up 15% a year when wages go up a mere 2-3%. He wasn’t convinced, but not a flipper or HELOC guy, just a wishful thinker). Someone has to buy that first house to enable the flippers, like with any Ponzi scheme. Except in this one, the entry price to the scheme was constantly going up.

[quote]Their rent-versus-buy calculator is crap compared to the IHB calculator. [/quote]

your calculator is broken.

i click the “edit” button.

http://www.idealhomebrokers.com/calculator/

and i see this error message:

“Sorry, you have no permission to access this page.”

Try this first and then try Editing the calculator again:

http://www.editgrid.com/tweak/

nope. still see the same error.

Shoot.. It’s worked for some people. Unfortunately, EditGrid doesn’t offer any support for their online spreadsheets. You should be able to download an Excel version of the calculator (click the arrow in the top left of the calculator). It isn’t as ideal as the online version but hopefully it is an acceptable alternative.

If anyone knows of another online tool to share the calculator, let us know and we’ll look into it.

works with Internet Explorer 6 and FireFox 3.5.3 on Windows XP.

Firefox 3.6 and Safari 4.0.4 on Max OS-X 10.5.8 don’t work.

looks like it doesn’t like browsers running on OS-X.

I had this problem also, but can’t find the email where zovall told me how to fix it. I am on os-x and both firefox and safari now work (I think in the past only safari didn’t work). There is a fix out there for this.

It’s (basically) working for me on Firefox on OS X, and I don’t recall doing anything special to make this happen.

However, while I agree that most mortgage calculators are crap because they don’t allow you to input certain important variables or force certain assumptions, the IHB calculator is crap in terms of usability.

Zovall / IR, this has been mentioned before, but you guys really need to add some text to the calculator page explaining how to use it effectively.

For instance, I was not expecting to get a formula when I clicked on the Gross Annual Income Input field — I would have thought only the Calculations version (and this dichotomy, too, is no doubt confusing for many when there’s no explanatory text) would have formulae in it.

I changed the formula to a static value with my income, which I assume is the correct way to do it. I then came upon “Monthly Rent @ 31%”. Again, confusing. Why is it forcing rent to be 31%? Shouldn’t this just say “Monthly Rent”? Or maybe “Monthly Rent (default value is 31% of gross)”? I tried changing the Rent input field to my actual rent, and then for some reason the Calculations version of my Income went down by thousands of dollars.

Being a computer professional, I could probably figure out how to use this calculator properly after a long time spent examining the formulae and figuring out which cells they’re referring to and why (assuming the calculator isn’t flat-out broken in its current state), but I don’t have the time, and most of your readers wouldn’t have the capability.

How about adding some instructions to it…?

Typically, people don’t read instructions, and they add clutter. Perhaps I could put some instructions below or off to the side. Unfortunately, EditGrid doesn’t permit notes inside the cells like Excel does.

What I may do is create an excel version people can download and use at their leisure. It would be easier to annotate and add significant features that EditGrid lacks.

Thanks for ehe feedback.

“People don’t read instructions” is a ridiculous reason not to provide them to those who need them, as is “they add clutter” (a single “Help” link opening a popup window with textual instructions would add no clutter).

Those arguments can be used when you’re talking about a piece of software that’s so intuitive that almost no one would need instructions, but the IHB calculator is not that.

I don’t think you have to abandon the current platform to make the calculator usable, but an Excel replacement would be better than doing nothing (and being able to work with it offline would be of value; true).

Irvine in national sports news

And here I thought IR was a great golfer and he goes and does this….

I will say that the photoshop opportunities are almost limitless from this story to this blog (cough cough, David, cough)

That story is hilarious. I wish I were out playing Shady Canyon. It is one of the finest golf courses in the area.

I’m calling BS on this one. $50 says it was a cigar/cigarette ash that started the blaze.

No wonder the air quality has been so bad — thanks for the post.

Unfortunately, the story doesn’t quite end there.

The king, finds a partner, a seignior, meaning “top dog” banker who takes a cut.

Then this dynamic duo, the world king and the world banker, lord it over the entire planet.

Finally when all the carry trade investing unwinds, and all the banks fail, the Seignior, establishes his 666 credit system, and brands everyone with a charagma, meaning ethching or tattoo, upon the head or hand, which is necessary to conduct trade or commerce; those failing to take the mark getting executed.

I provide a link to one of my articles where I present the Sovereign and the Seignior.

Wow, everyone is talking about IHB today, congrats!

Housing (Greed – Fear – Bottom) Cycle (@ EconomicPic)

http://econompicdata.blogspot.com/2010/08/housing-greed-fear-bottom-cycle.html

Psychological Stages of a RE Bubble Market (@ The Big Picture)

http://www.ritholtz.com/blog/2010/08/psychological-stages-of-a-bubble-market/

One of my favorite parables in the Gospels. Our king certainly isn’t a just one. Ask any renter who has missed out on the gravy train homedebtors are being fed off of today.

http://www.homesalegold.com – get foreclosure help

IR, enjoyed the Life Of Brian cartoons, especially the ones with just a line or two of dialogue. Some of your cartoons are way too wordy to be funny (yeah, I realize some of those are meant more for illustration than humor).

I’m buying up California Land for under $150 per acre. Goal is 10-20,000 acres. 40,000 acres if the OBAMA BOMB LASTS TO 2015!

I’m paying 1-3cents on the Dollar vs. 2005-2006!

Irr will be about 30-40% per month net IRR by the time Obama leaves office!

All I keep hearing is that prices are going down but I’ve been looking at listings for over 2 years and prices have not been going down since early 2009. I agree that prices are still high relative to long term trend but what I would like to see is a chart of average mortgage payments relative to average income over time. I think these housing prices will not return to the long term trend until interest rates return to the normal range.

Hilarious.

I love the property profile. Schuck buy it 11 years ago and expects to make 100K, like living in the building was worth an added value of 10K+ a year. Given where wages have gone the past 30 years, housing should be priced at 1970s levels.