Pete Flint, CEO of Trulia, expects sellers to become desperate this summer and begin lowering prices to sell before prices fall further.

Irvine Home Address … 221 MANTLE Irvine, CA 92618

Resale Home Price …… $688,000

I'd pay any price just to get you

I'd work all my life and I will

To win you I'd stand naked, stoned and stabbed

I'd call that a bargain

The best I ever had

The best I ever had

The Who — Bargain

With the failure of this year's spring rally, market observers are looking to the summer for sellers to become more motivated and begin to lower their asking prices in earnest.

Home clearance sale coming ‘desperate’ sellers expected this summer

Kerry Suess — Saturday, June 11, 2011 7:27 am

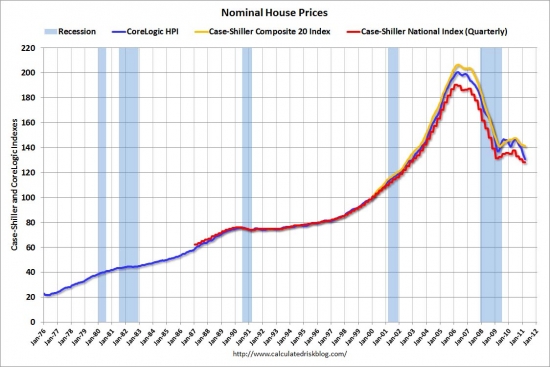

Home prices are already a third off their highs, but this summer could bring the real discounts. Buyers are still cautious, and anxious sellers will have to price aggressively to get them off the fence. That could result in a “summer clearance sale,” predicts Pete Flint, CEO of Trulia, the real estate web site.

Realistically, I don't see any bargains this summer, but the continued light transaction volume will signal to motivated sellers that they will need to lower their price if they want to transact. By August and September, fear will begin to permeate the market. Then in October when the conforming limit drops from $729,750 to $625,000 and credit becomes even tighter, fear may turn to panic, and capitulation may be upon us. If we don't see more motivated sellers, transaction volumes will decline further from their already low levels. Lenders will be stuck with a huge portfolio of REO burning a 1.5% per month hole in their balance sheets.

“We don’t imagine a stampede of buyers, like outside of Macy’s on Black Friday,” he said. “We see this more akin to January sales where retailers are trying to get rid of stock before it gets stale.”

That's exactly what it will be like. Retail sales volumes in January can only be obtained by lowering prices significantly because most of buyer demand was spent in December. Similarly, most buying demand is spent in the spring and early summer, so sales late in the year usually require significant discounting as sellers compete with each other for the few buyers who remain.

Several factors, he said, will lead to blow-out prices. Accelerating price drops could be the result as home prices have already reached their lowest level since the housing bubble burst, and are now at 2002 levels.

Sellers may feel the pressure to make deals before their homes potentially lose even more value. There is a bloated inventory of homes on the market with more than eight months worth at the current rate of sales. Many are distressed properties — short sales and bank repossessions. Such homes are often selling at substantial discounts.

Prior to the expiration of the tax-credit stimulus last spring, lenders believed the delusion that market props had created positive momentum that would sustain prices and allow them greater recovery on their REO. With the expiration of the tax credits, the housing market promptly reversed, and prices resumed their declines. Lenders are now faced with the collapse of their cartel arrangement as they compete with each other to liquidate in a declining market.

Credit is still very tight and many potential homebuyers still can’t obtain a mortgage which is limiting the demand. Unemployment is still a major concern and while the job picture has supposedly brightened, unemployment is still hovering around 9 percent nationally and is higher here in California.

People without jobs don’t buy homes, obviously, but high unemployment also rattles working people. Lacking the confidence that their jobs are secure, they may not look to buy. These forces could all come to a head this summer, according to Flint, because of the cyclical nature of home buying.

Buying usually takes off in spring as many young families hope to make their moves before the new school year. “By the end of the home buying season, sellers will become increasingly desperate,” said Flint.

Discretionary sellers who merely wanted to sell their homes will withdraw them from the market, but more motivated sellers who for one reason or another feel they must sell, they will cut their prices to get out.

Adding to already swollen inventories might be a flood of new distressed properties poised to hit the market. Banks trying to foreclose on homeowners hit a roadblock, as some delinquent borrowers successfully argued that their mortgage companies can’t prove they own the loans and therefore don’t have the right to foreclose.

This year, cases in California, North Carolina, Alabama, Florida, Maine, New York, New Jersey, Texas, Massachusetts and others have raised questions about whether banks properly demonstrated ownership. Last fall, banks temporarily suspended foreclosures to address so-called robo-signing problems, where employees were approving legal documents without properly reviewing them. “By the summer, most of the ‘robo-signing’ delays will be over and more distressed properties will be on the market,” said Celia Chen of Moody’s analytics.

I don't believe we will see any large influx of REO. First, the entire robo-signer scandal was a ruse used by the banks to continue their amend-extend-pretend policy of withholding inventory from the market. Now that robo-signer is past, lenders will find a new excuse for delaying foreclosure or liquidation of their REO. Lenders will sell what they can, but many will simply add to their REO and shadow inventory to prevent a catastrophic decline in prices similar to what happened in Las Vegas.

Many banks had slowed foreclosure proceedings until they made sure that paperwork was in order. That put hundreds of thousands of homes into foreclosure limbo and borrowers were no longer making payments in many cases, but were allowed to remain living in the homes.

Shadow inventory is made up of millions of delinquent mortgage squatters, and many more will be added before lenders ramp up foreclosure efforts in earnest.

There’s little urgency for buyers to act in this stagnant market because no one expects prices to turnaround, according to Ken Johnson, a real estate professor at Florida International University and co-author of a new study on whether it’s better to buy or rent.

Realizing that home prices will likely get even better, buyers can wait for even better deals. “If people think we’re at the bottom of the market, they’ll act,” he said.

People will not necessarily act if they believe we're at the bottom. They may no longer wait out of fear of further price declines, but if people believe the bottom will be a long flattening followed by tepid appreciation — which is what will likely occur — then buyers will not feel a great sense of urgency to buy for financial reasons.

Many of the experts, however, are telling buyers that prices will continue to erode all through 2011. Even after that, no one is predicting outsized price gains.

Actually, realtors constantly call the bottom to increase buyer motivation, and they also predict outsized gains because of pent-up demand or whatever other nonsense they can think of.

“There will be a lousy housing market for another year or two,” said Michael Larson, a housing analyst for Weiss Research. Even if we’re at or near the bottom, buyers are unlikely to see prices rise much if they wait. “I myself continue to rent,” said Johnson. “I know that even if I don’t buy for a year, it’s no big deal. Who cares if I miss the bottom if prices only go up a couple of points or so?”

Ditto.

The first 95% of this article is very good, but the closing was written by a realtor. Can you smell the bullshit?

That can be a risky proposition and to many it sounds like good common sense. Why buy now if prices are going to continue to fall and maybe increase only a little if at all over the next couple of years? That is certainly the case for the cash buyer, but if you’re like me and would need to finance a home or investment you might consider that terms can sometimes be more important than just the price. If interest rates rise or loans become more difficult to obtain you can easily miss the boat. Between now and the end of the year might be the best time of our lifetime to buy a first home or investment property. Don’t be kicking yourself down the road. Talk to your local lender about pre-approval and your local Realtor about your options.

Questions or comments can be made to Kerry Suess at larpres2011@yahoo.com

Another recent buyer bails on Irvine

Anyone on The Irvine Company's mailing list has probably seen the deals closing out Woodbury East. The last few units in any project are the most difficult to sell. The builder or developer has often shut down the sales operation and moved on to other projects, and the last few units are often the least desirable, or they would have sold already. If a project has good momentum, the scarcity can work to the builder's advantage in selling the last few units. Unfortunately, with the weak sales of this spring, price reductions and incentives are the order of the day.

Since the builder is cutting price and adding incentives, any early resales face stiff competition. Why would someone pay 15% – 20% more to obtain a resale when you can get a new one directly from the builder for less?

The owner's of today's featured property paid $632,000 on 2/25/2011. They put plenty of money down, but this wasn't an all-cash purchase. It doesn't look as if the owners moved in. If these owners bought from a motivated seller who gave them a 15% discount, and prices have been declining ever since, what makes them think they can get a 20% premium?

| Date | Event | Price | ||

|---|---|---|---|---|

| Jun 05, 2011 | Price Changed | $688,000 | ||

| May 26, 2011 | Listed (Active) | $699,000 | ||

| Feb 25, 2011 | Sold (MLS) (Closed) | $632,000 | ||

| Jan 24, 2011 | Pending | — | ||

| Aug 04, 2010 | Listed (Active) | $677,000 | ||

I also find it interesting that this property was listed and sold on the MLS. Builders don't typically do that. Of course, since the housing bubble popped, builders have been trying new things to generate sales. Perhaps new homes being listed on the MLS is the future of new home sales. We will see.

Irvine House Address … 221 MANTLE Irvine, CA 92618 ![]()

Resale House Price …… $688,000

House Purchase Price … $632,000

House Purchase Date …. 2/25/2011

Net Gain (Loss) ………. $14,720

Percent Change ………. 2.3%

Annual Appreciation … 25.7%

Cost of House Ownership

————————————————-

$688,000 ………. Asking Price

$137,600 ………. 20% Down Conventional

4.49% …………… Mortgage Interest Rate

$550,400 ………. 30-Year Mortgage

$119,380 ………. Income Requirement

$2,786 ………. Monthly Mortgage Payment

$596 ………. Property Tax (@1.04%)

$133 ………. Special Taxes and Levies (Mello Roos)

$143 ………. Homeowners Insurance (@ 0.25%)

$0 ………. Private Mortgage Insurance

$134 ………. Homeowners Association Fees

============================================

$3,792 ………. Monthly Cash Outlays

-$465 ………. Tax Savings (% of Interest and Property Tax)

-$726 ………. Equity Hidden in Payment (Amortization)

$229 ………. Lost Income to Down Payment (net of taxes)

$106 ………. Maintenance and Replacement Reserves

============================================

$2,936 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,880 ………. Furnishing and Move In @1%

$6,880 ………. Closing Costs @1%

$5,504 ………… Interest Points @1% of Loan

$137,600 ………. Down Payment

============================================

$156,864 ………. Total Cash Costs

$45,000 ………… Emergency Cash Reserves

============================================

$201,864 ………. Total Savings Needed

Property Details for 221 MANTLE Irvine, CA 92618

——————————————————————————

Beds: 3

Baths: 2

Sq. Ft.: 2181

$315/SF

Property Type: Residential, Single Family

Style: Two Level, Spanish

Year Built: 2010

Community: 0

County: Orange

MLS#: S660361

Source: SoCalMLS

Status: Active

——————————————————————————

Almost brand-new detached home located at Santa Cruz in beautiful Woodbury East. This plan offers a 3 bedroom, 2.5 bath, features the Conservatory Room for additional living space next to the Great Room w/ decorative fireplace. The kitchen offers white cabinets, upgraded stainless steel appliances including a refrigerator and washer/dryer, granite kitchen counter tops with a full backsplash. . Upgraded carpeting. Upgraded flooring in bathrooms. Custom paint. Tankless waterheater. Garage floor with epoxy coating. Professional landscaping. Cozy back/side yard. Enjoy resort-style amenities, Irvine Schools, and upscale shopping in Woodbury's distinctive Town Center!

Question of the day

Will lenders succeed in withholding inventory and preventing further price declines here in Orange County?

Breaking News: Attorney: Realtor group violates law on speech. More on that tomorrow.

Must be

http://www.crackthecode.us/images/professional_landscaping.jpg

“If these owners bought from a motivated seller who gave them a 15% discount, and prices have been declining ever since, what makes them think they can get a 20% premium?”

Because if you aren’t getting a 10% raise every year, there is something wrong with you?

or

Because the parking lot at the Irvine Spectrum was full last Saturday night?

or

Foreign cash buyers will buy anything in Irvine and pay dearly for the priviledge of their children attending Uni High.

Prices don’t go down in Irvine! They remain flat absolutely worst case scenario! I am not bullish at all! I’m so bearish! Go check the parking lot at Irvine Spectrum if you don’t believe me!

“By August and September, fear will begin to permeate the market. Then in October when the conforming limit drops from $729,750 to $625,000 and credit becomes even tighter, fear may turn to panic, and capitulation may be upon us.”

Thank God, more than 5 years post bubble. Now dear readers we are only 2 months away from fear and 3 or 4 months away from all out Irvine capitulation… And it’s all caused by the very high percent of loans in the 625 to 729 range and a marginal higher lower rate… Get it? Marginally higher lower rate

Only months away

5-Years post bubble, that’s rich. PR hasn’t figured it out that Irvine has yet to leave the bubble so there is no “post bubble”.

How bout those sales numbers, PR? Must be all that pent-up demand LOL

Yep – the summer of 2011 in Irvine. The summer of fear and capitulation. All caused by only 4% of all loans with a very high 5% interest rate, complete capitulation 5 years later.

Low sales volume, low inventory at 4 months. The perfect storm.

Oh is 4 months the official inventory number that the used house peddlers are putting out there? Another convenient little lie?

Irvine Inventory: 863

Recent month sales: 224

Irvine Inventory (months) = 863 / 224 = 3.8

How much of the 863 is even really available for transaction with either short sell or wishing price equity seller turned rental.

Sorry to disappoint but that is not a capitulation atmosphere. That capitulation must be in the shadows of 2018. 12 years post bubble

I don’t think capitulation is at hand in Irvine either. Looks like some price cuts are on the way, but the sellers should be able to find a knife catcher.

Yes,I know how you got your 4 month figure but we all know that that is leaving out a lot of pending foreclosures so that figure is about as useful as the official unemployment number.

PR,

Congratulations on making a data-driven argument. If you did that more often, you would have more credibility.

BTW, the Irvine inventory from the MLS does not include most of the Irvine Company offerings. The actual number of homes for sale in Irvine is considerably larger than the 863 you show.

My arguments are always data driven and factual – you need a math formula to understand that?

What about the new sales in the numerator? At least part of why transaction volume is low is because the number of homes available for transaction is much lower than 3.8 months.

You still think the small number of mortgages in the 625 to 729 range at a 5% rate are going to mean anything? Capitulation no less?

NA”r” press releases are also data driven and “factual”as well.

A 3.8 months of inventory number doesn’t exactly scream market capitulation. However, recent history shows that it’s entirely compatible with a continued slow grind of prices.

Check out this article from last July:

http://irvinehomes.ocregister.com/2010/07/29/irvine-home-inventory-keeps-growing/14131/

The headline months of inventory figure last July was at about 4 months… pretty similar to right now. And then, over the next 9 months, the price per square foot in Irvine fell 8.4%. So obviously whatever the current inventory number means, it definitely DOES NOT mean that prices are done falling.

Salsa, rrrrright like todays featured property for example. The declines have been devastating.

“Salsa, rrrrright like todays featured property for example.”

Ummmm, how exactly does todays property contradict anything I said? Surely someone like yourself who’s interested in data-driven analysis cares more about the median price per square foot for the city than about the unmet asking price of an individual property, right?

Get used to PR’s “Devastation” blogspam. Now that prices are double dipping (he thought they would remain flat) – the game plan is to play down and mock any and all declines.

PR, please get a little more creative with your descriptions of the mayhem in the Irvine real-estate market. Give us something worth reading.

I was out in Laguna Altura the other day and when I enquired from a select supervisor, I was told Laguna Altura has a total of THREE, yes 3, sales.

I said in the past and I will repeat it, I believe The Donald realizes the real estate bubble is over and he is cashing out as fast as he possibly can.

The focus on rates is always a one-line throwaway argument. Consider if there is a sell-off of Euro-area debt (Greece, et al). What are the sellers going to buy? $UST$, meaning lower US rates, as our mortgages are nearly USTs today.

What about when rates rise? What if that causes prices to fall? (Prices may not fall if rates rising are from wage-related inflation). Do you think Bernanke will just sit there and let deflation ring? He’ll take the cash from maturing treasuries & GSE prepay’s and put that back into the market.

It’ll take 4+ years of ~4% inflation to put the market in a situation where a lot of the negative equity has been eaten by inflation. Over the next 4 years or so, global instability and the Fed will both contribute to rates staying low.

And if/when mortgage rates exceed their historical average, what will be the typical real estate sales person’s go-to line then? They’ll just keep playing their game – “Act now before rates go even higher!” Or, “You can always refi in a couple years WHEN rates get back to normal.”

It’s been said here many times, but is so true. These sales people need to be regulated…

You have to think about what will push rates higher. Fannie/Freddie bonds are really US Treasuries (they have the same backer). So, what will push US Treasuries higher? The increased premium the GSEs will charge will be in the ballpark of 0.25% – 1%, so it is what will really move treasuries. The things are: higher growth, better investment alternatives (which signals a strong economy), or inflation. All 3 of those will put upward pressure on home prices. You might not see real appreciation, but nominally, for interest rates to be rising, home prices will be flat to modestly increasing. Counting on higher rates to push prices down does not seem a winning bet to me.

Correct.

House prices will under perform inflation.

Maybe inflation will be 6% while appreciation is only 3%. However leveraged appreciation would be 12-15% out pacing inflation.

Under a free market of informed actors – hahahaha! – this problem would fix itself. An efficient use of resources would require that they be ground up for fertilizer or used for medical experiments, excepting those experiments which require individuals of normal cephalic function.

One of the biggest misunderstandings of home buying is that the better time to buy a home is NOT when the interest rates are at their lowest, but rather at the highest. When the interest rates are close to the lowest, the home prices tend to be near the highest. When the interest rates are close to the highest, the (inflation-adjusted) home prices will be close to their lowest.

Once the long term bond market bubble burst, it will create the second down wave in real estate market.

Looks like bond market bubble may burst around 2016. Based on some cycle theory, US real estate won’t start to recover until 2033. For any post-bubble buy/investment, you can look to see how people do after 1990 Nikkei and 2000 Nasdaq high-tech bubbles. Bubbles just do NOT come back in less than 16 to 20 years throughout ALL human history. And for some bubbles like Tulip bubble, the answer is NEVER.

I hope some people here would listen to my advice and save yourself some hard-earned money.

Good theory.

Now can you please explain why interest rates AND house prices increased in the 1970s?

Never mind stick to the theory and buy at the next interest rate peak. Judging by historic interest rate cycles that should be in 20 or 30 years. Be very patient.

“Now can you please explain why interest rates AND house prices increased in the 1970s?”

Lenders loaned out money at 60%+ debt-to-income ratios in anticipation of 10% yearly raises in salaries from their borrowers. This was the Ponzi virus Paul Volcker eliminated by raising interest rates until banks stopped loaning money on insane DTIs.

The only way prices go up on a sustained basis is through increasing incomes. Wage inflation does not seem likely in the wake of 9% unemployment, and since all lending is now government lending with reasonable DTIs, I don’t see escalating DTIs pushing up loan balances either.

I forgot to add (inflation-adjusted) to my first reference of housing price, but it was there for my second reference. It is always inflation-adjusted price that matters for your long-term ROI of your portfolio.

Please also note carefully about my wording. I only said that it “tends” to be “near” the highest. I didn’t say that the peak/bottom of the interest rates will coincide exactly with the peak/bottom of the real estate prices.

There are just too many variables going into the actual housing prices. Interest rate is just one of them (but important one). Income is obviously another very important factor.

As far as I can see, real estate in this country as an asset class for investment is in general dead in the water for most people. However, I don’t deny that locally there may be certain investable area such as Las Vegas that IrvineRenter is advocating. Real estate after all is indeed local.

These are just my humble opinions. But of course, you can always listen to those people who cannot identify the biggest bubble in human history before it crashed.

Because only a moron equates correlation with causation?

Exactly right. When you buy at low interest rates, you have nothing but downside risk with regards to the underlying value of the property. The next buyer will likely need financing, and since such financing is more expensive for that buyer, it directly reduces what he is willing to pay.

When you buy at high interest rates, you have much more upside from potential rate decreases. In addition, you can always refinance to a lower-cost loan — giving you benefit on both the monthly outflow and the underlying valuation of the property.

Finally, in “Prop 13” states like California, the benefit of buying at the lowest possible sales price (not lowest monthly payment) is compounded by locking in low property taxes for the life of ownership.

By any metric, low interest rates are great for SELLERS. For buyer, they are a risky gamble related to buying a cheap monthly payment in exchange for high risk to the underlying valuation and overpaying property taxes for years.

Only a fool would think that low rates actually “help” sellers. I guess that’s why Realtors love to spout that drivel.

Typo Correction: last line should begin with “Only a fool would think that low rates actually ‘help’ buyers.”

Just ask PR who bought in ’96 and enjoyed steady rate declines over a 15 year period. Not going to work out so well for someone who buys today.

Life is good, the rate declines keep on a coming. I’m sure Ben Bernanke will be quick to raise rates at the very first sign of inflation. (sarcasm) There’s still life in this down cycle for mortgage rates. The bottom for mortgage rates may be soon, but the next peak is decades away.

Ben will not be allowed to raise any Fed interest rates, because the Treasury Dept. would not be able to pay the interest on the debt. And the member banks, especially JPM will not allow hime to raise rates because of the trillions of dollars of interest rate swaps that would implode.

But, that does not mean that rates will not rise of their own accord. When? Sorry, I don’t have a clue and have been wrong too often guessing on that one.

Agree with Awgee. It seems we have dug ourselves into quite the hole and nobody in charge whether it be the Treasury or the Fed appear to have any concerns. Run out of money? Ok, we’ll just make some more. Reach your debt limit? Just put on a sideshow and then raise the limit. The middle class is in for it.

I Agree with Awgee too.

The best plan I have come up with is to borrow as much as I can to buy hard assets. That means one thing, take out mortgages to buy RE. I agree that RE is not at a bottom, but this is one of those hold your nose investments for me.

The second best investment would be HELOCing into gold at a 2.9% 5 year ARM. If only it was easier to borrow money for other hard assets it’s a piece of cake for housing.

“HELOCing into gold”

Not for me. I am only interested in rent producing assets that can pay the cash costs of the debt.

Ya know, I try not to give advice, but on this I can not keep quiet. Sorry.

Do NOT borrow to buy gold. Buy gold as a wealth preservative, not a speculation. If you buy gold on margin, (borrow to buy), you will lose.

“US real estate won’t start to recover until 2033”

sweet ; gives me time to save up my 20% down

From what I recall reading, Japan reached rental parity around 1996. House prices continued to drop anyway for another ten years, and 10-year JGB bonds have stayed below 2% for the whole of this past decade, currently around 1.14% and dropping down to as low as 0.5% even as the deficit exploded. Despite the significant debt of wartime America, ten year interest rates averaged around 3% or below until around 1958. Ten year AAA bonds were below 2.5% range for most of the 1940s. The point being that interest rates could stay low for a much more extended period than Peter Schiff-ites might presume.

put your money where your mouth is and double down on 10 yr treasury bonds.

you might be right but your upside is somewhat limited.

Well, I’m actually doing OK in 20-year bonds, but I might execute a tactical retreat in the short-term. In any case, returns are low if we just bounce around the 3% yield but an extended period of 3% interest rates would be good for housing.

really? how about the commercial real estate bubble prices in late 80s? Blown through.

How about Hong Kong 1997 bubble? Already topped and blown through.

Fascinating . . . .

http://money.cnn.com/2011/06/09/real_estate/foreclosure_squatter/index.htm?wwparam=1307987247

Excerpts:

“It’s very hard to save,” said Jill Segal. “Our company’s billing is 90% off and my husband is only working about four days a week.”

Lynn, who didn’t want her last name used, purchased a two-bedroom on Tampa Bay in 1998 for $135,000.

As the waterfront property’s value skyrocketed, eventually reaching $750,000, she refinanced twice (once to expand a business), and took out a second mortgage. She now owes more than $600,000 on the home, which is worth only $235,000.

Able to pay, but walking away, she’s still hoping to negotiate the loan. In the meantime, small things bother her. “A couple years ago, I lost my dog and I can’t decide on getting a new one,” she said. If she has to move, she can’t be sure she’ll go somewhere that allows pets.

———————

The actor from Thousand Oaks, Calif. began having problems during the screenwriters’ strike in late 2007, followed by a threat of a strike by the Screen Actors Guild.

“In a way, I feel like I’m lucky because I haven’t had to pay any ‘rent’ for 30 months,” he said.

But he feels like he’s always under a cloud. “I haven’t slept in three years,” he said. “It’s terrifying. I have to have the ultimate poker face in front of my kids.”

Article: Squatters–5 years with no mortgage payments:

http://money.cnn.com/2011/06/09/real_estate/foreclosure_squatter/index.htm

Some excerpts . . .

Lynn, who didn’t want her last name used, purchased a two-bedroom on Tampa Bay in 1998 for $135,000.

As the waterfront property’s value skyrocketed, eventually reaching $750,000, she refinanced twice (once to expand a business), and took out a second mortgage. She now owes more than $600,000 on the home, which is worth only $235,000.

Able to pay, but walking away. She’s still hoping to negotiate the loan. In the meantime, small things bother her. “A couple years ago, I lost my dog and I can’t decide on getting a new one,” she said. If she has to move, she can’t be sure she’ll go somewhere that allows pets.

———————–

The actor from Thousand Oaks, Calif. began having problems during the screenwriters’ strike in late 2007, followed by a threat of a strike by the Screen Actors Guild.

“In a way, I feel like I’m lucky because I haven’t had to pay any ‘rent’ for 30 months,” he said.

But he feels like he’s always under a cloud. “I haven’t slept in three years,” he said. “It’s terrifying. I have to have the ultimate poker face in front of my kids.”

Looks like that Tampa Bay property is close to bottoming out at the ’98 comp. Can you believe she sucked 500K out of that thing to “expand a business”. I would LOVE to know what the nature of that business was. Rehabbing and flipping real-estate, perhaps? No, gosh no. No way. And now her life is so upside down that she cannot even replace her late dog if she is a lowly renter. I see people all over my area with dogs – apparently they do just fine in rentals.

The actor hasn’t slept in 3 years! What a drama-queen. Lay of the Meth, sir. If that cloud bothers you so much then go find a rental.

They act like they are victims but each one has the power to drop the keys in the mail, find a rental, and call it a day. Yet they choose to stay and continue to enjoy the free rent and “live in fear”. PFFFFF.

Oh, and the poker face for the children –

Nice touch.

When weighing the difference between an FHA-insured loan and a conventional mortgage, homeowners should also consider the future of home prices and mortgage rates, check the “123 Mortgage Refinancing” page for more

I don’t see much evidence that many buyers have a clue what is happening in the market.